a048d2d8a012a0d686a7cec6beb74241.ppt

- Количество слайдов: 53

Legislative and Budget Update Dr. Chuck Essigs Arizona Association of School Business Officials Janice Palmer Arizona School Boards Association

Non-Budget Legislation Affecting Public Schools

School Districts and Associations HB 2002 (school district monies; associations; elections) Prohibits a school districts from paying for membership in an association that attempts to influence an election.

Unification and Consolidation HB 2219 (s/e: study committee; unification; consolidation) Establishes the 16 -member Joint Legislative Study Committee on School District Unification and Consolidation Requires the Committee to report by Dec. 31 st Requires the Committee to: Study issues regarding the unification and consolidation of school districts Prepare legislation for consideration during the subsequent Legislative Session that encourages the unification and consolidation of school districts Consider proposals for possible school district unifications or consolidations that include a process for a district governing board to develop its own unification or consolidation plan and a process for a county school superintendent to develop a unification or consolidation plan if the district governing board is unable to develop its own plan.

School Accountability HB 2234 (persistently lowest performing schools) Allows the State Board of Education (SBE) to assign a school a letter grade of F under AZ LEARNS if the school is among the persistently lowest-achieving schools HB 2706 (now: supplementary reading instruction; teachers) Requires SBE to adopt guidelines to include supplementary training in reading instruction as part of a school’s improvement plan for K-3 teachers who teach in a school that receives a label of underperforming or D under AZ LEARNS.

Bullying HB 2415 (schools; bullying policies) Expands those eligible to report from students to also parents and school district employees ▪ Requires the district to supply a form and to establish appropriate disciplinary procedures for employees who fail to report suspected incidents known to them Includes electronic technology and communication on school equipment and during school hours

Bullying (cont. ) All students must receive a written copy of the rights, protections, and support services available to bullying victims at the beginning of each school year and provide that information to the alleged victims when an incident is reported. District must maintain records of reported incidents for at least six years. District must develop procedures designed to protect the health and safety of victims who are physically harmed as the result of bullying or harassment, including, when appropriate, procedures for contacting emergency or law enforcement personnel, or both.

Financial Transparency HB 2421 (school districts; budgets; financial reports) Requires school districts to follow the same annual public meeting requirements to update voters on the use of monies spent as authorized by an M&O override as currently required for monies spent as authorized by a Capital Outlay override. Requires ADE, within 6 months of the bill’s enactment, to post the following information on their website: ▪ ▪ ▪ The annual financial report, by October 15 each year. The proposed budget, by July 5 each year or no later than the publication of notice of the required public hearing. The finalized budget, by July 18 each year. Directs any school district that has its own website to post a link to the location on ADE’s website where its financial documents can be viewed.

Financial Transparency HB 2572 (government expenditure database; transparency; CAFR) Requires the Arizona Department of Administration and each local government to post the comprehensive annual financial report of a budget unit on their official Internet website Requires each local government to post a link, prominently displayed, on their website School districts must comply on or before January 1, 2013

“Spice” HB 2167 (definition of dangerous drugs; synthetic) Expands the definition of dangerous drugs to include specific chemical compounds that typically compose synthetic cannabinoids (i. e. spice) Contains an emergency clause

Military Recruiting HB 2587 (high schools; military recruiting; form) Requires charter schools to comply with state statutes regarding access to student information by educational and occupational recruiters Directs a school district or charter school that chooses to release student directory information to do so by October 31 each year

JTEDs HB 2646 (JTEDs; adult students) Allows adult students to attend vocational programs on a central campus of a Joint Technical Education District (JTED) during school hours if they have a valid fingerprint clearance card Requires JTEDs to send written notification to the parent or guardian of each student under the age of 18 when an adult enrolls in that same vocational program States that adult students can only participate in vocational education programs offered by a school district if the purpose of the program is skill retraining or skill upgrading. Adult students are prohibited from receiving college-level credit for those programs. Prohibits adult students in massage therapy programs

School Funding Study Committee HB 2710 (study committee; outcome-based funding) Establishes the 13 -member Joint Legislative Study Committee on Outcome-Based Education Funding Must report by December 31 st Committee is repealed as of September 30, 2012 Contains an emergency clause

Residency SB 1141 (s/e: schools; residency requirements) Requires parents, or persons who have custody, of a child who will attend a public, private or charter school to provide verifiable documentation of Arizona residency Requires school districts and charter schools to maintain the documentation

Private Schools/ Public Monies SB 1186 (now: tax corrections; STO expansion; class six)-- VETO Creates a new individual income tax credit for contributions to an STO that is certified as an STO for purposes of corporate tax credits. Limits the amount of the credit to $250 for single filers and $500 for joint filers, and allows any excess credits to be carried forward up to five consecutive taxable years. JLBC estimates the cost at $9 million to the state general fund Contains numerous other provisions

Private Schools/ Public Monies SB 1553 (education; disabled students; empowerment accounts) Establishes and prescribes rules and requirements for the Arizona Empowerment Accounts program (essentially a voucher) for special education students

School Boards SB 1205 (small transportation school districts; dissolution) Establishes a process to call an election for the dissolution of a transporting school district with fewer than 10 pupils. SB 1303 (schools; dropout recovery programs) Establishes a dropout recovery program and specifies program requirements and funding Voluntary for school districts

School Boards SB 1521 (schools; head injury policies; athletics) Requires district governing boards to consult with AIA to develop guidelines, information, and forms to educate coaches, students, and parents about “the dangers of concussions and head injuries and the risks of continued sports play after a concussion” Requires district governing boards to enforce a concussion policy that addresses risk awareness and appropriate response procedures Grants civil immunity to a school district, school district employee, team coach, official, team volunteer, or a parent or guardian of a team member for good-faith efforts to comply with the requirements of the bill, and to school districts and their employees for the failure of another person or organization to comply with the requirements of the bill. Applies the provisions of the bill to any group or organization, except an outof-state team, that uses school district property for athletic purposes.

Education Omnibus SB 1256 (education; omnibus) Makes clarifying and technical changes to teacher certification, ADM/ADA, early kindergarten repeaters, etc.

Public Employee Lobbying SB 1329 (public employees; lobbying; political activities) Prohibits a public employee who is paid in whole or in part from taxpayer monies from lobbying a governmental entity or engaging in any political activity during the employee’s hours of employment unless the employee lobbies using their vacation or compensatory time, uses authorized release time within the framework of a labor -management agreement such as a memorandum of understanding or takes an unpaid leave of absence. Does not apply to a public employee who is registered as an authorized or designated public lobbyist and who lobbies for the employer as part of the employee’s official duties.

Paycheck Deductions SB 1365 (paycheck deductions; political purposes) For payroll deductions made after October 1, 2011, prohibits a public or private employer from deducting a payment from an employee's paycheck for political purposes unless the employee gives written or electronic authorization on a yearly basis Directs the Attorney General to adopt administrative rules for the acceptable forms for employee authorization and entity statements within 90 days of the effective date Employer knowing violation = at least a $10, 000 civil penalty for each violation

Move on When Ready SB 1451 (high schools; board examination systems) Clean up bill for the Grand Canyon diploma

Parents Rights SB 1453 (now: parents’ rights; schools) States parents have a right to review learning material and activities and remove their child from certain activities or classes deemed harmful by the parent.

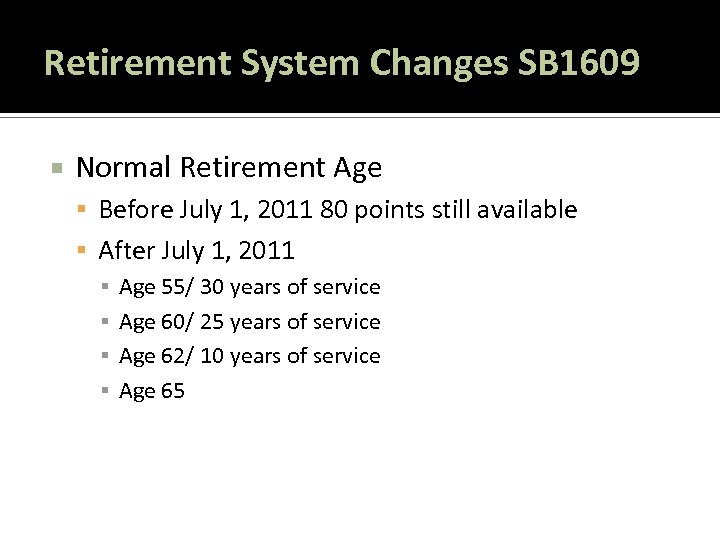

Retirement System Changes SB 1609 Normal Retirement Age Before July 1, 2011 80 points still available After July 1, 2011 ▪ Age 55/ 30 years of service ▪ Age 60/ 25 years of service ▪ Age 62/ 10 years of service ▪ Age 65

Retirement System Changes SB 1609 Alternate Contribution Rate (ACR) Require employers beginning July 1, 2012 to pay an ACR (Est. 7%+) Required for employees who are retired including direct/leasing/contracted (less than 20 hours too)

Retirement System Changes SB 1609 Service Purchase 10 years to quality vs. 5 years Purchase only up to 5 years of service Require members to forfeit time in old system to purchase it

FY 2011/FY 2012 State Budget and Budget Related Legislation

State Budget for FY 2011 State Funding Reduced by estimated $132 Million Districts and Charters Budget Capacity Reduced by estimated $132 Million Districts Could Use Edu. Jobs Funds to Cover Reduction Budget Revision Not Required

State Budget FY 2012 Base Level stays at $3, 267. 72/ No Increases Inflation Increase of 0. 9% Transportation $0. 02 Mile Increase Addition Assistance for Charters ▪ K-8 Increase of $14. 47 to $1, 621. 97 ▪ 9 -12 Increase of $16. 86 to $1, 890. 38

Reductions to Soft Capital and CORL Soft Capital Cut by $188. 1 Million – Most Likely a Greater than 90% Reduction CORL Cut #1 by $63. 9 Million CORL #2 Cut by an Additional $35 Million – Edu. Jobs Issue

Reduction to Additional Assistance for Charters Additional Assistance Cut by $17. 7 Million (Average $135 per student)

Small District Adjustment For districts with fewer than 1100 students, Soft Capital and CORL cuts cannot total more than $5 million statewide

Phase Out of Career Ladder and OPIP Base Level Adjustment 4% FY 2012 3% FY 2013 2% FY 2014 1% FY 2015 Qualifying Tax Rate $0. 10 K-8 and 9 -12 districts $0. 20 K-12 Districts

Facilities Funding New School Formula – Suspended Building Renewal Formula - Suspended

Joint Tech Districts Prohibits JTED’s from Receiving State Funding for 9 th Grade Students Spending on 9 th Grade Students Still Allowed (HB 2237)

JTEDs HB 2237 (JTEDs; ADM; student count) conforms state funding for JTEDs with ADM in place of ADA Beginning in FY 2011 -12, states the student count for a JTED is equal to the JTED’s ADM Stipulates that a student enrolled in an approved JTED course generates 0. 25 ADM for each course, capped at the limits currently prescribed by statute Allows JTEDs to use their property tax revenues to provide JTED courses to ninth grade pupils. Allows students whose district of attendance is a member district of a JTED, and whose district of residence pays tuition to the district of attendance, to attend that JTED as a resident student.

Other Items Actual Utility Funding Formula Eliminated Teacher Performance Pay Program (ARS 15 -977) Eliminated

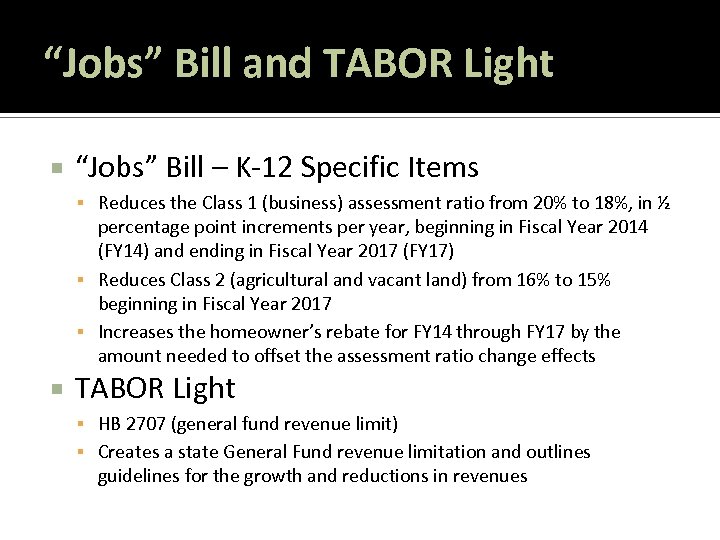

“Jobs” Bill and TABOR Light “Jobs” Bill – K-12 Specific Items Reduces the Class 1 (business) assessment ratio from 20% to 18%, in ½ percentage point increments per year, beginning in Fiscal Year 2014 (FY 14) and ending in Fiscal Year 2017 (FY 17) Reduces Class 2 (agricultural and vacant land) from 16% to 15% beginning in Fiscal Year 2017 Increases the homeowner’s rebate for FY 14 through FY 17 by the amount needed to offset the assessment ratio change effects TABOR Light HB 2707 (general fund revenue limit) Creates a state General Fund revenue limitation and outlines guidelines for the growth and reductions in revenues

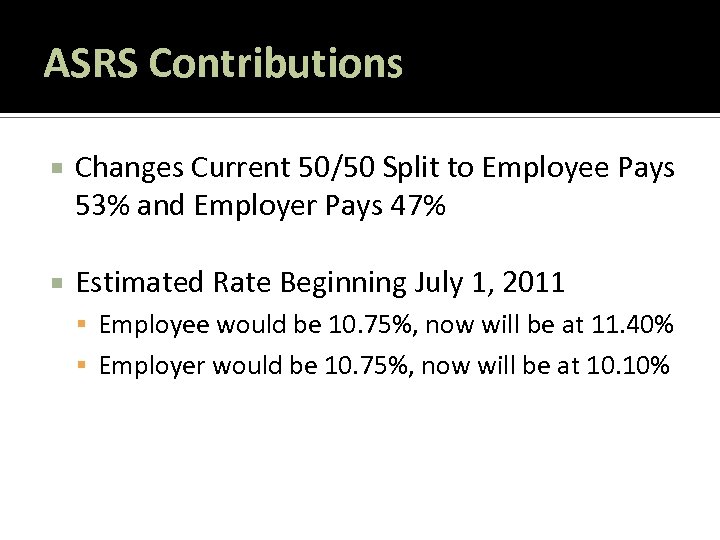

ASRS Contributions Changes Current 50/50 Split to Employee Pays 53% and Employer Pays 47% Estimated Rate Beginning July 1, 2011 Employee would be 10. 75%, now will be at 11. 40% Employer would be 10. 75%, now will be at 10. 10%

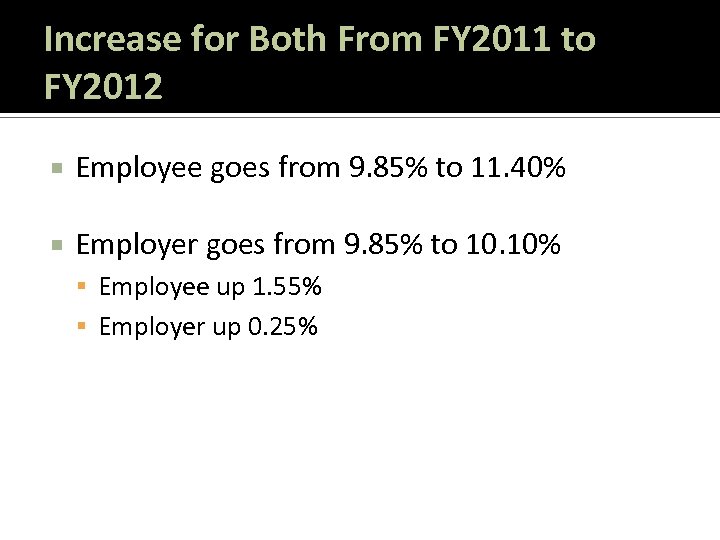

Increase for Both From FY 2011 to FY 2012 Employee goes from 9. 85% to 11. 40% Employer goes from 9. 85% to 10. 10% Employee up 1. 55% Employer up 0. 25%

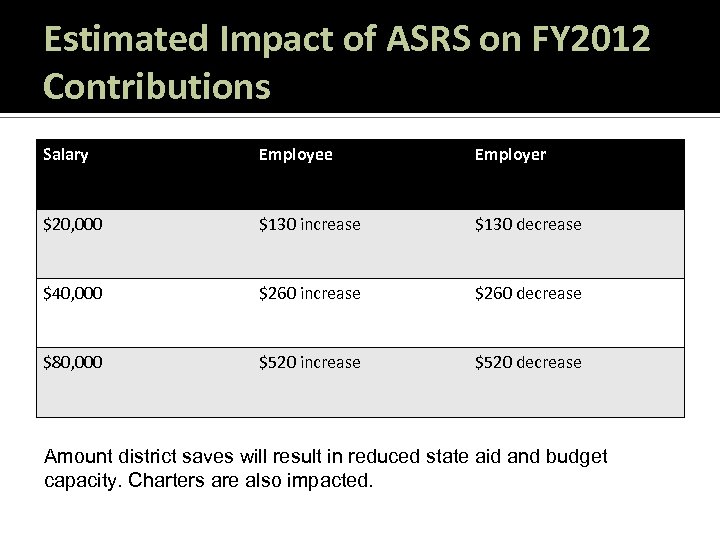

Estimated Impact of ASRS on FY 2012 Contributions Salary Employee Employer $20, 000 $130 increase $130 decrease $40, 000 $260 increase $260 decrease $80, 000 $520 increase $520 decrease Amount district saves will result in reduced state aid and budget capacity. Charters are also impacted.

Classroom Site Fund Started In FY 2002 Highest year FY 2008 $397 per weighted student District had been allowed to spend to estimate For FY 2010 cumulative shortfall of $195 Starting in FY 2011 state had to adjust for shortfall

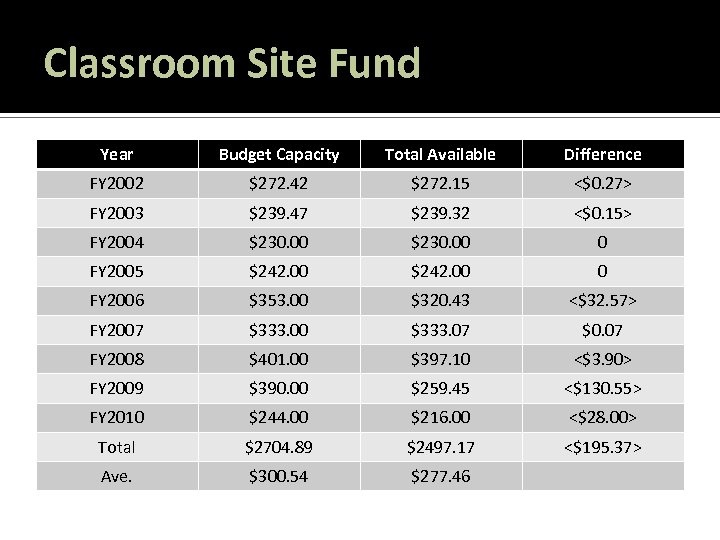

Classroom Site Fund Year Budget Capacity Total Available Difference FY 2002 $272. 42 $272. 15 <$0. 27> FY 2003 $239. 47 $239. 32 <$0. 15> FY 2004 $230. 00 0 FY 2005 $242. 00 0 FY 2006 $353. 00 $320. 43 <$32. 57> FY 2007 $333. 00 $333. 07 $0. 07 FY 2008 $401. 00 $397. 10 <$3. 90> FY 2009 $390. 00 $259. 45 <$130. 55> FY 2010 $244. 00 $216. 00 <$28. 00> Total $2704. 89 $2497. 17 <$195. 37> Ave. $300. 54 $277. 46

FY 2012 Number Estimated amount $219 Adjusted for shortfall $219 -$124. 99 = $94 Legislature may set amount at $120 (SB 1263)

Budget Limit – Classroom Site Fund Allocation from ARS 15 -979 (per weighted student) $120* per weighted student Unexpended budget balance from FY 2011 The net interest earned during FY 2011 *with SB 1263

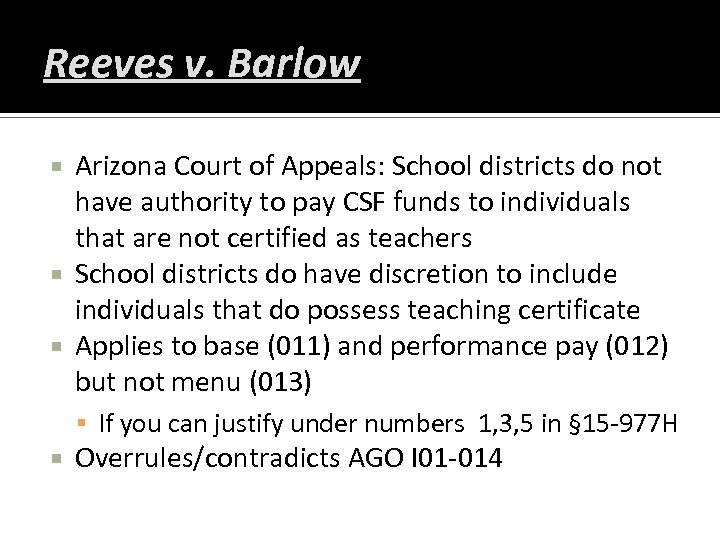

Reeves v. Barlow Arizona Court of Appeals: School districts do not have authority to pay CSF funds to individuals that are not certified as teachers School districts do have discretion to include individuals that do possess teaching certificate Applies to base (011) and performance pay (012) but not menu (013) If you can justify under numbers 1, 3, 5 in § 15 -977 H Overrules/contradicts AGO I 01 -014

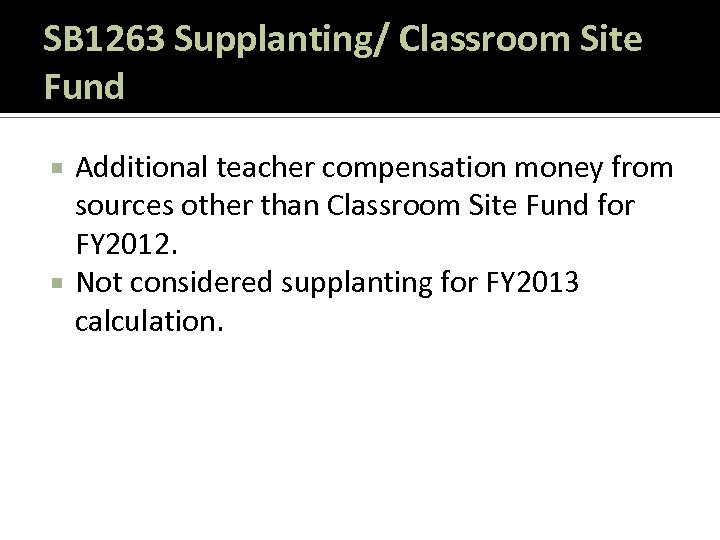

SB 1263 Supplanting/ Classroom Site Fund Additional teacher compensation money from sources other than Classroom Site Fund for FY 2012. Not considered supplanting for FY 2013 calculation.

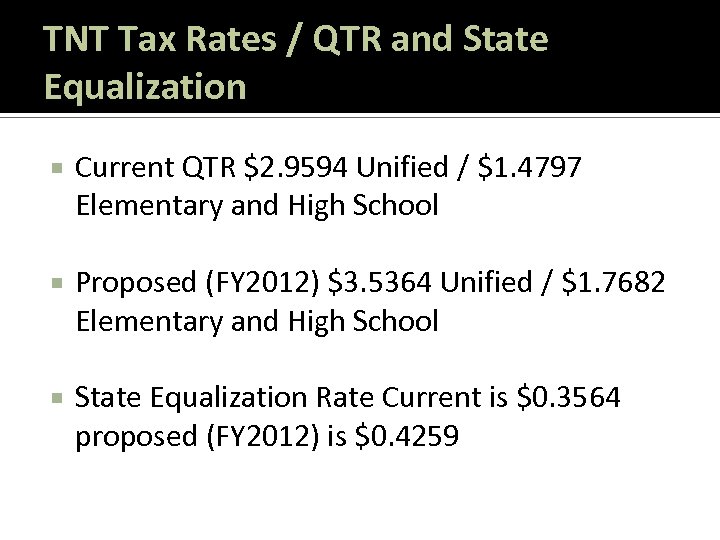

TNT Tax Rates / QTR and State Equalization Current QTR $2. 9594 Unified / $1. 4797 Elementary and High School Proposed (FY 2012) $3. 5364 Unified / $1. 7682 Elementary and High School State Equalization Rate Current is $0. 3564 proposed (FY 2012) is $0. 4259

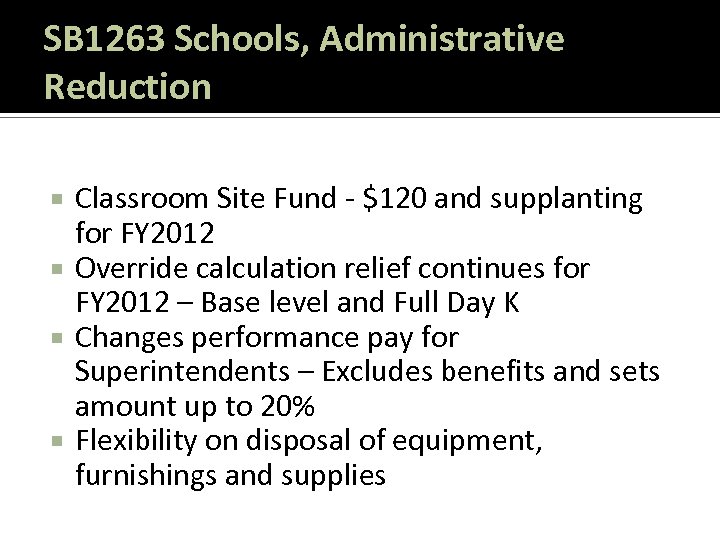

SB 1263 Schools, Administrative Reduction Classroom Site Fund - $120 and supplanting for FY 2012 Override calculation relief continues for FY 2012 – Base level and Full Day K Changes performance pay for Superintendents – Excludes benefits and sets amount up to 20% Flexibility on disposal of equipment, furnishings and supplies

SB 1263 Schools, Administrative Reduction Continued Allows warrants drawn on the County Treasurer to be processed through an electronic system Shortens timelines for school closures Allows for elections to change list of projects and time period to issue extended from 6 to 10 years Increases bonding capacity for bonds approved prior to April 15, 2011 – Elem/HS 5% to 10% and unified 10% to 20%

SB 1263 Schools, Administrative Reduction Continued Removed from bill For FY 2012 and 2013 allows unrestricted capital to be used for any capital or operational expense (excludes SFB and override funds) Removed from bill For FY 2012 and 2013 permits carryover in excess of 4%

HB 2301 Soft Capital and Extracurricular Tax Credit (Maybe) Soft Capital could be used for operational expenses (Permanent) Unspent contributions for a program that has been discontinued or has not been used for 2 consecutive fiscal years may be used for any extracurricular purpose Unencumbered monies 50% may be used for short-term items such as technology, textbooks, library resources, instructional aids, pupil transportation vehicles and furniture and equipment in FY 2012 and FY 2013 (Does not apply to funds received after FY 2010)

Questions? ? ?

a048d2d8a012a0d686a7cec6beb74241.ppt