3 banking Institutions in Kazakhstan.ppt

- Количество слайдов: 35

legal regulation of Banking institutions in kazakhstan

Outline n n n n Defining of Financial Institutions National Bank of RK Investment Banks Investment Funds Pension Funds Insurance companies Conclusion

Financial Institutions n The firms which specialize on mediation between owners and lenders are called FINANCIAL INSTITUTIONS.

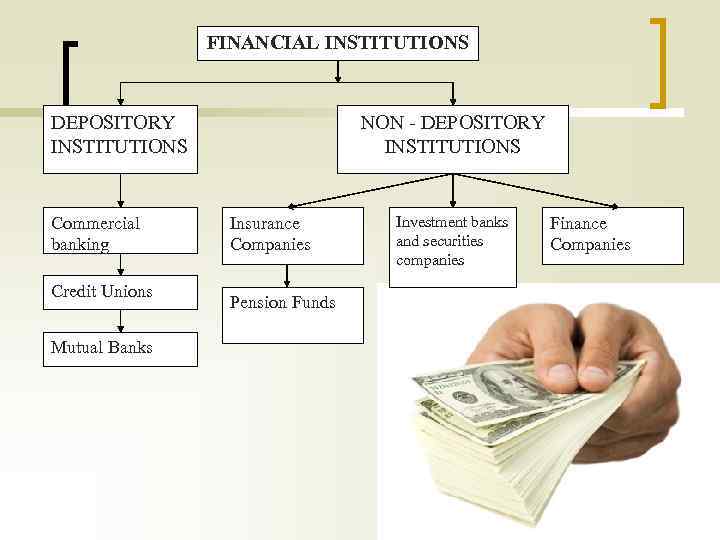

FINANCIAL INSTITUTIONS DEPOSITORY INSTITUTIONS Commercial banking Credit Unions Mutual Banks NON - DEPOSITORY INSTITUTIONS Insurance Companies Pension Funds Investment banks and securities companies Finance Companies

National Bank of RK n n n Central Bank of RK the highest level of banking system accountable to the President of RK in the frames of Decree of President with the force of law “About National Bank of Republic of Kazakhstan”. followed by Constitution and by other legislative acts of RK

National Bank of RK n juridical face n has its own balance represents united centralized structure with vertical relationships of subordination coordinates its activity with the Government of Kazakhstan n n

Functions of National Bank of RK n n provides internal and external stability of national currency of RK development and implementation of policy of the government in the sphere of currency, credits, organization of banking payments and exchange payments protection of interests of creditors and investors n

n n In accordance with Chapter 2 of the Law "On Banks and Banking Activities in the Republic of Kazakhstan" legal and physical persons may apply to the authority with a statement at the opening of the bank. The Bank is a joint-stock company. Founders and shareholders may be legal and natural persons-residents and non-residents. The main constituent documents of the bank are memorandum on the establishment of the bank and the bank's charter.

n n The authorized capital of the bank is expressed and formed in the national currency of Kazakhstan through the sale of shares or contributions of the founders. State registration is carried out by the Bank of Justice under the authority of the authorized body for the opening of the bank. License to carry out banking and other operations is established by Law, which is issued by the National Bank. The license is charged by fee, and the order of its payment is determined by the laws of RK.

In order to receive a license to conduct banking operations within one year from the date of state registration the applicant must: a) comply with all organizational and technical measures, including preparation of the space and equipment that meet standards. Also it is needed to prepare legal acts of the authorized body or National Bank, as well as hire qualified staff. b) to pay the share capital. n Voluntary reorganization (merger, separation, transformation) of the banks can be made at the general meeting of shareholders with the permission of the authorized body. n The basis for the permit application of a voluntary reorganization of the bank is a decision of the general meeting of shareholders of the bank. n

Bank may be liquidated if: 1) There is a decision of its shareholders at the permission of the authorized body (voluntary liquidation) 2) There is a court decision n Based on the decision of the general meeting of shareholders bank may apply to the authority with a request for authorization for its voluntary liquidation. n

Forced liquidation of the bank by the court could be in connection with: 1) bank failures 2) termination of the bank's license to conduct banking transactions on the issues provided by the banking legislation. 3) statement (claim) of authorized state bodies, entities or persons on the termination of the bank on other issues. n

Investment Banks n Investment Banks are the firms that specialize in the help for business and government on the selling their new issues of securities (bonds and stocks) on the primary market in order to finance their investments.

Investment Banks cont’ n n Additionally after selling the securities on the primary market investment bankers form the secondary market for the securities as brokers and dealers. The new issuance of stocks is called IPO (Initial Public Offering) Underwriting is the process when investment banks guarantee the purchase of the whole IPO under the fixed price.

Investment Banks cont’ n The Financial Consultancy is one of the main service of investment bank, it includes: Financial Planning n Optimal Structure Planning n Dividend Policy Planning n Investment Projects Research n

Investment Banks cont’ n Another very important service of Investment Bank is the Real Estate. Usually Investment Bank tends to buy the Real Estate and to held it as the financial instrument or the security.

NON-DEPOSITORY FINANCIAL INSTITUTIONS n Role of nondepository financial institutions ¡ Non-depository institutions generate funds from sources other than deposits • Finance companies - Obtain funds by issuing securities - Lend funds to individuals and small businesses

INVESTMENT COMPANIES 1. 2. 3. The investment company sells shares to the public and invests the proceeds into a diversified portfolio of securities Investors pool their capital and delegate the investment decision to a central authority The central authority making the investment decisions earns a fee for their service

BENEFITS n n n Diversification & Divisibility Liquidity Record Keeping Professional Management Reduced transaction costs

TYPES OF INVESTMENT COMPANIES n Closed end fund: This fund is closed to new investment ¡ ¡ ¡ n Number of shares stays constant Liquidity provided for in secondary market Deviations in valuation Unit Trust ¡ ¡ Number of units is fixed Investments do not change

TYPES OF INVESTMENT COMPANIES n Exchange Traded Fund: A cross between all three of the prior investment companies ü Continuous trading of shares ü Investors can redeem shares ü Investments are generally passive (do not change), tracking an index

TYPES OF INVESTMENT COMPANIES n Open end fund: (a. k. a. mutual fund) ¡ ¡ ¡ Most common investment company Funds are open to new investment Investors buy-in at the Net Asset Value (NAV) The market value is easy to calculate at any point in time if the underlying securities are traded in liquid markets Fund size is determined by: n n n The change in value of investments Net flow of funds Growth through Net New Flow of Funds

REASONS FOR NOT USING INVESTMENT COMPANIES n n n Internet has revolutionized investing within the last decade Double taxation – investment companies are pass through entities, which refers to tax liabilities Indexing investments requires no Active management

Pension Funds n Earning Pension Fund is a juridical face which fulfills activity on attraction of pension fees and pension payments.

Pension A sum of money paid regularly usually as a retirement benefit.

General n By the law of Kazakhstan pension is giving to men from 63 years old. - There’re some arguments against this age cause on average man’s life is 59 – 61 in Kazakhstan. - However Kazakhstan has shortage in labor resources.

Types of funds n n n GEPF – Government earning pension funds NGEPF – Non Government earning pension funds Open &/or Corporate EPF 10% of salary may be transferred PEF (pension earning fund)

Insurance is defined as the equitable transfer of the risk of a loss, from one entity to another, in exchange for a premium. An insurer is a company selling the insurance. Insurance used as a hedging instrument against future contingent losses.

Insurance Company n n Commercial organization based on the corresponding license; In KZ established as joint-stock companies; Stockholders can be physical, juridical faces, citizens and foreigners of RK; State also can be a founder of insurance company;

Insurance Company Required to have a restriction on diversification of investment portfolio; n Diversification in finance is a risk management technique, related to hedging, that mixes a wide variety of investments within a portfolio.

Insurance Company One of the main characteristic of the Insurance Company is the specific form of capital formation is the selling of insurance. Profit from selling they invest in stocks and bonds of other companies, and Government securities.

Conditions n n n A condition of budget balance (when revenue equals to planned expenditures); A condition of budget profit (when revenue is greater than planned expenditures); A condition of budget deficit (when expenditures are higher than revenue).

Investment banks n The main activity of investment banks is to issue securities on the market and to support brokers and dealers.

Investment funds n They help investors to avoid investment risks through financial mediators by the means of capital investment in diversified assets portfolio. Usually, funds introduce financial obligations of different face-values as well as ensure quick and unhampered purchase or sale of any financial obligations for which the market already exists. Also, funds guarantee redemption of shares at their present market value.

Thank you for your attention!

3 banking Institutions in Kazakhstan.ppt