0c3e3ff6661dce27ce1eb153e35d3cd2.ppt

- Количество слайдов: 51

LEE MEMORIAL HEALTH SYSTEM Presentation to Community Task Force January 27, 2003

LEE MEMORIAL HEALTH SYSTEM Presentation to Community Task Force January 27, 2003

PRESENTATION OUTLINE I. LMHS – A Valuable Community Owned Asset II. Financial Information III. Cost Effectiveness & Operational Efficiencies IV. Challenges and Future Needs V. Trauma Center

PRESENTATION OUTLINE I. LMHS – A Valuable Community Owned Asset II. Financial Information III. Cost Effectiveness & Operational Efficiencies IV. Challenges and Future Needs V. Trauma Center

LMHS – VALUABLE COMMUNITY OWNED ASSET Services LEE MEMORIAL HOSPITAL THE REHABILITATION HOSPITAL • • • Spinal Cord Injury Brain Injury Stroke Neurological Disorders Arthritis Amputation and Multiple Trauma HS Neurosciences Orthopedics Stroke Trauma Center (1 of 20 in Florida) Lee Cancer Care Memory Disorder Clinic (1 of 14 in Florida) Diabetes Care LM • • (367 beds) JCAHO Accredited (60 beds) CARF Accredited

LMHS – VALUABLE COMMUNITY OWNED ASSET Services LEE MEMORIAL HOSPITAL THE REHABILITATION HOSPITAL • • • Spinal Cord Injury Brain Injury Stroke Neurological Disorders Arthritis Amputation and Multiple Trauma HS Neurosciences Orthopedics Stroke Trauma Center (1 of 20 in Florida) Lee Cancer Care Memory Disorder Clinic (1 of 14 in Florida) Diabetes Care LM • • (367 beds) JCAHO Accredited (60 beds) CARF Accredited

LMHS – VALUABLE COMMUNITY OWNED ASSET Services – continued HEALTHPARK MEDICAL CENTER (166 beds) JCAHO Accredited • Cardiovascular • Obstetrics (including regional high risk) CHILDRENS HOSPITAL OF SW FL • • • (72 beds) JCAHO Accredited Regional Perinatal Intensive Care (1 of 11 in Florida) Pediatric Intensive Care Children’s Rehab Center Children’s Cancer Center (1 of 11 in Florida) Alliance with Doctors for Kids

LMHS – VALUABLE COMMUNITY OWNED ASSET Services – continued HEALTHPARK MEDICAL CENTER (166 beds) JCAHO Accredited • Cardiovascular • Obstetrics (including regional high risk) CHILDRENS HOSPITAL OF SW FL • • • (72 beds) JCAHO Accredited Regional Perinatal Intensive Care (1 of 11 in Florida) Pediatric Intensive Care Children’s Rehab Center Children’s Cancer Center (1 of 11 in Florida) Alliance with Doctors for Kids

LMHS – VALUABLE COMMUNITY OWNED ASSET Services – continued CAPE CORAL HOSPITAL (281 beds) JCAHO Accredited • Orthopedics • • Obstetrics Neurosurgery General Medical & Surgical Services Designated Intake Facility for Bioterrorism Events Other Services LEE MEMORIAL HOME HEALTH CHAP Accredited LEE PHYSICIAN GROUP JCAHO Accredited (65 PHYSICIANS; 20 office locations) HEALTHPARK CARE CENTER (112 beds) JCAHO Accredited

LMHS – VALUABLE COMMUNITY OWNED ASSET Services – continued CAPE CORAL HOSPITAL (281 beds) JCAHO Accredited • Orthopedics • • Obstetrics Neurosurgery General Medical & Surgical Services Designated Intake Facility for Bioterrorism Events Other Services LEE MEMORIAL HOME HEALTH CHAP Accredited LEE PHYSICIAN GROUP JCAHO Accredited (65 PHYSICIANS; 20 office locations) HEALTHPARK CARE CENTER (112 beds) JCAHO Accredited

LMHS – VALUABLE COMMUNITY OWNED ASSET TOP 100 NATIONAL HOSPITAL AWARDS* Cardiovascular Benchmark for Success – 2002 Health. Park Medical Center Cardiovascular Benchmark for Success – 2001 Health. Park Medical Center Top 100 Hospital National Winner – 2000 Cape Coral Hospital Orthopedic Benchmark for Success – 2000 Lee Memorial Hospital Orthopedic Benchmark for Success – 2000 Cape Coral Hospital Stroke Benchmark for Success – 2000 Lee Memorial Hospital ICU Benchmark for Success – 2000 LMH and HPMC Cardiovascular Cardiac Bypass Surgery – 1999 Health. Park Medical Center Orthopedic Benchmark for Success – 1999 Lee Memorial Hospital *Solucient: measures of over 5000 hospitals looking at mortality, complications, readmission rates, volume, length of stay, cost of procedure

LMHS – VALUABLE COMMUNITY OWNED ASSET TOP 100 NATIONAL HOSPITAL AWARDS* Cardiovascular Benchmark for Success – 2002 Health. Park Medical Center Cardiovascular Benchmark for Success – 2001 Health. Park Medical Center Top 100 Hospital National Winner – 2000 Cape Coral Hospital Orthopedic Benchmark for Success – 2000 Lee Memorial Hospital Orthopedic Benchmark for Success – 2000 Cape Coral Hospital Stroke Benchmark for Success – 2000 Lee Memorial Hospital ICU Benchmark for Success – 2000 LMH and HPMC Cardiovascular Cardiac Bypass Surgery – 1999 Health. Park Medical Center Orthopedic Benchmark for Success – 1999 Lee Memorial Hospital *Solucient: measures of over 5000 hospitals looking at mortality, complications, readmission rates, volume, length of stay, cost of procedure

LMHS – VALUABLE COMMUNITY OWNED ASSET • American Association of Retired Persons (AARP) - Lee Memorial Hospital one of the Top 10 Orthopedic hospitals in the nation based on clinical outcomes • Health. Grades. com identified the following clinical services as among the best in the nation: – – Cardiac (Health. Park Medical Center) Orthopedics (Lee Memorial Hospital) Stroke (Lee Memorial Hospital) Obstetrics (Health. Park Medical Center) • Joint Commission on Accreditation of Health Care - Disease specific Certification awarded to Lee Diabetes Care: 1 st hospital in Florida; 6 th in nation 7

LMHS – VALUABLE COMMUNITY OWNED ASSET • American Association of Retired Persons (AARP) - Lee Memorial Hospital one of the Top 10 Orthopedic hospitals in the nation based on clinical outcomes • Health. Grades. com identified the following clinical services as among the best in the nation: – – Cardiac (Health. Park Medical Center) Orthopedics (Lee Memorial Hospital) Stroke (Lee Memorial Hospital) Obstetrics (Health. Park Medical Center) • Joint Commission on Accreditation of Health Care - Disease specific Certification awarded to Lee Diabetes Care: 1 st hospital in Florida; 6 th in nation 7

LMHS – VALUABLE COMMUNITY OWNED ASSET Lee Memorial Health System Most Preferred Hospital Overall Quality & Image 1999, 2000, 2001, 2002 Based on the Fort Myers’ MSA, U. S. Census Bureau

LMHS – VALUABLE COMMUNITY OWNED ASSET Lee Memorial Health System Most Preferred Hospital Overall Quality & Image 1999, 2000, 2001, 2002 Based on the Fort Myers’ MSA, U. S. Census Bureau

LMHS – VALUABLE COMMUNITY OWNED ASSET • The University of PA, The Wharton School - Distinction for advancement of Nursing and Hospital Management • Florida Nurses Association, District 7 - Award for Excellence for three consecutive years • Healthcare Advisory Board (2000, 2001, 2002) - Lee Cancer Care profiled nationally as Center of Excellence LMHS

LMHS – VALUABLE COMMUNITY OWNED ASSET • The University of PA, The Wharton School - Distinction for advancement of Nursing and Hospital Management • Florida Nurses Association, District 7 - Award for Excellence for three consecutive years • Healthcare Advisory Board (2000, 2001, 2002) - Lee Cancer Care profiled nationally as Center of Excellence LMHS

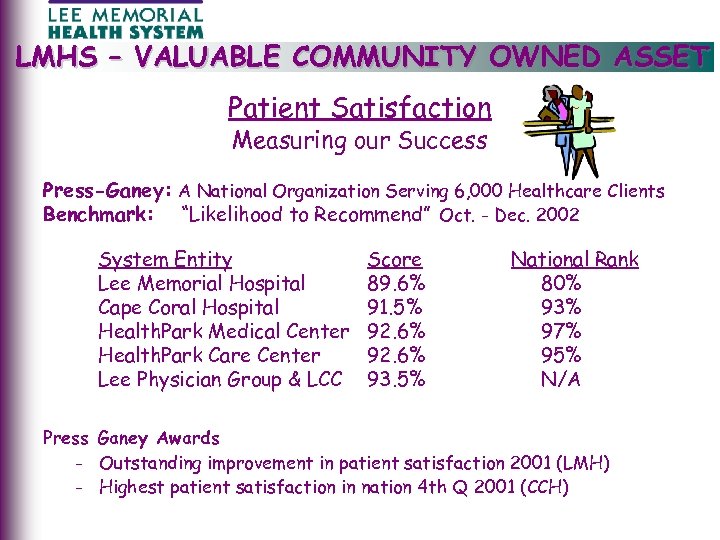

LMHS – VALUABLE COMMUNITY OWNED ASSET ) Patient Satisfaction Measuring our Success Press-Ganey: A National Organization Serving 6, 000 Healthcare Clients Benchmark: “Likelihood to Recommend” Oct. - Dec. 2002 System Entity Lee Memorial Hospital Cape Coral Hospital Health. Park Medical Center Health. Park Care Center Lee Physician Group & LCC Score 89. 6% 91. 5% 92. 6% 93. 5% National Rank 80% 93% 97% 95% N/A Press Ganey Awards - Outstanding improvement in patient satisfaction 2001 (LMH) - Highest patient satisfaction in nation 4 th Q 2001 (CCH)

LMHS – VALUABLE COMMUNITY OWNED ASSET ) Patient Satisfaction Measuring our Success Press-Ganey: A National Organization Serving 6, 000 Healthcare Clients Benchmark: “Likelihood to Recommend” Oct. - Dec. 2002 System Entity Lee Memorial Hospital Cape Coral Hospital Health. Park Medical Center Health. Park Care Center Lee Physician Group & LCC Score 89. 6% 91. 5% 92. 6% 93. 5% National Rank 80% 93% 97% 95% N/A Press Ganey Awards - Outstanding improvement in patient satisfaction 2001 (LMH) - Highest patient satisfaction in nation 4 th Q 2001 (CCH)

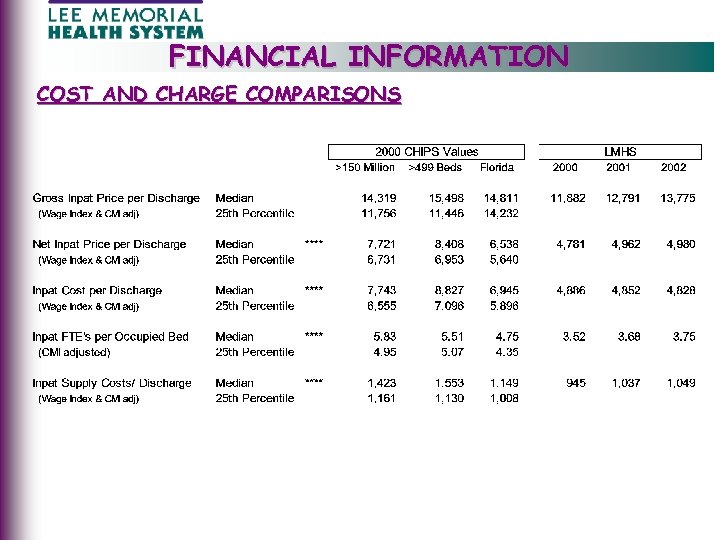

LMHS – VALUABLE COMMUNITY OWNED ASSET Cost comparison • LMHS operating costs are below the 25 th percentile in the nation Charge Comparison • LMHS average inpatient charge is below the 25 th percentile of all hospitals in Florida (CMI and Wage Index Adjusted) Safety Net • Florida’s largest public health care system operating without taxing power or direct tax support • Provide nearly $50 million annually in services to uninsured and underinsured

LMHS – VALUABLE COMMUNITY OWNED ASSET Cost comparison • LMHS operating costs are below the 25 th percentile in the nation Charge Comparison • LMHS average inpatient charge is below the 25 th percentile of all hospitals in Florida (CMI and Wage Index Adjusted) Safety Net • Florida’s largest public health care system operating without taxing power or direct tax support • Provide nearly $50 million annually in services to uninsured and underinsured

LMHS – VALUABLE COMMUNITY OWNED ASSET Low charges Efficient operating expenses High quality outcomes and patient safety

LMHS – VALUABLE COMMUNITY OWNED ASSET Low charges Efficient operating expenses High quality outcomes and patient safety

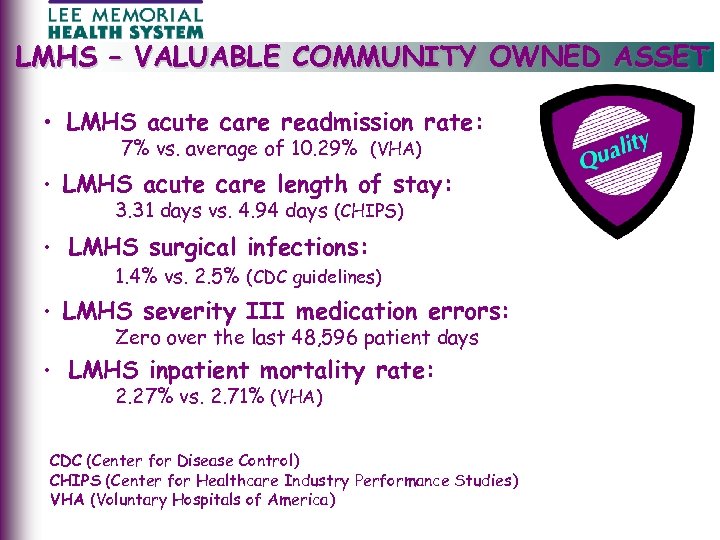

LMHS – VALUABLE COMMUNITY OWNED ASSET • LMHS acute care readmission rate: 7% vs. average of 10. 29% (VHA) • LMHS acute care length of stay: 3. 31 days vs. 4. 94 days (CHIPS) • LMHS surgical infections: 1. 4% vs. 2. 5% (CDC guidelines) • LMHS severity III medication errors: Zero over the last 48, 596 patient days • LMHS inpatient mortality rate: 2. 27% vs. 2. 71% (VHA) CDC (Center for Disease Control) CHIPS (Center for Healthcare Industry Performance Studies) VHA (Voluntary Hospitals of America)

LMHS – VALUABLE COMMUNITY OWNED ASSET • LMHS acute care readmission rate: 7% vs. average of 10. 29% (VHA) • LMHS acute care length of stay: 3. 31 days vs. 4. 94 days (CHIPS) • LMHS surgical infections: 1. 4% vs. 2. 5% (CDC guidelines) • LMHS severity III medication errors: Zero over the last 48, 596 patient days • LMHS inpatient mortality rate: 2. 27% vs. 2. 71% (VHA) CDC (Center for Disease Control) CHIPS (Center for Healthcare Industry Performance Studies) VHA (Voluntary Hospitals of America)

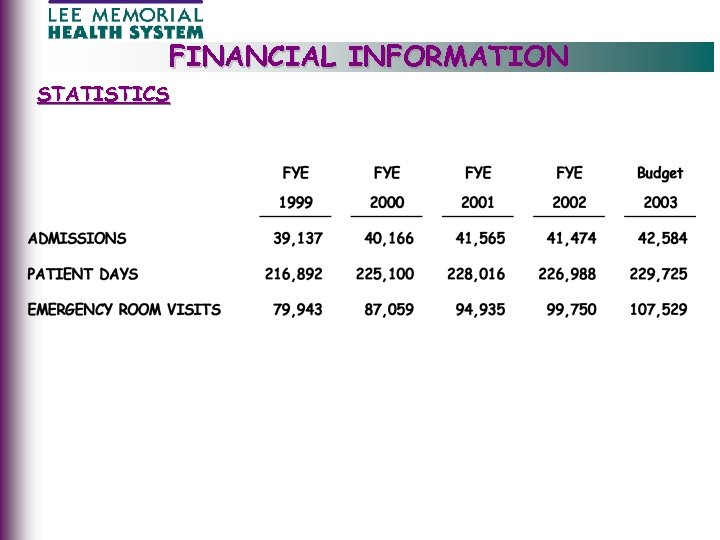

FINANCIAL INFORMATION STATISTICS

FINANCIAL INFORMATION STATISTICS

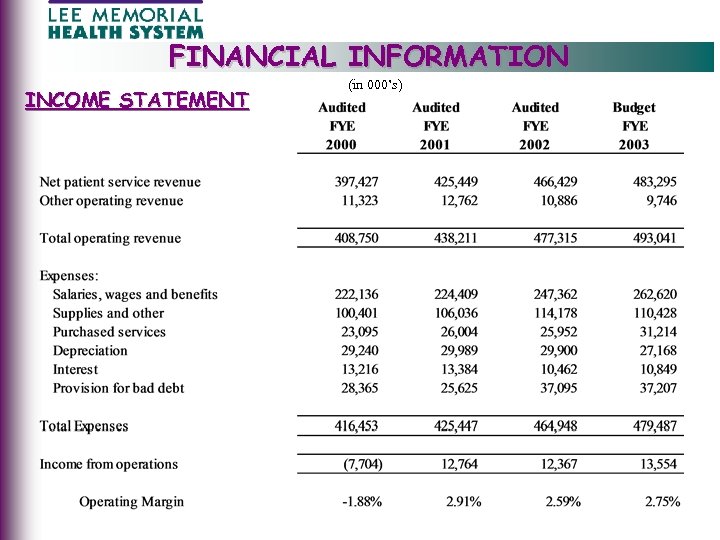

FINANCIAL INFORMATION INCOME STATEMENT (in 000’s)

FINANCIAL INFORMATION INCOME STATEMENT (in 000’s)

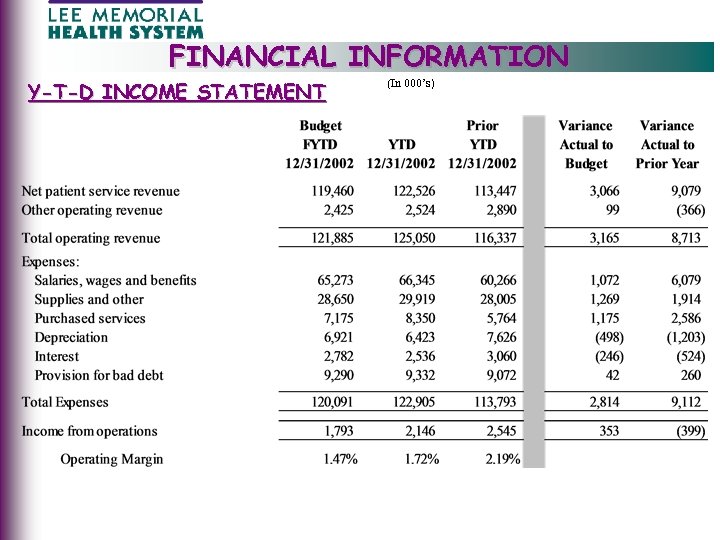

FINANCIAL INFORMATION Y-T-D INCOME STATEMENT (In 000’s)

FINANCIAL INFORMATION Y-T-D INCOME STATEMENT (In 000’s)

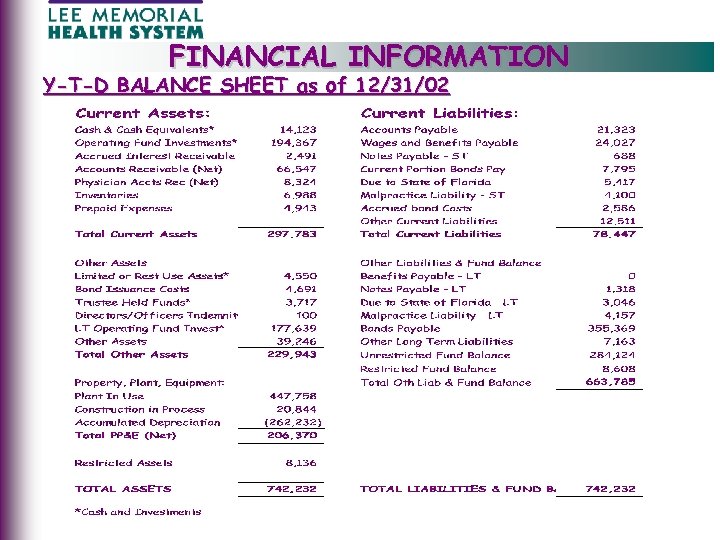

FINANCIAL INFORMATION Y-T-D BALANCE SHEET as of 12/31/02

FINANCIAL INFORMATION Y-T-D BALANCE SHEET as of 12/31/02

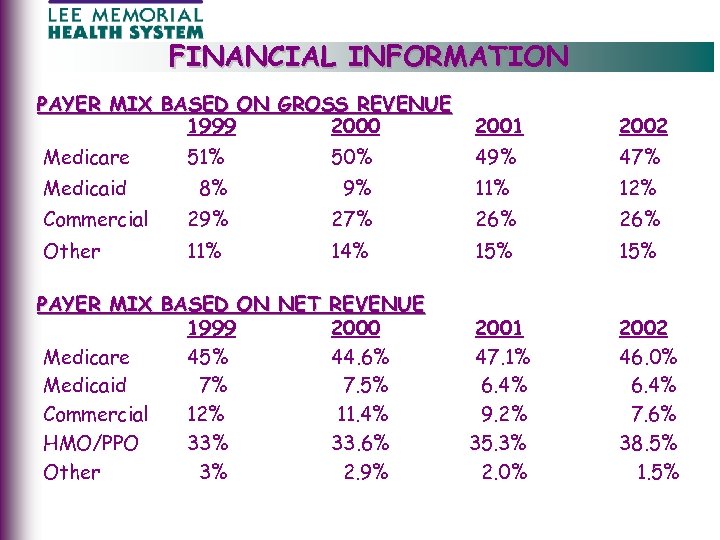

FINANCIAL INFORMATION PAYER MIX BASED ON GROSS REVENUE 1999 2000 2001 2002 Medicare 51% 50% 49% 47% Medicaid 8% 9% 11% 12% Commercial 29% 27% 26% Other 11% 14% 15% PAYER MIX BASED ON NET REVENUE 1999 2000 Medicare 45% 44. 6% Medicaid 7% 7. 5% Commercial 12% 11. 4% HMO/PPO 33% 33. 6% Other 3% 2. 9% 2001 47. 1% 6. 4% 9. 2% 35. 3% 2. 0% 2002 46. 0% 6. 4% 7. 6% 38. 5% 1. 5%

FINANCIAL INFORMATION PAYER MIX BASED ON GROSS REVENUE 1999 2000 2001 2002 Medicare 51% 50% 49% 47% Medicaid 8% 9% 11% 12% Commercial 29% 27% 26% Other 11% 14% 15% PAYER MIX BASED ON NET REVENUE 1999 2000 Medicare 45% 44. 6% Medicaid 7% 7. 5% Commercial 12% 11. 4% HMO/PPO 33% 33. 6% Other 3% 2. 9% 2001 47. 1% 6. 4% 9. 2% 35. 3% 2. 0% 2002 46. 0% 6. 4% 7. 6% 38. 5% 1. 5%

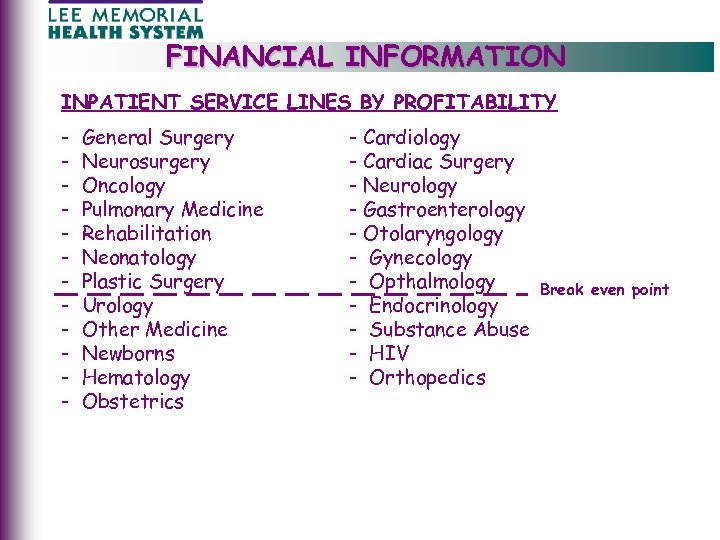

FINANCIAL INFORMATION INPATIENT SERVICE LINES BY PROFITABILITY - General Surgery Neurosurgery Oncology Pulmonary Medicine Rehabilitation Neonatology Plastic Surgery Urology Other Medicine Newborns Hematology Obstetrics - Cardiology - Cardiac Surgery - Neurology - Gastroenterology - Otolaryngology - Gynecology - Opthalmology - Endocrinology - Substance Abuse - HIV - Orthopedics Break even point

FINANCIAL INFORMATION INPATIENT SERVICE LINES BY PROFITABILITY - General Surgery Neurosurgery Oncology Pulmonary Medicine Rehabilitation Neonatology Plastic Surgery Urology Other Medicine Newborns Hematology Obstetrics - Cardiology - Cardiac Surgery - Neurology - Gastroenterology - Otolaryngology - Gynecology - Opthalmology - Endocrinology - Substance Abuse - HIV - Orthopedics Break even point

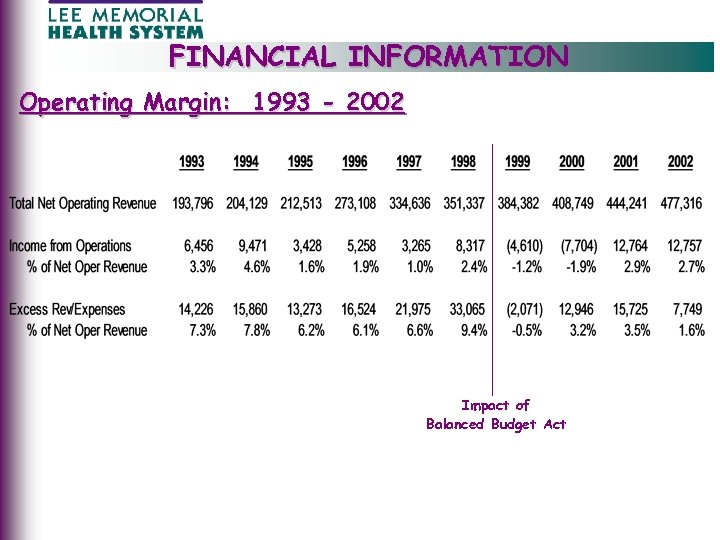

FINANCIAL INFORMATION Operating Margin: 1993 - 2002 Impact of Balanced Budget Act

FINANCIAL INFORMATION Operating Margin: 1993 - 2002 Impact of Balanced Budget Act

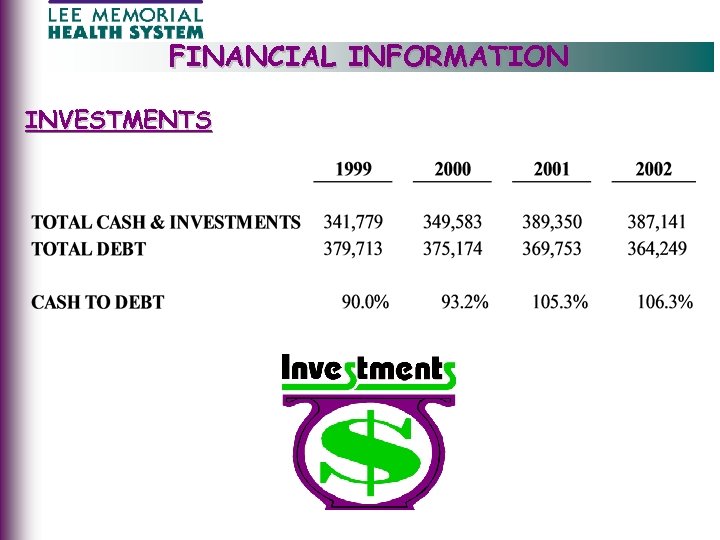

FINANCIAL INFORMATION INVESTMENTS

FINANCIAL INFORMATION INVESTMENTS

FINANCIAL INFORMATION JOHN SITTIG - PARTNER, PRICE WATERHOUSE COOPERS • 16 years of public accounting experience dedicated solely to non-profit and public healthcare clients - Acute care hospitals - Nursing Homes - Home Health Agencies - Skilled nursing Facilities - Physician groups - Foundations • Specializes in: - Reimbursement - Mergers and acquisitions - Revenue cycle projects - Corporate compliance - Bond financing

FINANCIAL INFORMATION JOHN SITTIG - PARTNER, PRICE WATERHOUSE COOPERS • 16 years of public accounting experience dedicated solely to non-profit and public healthcare clients - Acute care hospitals - Nursing Homes - Home Health Agencies - Skilled nursing Facilities - Physician groups - Foundations • Specializes in: - Reimbursement - Mergers and acquisitions - Revenue cycle projects - Corporate compliance - Bond financing

FINANCIAL INFORMATION COST AND CHARGE COMPARISONS

FINANCIAL INFORMATION COST AND CHARGE COMPARISONS

FINANCIAL INFORMATION JIM ANDREWS - V. P. GOLDMAN, SACHS • 27 years of investment banking and healthcare financial consulting experience - Debt financing - Acquisitions and divestitures - Long-term capital plans • Clients include: - Adventist Health Systems/Sunbelt - Care. Alliance Health - Mt. Sinai NYU Health - North Mississippi Health Services - Sentara Healthcare - Trinity Health Corporation - Vanderbilt University

FINANCIAL INFORMATION JIM ANDREWS - V. P. GOLDMAN, SACHS • 27 years of investment banking and healthcare financial consulting experience - Debt financing - Acquisitions and divestitures - Long-term capital plans • Clients include: - Adventist Health Systems/Sunbelt - Care. Alliance Health - Mt. Sinai NYU Health - North Mississippi Health Services - Sentara Healthcare - Trinity Health Corporation - Vanderbilt University

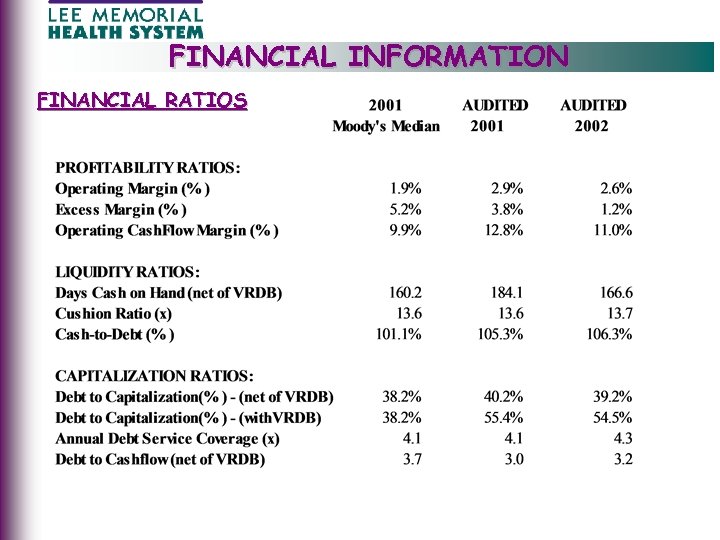

FINANCIAL INFORMATION FINANCIAL RATIOS

FINANCIAL INFORMATION FINANCIAL RATIOS

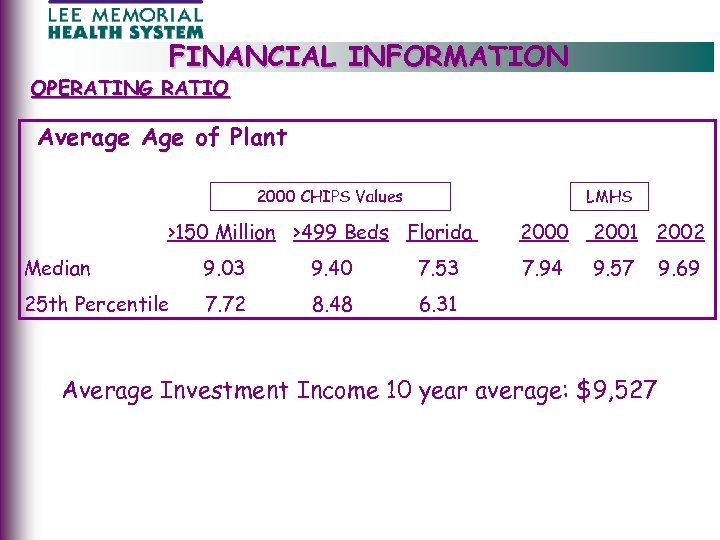

FINANCIAL INFORMATION OPERATING RATIO Average Age of Plant 2000 CHIPS Values LMHS >150 Million >499 Beds Florida Median 9. 03 9. 40 7. 53 25 th Percentile 7. 72 8. 48 2000 2001 2002 7. 94 9. 57 6. 31 Average Investment Income 10 year average: $9, 527 9. 69

FINANCIAL INFORMATION OPERATING RATIO Average Age of Plant 2000 CHIPS Values LMHS >150 Million >499 Beds Florida Median 9. 03 9. 40 7. 53 25 th Percentile 7. 72 8. 48 2000 2001 2002 7. 94 9. 57 6. 31 Average Investment Income 10 year average: $9, 527 9. 69

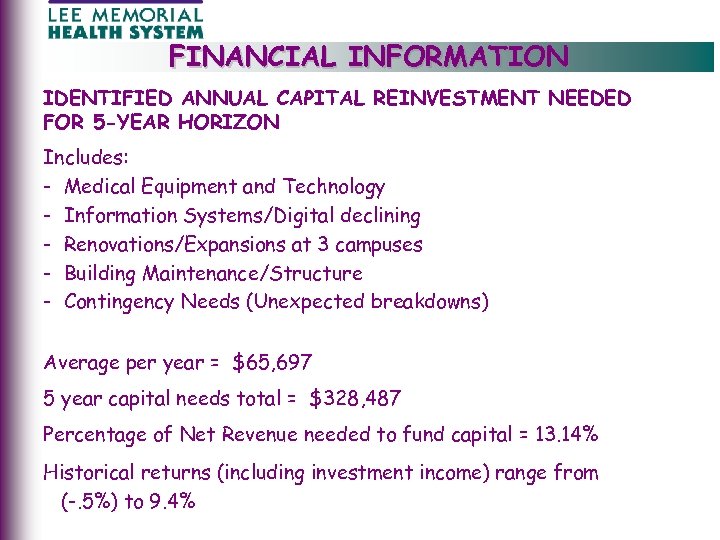

FINANCIAL INFORMATION IDENTIFIED ANNUAL CAPITAL REINVESTMENT NEEDED FOR 5 -YEAR HORIZON Includes: - Medical Equipment and Technology - Information Systems/Digital declining - Renovations/Expansions at 3 campuses - Building Maintenance/Structure - Contingency Needs (Unexpected breakdowns) Average per year = $65, 697 5 year capital needs total = $328, 487 Percentage of Net Revenue needed to fund capital = 13. 14% Historical returns (including investment income) range from (-. 5%) to 9. 4%

FINANCIAL INFORMATION IDENTIFIED ANNUAL CAPITAL REINVESTMENT NEEDED FOR 5 -YEAR HORIZON Includes: - Medical Equipment and Technology - Information Systems/Digital declining - Renovations/Expansions at 3 campuses - Building Maintenance/Structure - Contingency Needs (Unexpected breakdowns) Average per year = $65, 697 5 year capital needs total = $328, 487 Percentage of Net Revenue needed to fund capital = 13. 14% Historical returns (including investment income) range from (-. 5%) to 9. 4%

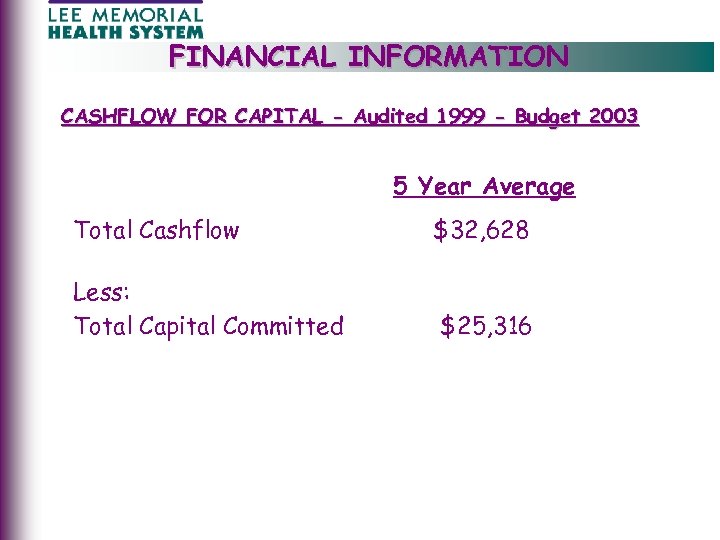

FINANCIAL INFORMATION CASHFLOW FOR CAPITAL - Audited 1999 - Budget 2003 5 Year Average Total Cashflow $32, 628 Less: Total Capital Committed $25, 316

FINANCIAL INFORMATION CASHFLOW FOR CAPITAL - Audited 1999 - Budget 2003 5 Year Average Total Cashflow $32, 628 Less: Total Capital Committed $25, 316

FINANCIAL INFORMATION • Insufficient cash from operations to meet capital needs • Limited capacity to borrow more money • Has LMHS maximized what it can from operations to fund capital? WE BELIEVE WE HAVE!

FINANCIAL INFORMATION • Insufficient cash from operations to meet capital needs • Limited capacity to borrow more money • Has LMHS maximized what it can from operations to fund capital? WE BELIEVE WE HAVE!

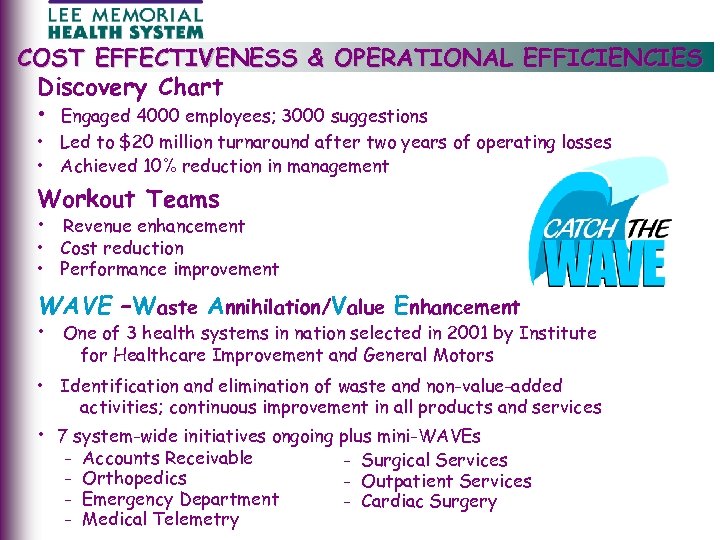

COST EFFECTIVENESS & OPERATIONAL EFFICIENCIES Discovery Chart • Engaged 4000 employees; 3000 suggestions • Led to $20 million turnaround after two years of operating losses • Achieved 10% reduction in management Workout Teams • Revenue enhancement • Cost reduction • Performance improvement WAVE –Waste Annihilation/Value Enhancement • One of 3 health systems in nation selected in 2001 by Institute for Healthcare Improvement and General Motors • Identification and elimination of waste and non-value-added activities; continuous improvement in all products and services • 7 system-wide initiatives ongoing plus mini-WAVEs - Accounts Receivable Orthopedics Emergency Department Medical Telemetry - Surgical Services - Outpatient Services - Cardiac Surgery

COST EFFECTIVENESS & OPERATIONAL EFFICIENCIES Discovery Chart • Engaged 4000 employees; 3000 suggestions • Led to $20 million turnaround after two years of operating losses • Achieved 10% reduction in management Workout Teams • Revenue enhancement • Cost reduction • Performance improvement WAVE –Waste Annihilation/Value Enhancement • One of 3 health systems in nation selected in 2001 by Institute for Healthcare Improvement and General Motors • Identification and elimination of waste and non-value-added activities; continuous improvement in all products and services • 7 system-wide initiatives ongoing plus mini-WAVEs - Accounts Receivable Orthopedics Emergency Department Medical Telemetry - Surgical Services - Outpatient Services - Cardiac Surgery

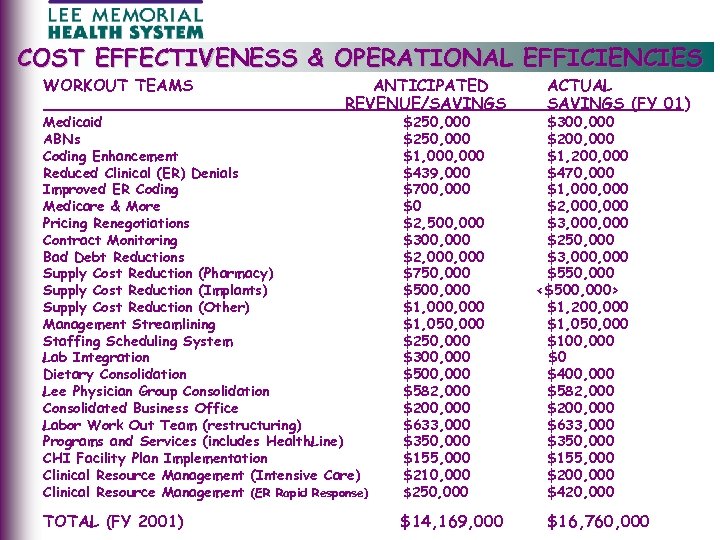

COST EFFECTIVENESS & OPERATIONAL EFFICIENCIES WORKOUT TEAMS ANTICIPATED REVENUE/SAVINGS Medicaid ABNs Coding Enhancement Reduced Clinical (ER) Denials Improved ER Coding Medicare & More Pricing Renegotiations Contract Monitoring Bad Debt Reductions Supply Cost Reduction (Pharmacy) Supply Cost Reduction (Implants) Supply Cost Reduction (Other) Management Streamlining Staffing Scheduling System Lab Integration Dietary Consolidation Lee Physician Group Consolidation Consolidated Business Office Labor Work Out Team (restructuring) Programs and Services (includes Health. Line) CHI Facility Plan Implementation Clinical Resource Management (Intensive Care) Clinical Resource Management (ER Rapid Response) $250, 000 $1, 000 $439, 000 $700, 000 $0 $2, 500, 000 $300, 000 $2, 000 $750, 000 $500, 000 $1, 050, 000 $250, 000 $300, 000 $582, 000 $200, 000 $633, 000 $350, 000 $155, 000 $210, 000 $250, 000 TOTAL (FY 2001) $14, 169, 000 ACTUAL SAVINGS (FY 01) $300, 000 $200, 000 $1, 200, 000 $470, 000 $1, 000 $2, 000 $3, 000 $250, 000 $3, 000 $550, 000 <$500, 000> $1, 200, 000 $1, 050, 000 $100, 000 $0 $400, 000 $582, 000 $200, 000 $633, 000 $350, 000 $155, 000 $200, 000 $420, 000 $16, 760, 000

COST EFFECTIVENESS & OPERATIONAL EFFICIENCIES WORKOUT TEAMS ANTICIPATED REVENUE/SAVINGS Medicaid ABNs Coding Enhancement Reduced Clinical (ER) Denials Improved ER Coding Medicare & More Pricing Renegotiations Contract Monitoring Bad Debt Reductions Supply Cost Reduction (Pharmacy) Supply Cost Reduction (Implants) Supply Cost Reduction (Other) Management Streamlining Staffing Scheduling System Lab Integration Dietary Consolidation Lee Physician Group Consolidation Consolidated Business Office Labor Work Out Team (restructuring) Programs and Services (includes Health. Line) CHI Facility Plan Implementation Clinical Resource Management (Intensive Care) Clinical Resource Management (ER Rapid Response) $250, 000 $1, 000 $439, 000 $700, 000 $0 $2, 500, 000 $300, 000 $2, 000 $750, 000 $500, 000 $1, 050, 000 $250, 000 $300, 000 $582, 000 $200, 000 $633, 000 $350, 000 $155, 000 $210, 000 $250, 000 TOTAL (FY 2001) $14, 169, 000 ACTUAL SAVINGS (FY 01) $300, 000 $200, 000 $1, 200, 000 $470, 000 $1, 000 $2, 000 $3, 000 $250, 000 $3, 000 $550, 000 <$500, 000> $1, 200, 000 $1, 050, 000 $100, 000 $0 $400, 000 $582, 000 $200, 000 $633, 000 $350, 000 $155, 000 $200, 000 $420, 000 $16, 760, 000

COST EFFECTIVENESS & OPERATIONAL EFFICIENCIES Hospitalists • Designed to reduce length of stay • Improve ICU efficiency • Support unassigned patients Institute for Healthcare Improvement (1 of 80 in the United States) • Improve room turnover and bed availability by 25% • Reduce delays and waiting by 25%

COST EFFECTIVENESS & OPERATIONAL EFFICIENCIES Hospitalists • Designed to reduce length of stay • Improve ICU efficiency • Support unassigned patients Institute for Healthcare Improvement (1 of 80 in the United States) • Improve room turnover and bed availability by 25% • Reduce delays and waiting by 25%

COST EFFECTIVENESS & OPERATIONAL EFFICIENCIES National Nursing Services Magnet Recognition • Gold standard for nursing services • 64 hospitals out of 6000 have thus far achieved Electronic Intensive Care Units (Visicu, Inc. , Johns Hopkins) • • • Mortality (-25%) Length of stay (-20%) Average treatment cost per patient (-$2000) Capital investment $2, 800, 000 Annual operating costs $2, 200, 000 National Quality Forum Safety Practices • Over 2/3 s of identified best practices already implemented at LMHS

COST EFFECTIVENESS & OPERATIONAL EFFICIENCIES National Nursing Services Magnet Recognition • Gold standard for nursing services • 64 hospitals out of 6000 have thus far achieved Electronic Intensive Care Units (Visicu, Inc. , Johns Hopkins) • • • Mortality (-25%) Length of stay (-20%) Average treatment cost per patient (-$2000) Capital investment $2, 800, 000 Annual operating costs $2, 200, 000 National Quality Forum Safety Practices • Over 2/3 s of identified best practices already implemented at LMHS

COST EFFECTIVENESS & OPERATIONAL EFFICIENCIES Cape Coral Hospital Acquisition • CCH lost $2 million per month for two years prior to LMHS acquisition 1996 • Helped spread fixed costs; reduce management overhead • Under LMHS leadership, turned profit in eight months • Solidified market position Lee. Sar & Cooperative Services of Florida • • • In partnership with Sarasota Memorial Healthcare System Centralized buying power, inventory control and distribution Significant purchasing and distribution savings Savings for FY 2002 $5. 3 million Savings sinception $30. 54 million

COST EFFECTIVENESS & OPERATIONAL EFFICIENCIES Cape Coral Hospital Acquisition • CCH lost $2 million per month for two years prior to LMHS acquisition 1996 • Helped spread fixed costs; reduce management overhead • Under LMHS leadership, turned profit in eight months • Solidified market position Lee. Sar & Cooperative Services of Florida • • • In partnership with Sarasota Memorial Healthcare System Centralized buying power, inventory control and distribution Significant purchasing and distribution savings Savings for FY 2002 $5. 3 million Savings sinception $30. 54 million

COST EFFECTIVENESS & OPERATIONAL EFFICIENCIES Tomorrow’s Workforce Initiative • 54 leading health systems nationally • Focused on becoming “Employers of Choice” • Nationally highlighted for “best practice” – LMHS employee turnover 12% vs. Florida at 23% – LMHS RN turnover 10. 9% vs. Florida at 20. 5% – LMHS RN vacancy rate 9. 85% vs. Florida at 15. 6% Arbitrage • Since 1985 have borrowed against previously spent capital to reinvest at higher return • Helped create capital to acquire Cape Coral Hospital • Provides income to be used for facility replacement and new technology • FY 2000 cash to debt 93% • FY 2002 cash to debt 108%

COST EFFECTIVENESS & OPERATIONAL EFFICIENCIES Tomorrow’s Workforce Initiative • 54 leading health systems nationally • Focused on becoming “Employers of Choice” • Nationally highlighted for “best practice” – LMHS employee turnover 12% vs. Florida at 23% – LMHS RN turnover 10. 9% vs. Florida at 20. 5% – LMHS RN vacancy rate 9. 85% vs. Florida at 15. 6% Arbitrage • Since 1985 have borrowed against previously spent capital to reinvest at higher return • Helped create capital to acquire Cape Coral Hospital • Provides income to be used for facility replacement and new technology • FY 2000 cash to debt 93% • FY 2002 cash to debt 108%

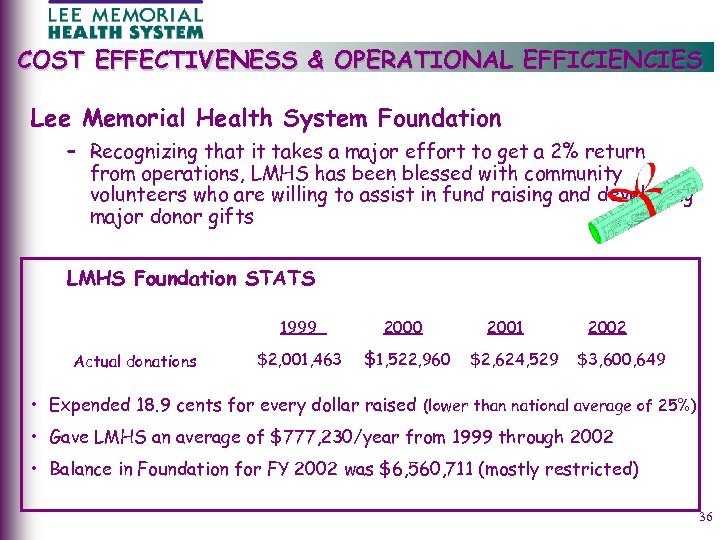

COST EFFECTIVENESS & OPERATIONAL EFFICIENCIES Lee Memorial Health System Foundation – Recognizing that it takes a major effort to get a 2% return from operations, LMHS has been blessed with community volunteers who are willing to assist in fund raising and developing major donor gifts LMHS Foundation STATS 1999 Actual donations 2000 $2, 001, 463 $1, 522, 960 2001 $2, 624, 529 2002 $3, 600, 649 • Expended 18. 9 cents for every dollar raised (lower than national average of 25%) • Gave LMHS an average of $777, 230/year from 1999 through 2002 • Balance in Foundation for FY 2002 was $6, 560, 711 (mostly restricted) 36

COST EFFECTIVENESS & OPERATIONAL EFFICIENCIES Lee Memorial Health System Foundation – Recognizing that it takes a major effort to get a 2% return from operations, LMHS has been blessed with community volunteers who are willing to assist in fund raising and developing major donor gifts LMHS Foundation STATS 1999 Actual donations 2000 $2, 001, 463 $1, 522, 960 2001 $2, 624, 529 2002 $3, 600, 649 • Expended 18. 9 cents for every dollar raised (lower than national average of 25%) • Gave LMHS an average of $777, 230/year from 1999 through 2002 • Balance in Foundation for FY 2002 was $6, 560, 711 (mostly restricted) 36

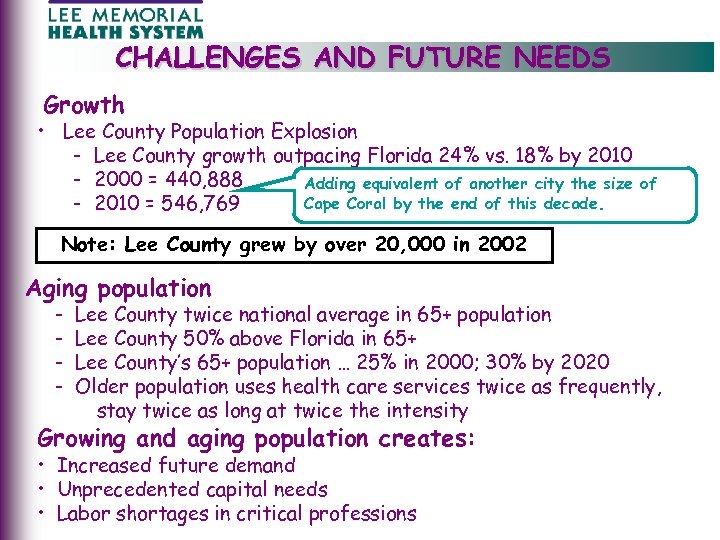

CHALLENGES AND FUTURE NEEDS Growth • Lee County Population Explosion - Lee County growth outpacing Florida 24% vs. 18% by 2010 - 2000 = 440, 888 Adding equivalent of another city the size Cape Coral by the end of this decade. - 2010 = 546, 769 of Note: Lee County grew by over 20, 000 in 2002 Aging population - Lee County twice national average in 65+ population Lee County 50% above Florida in 65+ Lee County’s 65+ population … 25% in 2000; 30% by 2020 Older population uses health care services twice as frequently, stay twice as long at twice the intensity Growing and aging population creates: • Increased future demand • Unprecedented capital needs • Labor shortages in critical professions

CHALLENGES AND FUTURE NEEDS Growth • Lee County Population Explosion - Lee County growth outpacing Florida 24% vs. 18% by 2010 - 2000 = 440, 888 Adding equivalent of another city the size Cape Coral by the end of this decade. - 2010 = 546, 769 of Note: Lee County grew by over 20, 000 in 2002 Aging population - Lee County twice national average in 65+ population Lee County 50% above Florida in 65+ Lee County’s 65+ population … 25% in 2000; 30% by 2020 Older population uses health care services twice as frequently, stay twice as long at twice the intensity Growing and aging population creates: • Increased future demand • Unprecedented capital needs • Labor shortages in critical professions

CHALLENGES AND FUTURE NEEDS Conditions unfavorable to meeting future community needs Uninsured increasing • • 1993: 37 million uninsured 2002: 43 million uninsured 75%+: uninsured are employed 21% of Floridians under age 65 are uninsured vs. national average of 16% Underinsured increasing • • Government(s) reducing coverage Insurance rates increasing Employers passing on greater insurance risk Insurance companies leaving unprofitable markets NUMBER OF INSURED

CHALLENGES AND FUTURE NEEDS Conditions unfavorable to meeting future community needs Uninsured increasing • • 1993: 37 million uninsured 2002: 43 million uninsured 75%+: uninsured are employed 21% of Floridians under age 65 are uninsured vs. national average of 16% Underinsured increasing • • Government(s) reducing coverage Insurance rates increasing Employers passing on greater insurance risk Insurance companies leaving unprofitable markets NUMBER OF INSURED

CHALLENGES AND FUTURE NEEDS Conditions unfavorable to meeting future community needs (continued) Payments • Dependent on fixed government reimbursement (Medicare, Medicaid) • Managed care negotiate price discounts • Increases in costs are more than payment increases • Physician reimbursement declining - 2002 (declined 5. 4%) - 2003 (declining 4. 4%) - 2003 -2006 (declining 18%)

CHALLENGES AND FUTURE NEEDS Conditions unfavorable to meeting future community needs (continued) Payments • Dependent on fixed government reimbursement (Medicare, Medicaid) • Managed care negotiate price discounts • Increases in costs are more than payment increases • Physician reimbursement declining - 2002 (declined 5. 4%) - 2003 (declining 4. 4%) - 2003 -2006 (declining 18%)

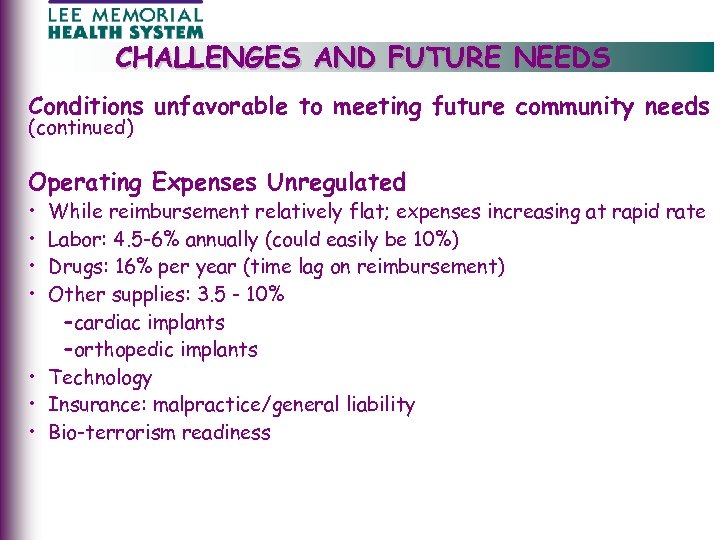

CHALLENGES AND FUTURE NEEDS Conditions unfavorable to meeting future community needs (continued) Operating Expenses Unregulated • • While reimbursement relatively flat; expenses increasing at rapid rate Labor: 4. 5 -6% annually (could easily be 10%) Drugs: 16% per year (time lag on reimbursement) Other supplies: 3. 5 - 10% –cardiac implants –orthopedic implants • Technology • Insurance: malpractice/general liability • Bio-terrorism readiness

CHALLENGES AND FUTURE NEEDS Conditions unfavorable to meeting future community needs (continued) Operating Expenses Unregulated • • While reimbursement relatively flat; expenses increasing at rapid rate Labor: 4. 5 -6% annually (could easily be 10%) Drugs: 16% per year (time lag on reimbursement) Other supplies: 3. 5 - 10% –cardiac implants –orthopedic implants • Technology • Insurance: malpractice/general liability • Bio-terrorism readiness

TRAUMA CENTER • Florida has state-wide designation of trauma centers (declined from 36 to 20 in recent years) • Hospital and Physician participation is voluntary • Designation has specific requirements for physician specialty coverage and timeliness for “Golden Hour” as well as training, equipment, facilities and staffing demands • Communities without organized trauma centers experience a preventable death rate of approximately 30% • Preventable death rate with trauma centers … 4 -5% • Lee Memorial’s Trauma Center among the best in state and nation in treating preventable deaths … 2% LMH

TRAUMA CENTER • Florida has state-wide designation of trauma centers (declined from 36 to 20 in recent years) • Hospital and Physician participation is voluntary • Designation has specific requirements for physician specialty coverage and timeliness for “Golden Hour” as well as training, equipment, facilities and staffing demands • Communities without organized trauma centers experience a preventable death rate of approximately 30% • Preventable death rate with trauma centers … 4 -5% • Lee Memorial’s Trauma Center among the best in state and nation in treating preventable deaths … 2% LMH

TRAUMA CENTER Physician surgical specialties required for Trauma Center Designation: - Trauma surgeons - Emergency physicians - General Surgeons - OB/GYN physicians - Neurosurgery physicians - Ophthalmology physicians - Oral/Maxillofacial Surgeons - Hand Surgeons - Cardiac Surgeons - Orthopedic Surgeons - Plastic Surgeons - Thoracic Surgeons - Urology Surgeons - Otolaryngology Surgeons Other physician specialties required for Trauma Center Designation: - Cardiac - Gastroenterology - Hematology - Infectious Disease - Internal Medicine - Nephrology - Pathology - Pulmonary Medicine Trauma requires massive blood demands

TRAUMA CENTER Physician surgical specialties required for Trauma Center Designation: - Trauma surgeons - Emergency physicians - General Surgeons - OB/GYN physicians - Neurosurgery physicians - Ophthalmology physicians - Oral/Maxillofacial Surgeons - Hand Surgeons - Cardiac Surgeons - Orthopedic Surgeons - Plastic Surgeons - Thoracic Surgeons - Urology Surgeons - Otolaryngology Surgeons Other physician specialties required for Trauma Center Designation: - Cardiac - Gastroenterology - Hematology - Infectious Disease - Internal Medicine - Nephrology - Pathology - Pulmonary Medicine Trauma requires massive blood demands

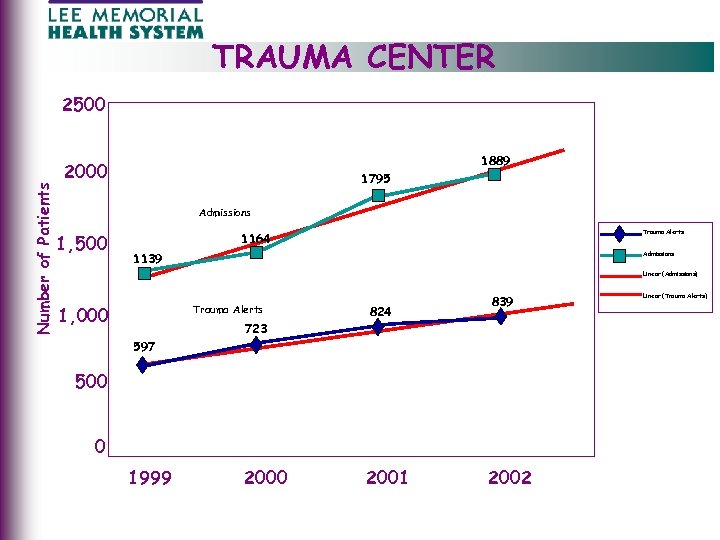

TRAUMA CENTER Number of Patients 2500 1889 2000 1795 Admissions 1, 500 Trauma Alerts 1164 Admissions 1139 Linear (Admissions) 1, 000 Trauma Alerts 824 839 723 597 500 0 1999 2000 2001 2002 Linear (Trauma Alerts)

TRAUMA CENTER Number of Patients 2500 1889 2000 1795 Admissions 1, 500 Trauma Alerts 1164 Admissions 1139 Linear (Admissions) 1, 000 Trauma Alerts 824 839 723 597 500 0 1999 2000 2001 2002 Linear (Trauma Alerts)

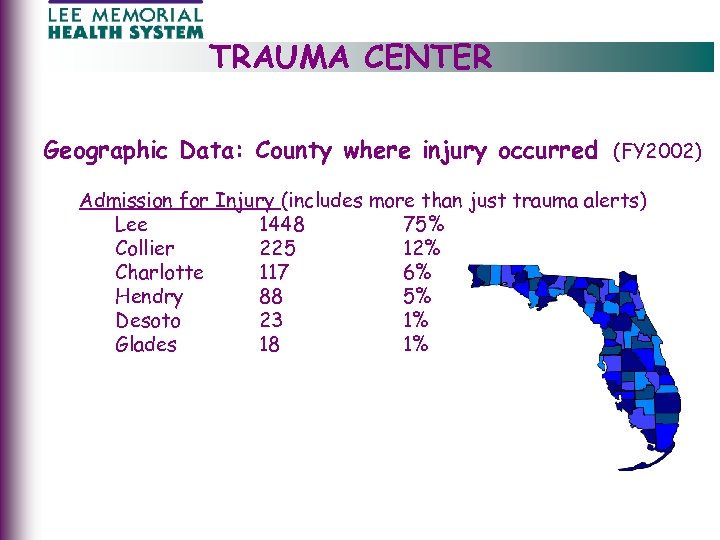

TRAUMA CENTER Geographic Data: County where injury occurred (FY 2002) Admission for Injury (includes more than just trauma alerts) Lee 1448 75% Collier 225 12% Charlotte 117 6% Hendry 88 5% Desoto 23 1% Glades 18 1%

TRAUMA CENTER Geographic Data: County where injury occurred (FY 2002) Admission for Injury (includes more than just trauma alerts) Lee 1448 75% Collier 225 12% Charlotte 117 6% Hendry 88 5% Desoto 23 1% Glades 18 1%

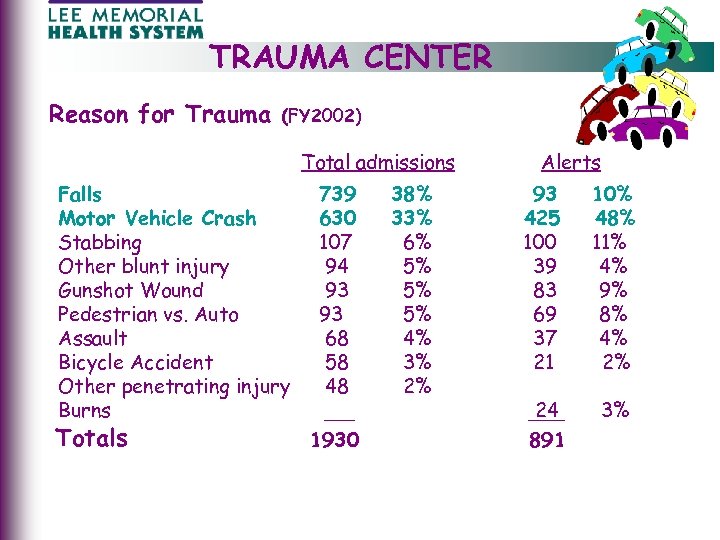

TRAUMA CENTER Reason for Trauma (FY 2002) Total admissions Falls Motor Vehicle Crash Stabbing Other blunt injury Gunshot Wound Pedestrian vs. Auto Assault Bicycle Accident Other penetrating injury Burns Totals 739 630 107 94 93 93 68 58 48 1930 38% 33% 6% 5% 5% 5% 4% 3% 2% Alerts 93 425 100 39 83 69 37 21 10% 48% 11% 4% 9% 8% 4% 2% 24 891 3%

TRAUMA CENTER Reason for Trauma (FY 2002) Total admissions Falls Motor Vehicle Crash Stabbing Other blunt injury Gunshot Wound Pedestrian vs. Auto Assault Bicycle Accident Other penetrating injury Burns Totals 739 630 107 94 93 93 68 58 48 1930 38% 33% 6% 5% 5% 5% 4% 3% 2% Alerts 93 425 100 39 83 69 37 21 10% 48% 11% 4% 9% 8% 4% 2% 24 891 3%

TRAUMA CENTER Disruption to normal operations • Trauma patients take precedence – emergency – diagnostic (CT, MRI, X-ray) – operating rooms – staff - physician, patient and family frustration and clinical concerns • Backlog of patients in the emergency department • Capacity issues cause diversions to other facilities and delays in available inpatient beds • Staff frustration, burnout can result in transfers to less stressful environment

TRAUMA CENTER Disruption to normal operations • Trauma patients take precedence – emergency – diagnostic (CT, MRI, X-ray) – operating rooms – staff - physician, patient and family frustration and clinical concerns • Backlog of patients in the emergency department • Capacity issues cause diversions to other facilities and delays in available inpatient beds • Staff frustration, burnout can result in transfers to less stressful environment

TRAUMA CENTER Competition for physician support • • • Prolonged work hours; heavy workload Complicated cases Increased liability risk Non-reimbursement Recruitment and retention Opportunity to choose other hospitals for active staff privileges - loss of neurosurgeons - loss of general surgeons Cost factors • • • Low payment for services Collection rate under 30% Opportunity costs far exceed direct losses

TRAUMA CENTER Competition for physician support • • • Prolonged work hours; heavy workload Complicated cases Increased liability risk Non-reimbursement Recruitment and retention Opportunity to choose other hospitals for active staff privileges - loss of neurosurgeons - loss of general surgeons Cost factors • • • Low payment for services Collection rate under 30% Opportunity costs far exceed direct losses

TRAUMA CENTER Community Impact if Trauma Designation is Lost: • Destination protocols for EMS Transportation change to nearest facility • Potential to create back logs and diversions in all Emergency Departments in Lee County • No organized trauma support system Short-Term Solutions (2003) • LMHS committed $7 million for FY 2003 • County working to assist with $1. 5 million • Fundraising and other efforts - $1. 5 million Equaling $10 million

TRAUMA CENTER Community Impact if Trauma Designation is Lost: • Destination protocols for EMS Transportation change to nearest facility • Potential to create back logs and diversions in all Emergency Departments in Lee County • No organized trauma support system Short-Term Solutions (2003) • LMHS committed $7 million for FY 2003 • County working to assist with $1. 5 million • Fundraising and other efforts - $1. 5 million Equaling $10 million

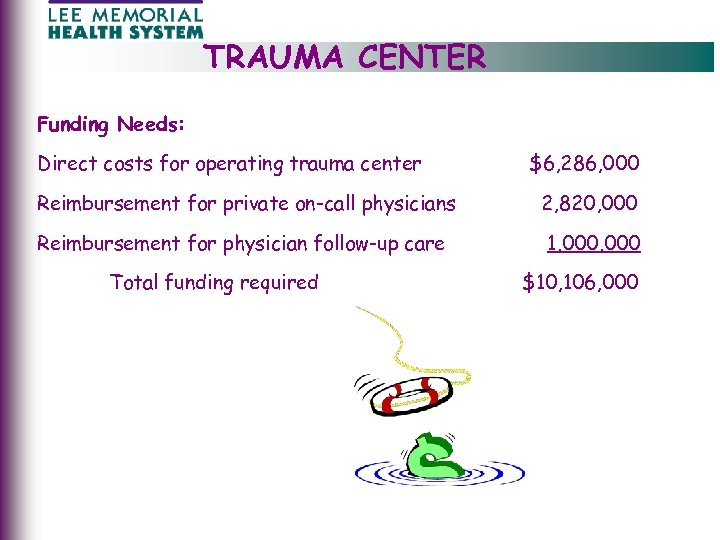

TRAUMA CENTER Funding Needs: Direct costs for operating trauma center $6, 286, 000 Reimbursement for private on-call physicians 2, 820, 000 Reimbursement for physician follow-up care 1, 000 Total funding required $10, 106, 000

TRAUMA CENTER Funding Needs: Direct costs for operating trauma center $6, 286, 000 Reimbursement for private on-call physicians 2, 820, 000 Reimbursement for physician follow-up care 1, 000 Total funding required $10, 106, 000

TRAUMA CENTER LMHS Recommendations to Legislative Delegation • Create Lee County Trauma District • Strengthen the Health Care Responsibility Act to assure out of county payments • Amend or create statute that allows for sales tax to solely fund trauma services • Pursue dedicated sources of funding – i. e. - surcharges on automobile licenses - expanded fees on DUI violations • Strengthen Florida’s Good Samaritan Act and/or provide/expand limits of sovereign immunity to protect physicians and hospital emergency personnel • Clarify laws between state and federal EMTALA lessening conflicts and confusion • Expand health insurance coverage to reduce the number of uninsured

TRAUMA CENTER LMHS Recommendations to Legislative Delegation • Create Lee County Trauma District • Strengthen the Health Care Responsibility Act to assure out of county payments • Amend or create statute that allows for sales tax to solely fund trauma services • Pursue dedicated sources of funding – i. e. - surcharges on automobile licenses - expanded fees on DUI violations • Strengthen Florida’s Good Samaritan Act and/or provide/expand limits of sovereign immunity to protect physicians and hospital emergency personnel • Clarify laws between state and federal EMTALA lessening conflicts and confusion • Expand health insurance coverage to reduce the number of uninsured

CONCLUSION Lee Memorial Health System is: • Credible • Committed to our community and quality patient care • Committed to our employees/volunteers • Currently financially stable • Attempting to effectively plan for medical needs of a growing and aging population • Attempting to protect the future of an excellent Trauma Center with a long-term solution rather than a band-aid approach

CONCLUSION Lee Memorial Health System is: • Credible • Committed to our community and quality patient care • Committed to our employees/volunteers • Currently financially stable • Attempting to effectively plan for medical needs of a growing and aging population • Attempting to protect the future of an excellent Trauma Center with a long-term solution rather than a band-aid approach