f7d2d2673aaa4d32ed7aab5e14f02515.ppt

- Количество слайдов: 19

Leveraging Technology to Effectively Manage Information Obtained under Bilateral or Multilateral Exchange of Information CATA Technical Conference Bridgetown, Barbados 7 -11 November 2016

GLOBAL TAX ENVIRONMENT § Challenges: • Advances in technology and consumer education make international financial transactions increasingly simple and secure • Aggressive tax planning schemes for all socio-economic levels are more sophisticated • Specific international developments (e. g. Panama Papers) § Exchange of Information Solutions • Improving current processes for specific, spontaneous and automatic exchanges • New developments in exchange of information: ü Common Reporting Standard ü Country-by-Country Reporting ü Exchange of rulings 2

IMPLICATIONS FOR TAX ADMINISTRATIONS § Safeguarding confidentiality of information • Global Forum safeguard reviews § Appropriate use • Guidance • Training § Effective use • Technology – including analytics 3

THE CRA’S INTERNATIONAL TAX COMPLIANCE STRATEGY § Two primary goals: o Mitigate the risks of non-compliance arising from cross -border transactions o Strengthen collaboration with foreign tax administrations 4

EXCHANGE OF INFORMATION (EOI) § At CRA, EOI is facilitated using: o Bilateral and Multilateral Tax Conventions o Tax Information Exchange Agreements (TIEAs) o Convention on Mutual Administrative Assistance in Tax Matters (MAC) § Domestic legislation to ensure confidentiality and integrity of information 5

MECHANISMS FOR EFFECTIVE EXCHANGE OF INFORMATION § The broadest application of our treaty provisions is vital as the Exchange of Information world is evolving: o Past: § § Specific requests for information Spontaneous exchanges of information Simultaneous audit or examination Automatic exchange of information o Present § Foreign Accounts Tax Compliance Act (FATCA) § Exchange of rulings and unilateral APAs o Future § Common Reporting Standard (CRS) § Country by Country Reporting (Cb. CR) § Enhancements to automatic exchange 6

MECHANISMS FOR EFFECTIVE EXCHANGE OF INFORMATION (CONTINUED) § CRA efforts to ensure that our employees are aware of current and future developments in EOI: • Increased duties for EOI officers (obtaining information directly from third parties and taxpayers) • Ongoing outreach to create awareness and train employees (classroom and webinar sessions) • Updating the CRA’s Exchange of Information reference guide • Increased international engagement/collaboration 7

CRA USE OF INFORMATION: AUTOMATIC EOI § Analyze and manipulate information § Risk Assessment (Income Type, Income Amount…) § Matching with Canadian taxpayer’s filing history to determine compliance § Initiate compliance activities when necessary 8

CRA USE OF INFORMATION: EOI ON REQUEST (SPECIFIC) § Specific requests are usually made in the course of an audit § Determine if offshore assets from a Canadian taxpayer have been identified for Canadian tax purposes § e. g. foreign reporting forms completed when required § Examples of previous requests include: property searches, requests for bank account statements or requests for financial statements 9

CRA USE OF INFORMATION: SPONTANEOUS EOI § To other countries: o If CRA comes across information we feel may be beneficial to treaty partners, we will provide to partners o CRA has provided relevant information to treaty partners § Received from other countries o Information provided by another country is reviewed o Determine if non-compliance risk is present o Information obtained by our treaty partner and used to start projects in Canada identifying potential noncompliant Canadian taxpayers 10

COMMON REPORTING STANDARD (CRS) § In July 2014, Organisation for Economic Co-operation and Development (OECD) approved new global standard for Automatic Exchange of Financial Account Information in Tax Matters – CRS § Common Transmission System (CTS) • Operationalize automatic exchanges • Data security using leading industry standards of encryption • BEPS initiatives expected to leverage CTS: Country-by-Country Reporting (Action 13), Exchange of Rulings (Action 5) § Common Reporting Template • FTA’s Offshore Compliance Programme • Measuring success of CRS • Voluntary disclosure programmes and increased compliance 11

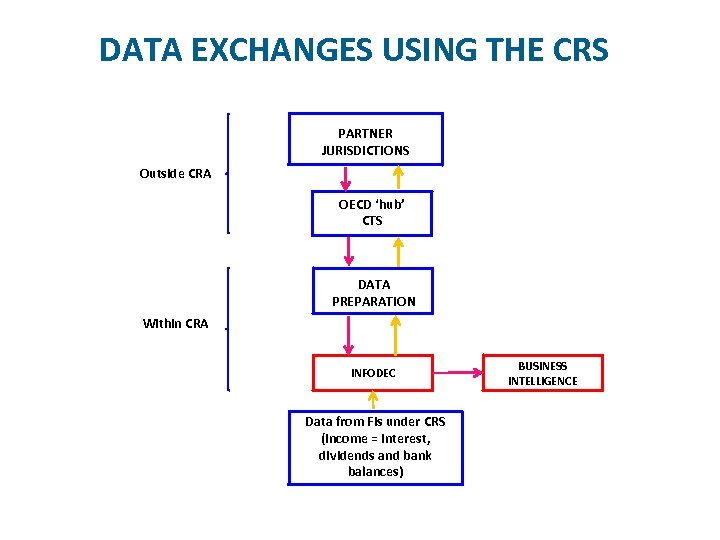

DATA EXCHANGES USING THE CRS PARTNER JURISDICTIONS Outside CRA OECD ‘hub’ CTS DATA PREPARATION Within CRA INFODEC Data from Fis under CRS (Income = interest, dividends and bank balances) BUSINESS INTELLIGENCE

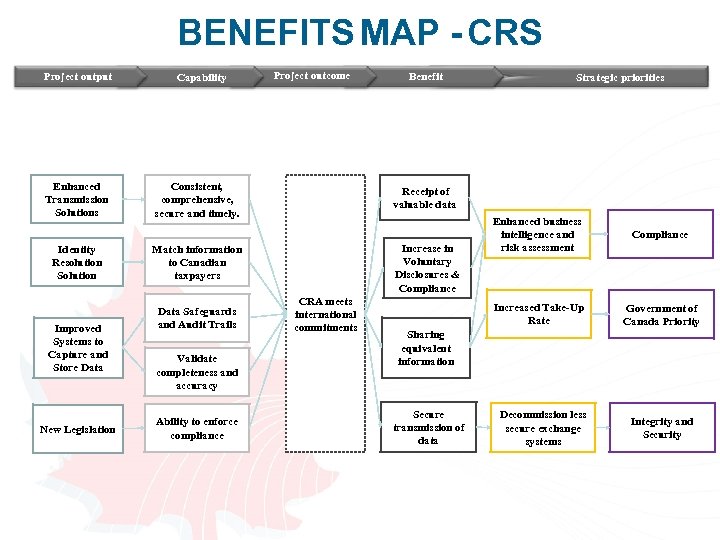

BENEFITS MAP - CRS Project output Enhanced Transmission Solutions Identity Resolution Solution Improved Systems to Capture and Store Data New Legislation Capability Project outcome Benefit Consistent, comprehensive, secure and timely. Receipt of valuable data Match information to Canadian taxpayers Increase in Voluntary Disclosures & Compliance Strategic priorities Data Safeguards and Audit Trails Validate completeness and accuracy Ability to enforce compliance CRA meets international commitments Enhanced business intelligence and risk assessment Compliance Increased Take-Up Rate Government of Canada Priority Sharing equivalent information Secure transmission of data Decommission less secure exchange systems Integrity and Security

CRA SYSTEMS FOR EOI § CRA typically develops systems in-house § Two in-house database for EOI 1) Tracking system on all details of exchanges of information 2) Storage system of bulk database related to automatic exchange § Current storage system being replaced by enhanced system with implementation of CRS o § Allow better consultation, access and use of information New enterprise solution for EOI – will include analytics tools 14

1) CURRENT EOI TRACKING SYSTEM § In-house system to control the flow of all types of exchange of information requests § Allows officers to add and update assigned files § Provides a proper audit trail for both incoming and outgoing exchanges § Each file is categorized by the type of exchange (specific, spontaneous, automatic…) § New categories are being created for exchanges made under CRS, Cb. CR 15

2) CURRENT STORAGE SYSTEM § In-house system to store information slips exchanged automatically § On-line system and access is restricted to EOI officers. • CRA’s field auditors and investigators can request copies of information slips from EOI officers § Reporting capabilities to identify trends, areas of compliance, etc. . non- 16

NEW EOI STORAGE SYSTEM § Enhanced system being developed o Information will be on the CRA’s central system and all authorized users will have access o CRA officers will be able to access information without contacting an EOI officer. o More efficient matching process (slips to Canadian taxpayers) o More information to be analyzed by CRA officers with direct access o Better Business Intelligence 17

Future Directions § Enterprise system for better use and business intelligence § Improved EOI mechanisms § Continued engagement/collaboration at international level – including sharing of best practices § Addressing technological barriers § Ongoing development of compliance strategies 18

Thank you 19

f7d2d2673aaa4d32ed7aab5e14f02515.ppt