2965a3e5ab58d6d1a738c929dfcd09f2.ppt

- Количество слайдов: 23

Lesson 16 -2 -2016 • Money market and the crisis

Lesson 16 -2 -2016 • Money market and the crisis

Money market • Decentralized payments system

Money market • Decentralized payments system

Single big bank • Idealized world • Everyone has a deposit account and a line of credit at a single big bank.

Single big bank • Idealized world • Everyone has a deposit account and a line of credit at a single big bank.

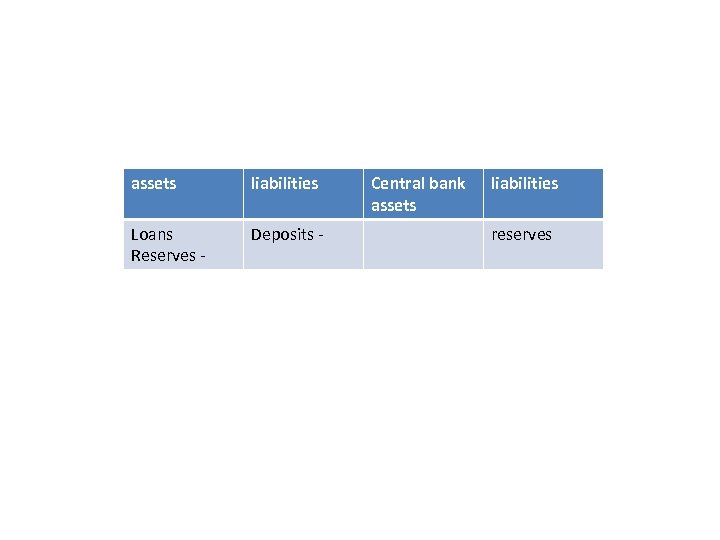

assets liabilities Loans Reserves - Deposits - Central bank assets liabilities reserves

assets liabilities Loans Reserves - Deposits - Central bank assets liabilities reserves

Endogenous money • • • Endogenous money First come loans Then deposits Then reserves Not the reverse

Endogenous money • • • Endogenous money First come loans Then deposits Then reserves Not the reverse

• After the loan has been granted and deposit created the bank balance sheet is balanced but as the depositor draws down the its deposit to pay another person the bank loan must be funded either by attracting new depositors or by interbank borrowing or new reserves at the central bank. The central banks grants reserves at a cost which is represented by the interest rate.

• After the loan has been granted and deposit created the bank balance sheet is balanced but as the depositor draws down the its deposit to pay another person the bank loan must be funded either by attracting new depositors or by interbank borrowing or new reserves at the central bank. The central banks grants reserves at a cost which is represented by the interest rate.

• If there is a single bank then the depositor drawing down will be credited to another acount at the same bank thus not requiring anything to change. Total assets and liabilities of the big bank remain the same. • In case of many banks then their credit and debit positions due to depositors operations will be settled by means of changes in their reserve accounts at the central bank.

• If there is a single bank then the depositor drawing down will be credited to another acount at the same bank thus not requiring anything to change. Total assets and liabilities of the big bank remain the same. • In case of many banks then their credit and debit positions due to depositors operations will be settled by means of changes in their reserve accounts at the central bank.

Single bank • Alll payments imply entries on the books of the bank.

Single bank • Alll payments imply entries on the books of the bank.

Total assets unchanged • Net depositor A pays net depositor B by oredering the bank to debit his account and credit B’s account • Total bank liabilities and assets are unchanged. • It all works so long as chash outflows and inflows on the books fo the single big banks are equal.

Total assets unchanged • Net depositor A pays net depositor B by oredering the bank to debit his account and credit B’s account • Total bank liabilities and assets are unchanged. • It all works so long as chash outflows and inflows on the books fo the single big banks are equal.

Money market • In the real world we do not have a single big • Bank but a single integrated banking system • And key to that integration is the money market.

Money market • In the real world we do not have a single big • Bank but a single integrated banking system • And key to that integration is the money market.

payments • When depositor A pays depositor B there is a debit to A’s account at A’s bank and a credit to B’s account at B’s bank and a corresponding debit to the reserve account of A’s bank and a credit to the reserve account of B’s bank.

payments • When depositor A pays depositor B there is a debit to A’s account at A’s bank and a credit to B’s account at B’s bank and a corresponding debit to the reserve account of A’s bank and a credit to the reserve account of B’s bank.

• Pyment s elalsticity depends on interbank credit to relax the reserve constraint facing individual banks.

• Pyment s elalsticity depends on interbank credit to relax the reserve constraint facing individual banks.

• In the world before 2007 banks had almost no reserves at the central bank and settled accounts largely by borrowing and lending in the money market.

• In the world before 2007 banks had almost no reserves at the central bank and settled accounts largely by borrowing and lending in the money market.

Federal funds market • The central mechanism for this type of interbank credit is the federal funds market where banks borrow and lend deposits at he Federal reserve in order to keep their net balances near zero.

Federal funds market • The central mechanism for this type of interbank credit is the federal funds market where banks borrow and lend deposits at he Federal reserve in order to keep their net balances near zero.

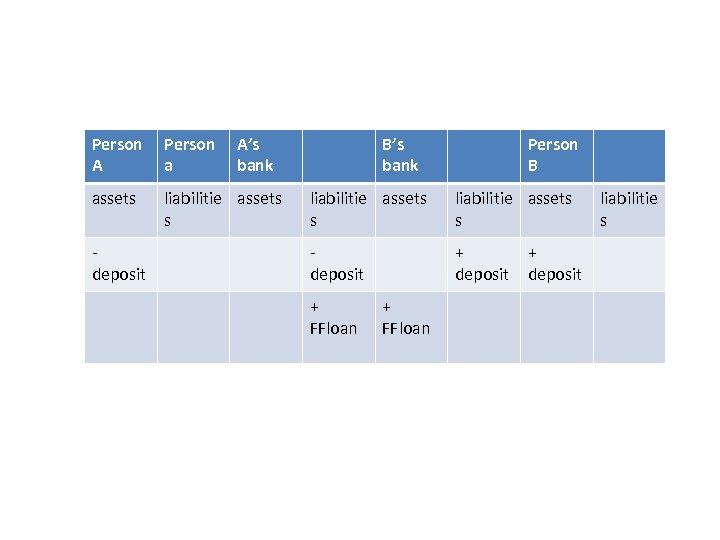

Interbank credit changes • In the transaction between A and B total retail bank deposits do not change but total interbank credit does becuase A’s bank borrows the reserves it needs form B’s bank.

Interbank credit changes • In the transaction between A and B total retail bank deposits do not change but total interbank credit does becuase A’s bank borrows the reserves it needs form B’s bank.

efficiency • Interbank borrowing and lending (money market) • Mechanism that allows • Decentralized payments system • Efficiency of one single big bank

efficiency • Interbank borrowing and lending (money market) • Mechanism that allows • Decentralized payments system • Efficiency of one single big bank

• It all works so long as cash inflows equal cash outflows in the banking system as a whole.

• It all works so long as cash inflows equal cash outflows in the banking system as a whole.

Person A Person a assets liabilitie assets s deposit A’s bank B’s bank Person B liabilitie assets s deposit + FFloan + deposit liabilitie s

Person A Person a assets liabilitie assets s deposit A’s bank B’s bank Person B liabilitie assets s deposit + FFloan + deposit liabilitie s

Discount window • Payments system clears every day if the decentralized money market does not work well the fed intervenes through the discount window.

Discount window • Payments system clears every day if the decentralized money market does not work well the fed intervenes through the discount window.

fed • If A’s and B’s banks cannot find each other in the money market they can meet with the intermediation of the Fed.

fed • If A’s and B’s banks cannot find each other in the money market they can meet with the intermediation of the Fed.

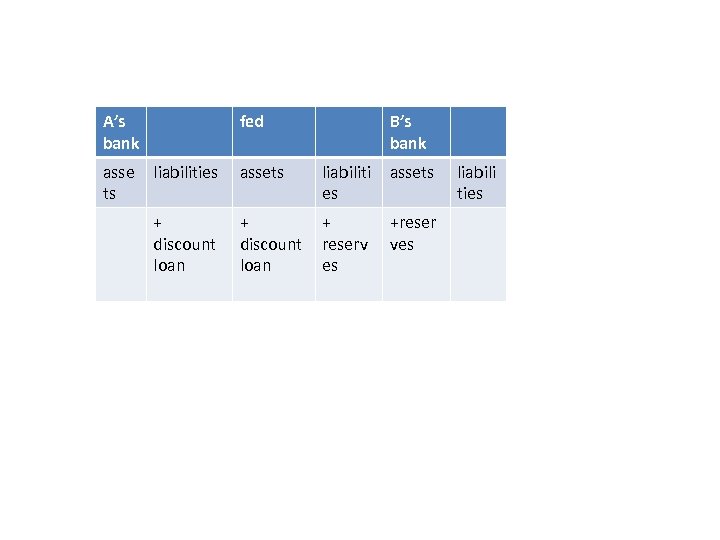

A’s bank asse ts fed B’s bank liabilities assets liabiliti es assets + discount loan + reserv es +reser ves liabili ties

A’s bank asse ts fed B’s bank liabilities assets liabiliti es assets + discount loan + reserv es +reser ves liabili ties

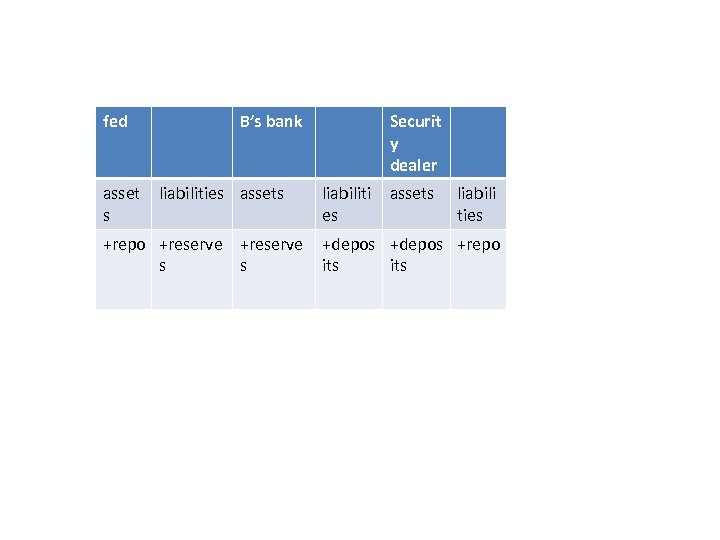

fed asset s B’s bank liabilities assets +repo +reserve s s Securit y dealer liabiliti es assets liabili ties +depos +repo its

fed asset s B’s bank liabilities assets +repo +reserve s s Securit y dealer liabiliti es assets liabili ties +depos +repo its