8d63df3c6521700fd8e1d4692f69fd1d.ppt

- Количество слайдов: 19

Legg Mason Capital Management NYU Stern Business School May 9, 2005 Bill Miller Chief Executive Officer

“When we think about the future of the world, we always have in mind its being where it would be if it continued to move as we see it moving now. We do not realize that it moves not in a straight line…and that its direction changes constantly. ” - Ludwig Wittgenstein “Culture and Value” 2

“Take as an example the aspects of a triangle. This triangle can be seen as a triangular hole, as a solid, as a geometrical drawing; as standing on it’s base, as hanging from its apex, as a mountain, as a wedge, as an arrow or a pointer, as an overturned object which is meant to stand on the shorter side of the right angle, as a half parallelogram, and as various other things. ” Source: Ludwig Wittgenstein, Philosophical Investigations 3

“I have personally tried to invest money, my client’s and my own, in every single anomaly and predictive result that academics have dreamed up. And I have yet to make a nickel on any of these supposed market inefficiencies. An inefficiency ought to be an exploitable opportunity. If there’s nothing investors can exploit in a systematic way, time in and time out, then it’s very hard to say that information is not being properly incorporated into stock prices. Real money investment strategies don’t produce the results that academic papers say they should. ” Richard Roll and Robert J. Shiller, “Comments: Symposium on Volatility in U. S. and Japanese Stock Markets, ” Journal of Applied Corporate Finance, Vol. 5, Issue 1, 1992, 25 -29. 4

D Don’t Believe Everything You Read Fortune’s Year 2000 Guide to Retire Rich July 19, 2000 Broadcom Charles Schwab Enron Genentech Morgan Stanley Nokia Nortel Networks Oracle Univision Viacom Total Investment 7/19/00 Price* Total Investment 12/31/04 Price Value** $237 $36 $73 $38 $89 $54 $77 $37 $57 $69 $10, 000 $10, 000 $10, 000 $32 $12 $0 $54 $56 $16 $3 $14 $29 $37 $1, 350 $3, 333 $0 $14, 211 $6, 292 $2, 963 $390 $3, 784 $5, 088 $5, 362 $100, 000 $42, 773 Percent Loss (57%) S&P 500 Percent Loss (18%) 5 Source: Fortune Magazine, August 14, 2000 *Adjusted for splits ** Not including dividends.

T “ 10 Stocks for 2010: Buy & Hold Picks From Top Investors” 1999 Return Zee Telefilms Ltd. 2000 Return 2001 Return 2002 Return 2003 Return 2004 Return Total Return 0004 1610% -75% -62% -12% 55% -22% -84% JDS Uniphase 830% -48% -79% -72% 47% 20% -96% Oracle 290% 4% -52% -22% 23% -9% -51% Nokia 220% -9% -43% -36% 12% 26% -65% Cisco 131% -29% -53% -28% 85% -64% Flextronics 115% 24% -16% -66% 81% 14% -40% Jones Apparel 23% 19% 3% 7% 0% 4% 37% Medtronic -2% 66% -15% -10% 7% 4% 40% Waste Management -63% 62% 15% -28% 29% 1% 79% Henry Schein -70% 160% 7% 22% 50% 8% 423% Average Performance 308% 17% -30% -25% 39% 4% 18% S&P 500 Performance 2% -9% -12% -22% 29% 11% -11% Source: The New York Times, February 20, 2000; Bloomberg Article author Kenneth N. Gilpin asks 10 successful investment professionals to pick one stock they would feel comfortable buying now and holding until Jan. 1, 2010. The 10 investment professionals are John W. Ballen, Laszlo Birinyl, George A. Mairs 3 rd, Roger Mc. Namee, Bill Nasgovitz, Bill Miller, Liz Ann Sonders, Justin Thomson, Robert E. Turner and Ralph Wanger. 6

T The Common “Uncommon” Mistake Investors Make “Lehman Brothers 10 Uncommon Values® to Own for the Next 12 Months” Stocks Placed on the List 6/30/99 Symbol AOL T FSR F GIC INTC KLAC LLY MSFT TYC Name Subsequent 12 Month Performance Prior 12 Month Performance (6)% (43)% (20)% (21)% 22% 113% 70% 35% (12)% (4)% 297% 50% 32% -046% 59% 134% 12% 65% 47% 13% 7% 74% 21% AOL AT&T Firstar Ford General Instrument* Intel KLA Tencor Eli Lilly Microsoft Tyco International Average Performance S&P 500 Performance Figures on Total Return Basis *Acquired by MOT 1/5/00. Performance based on owning stock for entire 12 months. The 10 Uncommon Values® were selected by Lehman Brothers' Investment Policy Committee; each stock was chosen because of its value relative to the opportunity Lehman sees for the company 12 months from today. Every year the Investment Policy Committee reviews each analyst's best idea to arrive at the list of 10 Uncommon Values®. This process has been a fixture at Lehman Brothers.

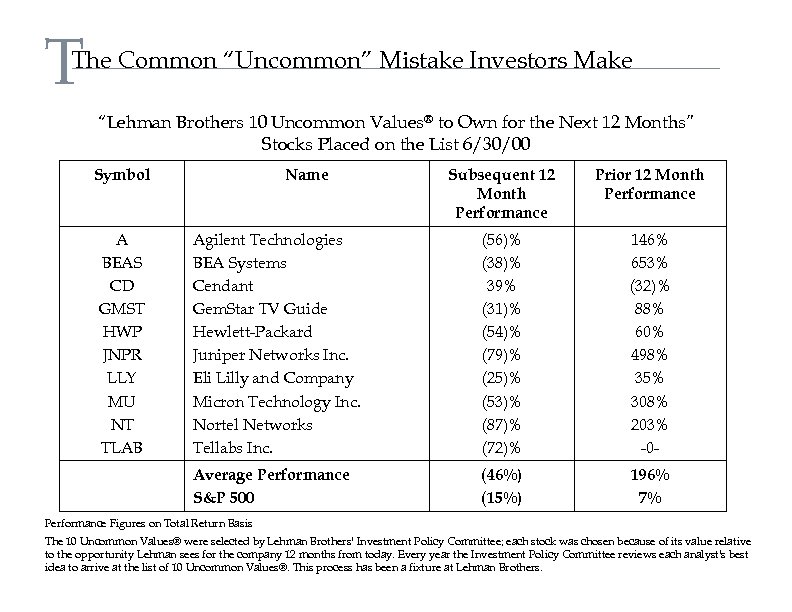

T The Common “Uncommon” Mistake Investors Make “Lehman Brothers 10 Uncommon Values® to Own for the Next 12 Months” Stocks Placed on the List 6/30/00 Symbol Subsequent 12 Month Performance Prior 12 Month Performance Agilent Technologies BEA Systems Cendant Gem. Star TV Guide Hewlett-Packard Juniper Networks Inc. Eli Lilly and Company Micron Technology Inc. Nortel Networks Tellabs Inc. (56)% (38)% 39% (31)% (54)% (79)% (25)% (53)% (87)% (72)% 146% 653% (32)% 88% 60% 498% 35% 308% 203% -0 - Average Performance S&P 500 A BEAS CD GMST HWP JNPR LLY MU NT TLAB Name (46%) (15%) 196% 7% Performance Figures on Total Return Basis The 10 Uncommon Values® were selected by Lehman Brothers' Investment Policy Committee; each stock was chosen because of its value relative to the opportunity Lehman sees for the company 12 months from today. Every year the Investment Policy Committee reviews each analyst's best idea to arrive at the list of 10 Uncommon Values®. This process has been a fixture at Lehman Brothers.

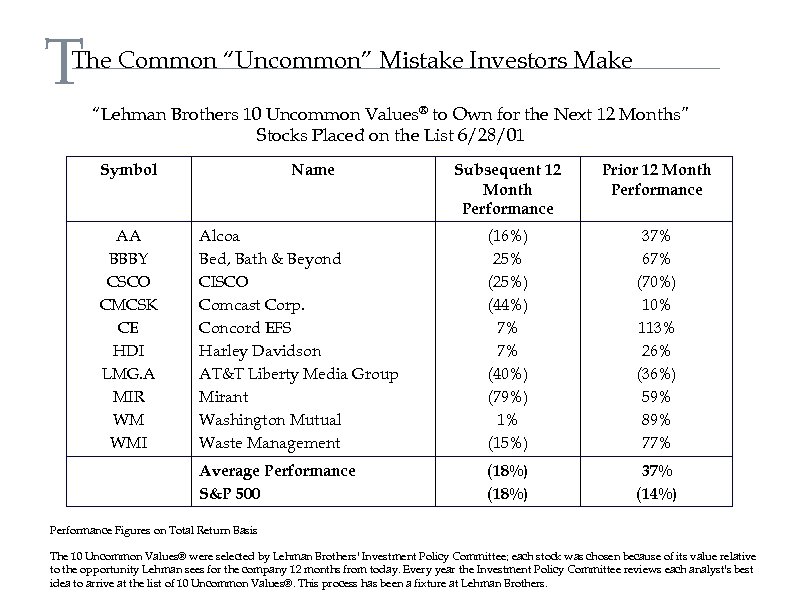

T The Common “Uncommon” Mistake Investors Make “Lehman Brothers 10 Uncommon Values® to Own for the Next 12 Months” Stocks Placed on the List 6/28/01 Symbol Subsequent 12 Month Performance Prior 12 Month Performance Alcoa Bed, Bath & Beyond CISCO Comcast Corp. Concord EFS Harley Davidson AT&T Liberty Media Group Mirant Washington Mutual Waste Management (16%) 25% (25%) (44%) 7% 7% (40%) (79%) 1% (15%) 37% 67% (70%) 10% 113% 26% (36%) 59% 89% 77% Average Performance S&P 500 AA BBBY CSCO CMCSK CE HDI LMG. A MIR WM WMI Name (18%) 37% (14%) Performance Figures on Total Return Basis The 10 Uncommon Values® were selected by Lehman Brothers' Investment Policy Committee; each stock was chosen because of its value relative to the opportunity Lehman sees for the company 12 months from today. Every year the Investment Policy Committee reviews each analyst's best idea to arrive at the list of 10 Uncommon Values®. This process has been a fixture at Lehman Brothers.

T The Common “Uncommon” Mistake Investors Make “Lehman Brothers 10 Uncommon Values® to Own for the Next 12 Months” Stocks Placed on List 6/26/02 Symbol Name Subsequent 12 Month Performance Prior 12 Month Performance AIG APOL BBBY COF HRC KLAC MCK PFE WEN WY American International Group, Inc. Apollo Group, Inc. Bed Bath & Beyond Capital One Financial Corp. Health. South Corp. KLA-Yencor Corporation Mc. Kesson Corporation Pfizer, Inc. Wendy’s International, Inc. Weyerhaeuser Co. (14)% 64% 7% (13)% (97)% 5% 7% 3% (24)% (14)% (23)% 45% 23% (6)% (20)% (24)% (9)% (16)% 54% 21% Average Performance S&P 500 (8)% 3% 5% (19)% Performance Figures on Total Return Basis The 10 Uncommon Values® were selected by Lehman Brothers' Investment Policy Committee; each stock was chosen because of its value relative to the opportunity Lehman sees for the company 12 months from today. Every year the Investment Policy Committee reviews each analyst's best idea to arrive at the list of 10 Uncommon Values®. This process has been a fixture at Lehman Brothers.

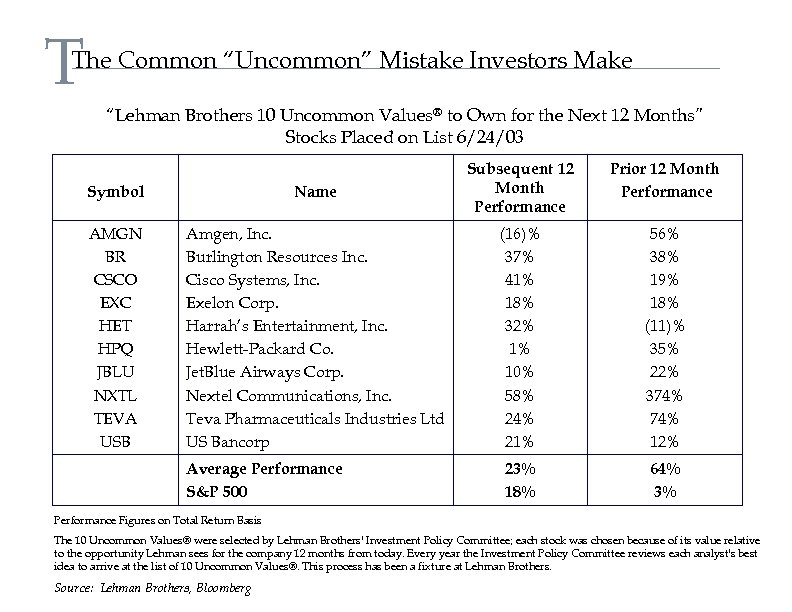

T The Common “Uncommon” Mistake Investors Make “Lehman Brothers 10 Uncommon Values® to Own for the Next 12 Months” Stocks Placed on List 6/24/03 Symbol Name Subsequent 12 Month Performance AMGN BR CSCO EXC HET HPQ JBLU NXTL TEVA USB Amgen, Inc. Burlington Resources Inc. Cisco Systems, Inc. Exelon Corp. Harrah’s Entertainment, Inc. Hewlett-Packard Co. Jet. Blue Airways Corp. Nextel Communications, Inc. Teva Pharmaceuticals Industries Ltd US Bancorp (16)% 37% 41% 18% 32% 1% 10% 58% 24% 21% 56% 38% 19% 18% (11)% 35% 22% 374% 12% 23% 18% 64% 3% Average Performance S&P 500 Prior 12 Month Performance Figures on Total Return Basis The 10 Uncommon Values® were selected by Lehman Brothers' Investment Policy Committee; each stock was chosen because of its value relative to the opportunity Lehman sees for the company 12 months from today. Every year the Investment Policy Committee reviews each analyst's best idea to arrive at the list of 10 Uncommon Values®. This process has been a fixture at Lehman Brothers. Source: Lehman Brothers, Bloomberg

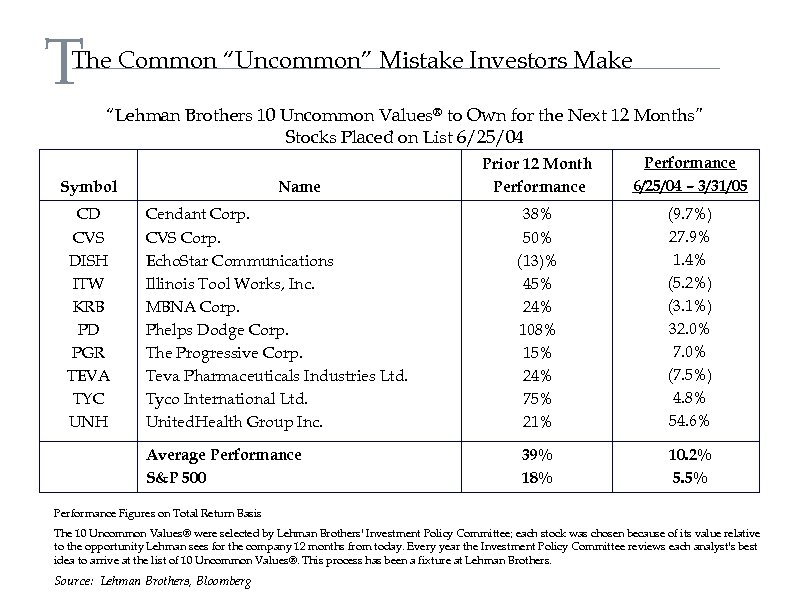

T The Common “Uncommon” Mistake Investors Make “Lehman Brothers 10 Uncommon Values® to Own for the Next 12 Months” Stocks Placed on List 6/25/04 Symbol CD CVS DISH ITW KRB PD PGR TEVA TYC UNH Name Cendant Corp. CVS Corp. Echo. Star Communications Illinois Tool Works, Inc. MBNA Corp. Phelps Dodge Corp. The Progressive Corp. Teva Pharmaceuticals Industries Ltd. Tyco International Ltd. United. Health Group Inc. Average Performance S&P 500 Prior 12 Month Performance 6/25/04 – 3/31/05 38% 50% (13)% 45% 24% 108% 15% 24% 75% 21% (9. 7%) 27. 9% 1. 4% (5. 2%) (3. 1%) 32. 0% 7. 0% (7. 5%) 4. 8% 54. 6% 39% 18% 10. 2% 5. 5% Performance Figures on Total Return Basis The 10 Uncommon Values® were selected by Lehman Brothers' Investment Policy Committee; each stock was chosen because of its value relative to the opportunity Lehman sees for the company 12 months from today. Every year the Investment Policy Committee reviews each analyst's best idea to arrive at the list of 10 Uncommon Values®. This process has been a fixture at Lehman Brothers. Source: Lehman Brothers, Bloomberg

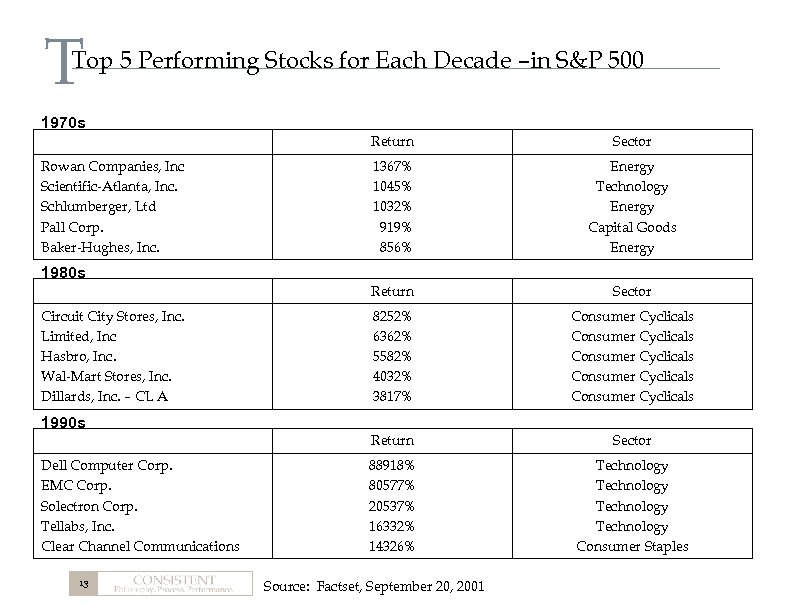

T Top 5 Performing Stocks for Each Decade –in S&P 500 1970 s Return 1367% 1045% 1032% 919% 856% Energy Technology Energy Capital Goods Energy Return Sector 8252% 6362% 5582% 4032% 3817% Consumer Cyclicals Consumer Cyclicals Return Rowan Companies, Inc Scientific-Atlanta, Inc. Schlumberger, Ltd Pall Corp. Baker-Hughes, Inc. Sector 88918% 80577% 20537% 16332% 14326% Technology Consumer Staples 1980 s Circuit City Stores, Inc. Limited, Inc Hasbro, Inc. Wal-Mart Stores, Inc. Dillards, Inc. – CL A 1990 s Dell Computer Corp. EMC Corp. Solectron Corp. Tellabs, Inc. Clear Channel Communications 13 Source: Factset, September 20, 2001

“I don’t buy options. Buying options is another way to go to the poorhouse. Someone did a study for the SEC and discovered that 90 percent of all options expire as losses. Well, I figured out that if 90 percent of all long option positions lost money, that meant that 90 percent of all short option positions make money. If I want to use options to be bearish, I sell calls. ” - Jim Rogers 14

W What is the Bet? Event Probability Outcome Expectation A 999/1000 $1 $. 999 B 1/1000 ($10, 000) ($10. 00) Total ($9. 001) Source: Nassim Nicholas Taleb, “Fooled by Randomness”, copyrighted material, 2001 15

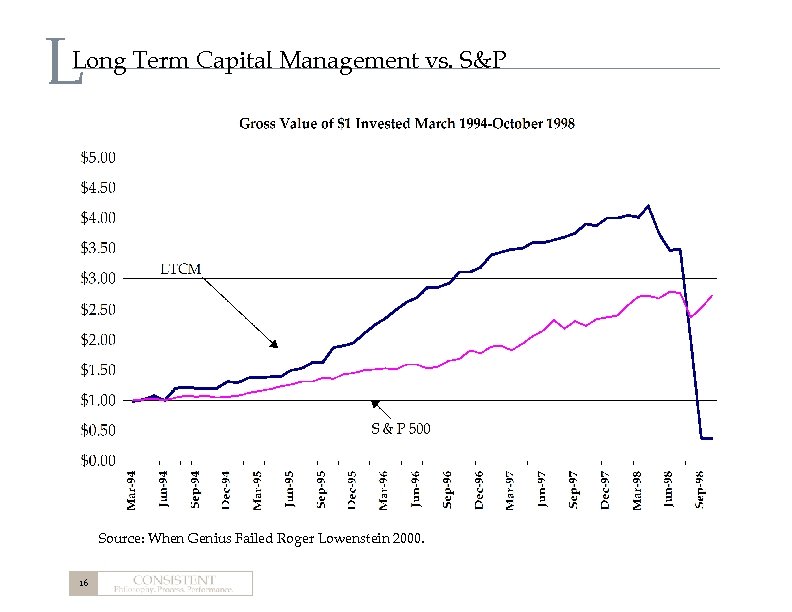

L Long Term Capital Management vs. S&P Source: When Genius Failed Roger Lowenstein 2000. 16

W We are value investors What We Do: § We buy fractional ownership interests in companies at large discounts to our assessment of intrinsic business value. § We invest in them long term.

W We are value investors What We Don’t Do: § Buy stocks based on price relationship to pure accounting based metrics: P/E, Price/Book, Price/Cash Flow. § Trade out of stocks when they reach some predetermined level based on those metrics.

19 Source: Money, June 2002. Copyright 2002. Used by permission. All rights reserved.

8d63df3c6521700fd8e1d4692f69fd1d.ppt