Lecture 2. The budget system Lecturer: Letyukhin Ivan

lekciya_2_2017.ppt

- Размер: 845.5 Кб

- Автор:

- Количество слайдов: 33

Описание презентации Lecture 2. The budget system Lecturer: Letyukhin Ivan по слайдам

Lecture 2. The budget system Lecturer: Letyukhin Ivan Dmitrievich, Finance department

Lecture 2. The budget system Lecturer: Letyukhin Ivan Dmitrievich, Finance department

Plan of the lecture • State and municipal budget: definition and functions • Budgetary system • Budget revenues and expenditures The budget process

Plan of the lecture • State and municipal budget: definition and functions • Budgetary system • Budget revenues and expenditures The budget process

Key words • Budgetary system • Taxes • Non-tax incomes

Key words • Budgetary system • Taxes • Non-tax incomes

What is a budget?

What is a budget?

A budget A form of generation and spending of monetary funds intended for maintenance of problems and functions are referred to state or local government

A budget A form of generation and spending of monetary funds intended for maintenance of problems and functions are referred to state or local government

Budgetary system • State (or federal) budget • Regional budget • Local budget

Budgetary system • State (or federal) budget • Regional budget • Local budget

Budgetary system • State (or federal) budget • Regional budget • Local budget

Budgetary system • State (or federal) budget • Regional budget • Local budget

The functions of the federal budget • To account the government revenues and expenditures • To make for a more equal distribution of income • To smooth out fluctuation in aggregate economic activity

The functions of the federal budget • To account the government revenues and expenditures • To make for a more equal distribution of income • To smooth out fluctuation in aggregate economic activity

Budget revenues and expenditures

Budget revenues and expenditures

Sources of budget revenues • Tax revenue • Non-tax revenue

Sources of budget revenues • Tax revenue • Non-tax revenue

A tax a financial charge or other levy imposed upon a taxpayer (an individual or legal entity) by a state or the functional equivalent of a state to fund various public expenditures.

A tax a financial charge or other levy imposed upon a taxpayer (an individual or legal entity) by a state or the functional equivalent of a state to fund various public expenditures.

The types of taxes • Taxes on income • Taxes on wealth and property • Taxes on commodities

The types of taxes • Taxes on income • Taxes on wealth and property • Taxes on commodities

The types of taxes • Direct and indirect taxes • Progressive, Proportional, Regressive and Degressive Taxes

The types of taxes • Direct and indirect taxes • Progressive, Proportional, Regressive and Degressive Taxes

Characteristics of a Tax • It is compulsory payments to the government from the citizen • It is imposes a personal obligation. • Absence of direct benefit or quid pro quo between the State and people.

Characteristics of a Tax • It is compulsory payments to the government from the citizen • It is imposes a personal obligation. • Absence of direct benefit or quid pro quo between the State and people.

Characteristics of a Tax • It is payments for meeting the expenses in the common interest of all citizens. • Certain taxes are imposed on specific objectives • There is no tax without representation

Characteristics of a Tax • It is payments for meeting the expenses in the common interest of all citizens. • Certain taxes are imposed on specific objectives • There is no tax without representation

Characteristics of a Tax • It is payments for meeting the expenses in the common interest of all citizens. • Certain taxes are imposed on specific objectives • There is no tax without representation

Characteristics of a Tax • It is payments for meeting the expenses in the common interest of all citizens. • Certain taxes are imposed on specific objectives • There is no tax without representation

Non — Tax Revenue • Commercial Revenue. (Income from public property and enterprises) • Administrative Revenue (Fee, Fine, Special assessment) • Gifts and grants • Others Commercial Revenue

Non — Tax Revenue • Commercial Revenue. (Income from public property and enterprises) • Administrative Revenue (Fee, Fine, Special assessment) • Gifts and grants • Others Commercial Revenue

Objectives of Taxes • Raising Revenue • Regulation of Consumption and Production • Stimulating Investment • Reducing Income Inequalities • Promoting Economic Growth • Development of Backward Regions • Ensuring Price Stability

Objectives of Taxes • Raising Revenue • Regulation of Consumption and Production • Stimulating Investment • Reducing Income Inequalities • Promoting Economic Growth • Development of Backward Regions • Ensuring Price Stability

Government expenditure includes all government consumption, investment, and transfer payments

Government expenditure includes all government consumption, investment, and transfer payments

The features of the growth of public expenditure. • Welfare state • Defence expenditure • Growth of democracy • Growth of population • Rise in price level

The features of the growth of public expenditure. • Welfare state • Defence expenditure • Growth of democracy • Growth of population • Rise in price level

The features of the growth of public expenditure. • Welfare state • Defence expenditure • Growth of democracy • Growth of population • Rise in price level

The features of the growth of public expenditure. • Welfare state • Defence expenditure • Growth of democracy • Growth of population • Rise in price level

The features of the growth of public expenditure. • Expansion public sector • Development expenditure • Public debt • Grants and loans to state governments • Poverty alleviation programs

The features of the growth of public expenditure. • Expansion public sector • Development expenditure • Public debt • Grants and loans to state governments • Poverty alleviation programs

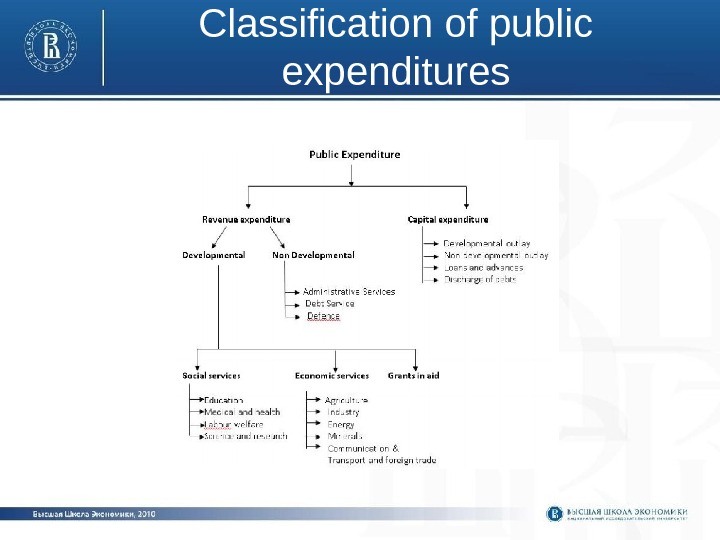

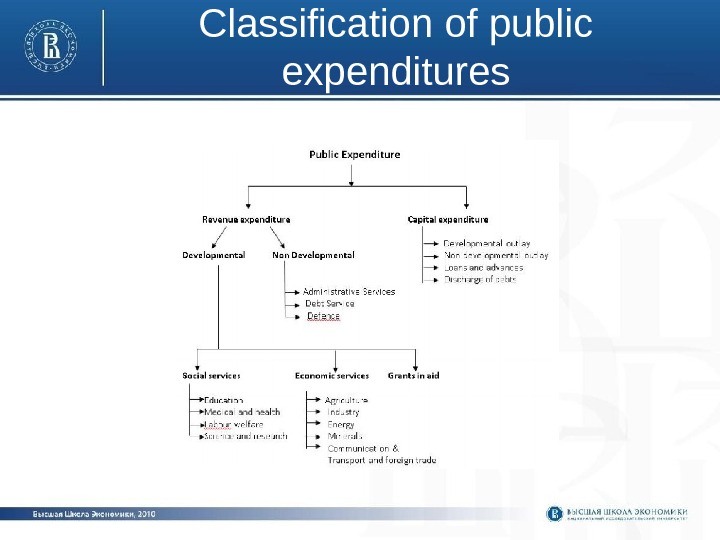

Classification of public expenditures

Classification of public expenditures

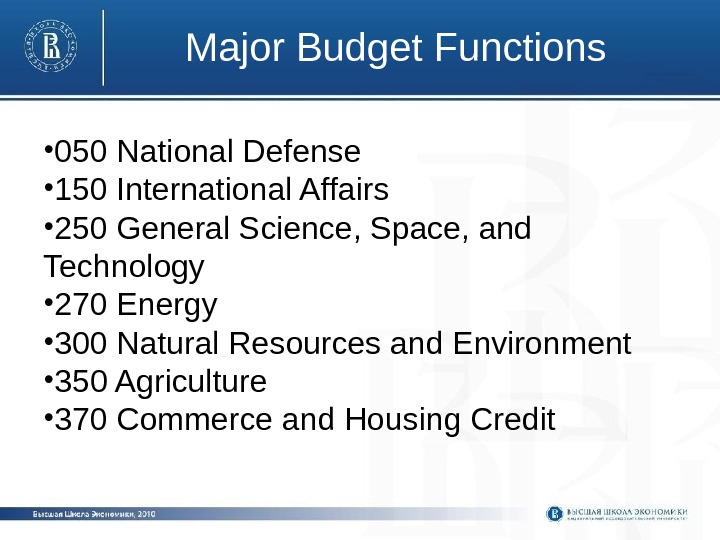

Budget functions The federal budget of USA is divided into approximately 20 categories known as budget functions

Budget functions The federal budget of USA is divided into approximately 20 categories known as budget functions

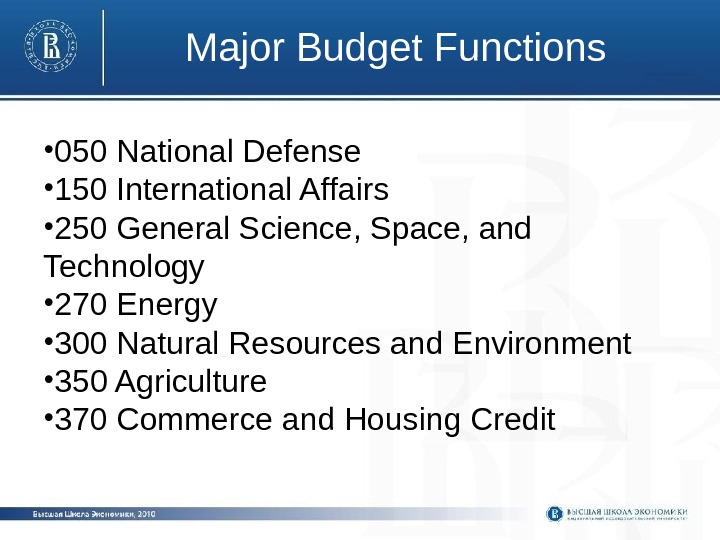

Major Budget Functions • 050 National Defense • 150 International Affairs • 250 General Science, Space, and Technology • 270 Energy • 300 Natural Resources and Environment • 350 Agriculture • 370 Commerce and Housing Credit

Major Budget Functions • 050 National Defense • 150 International Affairs • 250 General Science, Space, and Technology • 270 Energy • 300 Natural Resources and Environment • 350 Agriculture • 370 Commerce and Housing Credit

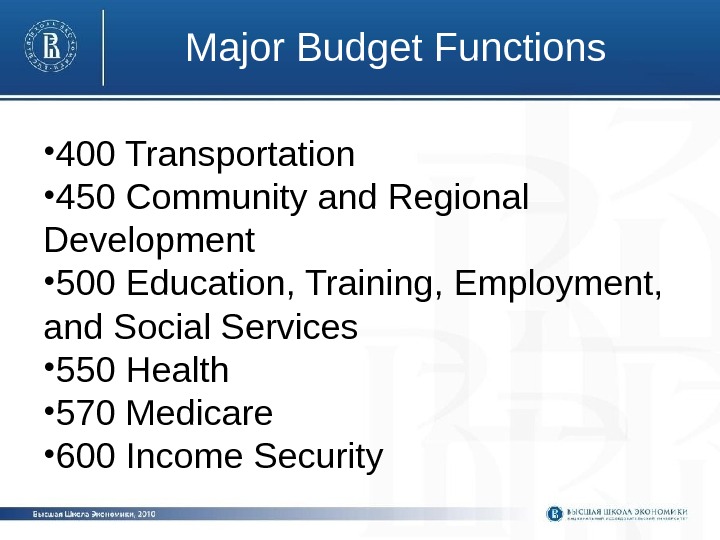

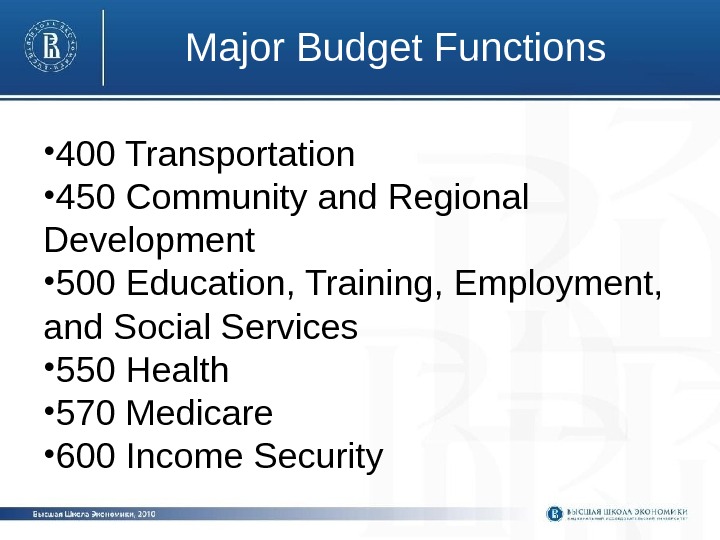

Major Budget Functions • 400 Transportation • 450 Community and Regional Development • 500 Education, Training, Employment, and Social Services • 550 Health • 570 Medicare • 600 Income Security

Major Budget Functions • 400 Transportation • 450 Community and Regional Development • 500 Education, Training, Employment, and Social Services • 550 Health • 570 Medicare • 600 Income Security

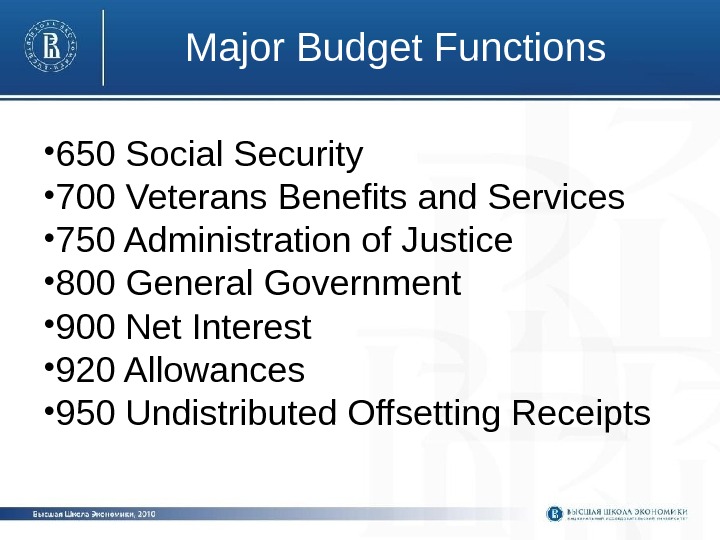

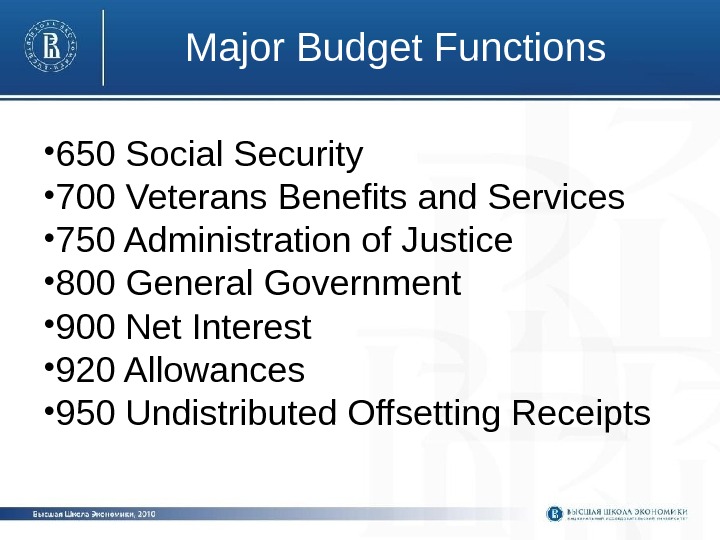

Major Budget Functions • 650 Social Security • 700 Veterans Benefits and Services • 750 Administration of Justice • 800 General Government • 900 Net Interest • 920 Allowances • 950 Undistributed Offsetting Receipts

Major Budget Functions • 650 Social Security • 700 Veterans Benefits and Services • 750 Administration of Justice • 800 General Government • 900 Net Interest • 920 Allowances • 950 Undistributed Offsetting Receipts

Budget process refers to the process by which governments create and approve a budget

Budget process refers to the process by which governments create and approve a budget

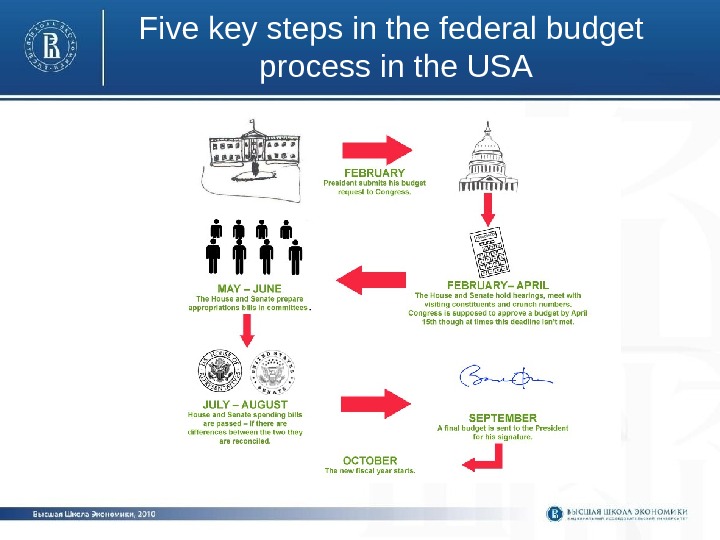

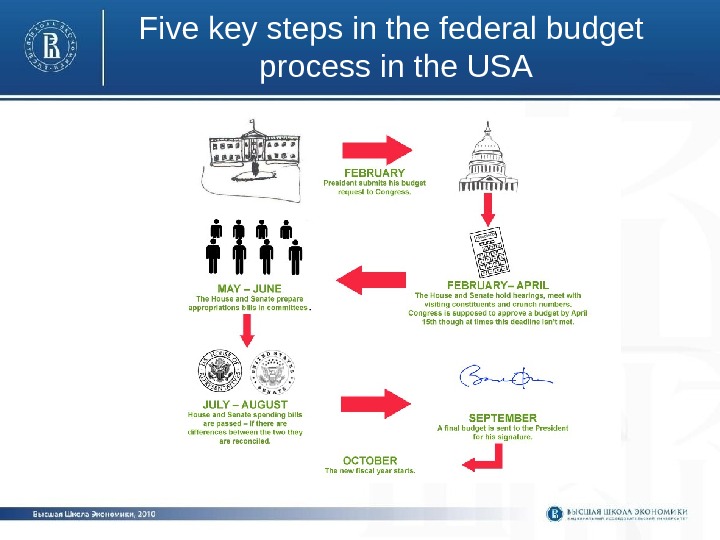

Five key steps in the federal budget process in the US

Five key steps in the federal budget process in the US

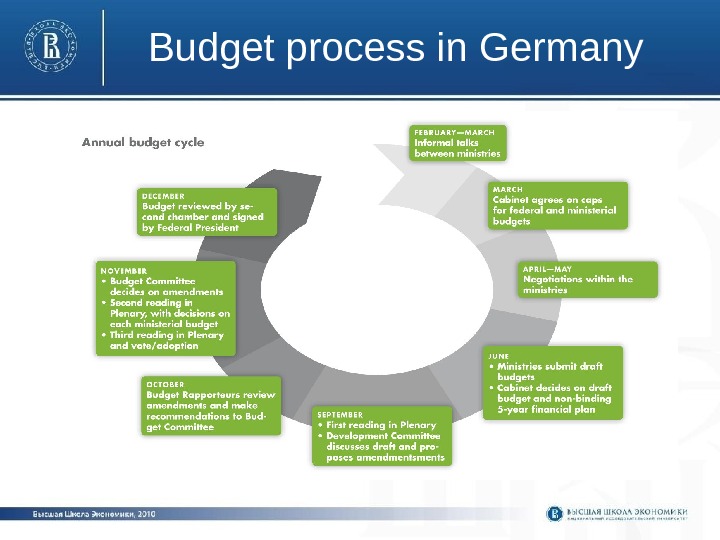

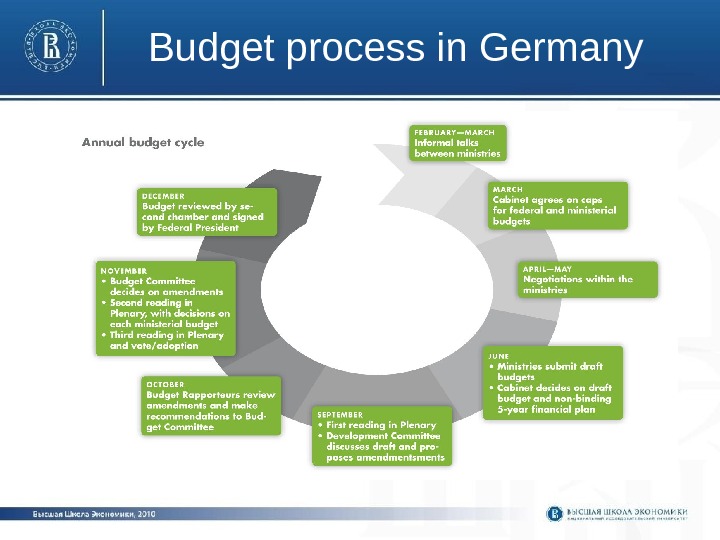

Budget process in Germany

Budget process in Germany

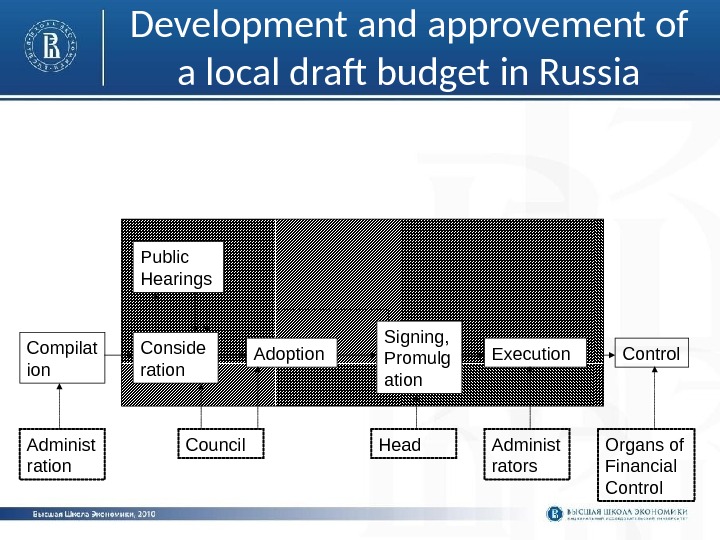

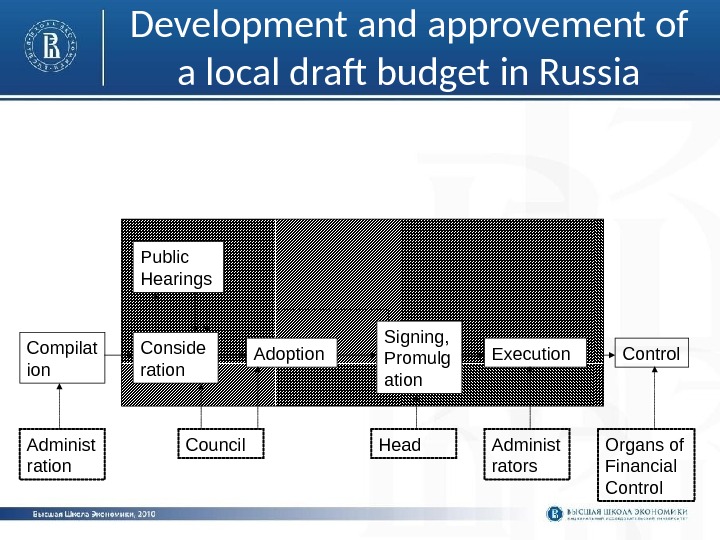

D evelopment and approv e ment of a local draft budget in Russia Conside ration Adoption Signing, Promulg ation Execution Control Organs of Financial Control. Administ rators. Head. Council. Public Hearings Compilat ion Administ ration

D evelopment and approv e ment of a local draft budget in Russia Conside ration Adoption Signing, Promulg ation Execution Control Organs of Financial Control. Administ rators. Head. Council. Public Hearings Compilat ion Administ ration

Summary Budget is a form of generation and spending of monetary funds intended for maintenance of problems and functions are referred to state or local government Budget system includes budgets of diferent levels of management of the country

Summary Budget is a form of generation and spending of monetary funds intended for maintenance of problems and functions are referred to state or local government Budget system includes budgets of diferent levels of management of the country

Thank you for attention!

Thank you for attention!