364d0071c62e3bb7e74e08cbb1bd6500.ppt

- Количество слайдов: 19

Lecture 7 Understanding and Measuring Transaction Costs

Lecture 7 Understanding and Measuring Transaction Costs

Trading Cost l Cost of implementing a trading strategy l Contractual cost l Market impact l Difference between the trade price and the underlying fundamental value at the time of the trade l Lost opportunity cost l Trading cost depends on the order size. l Time to execute the order is also important. l Retail investors vs. Institutional investors

Trading Cost l Cost of implementing a trading strategy l Contractual cost l Market impact l Difference between the trade price and the underlying fundamental value at the time of the trade l Lost opportunity cost l Trading cost depends on the order size. l Time to execute the order is also important. l Retail investors vs. Institutional investors

Contractual Costs l Commissions (deregulated in 1975 in the US). l For retail investors. l Online brokers are cheaper (~$5 -20 / trade) l l Full-service brokers are much more expensive, but are bundled with services l l Merrill, Dean Witter, A. G. Edwards, Edward Jones etc. For institutional investors (usually fixed per share). l l l E*Trade, Ameri. Trade, Schwab etc. For listed stocks, it is 2 -5 cents per share. For Nasdaq stocks, commissions were built into prices as brokers often filled these orders on a principal basis (“net” trading). Since the late 1990’s brokers started trading on the agency basis as well. Market fees (small) l l Super. DOT fee ECN access fee

Contractual Costs l Commissions (deregulated in 1975 in the US). l For retail investors. l Online brokers are cheaper (~$5 -20 / trade) l l Full-service brokers are much more expensive, but are bundled with services l l Merrill, Dean Witter, A. G. Edwards, Edward Jones etc. For institutional investors (usually fixed per share). l l l E*Trade, Ameri. Trade, Schwab etc. For listed stocks, it is 2 -5 cents per share. For Nasdaq stocks, commissions were built into prices as brokers often filled these orders on a principal basis (“net” trading). Since the late 1990’s brokers started trading on the agency basis as well. Market fees (small) l l Super. DOT fee ECN access fee

Historical commissions per share – Greenwich Associates Data Institutional investor average cents-per-share commission, 1977 -2004. 1997 2003

Historical commissions per share – Greenwich Associates Data Institutional investor average cents-per-share commission, 1977 -2004. 1997 2003

Institutional Commissions on a grid of $0. 01; 1997 Execution only Full service commissions

Institutional Commissions on a grid of $0. 01; 1997 Execution only Full service commissions

Institutional Commissions on a grid of $0. 01; 2003 Execution only Full service commissions

Institutional Commissions on a grid of $0. 01; 2003 Execution only Full service commissions

Evolution of Commissions l Commissions were traditionally paying for other services (e. g. research, IPO) as well. l Over time there is a proliferation of alternative trading systems that only provide execution. l Unbundling of the execution from research. l Decline in commission revenue for the large institutional brokers.

Evolution of Commissions l Commissions were traditionally paying for other services (e. g. research, IPO) as well. l Over time there is a proliferation of alternative trading systems that only provide execution. l Unbundling of the execution from research. l Decline in commission revenue for the large institutional brokers.

Soft Dollars l Accounts into which brokers deposit excess commissions and from which the manager can pay for research, equipment, sales expenses, l l Potential conflicts of interest and failure of the fiduciary duty of the broker to get the best execution. Mutual funds rarely publish trading cost information l l SEC is investigating this practice, but has not ruled yet. UK has already banned the practice for mutual funds.

Soft Dollars l Accounts into which brokers deposit excess commissions and from which the manager can pay for research, equipment, sales expenses, l l Potential conflicts of interest and failure of the fiduciary duty of the broker to get the best execution. Mutual funds rarely publish trading cost information l l SEC is investigating this practice, but has not ruled yet. UK has already banned the practice for mutual funds.

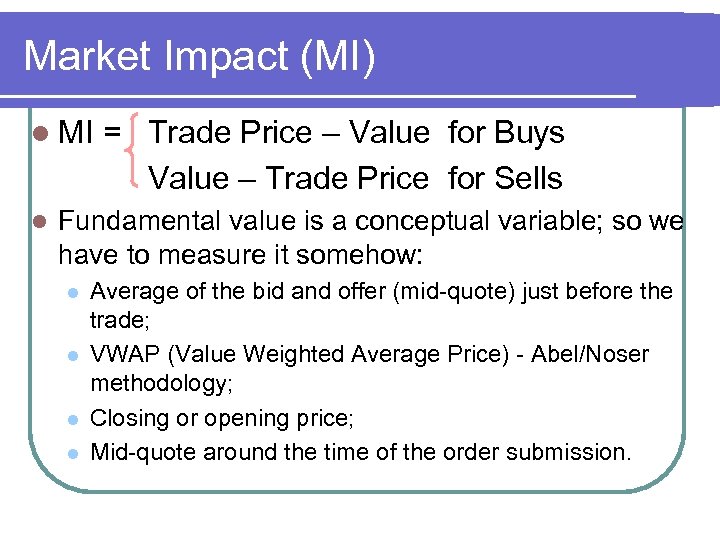

Market Impact (MI) l MI l = Trade Price – Value for Buys Value – Trade Price for Sells Fundamental value is a conceptual variable; so we have to measure it somehow: l l Average of the bid and offer (mid-quote) just before the trade; VWAP (Value Weighted Average Price) - Abel/Noser methodology; Closing or opening price; Mid-quote around the time of the order submission.

Market Impact (MI) l MI l = Trade Price – Value for Buys Value – Trade Price for Sells Fundamental value is a conceptual variable; so we have to measure it somehow: l l Average of the bid and offer (mid-quote) just before the trade; VWAP (Value Weighted Average Price) - Abel/Noser methodology; Closing or opening price; Mid-quote around the time of the order submission.

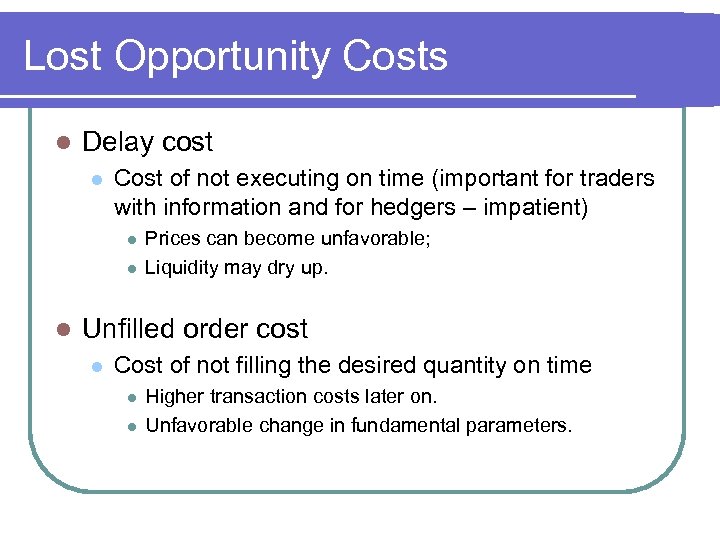

Lost Opportunity Costs l Delay cost l Cost of not executing on time (important for traders with information and for hedgers – impatient) l l l Prices can become unfavorable; Liquidity may dry up. Unfilled order cost l Cost of not filling the desired quantity on time l l Higher transaction costs later on. Unfavorable change in fundamental parameters.

Lost Opportunity Costs l Delay cost l Cost of not executing on time (important for traders with information and for hedgers – impatient) l l l Prices can become unfavorable; Liquidity may dry up. Unfilled order cost l Cost of not filling the desired quantity on time l l Higher transaction costs later on. Unfavorable change in fundamental parameters.

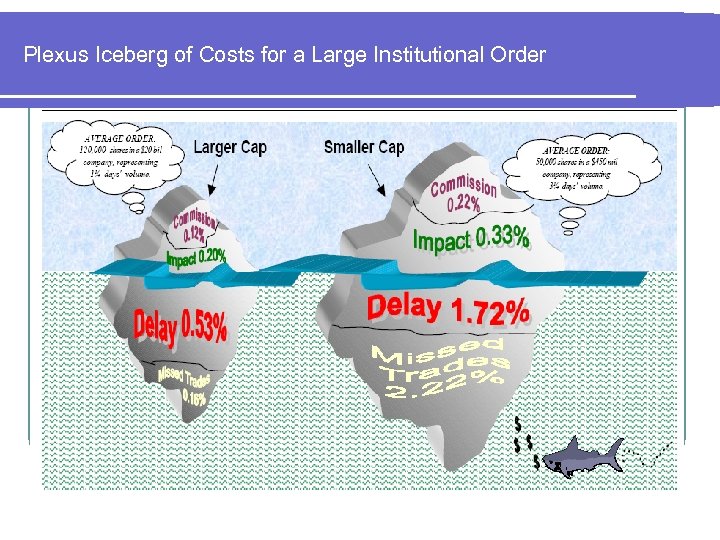

Plexus Iceberg of Costs for a Large Institutional Order

Plexus Iceberg of Costs for a Large Institutional Order

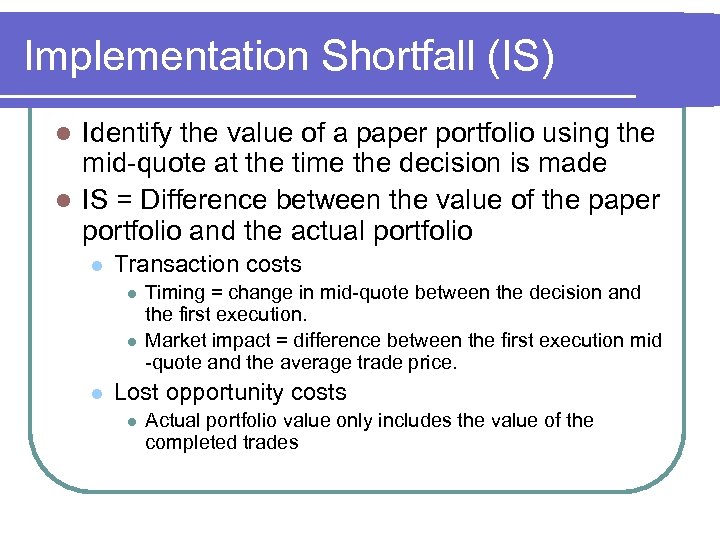

Implementation Shortfall (IS) Identify the value of a paper portfolio using the mid-quote at the time the decision is made l IS = Difference between the value of the paper portfolio and the actual portfolio l l Transaction costs l l l Timing = change in mid-quote between the decision and the first execution. Market impact = difference between the first execution mid -quote and the average trade price. Lost opportunity costs l Actual portfolio value only includes the value of the completed trades

Implementation Shortfall (IS) Identify the value of a paper portfolio using the mid-quote at the time the decision is made l IS = Difference between the value of the paper portfolio and the actual portfolio l l Transaction costs l l l Timing = change in mid-quote between the decision and the first execution. Market impact = difference between the first execution mid -quote and the average trade price. Lost opportunity costs l Actual portfolio value only includes the value of the completed trades

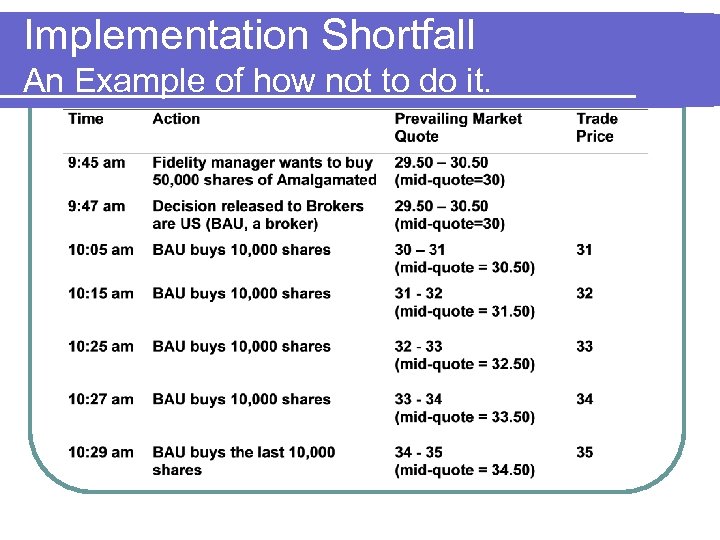

Implementation Shortfall An Example of how not to do it.

Implementation Shortfall An Example of how not to do it.

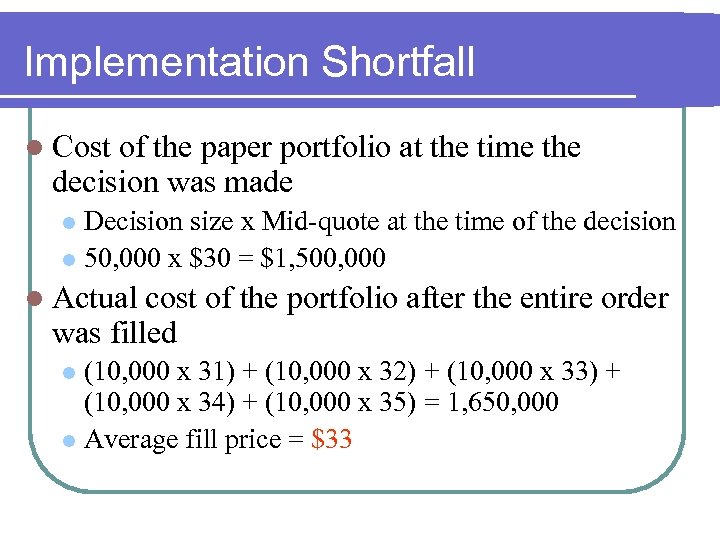

Implementation Shortfall l Cost of the paper portfolio at the time the decision was made Decision size x Mid-quote at the time of the decision l 50, 000 x $30 = $1, 500, 000 l l Actual cost of the portfolio after the entire order was filled (10, 000 x 31) + (10, 000 x 32) + (10, 000 x 33) + (10, 000 x 34) + (10, 000 x 35) = 1, 650, 000 l Average fill price = $33 l

Implementation Shortfall l Cost of the paper portfolio at the time the decision was made Decision size x Mid-quote at the time of the decision l 50, 000 x $30 = $1, 500, 000 l l Actual cost of the portfolio after the entire order was filled (10, 000 x 31) + (10, 000 x 32) + (10, 000 x 33) + (10, 000 x 34) + (10, 000 x 35) = 1, 650, 000 l Average fill price = $33 l

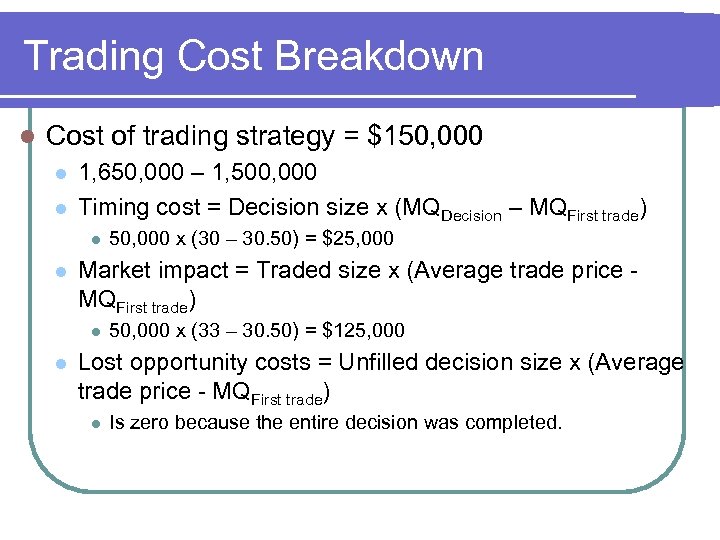

Trading Cost Breakdown l Cost of trading strategy = $150, 000 l l 1, 650, 000 – 1, 500, 000 Timing cost = Decision size x (MQDecision – MQFirst trade) l l Market impact = Traded size x (Average trade price MQFirst trade) l l 50, 000 x (30 – 30. 50) = $25, 000 50, 000 x (33 – 30. 50) = $125, 000 Lost opportunity costs = Unfilled decision size x (Average trade price - MQFirst trade) l Is zero because the entire decision was completed.

Trading Cost Breakdown l Cost of trading strategy = $150, 000 l l 1, 650, 000 – 1, 500, 000 Timing cost = Decision size x (MQDecision – MQFirst trade) l l Market impact = Traded size x (Average trade price MQFirst trade) l l 50, 000 x (30 – 30. 50) = $25, 000 50, 000 x (33 – 30. 50) = $125, 000 Lost opportunity costs = Unfilled decision size x (Average trade price - MQFirst trade) l Is zero because the entire decision was completed.

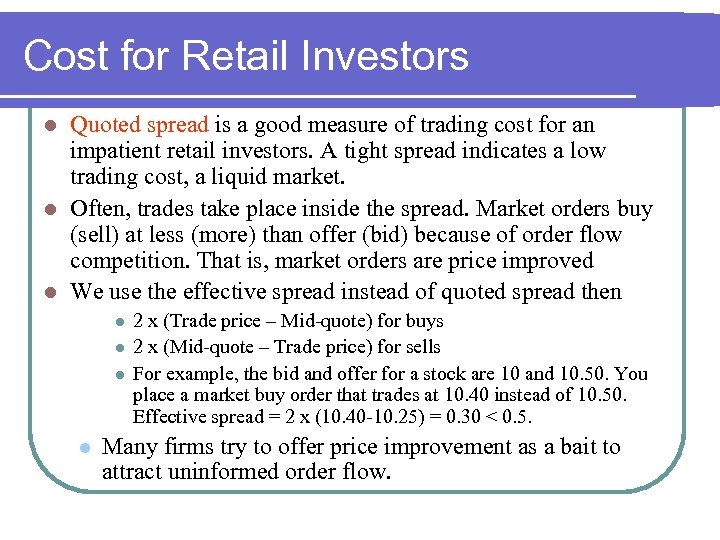

Cost for Retail Investors Quoted spread is a good measure of trading cost for an impatient retail investors. A tight spread indicates a low trading cost, a liquid market. l Often, trades take place inside the spread. Market orders buy (sell) at less (more) than offer (bid) because of order flow competition. That is, market orders are price improved l We use the effective spread instead of quoted spread then l l l 2 x (Trade price – Mid-quote) for buys 2 x (Mid-quote – Trade price) for sells For example, the bid and offer for a stock are 10 and 10. 50. You place a market buy order that trades at 10. 40 instead of 10. 50. Effective spread = 2 x (10. 40 -10. 25) = 0. 30 < 0. 5. Many firms try to offer price improvement as a bait to attract uninformed order flow.

Cost for Retail Investors Quoted spread is a good measure of trading cost for an impatient retail investors. A tight spread indicates a low trading cost, a liquid market. l Often, trades take place inside the spread. Market orders buy (sell) at less (more) than offer (bid) because of order flow competition. That is, market orders are price improved l We use the effective spread instead of quoted spread then l l l 2 x (Trade price – Mid-quote) for buys 2 x (Mid-quote – Trade price) for sells For example, the bid and offer for a stock are 10 and 10. 50. You place a market buy order that trades at 10. 40 instead of 10. 50. Effective spread = 2 x (10. 40 -10. 25) = 0. 30 < 0. 5. Many firms try to offer price improvement as a bait to attract uninformed order flow.

New Rules on Disclosure of Execution Quality SEC Rule 11 Ac 1 -5 Each market center / participant is obligated to publish information about effective spreads for different order sizes/types for each stock on a monthly basis

New Rules on Disclosure of Execution Quality SEC Rule 11 Ac 1 -5 Each market center / participant is obligated to publish information about effective spreads for different order sizes/types for each stock on a monthly basis

Difficulties l Quoted spreads are much easier to calculate by an outside observer (econometrician) than the effective ones. l Effective spreads require matching of the time of trades and quotes: Time stamps may be off; l How do one know which trade was a buy? l l Internal calculations are much more accurate.

Difficulties l Quoted spreads are much easier to calculate by an outside observer (econometrician) than the effective ones. l Effective spreads require matching of the time of trades and quotes: Time stamps may be off; l How do one know which trade was a buy? l l Internal calculations are much more accurate.

Summary l In the last decade the trading costs became the focal point of the institutional investors, at the expense of research. l We are witnessing the reduction of these costs along with proliferation of new conceptually different trading venues. l The trend is likely to continue, yet the decline in transaction costs is likely to stop soon.

Summary l In the last decade the trading costs became the focal point of the institutional investors, at the expense of research. l We are witnessing the reduction of these costs along with proliferation of new conceptually different trading venues. l The trend is likely to continue, yet the decline in transaction costs is likely to stop soon.