LECTURE_3.pptx

- Количество слайдов: 81

LECTURE 3: TECHNICAL ANALYSIS OF FINANCIAL MARKETS

LECTURE 3: TECHNICAL ANALYSIS OF FINANCIAL MARKETS

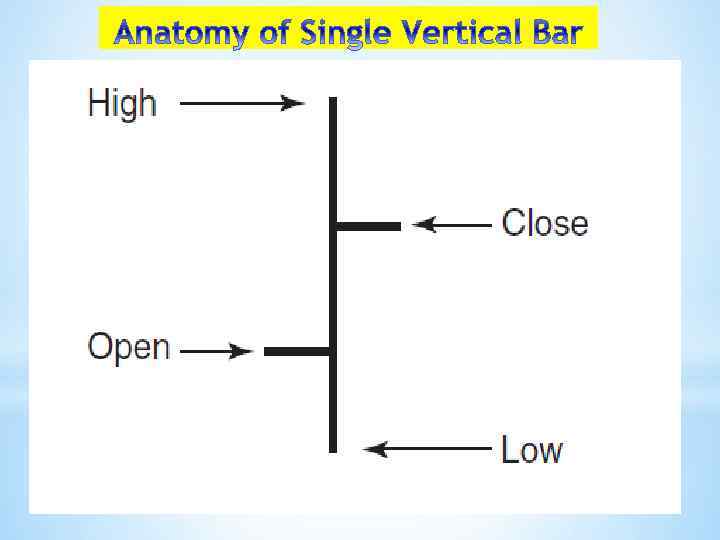

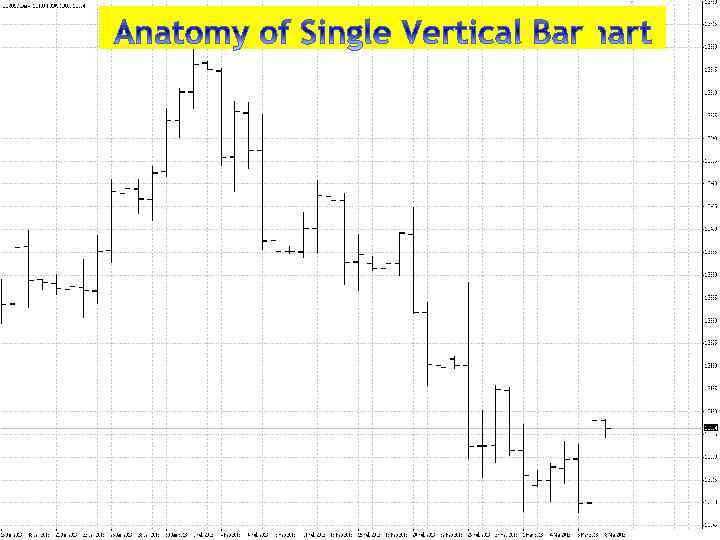

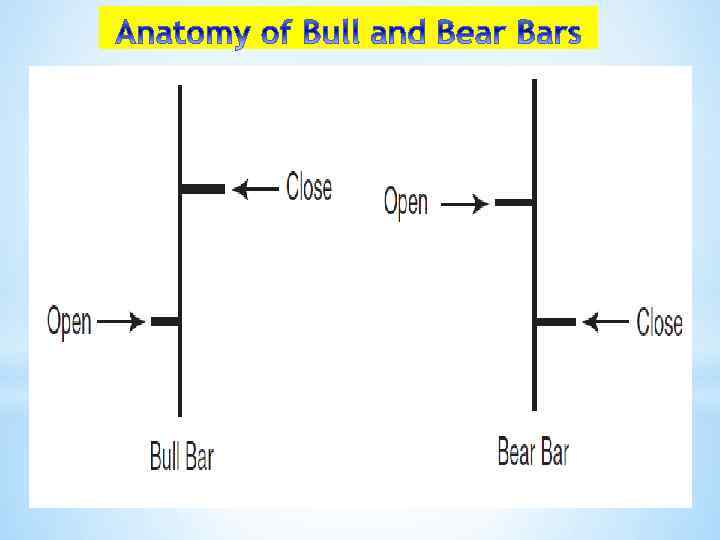

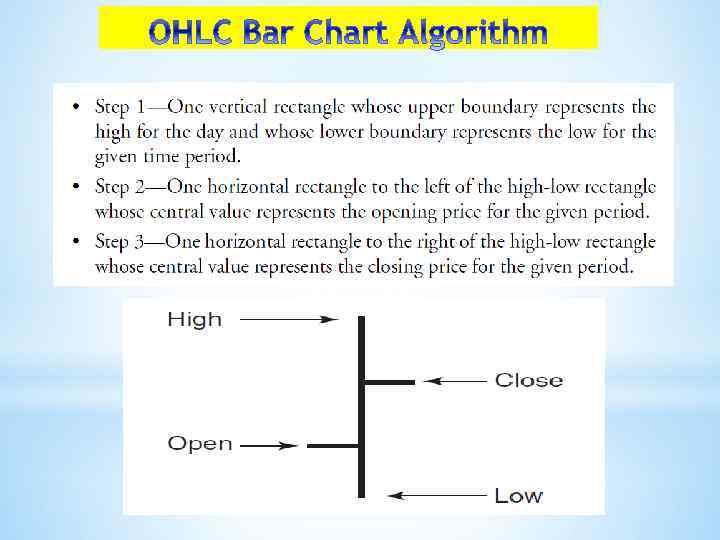

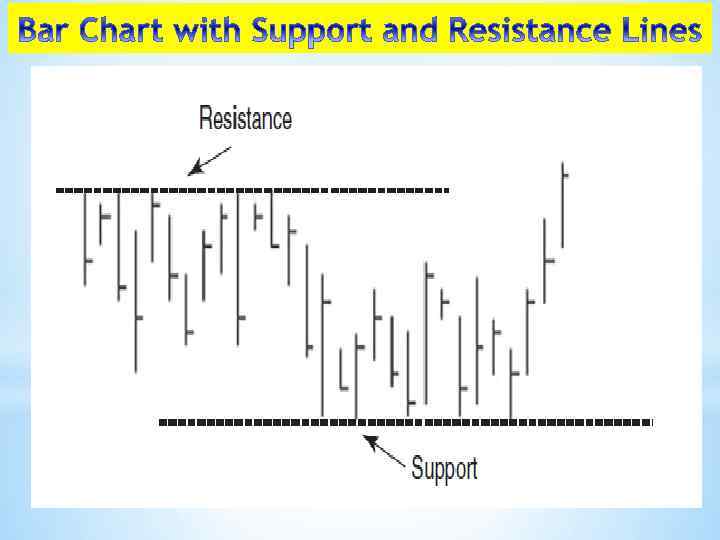

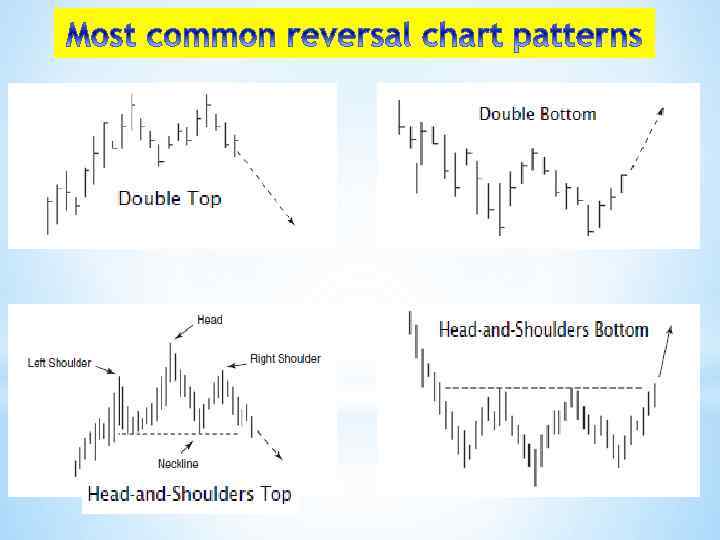

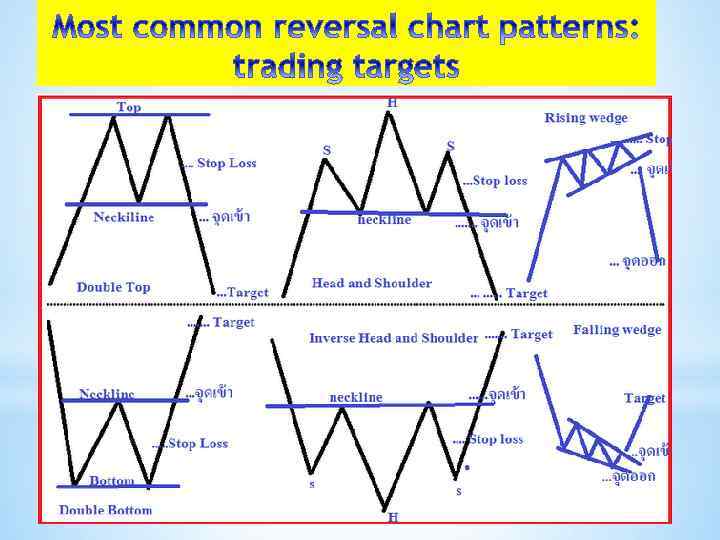

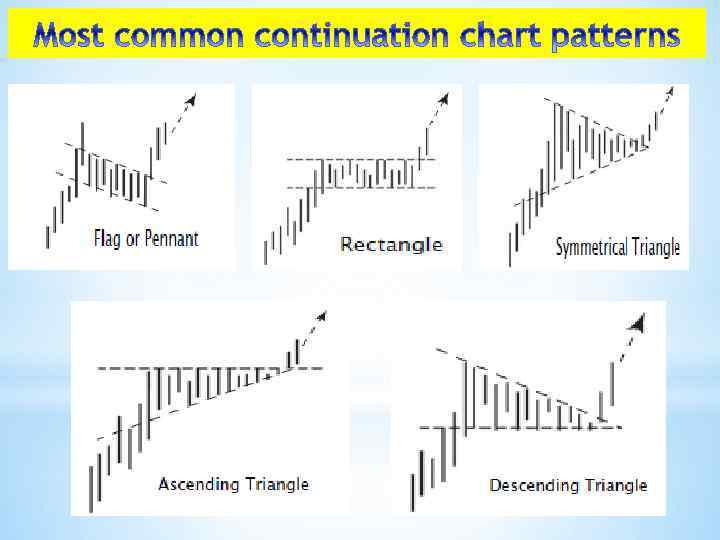

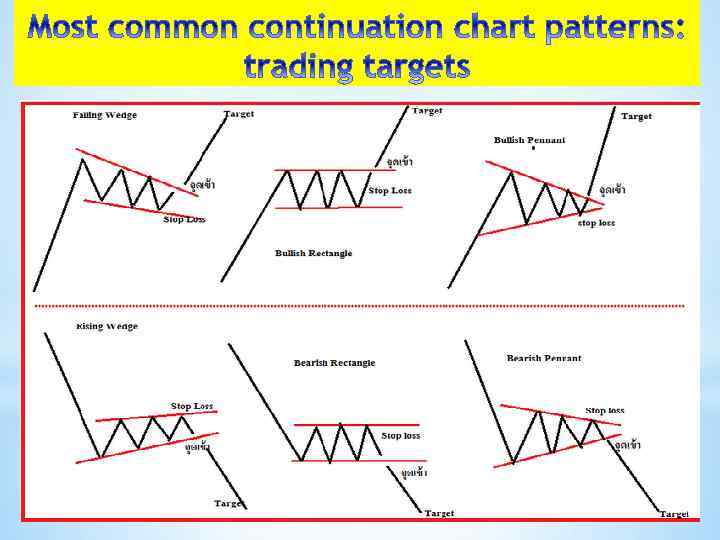

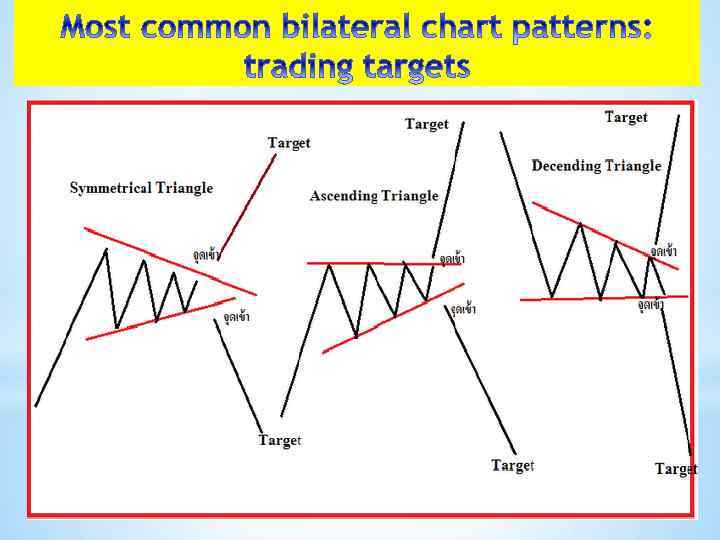

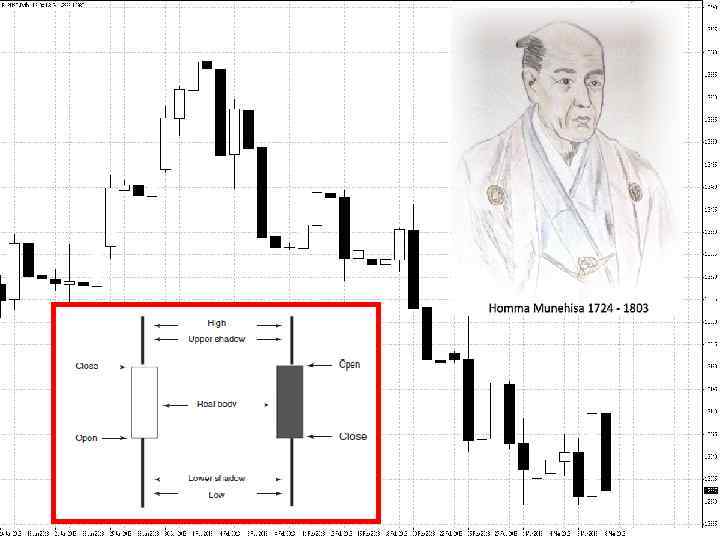

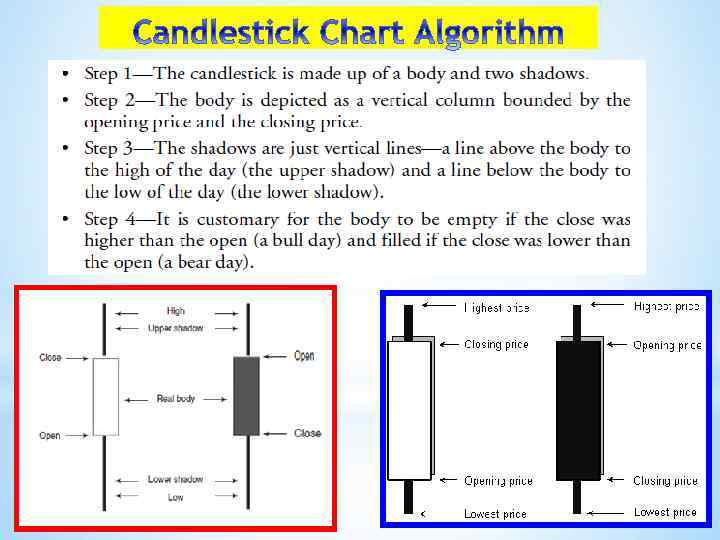

PLAN OF THE Overview. LECTURE 1. 2. Bar Charts. 3. Trendlines: Support and Resistance. 4. Recognizing Chart Patterns: Reversal, Continuation & Bilateral. 5. Japanese Candlestick Charts &

PLAN OF THE Overview. LECTURE 1. 2. Bar Charts. 3. Trendlines: Support and Resistance. 4. Recognizing Chart Patterns: Reversal, Continuation & Bilateral. 5. Japanese Candlestick Charts &

РЕКОМЕНДОВАНА ЛІТЕРАТУРА

РЕКОМЕНДОВАНА ЛІТЕРАТУРА

Overview The most popular and successful method Ignores fundamental factors and is applied only to the price action of the market Primary tool to successfully analyze and trade shorter-term price movements, as well as to set profit targets and stop-loss safeguards Six price fields available during any given period of time: open, high, low, close, volume, and open interest A PICTURE IS WORTH A THOUSAND WORDS

Overview The most popular and successful method Ignores fundamental factors and is applied only to the price action of the market Primary tool to successfully analyze and trade shorter-term price movements, as well as to set profit targets and stop-loss safeguards Six price fields available during any given period of time: open, high, low, close, volume, and open interest A PICTURE IS WORTH A THOUSAND WORDS

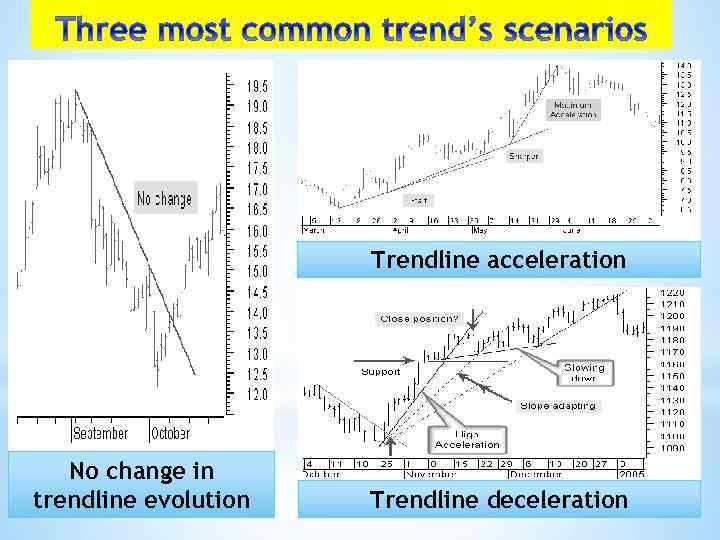

Trendline acceleration No change in trendline evolution Trendline deceleration

Trendline acceleration No change in trendline evolution Trendline deceleration

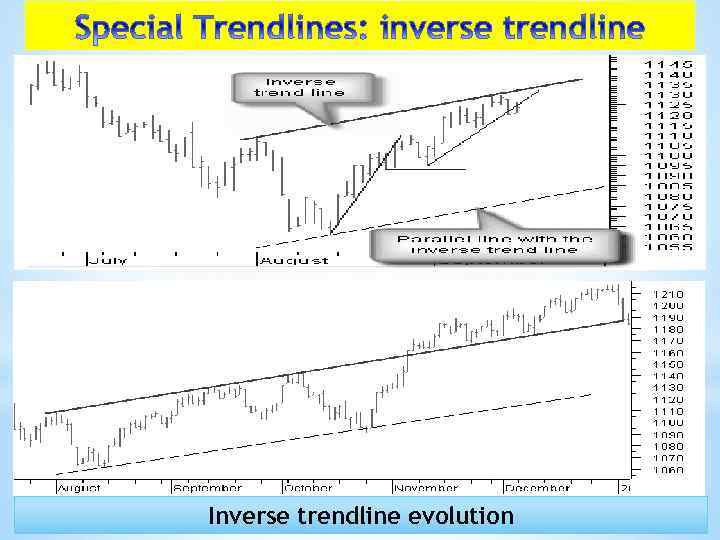

Inverse trendline evolution

Inverse trendline evolution

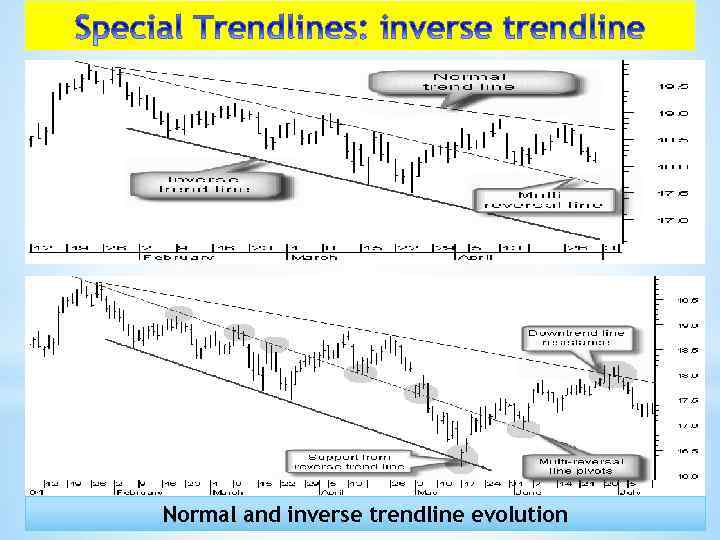

Normal and inverse trendline evolution

Normal and inverse trendline evolution

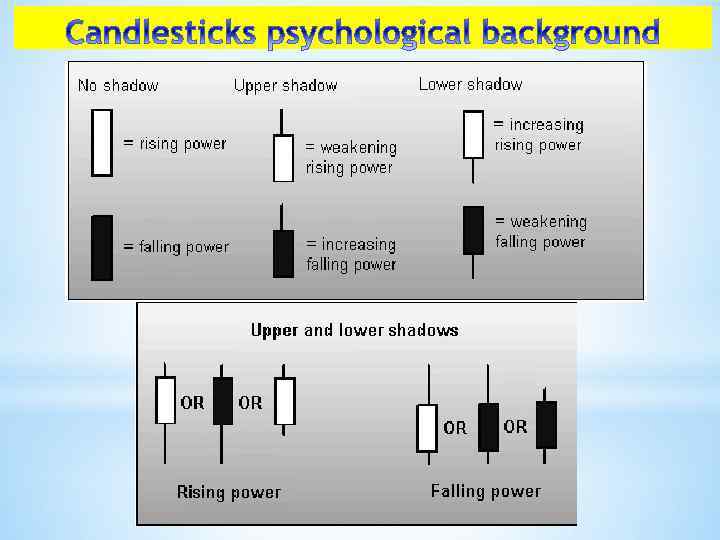

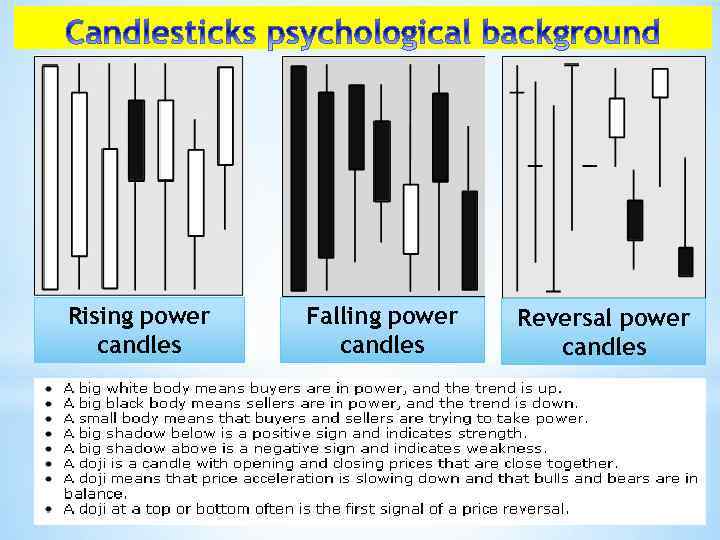

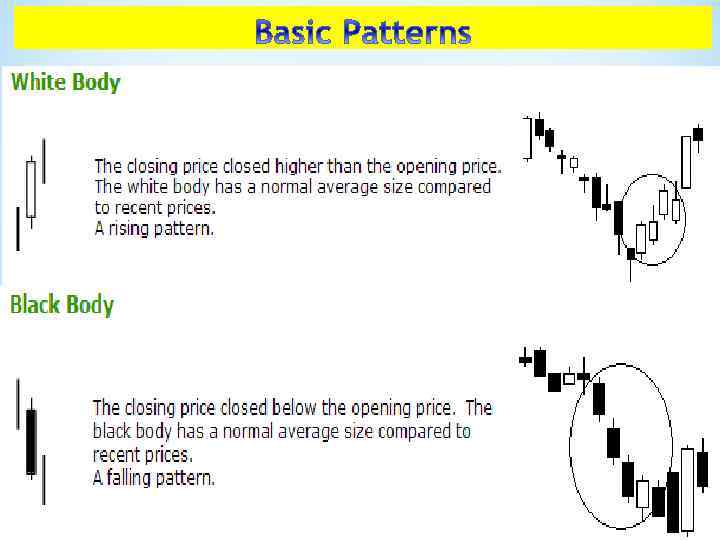

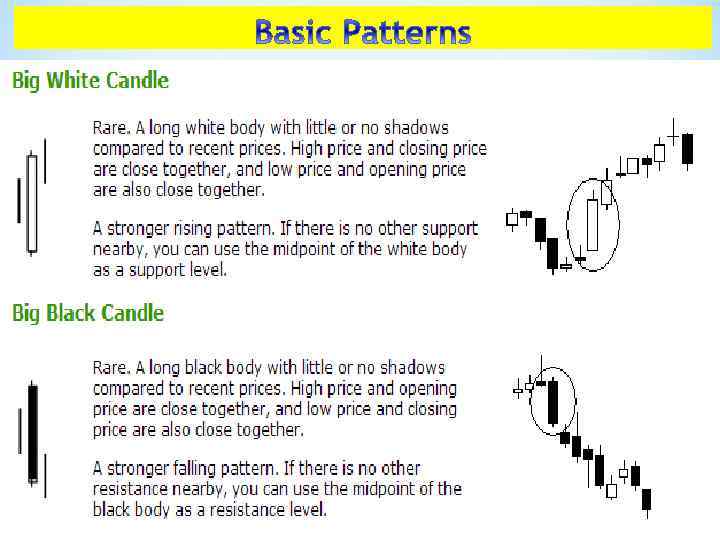

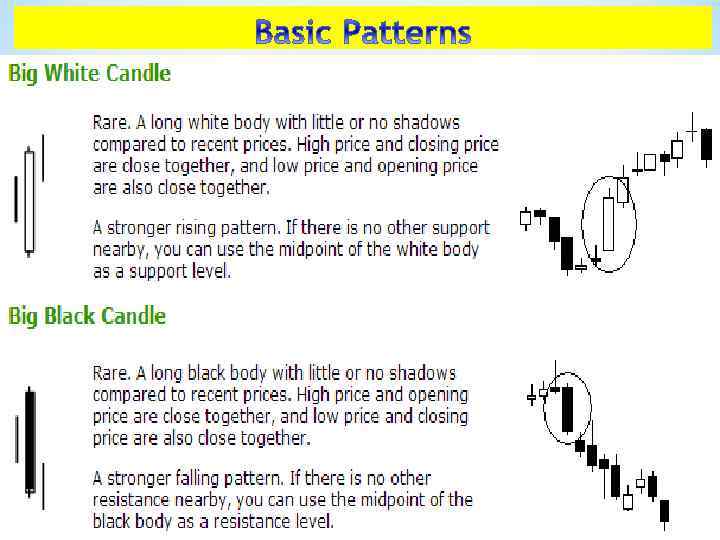

Rising power candles Falling power candles Reversal power candles

Rising power candles Falling power candles Reversal power candles

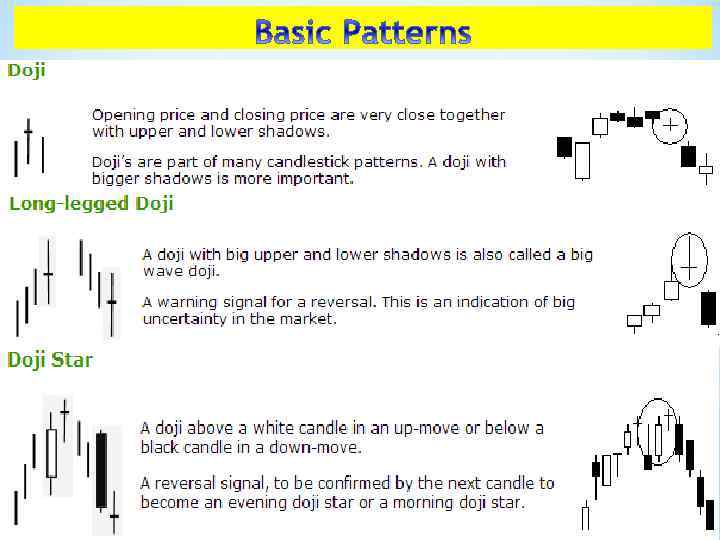

A DOJI AFTER AN UP MOVE AND A CLOSING BELOW THE PREVIOUS CLOSING IS A STRONG INDICATION FOR A PRICE REVERSAL

A DOJI AFTER AN UP MOVE AND A CLOSING BELOW THE PREVIOUS CLOSING IS A STRONG INDICATION FOR A PRICE REVERSAL

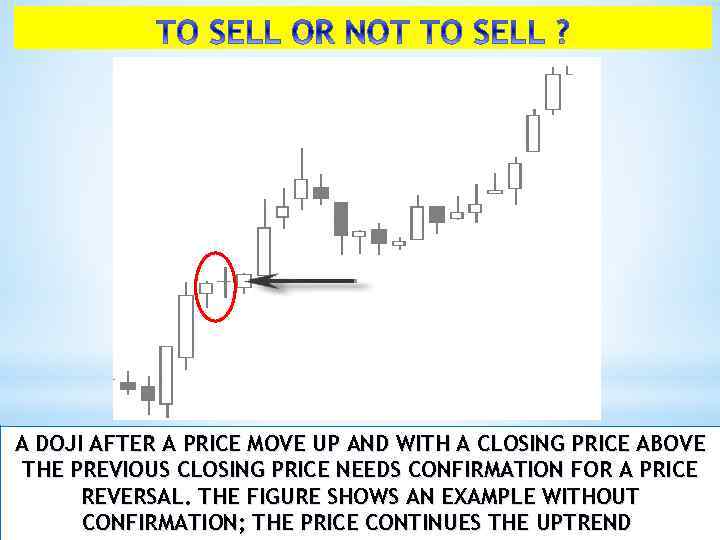

A DOJI AFTER A PRICE MOVE UP AND WITH A CLOSING PRICE ABOVE THE PREVIOUS CLOSING PRICE NEEDS CONFIRMATION FOR A PRICE REVERSAL. THE FIGURE SHOWS AN EXAMPLE WITHOUT CONFIRMATION; THE PRICE CONTINUES THE UPTREND

A DOJI AFTER A PRICE MOVE UP AND WITH A CLOSING PRICE ABOVE THE PREVIOUS CLOSING PRICE NEEDS CONFIRMATION FOR A PRICE REVERSAL. THE FIGURE SHOWS AN EXAMPLE WITHOUT CONFIRMATION; THE PRICE CONTINUES THE UPTREND

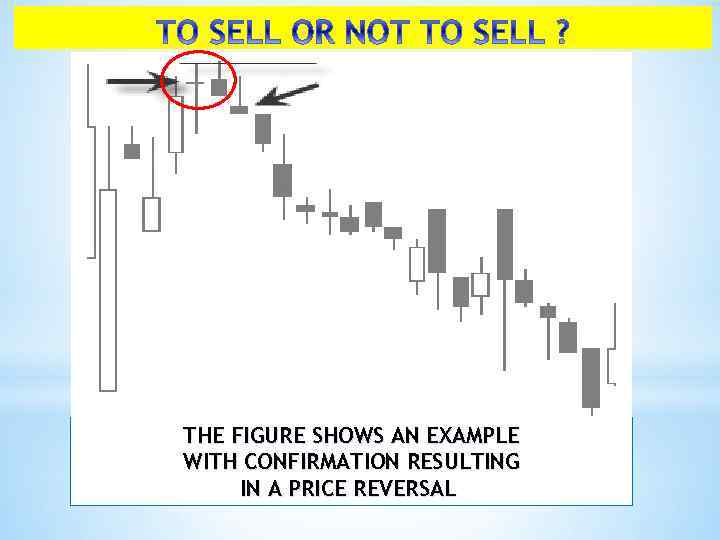

THE FIGURE SHOWS AN EXAMPLE WITH CONFIRMATION RESULTING IN A PRICE REVERSAL

THE FIGURE SHOWS AN EXAMPLE WITH CONFIRMATION RESULTING IN A PRICE REVERSAL

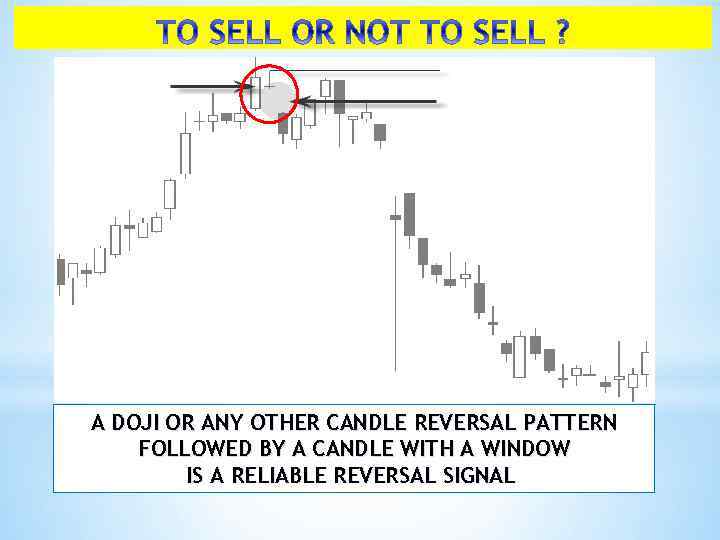

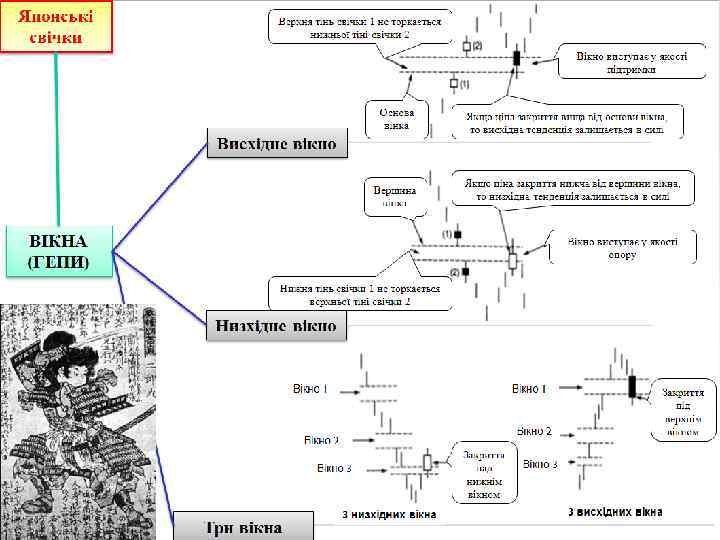

A DOJI OR ANY OTHER CANDLE REVERSAL PATTERN FOLLOWED BY A CANDLE WITH A WINDOW IS A RELIABLE REVERSAL SIGNAL

A DOJI OR ANY OTHER CANDLE REVERSAL PATTERN FOLLOWED BY A CANDLE WITH A WINDOW IS A RELIABLE REVERSAL SIGNAL

THERE IS EXTRA PRESSURE ON THE MARKET WHEN MORE DOJI’S APPEAR TOGETHER

THERE IS EXTRA PRESSURE ON THE MARKET WHEN MORE DOJI’S APPEAR TOGETHER

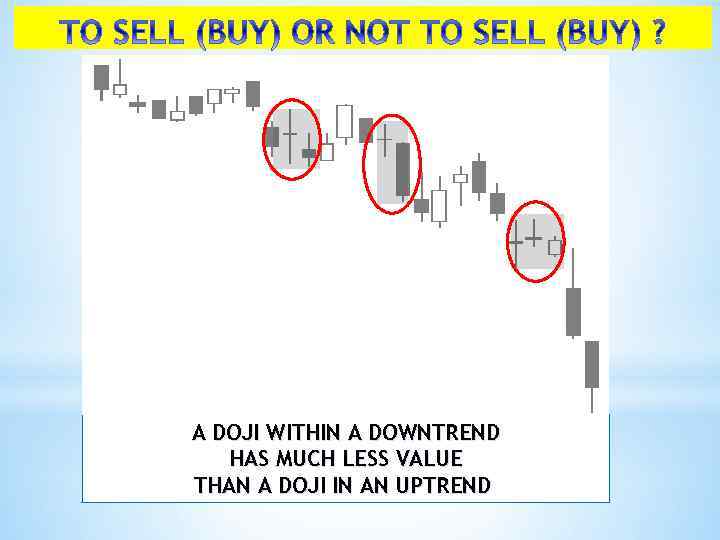

A DOJI WITHIN A DOWNTREND HAS MUCH LESS VALUE THAN A DOJI IN AN UPTREND

A DOJI WITHIN A DOWNTREND HAS MUCH LESS VALUE THAN A DOJI IN AN UPTREND

A DOJI IN A DOWNTREND ALWAYS NEEDS CONFIRMATION FOR A REVERSAL SIGNAL

A DOJI IN A DOWNTREND ALWAYS NEEDS CONFIRMATION FOR A REVERSAL SIGNAL

A DOJI WITHIN A FLAT, NEUTRAL PRICE ZONE HAS NO MEANING

A DOJI WITHIN A FLAT, NEUTRAL PRICE ZONE HAS NO MEANING

A DOJI OR ANY OTHER CANDLE PATTERN CONFIRMS EXISTING SUPPORT OR RESISTANCE

A DOJI OR ANY OTHER CANDLE PATTERN CONFIRMS EXISTING SUPPORT OR RESISTANCE

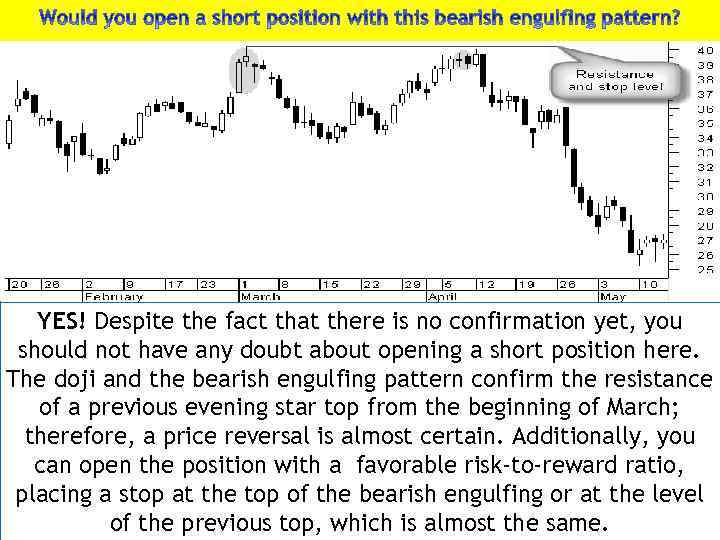

YES! Despite the fact that there is no confirmation yet, you should not have any doubt about opening a short position here. The doji and the bearish engulfing pattern confirm the resistance of a previous evening star top from the beginning of March; therefore, a price reversal is almost certain. Additionally, you can open the position with a favorable risk-to-reward ratio, placing a stop at the top of the bearish engulfing or at the level of the previous top, which is almost the same.

YES! Despite the fact that there is no confirmation yet, you should not have any doubt about opening a short position here. The doji and the bearish engulfing pattern confirm the resistance of a previous evening star top from the beginning of March; therefore, a price reversal is almost certain. Additionally, you can open the position with a favorable risk-to-reward ratio, placing a stop at the top of the bearish engulfing or at the level of the previous top, which is almost the same.

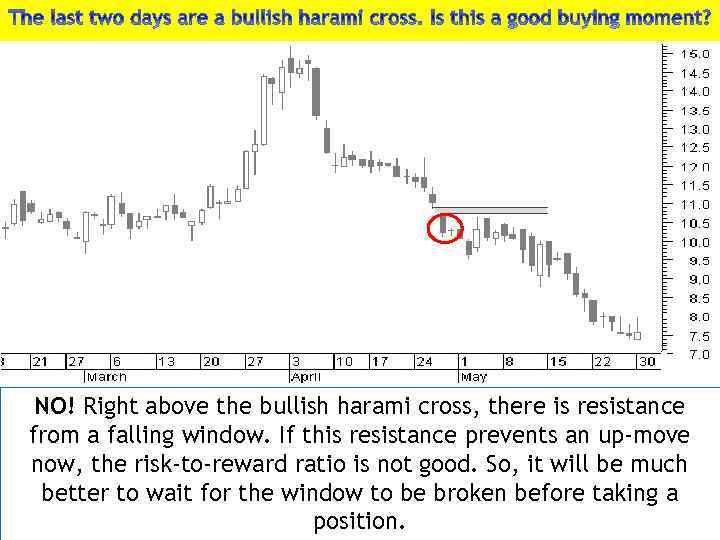

NO! Right above the bullish harami cross, there is resistance from a falling window. If this resistance prevents an up-move now, the risk-to-reward ratio is not good. So, it will be much better to wait for the window to be broken before taking a position.

NO! Right above the bullish harami cross, there is resistance from a falling window. If this resistance prevents an up-move now, the risk-to-reward ratio is not good. So, it will be much better to wait for the window to be broken before taking a position.

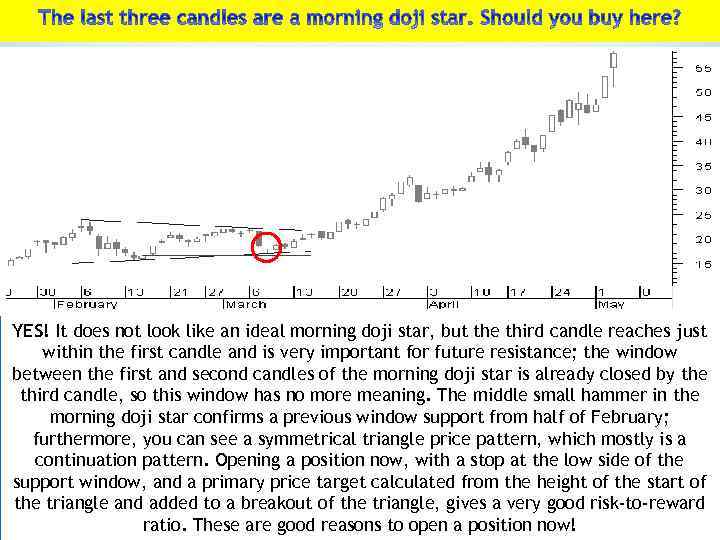

YES! It does not look like an ideal morning doji star, but the third candle reaches just within the first candle and is very important for future resistance; the window between the first and second candles of the morning doji star is already closed by the third candle, so this window has no more meaning. The middle small hammer in the morning doji star confirms a previous window support from half of February; furthermore, you can see a symmetrical triangle price pattern, which mostly is a continuation pattern. Opening a position now, with a stop at the low side of the support window, and a primary price target calculated from the height of the start of the triangle and added to a breakout of the triangle, gives a very good risk-to-reward ratio. These are good reasons to open a position now!

YES! It does not look like an ideal morning doji star, but the third candle reaches just within the first candle and is very important for future resistance; the window between the first and second candles of the morning doji star is already closed by the third candle, so this window has no more meaning. The middle small hammer in the morning doji star confirms a previous window support from half of February; furthermore, you can see a symmetrical triangle price pattern, which mostly is a continuation pattern. Opening a position now, with a stop at the low side of the support window, and a primary price target calculated from the height of the start of the triangle and added to a breakout of the triangle, gives a very good risk-to-reward ratio. These are good reasons to open a position now!

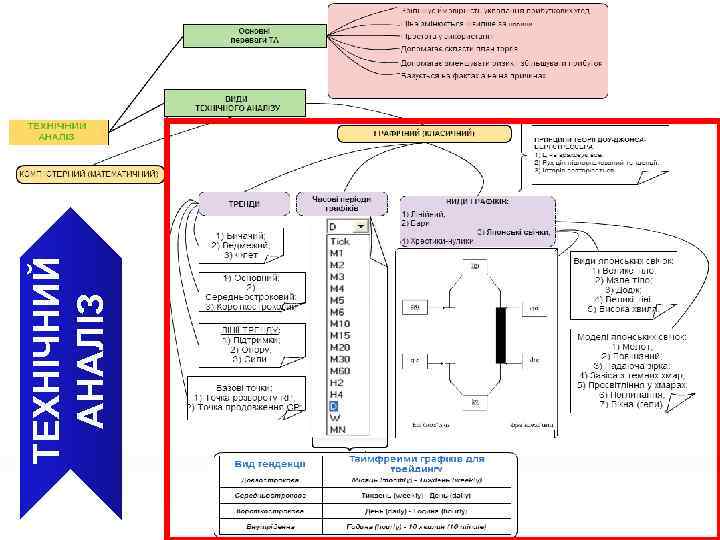

ТЕХНІЧНИЙ АНАЛІЗ

ТЕХНІЧНИЙ АНАЛІЗ

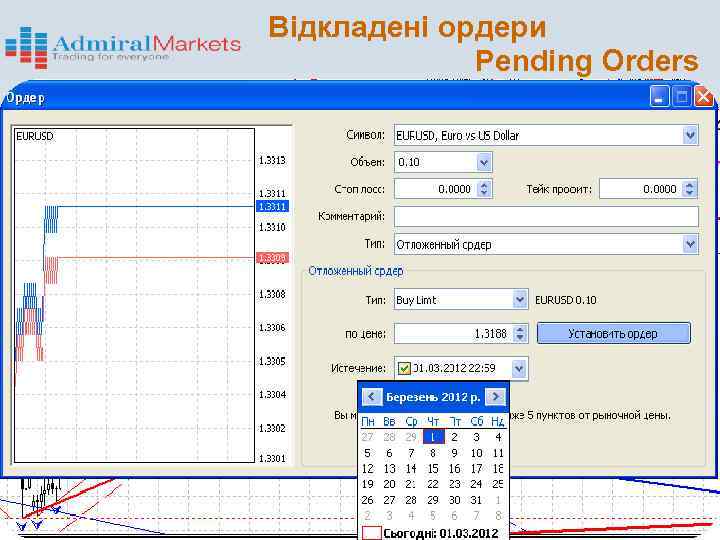

Відкладені ордери Pending Orders На пробиття На відскік Стан ринку на даний момент часу На пробиття Прогноз

Відкладені ордери Pending Orders На пробиття На відскік Стан ринку на даний момент часу На пробиття Прогноз

Відкладені ордери Pending Orders

Відкладені ордери Pending Orders