6ad6864c2db0da9e41902ee76f36ebc0.ppt

- Количество слайдов: 65

Lecture Note 1 Valuation under MM Corporate Finance Lecture Note 1 1

Lecture Note 1 Valuation under MM Corporate Finance Lecture Note 1 1

What is in This Note? • Overview of Modigliani-Miller Proposition I and II (No Tax) • Overview of Modigliani-Miller Proposition I and II (with Corporate and Personal Tax) • Overview of Modigliani-Miller Proposition I and II (with Asymmetric Information) Reference: Chapters 14, 15, and 16 of Corporate Finance Lecture Note 1 RWJJ, Chapters 17, and 18 of BMA 2

What is in This Note? • Overview of Modigliani-Miller Proposition I and II (No Tax) • Overview of Modigliani-Miller Proposition I and II (with Corporate and Personal Tax) • Overview of Modigliani-Miller Proposition I and II (with Asymmetric Information) Reference: Chapters 14, 15, and 16 of Corporate Finance Lecture Note 1 RWJJ, Chapters 17, and 18 of BMA 2

Roadmap n Overview of Modigliani-Miller Propositions I and II (No Taxes) n Overview of Modigliani-Miller Propositions I and II (with corporate Taxes) n Overview of Modigliani-Miller Propositions I and II (with both corporate and personal Taxes) n Overview of Modigliani-Miller Propositions I and II (with asymmetric information) Corporate Finance Lecture Note 1 3

Roadmap n Overview of Modigliani-Miller Propositions I and II (No Taxes) n Overview of Modigliani-Miller Propositions I and II (with corporate Taxes) n Overview of Modigliani-Miller Propositions I and II (with both corporate and personal Taxes) n Overview of Modigliani-Miller Propositions I and II (with asymmetric information) Corporate Finance Lecture Note 1 3

MM Proposition I (No Taxes) Corporate Finance Lecture Note 1 4

MM Proposition I (No Taxes) Corporate Finance Lecture Note 1 4

Roadmap n Overview of Modigliani-Miller Propositions I n Homemade Leverage and Leveraged Equity n Assumption of Modigliani-Miller Propositions I n Modigliani-Miller Propositions I Corporate Finance Lecture Note 1 5

Roadmap n Overview of Modigliani-Miller Propositions I n Homemade Leverage and Leveraged Equity n Assumption of Modigliani-Miller Propositions I n Modigliani-Miller Propositions I Corporate Finance Lecture Note 1 5

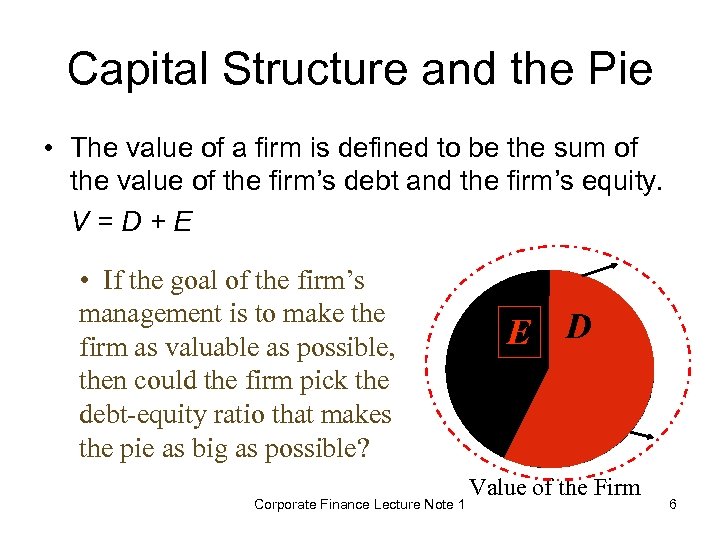

Capital Structure and the Pie • The value of a firm is defined to be the sum of the value of the firm’s debt and the firm’s equity. V=D+E • If the goal of the firm’s management is to make the firm as valuable as possible, then could the firm pick the debt-equity ratio that makes the pie as big as possible? Corporate Finance Lecture Note 1 S E D Value of the Firm 6

Capital Structure and the Pie • The value of a firm is defined to be the sum of the value of the firm’s debt and the firm’s equity. V=D+E • If the goal of the firm’s management is to make the firm as valuable as possible, then could the firm pick the debt-equity ratio that makes the pie as big as possible? Corporate Finance Lecture Note 1 S E D Value of the Firm 6

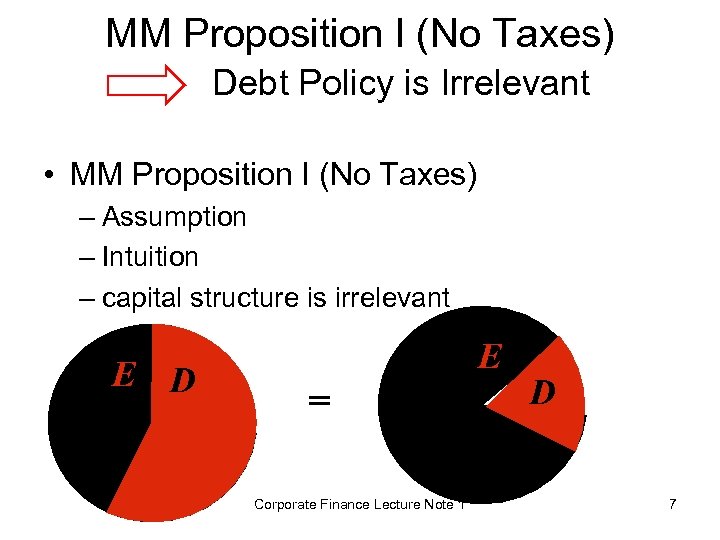

MM Proposition I (No Taxes) Debt Policy is Irrelevant • MM Proposition I (No Taxes) – Assumption – Intuition – capital structure is irrelevant E D S = B B Corporate Finance Lecture Note 1 E S D 7

MM Proposition I (No Taxes) Debt Policy is Irrelevant • MM Proposition I (No Taxes) – Assumption – Intuition – capital structure is irrelevant E D S = B B Corporate Finance Lecture Note 1 E S D 7

Modigliani-Miller Proposition I (No Taxes) • The total value of the securities issued by a firm is independent of the firm’s choice of capital structure. • The firm’s value is determined by its real assets and growth opportunities, not by the types of securities it issues. *This is the very step Modigliani-Miller results, and it holds in an idealized world. Corporate Finance Lecture Note 1 8

Modigliani-Miller Proposition I (No Taxes) • The total value of the securities issued by a firm is independent of the firm’s choice of capital structure. • The firm’s value is determined by its real assets and growth opportunities, not by the types of securities it issues. *This is the very step Modigliani-Miller results, and it holds in an idealized world. Corporate Finance Lecture Note 1 8

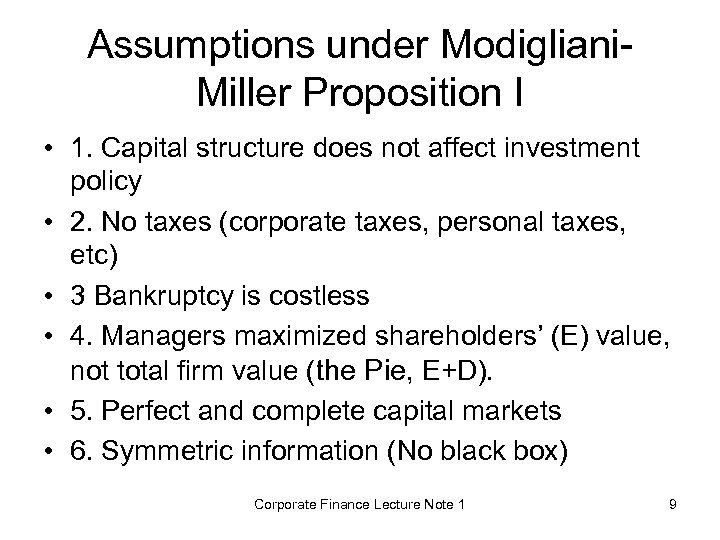

Assumptions under Modigliani. Miller Proposition I • 1. Capital structure does not affect investment policy • 2. No taxes (corporate taxes, personal taxes, etc) • 3 Bankruptcy is costless • 4. Managers maximized shareholders’ (E) value, not total firm value (the Pie, E+D). • 5. Perfect and complete capital markets • 6. Symmetric information (No black box) Corporate Finance Lecture Note 1 9

Assumptions under Modigliani. Miller Proposition I • 1. Capital structure does not affect investment policy • 2. No taxes (corporate taxes, personal taxes, etc) • 3 Bankruptcy is costless • 4. Managers maximized shareholders’ (E) value, not total firm value (the Pie, E+D). • 5. Perfect and complete capital markets • 6. Symmetric information (No black box) Corporate Finance Lecture Note 1 9

Intuition • We can create a levered or (un)levered position by adjusting the trading in our own account. • This homemade leverage suggests that capital structure is irrelevant in determining the value of the firm: VL = VU Corporate Finance Lecture Note 1 10

Intuition • We can create a levered or (un)levered position by adjusting the trading in our own account. • This homemade leverage suggests that capital structure is irrelevant in determining the value of the firm: VL = VU Corporate Finance Lecture Note 1 10

Homemade Leverage: An Example Recession. Expected Expansion EPS of Unlevered Firm$2. 50 $5. 00 $7. 50 Earnings for 40 shares $100 $200 $300 Less interest on $800 (8%)$64 $64 Net Profits $36 $136 $236 ROE (Net Profits / $1, 200) 3. 0% 11. 3% 19. 7% We are buying 40 shares of a $50 stock, using $800 in margin. We get the same ROE as if we bought into a levered firm. Our personal debt-equity ratio is: Corporate Finance Lecture Note 1 11

Homemade Leverage: An Example Recession. Expected Expansion EPS of Unlevered Firm$2. 50 $5. 00 $7. 50 Earnings for 40 shares $100 $200 $300 Less interest on $800 (8%)$64 $64 Net Profits $36 $136 $236 ROE (Net Profits / $1, 200) 3. 0% 11. 3% 19. 7% We are buying 40 shares of a $50 stock, using $800 in margin. We get the same ROE as if we bought into a levered firm. Our personal debt-equity ratio is: Corporate Finance Lecture Note 1 11

• 公司的資產負債表/損益 表, • 股東的資產負債表/損益 表 Corporate Finance Lecture Note 1 12

• 公司的資產負債表/損益 表, • 股東的資產負債表/損益 表 Corporate Finance Lecture Note 1 12

Homemade (Un)Leverage: An Example Recession. Expected Expansion EPS of Levered Firm $1. 50 $5. 67 $9. 83 Earnings for 24 shares $36 $136 $236 Plus interest on $800 (8%)$64 $64 Net Profits $100 $200 $300 ROE (Net Profits / $2, 000) 5% 10% 15% Buying 24 shares of an otherwise identical levered firm along with some of the firm’s debt gets us to the ROE of the unlevered firm. This is the fundamental insight of M&M Corporate Finance Lecture Note 1 13

Homemade (Un)Leverage: An Example Recession. Expected Expansion EPS of Levered Firm $1. 50 $5. 67 $9. 83 Earnings for 24 shares $36 $136 $236 Plus interest on $800 (8%)$64 $64 Net Profits $100 $200 $300 ROE (Net Profits / $2, 000) 5% 10% 15% Buying 24 shares of an otherwise identical levered firm along with some of the firm’s debt gets us to the ROE of the unlevered firm. This is the fundamental insight of M&M Corporate Finance Lecture Note 1 13

• 公司的資產負債表/損益 表, • 股東的資產負債表/損益 表 Corporate Finance Lecture Note 1 14

• 公司的資產負債表/損益 表, • 股東的資產負債表/損益 表 Corporate Finance Lecture Note 1 14

In-Class Exercise • Ross, Westerfield, and Jaffe Question 1 (pp. 449) • Firm has a total market value of $150, 000 under no debt. EBIT (Earnings before interest and taxes) is $14, 000 under normal case and is 40% higher if in expansion and is 70% lower when it is recession. There are currently 2, 500 shares outstanding. • 1. Calculate EPS (Earnings per share) • 2. Repeat 1 when the firms issues $60, 000 to buyback the shares in the open market. Corporate Finance Lecture Note 1 15

In-Class Exercise • Ross, Westerfield, and Jaffe Question 1 (pp. 449) • Firm has a total market value of $150, 000 under no debt. EBIT (Earnings before interest and taxes) is $14, 000 under normal case and is 40% higher if in expansion and is 70% lower when it is recession. There are currently 2, 500 shares outstanding. • 1. Calculate EPS (Earnings per share) • 2. Repeat 1 when the firms issues $60, 000 to buyback the shares in the open market. Corporate Finance Lecture Note 1 15

In-Class Exercise Shares repurchased = 1, 000 shares ? Corporate Finance Lecture Note 1 16

In-Class Exercise Shares repurchased = 1, 000 shares ? Corporate Finance Lecture Note 1 16

Summary: MM Proposition I (No Taxes) n We can create a levered or unlevered position by adjusting the trading in our own account. n This homemade leverage suggests that capital structure is irrelevant in determining the value of the firm: VL = VU Corporate Finance Lecture Note 1 17

Summary: MM Proposition I (No Taxes) n We can create a levered or unlevered position by adjusting the trading in our own account. n This homemade leverage suggests that capital structure is irrelevant in determining the value of the firm: VL = VU Corporate Finance Lecture Note 1 17

MM Proposition II (No Taxes) Corporate Finance Lecture Note 1 18

MM Proposition II (No Taxes) Corporate Finance Lecture Note 1 18

Roadmap n MM Proposition I (No Taxes) n Equity risk increases wit the level of debt n Proof n Economic Intuition Corporate Finance Lecture Note 1 19

Roadmap n MM Proposition I (No Taxes) n Equity risk increases wit the level of debt n Proof n Economic Intuition Corporate Finance Lecture Note 1 19

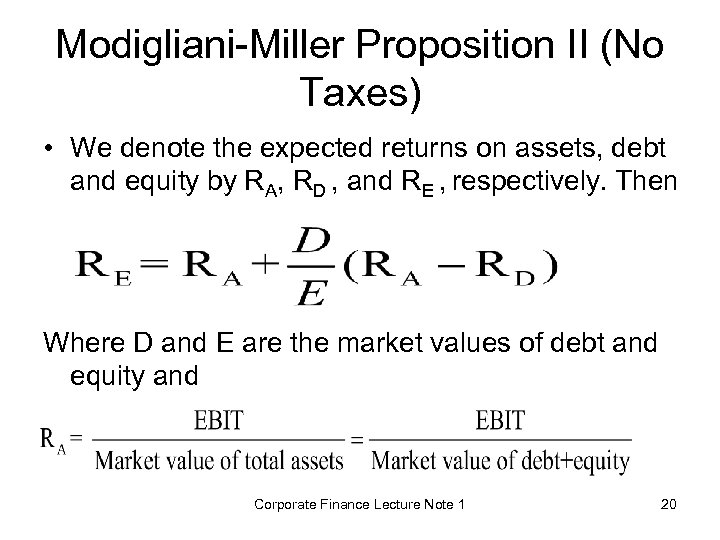

Modigliani-Miller Proposition II (No Taxes) • We denote the expected returns on assets, debt and equity by RA, RD , and RE , respectively. Then Where D and E are the market values of debt and equity and Corporate Finance Lecture Note 1 20

Modigliani-Miller Proposition II (No Taxes) • We denote the expected returns on assets, debt and equity by RA, RD , and RE , respectively. Then Where D and E are the market values of debt and equity and Corporate Finance Lecture Note 1 20

Modigliani-Miller Proposition II (No Taxes) • Proof: • Let total market value of the assets, debt, and equity as A, D, and E, respectively Corporate Finance Lecture Note 1 21

Modigliani-Miller Proposition II (No Taxes) • Proof: • Let total market value of the assets, debt, and equity as A, D, and E, respectively Corporate Finance Lecture Note 1 21

Cost of capital: R (%) MM Proposition II (No Taxes) RA RA RD RD Debt-to-equity Ratio Corporate Finance Lecture Note 1 22

Cost of capital: R (%) MM Proposition II (No Taxes) RA RA RD RD Debt-to-equity Ratio Corporate Finance Lecture Note 1 22

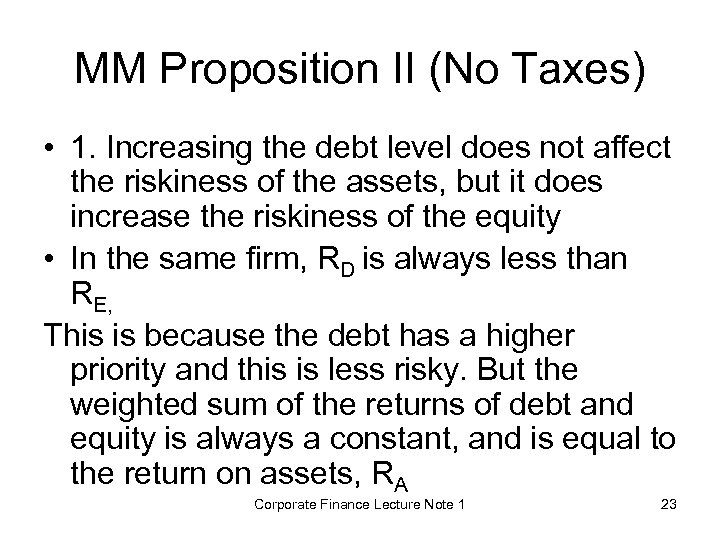

MM Proposition II (No Taxes) • 1. Increasing the debt level does not affect the riskiness of the assets, but it does increase the riskiness of the equity • In the same firm, RD is always less than RE, This is because the debt has a higher priority and this is less risky. But the weighted sum of the returns of debt and equity is always a constant, and is equal to the return on assets, RA Corporate Finance Lecture Note 1 23

MM Proposition II (No Taxes) • 1. Increasing the debt level does not affect the riskiness of the assets, but it does increase the riskiness of the equity • In the same firm, RD is always less than RE, This is because the debt has a higher priority and this is less risky. But the weighted sum of the returns of debt and equity is always a constant, and is equal to the return on assets, RA Corporate Finance Lecture Note 1 23

In-Class Exercise • Please evaluate the following argument: “ Equity is cheap because the firm does not have to pay investors any dividends if it does not want to. ” Corporate Finance Lecture Note 1 24

In-Class Exercise • Please evaluate the following argument: “ Equity is cheap because the firm does not have to pay investors any dividends if it does not want to. ” Corporate Finance Lecture Note 1 24

In-Class Exercise: P/E ratio • Firm X has expected revenues (or EBIT) of $5 million per year. It has a capital structure with $10 million in risk-free debt paying 4% and 4 million shares which sell at $10/share. This implies that firm value is $50 million. • 1. What are the RA, RD , and RE, and EPS • 2. What is the P/E ratio? Corporate Finance Lecture Note 1 25

In-Class Exercise: P/E ratio • Firm X has expected revenues (or EBIT) of $5 million per year. It has a capital structure with $10 million in risk-free debt paying 4% and 4 million shares which sell at $10/share. This implies that firm value is $50 million. • 1. What are the RA, RD , and RE, and EPS • 2. What is the P/E ratio? Corporate Finance Lecture Note 1 25

In-Class Exercise: P/E ratio • RA= $5 /(40+10)=10% l. EPS=(5 -10*0. 04)/4=$1. 15/share l. P/E=10/1. 15=8. 7 Corporate Finance Lecture Note 1 26

In-Class Exercise: P/E ratio • RA= $5 /(40+10)=10% l. EPS=(5 -10*0. 04)/4=$1. 15/share l. P/E=10/1. 15=8. 7 Corporate Finance Lecture Note 1 26

Continued • The CEO decides to boost the P/E ratio in order to “increase shareholder value”. The firm issues 1 million new shares at $10/share and uses the proceeds to buy back all its debt. • What are the EPS and P/E ratio? • Can you evaluate the firms based on the P/E ratio and EPS? Corporate Finance Lecture Note 1 27

Continued • The CEO decides to boost the P/E ratio in order to “increase shareholder value”. The firm issues 1 million new shares at $10/share and uses the proceeds to buy back all its debt. • What are the EPS and P/E ratio? • Can you evaluate the firms based on the P/E ratio and EPS? Corporate Finance Lecture Note 1 27

In-Class Exercise: P/E ratio • EPS=(5 -)/5=$1/share l P/E=10/1=10 • In evaluating firms, we must focus on expected cash flows and risk, not P-E ratios and earnings per share Corporate Finance Lecture Note 1 28

In-Class Exercise: P/E ratio • EPS=(5 -)/5=$1/share l P/E=10/1=10 • In evaluating firms, we must focus on expected cash flows and risk, not P-E ratios and earnings per share Corporate Finance Lecture Note 1 28

In-Class Exercise: Share repurchase Profit Shares EPS P/E ratio Share price (per share) 500 8 100 5 40 • The firm now repurchases 20 shares. Profit Shares EPS 500 80 6. 25 P/E ratio Share price (per share) 6. 4 40 • Can you evaluate the firms based on the P/E ratio and EPS? Corporate Finance Lecture Note 1 29

In-Class Exercise: Share repurchase Profit Shares EPS P/E ratio Share price (per share) 500 8 100 5 40 • The firm now repurchases 20 shares. Profit Shares EPS 500 80 6. 25 P/E ratio Share price (per share) 6. 4 40 • Can you evaluate the firms based on the P/E ratio and EPS? Corporate Finance Lecture Note 1 29

Corporate Taxes and Firm Value MM Propositions I and II (with Corporate Taxes) Corporate Finance Lecture Note 1 30

Corporate Taxes and Firm Value MM Propositions I and II (with Corporate Taxes) Corporate Finance Lecture Note 1 30

Roadmap n Corporate Tax Shield n MM Propositions I and II (with Taxes) n The implication of optimal debt level under MM Propositions I and II (with Taxes) Corporate Finance Lecture Note 1 31

Roadmap n Corporate Tax Shield n MM Propositions I and II (with Taxes) n The implication of optimal debt level under MM Propositions I and II (with Taxes) Corporate Finance Lecture Note 1 31

Capital Structure & Corporate Taxes The tax deductibility of interest increases the total distributed income to both bondholders and shareholders. Corporate Finance Lecture Note 1 32

Capital Structure & Corporate Taxes The tax deductibility of interest increases the total distributed income to both bondholders and shareholders. Corporate Finance Lecture Note 1 32

Corporate Taxes and Value Interest Tax Shield • Corporate Taxes Shied: Tax savings resulting from deductibility of interest payments. • More interest payments, more tax savings. What is the optimal level of debt? Corporate Finance Lecture Note 1 33

Corporate Taxes and Value Interest Tax Shield • Corporate Taxes Shied: Tax savings resulting from deductibility of interest payments. • More interest payments, more tax savings. What is the optimal level of debt? Corporate Finance Lecture Note 1 33

MM Proposition I (With Taxes) The present value of this stream of cash flows is VL The present value of the first term is VU The present value of the second term is TCD Corporate Finance Lecture Note 1 34

MM Proposition I (With Taxes) The present value of this stream of cash flows is VL The present value of the first term is VU The present value of the second term is TCD Corporate Finance Lecture Note 1 34

MM Proposition I (With Taxes) Corporate Finance Lecture Note 1 35

MM Proposition I (With Taxes) Corporate Finance Lecture Note 1 35

All equity-firm and levered firm Taxes Equity TAXES Equity Corporate Finance Lecture Note 1 Debt 36

All equity-firm and levered firm Taxes Equity TAXES Equity Corporate Finance Lecture Note 1 Debt 36

MM Proposition II (With Taxes) • We denote the expected returns on assets, debt and equity by RA, RD , and RE, respectively. Then Where D and E are the market values of debt and equity and Corporate Finance Lecture Note 1 37

MM Proposition II (With Taxes) • We denote the expected returns on assets, debt and equity by RA, RD , and RE, respectively. Then Where D and E are the market values of debt and equity and Corporate Finance Lecture Note 1 37

MM Proposition II (With Taxes) • Proof: • Let total market value of the assets, debt, and equity as A, D, and E, respectively Corporate Finance Lecture Note 1 38

MM Proposition II (With Taxes) • Proof: • Let total market value of the assets, debt, and equity as A, D, and E, respectively Corporate Finance Lecture Note 1 38

MM Proposition II (with Taxes) • 1. Increasing the debt level does not affect the riskiness of the assets, but it does increase the riskiness of the equity • In the same firm, RD is always less than RE, This is because the debt has a higher priority and this is less risky. But the weighted sum of the returns of debt and equity is always a constant, and is equal to the return on assets, RA Corporate Finance Lecture Note 1 39

MM Proposition II (with Taxes) • 1. Increasing the debt level does not affect the riskiness of the assets, but it does increase the riskiness of the equity • In the same firm, RD is always less than RE, This is because the debt has a higher priority and this is less risky. But the weighted sum of the returns of debt and equity is always a constant, and is equal to the return on assets, RA Corporate Finance Lecture Note 1 39

MM Proposition I and II (With Taxes) Firm Value = Value of All Equity Firm + PV Tax Shield Corporate Finance Lecture Note 1 40

MM Proposition I and II (With Taxes) Firm Value = Value of All Equity Firm + PV Tax Shield Corporate Finance Lecture Note 1 40

Tax Shield Effect Value of firm (V) Value of firm under MM with corporate taxes and debt Present value of tax shield on debt VL = VU + TCD Maximum firm value VU = Value of firm with no debt 0 D* Optimal amount of debt Corporate Finance Lecture Note 1 Debt (D) 41

Tax Shield Effect Value of firm (V) Value of firm under MM with corporate taxes and debt Present value of tax shield on debt VL = VU + TCD Maximum firm value VU = Value of firm with no debt 0 D* Optimal amount of debt Corporate Finance Lecture Note 1 Debt (D) 41

In-Class Exercise • Ross, Westerfield, and Jaffe Question 2 (pp. 449) • Firm has a total market value of $150, 000 under no debt. EBIT (Earnings before interest and taxes) is $14, 000 under normal case and is 40% higher if in expansion and is 70% lower when it is recession. The corporate tax rate is 40%. There are currently 2, 500 shares outstanding. • 1. Calculate EPS (Earnings per share) • 2. Repeat 1 when the firms issues $60, 000 to buyback the shares in the open market. Debt pays 5% interest. Corporate Finance Lecture Note 1 42

In-Class Exercise • Ross, Westerfield, and Jaffe Question 2 (pp. 449) • Firm has a total market value of $150, 000 under no debt. EBIT (Earnings before interest and taxes) is $14, 000 under normal case and is 40% higher if in expansion and is 70% lower when it is recession. The corporate tax rate is 40%. There are currently 2, 500 shares outstanding. • 1. Calculate EPS (Earnings per share) • 2. Repeat 1 when the firms issues $60, 000 to buyback the shares in the open market. Debt pays 5% interest. Corporate Finance Lecture Note 1 42

Recession EPS % EPS 0 0 0 5, 600 7, 840 $8, 400 $11, 760 $1. 01 NI $19, 600 $2, 520 Taxes $14, 000 1, 680 Interest Expansion $4, 200 EBIT Normal $3. 36 $4. 70 ––– +40 Recession Normal Expansion $4, 200 $14, 000 $19, 600 3, 000 480 4, 400 6, 640 NI $720 $6, 600 $9, 960 EPS $. 48 $4. 40 $6. 64 – 89. 09 ––– +50. 91 EBIT Interest Taxes % EPS Corporate Finance Lecture Note 1 43

Recession EPS % EPS 0 0 0 5, 600 7, 840 $8, 400 $11, 760 $1. 01 NI $19, 600 $2, 520 Taxes $14, 000 1, 680 Interest Expansion $4, 200 EBIT Normal $3. 36 $4. 70 ––– +40 Recession Normal Expansion $4, 200 $14, 000 $19, 600 3, 000 480 4, 400 6, 640 NI $720 $6, 600 $9, 960 EPS $. 48 $4. 40 $6. 64 – 89. 09 ––– +50. 91 EBIT Interest Taxes % EPS Corporate Finance Lecture Note 1 43

Corporate Taxes and Firm Value under the Presence of Financial Distress Costs Corporate Finance Lecture Note 1 44

Corporate Taxes and Firm Value under the Presence of Financial Distress Costs Corporate Finance Lecture Note 1 44

Roadmap n What are the costs of financial distress? n What are the direct and indirect costs of financial distress n The implication of optimal debt level under MM Propositions I and II with significant costs of financial distress Corporate Finance Lecture Note 1 45

Roadmap n What are the costs of financial distress? n What are the direct and indirect costs of financial distress n The implication of optimal debt level under MM Propositions I and II with significant costs of financial distress Corporate Finance Lecture Note 1 45

Corporate Taxes and Firm Value Interest Tax Shield Financial Distress Ccosts Costs of Financial Distress - Costs arising from bankruptcy or distorted business decisions before bankruptcy. • Direct Costs: Legal and administrative costs • Indirect Costs: Impaired ability to conduct business (e. g. , lost sales) Corporate Finance Lecture Note 1 46

Corporate Taxes and Firm Value Interest Tax Shield Financial Distress Ccosts Costs of Financial Distress - Costs arising from bankruptcy or distorted business decisions before bankruptcy. • Direct Costs: Legal and administrative costs • Indirect Costs: Impaired ability to conduct business (e. g. , lost sales) Corporate Finance Lecture Note 1 46

Corporate Finance Lecture Note 1 47

Corporate Finance Lecture Note 1 47

Corporate Finance Lecture Note 1 48

Corporate Finance Lecture Note 1 48

Corporate Finance Lecture Note 1 49

Corporate Finance Lecture Note 1 49

Financial Distress Costs of Financial Distress - Costs arising from bankruptcy or distorted business decisions before bankruptcy. Market Value = Value if all Equity Financed + PV Tax Shield - PV Costs of Financial Distress Corporate Finance Lecture Note 1 50

Financial Distress Costs of Financial Distress - Costs arising from bankruptcy or distorted business decisions before bankruptcy. Market Value = Value if all Equity Financed + PV Tax Shield - PV Costs of Financial Distress Corporate Finance Lecture Note 1 50

Tax Savings and Financial Distress Costs Value of firm (V) Value of firm under MM with corporate taxes and debt Present value of tax shield on debt VL = VU + TCD Maximum firm value Present value of financial distress costs V = Actual value of firm VU = Value of firm with no debt 0 D* Optimal amount of debt Corporate Finance Lecture Note 1 Debt (D) 51

Tax Savings and Financial Distress Costs Value of firm (V) Value of firm under MM with corporate taxes and debt Present value of tax shield on debt VL = VU + TCD Maximum firm value Present value of financial distress costs V = Actual value of firm VU = Value of firm with no debt 0 D* Optimal amount of debt Corporate Finance Lecture Note 1 Debt (D) 51

Capital Structure and the Pie Model Revisited • Taxes and bankruptcy costs can be viewed as just another claim on the cash flows of the firm. • Let G and L stand for payments to the government and bankruptcy lawyers, respectively. • VT = E + D + G + L E D L G • The essence of the M&M intuition is that VT depends on the cash flow of the firm; capital structure just slices the pie. Corporate Finance Lecture Note 1 52

Capital Structure and the Pie Model Revisited • Taxes and bankruptcy costs can be viewed as just another claim on the cash flows of the firm. • Let G and L stand for payments to the government and bankruptcy lawyers, respectively. • VT = E + D + G + L E D L G • The essence of the M&M intuition is that VT depends on the cash flow of the firm; capital structure just slices the pie. Corporate Finance Lecture Note 1 52

Taxes and Firm Value MM Proposition I (with Corporate Taxes and Personal Taxes) Corporate Finance Lecture Note 1 53

Taxes and Firm Value MM Proposition I (with Corporate Taxes and Personal Taxes) Corporate Finance Lecture Note 1 53

Personal Taxes and Firm Value • Interest payments are only taxed at the individual level since they are tax deductible by the corporation, so the bondholder receives: (1 -TB) • Dividends face double taxation (firm and shareholder), which suggests a stockholder receives the net amount: (1 TC) x (1 -TS) Corporate Finance Lecture Note 1 54

Personal Taxes and Firm Value • Interest payments are only taxed at the individual level since they are tax deductible by the corporation, so the bondholder receives: (1 -TB) • Dividends face double taxation (firm and shareholder), which suggests a stockholder receives the net amount: (1 TC) x (1 -TS) Corporate Finance Lecture Note 1 54

Personal Taxes • If TS= TB then the firm should be financed primarily by debt (avoiding double tax). • The firm is indifferent between debt and equity when: (1 -TC) x (1 -TS) = (1 -TB) Corporate Finance Lecture Note 1 55

Personal Taxes • If TS= TB then the firm should be financed primarily by debt (avoiding double tax). • The firm is indifferent between debt and equity when: (1 -TC) x (1 -TS) = (1 -TB) Corporate Finance Lecture Note 1 55

Asymmetric Information and Firm Value Stock-for-debt exchange offers Stock price falls Corporate Finance Lecture Note 1 56

Asymmetric Information and Firm Value Stock-for-debt exchange offers Stock price falls Corporate Finance Lecture Note 1 56

New Equity Issues • Background information: 1. There are two equally probable states of nature. The true state is revealed to management at t=0 and to investors at t=1. 2. The firm has no cash and the firms want to issue stock to raise $100. Corporate Finance Lecture Note 1 57

New Equity Issues • Background information: 1. There are two equally probable states of nature. The true state is revealed to management at t=0 and to investors at t=1. 2. The firm has no cash and the firms want to issue stock to raise $100. Corporate Finance Lecture Note 1 57

New Equity Issues Good Bad No New Equity $250 $130 Corporate Finance Lecture Note 1 Issue New Equity $350 $230 58

New Equity Issues Good Bad No New Equity $250 $130 Corporate Finance Lecture Note 1 Issue New Equity $350 $230 58

New Equity Issues Questions: l What is the firm’s expected value, with or without new equity issue? l With new equity issue, what is the firm’s expected value that the old shareholders get, if the state is Good and if the state is Bad? l If the managers have superior information about the firm’s prospect, should they issue new equity when the state is Good? Corporate Finance Lecture Note 1 59

New Equity Issues Questions: l What is the firm’s expected value, with or without new equity issue? l With new equity issue, what is the firm’s expected value that the old shareholders get, if the state is Good and if the state is Bad? l If the managers have superior information about the firm’s prospect, should they issue new equity when the state is Good? Corporate Finance Lecture Note 1 59

New Equity Issues Firm Value (Issue no new equity) = (0. 5)(250 + 130) = $190 Firm Value (New equity) = (0. 5)(350 + 230) = $290 Note that old shareholders have a claim to the portion (190/290), or 65. 5% of the value of the firm if it issues new equity. Corporate Finance Lecture Note 1 60

New Equity Issues Firm Value (Issue no new equity) = (0. 5)(250 + 130) = $190 Firm Value (New equity) = (0. 5)(350 + 230) = $290 Note that old shareholders have a claim to the portion (190/290), or 65. 5% of the value of the firm if it issues new equity. Corporate Finance Lecture Note 1 60

New Equity Issues Thus, if the firm issues equity and the state is good, old shareholders are worth: (190/290)(350) = $229. 31 And, if the firm issues equity and the state is bad, old shareholders are worth: (190/290)(230) = $150. 69 Corporate Finance Lecture Note 1 61

New Equity Issues Thus, if the firm issues equity and the state is good, old shareholders are worth: (190/290)(350) = $229. 31 And, if the firm issues equity and the state is bad, old shareholders are worth: (190/290)(230) = $150. 69 Corporate Finance Lecture Note 1 61

New Equity Issues Let’s pull these numbers together, and see what happens if the management knows that the state is likely to be good or bad, and they are acting on behalf of the old shareholders: Old shareholder payoffs: Good news Bad news Do Nothing $250. 00 $130. 00 Corporate Finance Lecture Note 1 Issue Equity $229. 31 $150. 69 62

New Equity Issues Let’s pull these numbers together, and see what happens if the management knows that the state is likely to be good or bad, and they are acting on behalf of the old shareholders: Old shareholder payoffs: Good news Bad news Do Nothing $250. 00 $130. 00 Corporate Finance Lecture Note 1 Issue Equity $229. 31 $150. 69 62

New Equity Issues • The equilibrium payoffs: Do Nothing Equity • Good news • Bad news Issue $250. 00 $230 Corporate Finance Lecture Note 1 63

New Equity Issues • The equilibrium payoffs: Do Nothing Equity • Good news • Bad news Issue $250. 00 $230 Corporate Finance Lecture Note 1 63

New Equity Issues The optimal strategy for old equity is to not issue equity if they know state will be good, and issue equity if the state will be bad! But, markets can figure this out too: As a result, they will knock down the value of the firm when a new equity is announced! Corporate Finance Lecture Note 1 64

New Equity Issues The optimal strategy for old equity is to not issue equity if they know state will be good, and issue equity if the state will be bad! But, markets can figure this out too: As a result, they will knock down the value of the firm when a new equity is announced! Corporate Finance Lecture Note 1 64

Conclusion • What are the Modigliani-Miller Propositions I and II under perfect world? • What are the implications of optimal debt level under Modigliani-Miller Propositions I and II? • What are the Modigliani-Miller Propositions I and II with corporate taxes? • What are the implications of optimal debt level under Modigliani-Miller Propositions I and II with corporate taxes? • Why the stock price drops when there is an Stock-for-debt exchange offer? Corporate Finance Lecture Note 1 65

Conclusion • What are the Modigliani-Miller Propositions I and II under perfect world? • What are the implications of optimal debt level under Modigliani-Miller Propositions I and II? • What are the Modigliani-Miller Propositions I and II with corporate taxes? • What are the implications of optimal debt level under Modigliani-Miller Propositions I and II with corporate taxes? • Why the stock price drops when there is an Stock-for-debt exchange offer? Corporate Finance Lecture Note 1 65