c08a3cb7b8d77813fbc957006d65d1ce.ppt

- Количество слайдов: 45

Lecture 7 Technical Analysis Economics 98 / 198 Fall 2007

Lecture 7 Technical Analysis Economics 98 / 198 Fall 2007

Announcements • Hand in homework by the end of class

Announcements • Hand in homework by the end of class

Current Events / News Simulation Discussion

Current Events / News Simulation Discussion

Lecture Content

Lecture Content

Today… • Introduction to technical analysis – Basics & definitions – Stock charts & chart types – Moving Averages – Trends / Channels – Support & Resistance – Volume

Today… • Introduction to technical analysis – Basics & definitions – Stock charts & chart types – Moving Averages – Trends / Channels – Support & Resistance – Volume

Technical Analysis? Huh? • Don’t get intimidated when hear “technical analysis” • Comes down to your supply and demand – How is this different from fundamental analysis? • Tries to make sense of market emotions by studying the market actions

Technical Analysis? Huh? • Don’t get intimidated when hear “technical analysis” • Comes down to your supply and demand – How is this different from fundamental analysis? • Tries to make sense of market emotions by studying the market actions

Technical Analysis: Introduction to Stock Charts CHART BASICS

Technical Analysis: Introduction to Stock Charts CHART BASICS

Basic Terms • • • Volatility Fluctuations 52 -week high / low Price / trading range Open / closing price

Basic Terms • • • Volatility Fluctuations 52 -week high / low Price / trading range Open / closing price

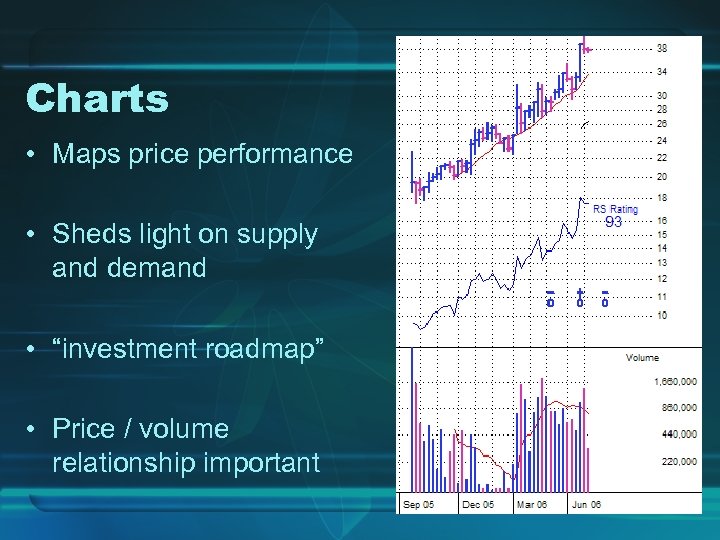

Charts • Maps price performance • Sheds light on supply and demand • “investment roadmap” • Price / volume relationship important

Charts • Maps price performance • Sheds light on supply and demand • “investment roadmap” • Price / volume relationship important

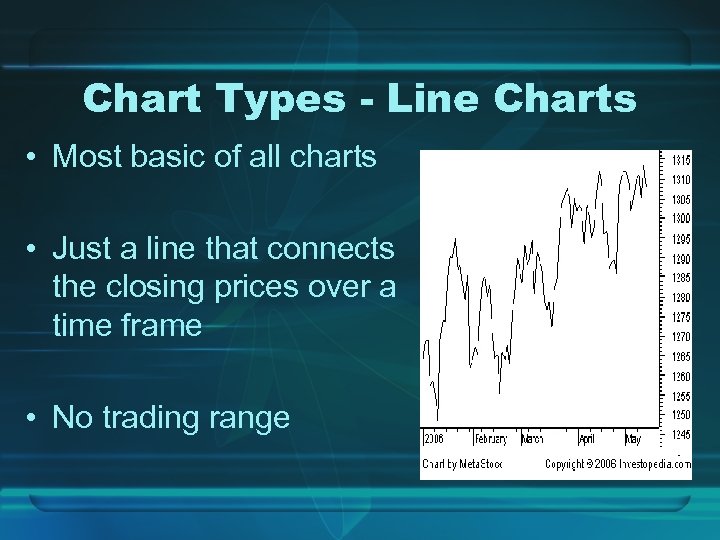

Chart Types - Line Charts • Most basic of all charts • Just a line that connects the closing prices over a time frame • No trading range

Chart Types - Line Charts • Most basic of all charts • Just a line that connects the closing prices over a time frame • No trading range

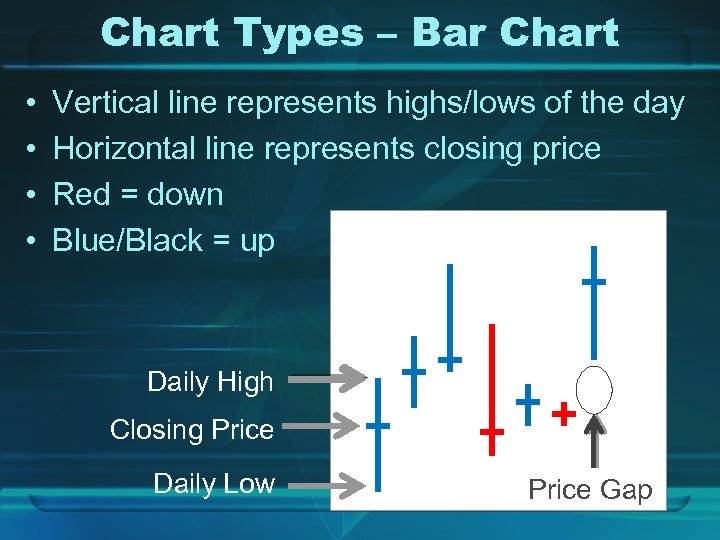

Chart Types – Bar Chart • • Vertical line represents highs/lows of the day Horizontal line represents closing price Red = down Blue/Black = up Daily High Closing Price Daily Low Price Gap

Chart Types – Bar Chart • • Vertical line represents highs/lows of the day Horizontal line represents closing price Red = down Blue/Black = up Daily High Closing Price Daily Low Price Gap

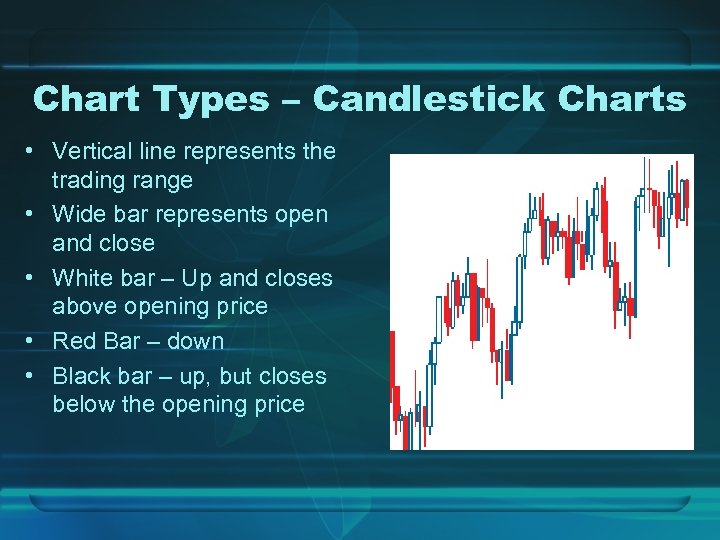

Chart Types – Candlestick Charts • Vertical line represents the trading range • Wide bar represents open and close • White bar – Up and closes above opening price • Red Bar – down • Black bar – up, but closes below the opening price

Chart Types – Candlestick Charts • Vertical line represents the trading range • Wide bar represents open and close • White bar – Up and closes above opening price • Red Bar – down • Black bar – up, but closes below the opening price

Chart Basics – Time Scale • Time Scale – Dates along bottom of chart (varies from seconds to decades) – Common Types: intraday, daily, weekly, monthly – Subtle differences between different time scales

Chart Basics – Time Scale • Time Scale – Dates along bottom of chart (varies from seconds to decades) – Common Types: intraday, daily, weekly, monthly – Subtle differences between different time scales

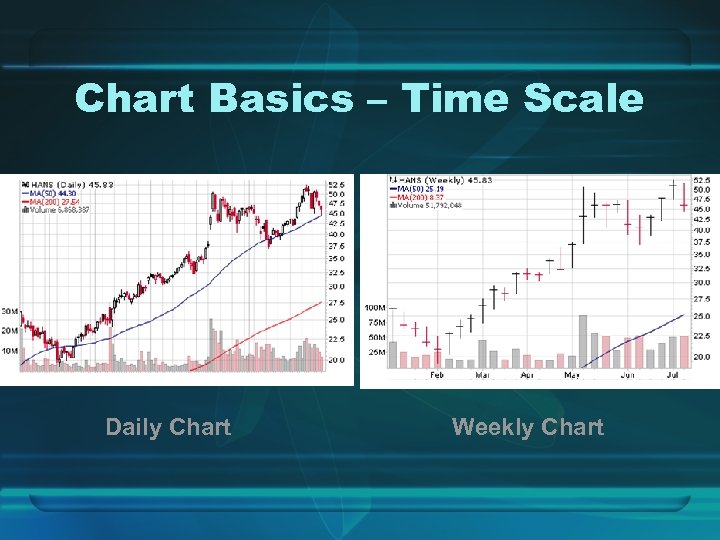

Chart Basics – Time Scale Daily Chart Weekly Chart

Chart Basics – Time Scale Daily Chart Weekly Chart

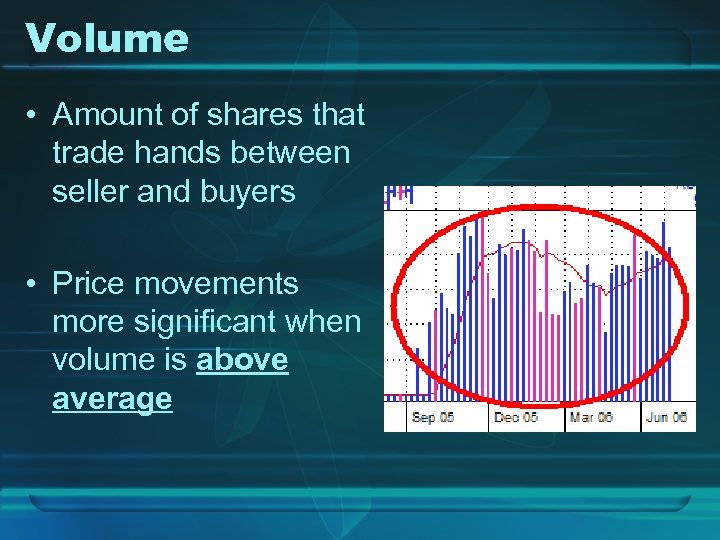

Volume • Amount of shares that trade hands between seller and buyers • Price movements more significant when volume is above average

Volume • Amount of shares that trade hands between seller and buyers • Price movements more significant when volume is above average

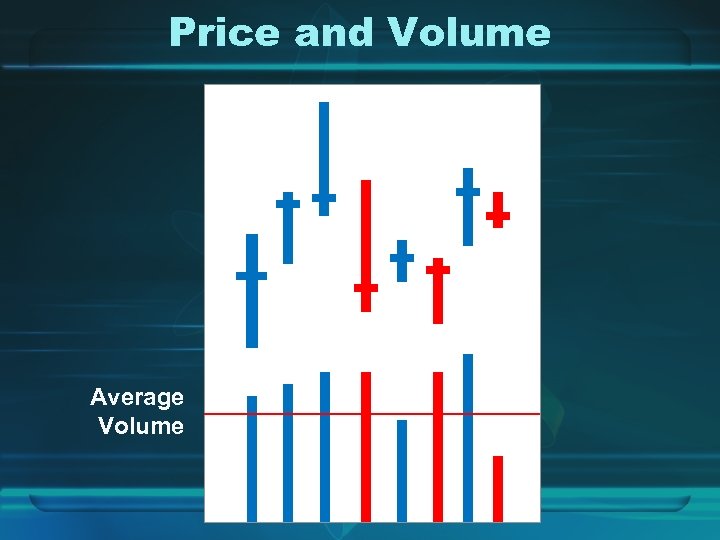

Price and Volume Average Volume

Price and Volume Average Volume

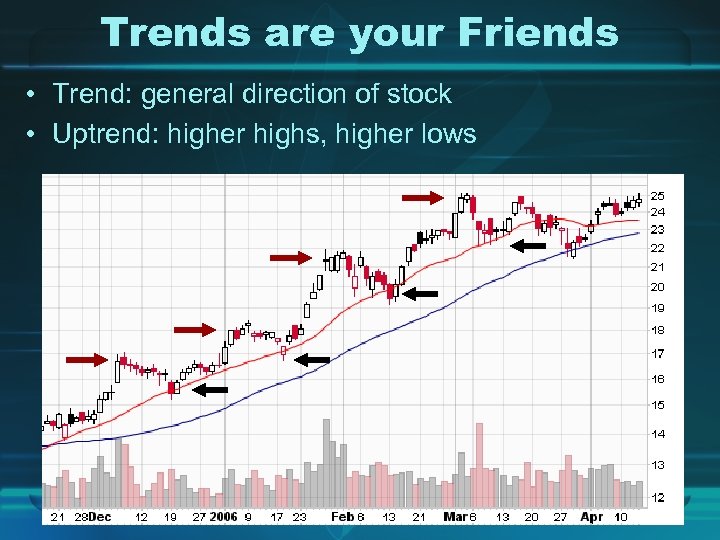

Trends are your Friends • Trend: general direction of stock • Uptrend: higher highs, higher lows

Trends are your Friends • Trend: general direction of stock • Uptrend: higher highs, higher lows

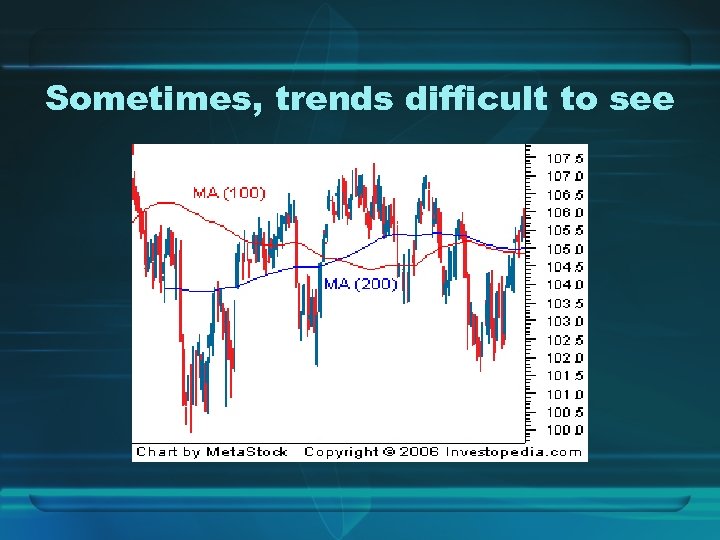

Sometimes, trends difficult to see

Sometimes, trends difficult to see

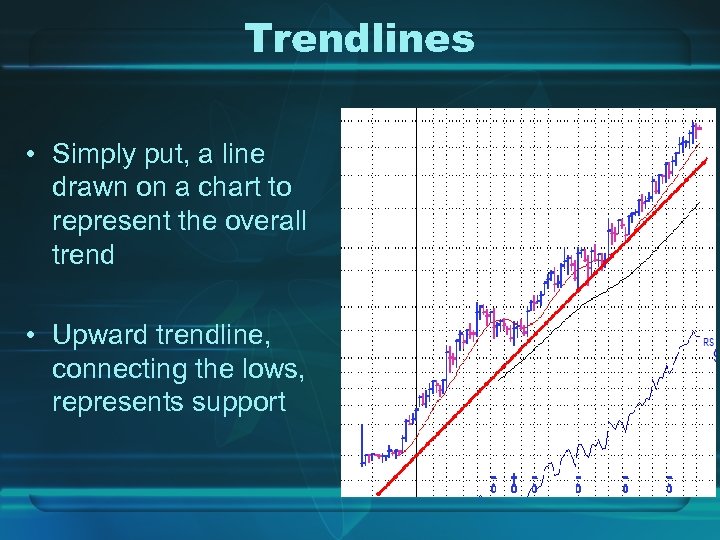

Trendlines • Simply put, a line drawn on a chart to represent the overall trend • Upward trendline, connecting the lows, represents support

Trendlines • Simply put, a line drawn on a chart to represent the overall trend • Upward trendline, connecting the lows, represents support

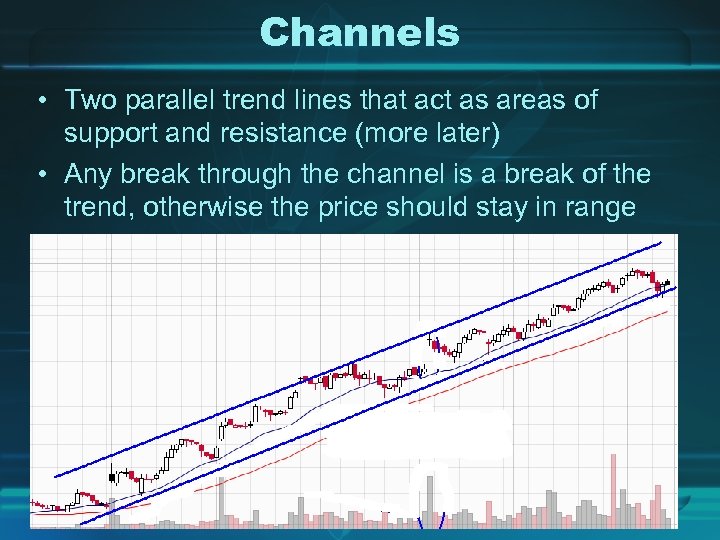

Channels • Two parallel trend lines that act as areas of support and resistance (more later) • Any break through the channel is a break of the trend, otherwise the price should stay in range

Channels • Two parallel trend lines that act as areas of support and resistance (more later) • Any break through the channel is a break of the trend, otherwise the price should stay in range

Technical Analysis: Introduction to Stock Charts SUPPORT / RESISTANCE By Johns Wu & thebulltrader. com

Technical Analysis: Introduction to Stock Charts SUPPORT / RESISTANCE By Johns Wu & thebulltrader. com

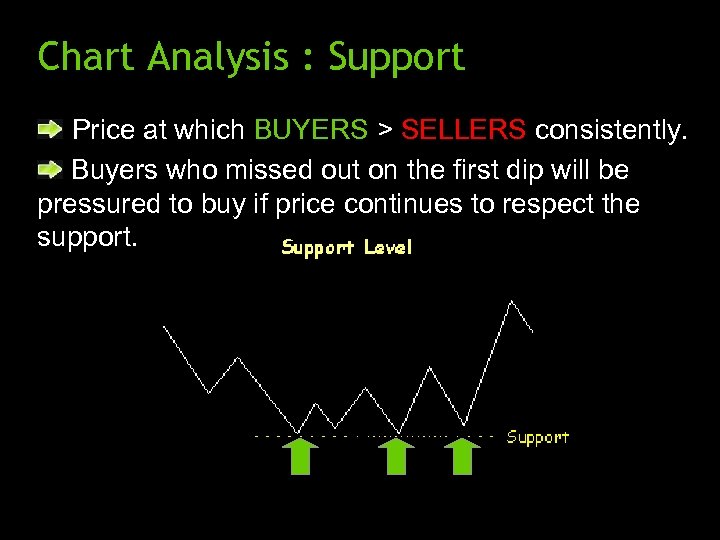

Chart Analysis : Support Price at which BUYERS > SELLERS consistently. Buyers who missed out on the first dip will be pressured to buy if price continues to respect the support.

Chart Analysis : Support Price at which BUYERS > SELLERS consistently. Buyers who missed out on the first dip will be pressured to buy if price continues to respect the support.

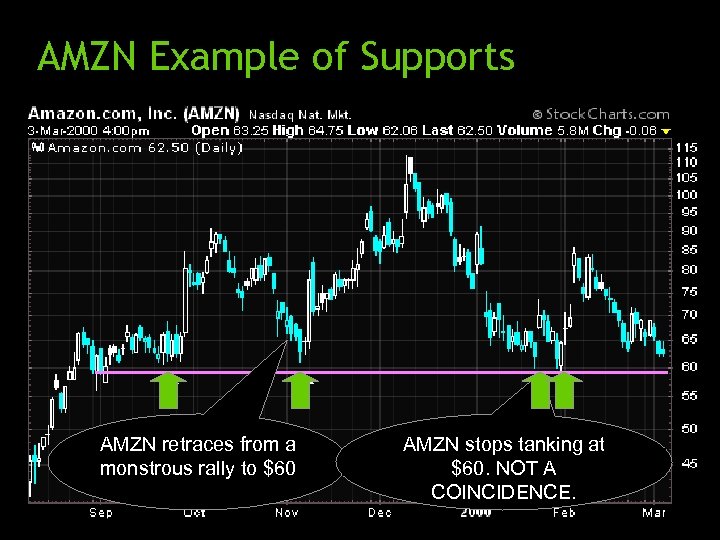

AMZN Example of Supports AMZN retraces from a monstrous rally to $60 AMZN stops tanking at $60. NOT A COINCIDENCE.

AMZN Example of Supports AMZN retraces from a monstrous rally to $60 AMZN stops tanking at $60. NOT A COINCIDENCE.

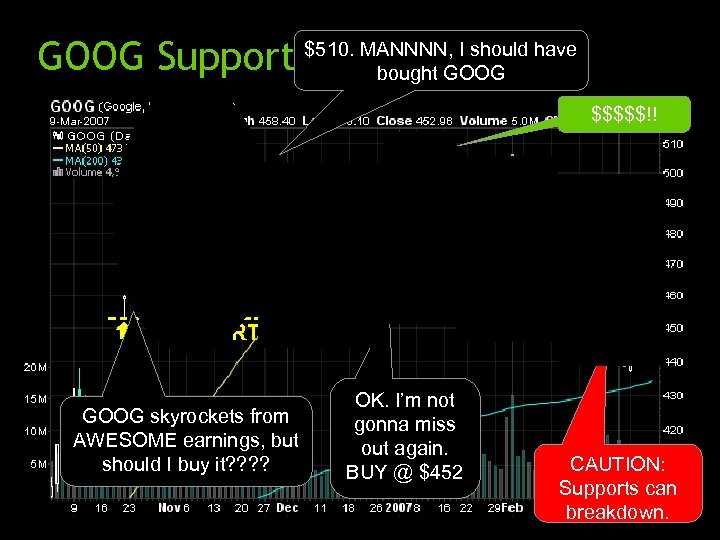

GOOG Support Psychology $510. MANNNN, I should have bought GOOG $$$$$!! GOOG skyrockets from AWESOME earnings, but should I buy it? ? OK. I’m not gonna miss out again. BUY @ $452 CAUTION: Supports can breakdown.

GOOG Support Psychology $510. MANNNN, I should have bought GOOG $$$$$!! GOOG skyrockets from AWESOME earnings, but should I buy it? ? OK. I’m not gonna miss out again. BUY @ $452 CAUTION: Supports can breakdown.

Support Breakdowns SELL if support “breaks down”, because it signifies that BUYERS no longer overpower SELLERS. Breakdowns are a BEARISH SELL signal. You should have sold here, at the BREAK DOWN.

Support Breakdowns SELL if support “breaks down”, because it signifies that BUYERS no longer overpower SELLERS. Breakdowns are a BEARISH SELL signal. You should have sold here, at the BREAK DOWN.

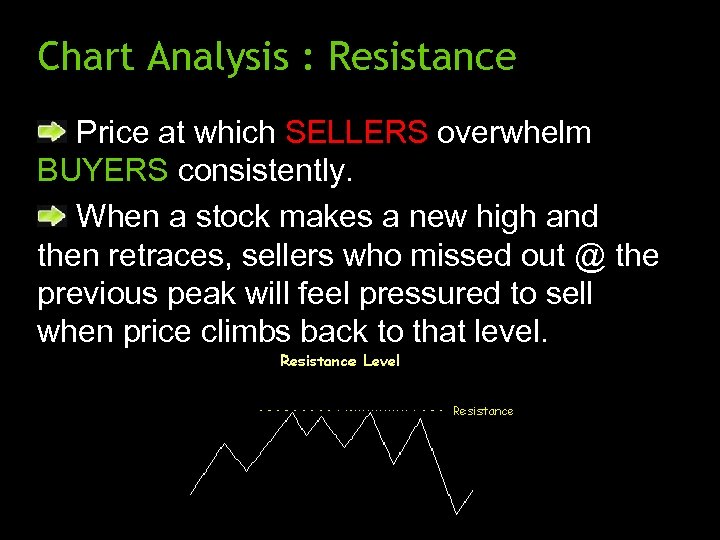

Chart Analysis : Resistance Price at which SELLERS overwhelm BUYERS consistently. When a stock makes a new high and then retraces, sellers who missed out @ the previous peak will feel pressured to sell when price climbs back to that level.

Chart Analysis : Resistance Price at which SELLERS overwhelm BUYERS consistently. When a stock makes a new high and then retraces, sellers who missed out @ the previous peak will feel pressured to sell when price climbs back to that level.

TM – Resistance Psychology Finally! $138. I better sell this time. Should I sell? ? Na, I’ll take my chances. I should have sold when TM was $138!!

TM – Resistance Psychology Finally! $138. I better sell this time. Should I sell? ? Na, I’ll take my chances. I should have sold when TM was $138!!

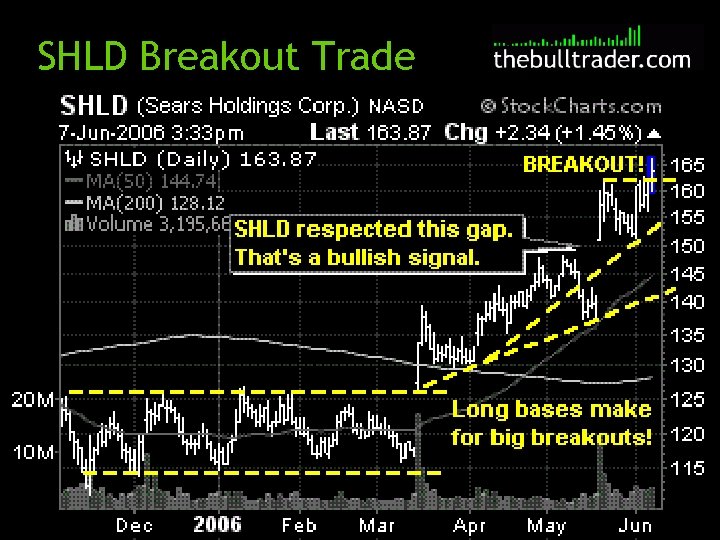

Resistance Breakouts When price “breaks out” above resistance, it becomes a new support level. *** IMPORTANT *** Breakout signifies clear dominance of BUYERS. (good time to buy) This is a BULLISH BUY signal. My favorite trade setup.

Resistance Breakouts When price “breaks out” above resistance, it becomes a new support level. *** IMPORTANT *** Breakout signifies clear dominance of BUYERS. (good time to buy) This is a BULLISH BUY signal. My favorite trade setup.

TGT Resistance Breakout BREAKOUT!! RESISTANCE BECOMES SUPPORT

TGT Resistance Breakout BREAKOUT!! RESISTANCE BECOMES SUPPORT

SHLD Breakout Trade

SHLD Breakout Trade

Technical Analysis: Introduction to Stock Charts MOVING AVERAGES

Technical Analysis: Introduction to Stock Charts MOVING AVERAGES

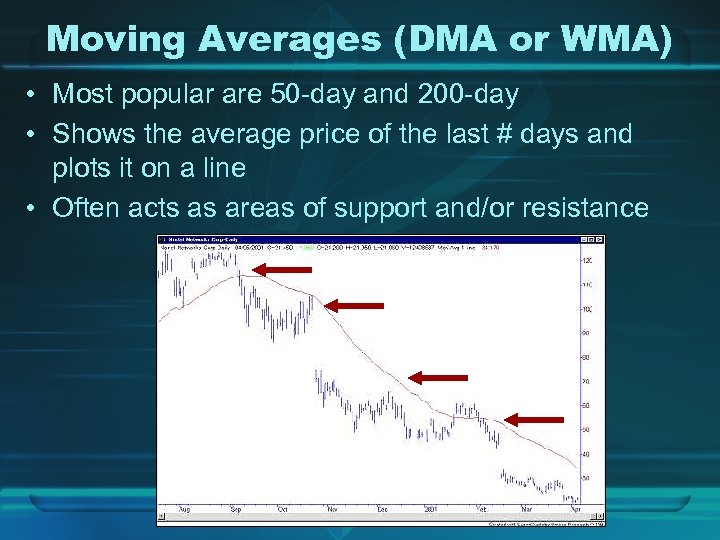

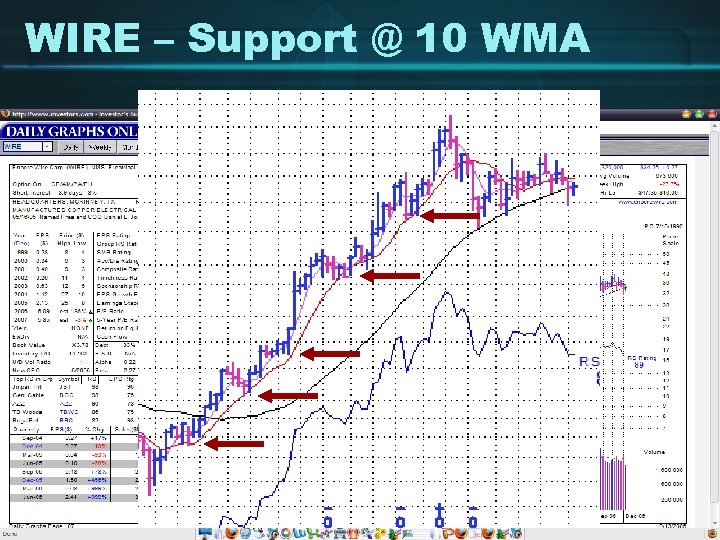

Moving Averages (DMA or WMA) • Most popular are 50 -day and 200 -day • Shows the average price of the last # days and plots it on a line • Often acts as areas of support and/or resistance

Moving Averages (DMA or WMA) • Most popular are 50 -day and 200 -day • Shows the average price of the last # days and plots it on a line • Often acts as areas of support and/or resistance

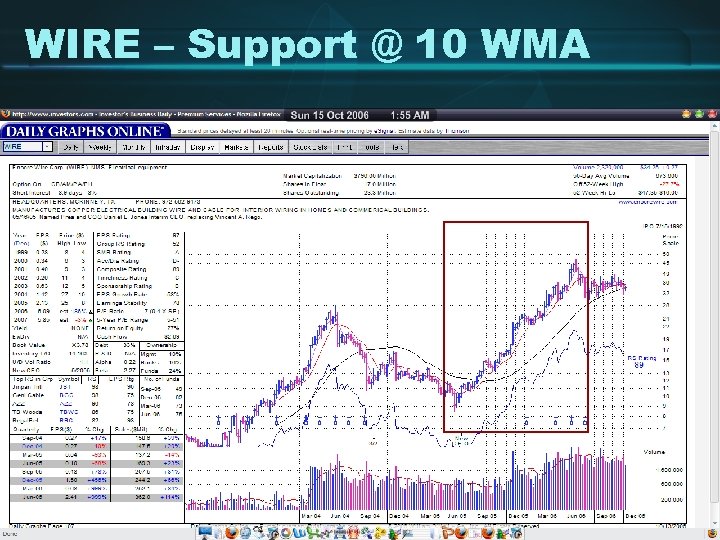

WIRE – Support @ 10 WMA

WIRE – Support @ 10 WMA

WIRE – Support @ 10 WMA

WIRE – Support @ 10 WMA

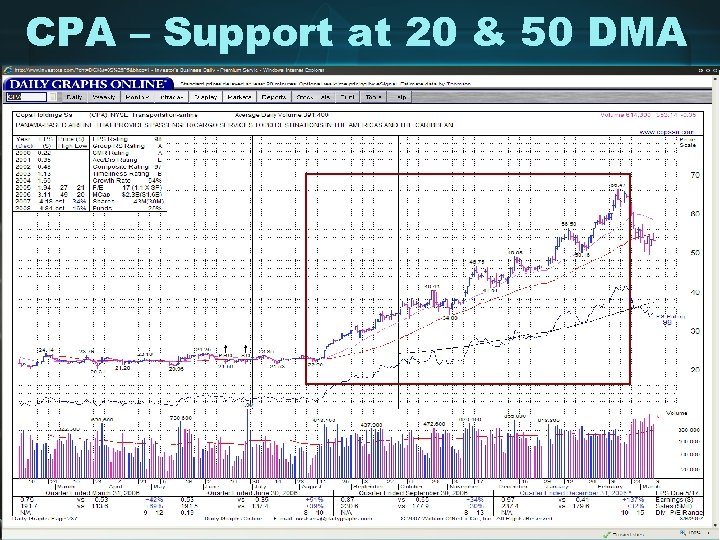

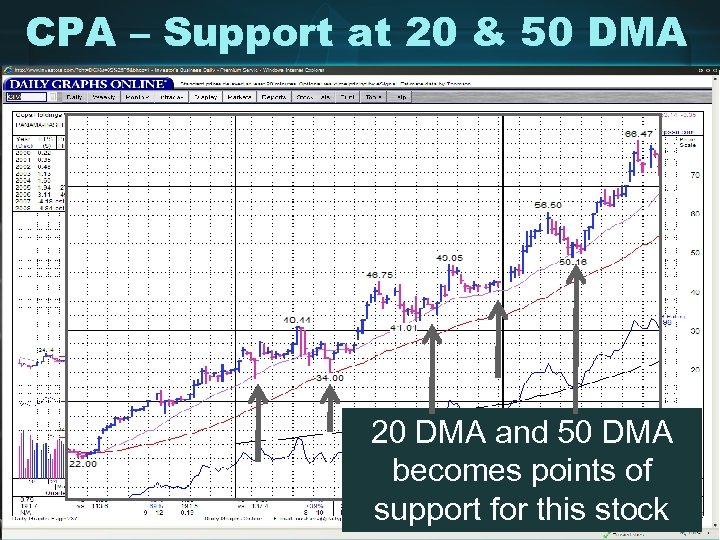

CPA – Support at 20 & 50 DMA

CPA – Support at 20 & 50 DMA

CPA – Support at 20 & 50 DMA 20 DMA and 50 DMA becomes points of support for this stock

CPA – Support at 20 & 50 DMA 20 DMA and 50 DMA becomes points of support for this stock

So… • Charts are fundamental to technical analysis • Important to understand what is shown on a chart and the information it conveys • Chart patterns and bases to come…

So… • Charts are fundamental to technical analysis • Important to understand what is shown on a chart and the information it conveys • Chart patterns and bases to come…

Technical Analysis: Introduction to Stock Charts TOOLS FOR STOCK CHARTS

Technical Analysis: Introduction to Stock Charts TOOLS FOR STOCK CHARTS

Charting on Stock. Charts. com Getting comprehensive stock charts • Type in the company symbol • Once you’re at the stock page, click on annotate to draw your own trendlines. • From there, you will get lots of tools for analyzing stock charts

Charting on Stock. Charts. com Getting comprehensive stock charts • Type in the company symbol • Once you’re at the stock page, click on annotate to draw your own trendlines. • From there, you will get lots of tools for analyzing stock charts

Stock. Charts. com

Stock. Charts. com

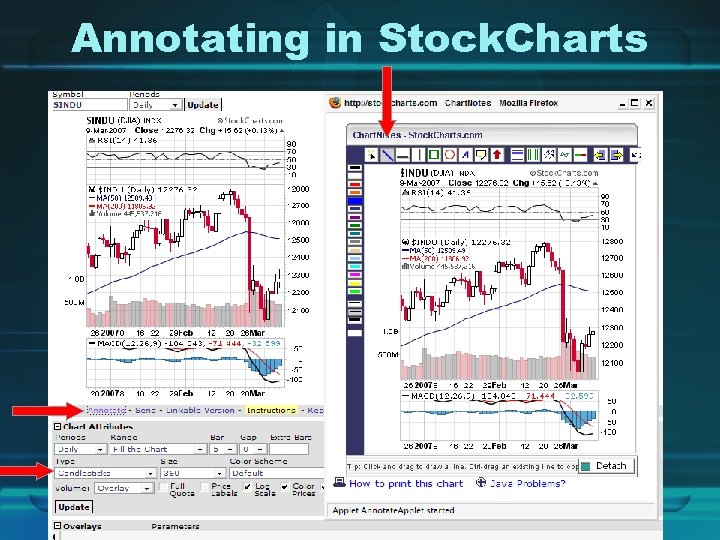

Annotating in Stock. Charts

Annotating in Stock. Charts

Using Charts on Investors. com • Log in using your username and password (you all have one as of now) • Enter a symbol for the stock and then click on IBD Charts just below it – There are links throughout the website that link to IBD charts – Right clicking on the chart will give you important data for that day or week

Using Charts on Investors. com • Log in using your username and password (you all have one as of now) • Enter a symbol for the stock and then click on IBD Charts just below it – There are links throughout the website that link to IBD charts – Right clicking on the chart will give you important data for that day or week

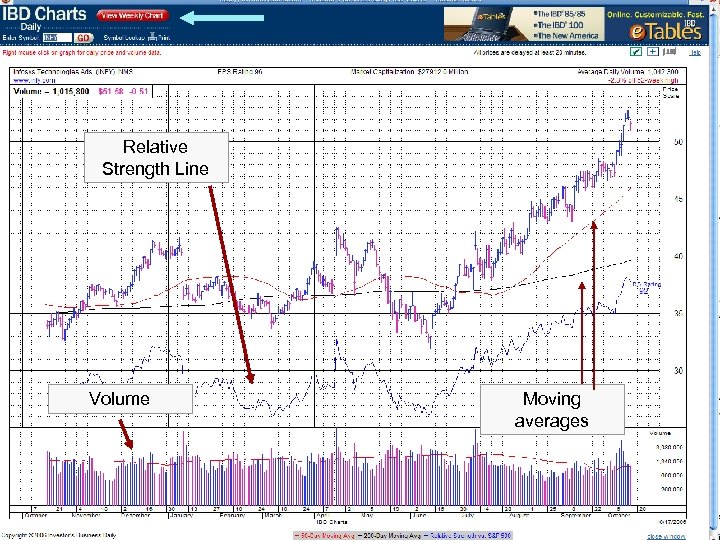

Relative Strength Line Volume Moving averages

Relative Strength Line Volume Moving averages

Homework / Reading • “Technical Analysis: Introduction” – Investopedia Tutorial – Link is on the download page of the website

Homework / Reading • “Technical Analysis: Introduction” – Investopedia Tutorial – Link is on the download page of the website

Next Week • We’ll be going over strategies using charts to buy stocks – Timing market bottoms – Identifying chart bases / patterns – Timing your stock purchases (after you’ve done your research / stock screens) • This is going to be the most technical / complicated part so make sure you understand the basics

Next Week • We’ll be going over strategies using charts to buy stocks – Timing market bottoms – Identifying chart bases / patterns – Timing your stock purchases (after you’ve done your research / stock screens) • This is going to be the most technical / complicated part so make sure you understand the basics