7c01d01ecaad67778fcc4a1256634d4f.ppt

- Количество слайдов: 18

Lecture 16: Conflict of interest and futures market Mishkin Ch 8 – A page 181 -205 Plus supplementary stuff about futures market Reference book: John Hull, ‘Futures, Options, and Other Derivatives’ 1

Lecture 16: Conflict of interest and futures market Mishkin Ch 8 – A page 181 -205 Plus supplementary stuff about futures market Reference book: John Hull, ‘Futures, Options, and Other Derivatives’ 1

Futures contract – a bet n n A futures contract is an agreement to trade something in the future, at an agreed upon price (strike price K). LIGHT CRUDE OIL, Aug '08, $137. 15 futures exchanges (CME, CBOT, NYME) corns, currencies, interest rates, stock prices, stock index, etc. 2

Futures contract – a bet n n A futures contract is an agreement to trade something in the future, at an agreed upon price (strike price K). LIGHT CRUDE OIL, Aug '08, $137. 15 futures exchanges (CME, CBOT, NYME) corns, currencies, interest rates, stock prices, stock index, etc. 2

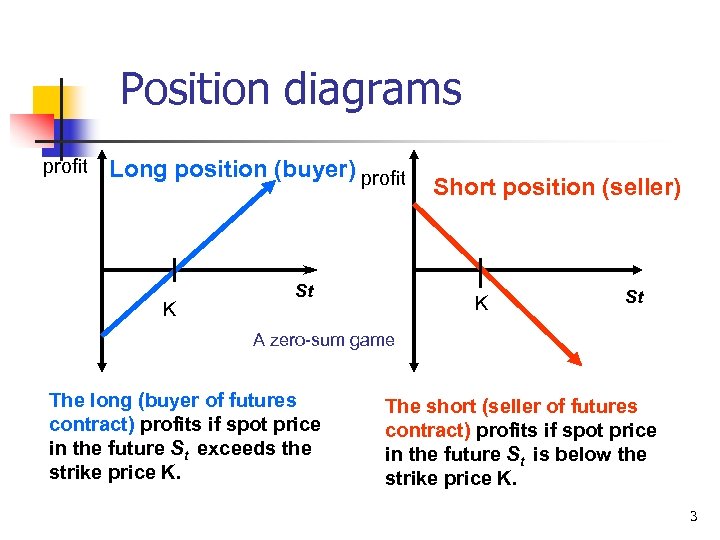

Position diagrams profit Long position (buyer) profit K St Short position (seller) K St A zero-sum game The long (buyer of futures contract) profits if spot price in the future St exceeds the strike price K. The short (seller of futures contract) profits if spot price in the future St is below the strike price K. 3

Position diagrams profit Long position (buyer) profit K St Short position (seller) K St A zero-sum game The long (buyer of futures contract) profits if spot price in the future St exceeds the strike price K. The short (seller of futures contract) profits if spot price in the future St is below the strike price K. 3

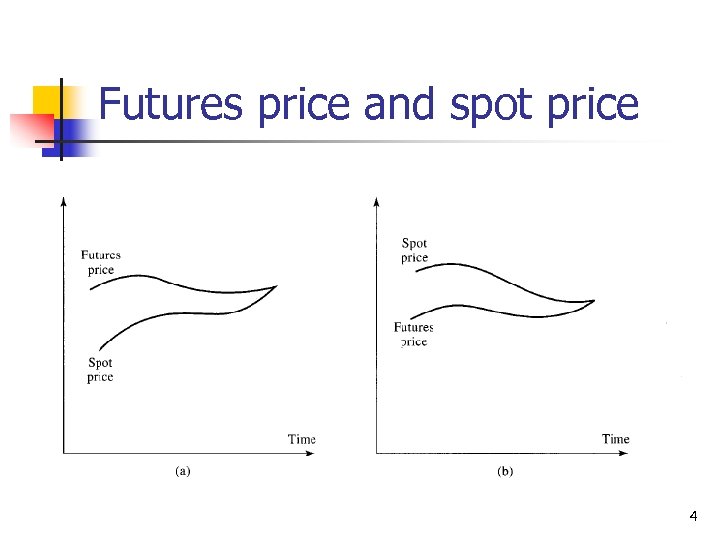

Futures price and spot price 4

Futures price and spot price 4

Functions of futures market n n Three groups of futures market users: n Speculators who wish to make lots of money. n Hedgers who wish to avoid losing lots of money. n Arbitragers who wish to make easy money by ‘price-discovery’. Futures market provides risk-sharing, liquidity, and information. 5

Functions of futures market n n Three groups of futures market users: n Speculators who wish to make lots of money. n Hedgers who wish to avoid losing lots of money. n Arbitragers who wish to make easy money by ‘price-discovery’. Futures market provides risk-sharing, liquidity, and information. 5

Speculation - idea n n n You believe that floods in Iowa will reduce soybean yields and hence soybean price would rise in Nov. How can you profit from this scenario? Bet on soybean prices to rise - long futures Today: buy Nov Bean at $5. 58; later: sell Nov Bean to offset. If price goes up, you profit. But you also bears the risk that price may decline as well. Why not speculate in spot market? 6

Speculation - idea n n n You believe that floods in Iowa will reduce soybean yields and hence soybean price would rise in Nov. How can you profit from this scenario? Bet on soybean prices to rise - long futures Today: buy Nov Bean at $5. 58; later: sell Nov Bean to offset. If price goes up, you profit. But you also bears the risk that price may decline as well. Why not speculate in spot market? 6

Speculation - example n n A speculator buys (takes a long position in) 1 Aug contract on July 1 st at $942. 10, pay initial margin $6, 500. contract size is 100 troy ounces , it has a market value of $94, 210. You are paying ($6, 500/94, 210 = 6. 9%) of contract value. Scenario 1: If Gold contract goes up to $960 by end of July, then: n n n Profit = ($960 - $942. 10)*100 = $1790 Return = $1790/$6500 = 27. 5% Scenario 2: If Gold contract goes down to $930. 00 by end of July, then: n n Profit = ($930 - $942. 10)*100 = - 1210 Return = - 1210/6500 = -18. 6% 7

Speculation - example n n A speculator buys (takes a long position in) 1 Aug contract on July 1 st at $942. 10, pay initial margin $6, 500. contract size is 100 troy ounces , it has a market value of $94, 210. You are paying ($6, 500/94, 210 = 6. 9%) of contract value. Scenario 1: If Gold contract goes up to $960 by end of July, then: n n n Profit = ($960 - $942. 10)*100 = $1790 Return = $1790/$6500 = 27. 5% Scenario 2: If Gold contract goes down to $930. 00 by end of July, then: n n Profit = ($930 - $942. 10)*100 = - 1210 Return = - 1210/6500 = -18. 6% 7

Hedging - idea n n People who would sell or buy commodities in the future could hedge price risk by holding positions in futures markets. Why? n n spot price and futures price move together offset lock in selling (purchase) price in advance Short hedgers: e. g. farmers Long hedgers: e. g. processors 8

Hedging - idea n n People who would sell or buy commodities in the future could hedge price risk by holding positions in futures markets. Why? n n spot price and futures price move together offset lock in selling (purchase) price in advance Short hedgers: e. g. farmers Long hedgers: e. g. processors 8

Short hedge - example n n A farmer who has an agriculture commodity to sell in the future will be hurt by a price decline in the future. Hedging: profit from the futures market whenever lose from the cash market. Risk in spot market is offset by trading in futures market. 9

Short hedge - example n n A farmer who has an agriculture commodity to sell in the future will be hurt by a price decline in the future. Hedging: profit from the futures market whenever lose from the cash market. Risk in spot market is offset by trading in futures market. 9

Short hedge - example n n Suppose lean hogs are now trading at $70 (per 100 pounds) in spot market. A farmer is afraid that in Aug when he is ready to sell the hog, he would not be able to sell at this good price. Step 1: Look at futures quote to find out Aug Lean Hogs futures contracts are trading at $70. 75 in Chicago Mercantile Exchange. Step 2: Call broker and place order to sell 1 Aug Lean Hogs contract and send margin money.

Short hedge - example n n Suppose lean hogs are now trading at $70 (per 100 pounds) in spot market. A farmer is afraid that in Aug when he is ready to sell the hog, he would not be able to sell at this good price. Step 1: Look at futures quote to find out Aug Lean Hogs futures contracts are trading at $70. 75 in Chicago Mercantile Exchange. Step 2: Call broker and place order to sell 1 Aug Lean Hogs contract and send margin money.

Short hedge example n n n It is now August and the farmer is ready to sell hogs to the packer. Scenario 1: Aug Lean Hogs trading at $74. 00, loss ($70. 75 - $74. 00 = -$3. 25 per 100 lb. ) in futures market. In spot market, sell hog at a high price of $74. 00 ($4 up). Scenario 2: Aug Lean Hogs trading at $65. 25, gain ($70. 75 - $65. 25 = $5. 5 per 100 lb. ) in futures market. Sell hog in spot market at a low price of $65 ($5 down).

Short hedge example n n n It is now August and the farmer is ready to sell hogs to the packer. Scenario 1: Aug Lean Hogs trading at $74. 00, loss ($70. 75 - $74. 00 = -$3. 25 per 100 lb. ) in futures market. In spot market, sell hog at a high price of $74. 00 ($4 up). Scenario 2: Aug Lean Hogs trading at $65. 25, gain ($70. 75 - $65. 25 = $5. 5 per 100 lb. ) in futures market. Sell hog in spot market at a low price of $65 ($5 down).

Conflicts of interest n Conflicts of interest arise when a financial institution (e. g. investment bank, accounting firms, etc. ) has multiple objectives and, as a result, has conflicts between those objectives. n Essentially a moral hazard problem. n Consequence of conflicts of interest is that funds are not channeled into the most productive investment opportunities. 12

Conflicts of interest n Conflicts of interest arise when a financial institution (e. g. investment bank, accounting firms, etc. ) has multiple objectives and, as a result, has conflicts between those objectives. n Essentially a moral hazard problem. n Consequence of conflicts of interest is that funds are not channeled into the most productive investment opportunities. 12

Underwriting and research in investment banks n Two objectives: ¨ research on firms to provide information for potential stock buyers ¨ underwrite n stocks to help firms’ IPO Conflicts of interest: ¨ firms want to hide bad news, investors need to know. ¨ ‘spinning’: investment bank allocates hot, but underpriced, IPOs to executives of other companies in return for their companies’ future business. 13

Underwriting and research in investment banks n Two objectives: ¨ research on firms to provide information for potential stock buyers ¨ underwrite n stocks to help firms’ IPO Conflicts of interest: ¨ firms want to hide bad news, investors need to know. ¨ ‘spinning’: investment bank allocates hot, but underpriced, IPOs to executives of other companies in return for their companies’ future business. 13

Auditing and consulting in accounting firms n Auditors may be willing to skew their judgments and opinions to win consulting business. n Auditors may be auditing information systems or tax and financial plans put in place by their nonaudit counterparts (tax consultants). n Auditors may provide an overly favorable audit to solicit or retain audit business. 14

Auditing and consulting in accounting firms n Auditors may be willing to skew their judgments and opinions to win consulting business. n Auditors may be auditing information systems or tax and financial plans put in place by their nonaudit counterparts (tax consultants). n Auditors may provide an overly favorable audit to solicit or retain audit business. 14

Remedies n Sarbanes-Oxley Act of 2002 (Public Accounting Return and Investor Protection Act) ¨ Increases supervisory oversight to monitor and prevent conflicts of interest ¨ Establishes a Public Company Accounting Oversight Board ¨ Increases the SEC’s budget ¨ Makes it illegal for a registered public accounting firm to provide any nonaudit service to a client contemporaneously with an impermissible audit 15

Remedies n Sarbanes-Oxley Act of 2002 (Public Accounting Return and Investor Protection Act) ¨ Increases supervisory oversight to monitor and prevent conflicts of interest ¨ Establishes a Public Company Accounting Oversight Board ¨ Increases the SEC’s budget ¨ Makes it illegal for a registered public accounting firm to provide any nonaudit service to a client contemporaneously with an impermissible audit 15

Remedies (cont’d) n Sarbanes-Oxley Act of 2002 (cont’d) ¨ Beefs up criminal charges for white-collar crime and obstruction of official investigations ¨ Requires the CEO and CFO to certify that financial statements and disclosures are accurate ¨ Requires members of the audit committee to be independent 16

Remedies (cont’d) n Sarbanes-Oxley Act of 2002 (cont’d) ¨ Beefs up criminal charges for white-collar crime and obstruction of official investigations ¨ Requires the CEO and CFO to certify that financial statements and disclosures are accurate ¨ Requires members of the audit committee to be independent 16

Remedies (cont’d) n Global Legal Settlement of 2002 ¨ Requires investment banks to cut the link between research and securities underwriting ¨ Bans spinning ¨ Imposes $1. 4 billion in fines on accused investment banks ¨ Requires investment banks to make their analysts’ recommendations public ¨ Over a 5 -year period, investment banks are required to contract with at least 3 independent research firms that would provide research to their brokerage customers 17

Remedies (cont’d) n Global Legal Settlement of 2002 ¨ Requires investment banks to cut the link between research and securities underwriting ¨ Bans spinning ¨ Imposes $1. 4 billion in fines on accused investment banks ¨ Requires investment banks to make their analysts’ recommendations public ¨ Over a 5 -year period, investment banks are required to contract with at least 3 independent research firms that would provide research to their brokerage customers 17

Recap Futures contract n Position diagrams n Functions of futures market n How to hedge and speculate using futures n Conflicts of interest in investment banks n Conflicts of interest in accounting firms n 18

Recap Futures contract n Position diagrams n Functions of futures market n How to hedge and speculate using futures n Conflicts of interest in investment banks n Conflicts of interest in accounting firms n 18