Lecture 14. Oligopoly.pptx

- Количество слайдов: 77

Lecture 15 Oligopoly

Lecture 15 Oligopoly

"There are two kinds of people in the world: Johnny Von Neumann and the rest of us. " Attributed to Eugene Wigner, a Nobel Prize winning physicist. What Von Neumann created is game theory

"There are two kinds of people in the world: Johnny Von Neumann and the rest of us. " Attributed to Eugene Wigner, a Nobel Prize winning physicist. What Von Neumann created is game theory

“The Nash equilibrium is without doubt the single game theoretic solution concept that is most frequently applied in economics. Economic applications include oligopoly, entry and exit, market equilibrium, search, location, bargaining, product quality, auctions, insurance, principal-agent problems, higher education, discrimination, public goods, what have you. Aumann, R. J. 1987. What is game theory trying to accomplish? In Frontiers of Economics , edited by K. Arrow and S. Honkapohja. Oxford: Basil Blackwell, 28 - 100.

“The Nash equilibrium is without doubt the single game theoretic solution concept that is most frequently applied in economics. Economic applications include oligopoly, entry and exit, market equilibrium, search, location, bargaining, product quality, auctions, insurance, principal-agent problems, higher education, discrimination, public goods, what have you. Aumann, R. J. 1987. What is game theory trying to accomplish? In Frontiers of Economics , edited by K. Arrow and S. Honkapohja. Oxford: Basil Blackwell, 28 - 100.

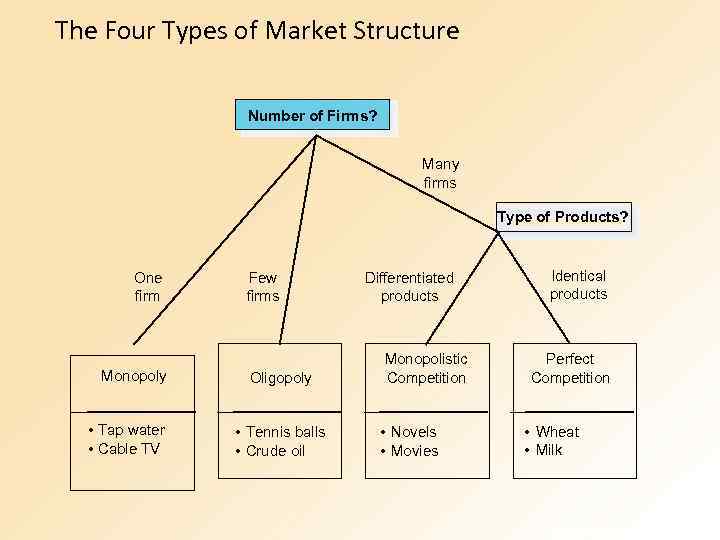

The Four Types of Market Structure Number of Firms? Many firms Type of Products? One firm Monopoly • Tap water • Cable TV Few firms Oligopoly • Tennis balls • Crude oil Differentiated products Monopolistic Competition • Novels • Movies Identical products Perfect Competition • Wheat • Milk Copyright © 2004 South-Western

The Four Types of Market Structure Number of Firms? Many firms Type of Products? One firm Monopoly • Tap water • Cable TV Few firms Oligopoly • Tennis balls • Crude oil Differentiated products Monopolistic Competition • Novels • Movies Identical products Perfect Competition • Wheat • Milk Copyright © 2004 South-Western

Oligopoly ü few firms ü either homogeneous or differentiated products ü interdependence of firms - policies of one firm affect the other firms ü substantial barriers to entry examples: auto industry and cigarette industry

Oligopoly ü few firms ü either homogeneous or differentiated products ü interdependence of firms - policies of one firm affect the other firms ü substantial barriers to entry examples: auto industry and cigarette industry

Collusion and Competition Oligopoly firms may collude (act as a monopoly) and earn positive profits. OR Oligopolists may compete with each other and drive prices down to where profits are zero.

Collusion and Competition Oligopoly firms may collude (act as a monopoly) and earn positive profits. OR Oligopolists may compete with each other and drive prices down to where profits are zero.

While it pays for firms to collude, in order to earn positive profits, it also pays to cheat on the collusive agreement. If one firm cuts its price to slightly below the others, it could gain a lot of business. If everyone cheats on the agreement, however, the agreement falls apart.

While it pays for firms to collude, in order to earn positive profits, it also pays to cheat on the collusive agreement. If one firm cuts its price to slightly below the others, it could gain a lot of business. If everyone cheats on the agreement, however, the agreement falls apart.

Collusive agreements less likely to succeed when Ø secret price cuts are difficult and costly to detect. (Quality changes are difficult to monitor. ) Ø market conditions are unstable. (Differences in expectations make it difficult to reach an agreement. ) Ø vigorous antitrust action increases the cost of collusion.

Collusive agreements less likely to succeed when Ø secret price cuts are difficult and costly to detect. (Quality changes are difficult to monitor. ) Ø market conditions are unstable. (Differences in expectations make it difficult to reach an agreement. ) Ø vigorous antitrust action increases the cost of collusion.

Some oligopolistic markets operate in a situation of price leadership. A single firm sets industry price and the remaining firms charge the same price as the leader.

Some oligopolistic markets operate in a situation of price leadership. A single firm sets industry price and the remaining firms charge the same price as the leader.

A Duopoly Example • A duopoly is an oligopoly with only two members. It is the simplest type of oligopoly.

A Duopoly Example • A duopoly is an oligopoly with only two members. It is the simplest type of oligopoly.

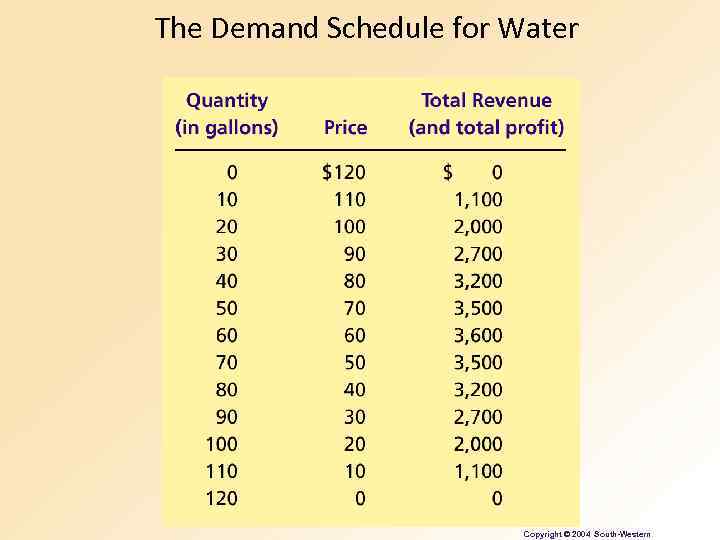

The Demand Schedule for Water Copyright © 2004 South-Western

The Demand Schedule for Water Copyright © 2004 South-Western

A Duopoly Example • Price and Quantity Supplied – The price of water in a perfectly competitive market would be driven to where the marginal cost is zero: • P = MC = $0 • Q = 120 gallons – The price and quantity in a monopoly market would be where total profit is maximized: • P = $60 • Q = 60 gallons

A Duopoly Example • Price and Quantity Supplied – The price of water in a perfectly competitive market would be driven to where the marginal cost is zero: • P = MC = $0 • Q = 120 gallons – The price and quantity in a monopoly market would be where total profit is maximized: • P = $60 • Q = 60 gallons

A Duopoly Example • Price and Quantity Supplied – The socially efficient quantity of water is 120 gallons, but a monopolist would produce only 60 gallons of water. – So what outcome then could be expected from duopolists?

A Duopoly Example • Price and Quantity Supplied – The socially efficient quantity of water is 120 gallons, but a monopolist would produce only 60 gallons of water. – So what outcome then could be expected from duopolists?

The Equilibrium for an Oligopoly • A Nash equilibrium is a situation in which economic actors interacting with one another each choose their best strategy given the strategies that all the others have chosen.

The Equilibrium for an Oligopoly • A Nash equilibrium is a situation in which economic actors interacting with one another each choose their best strategy given the strategies that all the others have chosen.

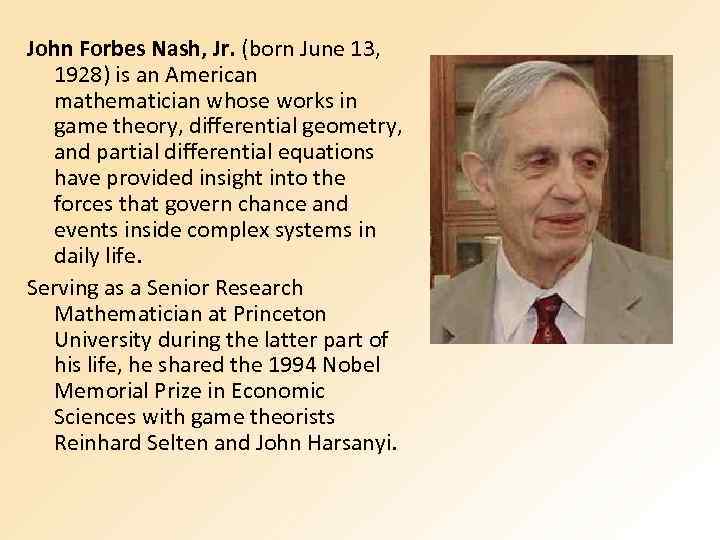

John Forbes Nash, Jr. (born June 13, 1928) is an American mathematician whose works in game theory, differential geometry, and partial differential equations have provided insight into the forces that govern chance and events inside complex systems in daily life. Serving as a Senior Research Mathematician at Princeton University during the latter part of his life, he shared the 1994 Nobel Memorial Prize in Economic Sciences with game theorists Reinhard Selten and John Harsanyi.

John Forbes Nash, Jr. (born June 13, 1928) is an American mathematician whose works in game theory, differential geometry, and partial differential equations have provided insight into the forces that govern chance and events inside complex systems in daily life. Serving as a Senior Research Mathematician at Princeton University during the latter part of his life, he shared the 1994 Nobel Memorial Prize in Economic Sciences with game theorists Reinhard Selten and John Harsanyi.

Movie

Movie

Properties of Nash Equilibrium: • Decision makers know the actions of their rivals. • No cooperation among players. • Each player has chosen the best action possible, given what the others have chosen. • Players believe that they correctly predict each other’s decisions. • Managers seek the mutually best decision in payoff table. • When participants in a game are in Nash equilibrium, no participant has an incentive to change. • No single player can unilaterally (by itself) make a different decision and do better (increase its payoff). • Thus, a Nash equilibrium is “strategically stable”, that is, players will likely decide on a Nash pair of decisions.

Properties of Nash Equilibrium: • Decision makers know the actions of their rivals. • No cooperation among players. • Each player has chosen the best action possible, given what the others have chosen. • Players believe that they correctly predict each other’s decisions. • Managers seek the mutually best decision in payoff table. • When participants in a game are in Nash equilibrium, no participant has an incentive to change. • No single player can unilaterally (by itself) make a different decision and do better (increase its payoff). • Thus, a Nash equilibrium is “strategically stable”, that is, players will likely decide on a Nash pair of decisions.

The Equilibrium for an Oligopoly • When firms in an oligopoly individually choose production to maximize profit, they produce quantity of output greater than the level produced by monopoly and less than the level produced by competition.

The Equilibrium for an Oligopoly • When firms in an oligopoly individually choose production to maximize profit, they produce quantity of output greater than the level produced by monopoly and less than the level produced by competition.

The Equilibrium for an Oligopoly • The oligopoly price is less than the monopoly price but greater than the competitive price (which equals marginal cost).

The Equilibrium for an Oligopoly • The oligopoly price is less than the monopoly price but greater than the competitive price (which equals marginal cost).

Equilibrium for an Oligopoly Summary Possible outcome if oligopoly firms pursue their own self-interests: • Joint output is greater than the monopoly quantity but less than the competitive industry quantity. • Market prices are lower than monopoly price but greater than competitive price. • Total profits are less than the monopoly profit.

Equilibrium for an Oligopoly Summary Possible outcome if oligopoly firms pursue their own self-interests: • Joint output is greater than the monopoly quantity but less than the competitive industry quantity. • Market prices are lower than monopoly price but greater than competitive price. • Total profits are less than the monopoly profit.

GAME THEORY AND THE ECONOMICS OF COOPERATION • Game theory is the study of how people behave in strategic situations. • Strategic decisions are those in which each person, in deciding what actions to take, must consider how others might respond to that action.

GAME THEORY AND THE ECONOMICS OF COOPERATION • Game theory is the study of how people behave in strategic situations. • Strategic decisions are those in which each person, in deciding what actions to take, must consider how others might respond to that action.

GAME THEORY AND THE ECONOMICS OF COOPERATION • Because the number of firms in an oligopolistic market is small, each firm must act strategically. • Each firm knows that its profit depends not only on how much it produces but also on how much the other firms produce.

GAME THEORY AND THE ECONOMICS OF COOPERATION • Because the number of firms in an oligopolistic market is small, each firm must act strategically. • Each firm knows that its profit depends not only on how much it produces but also on how much the other firms produce.

The Prisoners’ Dilemma • The prisoners’ dilemma provides insight into the difficulty in maintaining cooperation. • Often people (firms) fail to cooperate with one another even when cooperation would make them better off.

The Prisoners’ Dilemma • The prisoners’ dilemma provides insight into the difficulty in maintaining cooperation. • Often people (firms) fail to cooperate with one another even when cooperation would make them better off.

The Prisoners’ Dilemma • The prisoners’ dilemma is a particular “game” between two captured prisoners that illustrates why cooperation is difficult to maintain even when it is mutually beneficial.

The Prisoners’ Dilemma • The prisoners’ dilemma is a particular “game” between two captured prisoners that illustrates why cooperation is difficult to maintain even when it is mutually beneficial.

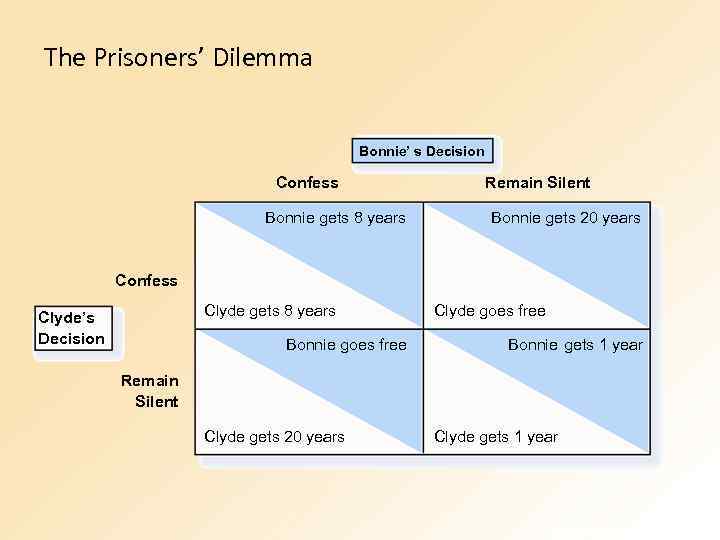

The Prisoners’ Dilemma Bonnie’ s Decision Confess Bonnie gets 8 years Remain Silent Bonnie gets 20 years Confess Clyde gets 8 years Clyde’s Decision Bonnie goes free Clyde goes free Bonnie gets 1 year Remain Silent Clyde gets 20 years Clyde gets 1 year Copyright© 2003 Southwestern/Thomson Learning

The Prisoners’ Dilemma Bonnie’ s Decision Confess Bonnie gets 8 years Remain Silent Bonnie gets 20 years Confess Clyde gets 8 years Clyde’s Decision Bonnie goes free Clyde goes free Bonnie gets 1 year Remain Silent Clyde gets 20 years Clyde gets 1 year Copyright© 2003 Southwestern/Thomson Learning

The Prisoners’ Dilemma • The dominant strategy is the best strategy for a player to follow, regardless of the strategies chosen by the other players. • Cooperation is difficult to maintain, because cooperation is not in the best interest of the individual player.

The Prisoners’ Dilemma • The dominant strategy is the best strategy for a player to follow, regardless of the strategies chosen by the other players. • Cooperation is difficult to maintain, because cooperation is not in the best interest of the individual player.

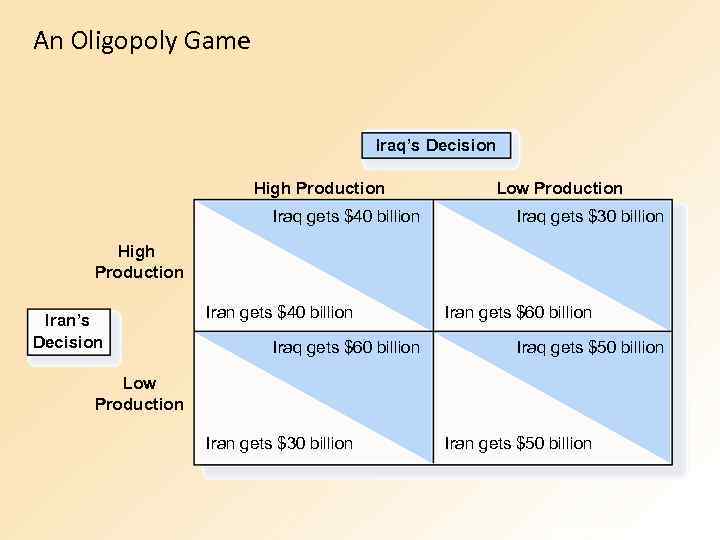

An Oligopoly Game Iraq’s Decision High Production Iraq gets $40 billion Low Production Iraq gets $30 billion High Production Iran’s Decision Iran gets $40 billion Iraq gets $60 billion Iran gets $60 billion Iraq gets $50 billion Low Production Iran gets $30 billion Iran gets $50 billion Copyright© 2003 Southwestern/Thomson Learning

An Oligopoly Game Iraq’s Decision High Production Iraq gets $40 billion Low Production Iraq gets $30 billion High Production Iran’s Decision Iran gets $40 billion Iraq gets $60 billion Iran gets $60 billion Iraq gets $50 billion Low Production Iran gets $30 billion Iran gets $50 billion Copyright© 2003 Southwestern/Thomson Learning

Oligopolies as a Prisoners’ Dilemma • Self-interest makes it difficult for the oligopoly to maintain a cooperative outcome with low production, high prices, and monopoly profits.

Oligopolies as a Prisoners’ Dilemma • Self-interest makes it difficult for the oligopoly to maintain a cooperative outcome with low production, high prices, and monopoly profits.

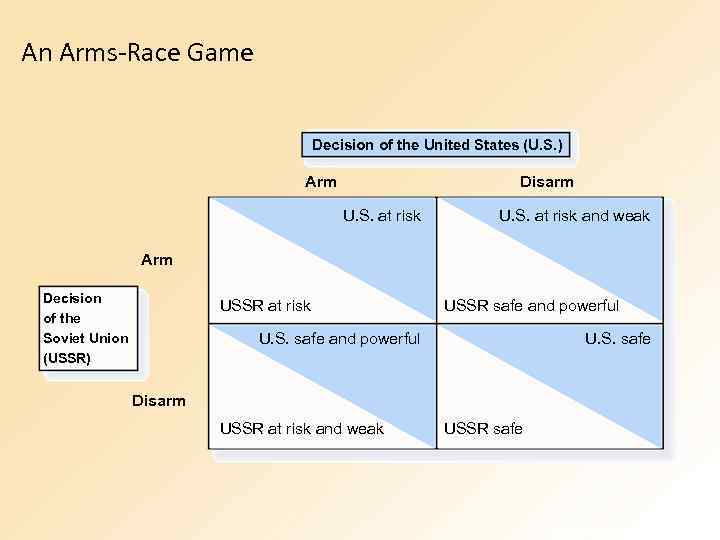

An Arms-Race Game Decision of the United States (U. S. ) Arm Disarm U. S. at risk and weak Arm Decision of the Soviet Union (USSR) USSR at risk USSR safe and powerful U. S. safe Disarm USSR at risk and weak USSR safe Copyright© 2003 Southwestern/Thomson Learning

An Arms-Race Game Decision of the United States (U. S. ) Arm Disarm U. S. at risk and weak Arm Decision of the Soviet Union (USSR) USSR at risk USSR safe and powerful U. S. safe Disarm USSR at risk and weak USSR safe Copyright© 2003 Southwestern/Thomson Learning

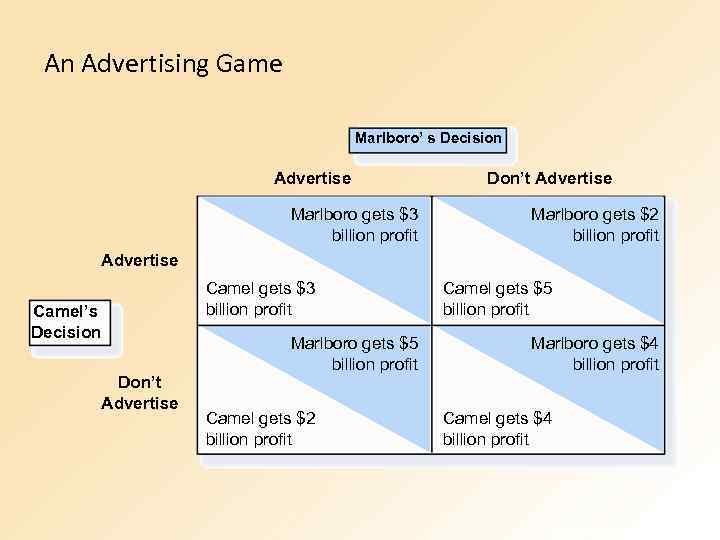

An Advertising Game Marlboro’ s Decision Advertise Marlboro gets $3 billion profit Don’t Advertise Marlboro gets $2 billion profit Advertise Camel’s Decision Don’t Advertise Camel gets $3 billion profit Marlboro gets $5 billion profit Camel gets $2 billion profit Camel gets $5 billion profit Marlboro gets $4 billion profit Camel gets $4 billion profit Copyright© 2003 Southwestern/Thomson Learning

An Advertising Game Marlboro’ s Decision Advertise Marlboro gets $3 billion profit Don’t Advertise Marlboro gets $2 billion profit Advertise Camel’s Decision Don’t Advertise Camel gets $3 billion profit Marlboro gets $5 billion profit Camel gets $2 billion profit Camel gets $5 billion profit Marlboro gets $4 billion profit Camel gets $4 billion profit Copyright© 2003 Southwestern/Thomson Learning

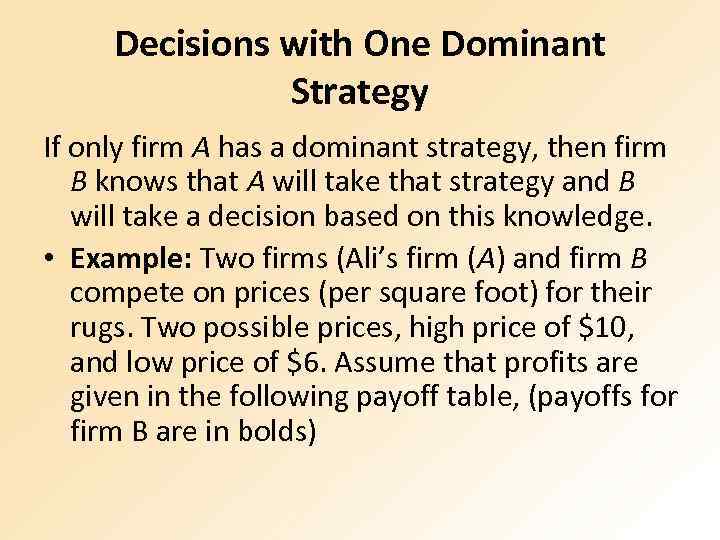

Decisions with One Dominant Strategy If only firm A has a dominant strategy, then firm B knows that A will take that strategy and B will take a decision based on this knowledge. • Example: Two firms (Ali’s firm (A) and firm B compete on prices (per square foot) for their rugs. Two possible prices, high price of $10, and low price of $6. Assume that profits are given in the following payoff table, (payoffs for firm B are in bolds)

Decisions with One Dominant Strategy If only firm A has a dominant strategy, then firm B knows that A will take that strategy and B will take a decision based on this knowledge. • Example: Two firms (Ali’s firm (A) and firm B compete on prices (per square foot) for their rugs. Two possible prices, high price of $10, and low price of $6. Assume that profits are given in the following payoff table, (payoffs for firm B are in bolds)

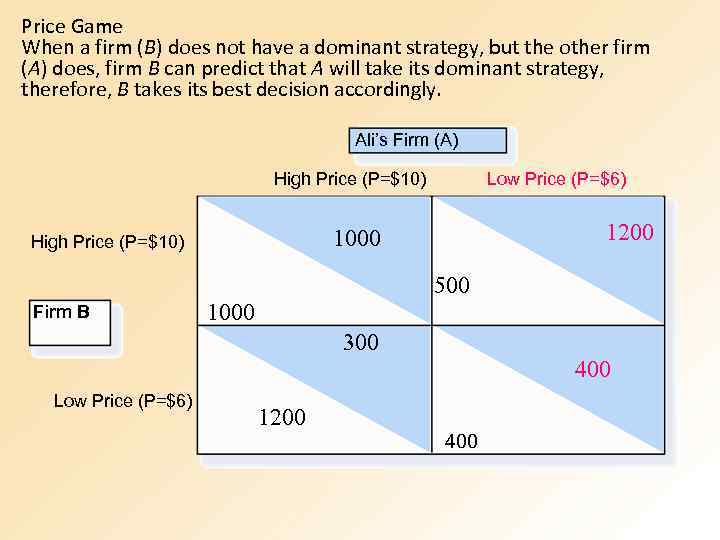

Price Game When a firm (B) does not have a dominant strategy, but the other firm (A) does, firm B can predict that A will take its dominant strategy, therefore, B takes its best decision accordingly. Ali’s Firm (A) High Price (P=$10) Low Price (P=$6) 1200 1000 High Price (P=$10) 500 Firm B 1000 300 400 Low Price (P=$6) 1200 400

Price Game When a firm (B) does not have a dominant strategy, but the other firm (A) does, firm B can predict that A will take its dominant strategy, therefore, B takes its best decision accordingly. Ali’s Firm (A) High Price (P=$10) Low Price (P=$6) 1200 1000 High Price (P=$10) 500 Firm B 1000 300 400 Low Price (P=$6) 1200 400

Why People Sometimes Cooperate • Firms that care about future profits will cooperate in repeated games rather than cheating in a single game to achieve a onetime gain.

Why People Sometimes Cooperate • Firms that care about future profits will cooperate in repeated games rather than cheating in a single game to achieve a onetime gain.

Oligopoly Games Collusion Suppose that the two firms enter into a collusive agreement. A collusive agreement is an agreement between two (or more) firms to restrict output, raise the price, and increase profits. Such agreements are illegal and are undertaken in secret. Firms in a collusive agreement operate a cartel.

Oligopoly Games Collusion Suppose that the two firms enter into a collusive agreement. A collusive agreement is an agreement between two (or more) firms to restrict output, raise the price, and increase profits. Such agreements are illegal and are undertaken in secret. Firms in a collusive agreement operate a cartel.

Oligopoly Games The strategies that firms in a cartel can pursue are to § Comply § Cheat Because each firm has two strategies, there are four possible combinations of actions for the firms: 1. Both comply. 2. Both cheat. 3. The first complies and the second cheats. 4. The second complies and the first cheats.

Oligopoly Games The strategies that firms in a cartel can pursue are to § Comply § Cheat Because each firm has two strategies, there are four possible combinations of actions for the firms: 1. Both comply. 2. Both cheat. 3. The first complies and the second cheats. 4. The second complies and the first cheats.

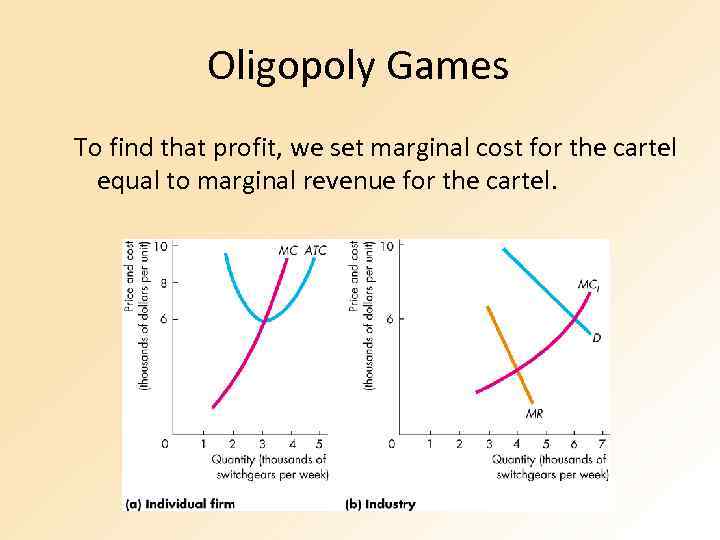

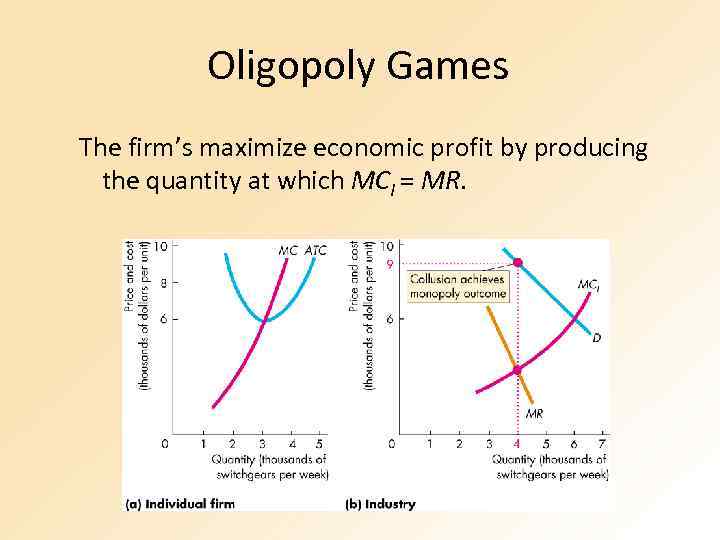

Oligopoly Games To find that profit, we set marginal cost for the cartel equal to marginal revenue for the cartel.

Oligopoly Games To find that profit, we set marginal cost for the cartel equal to marginal revenue for the cartel.

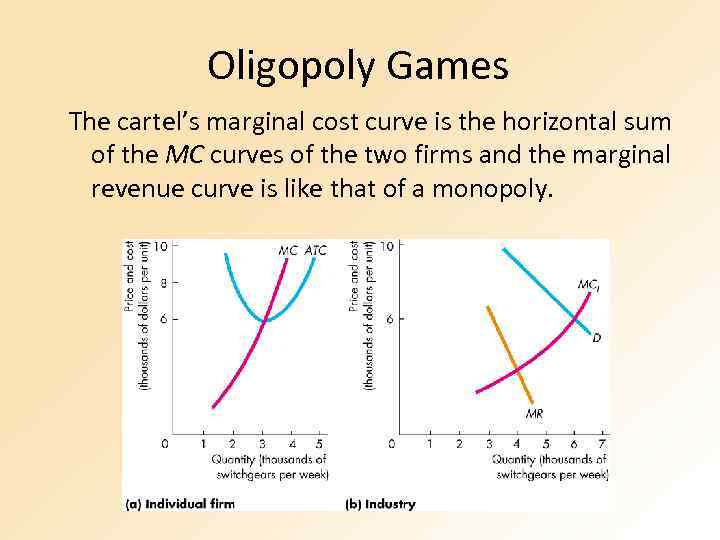

Oligopoly Games The cartel’s marginal cost curve is the horizontal sum of the MC curves of the two firms and the marginal revenue curve is like that of a monopoly.

Oligopoly Games The cartel’s marginal cost curve is the horizontal sum of the MC curves of the two firms and the marginal revenue curve is like that of a monopoly.

Oligopoly Games The firm’s maximize economic profit by producing the quantity at which MCI = MR.

Oligopoly Games The firm’s maximize economic profit by producing the quantity at which MCI = MR.

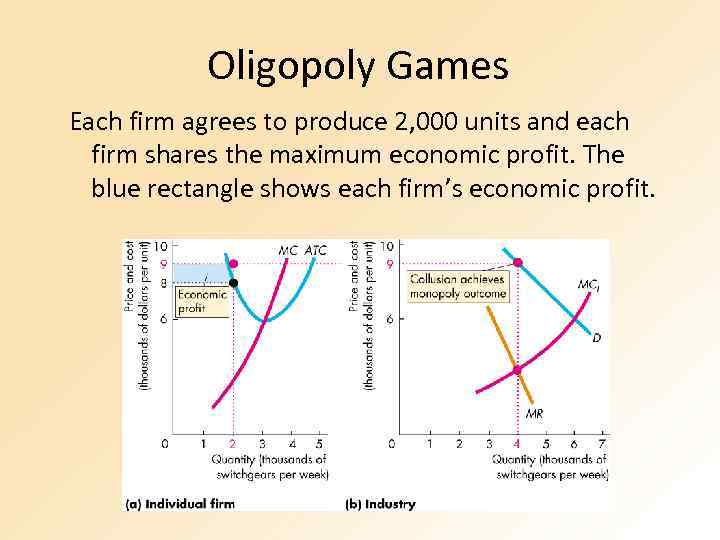

Oligopoly Games Each firm agrees to produce 2, 000 units and each firm shares the maximum economic profit. The blue rectangle shows each firm’s economic profit.

Oligopoly Games Each firm agrees to produce 2, 000 units and each firm shares the maximum economic profit. The blue rectangle shows each firm’s economic profit.

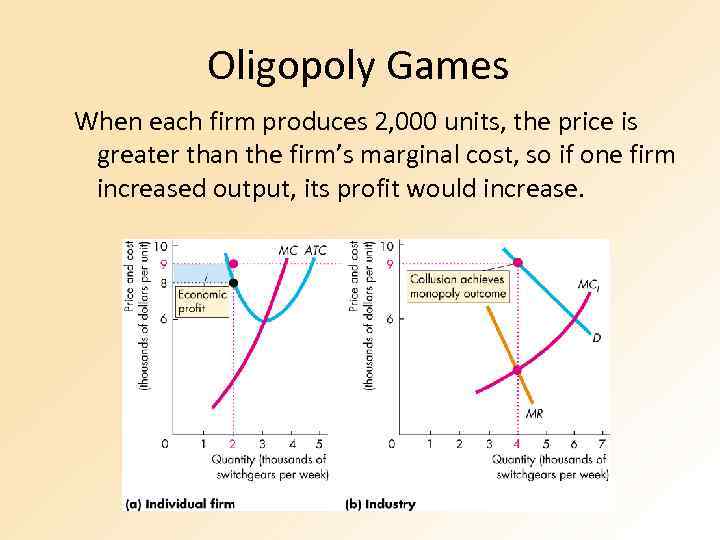

Oligopoly Games When each firm produces 2, 000 units, the price is greater than the firm’s marginal cost, so if one firm increased output, its profit would increase.

Oligopoly Games When each firm produces 2, 000 units, the price is greater than the firm’s marginal cost, so if one firm increased output, its profit would increase.

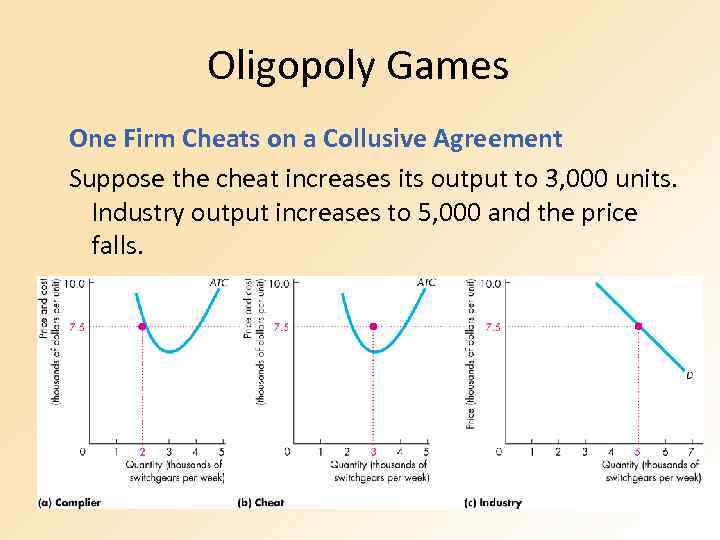

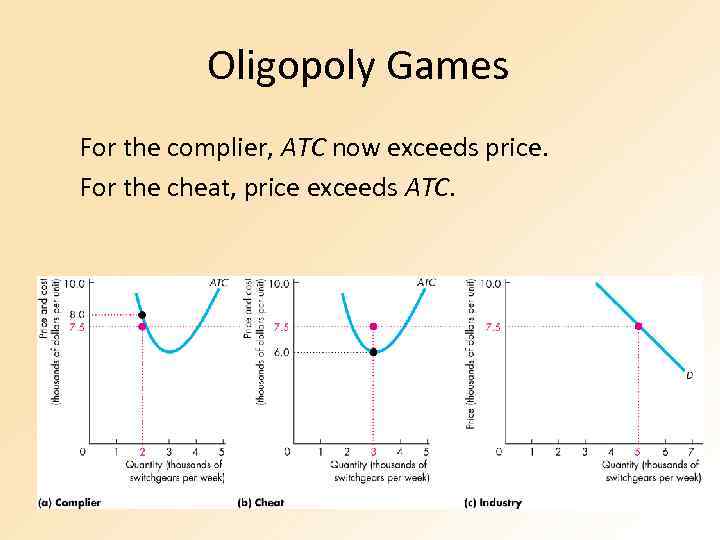

Oligopoly Games One Firm Cheats on a Collusive Agreement Suppose the cheat increases its output to 3, 000 units. Industry output increases to 5, 000 and the price falls.

Oligopoly Games One Firm Cheats on a Collusive Agreement Suppose the cheat increases its output to 3, 000 units. Industry output increases to 5, 000 and the price falls.

Oligopoly Games For the complier, ATC now exceeds price. For the cheat, price exceeds ATC.

Oligopoly Games For the complier, ATC now exceeds price. For the cheat, price exceeds ATC.

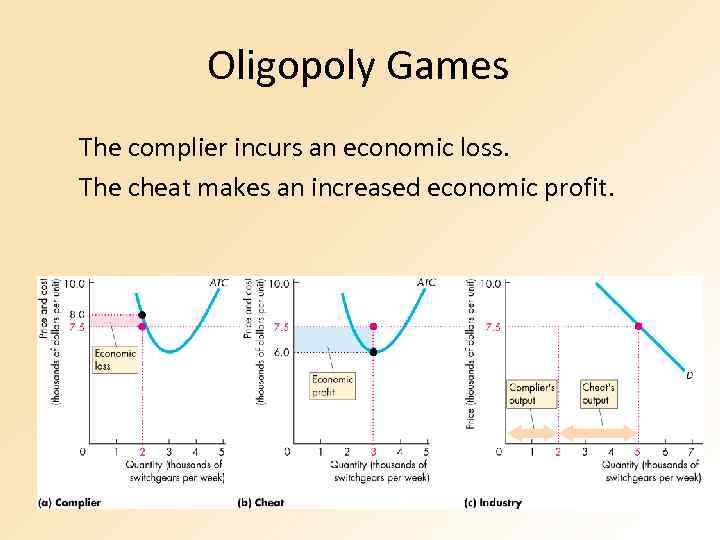

Oligopoly Games The complier incurs an economic loss. The cheat makes an increased economic profit.

Oligopoly Games The complier incurs an economic loss. The cheat makes an increased economic profit.

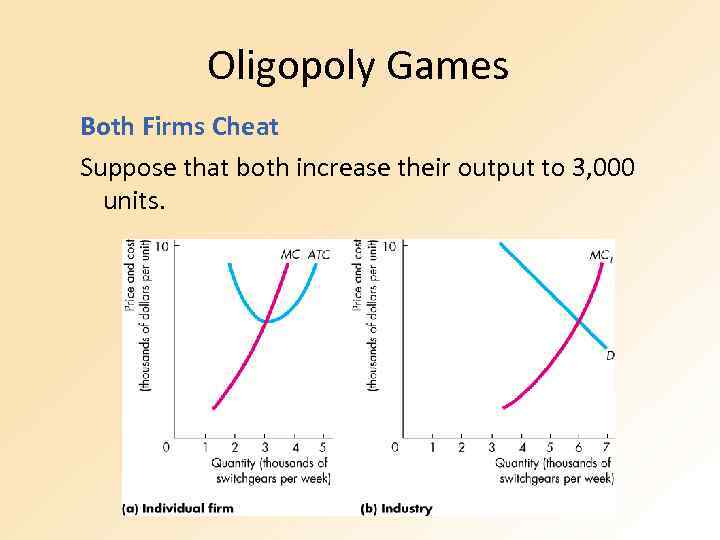

Oligopoly Games Both Firms Cheat Suppose that both increase their output to 3, 000 units.

Oligopoly Games Both Firms Cheat Suppose that both increase their output to 3, 000 units.

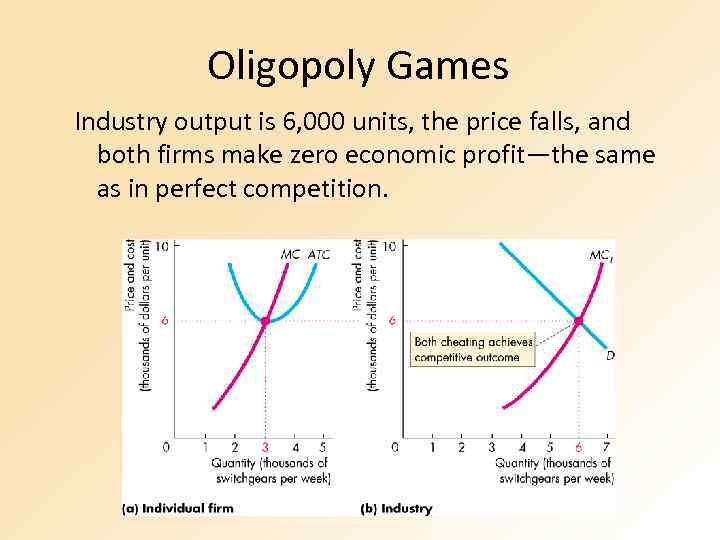

Oligopoly Games Industry output is 6, 000 units, the price falls, and both firms make zero economic profit—the same as in perfect competition.

Oligopoly Games Industry output is 6, 000 units, the price falls, and both firms make zero economic profit—the same as in perfect competition.

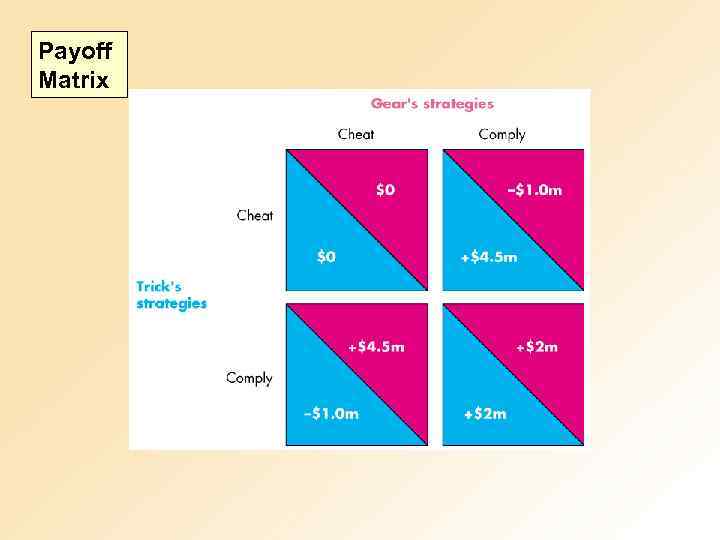

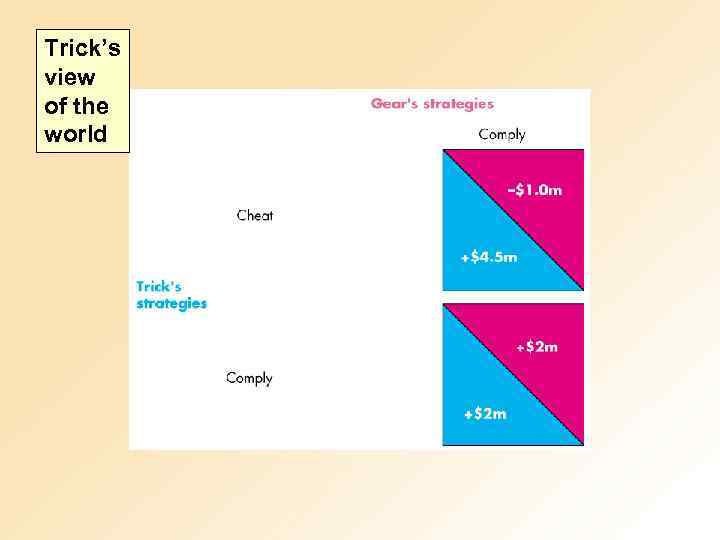

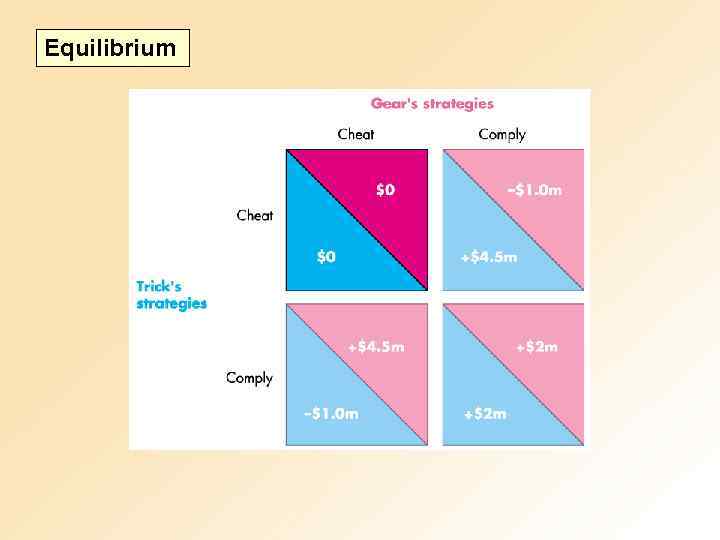

Payoff Matrix

Payoff Matrix

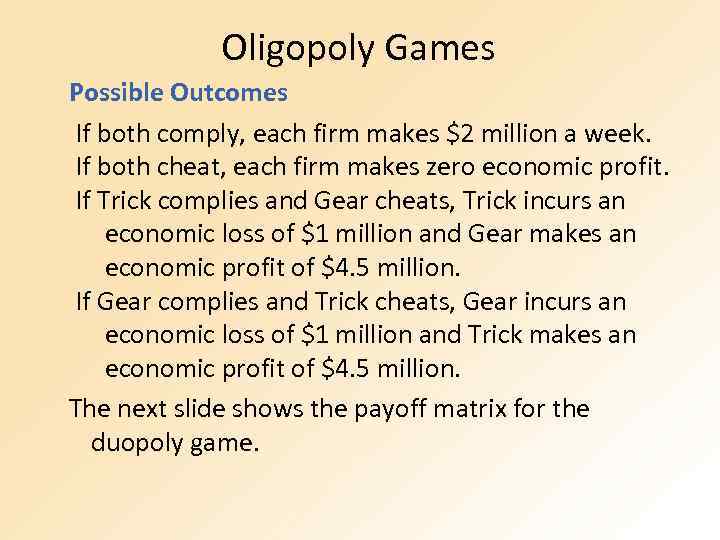

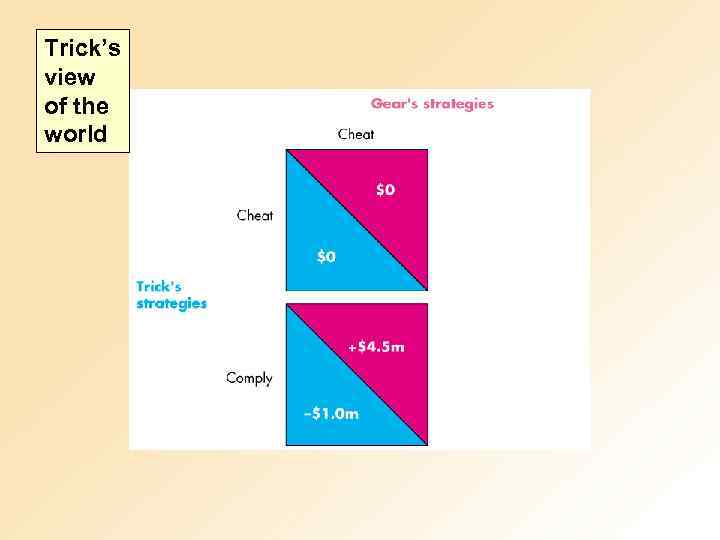

Oligopoly Games Possible Outcomes If both comply, each firm makes $2 million a week. If both cheat, each firm makes zero economic profit. If Trick complies and Gear cheats, Trick incurs an economic loss of $1 million and Gear makes an economic profit of $4. 5 million. If Gear complies and Trick cheats, Gear incurs an economic loss of $1 million and Trick makes an economic profit of $4. 5 million. The next slide shows the payoff matrix for the duopoly game.

Oligopoly Games Possible Outcomes If both comply, each firm makes $2 million a week. If both cheat, each firm makes zero economic profit. If Trick complies and Gear cheats, Trick incurs an economic loss of $1 million and Gear makes an economic profit of $4. 5 million. If Gear complies and Trick cheats, Gear incurs an economic loss of $1 million and Trick makes an economic profit of $4. 5 million. The next slide shows the payoff matrix for the duopoly game.

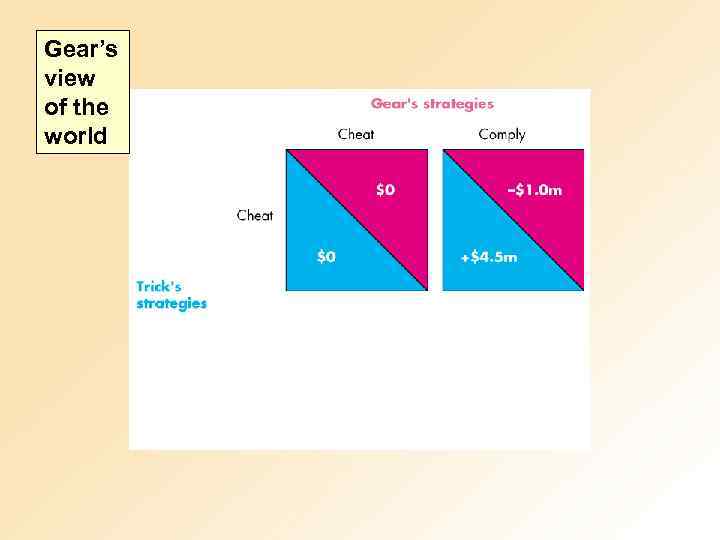

Trick’s view of the world

Trick’s view of the world

Trick’s view of the world

Trick’s view of the world

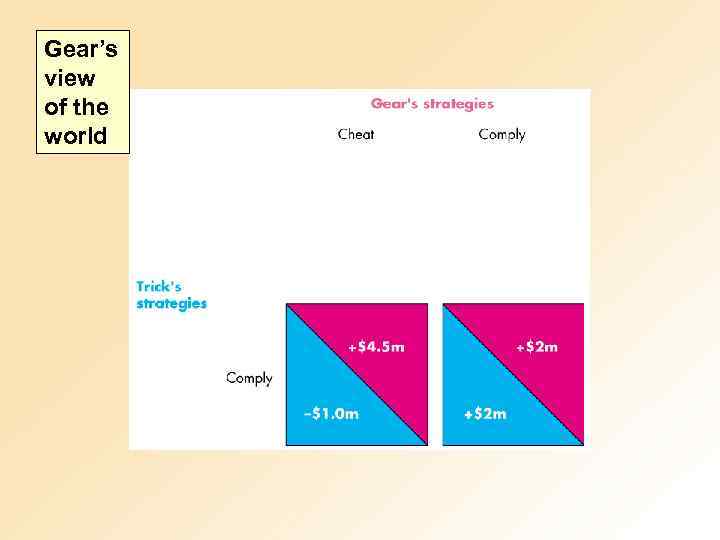

Gear’s view of the world

Gear’s view of the world

Gear’s view of the world

Gear’s view of the world

Equilibrium

Equilibrium

Oligopoly Games Nash Equilibrium The Nash equilibrium is that both firms cheat. The quantity and price are those of a competitive market, and the firms make zero economic profit.

Oligopoly Games Nash Equilibrium The Nash equilibrium is that both firms cheat. The quantity and price are those of a competitive market, and the firms make zero economic profit.

One of the points of the kinked demand curve model was that it provided an explanation for a behavior that economists were well aware of within oligopoly. It had been observed that firms in oligopolistic industries didn't change price and output often, even when production costs were known to have changed. It turns out that this simple bit of strategic thinking on the part of firms in an oligopoly was able to explain this otherwise strange phenomenon, strange because all our models have shown that profit maximizing firms will change price and output when variable costs change.

One of the points of the kinked demand curve model was that it provided an explanation for a behavior that economists were well aware of within oligopoly. It had been observed that firms in oligopolistic industries didn't change price and output often, even when production costs were known to have changed. It turns out that this simple bit of strategic thinking on the part of firms in an oligopoly was able to explain this otherwise strange phenomenon, strange because all our models have shown that profit maximizing firms will change price and output when variable costs change.

Sweezy’s kinked demand curve model of oligopoly Assumptions: 1. If a firm raises prices, other firms won’t follow and the firm loses a lot of business. So demand is very responsive or elastic to price increases. 2. If a firm lowers prices, other firms follow and the firm doesn’t gain much business. So demand is fairly unresponsive or inelastic to price decreases.

Sweezy’s kinked demand curve model of oligopoly Assumptions: 1. If a firm raises prices, other firms won’t follow and the firm loses a lot of business. So demand is very responsive or elastic to price increases. 2. If a firm lowers prices, other firms follow and the firm doesn’t gain much business. So demand is fairly unresponsive or inelastic to price decreases.

Sweezy’s kinked demand curve model of oligopoly The kinked demand curve model assumes that a business might face a dual demand curve for its product based on the likely reactions of other firms in the market to a change in its price or another variable.

Sweezy’s kinked demand curve model of oligopoly The kinked demand curve model assumes that a business might face a dual demand curve for its product based on the likely reactions of other firms in the market to a change in its price or another variable.

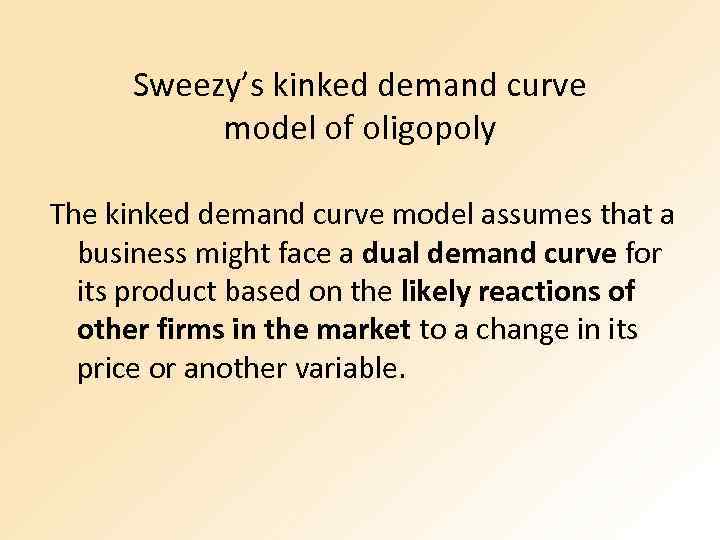

The Kinked Demand Curve $ P* An oligopolist faces a downward sloping demand curve but the elasticity may depend on the reaction of rivals to changes in price and output: (a) rivals will not follow a price Elastic demand increase by one firm - therefore demand will be relatively elastic and a rise in price would lead to a fall in the total revenue of the firm (b) rivals are more likely to match a Inelastic demand price fall by one firm to avoid a loss of market share. If this happens demand will be more inelastic and a fall in price will also lead to a fall in total revenue. D Q* quantity

The Kinked Demand Curve $ P* An oligopolist faces a downward sloping demand curve but the elasticity may depend on the reaction of rivals to changes in price and output: (a) rivals will not follow a price Elastic demand increase by one firm - therefore demand will be relatively elastic and a rise in price would lead to a fall in the total revenue of the firm (b) rivals are more likely to match a Inelastic demand price fall by one firm to avoid a loss of market share. If this happens demand will be more inelastic and a fall in price will also lead to a fall in total revenue. D Q* quantity

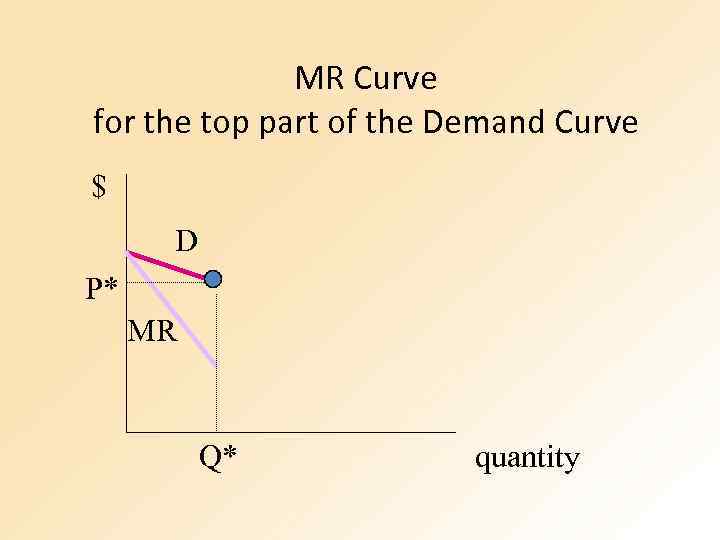

MR Curve for the top part of the Demand Curve $ D P* MR Q* quantity

MR Curve for the top part of the Demand Curve $ D P* MR Q* quantity

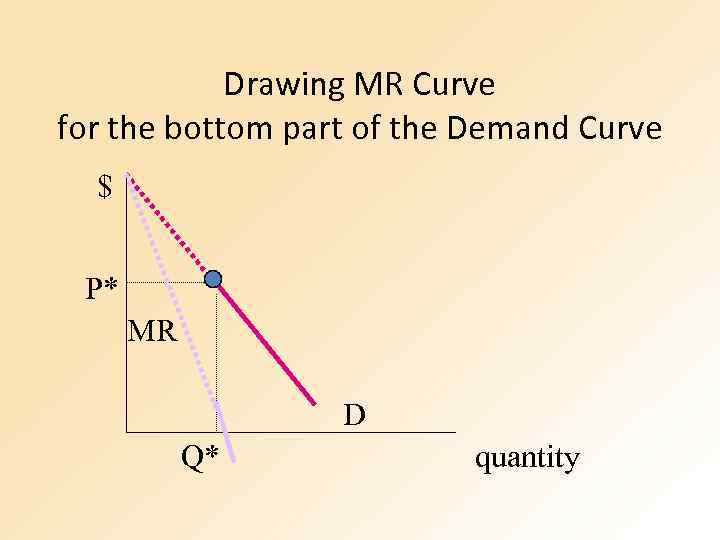

Drawing MR Curve for the bottom part of the Demand Curve $ P* MR D Q* quantity

Drawing MR Curve for the bottom part of the Demand Curve $ P* MR D Q* quantity

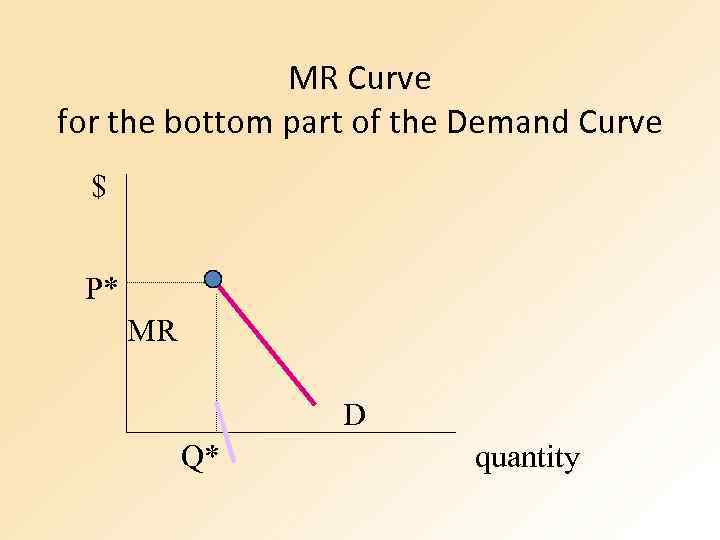

MR Curve for the bottom part of the Demand Curve $ P* MR D Q* quantity

MR Curve for the bottom part of the Demand Curve $ P* MR D Q* quantity

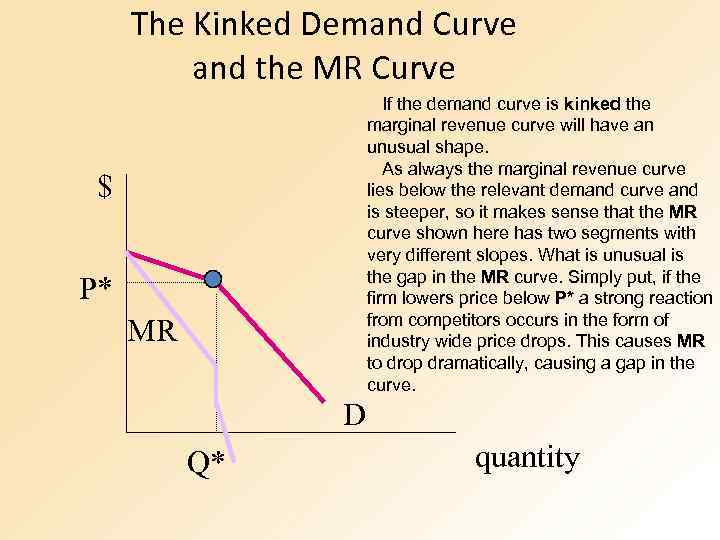

The Kinked Demand Curve and the MR Curve If the demand curve is kinked the marginal revenue curve will have an unusual shape. As always the marginal revenue curve lies below the relevant demand curve and is steeper, so it makes sense that the MR curve shown here has two segments with very different slopes. What is unusual is the gap in the MR curve. Simply put, if the firm lowers price below P* a strong reaction from competitors occurs in the form of industry wide price drops. This causes MR to drop dramatically, causing a gap in the curve. $ P* MR D Q* quantity

The Kinked Demand Curve and the MR Curve If the demand curve is kinked the marginal revenue curve will have an unusual shape. As always the marginal revenue curve lies below the relevant demand curve and is steeper, so it makes sense that the MR curve shown here has two segments with very different slopes. What is unusual is the gap in the MR curve. Simply put, if the firm lowers price below P* a strong reaction from competitors occurs in the form of industry wide price drops. This causes MR to drop dramatically, causing a gap in the curve. $ P* MR D Q* quantity

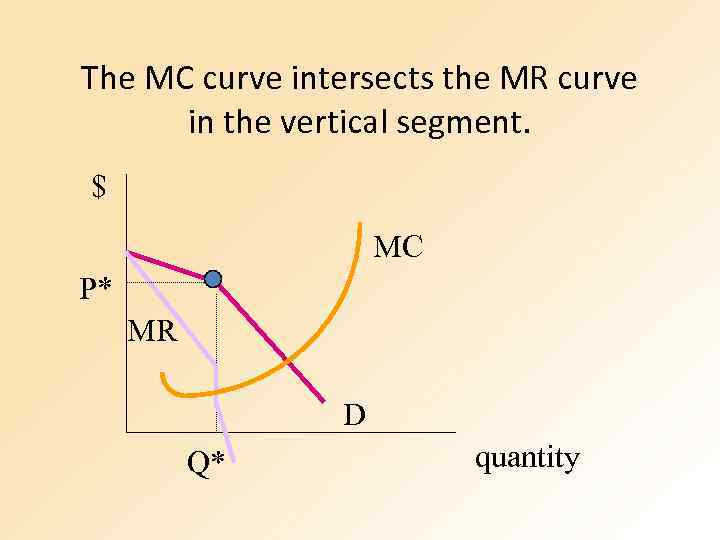

The MC curve intersects the MR curve in the vertical segment. $ MC P* MR D Q* quantity

The MC curve intersects the MR curve in the vertical segment. $ MC P* MR D Q* quantity

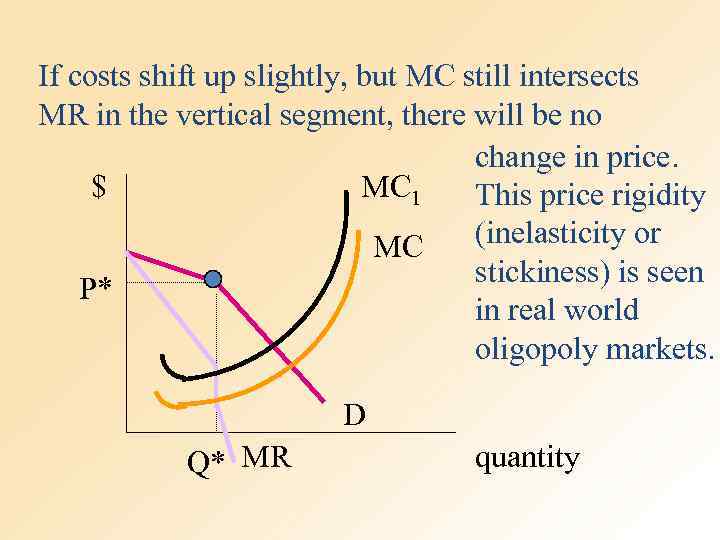

If costs shift up slightly, but MC still intersects MR in the vertical segment, there will be no change in price. $ MC 1 This price rigidity (inelasticity or MC stickiness) is seen P* in real world oligopoly markets. D Q* MR quantity

If costs shift up slightly, but MC still intersects MR in the vertical segment, there will be no change in price. $ MC 1 This price rigidity (inelasticity or MC stickiness) is seen P* in real world oligopoly markets. D Q* MR quantity

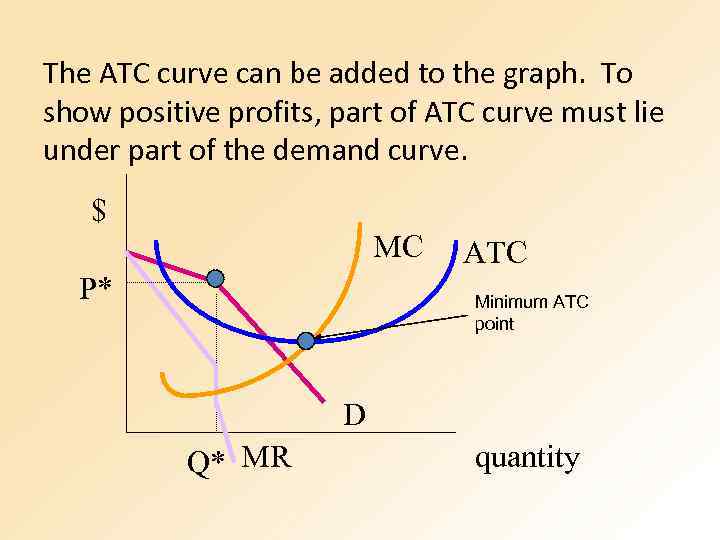

The ATC curve can be added to the graph. To show positive profits, part of ATC curve must lie under part of the demand curve. $ MC P* ATC Minimum ATC point D Q* MR quantity

The ATC curve can be added to the graph. To show positive profits, part of ATC curve must lie under part of the demand curve. $ MC P* ATC Minimum ATC point D Q* MR quantity

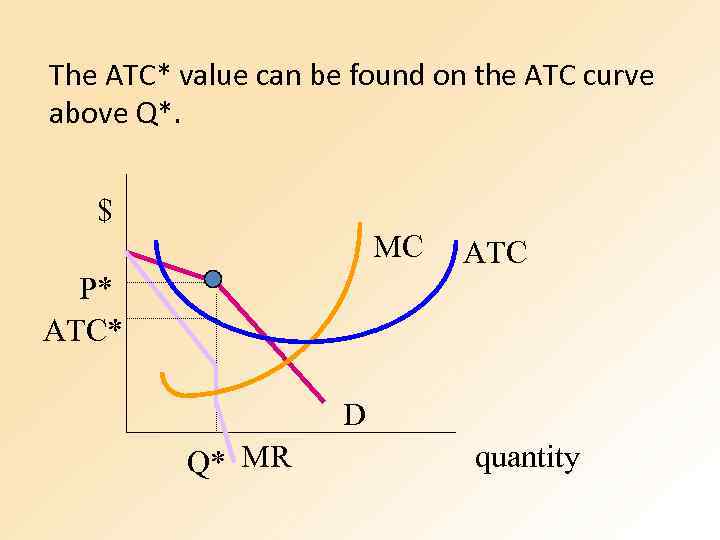

The ATC* value can be found on the ATC curve above Q*. $ MC ATC P* ATC* D Q* MR quantity

The ATC* value can be found on the ATC curve above Q*. $ MC ATC P* ATC* D Q* MR quantity

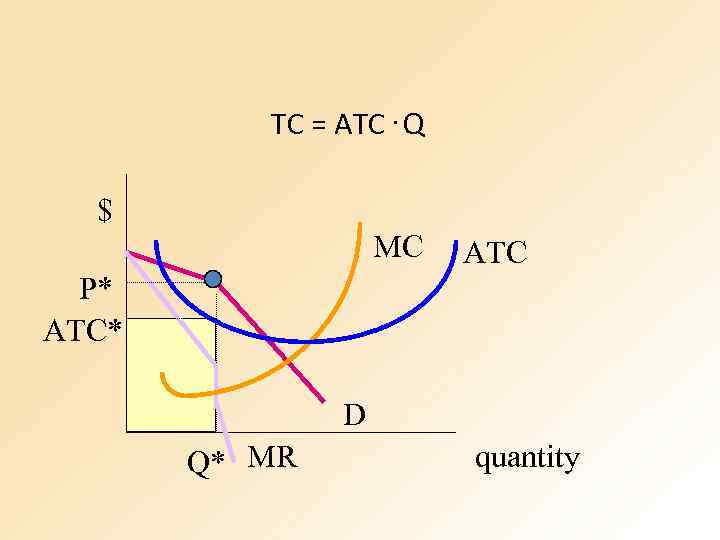

TC = ATC. Q $ MC ATC P* ATC* D Q* MR quantity

TC = ATC. Q $ MC ATC P* ATC* D Q* MR quantity

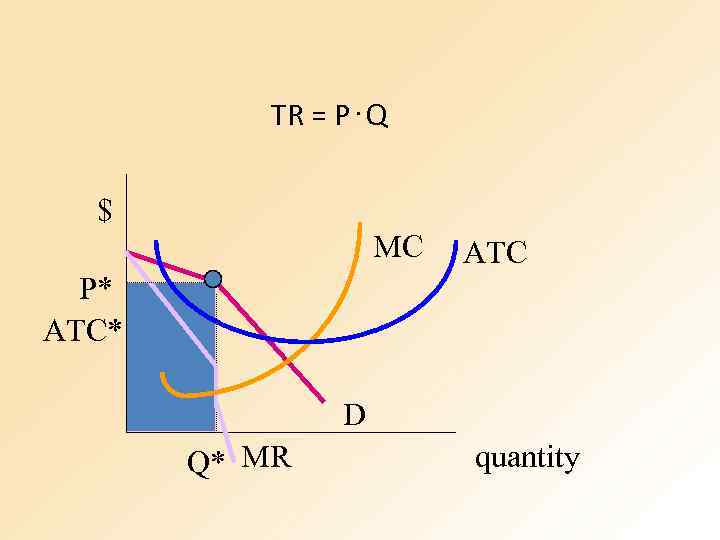

TR = P. Q $ MC ATC P* ATC* D Q* MR quantity

TR = P. Q $ MC ATC P* ATC* D Q* MR quantity

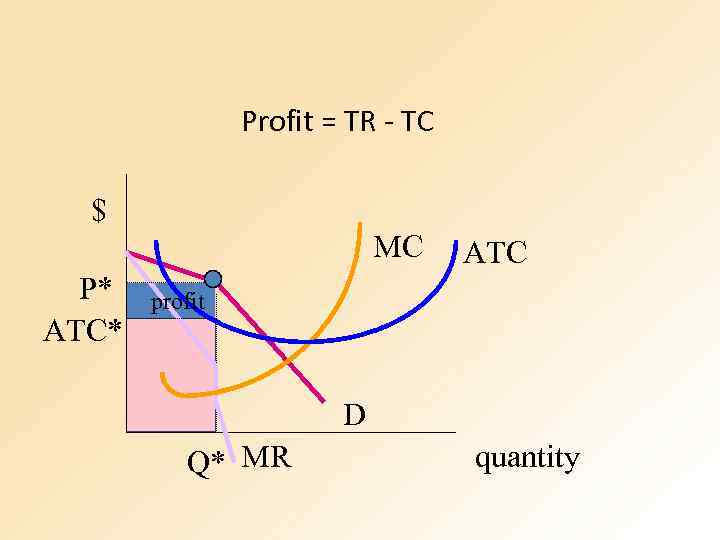

Profit = TR - TC $ MC P* ATC profit D Q* MR quantity

Profit = TR - TC $ MC P* ATC profit D Q* MR quantity

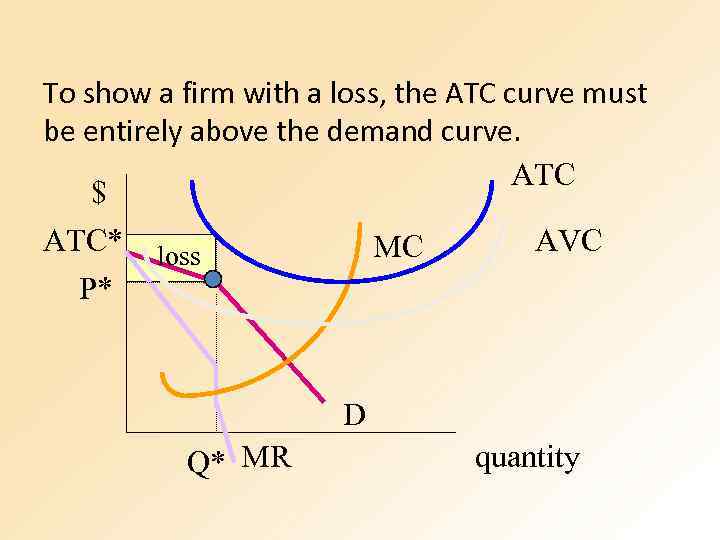

To show a firm with a loss, the ATC curve must be entirely above the demand curve. ATC $ ATC* loss AVC MC P* D Q* MR quantity

To show a firm with a loss, the ATC curve must be entirely above the demand curve. ATC $ ATC* loss AVC MC P* D Q* MR quantity

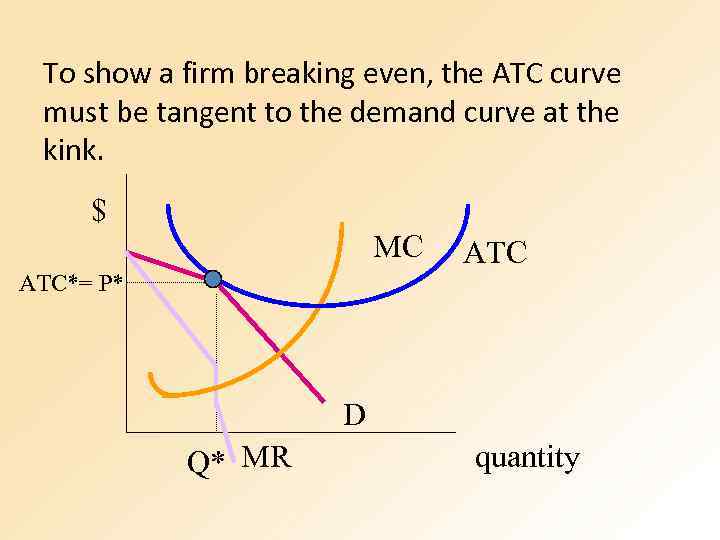

To show a firm breaking even, the ATC curve must be tangent to the demand curve at the kink. $ MC ATC*= P* ATC D Q* MR quantity

To show a firm breaking even, the ATC curve must be tangent to the demand curve at the kink. $ MC ATC*= P* ATC D Q* MR quantity

Profit Possibilities for the Oligopolist short run: positive profits, losses, or breaking even. long run: positive profits, or breaking even.

Profit Possibilities for the Oligopolist short run: positive profits, losses, or breaking even. long run: positive profits, or breaking even.

PUBLIC POLICY TOWARD OLIGOPOLIES Cooperation among oligopolists is undesirable from the standpoint of society as a whole because it leads to production that is too low and prices that are too high.

PUBLIC POLICY TOWARD OLIGOPOLIES Cooperation among oligopolists is undesirable from the standpoint of society as a whole because it leads to production that is too low and prices that are too high.

Three Types of Mergers

Three Types of Mergers

Horizontal Merger the combination under one ownership of the assets of two or more firms engaged in the production of similar products example: two steel manufacturing companies merging

Horizontal Merger the combination under one ownership of the assets of two or more firms engaged in the production of similar products example: two steel manufacturing companies merging

Vertical Merger the creation of a single firm from two firms, one of which was a supplier of the other example: a lumber company and a builder merging

Vertical Merger the creation of a single firm from two firms, one of which was a supplier of the other example: a lumber company and a builder merging

Conglomerate Merger the combining under one ownership of two or more firms that produce unrelated products example: a tire manufacturer and a coffee company merging

Conglomerate Merger the combining under one ownership of two or more firms that produce unrelated products example: a tire manufacturer and a coffee company merging

Obstacles to collusion – Demand cost differences – Number of firms – Cheating – Recession – Potential Entry – Legal Obstacles: Antitrust Law

Obstacles to collusion – Demand cost differences – Number of firms – Cheating – Recession – Potential Entry – Legal Obstacles: Antitrust Law