d39558565069cd88b5e2a74b1d25ebc1.ppt

- Количество слайдов: 19

Lesson 5. 2 Banking Services and Fees Learning Objectives LO 2 -1 Describe banking services available at most financial institutions. LO 2 -2 List and explain fees charged by banks for their services. Chapter 5 © 2010 South-Western, Cengage Learning © 2016 South-Western, Cengage Learning SLIDE 1

Banking Services n A full-service bank is one that offers every possible kind of service, from savings and checking accounts to credit cards, safe deposit boxes, loans, and ATMs. n Other services commonly offered are online banking, telephone banking, certified checks, cashier’s checks, money orders, and debit cards. n Most banks offer FDIC (Federal Deposit Insurance Corporation) insurance, which protects the deposits of customers against loss up to $250, 000 per account. Chapter 5 © 2010 South-Western, Cengage Learning © 2016 South-Western, Cengage Learning SLIDE 2

Guaranteed-payment Checks n A certified check is a personal check that the bank guarantees or certifies to be good. n A cashier’s check, also called a bank draft, is a check written by a bank on its own funds. n Traveler’s checks are check forms in specific denominations that are used instead of cash while traveling. Chapter 5 © 2010 South-Western, Cengage Learning © 2016 South-Western, Cengage Learning SLIDE 3

Money Orders n Banks sell money orders to people who do not wish to use cash or do not have a checking account. n A money order is like a check, except that it can never bounce. n There is a charge for purchasing a money order. n You also can purchase money orders through the post office and local merchants. Chapter 5 © 2010 South-Western, Cengage Learning © 2016 South-Western, Cengage Learning SLIDE 4

Debit Cards n A debit card is a plastic card that deducts money from a checking account almost immediately to pay for purchases. n The debit card is presented at the time of purchase. n The amount of the purchase is quickly deducted from the customer’s checking account and paid to the merchant. Chapter 5 © 2010 South-Western, Cengage Learning © 2016 South-Western, Cengage Learning SLIDE 5

Bank Credit Cards n You can apply to a full-service bank for a bank credit card, such as a Visa or Master. Card. n If you meet the requirements and are issued a card, you can use it instead of cash at any business that accepts credit cards. n Banks offering national credit cards usually charge both an annual fee for use of the card and interest on the unpaid account balance. Chapter 5 © 2010 South-Western, Cengage Learning © 2016 South-Western, Cengage Learning SLIDE 6

Debit Card vs Credit Card Chapter 9 © 2010 South-Western, Cengage Learning SLIDE 7

Overdraft Protection n Overdraft protection allows you to cover checks or withdrawals up to a specified amount, usually between $100 and $1, 000, depending on the typical balance in your account. n With overdraft protection, your checks will be covered even if you have insufficient funds in your checking account. Chapter 5 © 2010 South-Western, Cengage Learning © 2016 South-Western, Cengage Learning SLIDE 8

Automated Teller Machines n An automated teller machine is also called an ATM. n To use ATMs, you must n Have a card that is electronically coded n Know your personal identification number (PIN) n Getting cash is a common ATM transaction. n Using a debit card, you can withdraw cash from your checking or savings account. n Using a Visa or Master. Card, you can receive a cash advance electronically. Chapter 5 © 2010 South-Western, Cengage Learning © 2016 South-Western, Cengage Learning SLIDE 9

Online and Telephone Banking n Online and telephone banking services let you access your accounts from a computer or telephone any time, day or night. n Services include: n Transferring money from one account to another n Paying bills by authorizing the bank to disburse money n Getting account balances n Seeing which checks have cleared and which deposits have been entered Chapter 5 © 2010 South-Western, Cengage Learning © 2016 South-Western, Cengage Learning SLIDE 10

(continued) Online and Telephone Banking n Most banks also allow and encourage electronic transfers of money. n An electronic funds transfer (EFT) uses a computer-based system that enables you to move money from one account to another without writing a check or exchanging cash. Chapter 5 © 2010 South-Western, Cengage Learning © 2016 South-Western, Cengage Learning SLIDE 11

Stop Payment Orders n A stop-payment order is a request that the bank not honor a specific check. n The usual reason for stopping payment is that the check has been lost or stolen. n Most banks charge a fee for stopping payment on a check. Chapter 5 © 2010 South-Western, Cengage Learning © 2016 South-Western, Cengage Learning SLIDE 12

Safe Deposit Boxes n Financial institutions offer customers a safe deposit box to store valuable items or documents. n They charge a yearly fee based on the size of the box. n Keeping important documents and other items in a safe deposit box ensures that they won’t be stolen, lost, or destroyed. Chapter 5 © 2010 South-Western, Cengage Learning © 2016 South-Western, Cengage Learning SLIDE 13

(continued) Safe Deposit Boxes n Examples of items commonly kept in a safe deposit box include n Birth, marriage, and death certificates n Deeds and mortgage papers n Stocks and bonds n Jewelry n Coin collections Chapter 5 © 2010 South-Western, Cengage Learning © 2016 South-Western, Cengage Learning SLIDE 14

Loans and Trusts n Financial institutions make loans to finance the purchase of cars, home improvements, vacations, and other items. n Banks can also provide advice for estate planning and trusts. n Banks can act as trustees of estates for minors and others. n A trustee is a person or an institution that manages property for the benefit of someone else under a special agreement. Chapter 5 © 2010 South-Western, Cengage Learning © 2016 South-Western, Cengage Learning SLIDE 15

Notary Public n A notary public verifies a person’s identity, witnesses the person’s signature on a legal document, and then “notarizes” the signature as valid. n Financial institutions typically have a person on their staff who is a notary public. n This person provides notary services for account holders, usually without charge. n For noncustomers, there is typically a small fee. Chapter 5 © 2010 South-Western, Cengage Learning © 2016 South-Western, Cengage Learning SLIDE 16

Financial Services n Purchasing or selling savings bonds n Investment brokerage services Chapter 5 © 2010 South-Western, Cengage Learning © 2016 South-Western, Cengage Learning SLIDE 17

Bank Fees n Banks charge fees to their customers to help cover their operating costs. n The best way to avoid fees is to choose the right kind of account. n Shop around and find an account that is right for you. n Be aware of the rules of your account, so that you don’t violate them and have to pay high fees. Chapter 5 © 2010 South-Western, Cengage Learning © 2016 South-Western, Cengage Learning SLIDE 18

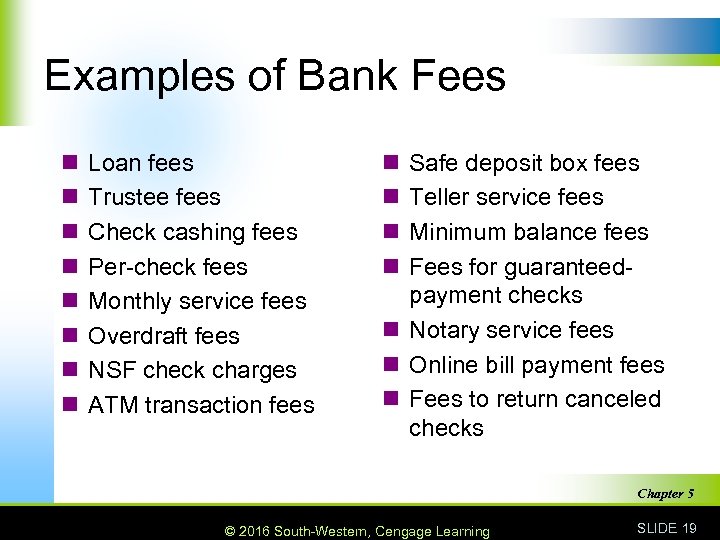

Examples of Bank Fees n n n n Loan fees Trustee fees Check cashing fees Per-check fees Monthly service fees Overdraft fees NSF check charges ATM transaction fees n n Safe deposit box fees Teller service fees Minimum balance fees Fees for guaranteedpayment checks n Notary service fees n Online bill payment fees n Fees to return canceled checks Chapter 5 © 2010 South-Western, Cengage Learning © 2016 South-Western, Cengage Learning SLIDE 19

d39558565069cd88b5e2a74b1d25ebc1.ppt