Lecture_4___Inflation_Unemployment.ppt

- Количество слайдов: 14

Lecture 4 Inflation & Unemployment

Lecture 4 Inflation & Unemployment

Lecture 4: Inflation & Unemployment 1. Inflation. Its Causes and Consequences. 1. Unemployment and Its Forms. 1. Relationship Between Inflation and Unemployment. Okun's Law, The Phillips Curve.

Lecture 4: Inflation & Unemployment 1. Inflation. Its Causes and Consequences. 1. Unemployment and Its Forms. 1. Relationship Between Inflation and Unemployment. Okun's Law, The Phillips Curve.

Lecture 4: Inflation & Unemployment Inflationary Spiral – інфляційна спіраль Creeping inflation — повзуча (помірна) інфляція Galloping inflation – галопуюча інфляція Cost-push inflation – інфляція витрат (пропозиції) Demand-pull inflation – інфляція попиту

Lecture 4: Inflation & Unemployment Inflationary Spiral – інфляційна спіраль Creeping inflation — повзуча (помірна) інфляція Galloping inflation – галопуюча інфляція Cost-push inflation – інфляція витрат (пропозиції) Demand-pull inflation – інфляція попиту

Lecture 4: Inflation & Unemployment Inflation is a rise in the general level of prices of goods and services in an economy over a period of time. When the price level rises, each unit of currency buys fewer goods and services; consequently, inflation is also an erosion in the purchasing power of money – a loss of real value in the internal medium of exchange and unit of account in the economy. A chief measure of price inflation is the inflation rate (π), the annualized percentage change in a general price index (normally the Consumer Price Index) over time. Other common measures of inflation are: GDP deflator, Producer price indices, Commodity price indices. . . Big Mac Index.

Lecture 4: Inflation & Unemployment Inflation is a rise in the general level of prices of goods and services in an economy over a period of time. When the price level rises, each unit of currency buys fewer goods and services; consequently, inflation is also an erosion in the purchasing power of money – a loss of real value in the internal medium of exchange and unit of account in the economy. A chief measure of price inflation is the inflation rate (π), the annualized percentage change in a general price index (normally the Consumer Price Index) over time. Other common measures of inflation are: GDP deflator, Producer price indices, Commodity price indices. . . Big Mac Index.

Lecture 4: Inflation & Unemployment Types of inflation depending on growth: Creeping inflation – an inflation at moderates but persisting over long periods (less than 10%). This is the normal state of affairs in many countries. Galloping inflation – the movement of price accelerates rapidly price increases about 10 -100% per year. Hyperinflation – an out-of-control inflationary spiral. Definitions used vary from the IASB´s (The International Accounting Standards Board ) a cumulative inflation rate over three years approaching 100% to academic literature´s "inflation exceeding 50% a month. " Deflation – a fall in the general price level. Disinflation – a decrease in the rate of inflation. Stagflation – a combination of inflation, slow economic growth and high unemployment.

Lecture 4: Inflation & Unemployment Types of inflation depending on growth: Creeping inflation – an inflation at moderates but persisting over long periods (less than 10%). This is the normal state of affairs in many countries. Galloping inflation – the movement of price accelerates rapidly price increases about 10 -100% per year. Hyperinflation – an out-of-control inflationary spiral. Definitions used vary from the IASB´s (The International Accounting Standards Board ) a cumulative inflation rate over three years approaching 100% to academic literature´s "inflation exceeding 50% a month. " Deflation – a fall in the general price level. Disinflation – a decrease in the rate of inflation. Stagflation – a combination of inflation, slow economic growth and high unemployment.

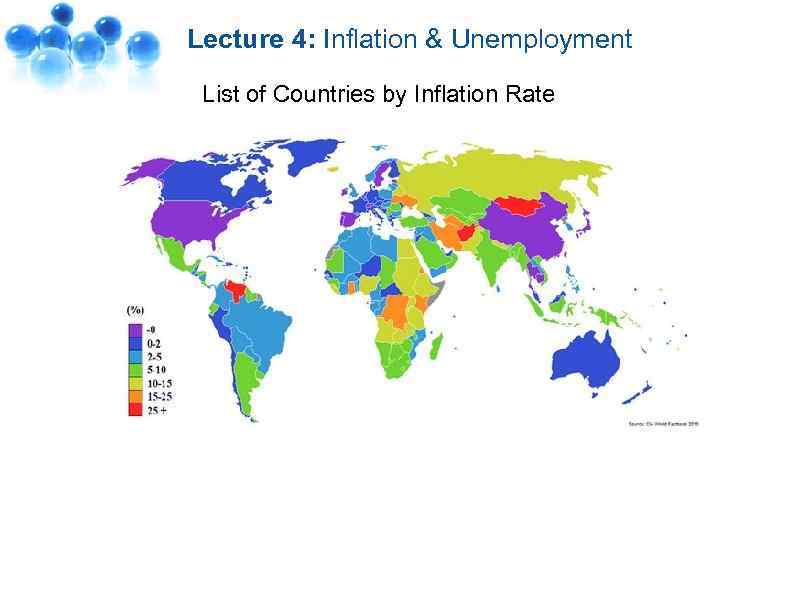

Lecture 4: Inflation & Unemployment List of Countries by Inflation Rate

Lecture 4: Inflation & Unemployment List of Countries by Inflation Rate

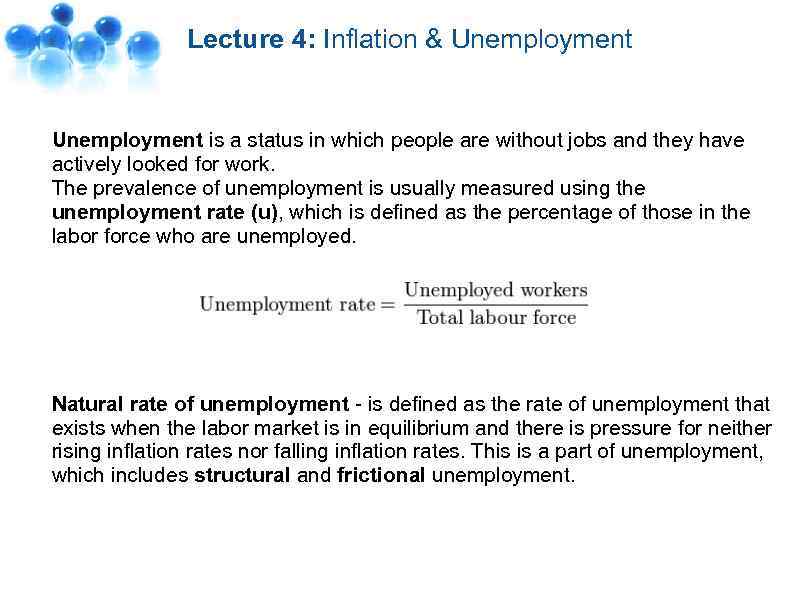

Lecture 4: Inflation & Unemployment is a status in which people are without jobs and they have actively looked for work. The prevalence of unemployment is usually measured using the unemployment rate (u), which is defined as the percentage of those in the labor force who are unemployed. Natural rate of unemployment - is defined as the rate of unemployment that exists when the labor market is in equilibrium and there is pressure for neither rising inflation rates nor falling inflation rates. This is a part of unemployment, which includes structural and frictional unemployment.

Lecture 4: Inflation & Unemployment is a status in which people are without jobs and they have actively looked for work. The prevalence of unemployment is usually measured using the unemployment rate (u), which is defined as the percentage of those in the labor force who are unemployed. Natural rate of unemployment - is defined as the rate of unemployment that exists when the labor market is in equilibrium and there is pressure for neither rising inflation rates nor falling inflation rates. This is a part of unemployment, which includes structural and frictional unemployment.

Lecture 4: Inflation & Unemployment Labor force (or labour force) are the suppliers of labor. The labor force is all the nonmilitary people who are officially employed (E) or unemployed (U). The labor force of a country consists of everyone of working age (typically above 16) and below retirement (around 60) who are participating workers, that is people actively employed or seeking employment. People not counted include students, retired people, stay-at-home parents, people in prisons or similar institutions, people employed in jobs or professions with unreported income, as well as discouraged workers who cannot find work. Pop = total population LF = labor force = U + E

Lecture 4: Inflation & Unemployment Labor force (or labour force) are the suppliers of labor. The labor force is all the nonmilitary people who are officially employed (E) or unemployed (U). The labor force of a country consists of everyone of working age (typically above 16) and below retirement (around 60) who are participating workers, that is people actively employed or seeking employment. People not counted include students, retired people, stay-at-home parents, people in prisons or similar institutions, people employed in jobs or professions with unreported income, as well as discouraged workers who cannot find work. Pop = total population LF = labor force = U + E

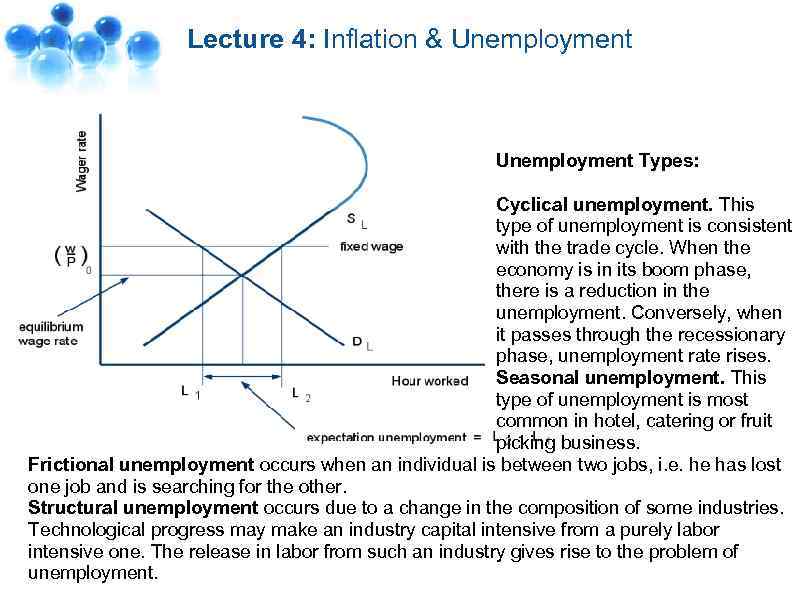

Lecture 4: Inflation & Unemployment Types: Cyclical unemployment. This type of unemployment is consistent with the trade cycle. When the economy is in its boom phase, there is a reduction in the unemployment. Conversely, when it passes through the recessionary phase, unemployment rate rises. Seasonal unemployment. This type of unemployment is most common in hotel, catering or fruit picking business. Frictional unemployment occurs when an individual is between two jobs, i. e. he has lost one job and is searching for the other. Structural unemployment occurs due to a change in the composition of some industries. Technological progress may make an industry capital intensive from a purely labor intensive one. The release in labor from such an industry gives rise to the problem of unemployment.

Lecture 4: Inflation & Unemployment Types: Cyclical unemployment. This type of unemployment is consistent with the trade cycle. When the economy is in its boom phase, there is a reduction in the unemployment. Conversely, when it passes through the recessionary phase, unemployment rate rises. Seasonal unemployment. This type of unemployment is most common in hotel, catering or fruit picking business. Frictional unemployment occurs when an individual is between two jobs, i. e. he has lost one job and is searching for the other. Structural unemployment occurs due to a change in the composition of some industries. Technological progress may make an industry capital intensive from a purely labor intensive one. The release in labor from such an industry gives rise to the problem of unemployment.

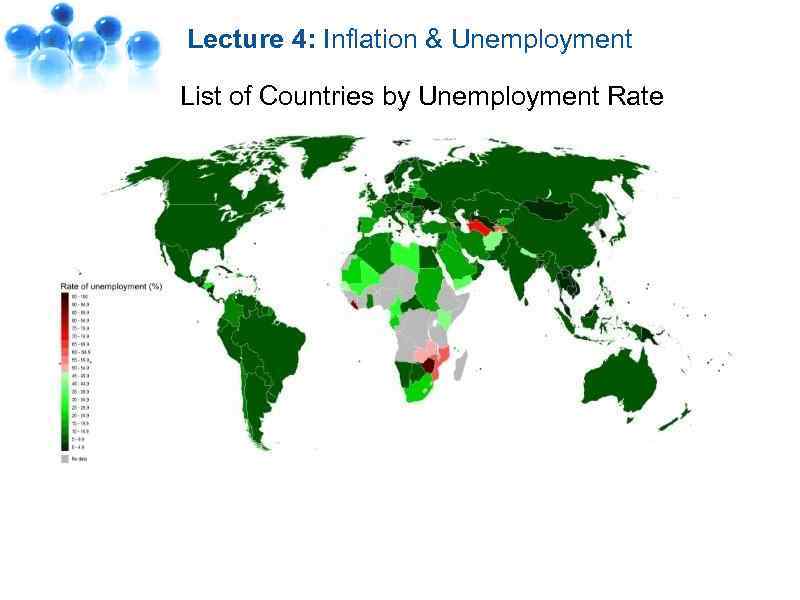

Lecture 4: Inflation & Unemployment List of Countries by Unemployment Rate

Lecture 4: Inflation & Unemployment List of Countries by Unemployment Rate

Lecture 4: Inflation & Unemployment Okun's law is an empirically observed relationship relating unemployment to losses in a country's production. For every 1% increase in the unemployment rate, a country's GDP will be an additional roughly 2% lower than its potential GDP. Mathematical statements of Okun's law is: ( Y* - Y ) / Y* = ß ( u — u* ), where: Y* - is potential output or GDP at full-employment Y - is actual output u*- is the natural rate of unemployment u - is actual unemployment rate ß - is the factor relating changes in unemployment to changes in output

Lecture 4: Inflation & Unemployment Okun's law is an empirically observed relationship relating unemployment to losses in a country's production. For every 1% increase in the unemployment rate, a country's GDP will be an additional roughly 2% lower than its potential GDP. Mathematical statements of Okun's law is: ( Y* - Y ) / Y* = ß ( u — u* ), where: Y* - is potential output or GDP at full-employment Y - is actual output u*- is the natural rate of unemployment u - is actual unemployment rate ß - is the factor relating changes in unemployment to changes in output

Lecture 4: Inflation & Unemployment Phillips curve is a historical inverse relationship between the rate of unemployment and the rate of inflation in an economy. Stated simply, the lower the unemployment in an economy, the higher the rate of inflation. While it has been observed that there is a stable short run tradeoff between unemployment and inflation, this has not been observed in the long run. π = πe - ß ( u — u* ) + v where π and πe are the inflation and expected inflation respectively, v - unexpected exogenous shocks to the world supply. This equation, plotting inflation rate π against unemployment U gives the downwardsloping curve in the diagram that characterises the Phillips curve. According to Okun's law π = πe+( Y* - Y ) / Y* + v where v is also a Cost-push inflation, called "supply shock inflation, " and ( Y* - Y ) / Y* - Demand-pull inflation or GDP-gap.

Lecture 4: Inflation & Unemployment Phillips curve is a historical inverse relationship between the rate of unemployment and the rate of inflation in an economy. Stated simply, the lower the unemployment in an economy, the higher the rate of inflation. While it has been observed that there is a stable short run tradeoff between unemployment and inflation, this has not been observed in the long run. π = πe - ß ( u — u* ) + v where π and πe are the inflation and expected inflation respectively, v - unexpected exogenous shocks to the world supply. This equation, plotting inflation rate π against unemployment U gives the downwardsloping curve in the diagram that characterises the Phillips curve. According to Okun's law π = πe+( Y* - Y ) / Y* + v where v is also a Cost-push inflation, called "supply shock inflation, " and ( Y* - Y ) / Y* - Demand-pull inflation or GDP-gap.

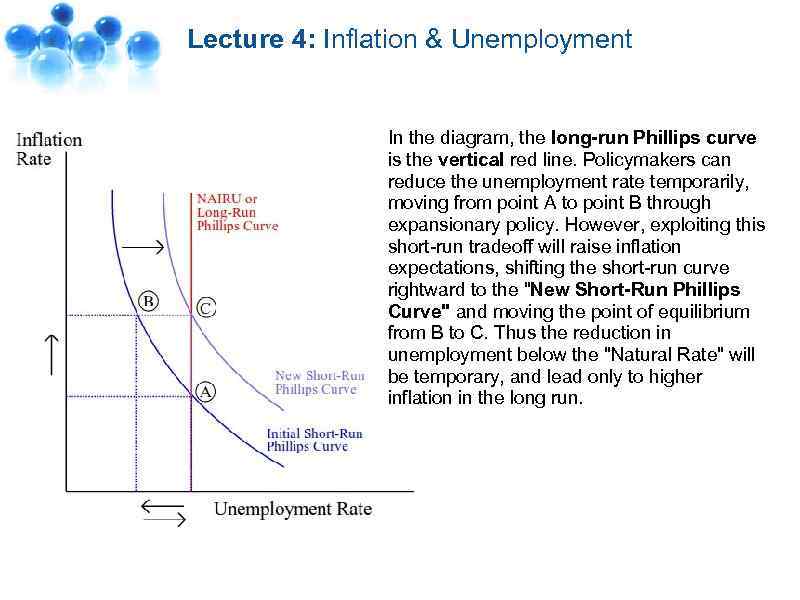

Lecture 4: Inflation & Unemployment In the diagram, the long-run Phillips curve is the vertical red line. Policymakers can reduce the unemployment rate temporarily, moving from point A to point B through expansionary policy. However, exploiting this short-run tradeoff will raise inflation expectations, shifting the short-run curve rightward to the "New Short-Run Phillips Curve" and moving the point of equilibrium from B to C. Thus the reduction in unemployment below the "Natural Rate" will be temporary, and lead only to higher inflation in the long run.

Lecture 4: Inflation & Unemployment In the diagram, the long-run Phillips curve is the vertical red line. Policymakers can reduce the unemployment rate temporarily, moving from point A to point B through expansionary policy. However, exploiting this short-run tradeoff will raise inflation expectations, shifting the short-run curve rightward to the "New Short-Run Phillips Curve" and moving the point of equilibrium from B to C. Thus the reduction in unemployment below the "Natural Rate" will be temporary, and lead only to higher inflation in the long run.

Module test is waiting for you. . .

Module test is waiting for you. . .