Lecture Financial Statements Analyses (FSA) / (АФО) D.

lecture_6_fsa_2012_2013_ac_year__ved_10.ppt

- Количество слайдов: 23

Lecture Financial Statements Analyses (FSA) / (АФО) D.S.Zukhba 2012-2013

Lecture Financial Statements Analyses (FSA) / (АФО) D.S.Zukhba 2012-2013

Lecture 6 Financial Statements Analyses (FSA) / (АФО) 6.1 Purposes of Financial Statements Analyses 6.2 Methods of Financial Statements Analyses 6.3 Classification of the financial ratios and their interpretation 6.4 Restrictions in using of financial ratios

Lecture 6 Financial Statements Analyses (FSA) / (АФО) 6.1 Purposes of Financial Statements Analyses 6.2 Methods of Financial Statements Analyses 6.3 Classification of the financial ratios and their interpretation 6.4 Restrictions in using of financial ratios

Question 6.1 Purposes of Financial Statements Analyses The Financial standing of the enterprise is complex category. It is characterized by system of the factors.

Question 6.1 Purposes of Financial Statements Analyses The Financial standing of the enterprise is complex category. It is characterized by system of the factors.

Exists 3 main purposes of FSA /(АФО): 1/ To analyze past financial activity of the enterprise 2/ Prepare information required for forecasting of future financial activity of the enterprise 3/ Compare indicators of the enterprise's activity with other enterprises at the same branch of the national economy

Exists 3 main purposes of FSA /(АФО): 1/ To analyze past financial activity of the enterprise 2/ Prepare information required for forecasting of future financial activity of the enterprise 3/ Compare indicators of the enterprise's activity with other enterprises at the same branch of the national economy

Question 6.1 Purposes of Financial Statements Analyses The Financial analysis is the base of creating enterprise's financial policy. It is impossible to measure the condition of the concrete enterprise's resources without financial analysis .

Question 6.1 Purposes of Financial Statements Analyses The Financial analysis is the base of creating enterprise's financial policy. It is impossible to measure the condition of the concrete enterprise's resources without financial analysis .

Question 6.1 Purposes of Financial Statements Analyses FSA helps to financial managers to difine: - What to search ? - What to fear? - What to do? - How to do?

Question 6.1 Purposes of Financial Statements Analyses FSA helps to financial managers to difine: - What to search ? - What to fear? - What to do? - How to do?

Question 6.1 Purposes of Financial Statements Analyses Analysis of the absolute data Ratio analysis (Анализ коэффициентов) Comparative analysis

Question 6.1 Purposes of Financial Statements Analyses Analysis of the absolute data Ratio analysis (Анализ коэффициентов) Comparative analysis

1. Метод расчёта соотношений показателей /коэффициентов/ Ratio Analysis 2. Метод определения удельного веса отдельных статей финансовых отчётов Vertical Analysis 3. Метод сравнения абсолютных и относительных величин во времени - горизонтальный анализ или анализ тенденций Horizontal Analysis

1. Метод расчёта соотношений показателей /коэффициентов/ Ratio Analysis 2. Метод определения удельного веса отдельных статей финансовых отчётов Vertical Analysis 3. Метод сравнения абсолютных и относительных величин во времени - горизонтальный анализ или анализ тенденций Horizontal Analysis

The Analysis of the absolute data: Analysis of the vertical percentage changes – characterizes correlations of financial reporting articles to one of the article (the volume of sales, profit and etc.) or to total sum of the balance / amounts. Analysis of the horizontal percentage changes – characterizes changes of separate articles of financial statements for several periods (years, quarter, months)

The Analysis of the absolute data: Analysis of the vertical percentage changes – characterizes correlations of financial reporting articles to one of the article (the volume of sales, profit and etc.) or to total sum of the balance / amounts. Analysis of the horizontal percentage changes – characterizes changes of separate articles of financial statements for several periods (years, quarter, months)

The Ratio Analysis based on calculation of the separate correlations of the data. It can be used for study of the relations between components of the financial statements. The ratios is data, used in estimation of the financial condition of the business. The Ratios shows the relations between two financial data for business. This data we usually can get from financial statements.

The Ratio Analysis based on calculation of the separate correlations of the data. It can be used for study of the relations between components of the financial statements. The ratios is data, used in estimation of the financial condition of the business. The Ratios shows the relations between two financial data for business. This data we usually can get from financial statements.

Ratios allow to conduct three types of the comparison: with similar own data of the companies in past (named by method of the temporary rows or "time-series comparisons" or "horizontal analysis" ), with relations of the other companies or with average data on branches (named internal-branch comparisons (cross-sectional comparisons)), and with the best enterprises (bench marks).

Ratios allow to conduct three types of the comparison: with similar own data of the companies in past (named by method of the temporary rows or "time-series comparisons" or "horizontal analysis" ), with relations of the other companies or with average data on branches (named internal-branch comparisons (cross-sectional comparisons)), and with the best enterprises (bench marks).

The Majority of correlations (ratios) compares certain interesting for users aspect of activity of the company, for instance, profit or liquidity, to the whole activity of the company, which also can be measured different way.

The Majority of correlations (ratios) compares certain interesting for users aspect of activity of the company, for instance, profit or liquidity, to the whole activity of the company, which also can be measured different way.

Question 6.2 Methods of Financial Statements Analyses The cross-sectional comparisons is the analysis of correlations of the separate data of the enterprise and data of other similar enterprises or branch's data.

Question 6.2 Methods of Financial Statements Analyses The cross-sectional comparisons is the analysis of correlations of the separate data of the enterprise and data of other similar enterprises or branch's data.

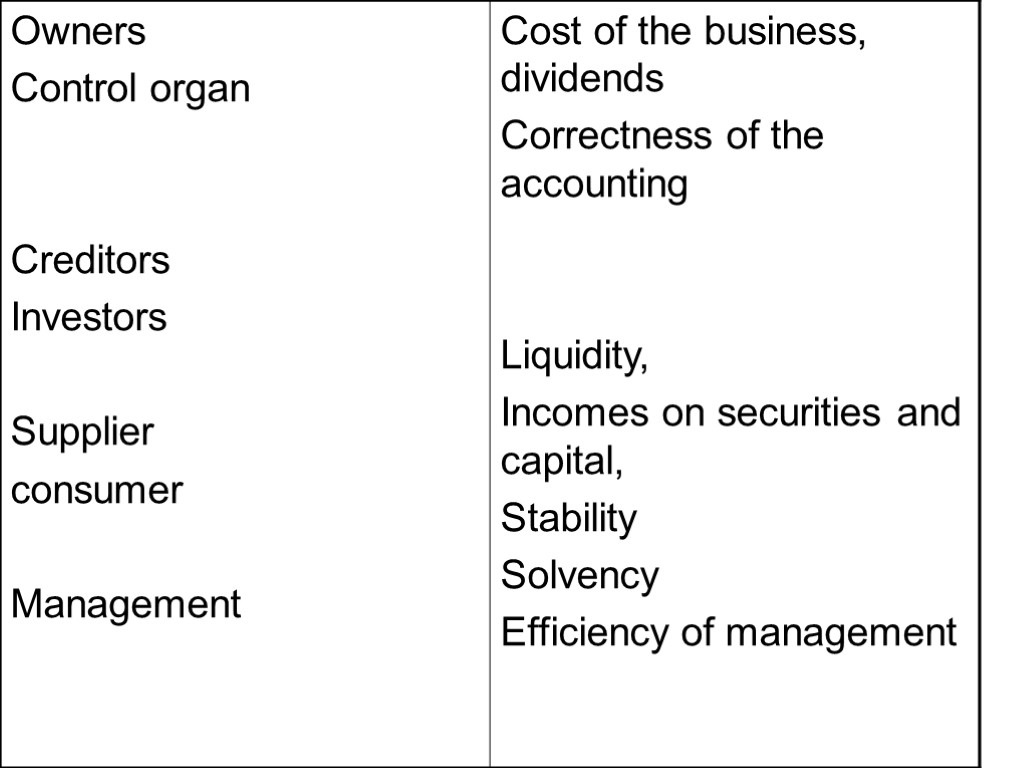

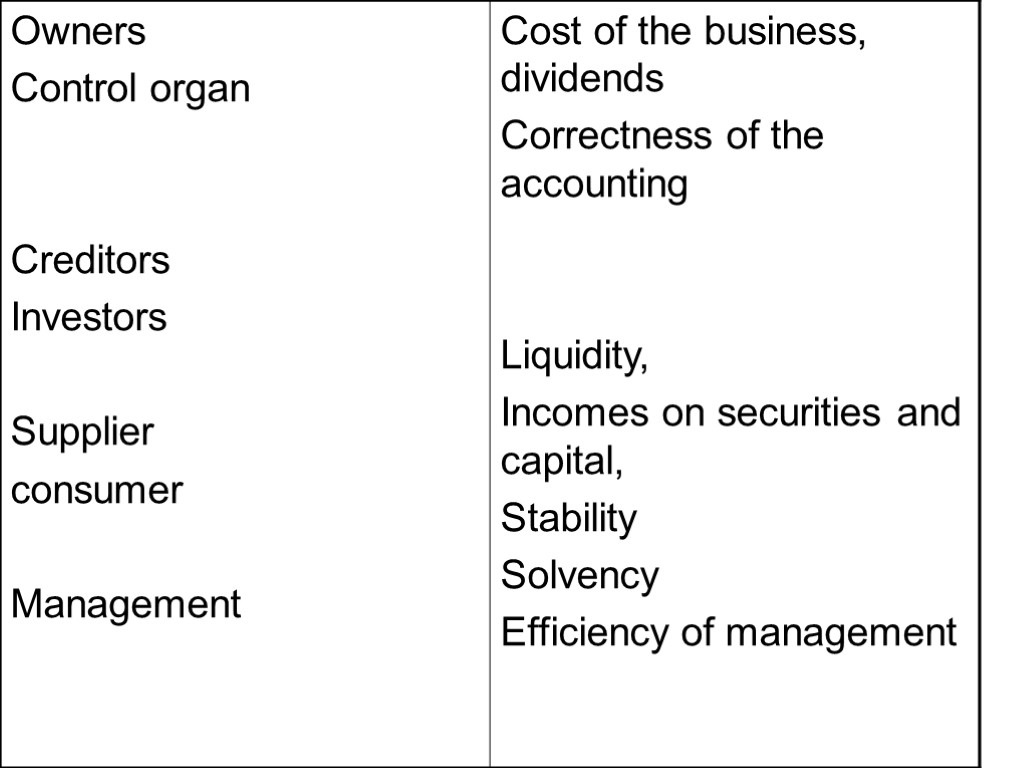

The Choice of the concrete methods of the analysis depends on delivered aims. F.S.A. is necessary for: Owners Control organ Management Supplier and consumer Creditors Investors

The Choice of the concrete methods of the analysis depends on delivered aims. F.S.A. is necessary for: Owners Control organ Management Supplier and consumer Creditors Investors

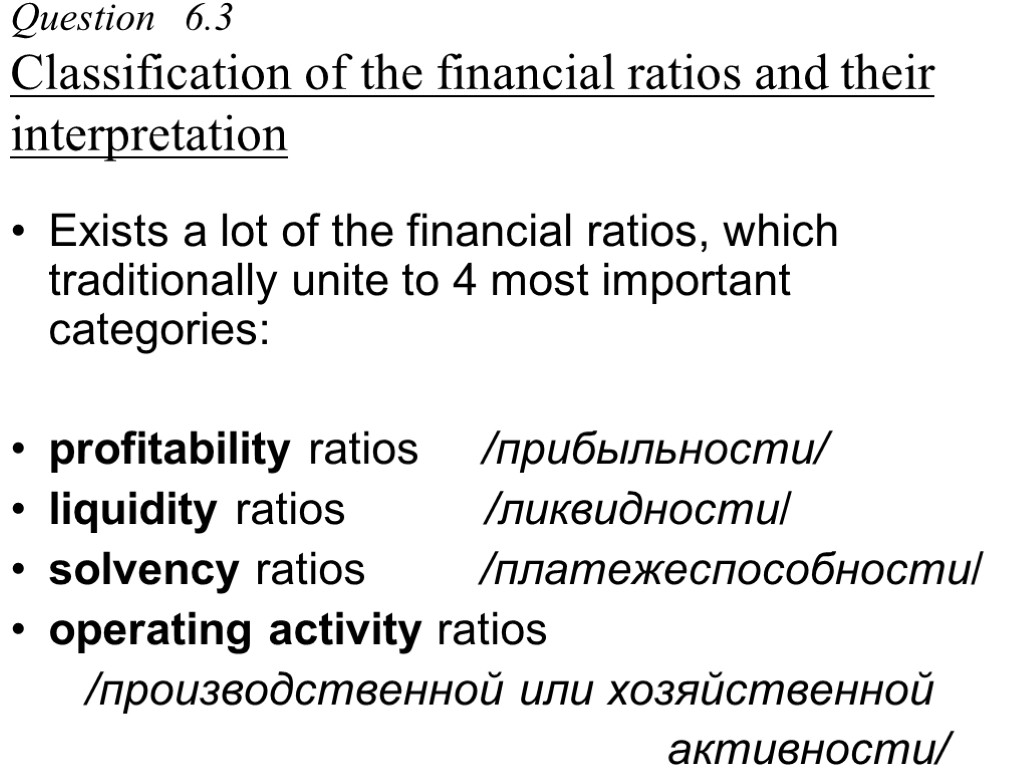

Question 6.3 Classification of the financial ratios and their interpretation Exists a lot of the financial ratios, which traditionally unite to 4 most important categories: profitability ratios /прибыльности/ liquidity ratios /ликвидности/ solvency ratios /платежеспособности/ operating activity ratios /производственной или хозяйственной активности/

Question 6.3 Classification of the financial ratios and their interpretation Exists a lot of the financial ratios, which traditionally unite to 4 most important categories: profitability ratios /прибыльности/ liquidity ratios /ликвидности/ solvency ratios /платежеспособности/ operating activity ratios /производственной или хозяйственной активности/

Question 6.3 Classification of the financial ratios and their interpretation The Users of financial information are, as usual, interested to have information about future of the companies. Will this loan be repaid? Will the share price rise? Are the company's bonds good?

Question 6.3 Classification of the financial ratios and their interpretation The Users of financial information are, as usual, interested to have information about future of the companies. Will this loan be repaid? Will the share price rise? Are the company's bonds good?

Question 6.3 Classification of the financial ratios and their interpretation Thermometer: current condition Financial ratioes: - first of all - Past - but also - Present - and even - Future

Question 6.3 Classification of the financial ratios and their interpretation Thermometer: current condition Financial ratioes: - first of all - Past - but also - Present - and even - Future

Question 6.3 Classification of the financial ratios and their interpretation FSA: Modeling Expert systems Training Experience Forecasting - if you concern with it …. Do it as possible more often

Question 6.3 Classification of the financial ratios and their interpretation FSA: Modeling Expert systems Training Experience Forecasting - if you concern with it …. Do it as possible more often

Question 6.4 Restrictions in using of financial ratios 1) Accounting policy 2) Data manipulation So-called " window dressing “ 3) Static character

Question 6.4 Restrictions in using of financial ratios 1) Accounting policy 2) Data manipulation So-called " window dressing “ 3) Static character

Question 6.4 Restrictions in using of financial ratios 4) Does not show quality side of calculated data 5) The obligations of the company can be unvalued 6) The company can be diversified, and therefore it is difficult relate its activity to one sector of industry

Question 6.4 Restrictions in using of financial ratios 4) Does not show quality side of calculated data 5) The obligations of the company can be unvalued 6) The company can be diversified, and therefore it is difficult relate its activity to one sector of industry

Question 6.4 Restrictions in using of financial ratios !!! Does Not exist the united factor or groups of factors sufficient for estimation all aspect of company’s position.

Question 6.4 Restrictions in using of financial ratios !!! Does Not exist the united factor or groups of factors sufficient for estimation all aspect of company’s position.

Вопросы к семинару

Вопросы к семинару