0872ebfde4ade2be0de73ca9c4000fd6.ppt

- Количество слайдов: 41

Lessons Learned about Anti. Bribery Foreign Corrupt Practices from Recent Cases Ted Acosta – Ernst & Young Keith Korenchuk – Covington & Burling Daniel Garen - Siemens

The Global Regulatory Maze • • • The FCPA OECD Convention on Combating Bribery U. K. Anti-Bribery Provisions Other Multilateral Initiatives Specific Country Laws/Guidelines – EU Directive 2001/83/EC • Industry Codes – – The WHO Criteria The IFPMA Code EFPIA Code ABPI Code

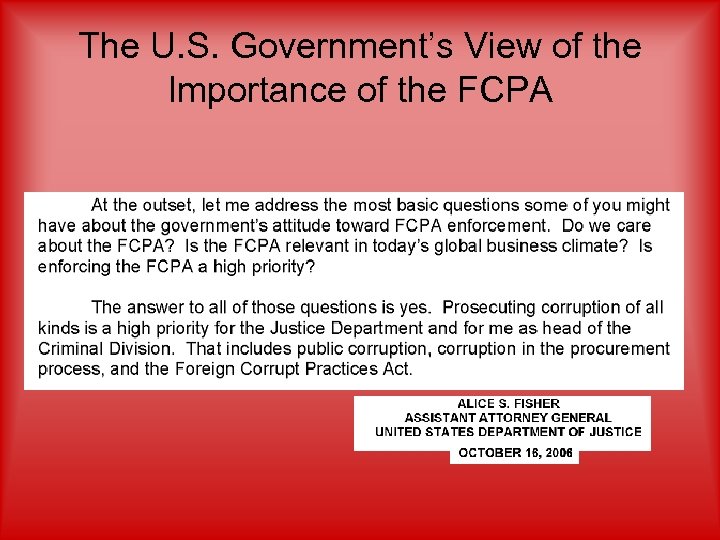

The U. S. Government’s View of the Importance of the FCPA

The Foreign Corrupt Practices Act The FCPA addresses the prohibition against foreign bribery. The bribery provisions of the FCPA apply to all companies, regardless of whether they have stock registered with the SEC. The FCPA also sets forth provisions on record-keeping and accounting practices which are aimed at prohibiting the establishment of corporate slush funds used to finance illegal payments. The record-keeping and accounting provisions apply to all U. S. companies that have stock registered with the SEC and not just those with foreign operations.

FCPA Details: How Are the FCPA Bribery Provisions Violated? • An offer, payment or gift of any money or thing of value is made • To any foreign official or other person while knowing that some or all of the payment will be passed on to a foreign official • For the purpose of obtaining or retaining business or obtaining any improper advantage

FCPA Details: When Is a Payment "Improper"? • A payment is for the purpose of obtaining or retaining business if it is made to reward a foreign official for using or endorsing the company’s products • A payment is for the purpose of obtaining an improper advantage if it is made to obtain a favourable regulatory decision

FCPA Details: How Are the FCPA Accounting Provisions Violated? A company and its subsidiaries must maintain accurate books and records that reflect transactions in reasonable detail u A company and its subsidiaries must maintain appropriate controls • Showing a bribe on the books as a payment for a consulting arrangement is a violation • Supporting payment of bribe with an invoice for a consulting arrangement is maintaining a false record u

FCPA Details: Who Is a "Foreign Official"? Anyone employed by a government agency, or by a government-owned commercial enterprise, including physicians or other healthcare professionals

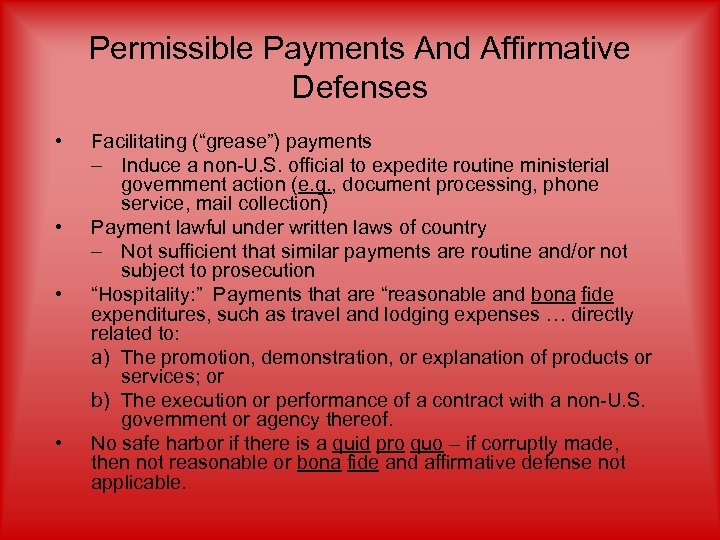

Permissible Payments And Affirmative Defenses • • Facilitating (“grease”) payments – Induce a non-U. S. official to expedite routine ministerial government action (e. g. , document processing, phone service, mail collection) Payment lawful under written laws of country – Not sufficient that similar payments are routine and/or not subject to prosecution “Hospitality: ” Payments that are “reasonable and bona fide expenditures, such as travel and lodging expenses … directly related to: a) The promotion, demonstration, or explanation of products or services; or b) The execution or performance of a contract with a non-U. S. government or agency thereof. No safe harbor if there is a quid pro quo – if corruptly made, then not reasonable or bona fide and affirmative defense not applicable.

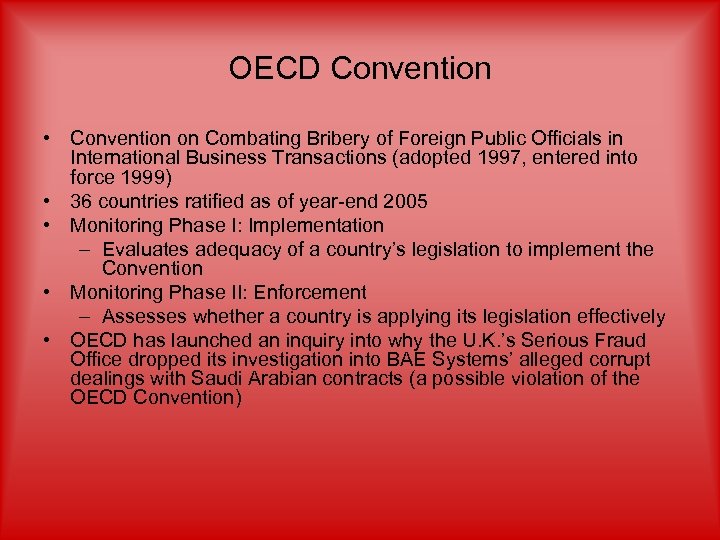

OECD Convention • Convention on Combating Bribery of Foreign Public Officials in International Business Transactions (adopted 1997, entered into force 1999) • 36 countries ratified as of year-end 2005 • Monitoring Phase I: Implementation – Evaluates adequacy of a country’s legislation to implement the Convention • Monitoring Phase II: Enforcement – Assesses whether a country is applying its legislation effectively • OECD has launched an inquiry into why the U. K. ’s Serious Fraud Office dropped its investigation into BAE Systems’ alleged corrupt dealings with Saudi Arabian contracts (a possible violation of the OECD Convention)

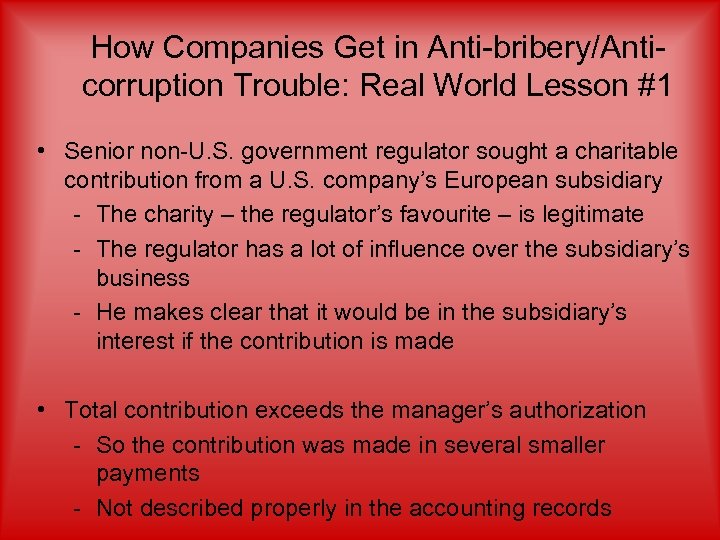

How Companies Get in Anti-bribery/Anticorruption Trouble: Real World Lesson #1 • Senior non-U. S. government regulator sought a charitable contribution from a U. S. company’s European subsidiary - The charity – the regulator’s favourite – is legitimate - The regulator has a lot of influence over the subsidiary’s business - He makes clear that it would be in the subsidiary’s interest if the contribution is made • Total contribution exceeds the manager’s authorization - So the contribution was made in several smaller payments - Not described properly in the accounting records

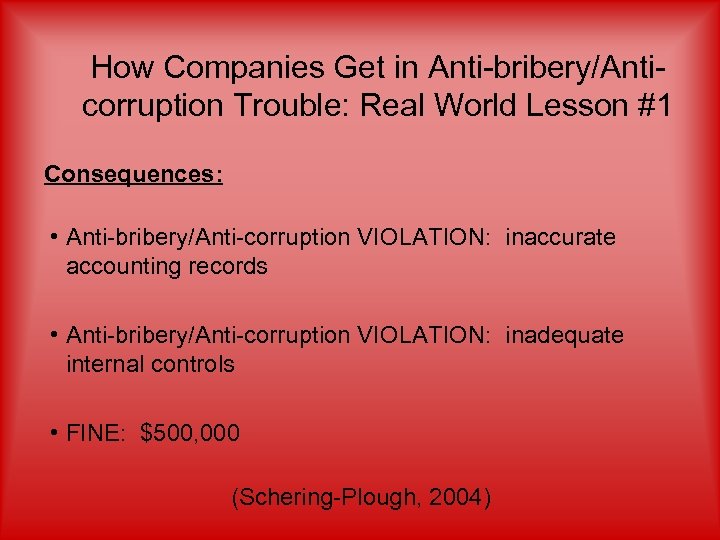

How Companies Get in Anti-bribery/Anticorruption Trouble: Real World Lesson #1 Consequences: • Anti-bribery/Anti-corruption VIOLATION: inaccurate accounting records • Anti-bribery/Anti-corruption VIOLATION: inadequate internal controls • FINE: $500, 000 (Schering-Plough, 2004)

How Companies Get in Anti-bribery/Anticorruption Trouble: Real World Lesson #1 Lesson: Companies must have standard due diligence procedures and controls governing charitable contributions

How Companies Get in Anti-bribery/Anticorruption Trouble: Real World Lesson #2 • Several subsidiaries of a U. S. healthcare company gave commissions and “gifts” to non-U. S. doctors – Cash, computers, digital cameras, wine, wristwatches – Leisure travel and sponsoring lavish social events • Officers of the U. S. parent company knew about the gifts • The gifts were not properly recorded – Recorded as capital or business expenses – On the books of a foreign subsidiary (enforcement was less strict)

How Companies Get in Anti-bribery/Anticorruption Trouble: Real World Lesson #2 Consequences: • Anti-bribery/Anti-corruption VIOLATION: anti-bribery provisions • Anti-bribery/Anti-corruption VIOLATION: accounting and internal controls provisions • FINES & PENALTIES: $2. 5 million • EXTERNAL Anti-bribery/Anti-corruption MONITOR (Syncor, 2002)

How Companies Get in Anti-bribery/Anticorruption Trouble: Real World Lesson #2 Lesson: Companies must have clear policies and procedures governing gifts and entertainment provided to non-U. S. healthcare providers and other government officials

How Companies Get in Anti-bribery/Anticorruption Trouble: Real World Lesson #3 • A U. S. manufacturer had a global distribution network of independent dealers • One dealer paid bribes to government officials to avoid penalties for late delivery • Executives of the manufacturer knew there was a high probability of bribery were paid, and took no action – In one case, they even authorized payments that helped subsidize the dealer’s cost for paying the bribes – They also knew there was a high probability that similar payments were made in other markets

How Companies Get in Anti-bribery/Anticorruption Trouble: Real World Lesson #3 Consequences: • Anti-bribery/Anti-corruption VIOLATION: anti-bribery provision • Anti-bribery/Anti-corruption VIOLATION: inaccurate accounting records, inadequate internal controls • DISGORGEMENT OF PROFITS: $618, 000 • CIVIL PENALTY: $500, 000 • MONITORING: External compliance monitor imposed on company for two years • ENFORCEMENT ACTION: Sales Manager charged with Antibribery/Anti-corruption violation; $65, 000 fine (Invision, 2005)

How Companies Get in Anti-bribery/Anticorruption Trouble: Real World Lesson #3 Lesson: Companies must have standard due diligence procedures and controls for selecting, retaining and overseeing distributors, consultants, and other key third parties

How Companies Get in Anti-bribery/Anticorruption Trouble: Real World Lesson #4 • A company was tendering in a developing country • Company sponsored “training” programs and travel for several government employees who were responsible for evaluating the company’s offer • Company paid all expenses and “per diem” payments to the government employees of $120 -$200 per day – The average income in the government employees’ country was under $800 per year – The “per diem” payments were distributed in cash from a paper bag and were disguised using false invoices

How Companies Get in Anti-bribery/Anticorruption Trouble: Real World Lesson #4 Consequences: • Anti-bribery/Anti-corruption VIOLATION: anti-bribery provisions • Anti-bribery/Anti-corruption VIOLATION: accounting provisions • FINE: $13 million • DISGORGEMENT: $15. 5 million (Titan, 2005)

How Companies Get in Anti-bribery/Anticorruption Trouble: Real World Lesson #4 Lesson: Companies must have clear procedures that are designed to prevent and detect potentially improper sponsorship and travel expenditures

FCPA - Accounting Practices, Recordkeeping, and Internal Controls • Despite the recent focus on bribery of foreign officials, the FCPA has much broader application • The FCPA imposes on public companies (SEC registrants) specific requirements for accounting, record-keeping and internal controls • These provisions are designed to complement the anti-bribery focus of the FCPA by making it much harder for companies to make – and hide – corrupt payments • At the same time, these requirements apply to ALL of the registrant’s books and records and transactions, not just those that are somehow related to foreign government officials or overseas business

![FCPA - Accounting and Internal Control Requirements • Issuer must “[m]ake and keep books, FCPA - Accounting and Internal Control Requirements • Issuer must “[m]ake and keep books,](https://present5.com/presentation/0872ebfde4ade2be0de73ca9c4000fd6/image-24.jpg)

FCPA - Accounting and Internal Control Requirements • Issuer must “[m]ake and keep books, records, and accounts, which, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the issuer. ” • Issuer must also “devise and maintain a system of internal accounting control sufficient to provide reasonable assurances” that: • Transactions are executed and access to assets is permitted only in accordance with management authorization and that • Transactions are recorded in a way to permit financial statements to be prepared in accordance with GAAP.

FCPA - Accounting and Internal Control Requirements • “Reasonable detail” and “reasonable assurance” mean the level of detail and degree of assurance as would satisfy prudent officials in the conduct of their own affairs. • No direct knowledge requirement – Issuer is subject to penalties even if issuer’s officers do not know of the inaccuracies – Effectively strict liability for inaccurate books of all subsidiaries whose books roll up into issuer’s financial statements • Requires issuer to exercise control over books and records of foreign subs and other controlled entities • A bribe to a foreign official must be recorded as a bribe, not as a “fee” or other seemingly innocuous transaction • Records violations can occur in immaterial contexts.

FCPA – Accounting Requirements • All amounts must be accurately recorded on the company’s books • Reasonable detail means such level that would satisfy prudent officials in the conduct of their own affairs • There is NO MATERIALITY STANDARD under the FCPA, all funds must be recorded accurately regardless of amount • Inadvertent mistakes will not give rise to enforcement actions or prosecution

FCPA – Accounting Requirements • Violations include: – Records that simply fail to record improper transactions – Records that are falsified to disguise aspects of improper transactions that were otherwise recorded correctly – Records that correctly set forth the quantitative aspects of the transactions but fail to record the qualitative aspects of the transactions that would have revealed their illegality or impropriety

FCPA – Accounting Requirements • Examples of transactions often recorded improperly: – Bribes to foreign government officials – Payments to agents – Commercial bribes or kickbacks – Expediting payments on imports/exports – Facilitating payments – Gifts – Excessive entertainment

FCPA – Accounting Requirements • Examples of FCPA Accounting Violations: – Knowingly false invoice paid and kept in company’s files – Knowingly false description of improper payment on employee’s T&E – Booking a bribe as a facilitating payment – Booking a bribe as a fee-for-service payment – Booking a bribe as a “promotional” expense – Making an improper payment out of subsidiary A on behalf of subsidiary B and then recording it on the books of subsidiary A

FCPA – Accounting Requirements Bottom Line: If you have an improper transaction, and it is not fully disclosed in the business or accounting records, you may have an FCPA “Books and Records” violation

FCPA – Internal Control Provisions • Issuer must devise and maintain a system of internal accounting control sufficient to provide reasonable assurances that: – Transactions are executed and access to assets is permitted only in accordance with management authorization and, that – Transactions are recorded in a way to permit financial statements to be prepared in accordance with GAAP. • Reasonable assurance – the level of assurance as would satisfy prudent officials in the conduct of their own affairs.

FCPA – Internal Control Provisions • Typical FCPA Internal Control Issues: – Unauthorized payments/off-books accounts – Payments contrary to company policies – Payments without prior due diligence – Payments just under authority limits – Payments without adequate documentation

FCPA – Internal Control Provisions • Key Elements: – Accounting and financial controls surrounding cash, petty cash, expense authorization and reimbursement – Controls around gift giving, travel and entertainment of government officials, and charitable contributions including pre-approval process and transparency for transactions – Controls around the selection and approval of vendors and third parties, including consultants – Controls around fee-for-service arrangements, tender processes, and – Documentation of FCPA internal control processes

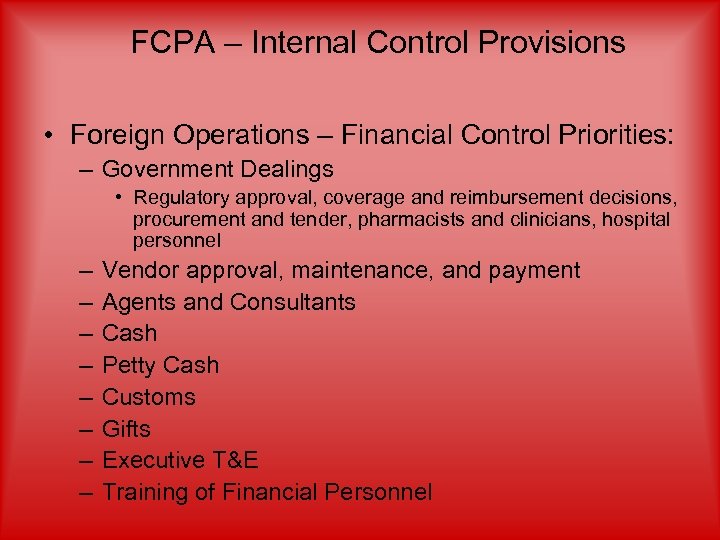

FCPA – Internal Control Provisions • Foreign Operations – Financial Control Priorities: – Government Dealings • Regulatory approval, coverage and reimbursement decisions, procurement and tender, pharmacists and clinicians, hospital personnel – – – – Vendor approval, maintenance, and payment Agents and Consultants Cash Petty Cash Customs Gifts Executive T&E Training of Financial Personnel

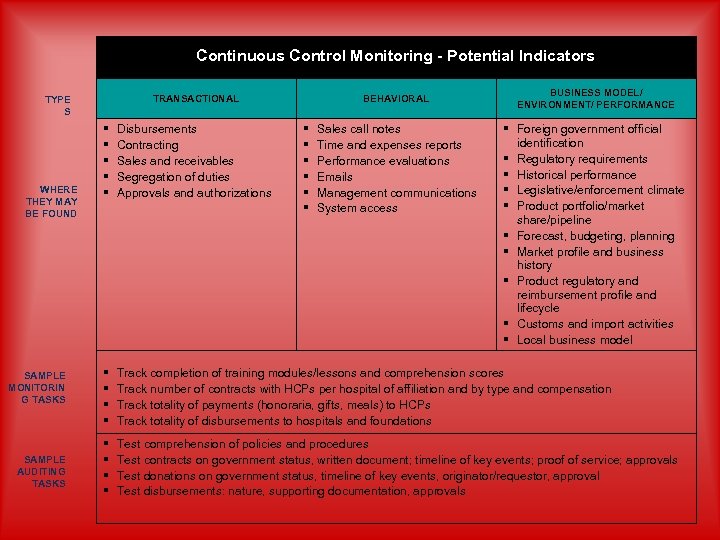

Continuous Control Monitoring - Potential Indicators TRANSACTIONAL TYPE S WHERE THEY MAY BE FOUND SAMPLE MONITORIN G TASKS SAMPLE AUDITING TASKS BEHAVIORAL § § § BUSINESS MODEL/ ENVIRONMENT/ PERFORMANCE § § § Disbursements Contracting Sales and receivables Segregation of duties Approvals and authorizations § § Track completion of training modules/lessons and comprehension scores Track number of contracts with HCPs per hospital of affiliation and by type and compensation Track totality of payments (honoraria, gifts, meals) to HCPs Track totality of disbursements to hospitals and foundations § § Test comprehension of policies and procedures Test contracts on government status, written document; timeline of key events; proof of service; approvals Test donations on government status, timeline of key events, originator/requestor, approval Test disbursements: nature, supporting documentation, approvals Sales call notes Time and expenses reports Performance evaluations Emails Management communications System access § Foreign government official identification § Regulatory requirements § Historical performance § Legislative/enforcement climate § Product portfolio/market share/pipeline § Forecast, budgeting, planning § Market profile and business history § Product regulatory and reimbursement profile and lifecycle § Customs and import activities § Local business model

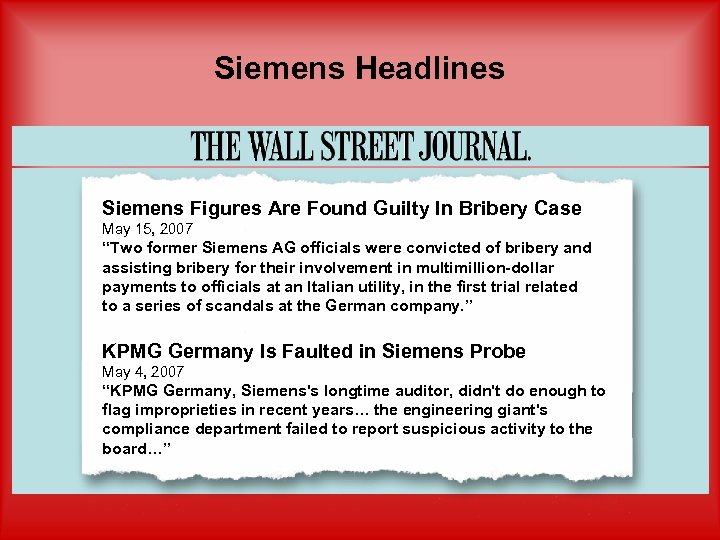

Siemens Headlines Siemens Figures Are Found Guilty In Bribery Case May 15, 2007 “Two former Siemens AG officials were convicted of bribery and assisting bribery for their involvement in multimillion-dollar payments to officials at an Italian utility, in the first trial related to a series of scandals at the German company. ” KPMG Germany Is Faulted in Siemens Probe May 4, 2007 “KPMG Germany, Siemens's longtime auditor, didn't do enough to flag improprieties in recent years… the engineering giant's compliance department failed to report suspicious activity to the board…”

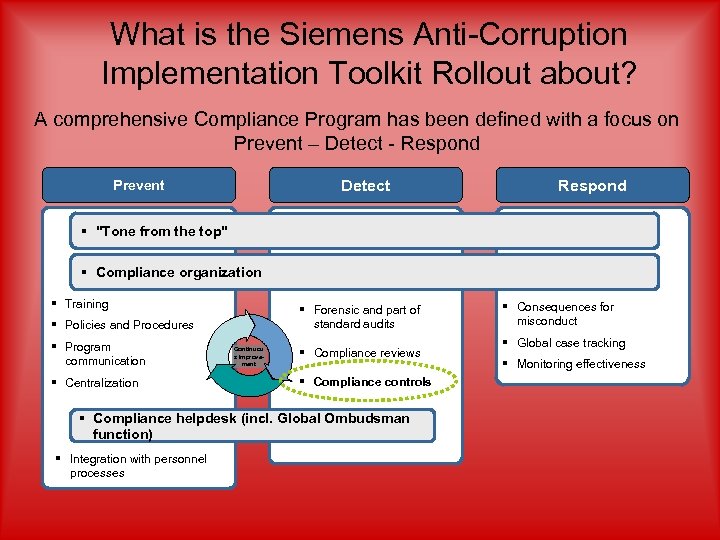

What is the Siemens Anti-Corruption Implementation Toolkit Rollout about? A comprehensive Compliance Program has been defined with a focus on Prevent – Detect - Respond Detect Prevent Respond § "Tone from the top" § Compliance organization § Training § Forensic and part of standard audits § Policies and Procedures § Program communication § Centralization Continuou s improvement § Compliance reviews § Compliance controls § Compliance helpdesk (incl. Global Ombudsman function) § Integration with personnel processes § Consequences for misconduct § Global case tracking § Monitoring effectiveness

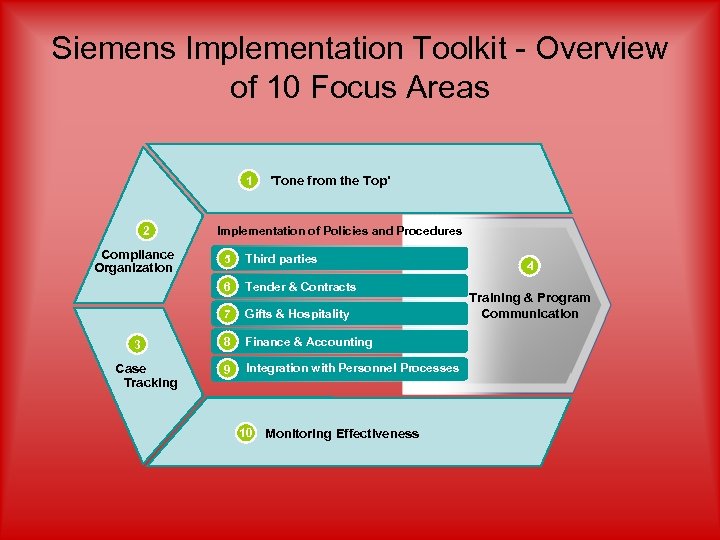

Siemens Implementation Toolkit - Overview of 10 Focus Areas 1 2 Compliance Organization 'Tone from the Top' Implementation of Policies and Procedures Tender & Contracts 7 Case Tracking Third parties 6 3 5 Gifts & Hospitality 8 Finance & Accounting 9 Integration with Personnel Processes 10 Monitoring Effectiveness 4 Training & Program Communication

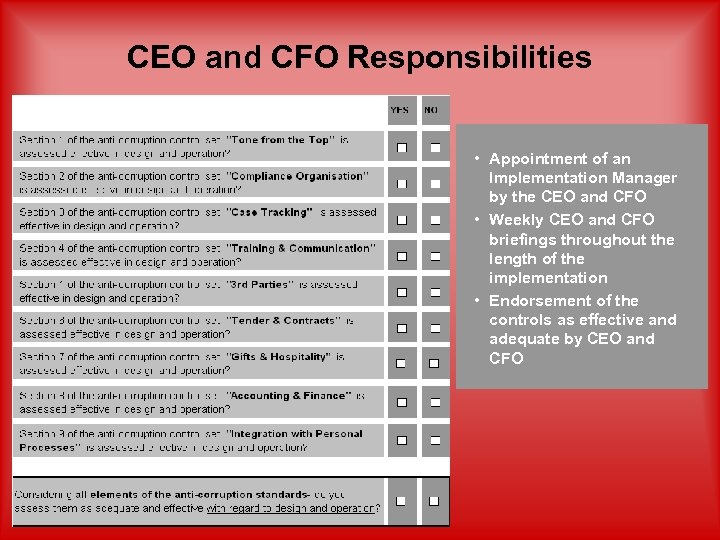

CEO and CFO Responsibilities • Appointment of an Implementation Manager by the CEO and CFO • Weekly CEO and CFO briefings throughout the length of the implementation • Endorsement of the controls as effective and adequate by CEO and CFO

Ongoing Interactions

0872ebfde4ade2be0de73ca9c4000fd6.ppt