Chapter 9-(B).pptx

- Количество слайдов: 44

Lecture 9 Prospective Analysis – Valuation theory and concepts (part 2) Chapter 7 – Palepu, Healy & Peek IFRS Edition

Lecture 9 Prospective Analysis – Valuation theory and concepts (part 2) Chapter 7 – Palepu, Healy & Peek IFRS Edition

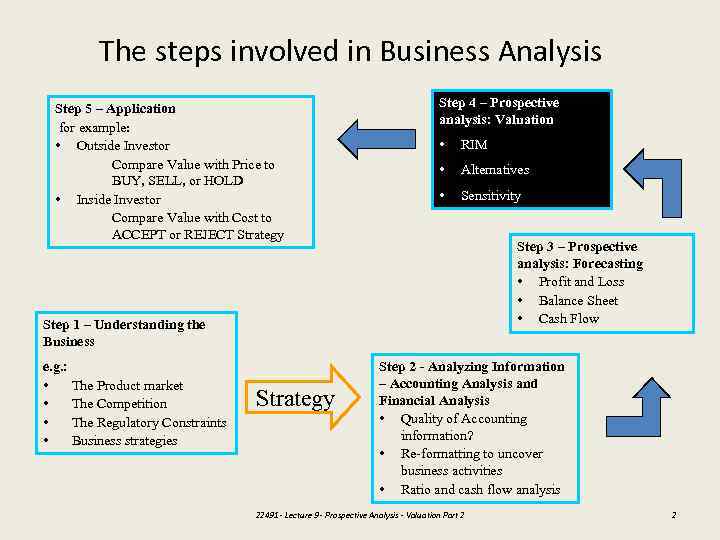

The steps involved in Business Analysis Step 5 – Application for example: • Outside Investor Compare Value with Price to BUY, SELL, or HOLD • Inside Investor Compare Value with Cost to ACCEPT or REJECT Strategy Step 4 – Prospective analysis: Valuation • RIM • Alternatives • Sensitivity Step 3 – Prospective analysis: Forecasting • Profit and Loss • Balance Sheet • Cash Flow Step 1 – Understanding the Business e. g. : • The Product market • The Competition • The Regulatory Constraints • Business strategies Strategy Step 2 - Analyzing Information – Accounting Analysis and Financial Analysis • Quality of Accounting information? • Re-formatting to uncover business activities • Ratio and cash flow analysis 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 2

The steps involved in Business Analysis Step 5 – Application for example: • Outside Investor Compare Value with Price to BUY, SELL, or HOLD • Inside Investor Compare Value with Cost to ACCEPT or REJECT Strategy Step 4 – Prospective analysis: Valuation • RIM • Alternatives • Sensitivity Step 3 – Prospective analysis: Forecasting • Profit and Loss • Balance Sheet • Cash Flow Step 1 – Understanding the Business e. g. : • The Product market • The Competition • The Regulatory Constraints • Business strategies Strategy Step 2 - Analyzing Information – Accounting Analysis and Financial Analysis • Quality of Accounting information? • Re-formatting to uncover business activities • Ratio and cash flow analysis 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 2

Learning Objectives At the conclusion of this lecture you should understand: Chapter 7: • How to value a firm using the following methods: Ø Residual income (Abnormal Earnings) Ø Residual operating income Ø Discounted cash flow • Comparing the results of valuation under each of the models covered in lecture 8 & 9. 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 3

Learning Objectives At the conclusion of this lecture you should understand: Chapter 7: • How to value a firm using the following methods: Ø Residual income (Abnormal Earnings) Ø Residual operating income Ø Discounted cash flow • Comparing the results of valuation under each of the models covered in lecture 8 & 9. 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 3

Valuation • Is the process of converting the forecast into a valuation of the assets of the business or the valuation of shareholders’ equity. • The different methods of business valuation include: 1. 2. 3. 4. 5. • Price multiples (covered in lecture 8) Dividend (covered in lecture 8) Residual income model (Discounted Abnormal Earnings Method) Residual Operating Income model Free cash flow (DCF model) Can use all to value either the equity or assets in the firm, (need to be sure which the model does!) 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 4

Valuation • Is the process of converting the forecast into a valuation of the assets of the business or the valuation of shareholders’ equity. • The different methods of business valuation include: 1. 2. 3. 4. 5. • Price multiples (covered in lecture 8) Dividend (covered in lecture 8) Residual income model (Discounted Abnormal Earnings Method) Residual Operating Income model Free cash flow (DCF model) Can use all to value either the equity or assets in the firm, (need to be sure which the model does!) 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 4

Revision • Last lecture we looked at 2 valuation techniques: 1. Price multiples 2. Dividend discount model 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 5

Revision • Last lecture we looked at 2 valuation techniques: 1. Price multiples 2. Dividend discount model 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 5

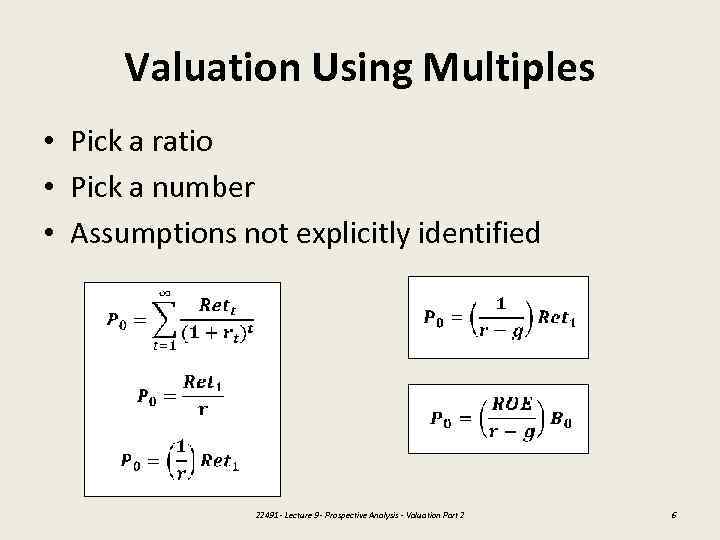

Valuation Using Multiples • Pick a ratio • Pick a number • Assumptions not explicitly identified 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 6

Valuation Using Multiples • Pick a ratio • Pick a number • Assumptions not explicitly identified 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 6

Discounted Dividend Model • DDM problem – dividends not always linked to value creation • Dividend policy irrelevance (M&M) • Firms not ‘presently’ paying dividends are difficult or impossible to value under this method. 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 7

Discounted Dividend Model • DDM problem – dividends not always linked to value creation • Dividend policy irrelevance (M&M) • Firms not ‘presently’ paying dividends are difficult or impossible to value under this method. 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 7

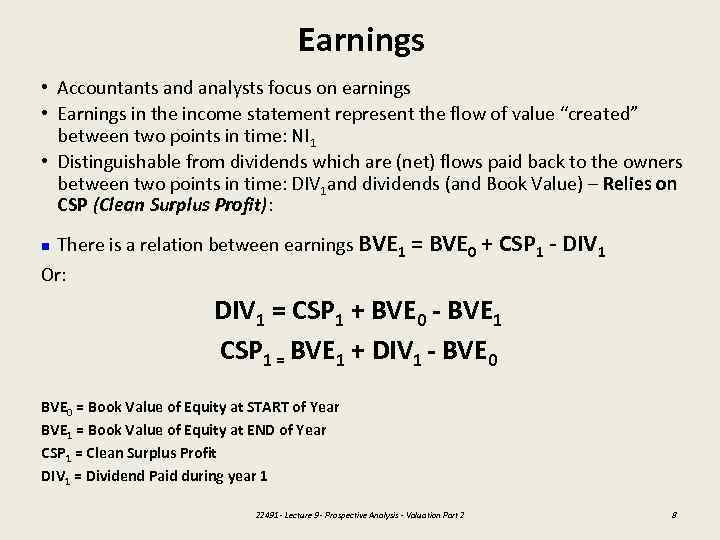

Earnings • Accountants and analysts focus on earnings • Earnings in the income statement represent the flow of value “created” between two points in time: NI 1 • Distinguishable from dividends which are (net) flows paid back to the owners between two points in time: DIV 1 and dividends (and Book Value) – Relies on CSP (Clean Surplus Profit): There is a relation between earnings BVE 1 = BVE 0 + CSP 1 - DIV 1 Or: n DIV 1 = CSP 1 + BVE 0 - BVE 1 CSP 1 = BVE 1 + DIV 1 - BVE 0 = Book Value of Equity at START of Year BVE 1 = Book Value of Equity at END of Year CSP 1 = Clean Surplus Profit DIV 1 = Dividend Paid during year 1 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 8

Earnings • Accountants and analysts focus on earnings • Earnings in the income statement represent the flow of value “created” between two points in time: NI 1 • Distinguishable from dividends which are (net) flows paid back to the owners between two points in time: DIV 1 and dividends (and Book Value) – Relies on CSP (Clean Surplus Profit): There is a relation between earnings BVE 1 = BVE 0 + CSP 1 - DIV 1 Or: n DIV 1 = CSP 1 + BVE 0 - BVE 1 CSP 1 = BVE 1 + DIV 1 - BVE 0 = Book Value of Equity at START of Year BVE 1 = Book Value of Equity at END of Year CSP 1 = Clean Surplus Profit DIV 1 = Dividend Paid during year 1 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 8

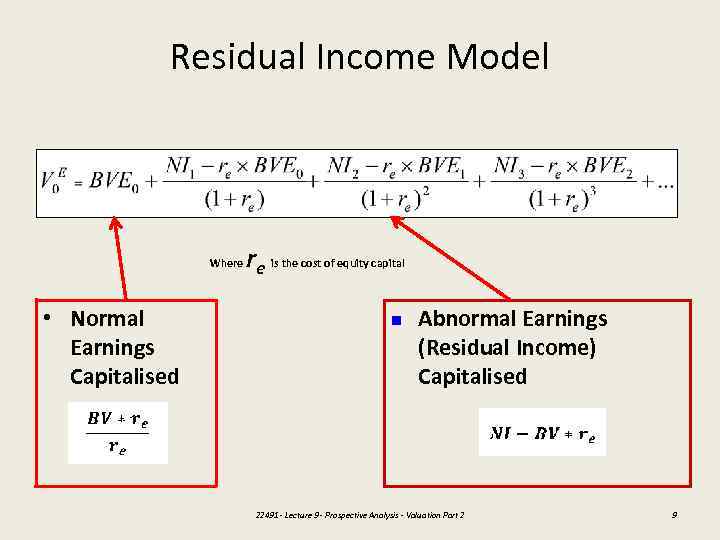

Residual Income Model Where • Normal Earnings Capitalised re is the cost of equity capital n Abnormal Earnings (Residual Income) Capitalised 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 9

Residual Income Model Where • Normal Earnings Capitalised re is the cost of equity capital n Abnormal Earnings (Residual Income) Capitalised 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 9

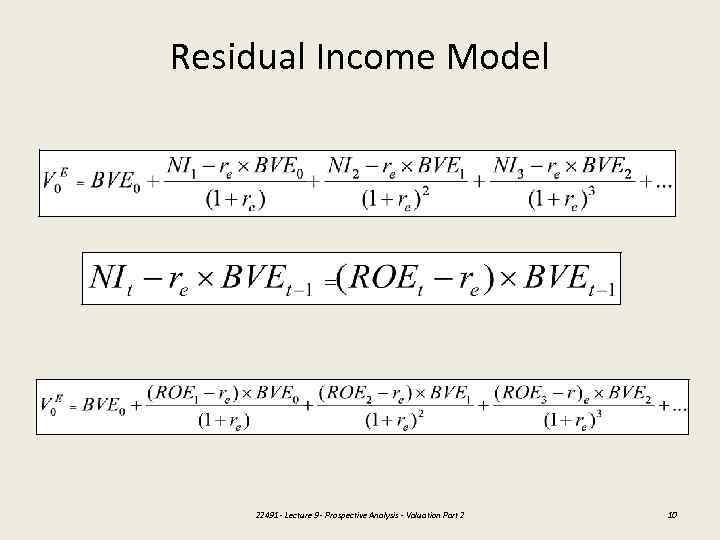

Residual Income Model 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 10

Residual Income Model 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 10

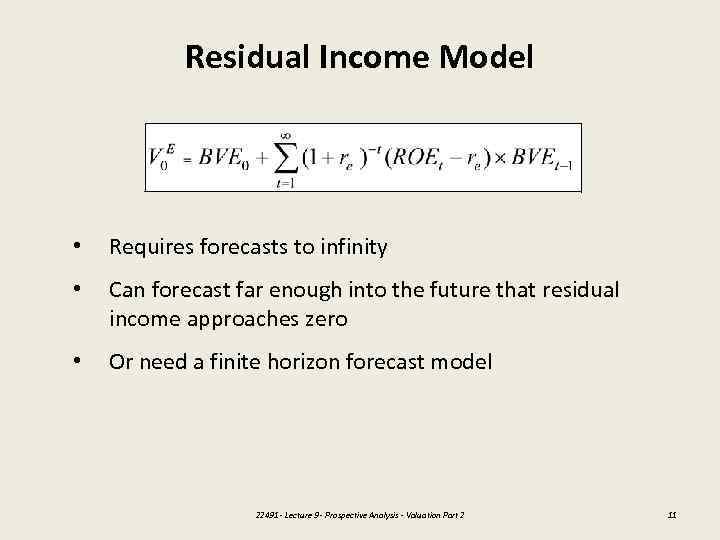

Residual Income Model • Requires forecasts to infinity • Can forecast far enough into the future that residual income approaches zero • Or need a finite horizon forecast model 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 11

Residual Income Model • Requires forecasts to infinity • Can forecast far enough into the future that residual income approaches zero • Or need a finite horizon forecast model 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 11

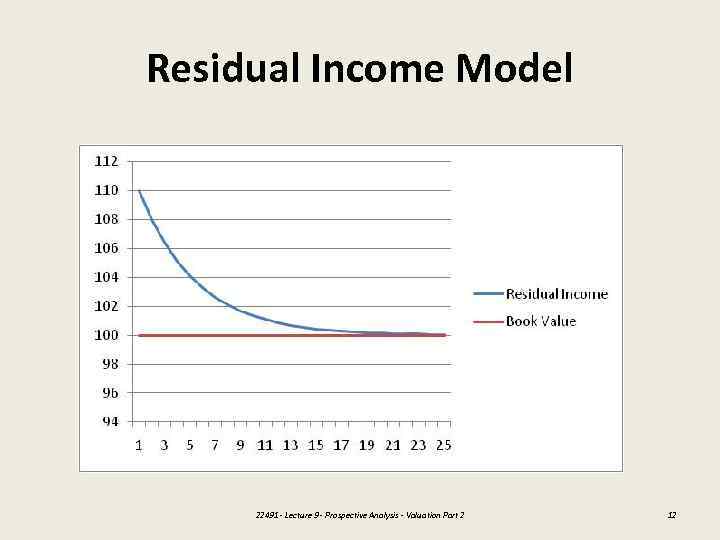

Residual Income Model 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 12

Residual Income Model 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 12

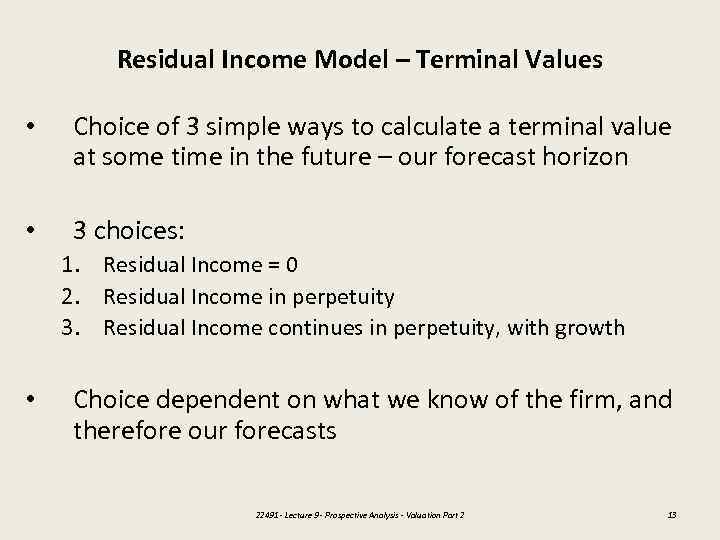

Residual Income Model – Terminal Values • Choice of 3 simple ways to calculate a terminal value at some time in the future – our forecast horizon • 3 choices: 1. Residual Income = 0 2. Residual Income in perpetuity 3. Residual Income continues in perpetuity, with growth • Choice dependent on what we know of the firm, and therefore our forecasts 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 13

Residual Income Model – Terminal Values • Choice of 3 simple ways to calculate a terminal value at some time in the future – our forecast horizon • 3 choices: 1. Residual Income = 0 2. Residual Income in perpetuity 3. Residual Income continues in perpetuity, with growth • Choice dependent on what we know of the firm, and therefore our forecasts 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 13

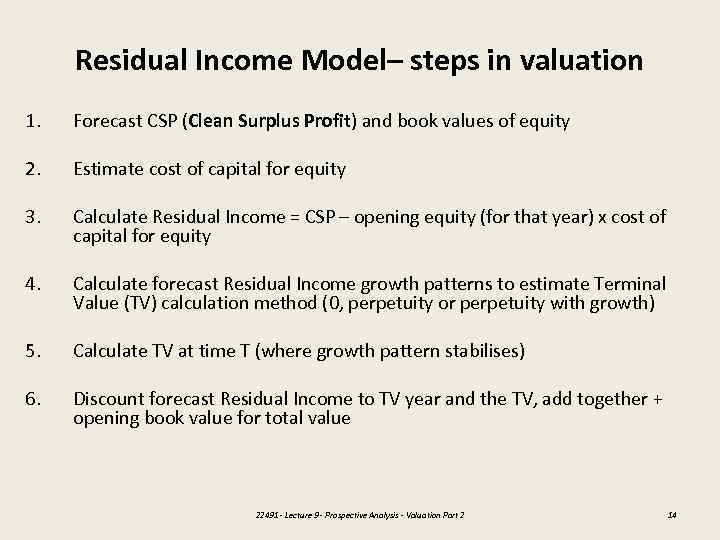

Residual Income Model– steps in valuation 1. Forecast CSP (Clean Surplus Profit) and book values of equity 2. Estimate cost of capital for equity 3. Calculate Residual Income = CSP – opening equity (for that year) x cost of capital for equity 4. Calculate forecast Residual Income growth patterns to estimate Terminal Value (TV) calculation method (0, perpetuity or perpetuity with growth) 5. Calculate TV at time T (where growth pattern stabilises) 6. Discount forecast Residual Income to TV year and the TV, add together + opening book value for total value 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 14

Residual Income Model– steps in valuation 1. Forecast CSP (Clean Surplus Profit) and book values of equity 2. Estimate cost of capital for equity 3. Calculate Residual Income = CSP – opening equity (for that year) x cost of capital for equity 4. Calculate forecast Residual Income growth patterns to estimate Terminal Value (TV) calculation method (0, perpetuity or perpetuity with growth) 5. Calculate TV at time T (where growth pattern stabilises) 6. Discount forecast Residual Income to TV year and the TV, add together + opening book value for total value 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 14

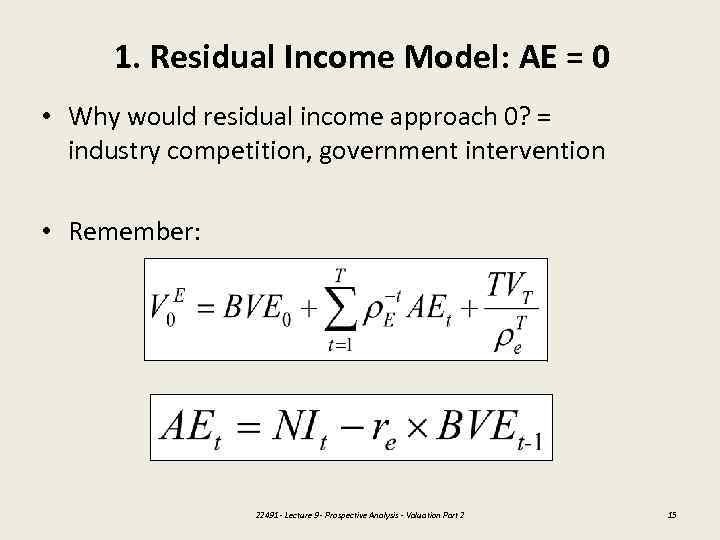

1. Residual Income Model: AE = 0 • Why would residual income approach 0? = industry competition, government intervention • Remember: 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 15

1. Residual Income Model: AE = 0 • Why would residual income approach 0? = industry competition, government intervention • Remember: 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 15

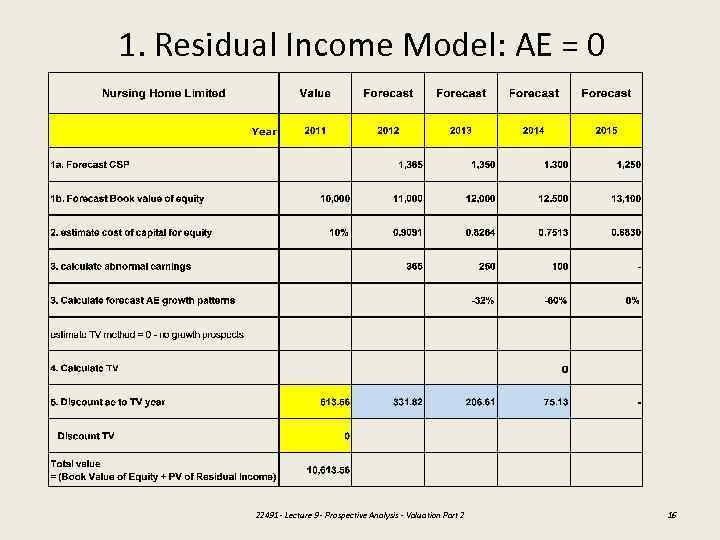

1. Residual Income Model: AE = 0 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 16

1. Residual Income Model: AE = 0 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 16

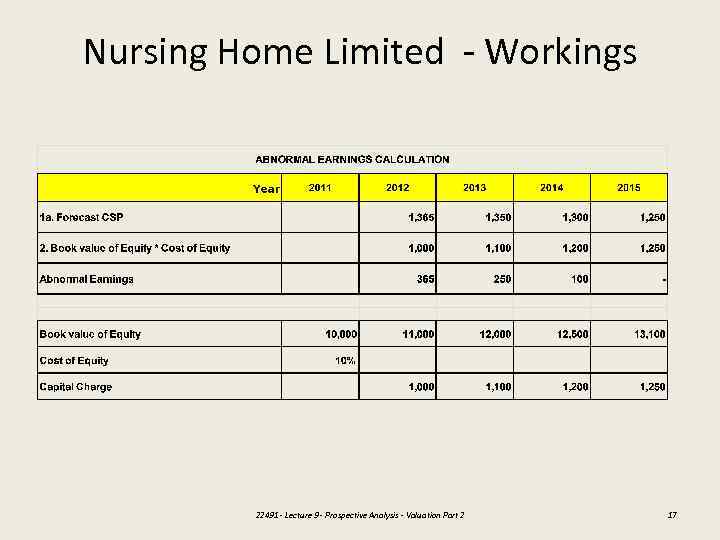

Nursing Home Limited - Workings 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 17

Nursing Home Limited - Workings 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 17

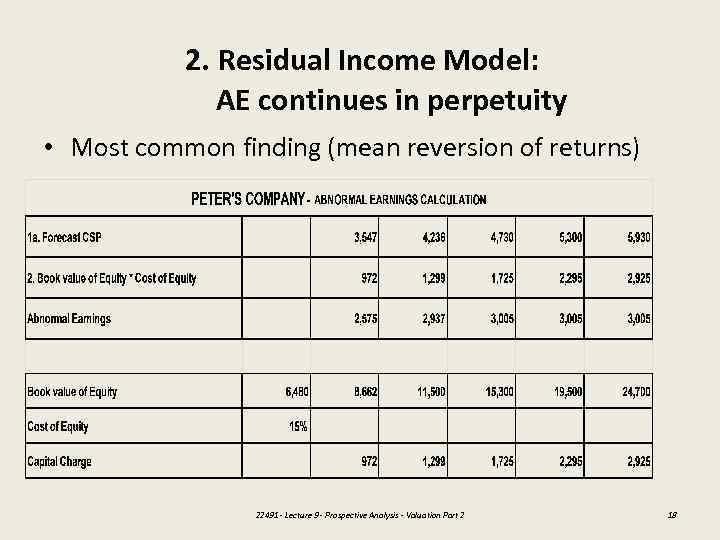

2. Residual Income Model: AE continues in perpetuity • Most common finding (mean reversion of returns) 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 18

2. Residual Income Model: AE continues in perpetuity • Most common finding (mean reversion of returns) 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 18

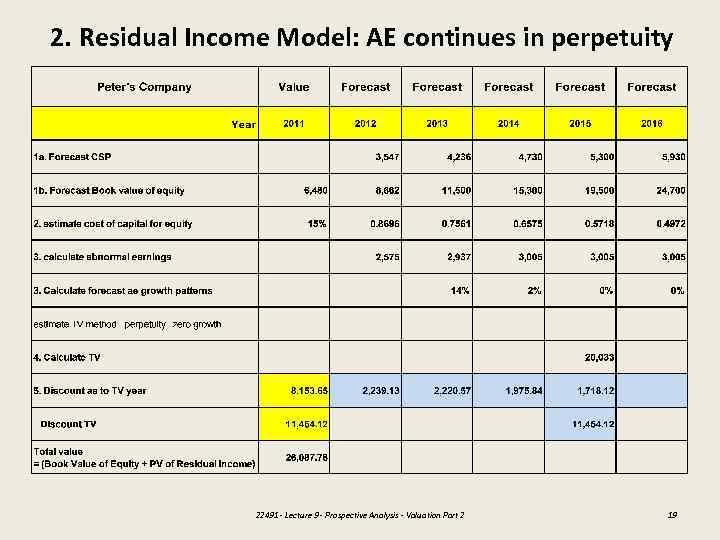

2. Residual Income Model: AE continues in perpetuity 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 19

2. Residual Income Model: AE continues in perpetuity 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 19

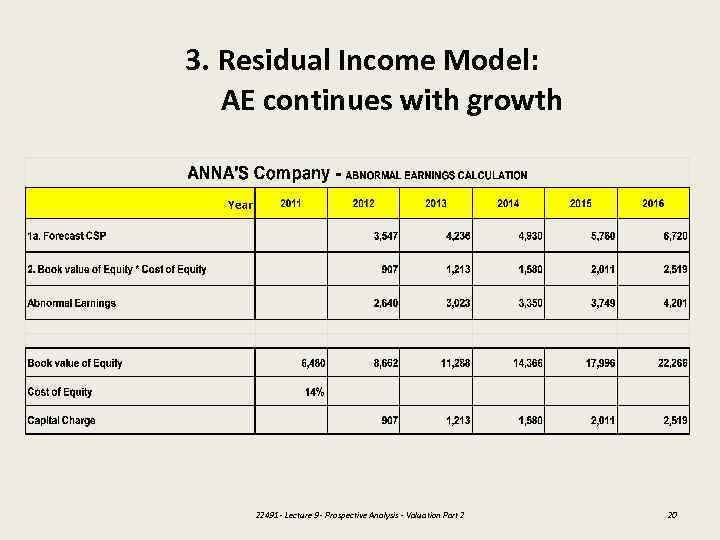

3. Residual Income Model: AE continues with growth 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 20

3. Residual Income Model: AE continues with growth 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 20

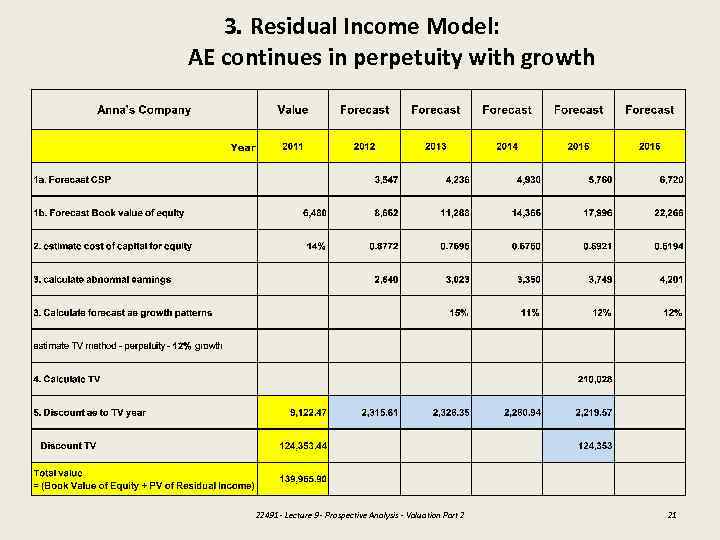

3. Residual Income Model: AE continues in perpetuity with growth 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 21

3. Residual Income Model: AE continues in perpetuity with growth 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 21

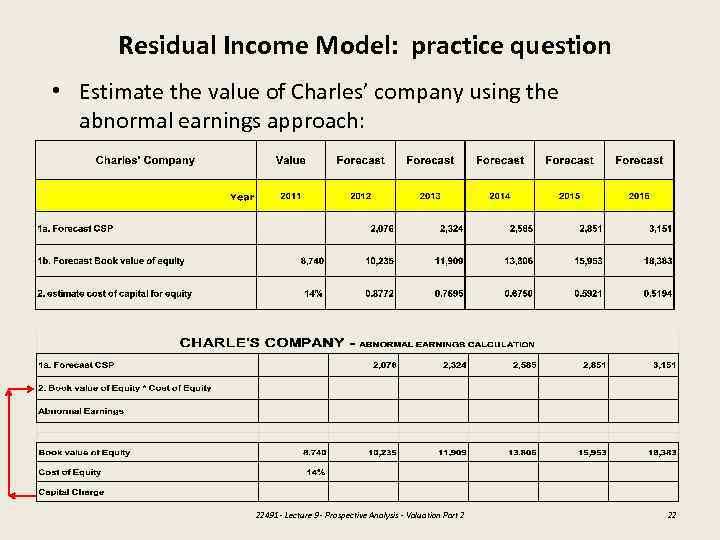

Residual Income Model: practice question • Estimate the value of Charles’ company using the abnormal earnings approach: 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 22

Residual Income Model: practice question • Estimate the value of Charles’ company using the abnormal earnings approach: 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 22

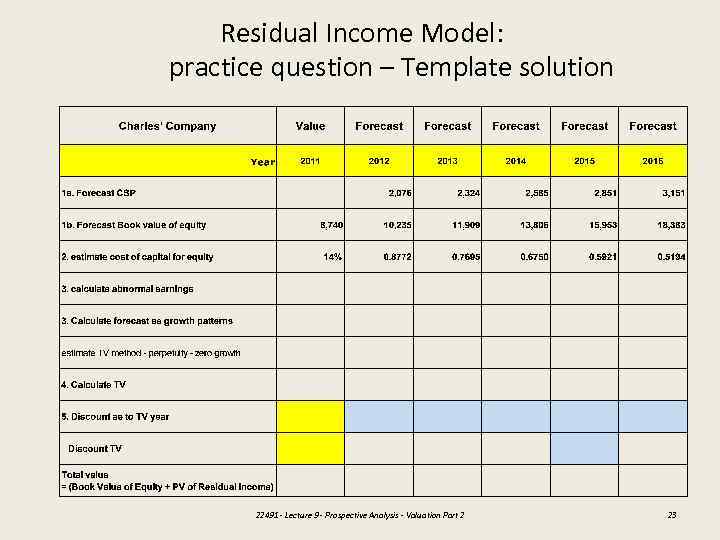

Residual Income Model: practice question – Template solution 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 23

Residual Income Model: practice question – Template solution 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 23

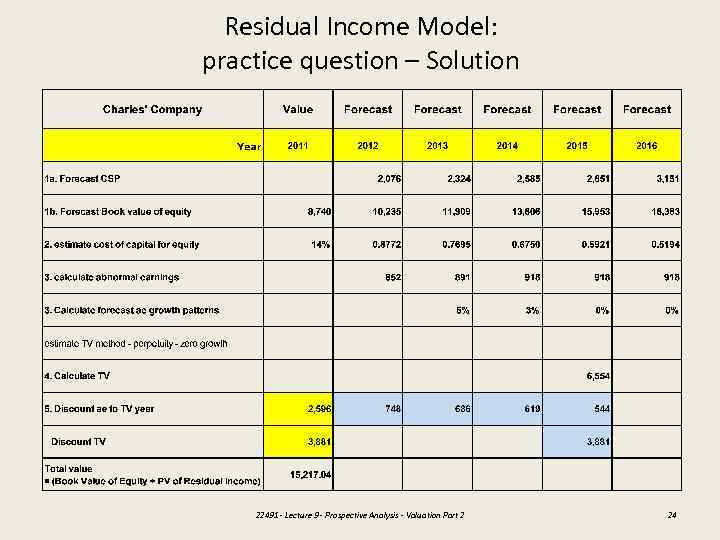

Residual Income Model: practice question – Solution 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 24

Residual Income Model: practice question – Solution 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 24

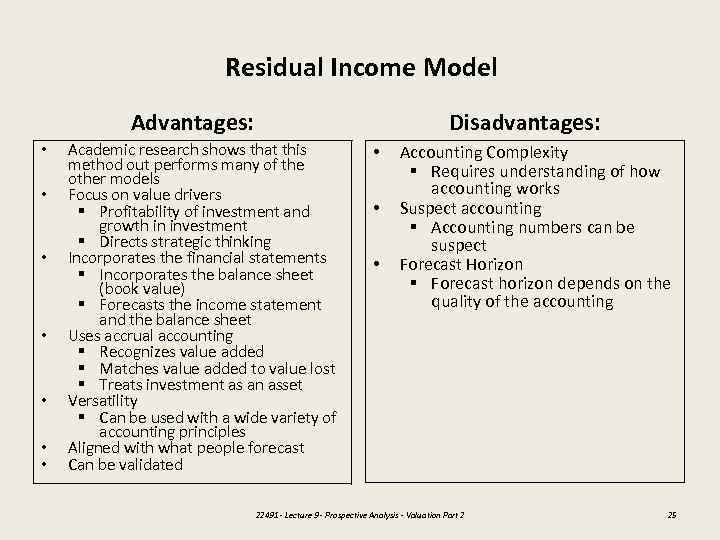

Residual Income Model Advantages: • • Disadvantages: Academic research shows that this method out performs many of the other models Focus on value drivers § Profitability of investment and growth in investment § Directs strategic thinking Incorporates the financial statements § Incorporates the balance sheet (book value) § Forecasts the income statement and the balance sheet Uses accrual accounting § Recognizes value added § Matches value added to value lost § Treats investment as an asset Versatility § Can be used with a wide variety of accounting principles Aligned with what people forecast Can be validated • • • Accounting Complexity § Requires understanding of how accounting works Suspect accounting § Accounting numbers can be suspect Forecast Horizon § Forecast horizon depends on the quality of the accounting 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 25

Residual Income Model Advantages: • • Disadvantages: Academic research shows that this method out performs many of the other models Focus on value drivers § Profitability of investment and growth in investment § Directs strategic thinking Incorporates the financial statements § Incorporates the balance sheet (book value) § Forecasts the income statement and the balance sheet Uses accrual accounting § Recognizes value added § Matches value added to value lost § Treats investment as an asset Versatility § Can be used with a wide variety of accounting principles Aligned with what people forecast Can be validated • • • Accounting Complexity § Requires understanding of how accounting works Suspect accounting § Accounting numbers can be suspect Forecast Horizon § Forecast horizon depends on the quality of the accounting 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 25

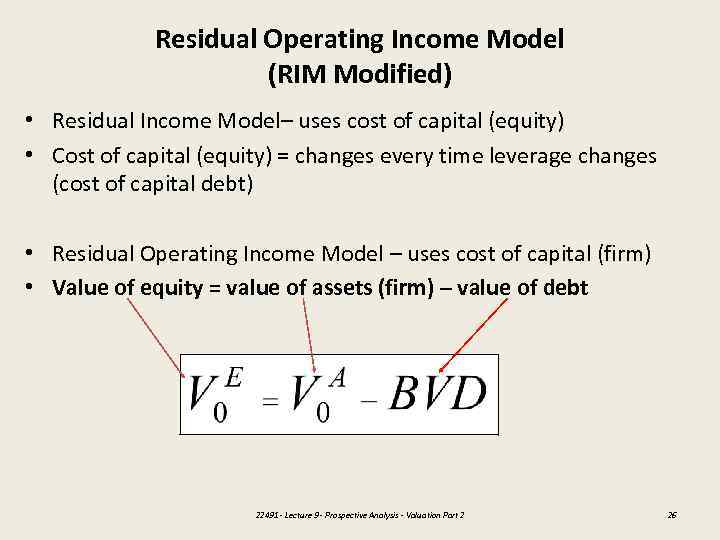

Residual Operating Income Model (RIM Modified) • Residual Income Model– uses cost of capital (equity) • Cost of capital (equity) = changes every time leverage changes (cost of capital debt) • Residual Operating Income Model – uses cost of capital (firm) • Value of equity = value of assets (firm) – value of debt 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 26

Residual Operating Income Model (RIM Modified) • Residual Income Model– uses cost of capital (equity) • Cost of capital (equity) = changes every time leverage changes (cost of capital debt) • Residual Operating Income Model – uses cost of capital (firm) • Value of equity = value of assets (firm) – value of debt 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 26

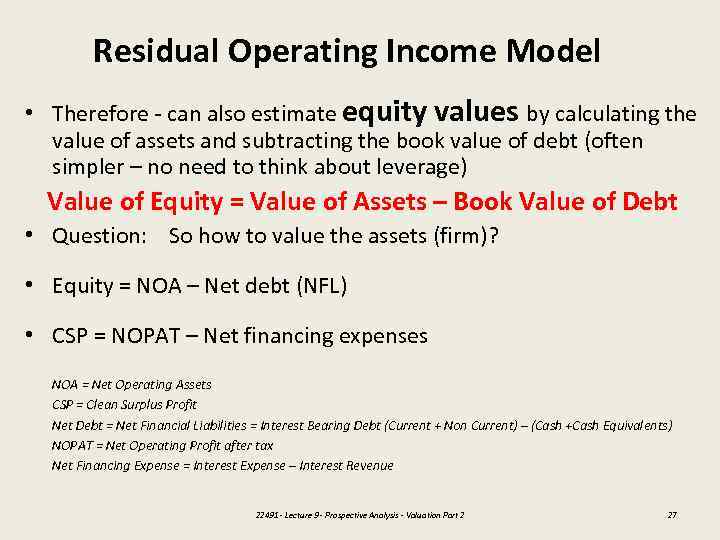

Residual Operating Income Model • Therefore - can also estimate equity values by calculating the value of assets and subtracting the book value of debt (often simpler – no need to think about leverage) Value of Equity = Value of Assets – Book Value of Debt • Question: So how to value the assets (firm)? • Equity = NOA – Net debt (NFL) • CSP = NOPAT – Net financing expenses NOA = Net Operating Assets CSP = Clean Surplus Profit Net Debt = Net Financial Liabilities = Interest Bearing Debt (Current + Non Current) – (Cash +Cash Equivalents) NOPAT = Net Operating Profit after tax Net Financing Expense = Interest Expense – Interest Revenue 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 27

Residual Operating Income Model • Therefore - can also estimate equity values by calculating the value of assets and subtracting the book value of debt (often simpler – no need to think about leverage) Value of Equity = Value of Assets – Book Value of Debt • Question: So how to value the assets (firm)? • Equity = NOA – Net debt (NFL) • CSP = NOPAT – Net financing expenses NOA = Net Operating Assets CSP = Clean Surplus Profit Net Debt = Net Financial Liabilities = Interest Bearing Debt (Current + Non Current) – (Cash +Cash Equivalents) NOPAT = Net Operating Profit after tax Net Financing Expense = Interest Expense – Interest Revenue 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 27

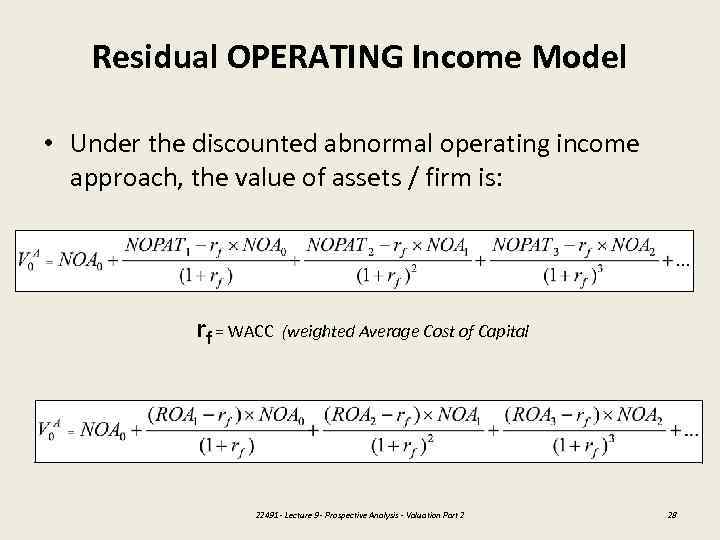

Residual OPERATING Income Model • Under the discounted abnormal operating income approach, the value of assets / firm is: rf = WACC (weighted Average Cost of Capital 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 28

Residual OPERATING Income Model • Under the discounted abnormal operating income approach, the value of assets / firm is: rf = WACC (weighted Average Cost of Capital 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 28

Residual Operating Income Model • Gives the same result as abnormal earnings valuation (as long as cost of capital for equity is adjusted each time leverage changes) 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 29

Residual Operating Income Model • Gives the same result as abnormal earnings valuation (as long as cost of capital for equity is adjusted each time leverage changes) 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 29

Residual Operating Income Model - steps 1. Forecast NOPAT and net operating assets 2. Estimate cost of capital for the firm 3. Calculate residual operating earnings = NOPAT – opening NOA (for that year) x cost of capital for firm 4. Calculate forecast residual operating earnings growth patterns to estimate TV calculation method (0, perpetuity or perpetuity with growth) 5. Calculate TV at time T (where growth pattern stabilises) 6. Discount forecast residual operating earnings to TV year and the TV, add together + opening NOA for total firm value 7. Firm value less book value of debt = equity value 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 30

Residual Operating Income Model - steps 1. Forecast NOPAT and net operating assets 2. Estimate cost of capital for the firm 3. Calculate residual operating earnings = NOPAT – opening NOA (for that year) x cost of capital for firm 4. Calculate forecast residual operating earnings growth patterns to estimate TV calculation method (0, perpetuity or perpetuity with growth) 5. Calculate TV at time T (where growth pattern stabilises) 6. Discount forecast residual operating earnings to TV year and the TV, add together + opening NOA for total firm value 7. Firm value less book value of debt = equity value 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 30

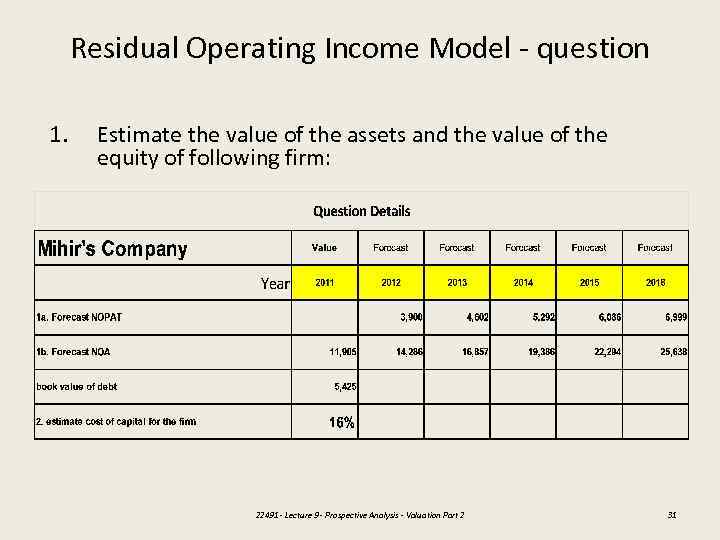

Residual Operating Income Model - question 1. Estimate the value of the assets and the value of the equity of following firm: 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 31

Residual Operating Income Model - question 1. Estimate the value of the assets and the value of the equity of following firm: 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 31

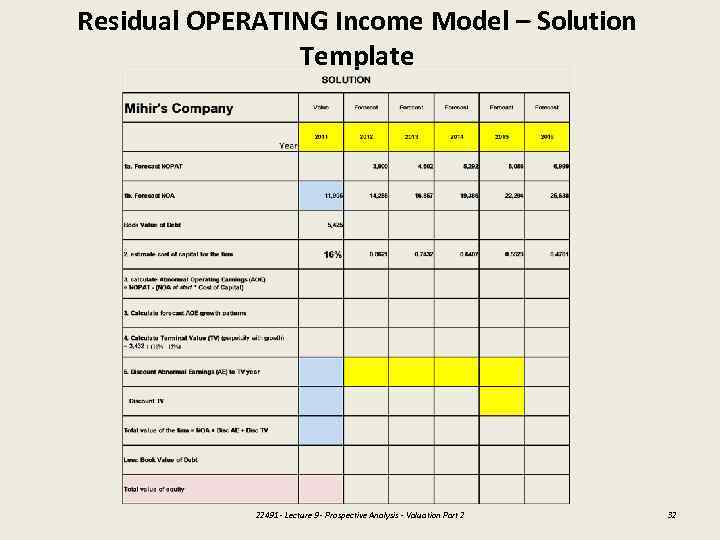

Residual OPERATING Income Model – Solution Template 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 32

Residual OPERATING Income Model – Solution Template 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 32

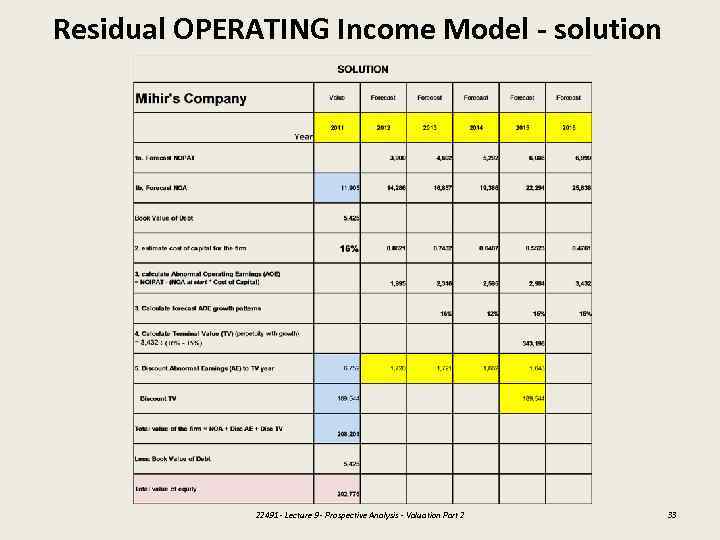

Residual OPERATING Income Model - solution 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 33

Residual OPERATING Income Model - solution 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 33

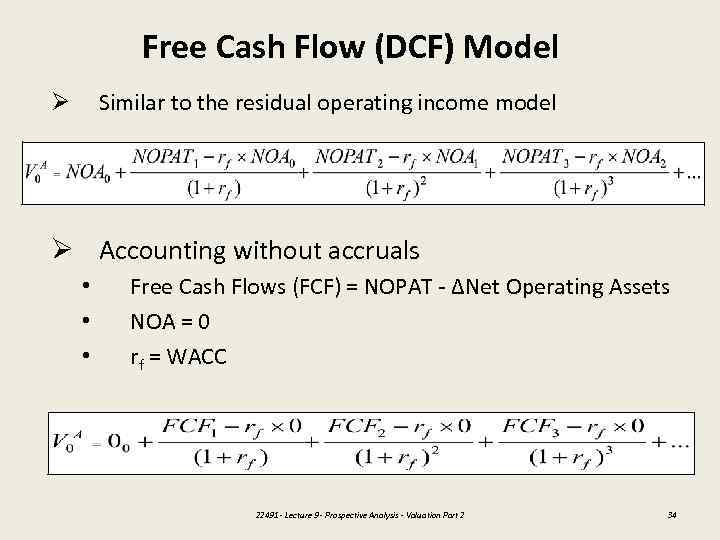

Free Cash Flow (DCF) Model Similar to the residual operating income model Ø Ø Accounting without accruals • • • Free Cash Flows (FCF) = NOPAT - ∆Net Operating Assets NOA = 0 rf = WACC 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 34

Free Cash Flow (DCF) Model Similar to the residual operating income model Ø Ø Accounting without accruals • • • Free Cash Flows (FCF) = NOPAT - ∆Net Operating Assets NOA = 0 rf = WACC 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 34

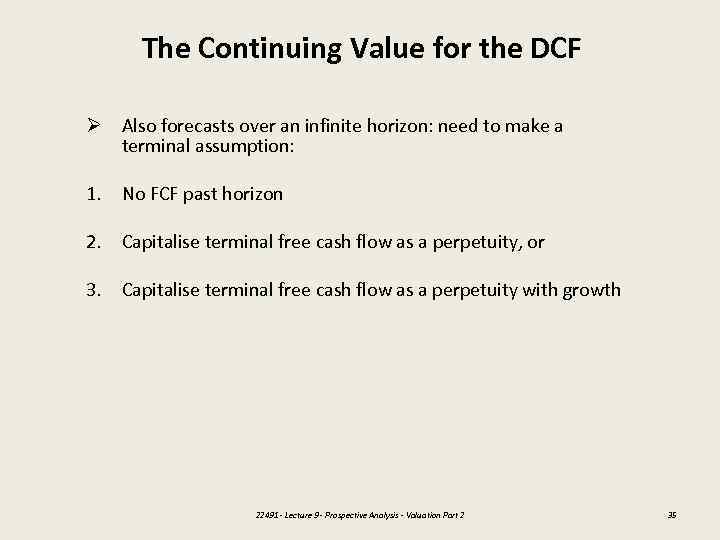

The Continuing Value for the DCF Ø Also forecasts over an infinite horizon: need to make a terminal assumption: 1. No FCF past horizon 2. Capitalise terminal free cash flow as a perpetuity, or 3. Capitalise terminal free cash flow as a perpetuity with growth 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 35

The Continuing Value for the DCF Ø Also forecasts over an infinite horizon: need to make a terminal assumption: 1. No FCF past horizon 2. Capitalise terminal free cash flow as a perpetuity, or 3. Capitalise terminal free cash flow as a perpetuity with growth 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 35

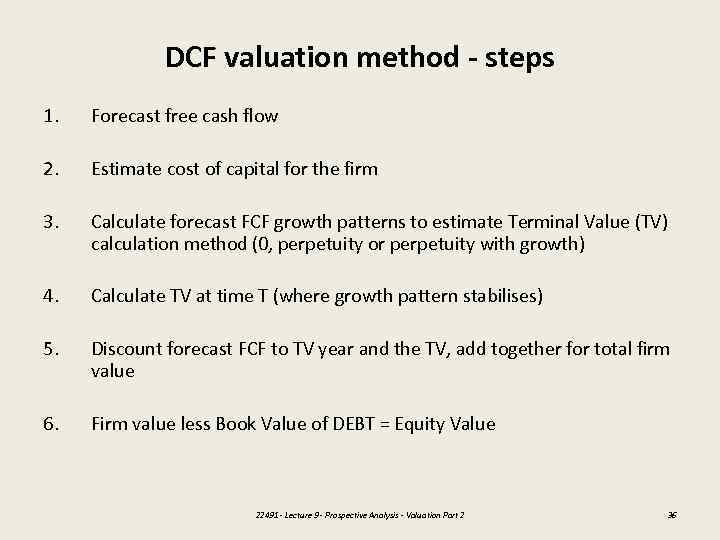

DCF valuation method - steps 1. Forecast free cash flow 2. Estimate cost of capital for the firm 3. Calculate forecast FCF growth patterns to estimate Terminal Value (TV) calculation method (0, perpetuity or perpetuity with growth) 4. Calculate TV at time T (where growth pattern stabilises) 5. Discount forecast FCF to TV year and the TV, add together for total firm value 6. Firm value less Book Value of DEBT = Equity Value 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 36

DCF valuation method - steps 1. Forecast free cash flow 2. Estimate cost of capital for the firm 3. Calculate forecast FCF growth patterns to estimate Terminal Value (TV) calculation method (0, perpetuity or perpetuity with growth) 4. Calculate TV at time T (where growth pattern stabilises) 5. Discount forecast FCF to TV year and the TV, add together for total firm value 6. Firm value less Book Value of DEBT = Equity Value 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 36

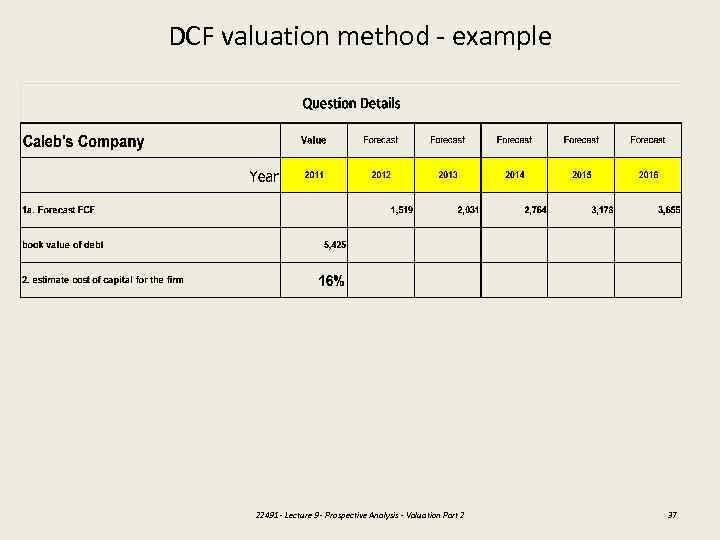

DCF valuation method - example 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 37

DCF valuation method - example 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 37

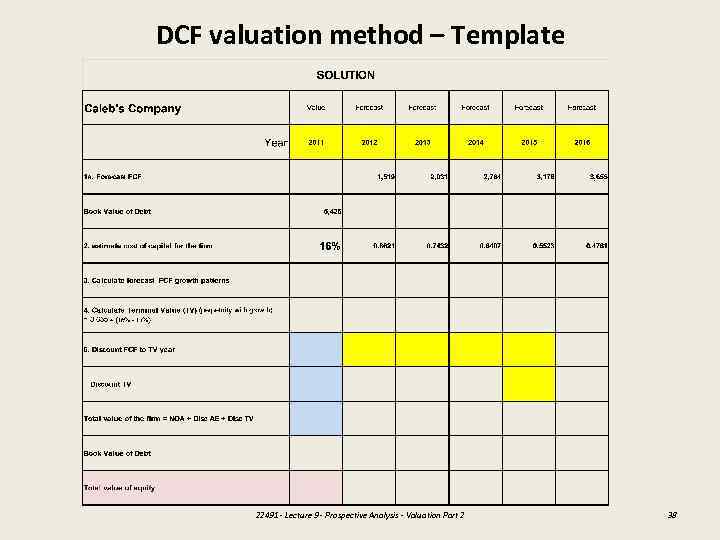

DCF valuation method – Template 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 38

DCF valuation method – Template 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 38

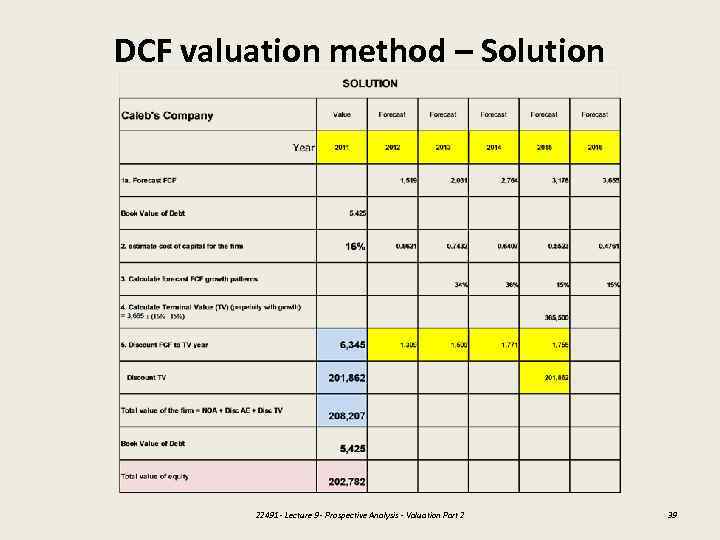

DCF valuation method – Solution 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 39

DCF valuation method – Solution 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 39

What are the problems with DCF? • Cash flow from operations (value added) is reduced by investments (which also add value): investments are treated as value losses • Value received is not matched against value surrendered to generate value - except for long forecast horizons Note: analysts forecast earnings, not cash flows 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 40

What are the problems with DCF? • Cash flow from operations (value added) is reduced by investments (which also add value): investments are treated as value losses • Value received is not matched against value surrendered to generate value - except for long forecast horizons Note: analysts forecast earnings, not cash flows 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 40

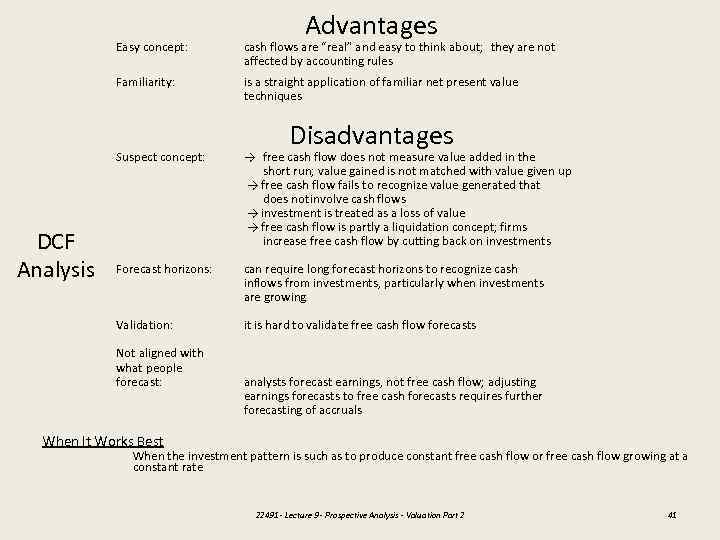

Advantages Easy concept: cash flows are “real” and easy to think about; they are not affected by accounting rules Familiarity: is a straight application of familiar net present value techniques Disadvantages Suspect concept: Forecast horizons: can require long forecast horizons to recognize cash inflows from investments, particularly when investments are growing Validation: DCF Analysis → free cash flow does not measure value added in the short run; value gained is not matched with value given up → free cash flow fails to recognize value generated that does not involve cash flows → investment is treated as a loss of value → free cash flow is partly a liquidation concept; firms increase free cash flow by cutting back on investments it is hard to validate free cash flow forecasts Not aligned with what people forecast: analysts forecast earnings, not free cash flow; adjusting earnings forecasts to free cash forecasts requires further forecasting of accruals When It Works Best When the investment pattern is such as to produce constant free cash flow or free cash flow growing at a constant rate 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 41

Advantages Easy concept: cash flows are “real” and easy to think about; they are not affected by accounting rules Familiarity: is a straight application of familiar net present value techniques Disadvantages Suspect concept: Forecast horizons: can require long forecast horizons to recognize cash inflows from investments, particularly when investments are growing Validation: DCF Analysis → free cash flow does not measure value added in the short run; value gained is not matched with value given up → free cash flow fails to recognize value generated that does not involve cash flows → investment is treated as a loss of value → free cash flow is partly a liquidation concept; firms increase free cash flow by cutting back on investments it is hard to validate free cash flow forecasts Not aligned with what people forecast: analysts forecast earnings, not free cash flow; adjusting earnings forecasts to free cash forecasts requires further forecasting of accruals When It Works Best When the investment pattern is such as to produce constant free cash flow or free cash flow growing at a constant rate 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 41

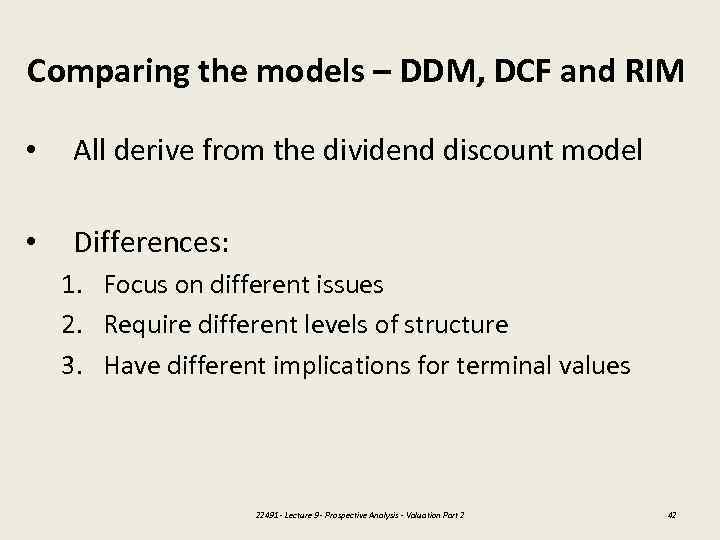

Comparing the models – DDM, DCF and RIM • All derive from the dividend discount model • Differences: 1. Focus on different issues 2. Require different levels of structure 3. Have different implications for terminal values 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 42

Comparing the models – DDM, DCF and RIM • All derive from the dividend discount model • Differences: 1. Focus on different issues 2. Require different levels of structure 3. Have different implications for terminal values 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 42

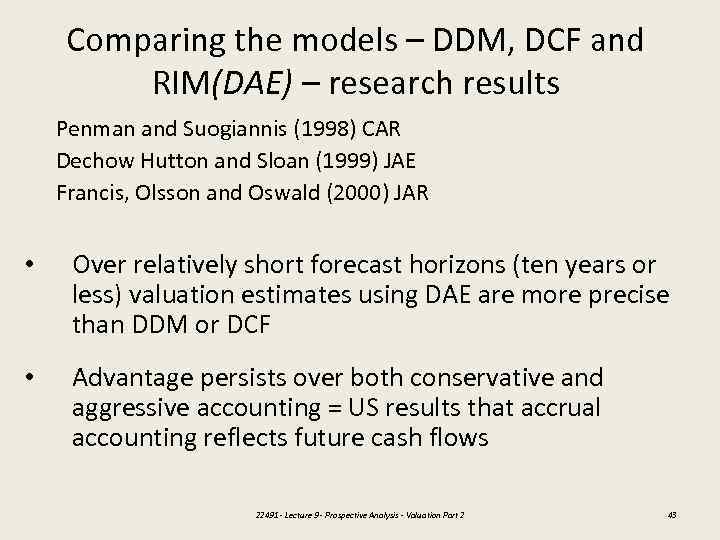

Comparing the models – DDM, DCF and RIM(DAE) – research results Penman and Suogiannis (1998) CAR Dechow Hutton and Sloan (1999) JAE Francis, Olsson and Oswald (2000) JAR • Over relatively short forecast horizons (ten years or less) valuation estimates using DAE are more precise than DDM or DCF • Advantage persists over both conservative and aggressive accounting = US results that accrual accounting reflects future cash flows 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 43

Comparing the models – DDM, DCF and RIM(DAE) – research results Penman and Suogiannis (1998) CAR Dechow Hutton and Sloan (1999) JAE Francis, Olsson and Oswald (2000) JAR • Over relatively short forecast horizons (ten years or less) valuation estimates using DAE are more precise than DDM or DCF • Advantage persists over both conservative and aggressive accounting = US results that accrual accounting reflects future cash flows 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 43

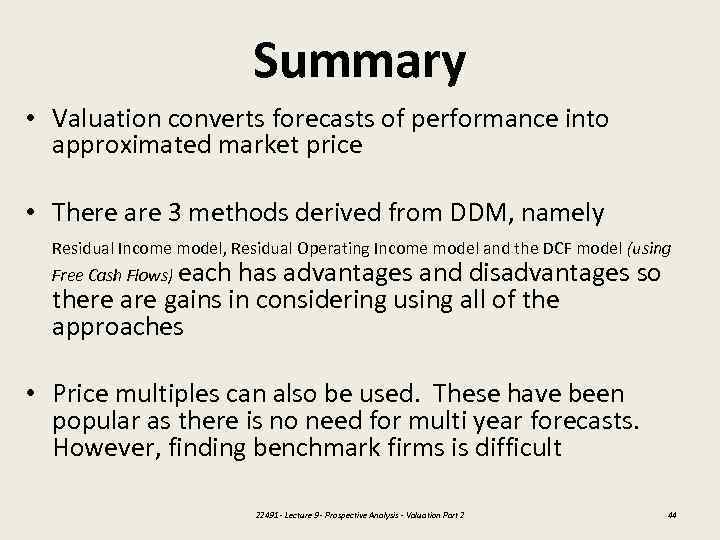

Summary • Valuation converts forecasts of performance into approximated market price • There are 3 methods derived from DDM, namely Residual Income model, Residual Operating Income model and the DCF model (using Free Cash Flows) each has advantages and disadvantages so there are gains in considering using all of the approaches • Price multiples can also be used. These have been popular as there is no need for multi year forecasts. However, finding benchmark firms is difficult 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 44

Summary • Valuation converts forecasts of performance into approximated market price • There are 3 methods derived from DDM, namely Residual Income model, Residual Operating Income model and the DCF model (using Free Cash Flows) each has advantages and disadvantages so there are gains in considering using all of the approaches • Price multiples can also be used. These have been popular as there is no need for multi year forecasts. However, finding benchmark firms is difficult 22491 - Lecture 9 - Prospective Analysis - Valuation Part 2 44