a7c438640afddf701424b19d06f13f61.ppt

- Количество слайдов: 103

LET’S GET STARTED-Back to the Basics ELAINE SCHMIDT, CPC, CPO-C, OCS REVIEW of KNOWLEDGE AND BACK TO THE BASICS 1

2

DISCLAIMER l l This information is current as to the time it was prepared and reasonable effort was made to assure accuracy. There is no guarantee of being completely error-free. This presentation is intended to be a tool to assist and guide understanding.

RED FLAGS RULE l l Essentially a extension of HIPAA to protect the patient’s financial information Was scheduled to go into effect by the end of 2010 The FTC has ruled specific businesses are exempt, including optometry. It now applies only to businesses using credit reports in the ordinary course of business; furnish information to credit reporting companies; or loaning money. 4 4

FRAUD VS ABUSE l 5 FRAUD: The intentional deception or misrepresentation that an individual knows to be false or does not believe to be true and makes, knowing the deception could result in some unauthorized benefit to himself/herself or some other person.

FRAUD VS ABUSE l 6 ABUSE: Practices of providers, physicians, or suppliers of services which, although not usually considered fraudulent, are inconsistent with accepted sound medical, business or fiscal practices, directly or indirectly resulting in unnecessary costs to the Medicare program, improper reimbursement, or program reimbursement for services which fail to meet professionally recognized standards of care or which are medically unnecessary.

NEW PATIENT l 7 Per CPT: “A new patient is one who has not received any professional services from the physician/qualified health care professional or another physician/qualified health care professional of the exact same specialty and subspecialty who belongs to the same group practice within the past three years. ”

NEW VS ESTABLISHED New Patient vs. Established Patient Normally, the fees should be higher for new patient services due to new/updated history, ie, the “work” is greater The allowable for new patient services is *generally higher than for established patient services l 8 8

NEW VS ESTABLISHED, con’t There is still an exception with Medicare allowable for intermediate exams: 92002 - $77. 54, 92012 - $ 81. 64 (2013) l New is more labor intensive; more detailed l If you have not seen the patient for over 3 years, it’s comparable to gathering new history l 9

“NO” to RULE OUT CODES Rule Out codes are not allowed l Wording such as “suspect”, “looks like”, “appears to be” are warning signs. l Get clarification documented from the doctor, or you must code according to signs and symptoms Ex: “suspect macular edema” – could not code as ME with this statement l 10

RULE-OUT l 11 Even though rule-out codes cannot be used for diagnosis claim submission, rule-out language can be used in the medical record to show necessity for procedures and or services

Reason for Visit l l l 12 The patient’s chief complaint (CC) should drive the diagnosis coding for the encounter as a general rule Consider coverage, ask the right questions, be mindful of either previous diagnosis or if a new patient…. . Use caution…….

13

92004, 92014 General Ophthalmological Service, Comprehensive-one or more visits (per CPT) Patient comes in for exam one day but the dilation is performed on a later (continued) date, there is not additional charge. It is a continuance of the comprehensive service. This should be clearly documented in the patient’s record. l 14

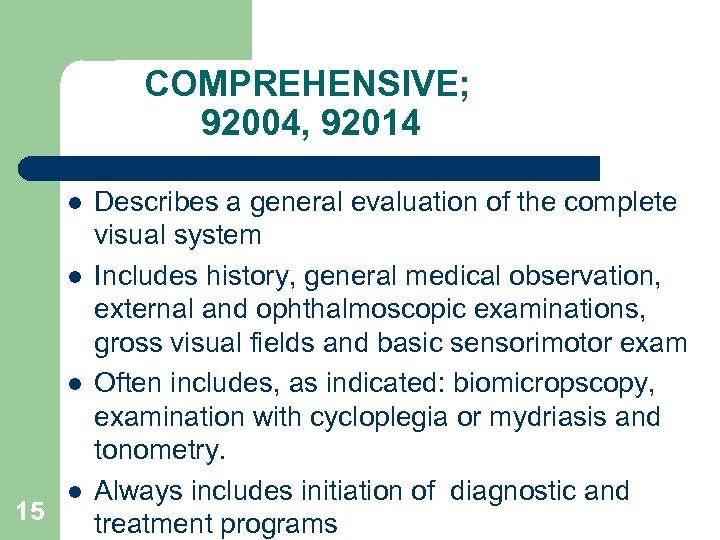

COMPREHENSIVE; 92004, 92014 l l l 15 l Describes a general evaluation of the complete visual system Includes history, general medical observation, external and ophthalmoscopic examinations, gross visual fields and basic sensorimotor exam Often includes, as indicated: biomicropscopy, examination with cycloplegia or mydriasis and tonometry. Always includes initiation of diagnostic and treatment programs

92004, 92014 l l May or may not include mydriasis (dilation), but many carriers require it unless contraindicated or refused Such instances must be included in the documentation of the patient record

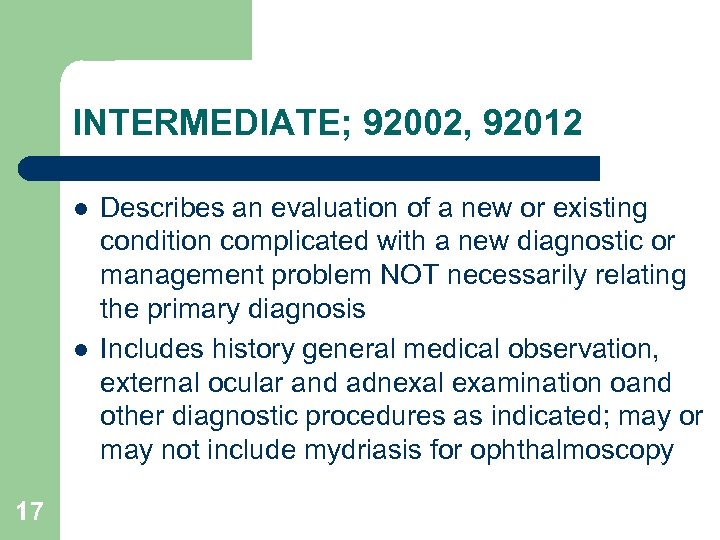

INTERMEDIATE; 92002, 92012 l l 17 Describes an evaluation of a new or existing condition complicated with a new diagnostic or management problem NOT necessarily relating the primary diagnosis Includes history general medical observation, external ocular and adnexal examination oand other diagnostic procedures as indicated; may or may not include mydriasis for ophthalmoscopy

92002, 92012 Examples l l Review of history, external examination, ophthalmoscopy, biomicroscopy for an acute complicated condition (such as iritis) not requiring comprehensive ophthalmological services Review of interval history, external examination, ophthalmoscopy, biomicroscopy and tonometry in established patient with known cataract not requiring comprehensive ophthalmological services

Reminder for Intermediate Service l 19 Even though fewer exam elements may be used, external examination/evaluation is a required element

Eye Codes 92 xxx Exams l l l 20 Documentation and coding criteria can vary from payer to payer. Some will want the 92 s to be non-medical Some will bundle the refraction in with the exam (not treat it as a separate procedure) Can go against CPT coding guidelines Sometimes, we have to “play the game” What does the contract SAY that your office signed?

21

Ophthalmological Testing Fundus Photography (92250), Visual Fields (92081 -92083), Scanning Laser (*9213292134) and most other ophthalmological testing is NOT bundled with the exam, so is separately reimbursed. If your claims are being denied, make sure your coding is correct and the referring physician information is entered on the claim. 22

Orders for Tests l l l 23 A physician’s ORDER for tests must be part of the patient’s medical record. The REASON for the test must be documented. Interpretation and Report (I&R) are part of the test procedure and MUST be included in the documentation. I&R should address findings, relevant clinical issues, and comparison of previous findings.

Co-pays, deductibles l l 24 The practice of waiving co-pays and or deductibles is likely to be a violation of the OIG (Office of Inspector General) False Claims Act. When you waive a co-pay or deductible, what you then submit on the insurance claim is not what you’re actually submitting for payment, which is an automatic violation of OIG and the False Claims Act.

NPI or National Provider Indentification number replaced the UPIN or Unique Physician Identification Number Why? There are not enough digits in the UPIN to mathematically allow for all the numbers needed for all providers l 25 25

PTAN or PIN l l 26 PTAN is the legacy (or historical) Provider Identification Number The NPI replaced the PTAN on claims, BUT is still required and needed for identification purposes 26

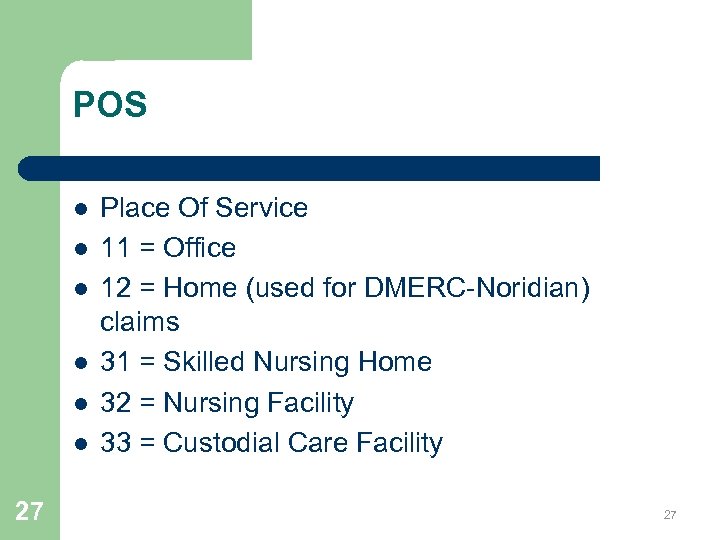

POS l l l 27 Place Of Service 11 = Office 12 = Home (used for DMERC-Noridian) claims 31 = Skilled Nursing Home 32 = Nursing Facility 33 = Custodial Care Facility 27

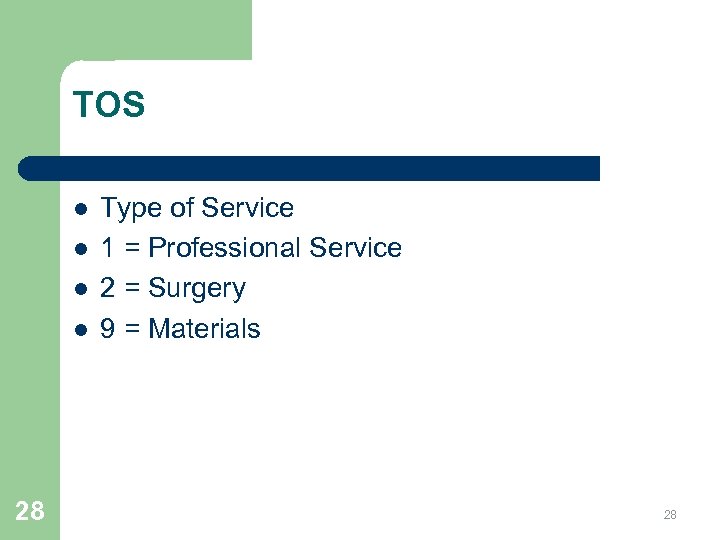

TOS l l 28 Type of Service 1 = Professional Service 2 = Surgery 9 = Materials 28

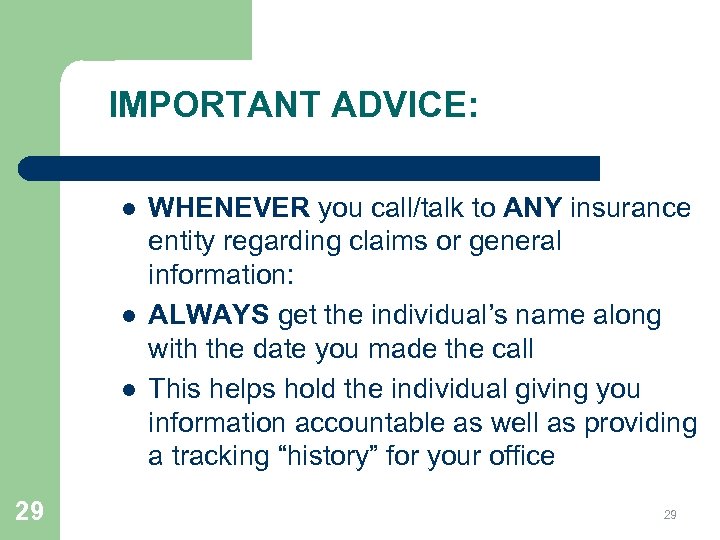

IMPORTANT ADVICE: l l l 29 WHENEVER you call/talk to ANY insurance entity regarding claims or general information: ALWAYS get the individual’s name along with the date you made the call This helps hold the individual giving you information accountable as well as providing a tracking “history” for your office 29

30

MEDICARE Optometry is Medicare Specialty “ 41” l Part A & B l Part A is hospital coverage only l Part B is for office visits and DME claims l The type of Medicare coverage a patient has is indicated on their Medicare ID card (This CAN change, so always ask to see their card) l 31 31

Medicare Coverage The Medicare Necessity Rules state Medicare pays for services or supplies that: *Not mainly for the convenience of the beneficiary or the beneficiary’s doctor *Do meet the standards of good medical practice in the local community 32

PART A l l l 33 Part A is hospital coverage ONLY You do not file Part A claims as a general rule Part A only concerns our claims if the patient is in a Part A stay. This is a temporary (up to 30 days) stay for a rehab situation 33

Example-Part A situation l l 34 If a Medicare patient is dispensed DMERC glasses (after cataract surgery) while in a SNF (skilled nursing facility) you will actually submit the claim to that SNF. This is due to the “global” arrangement the SNF has with Medicare. Any TC (technical component) element of a service such as visual fields or fundus photograph is billed to the SNF. The PC(professional component)(modifier 26), is submitted to insurance 34

TC & PC (26) Most testing procedures such as Visual Fields, Fundus Photography, Scanning Laser have a PC - professional component and a TC – technical component. Medicare has a separate allowable for each component. -For example: your office performs just the test – technical component – of scanning laser (9213392134) for another provider’s patient. The other provider will do the I&R (interpretation and report) which is the professional component. 35 35

MPPR-Multiple Procedure Payment Reduction l l 36 Affects services with TCs billed to Medicare Mainly special ophthalmological diagnostic services If MULTIPLE services WITH a TC are billed on the same date of service, Medicare will reduce the payment by 20% on only the TC of the lower value service(s) Does NOT affect the professional component (PC)

SEQUESTRATION l l l 37 Result of the federal government failing to agree on a deficit-reduction deal Once the patient’s deductible has been met, the Medicare payment will reflect a 2% reduction This did not affect the fee schedule You can NOT bill the patient; rather, it is an additional provider write-off (PWO) Affects both professional services and DME claims

MEDICARE Ask for the patient’s Medicare card. BY LAW, the provider must file with Medicare UNLESS the patient does not want the claim filed – BE SURE TO DOCUMENT The patient pays out-of-pocket The new HIPAA guidelines state that if a patient pays out-of-pocket, he/she has the right to tell the provider to NOT supply information to the insurance entity l 38 38

MEDICARE l l 39 Mandatory filing applies to both Par & Non-Par providers Not all beneficiaries are yet age 65 Part B deductible is $147. 00 for 2013 Part B deductible for 2014 remains at $147

Medicare l l l 40 Medicare pays 80% of the allowed charge after the deductible is satisfied Patient or supplement is responsible for the remaining 20% of the allowed charge. Remember, if you are a contracting provider, you must take a provider write-off of charges exceeding the Medicare allowable

Opting Out l l If you opt out of Medicare, you will not see those beneficiaries as patients Medicare providers are required to file claims regardless of being par or non-par; although non-par providers can choose on a case by case basis whether not to accept assignment

42

Medicare Requirements l l 43 Medicare contract requires providers bill the same for Medicare patients as for private/other insurance coverage (some sources state “not more”) SO: Same fees for same codes

TIMELY FILING-Medicare Rules regarding timely filing were revised in 2010 per CMS publication MLN Matters. MM 6960. Claims must be filed with the Medicare contractor no later than one calendar year (12 months) from the date of service – OR MEDICARE WILL DENY THOSE CLAIMS. 44 44

Timely Filing Do not bill the patient if original claim submitted is past timely filing. Exceptions could be made for Administrative error. This occurs when the filing deadline was not met caused by error or misrepresentation or an employee or the Medicare contractor. The timely filing could extend through the last day of the 6 th month following notice than an error was corrected. 45

MOST COMMON REASONS FOR DENIAL l l l 46 Invalid procedure Invalid or missing procedure modifier Missing referring physician information in 17 & 17 b Invalid to-from dates Truncated diagnosis – If an invalid dx is shown in field 21 -even if not used as a pointer, will cause the claim to deny. 46

REMITTANCE ADVICE l l 47 Pay close attention to the RA. It will provide information for how a claim was processed. Each procedure will have remark/action codes attached and the key for those remark/action codes will be found at the bottom of the RA. Processors as well as submitters make mistakes. 47

REFRACTION 92015 l l 48 92015 – Refraction became a separate procedure in 1992 It is it’s own CPT code. It is NOT bundled or included in other CPT codes Some payers will bundle on non-medical exams regardless of CPT If audited, you would be able to show the total billed is equal to the charges of the exam and refraction

49

PART B l l 50 Part B Medicare will be the vast majority of your Medicare claims. It will involve all professional office encounters and DMERC claims. (unless a Part A stay is in place at time of service (TOS) or date of service (DOS)) 50

51

SOCIAL SECURITY ACT l l l 52 Services to immediate relatives can NOT be billed to Medicare. VIOLATION OF THE SOCIAL SECURITY ACT INCLUDED: husband, wife, natural or adoptive parent, child and sibling; stepparent, stepchild, stepbrother, stepsister; in-laws, father, mother, son, daughter, brother, sister; grandparent and grandchild; spouse of 52 grandparent and grandchild.

ACRONYMS CERT – Comprehensive Error Rate Testing -A written request is sent to the provider -Providers must comply within 75 days (time sensitiveclaim could be denied) ADS – Automated Development Systems letter -Medicare is requesting further information from the provider MAP-Maximum Allowable Payment 53 53 PQRS – Physician Quality Reporting System

ACRONYMS l l l l RA – Remittance Advice EOB – Explanation of Benefits CC – Chief Complaint (reason for visit) OV – Office Visit or Encounter E & M – Evaluation & Management (99 xxx codes) CPT – Current Procedural Terminology ICD-9 – International Classification of Diseases CMS – Centers for Medicare & Medicaid Services 54 54

REFRACTION - 92015 l l l 55 1992 -became a separate code, not part of any other procedure code per CPT. Medicare does not cover it, but if it was performed, it must be billed. (but not mandatory to submit to Medicare) The provider cannot write that charge off as a general practice. That is considered fraud/abuse. 55

OIG l l 56 The Office of the Inspector General states that the practice of waiving copays or deductible violates the OIG regulations and False Claims Act. If there is an extreme hardship case, and not general practice, some exceptions exist.

GENERAL SUPERVISON GUIDELINES l l 57 Level 1 supervision Visual fields, fundus photography, external ocular photography, and scanning laser Can be performed without the doctor being in the office, but the doctor does need to be able to be reached by phone REMINDER: all the above have a TC & PC component and require I&R 57

58

GA, EY, KX, GZ l l l 59 GA – ABN in place (signed waiver) EY – (for DME) no physician order: used with ABN. *4 examples require mandatory use; AR (antireflective, tints, OS(oversize), polycarb KX – medically necessary-excluding UV(V 2755)already defined as medically necessary GZ – no ABN executed, but should have been *5 HCPCS codes

TC Only Service l l 60 When performing the technical component only do not bill the full global amount Another provider may request the test if he does not have the equipment That provider is the referring provider Match ordering provider’s Dx

MEDICARE Medicare handles professional service Part B claims. WPS-J 5: Iowa, Kansas, Missouri, Nebraska There are 15 A/B Medicare Administrative Contractors (MAC), including Railroad Medicare (Palmetto GBA). The RRMC patient ID cards begin with an alpha character/s followed by numbers. 61 61

General Claim Guidelines l l l 62 Procedure code line items are matched with the appropriate diagnosis code from field 19 Often there will be multiple diagnosis codes appropriate to the overall encounter; but the principle diagnosis code (reason for encounter) is to be listed 1 st. (Should relate back to the CC (chief complaint) Only one Dx is to be used per line item.

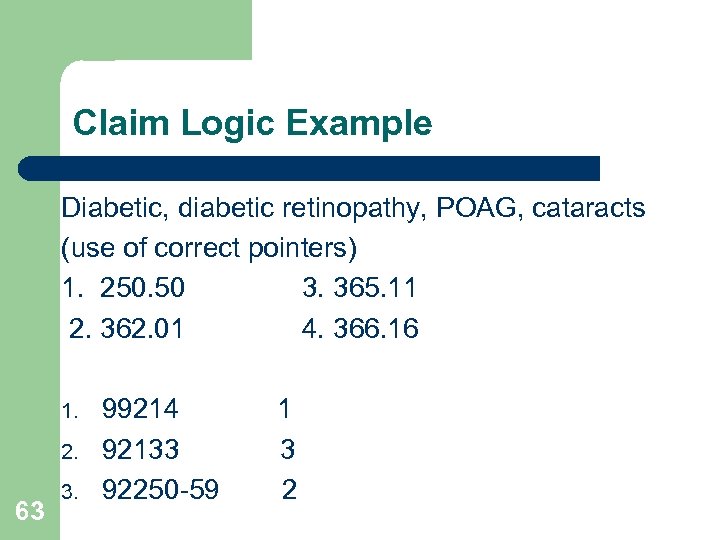

Claim Logic Example Diabetic, diabetic retinopathy, POAG, cataracts (use of correct pointers) 1. 250. 50 3. 365. 11 2. 362. 01 4. 366. 16 1. 2. 63 3. 99214 92133 92250 -59 1 3 2

DME l DME contractors l Handle all Medicare DMERC (Durable Medical Equipment) hardware claims For ODs: frames, lenses, contact lenses after cataract surgery l 64 64

DME MAC l l 65 Medicare beneficiaries are entitled to benefits on frames, and a pair of lenses after each surgery UNLESS the initial Rx is not ordered until after the 2 nd surgery Use your OD’s NPI for the referring physician – NOT the surgeon’s

DME Assignment Agreement Suppliers who violate assignment agreements could be charged up to $2000, up to 6 months imprisonment or both. An example would be charging or balance billing the patient when it should be a provider write-off (PWO) l 66

RISK l l 67 All it might take would be a complaint from a beneficiary Medicare takes complaints from beneficiaries very seriously

SIGNATURE ON FILE-needed for your provider to file claims on behalf of the patient. The patient will sign and date Your SOF form has to address Medicare separately from other insurance entities. l 68 68

HCFA 1500/CMS 1500 Form CMS 1500 has been revised – 02/12 Will accommodate changes to ICD-10 Expands # of diagnosis to 12 and are identified by alpha characters A-L, rather than by # No decimals used with the Dx Could use beginning 1/6/2014 Mandatory use as of April 1, 2014 69 69

CMS 1500 Provider Qualifiers l l l 70 Field 17 -Referring provider or other source Provider qualifiers will be used to identify: DN – Referring Provider DK – Ordering Provider DQ – Supervising Provider The qualifier will be entered to the left of the dotted vertical line in item 17

HCFA 1500 WARNING Word of Caution: Read the back of the 1500 form for the following warning: NOTICE: Any person who knowingly files a statement of claim containing any misrepresentation or any false, incomplete or misleading information may be guilty of a criminal act punishable under law and may be subject to civil penalties. l 71 71

ADVANCE BENEFICIARY NOTICE l l l 72 ABN – Advance Beneficiary Notice of Noncoverage -Must be date specific -Never have a patient sign a blank ABN Used to indicate procedures believed not to be covered by insurance Used as a waiver Not required for “statutorily” excluded services, such as the refraction or progressive lenses* 72

73

ABN The provider completes the top of the form; Notifier, Patient Name, ID number l Center (body) of Form, fields D, E, F; list items, reason for possible denial and estimated cost Commonly used reasons for noncoverage are: -Medicare does not pay for this test for your condition -Medicare does not pay for this test due to frequency -Medicare does not pay for experimental/research tests 74 -Medicare does not pay for not medically necessary item l

Unacceptable Narrative-ABN l 75 A statement such as “Medicare may not pay” is too general and does not allow the beneficiary to make an informed decision about whether or not to proceed with a service or order an item

Options on ABN Patient selects Option 1, 2, or 3 -Option 1: patient informed of non-coverage, but still wants items submitted -Option 2: patient informed, items wanted, provider does NOT have to submit -Option 3: patient does NOT want items/services listed & cannot be charged. *THIS IS AN IMPORTANT REASON FOR THE “ADVANCE” IN ABN. l 76

Refusal To Sign l 77 If a beneficiary refuses to sign a properly issued ABN, you should consider not furnishing the items or service

ABN The patient must sign and *date (*if the patient has physical difficulty writing and requests assistance, the notifier may insert the date) l The ABN protects both the beneficiary and the provider In general, keep the ABN for at least 5 years l The current revision is Form CMS-R-131 (03/11) 78

ABN & DME 79 The ABN is only *MANDATORY on 4(5) DME items (Noridian): A. R. , Tints, O. S. , Polycarb If these items are ONLY patient preference and not medically necessary, use the ABN and the EY modifier (no physician order) EY items must be on a separate claim (if patient selects option 1 on the ABN) -If option 2 is selected, those items do not have to be submitted Other deluxe items are defined as not medically necessary (per policy) and do NOT require the ABN

SUPPLIER STANDARDS l l l 80 30 Supplier Standards-for DME claims Federal requirement – not an option Indicates the provider adheres to government standards The patient must sign and date Used at the time of order 80

PROOF OF DELIVERY (Item #12 of Supplier Standards) “Proof of Delivery” – used for DME claims l Although not an individual form, this is a federal requirement. l The patient must sign and date when glasses are received. l Keep for 7 years l *This MUST also be the date of service. The order date is not (generally) the dispense or date received. 81 81 l

82

Surety Bond l l Part of the Social Security Act Physicians, including optometrists are currently EXEMPT from the requirements concerning surety bonds UNLESS: 83

Surety Bond Exception l l 84 Consumer- not your patient, but a Medicare beneficiary comes in with a script for hardware (materials) following cataract surgery: If you elect to fill this Rx without the consumer being your patient, you are required to have a surety bond. To avoid this situation, the consumer must be a patient. There often is reasonable medical justification for an office visit.

ACCREDITATION l 85 Optometrists are CURRENTLY exempt from the accreditation process

86

DMERC l l 87 (LCD L 51) V 43. 1 – Pseudophakia will be the diagnosis most used for DME claims. That states the patient has had cataract surgery with IOLs (intra-ocular lens). 379. 31 – Aphakia would be used IF the patient had cataract surgery with NO IOL. If 379. 31 is appropriate, be sure to state “true aphak-no IOL” in the narrative. These claims “tend” to get misprocessed, so providing this narrative may help. 87

DME CLAIMS l l 88 Your doctor name and NPI is to be used in field 17 & 17 b – NOT the surgeon’s. In the narrative state the surgery date, with IOL, rt – lt; whatever is appropriate. If Medicare has on file the surgery information, then this information is not needed. However, it will not hinder claim processing if that information is included. 88

DME CLAIMS l l l 89 Place of service is 12 Billed amounts reflect your U&C (usual and customary) charges. DATE OF SERVICE IS THE DISPENSE DATE 89

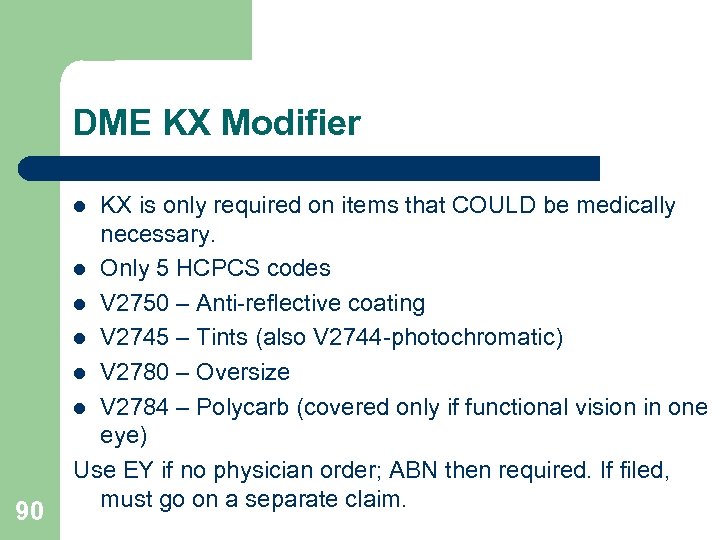

DME KX Modifier KX is only required on items that COULD be medically necessary. l Only 5 HCPCS codes l V 2750 – Anti-reflective coating l V 2745 – Tints (also V 2744 -photochromatic) l V 2780 – Oversize l V 2784 – Polycarb (covered only if functional vision in one eye) Use EY if no physician order; ABN then required. If filed, must go on a separate claim. l 90

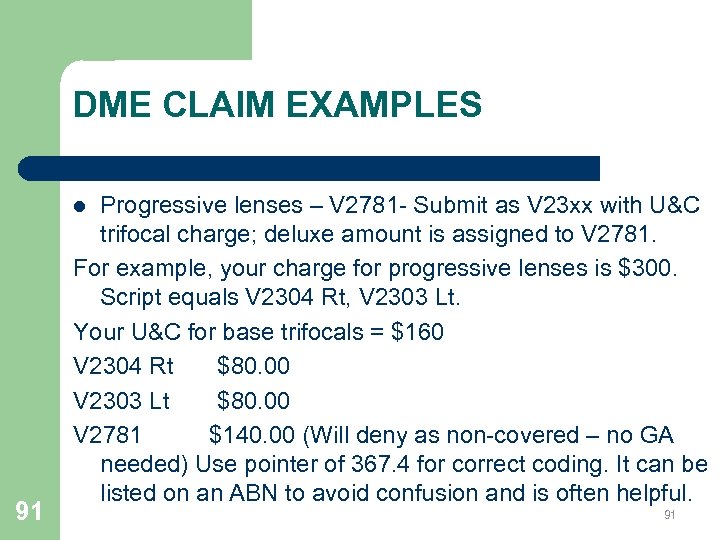

DME CLAIM EXAMPLES Progressive lenses – V 2781 - Submit as V 23 xx with U&C trifocal charge; deluxe amount is assigned to V 2781. For example, your charge for progressive lenses is $300. Script equals V 2304 Rt, V 2303 Lt. Your U&C for base trifocals = $160 V 2304 Rt $80. 00 V 2303 Lt $80. 00 V 2781 $140. 00 (Will deny as non-covered – no GA needed) Use pointer of 367. 4 for correct coding. It can be listed on an ABN to avoid confusion and is often helpful. l 91 91

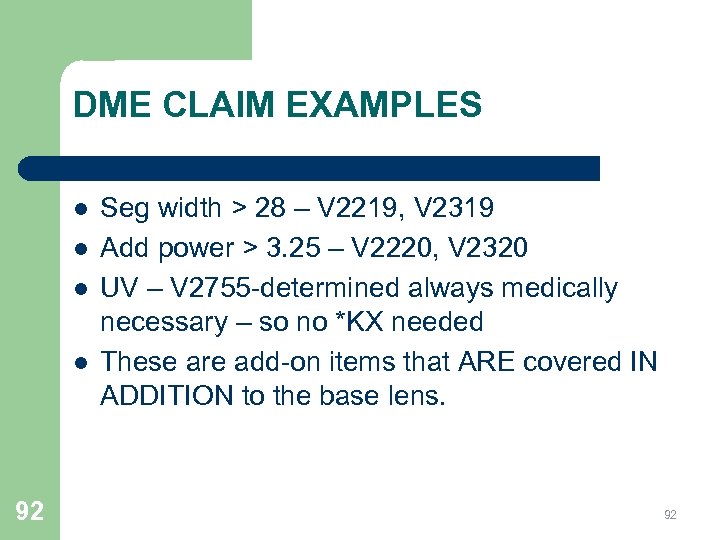

DME CLAIM EXAMPLES l l 92 Seg width > 28 – V 2219, V 2319 Add power > 3. 25 – V 2220, V 2320 UV – V 2755 -determined always medically necessary – so no *KX needed These are add-on items that ARE covered IN ADDITION to the base lens. 92

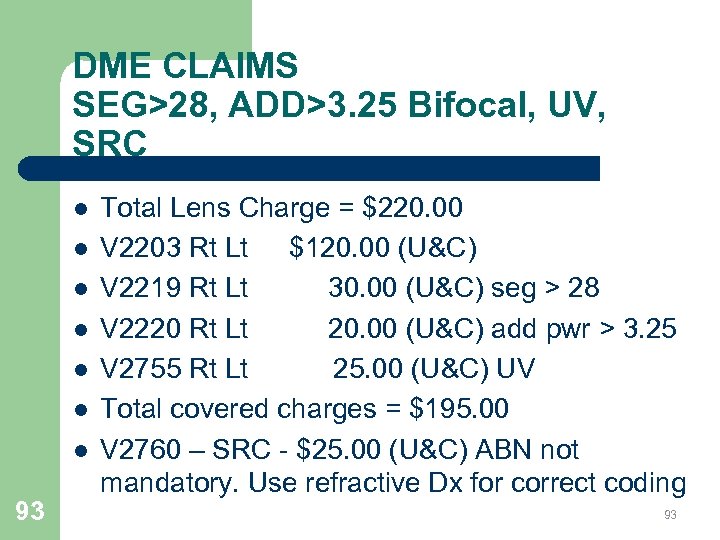

DME CLAIMS SEG>28, ADD>3. 25 Bifocal, UV, SRC l l l l 93 Total Lens Charge = $220. 00 V 2203 Rt Lt $120. 00 (U&C) V 2219 Rt Lt 30. 00 (U&C) seg > 28 V 2220 Rt Lt 20. 00 (U&C) add pwr > 3. 25 V 2755 Rt Lt 25. 00 (U&C) UV Total covered charges = $195. 00 V 2760 – SRC - $25. 00 (U&C) ABN not mandatory. Use refractive Dx for correct coding 93

DME CLAIM EXAMPLE Transition-V 2744 Transition lenses are normally not a true medical necessity, but usually includes UV which is a covered benefit to the patient. That charge needs to be broken out of the transition. Your additional charge for transition is $60. Your U&C for UV is $25. Submit the base lenses: V 2203 Rt Lt - $120 UV: V 2755 Rt Lt - $ 25 Transition: *V 2744 EY - $35 (separate claim) *Photochromatic – one of the 5 HCPCS l 94 94

DME CLAIM EXAMPLES Frame V 2020, Dlx Frame V 2025 l l l 95 Establish your standard frame charge. Use that same frame charge for all Medicare claims. Retail frame charge - $180. 00 (U&C) V 2020 $70. 00 (set your standard frame charge) V 2025 $110. 00 Again, the ABN is not mandatory. – Use a refractive Dx on deluxe items 95

FRAME ONLY A frame only may NOT be submitted to Noridian 96

DMERC l l 97 The DME allowed amounts are NOT to be used as your U&C charges. That is informational only. When patients receive an EOB (explanation of benefits) with a base pair of lenses being submitted and other covered lens items such as wide seg, it will look like you submitted for 2 pair of lenses. Be prepared to explain to the patient that Medicare requires we break all 97 charges down.

98

MEDICARE HMOs l l 99 Humana Gold, Advantra, etc. Medicare HMOs REPLACE Medicare. Claims are filed to the HMO, including hardware claims. Often the HMO takes the place of the supplemental insurance as well as Medicare 99

Medicare, Medicaid Overpayments Medicare and Medicaid overpayments must be returned within 60 days or face TRIPLE penalties. Not reporting/returning overpayments is a form of fraudulent billing. *per AOA NEWS, May 24, 2010 10 0

UPCOMING CHANGES ICD-9 will be replaced with ICD-10. By October 1, 2014 - ONLY ICD-10 diagnosis codes will be allowed. (but NOT before) ICD-10 could be related to a dictionary with more words. Still works the same way, just more codes (or words in the dictionary). l 10 1

WPS Medicare (J 5) # change l l l 10 2 Effective Feb 3, 2014, WPS Medicare will have a single toll-free number which will respond to your Medicare needs. It will guide you to Customer Service, Appeals, Electronic Data Interchange (EDI), Reopenings, and Provider Enrollment 866 -518 -3285 It does not include EFT, IVR, and Payment recovery. Those numbers can be found under “Contact Us”

10 3

a7c438640afddf701424b19d06f13f61.ppt