Lecture_2.ppt

- Количество слайдов: 15

Lecturer: Prof. Alexander Kostyuk, DBA, Ph. D Editor-in-Chief, Corporate Ownership & Control journal

Lecture 2 Corporate governance: evolution of the term Issues to consider 1. Origin of the term “corporate governance” 2. Evolution of the term 3. National approaches to the term 4. Conclusion 5. Seminar questions and recommended literature

Question 1 Origin of the term……. The year of origin Authors 1984 Bob Tricker Achievement Targeted on the role of corporate control Outcome The term “corporate governance” A book - Corporate Governance: Practices, Procedures and Powers in British Companies and their Boards of Directors “The governance role is not concerned with the running of the company, but with giving overall direction to the enterprise, with overseeing and controlling the executive actions of management and with satisfying legitimate expectations of accountability and regulation by interests beyond the corporate boundaries”

Question 2 Evolution of the term……. The year of origin Authors 1992 Sir Adrian Cadbury Achievement Targeted on the role of corporate governance as a system Outcome The term “corporate governance” A report – The Cadbury Report “A system by which companies are directed and controlled”

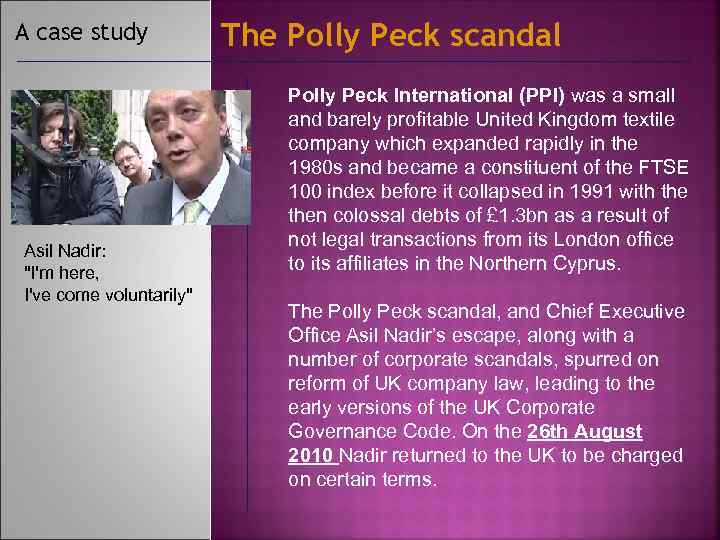

A case study The Cadbury report Produced by a committee chaired by Sir Adrian Cadbury, the Report was a response to major corporate scandals associated with governance failures in the UK. The committee was formed in 1991 after Polly Peck, a major UK company, went insolvency after years of falsifying financial reports.

A case study Asil Nadir: "I'm here, I've come voluntarily" The Polly Peck scandal Polly Peck International (PPI) was a small and barely profitable United Kingdom textile company which expanded rapidly in the 1980 s and became a constituent of the FTSE 100 index before it collapsed in 1991 with then colossal debts of £ 1. 3 bn as a result of not legal transactions from its London office to its affiliates in the Northern Cyprus. The Polly Peck scandal, and Chief Executive Office Asil Nadir’s escape, along with a number of corporate scandals, spurred on reform of UK company law, leading to the early versions of the UK Corporate Governance Code. On the 26 th August 2010 Nadir returned to the UK to be charged on certain terms.

Question 2 Evolution of the term……. . The year of origin Authors 1995 Margaret Blair Achievement Targeted on the role of various arrangements Outcome A book – Ownership and Control: Rethinking Corporate Governance for the Twenty-first Century The term “corporate governance” “the whole set of legal, cultural, and institutional arrangements that determine what public corporations can do, who controls them, how that control is exercised, and how the risks and return from the activities they undertake are allocated”

Question 2 Evolution of the term……. The year of origin Authors 1995 Monks & Minow Achievement Targeted on the relationships inside of the system Outcome The term “corporate governance” A book – Corporate Governance “the relationship among various participants [chief executive officer, management, shareholders, employees] in determining the direction and performance of corporations”

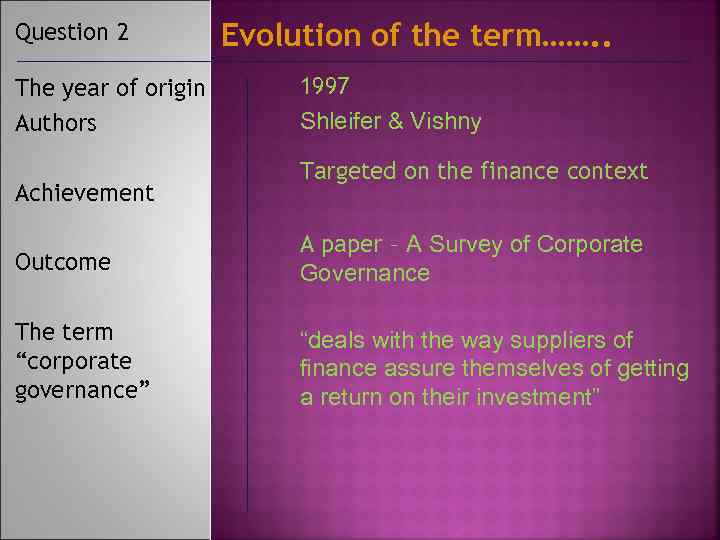

Question 2 The year of origin Authors Achievement Evolution of the term……. . 1997 Shleifer & Vishny Targeted on the finance context Outcome A paper – A Survey of Corporate Governance The term “corporate governance” “deals with the way suppliers of finance assure themselves of getting a return on their investment”

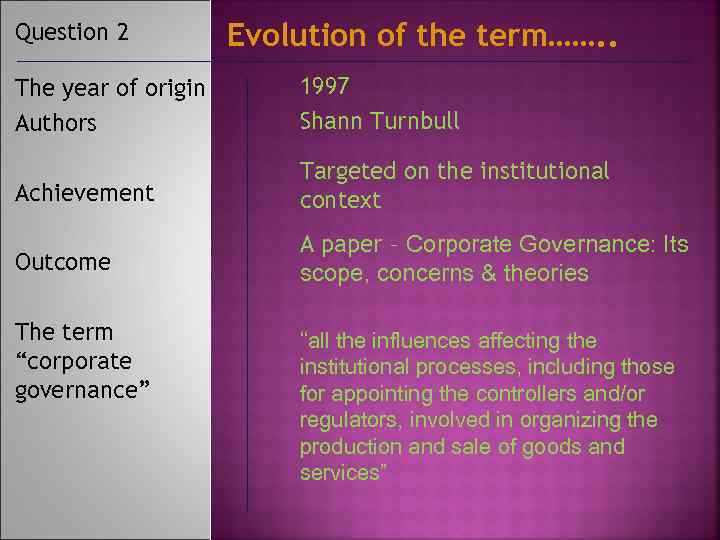

Question 2 Evolution of the term……. . The year of origin Authors 1997 Shann Turnbull Achievement Targeted on the institutional context Outcome A paper – Corporate Governance: Its scope, concerns & theories The term “corporate governance” “all the influences affecting the institutional processes, including those for appointing the controllers and/or regulators, involved in organizing the production and sale of goods and services”

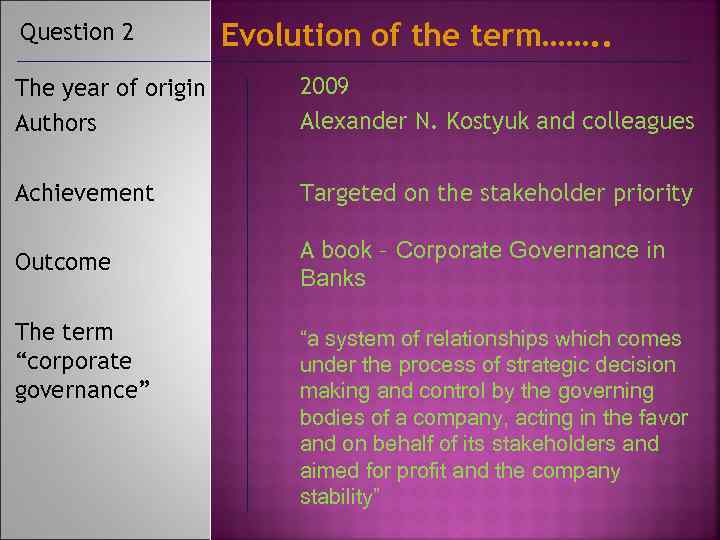

Question 2 Evolution of the term……. . The year of origin Authors 2009 Alexander N. Kostyuk and colleagues Achievement Targeted on the stakeholder priority Outcome A book – Corporate Governance in Banks The term “corporate governance” “a system of relationships which comes under the process of strategic decision making and control by the governing bodies of a company, acting in the favor and on behalf of its stakeholders and aimed for profit and the company stability”

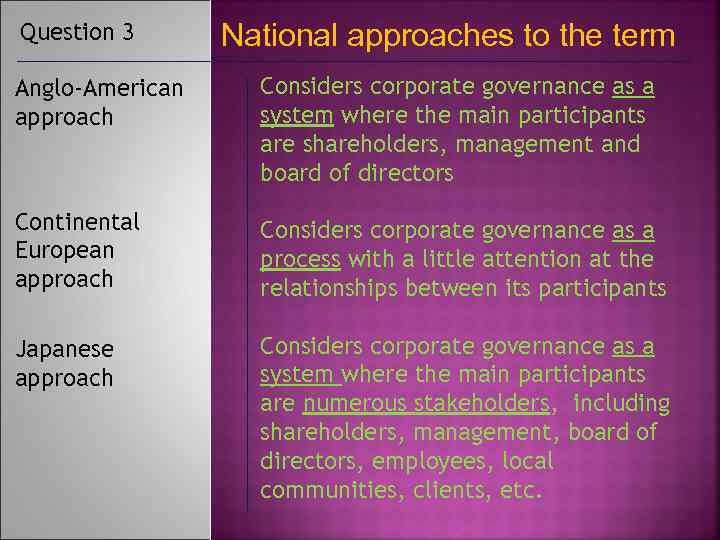

Question 3 National approaches to the term Anglo-American approach Considers corporate governance as a system where the main participants are shareholders, management and board of directors Continental European approach Considers corporate governance as a process with a little attention at the relationships between its participants Japanese approach Considers corporate governance as a system where the main participants are numerous stakeholders, including shareholders, management, board of directors, employees, local communities, clients, etc.

Video presentation

The term “corporate governance” should include the numerous groups of stakeholders The term should consider a system of relationships between all stakeholders The term should concentrate on certain mechanism to make the system work effectively, namely “board of directors”, “director remuneration”, etc.

SEMINAR QUESTIONS AND RECOMMENDED LITERATURE Recommended literature 1. Farinha, J. “Corporate Governance: a Review of the Literature”, Faculdade de Economia, Universidade do Porto, 2003. 2. Hasan, Z. “Corporate Governance From Western and Islamic Perspectives”, the Annual London Conference on Money, Economy and Management in 3 rd-4 th July 2008, United Kingdom. 3. Kostyuk A. N. Corporate Governance: textbook / A. N. Kostyuk, U. Braendle, R. Apreda. – Sumy : Virtus Interpress, 2007. – 424 c. 4. Phan, P. “Review Of Literature & Empirical Research on Corporate Governance”, The Monetary Authority Of Singapore, 2004. Seminar questions

Lecture_2.ppt