Subject 7 _ Profitability_engl _2013_ VED 10.ppt

- Количество слайдов: 23

Lecture 7 Judging profitability D. S. Zukhba 2012 -2013 ас. у.

Profitability ratios z. Df. Profitability ratios measure the overall effectiveness of management in operating the business.

z. The ratios compare earnings to some measure of the company's size, such as total assets, total sales, or shareholder's equity.

The most commonly used ratios are: z- Net profit margin, z- Gross profit margin, z- Return on assets (return on investment), z- Return on stockholders' equity.

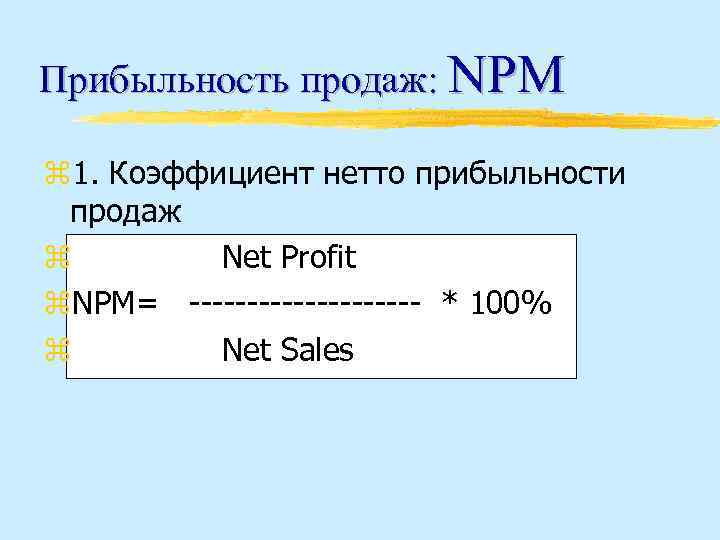

Прибыльность продаж: NPM z 1. Коэффициент нетто прибыльности продаж z Net Profit z. NPM= ---------- * 100% z Net Sales

Прибыльность продаж : NPM z 1. Коэффициент нетто прибыльности продаж z. Net Profit to Sales z. Net Profit Margin z. Profit Margin

Прибыльность продаж : NPM z 1. Net Profit Margin ratio Shows what part of each dollar of the sale becomes net profit

z. The profit margin on sales is good for comparisons of one year to the next, or between similar businesses, but cannot be used for comparisons between dissimilar businesses. z. A wholesaler /оптовый торговец/ normally has a smaller profit margin than a retailer /розничный торговец/, and a supermarket has a smaller margin than a jeweller, but we cannot say that wholesalers and supermarkets are less profitable. Rather, they rely on a high turnover to generate their profit.

z. Nor can we say that, of two comparable businesses, the one with the higher profit margin will necessarily be the business in better health. z 1/ Perhaps the enterprise charges higher prices, which might be a bad sign if it decrease sales volume, z 2/ or perhaps it has lower costs, which would be a healthy sign.

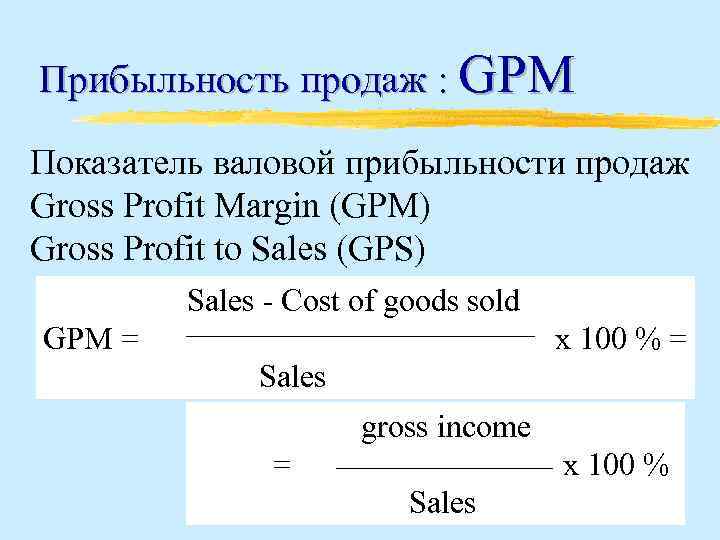

Прибыльность продаж : GPM Показатель валовой прибыльности продаж Gross Profit Margin (GPM) Gross Profit to Sales (GPS) Sales - Cost of goods sold GPM = x 100 % = Sales gross income = x 100 % Sales

Gross Profit Margin z. Another profitability ratio, used in particular by bankers to evaluate trading businesses, is the gross profit margin. The gross profit margin relates the income after the payment of direct costs of sales to the operating expenses, interest, dividends and taxes.

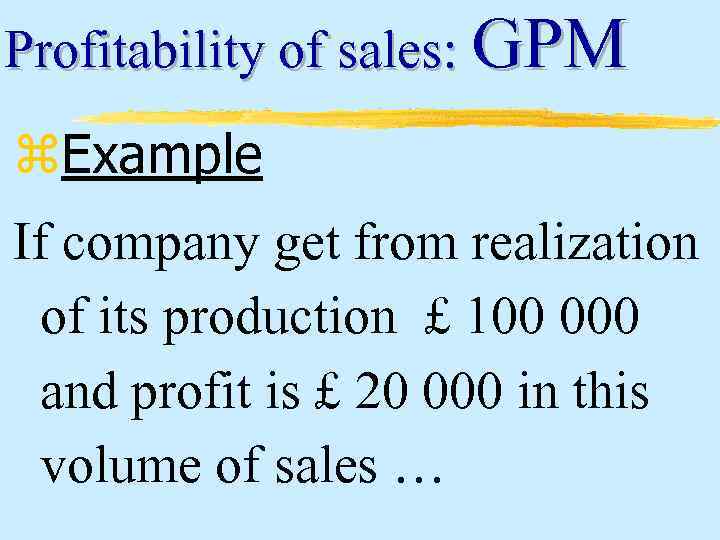

Profitability of sales: GPM z. Example If company get from realization of its production £ 100 000 and profit is £ 20 000 in this volume of sales …

Profitability of sales: GPM => : 1. NPM= 20% 2. This also means that cost of goods sold is 80% from volume of sales (realized production).

Profitability of sales: GPM z. High level of Profit Margin can indicates that: z 1. Enterprise successfully control level of the expenses since reduction relations expensesrealization brings about automatic increasing of the profitability ratio z 2. . .

Profitability of sales: GPM z. High level of Profit Margin can indicates that: z 1. Enterprise successfully control level of the expenses z 2. High sale prices

Profitability of sales: GPM z. Generally, the higher the gross profit margin, the more likely the company is to meet expenses and interest in times of uncertain income.

y. Of course, the higher the gross profit margin, the higher the price of products relative to cost, and the lower the sales volume is likely to be. GPM Sales

z!!! z. Enterprises with low gross profit margins, however, must be very careful about operating expenses and the amount of debt they can handle.

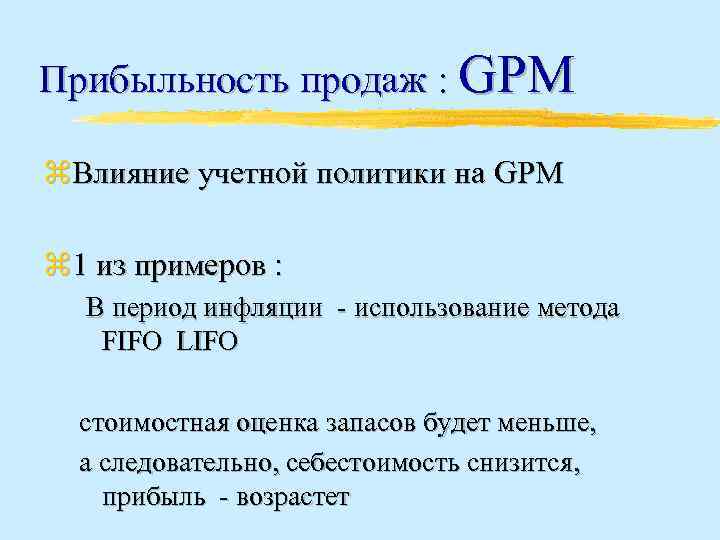

Прибыльность продаж : GPM z. Влияние учетной политики на GPM z 1 из примеров : В период инфляции - использование метода FIFO LIFO стоимостная оценка запасов будет меньше, а следовательно, себестоимость снизится, прибыль - возрастет

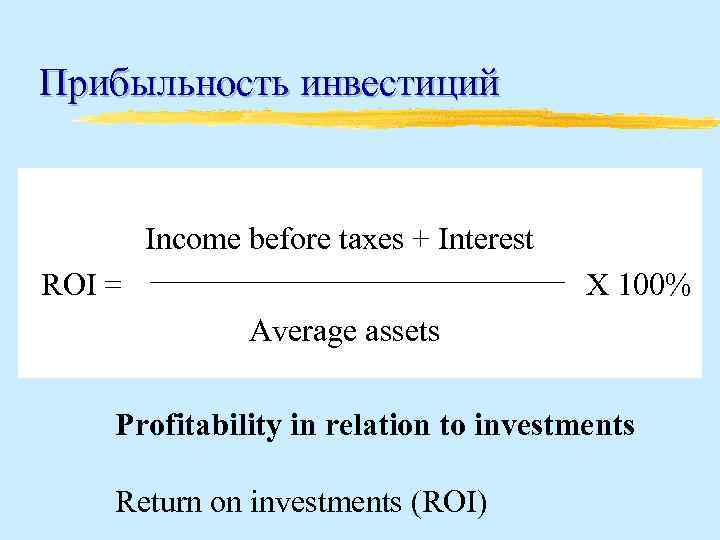

Прибыльность инвестиций Income before taxes + Interest ROI = X 100% Average assets Profitability in relation to investments Return on investments (ROI)

Прибыльность собственности (с. к-ла): Return on equity z. Despite the usefulness of the return on assets ratio, shareholders are often more interested in the return of their own investment (the return on equity) than in the return to both creditors and shareholders (the return on assets).

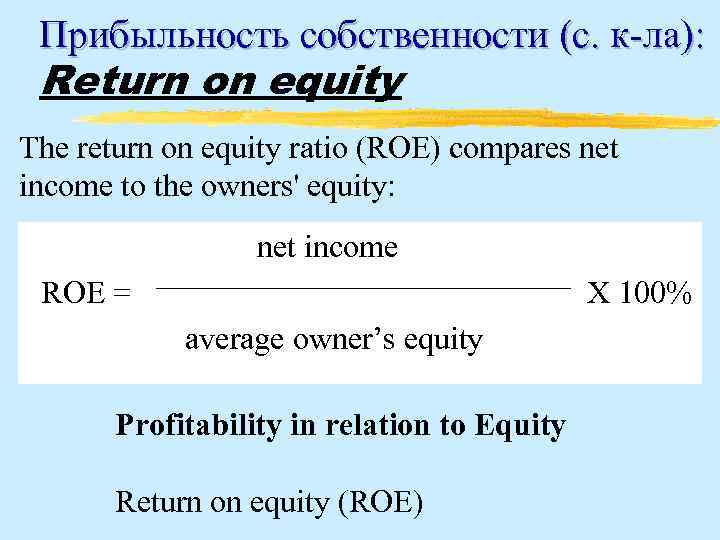

Прибыльность собственности (с. к-ла): Return on equity The return on equity ratio (ROE) compares net income to the owners' equity: net income ROE = X 100% average owner’s equity Profitability in relation to Equity Return on equity (ROE)

Subject 7 _ Profitability_engl _2013_ VED 10.ppt