Lecture 11. Perfect competition.ppt

- Количество слайдов: 75

Lecture 12 Perfect competition

Lecture 12 Perfect competition

Q. How many economists does it take to screw in a light bulb? A. Eight. One to screw it in and seven to hold everything else constant.

Q. How many economists does it take to screw in a light bulb? A. Eight. One to screw it in and seven to hold everything else constant.

Perfect Competition The concept of competition is used in two ways in economics. 1. Competition as a process is a rivalry among firms. 2. Competition as the perfectly competitive market structure.

Perfect Competition The concept of competition is used in two ways in economics. 1. Competition as a process is a rivalry among firms. 2. Competition as the perfectly competitive market structure.

A Perfectly Competitive Market A perfectly competitive market is one in which economic forces operate unimpeded.

A Perfectly Competitive Market A perfectly competitive market is one in which economic forces operate unimpeded.

A Perfectly Competitive Market A perfectly competitive market must meet the following requirements: ØBoth buyers and sellers are price takers. ØThe number of firms is large. ØThere are no barriers to entry. ØThe firms’ products are identical. ØThere is complete information. ØFirms are profit maximizers.

A Perfectly Competitive Market A perfectly competitive market must meet the following requirements: ØBoth buyers and sellers are price takers. ØThe number of firms is large. ØThere are no barriers to entry. ØThe firms’ products are identical. ØThere is complete information. ØFirms are profit maximizers.

The Necessary Conditions for Perfect Competition Both buyers and sellers are price takers. ØA price taker is a firm or individual who takes the market price as given. ØIn most markets, households are price takers – they accept the price offered in stores.

The Necessary Conditions for Perfect Competition Both buyers and sellers are price takers. ØA price taker is a firm or individual who takes the market price as given. ØIn most markets, households are price takers – they accept the price offered in stores.

The Necessary Conditions for Perfect Competition Ø The retailer is not perfectly competitive. Ø A retail store is not a price taker but a price maker. A grocery store near to your house

The Necessary Conditions for Perfect Competition Ø The retailer is not perfectly competitive. Ø A retail store is not a price taker but a price maker. A grocery store near to your house

The Necessary Conditions for Perfect Competition The number of firms is large. ØLarge means that what one firm does - has no bearing on what other firms do. ØAny one firm's output is very small when compared with the total market.

The Necessary Conditions for Perfect Competition The number of firms is large. ØLarge means that what one firm does - has no bearing on what other firms do. ØAny one firm's output is very small when compared with the total market.

The Necessary Conditions for Perfect Competition There are no barriers to entry. – Barriers to entry are social, political, or economic impediments that prevent other firms from entering the market. – Barriers sometimes take the form of patents granted to produce a certain good.

The Necessary Conditions for Perfect Competition There are no barriers to entry. – Barriers to entry are social, political, or economic impediments that prevent other firms from entering the market. – Barriers sometimes take the form of patents granted to produce a certain good.

The Necessary Conditions for Perfect Competition There are no barriers to entry. – Technology may prevent some firms from entering the market. – Social forces such as bankers only lending to certain people may create barriers.

The Necessary Conditions for Perfect Competition There are no barriers to entry. – Technology may prevent some firms from entering the market. – Social forces such as bankers only lending to certain people may create barriers.

The Necessary Conditions for Perfect Competition The firms' products are identical. This requirement means that each firm's output is indistinguishable from any competitor's product.

The Necessary Conditions for Perfect Competition The firms' products are identical. This requirement means that each firm's output is indistinguishable from any competitor's product.

The Necessary Conditions for Perfect Competition There is complete information. – Firms and consumers know all there is to know about the market – prices, products, and available technology. – Any technological breakthrough would be instantly known to all in the market.

The Necessary Conditions for Perfect Competition There is complete information. – Firms and consumers know all there is to know about the market – prices, products, and available technology. – Any technological breakthrough would be instantly known to all in the market.

The Necessary Conditions for Perfect Competition Firms are profit maximizers. – The goal of all firms in a perfectly competitive market is profit and only profit. – The only compensation firm owners receive is profit, not salaries.

The Necessary Conditions for Perfect Competition Firms are profit maximizers. – The goal of all firms in a perfectly competitive market is profit and only profit. – The only compensation firm owners receive is profit, not salaries.

The Definition of Supply and Perfect Competition If all the necessary conditions for perfect competition exist, we can talk formally about the supply of a produced good.

The Definition of Supply and Perfect Competition If all the necessary conditions for perfect competition exist, we can talk formally about the supply of a produced good.

The Definition of Supply and Perfect Competition Supply is a schedule of quantities of goods that will be offered to the market at various prices.

The Definition of Supply and Perfect Competition Supply is a schedule of quantities of goods that will be offered to the market at various prices.

The Definition of Supply and Perfect Competition When a firm operates in a perfectly competitive market, it’s supply curve is that portion of its short-run marginal cost curve above average variable cost.

The Definition of Supply and Perfect Competition When a firm operates in a perfectly competitive market, it’s supply curve is that portion of its short-run marginal cost curve above average variable cost.

Demand Curves for the Firm and the Industry The demand curves facing the firm is different from the industry demand curve. A perfectly competitive firm’s demand schedule is perfectly elastic even though the demand curve for the market is downward sloping. Why?

Demand Curves for the Firm and the Industry The demand curves facing the firm is different from the industry demand curve. A perfectly competitive firm’s demand schedule is perfectly elastic even though the demand curve for the market is downward sloping. Why?

Demand Curves for the Firm and the Industry Individual firms will increase their output in response to an increase in demand even though that will cause the price to fall thus making all firms collectively worse off.

Demand Curves for the Firm and the Industry Individual firms will increase their output in response to an increase in demand even though that will cause the price to fall thus making all firms collectively worse off.

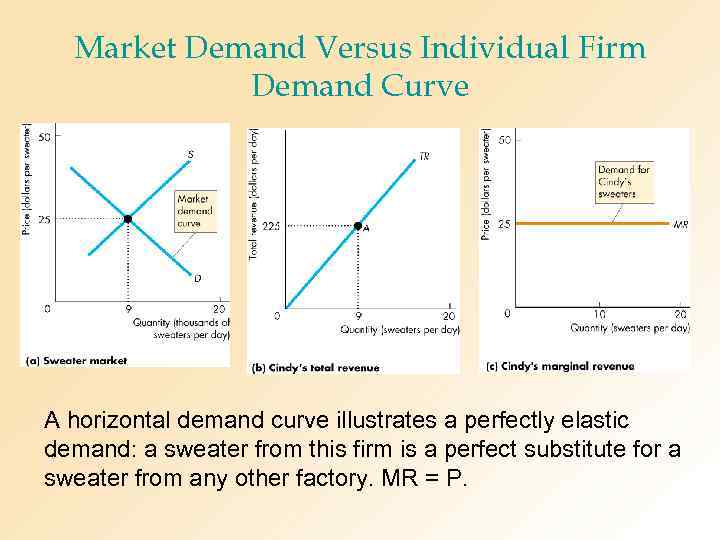

Market Demand Versus Individual Firm Demand Curve A horizontal demand curve illustrates a perfectly elastic demand: a sweater from this firm is a perfect substitute for a sweater from any other factory. MR = P.

Market Demand Versus Individual Firm Demand Curve A horizontal demand curve illustrates a perfectly elastic demand: a sweater from this firm is a perfect substitute for a sweater from any other factory. MR = P.

Profit-Maximizing Level of Output • The goal of the firm is to maximize profits. • Profit is the difference between total revenue and total cost.

Profit-Maximizing Level of Output • The goal of the firm is to maximize profits. • Profit is the difference between total revenue and total cost.

How to Maximize Profit • If marginal revenue does not equal marginal cost, a firm can increase profit by changing output. • The supplier will continue to produce as long as marginal cost is less than marginal revenue. • The supplier will cut back on production if marginal cost is greater than marginal revenue. • Thus, the profit-maximizing condition of a competitive firm is MC = MR = P.

How to Maximize Profit • If marginal revenue does not equal marginal cost, a firm can increase profit by changing output. • The supplier will continue to produce as long as marginal cost is less than marginal revenue. • The supplier will cut back on production if marginal cost is greater than marginal revenue. • Thus, the profit-maximizing condition of a competitive firm is MC = MR = P.

Profit-Maximizing Level of Output • Marginal revenue (MR) – the change in total revenue associated with a change in quantity. • Marginal cost (MC) – the change in total cost associated with a change in quantity.

Profit-Maximizing Level of Output • Marginal revenue (MR) – the change in total revenue associated with a change in quantity. • Marginal cost (MC) – the change in total cost associated with a change in quantity.

Profit-Maximizing Level of Output Marginal revenue (MR) and marginal cost (MC) determine what happens to profit in response to a change in output • A firm maximizes profit when MC = MR.

Profit-Maximizing Level of Output Marginal revenue (MR) and marginal cost (MC) determine what happens to profit in response to a change in output • A firm maximizes profit when MC = MR.

Marginal Revenue • A perfect competitor accepts the market price as given. • As a result, marginal revenue equals price (MR = P).

Marginal Revenue • A perfect competitor accepts the market price as given. • As a result, marginal revenue equals price (MR = P).

Marginal analysis To find a profit maximizing output one can use marginal analysis by comparing MR and MC. If MR > MC, then the revenue from selling one more unite exceeds the cost of producing that unite and an increase in output will increase the profit. If MR< MC …. . an increase in output will decrease the profit. If MR=MC economic profit is maximized and either an increase or decrease in output will decrease economic profit.

Marginal analysis To find a profit maximizing output one can use marginal analysis by comparing MR and MC. If MR > MC, then the revenue from selling one more unite exceeds the cost of producing that unite and an increase in output will increase the profit. If MR< MC …. . an increase in output will decrease the profit. If MR=MC economic profit is maximized and either an increase or decrease in output will decrease economic profit.

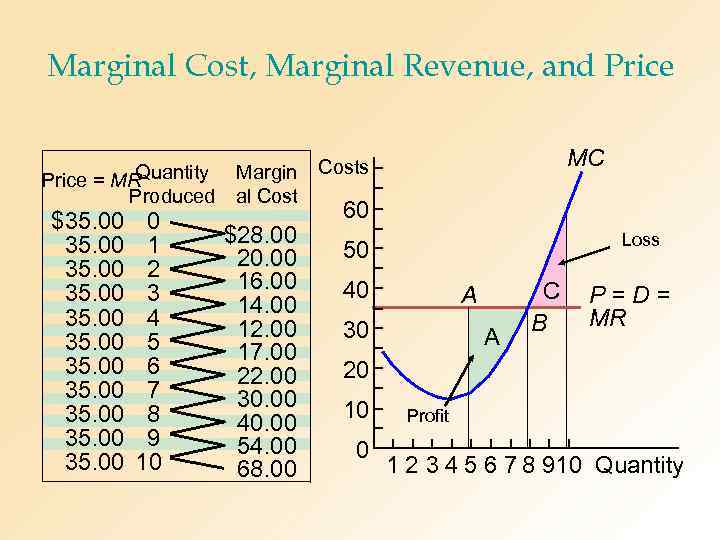

Marginal Cost, Marginal Revenue, and Price Quantity Price = MR Produced $35. 00 35. 00 0 1 2 3 4 5 6 7 8 9 10 Margin al Cost $28. 00 20. 00 16. 00 14. 00 12. 00 17. 00 22. 00 30. 00 40. 00 54. 00 68. 00 MC Costs 60 Loss 50 40 A 30 A C B P=D= MR 20 10 0 Profit 1 2 3 4 5 6 7 8 910 Quantity

Marginal Cost, Marginal Revenue, and Price Quantity Price = MR Produced $35. 00 35. 00 0 1 2 3 4 5 6 7 8 9 10 Margin al Cost $28. 00 20. 00 16. 00 14. 00 12. 00 17. 00 22. 00 30. 00 40. 00 54. 00 68. 00 MC Costs 60 Loss 50 40 A 30 A C B P=D= MR 20 10 0 Profit 1 2 3 4 5 6 7 8 910 Quantity

The Marginal Cost Curve Is the Supply Curve • The MC curve tells the competitive firm how much it should produce at a given price. • The firm can do no better than produce the quantity at which marginal cost equals marginal revenue which in turn equals price.

The Marginal Cost Curve Is the Supply Curve • The MC curve tells the competitive firm how much it should produce at a given price. • The firm can do no better than produce the quantity at which marginal cost equals marginal revenue which in turn equals price.

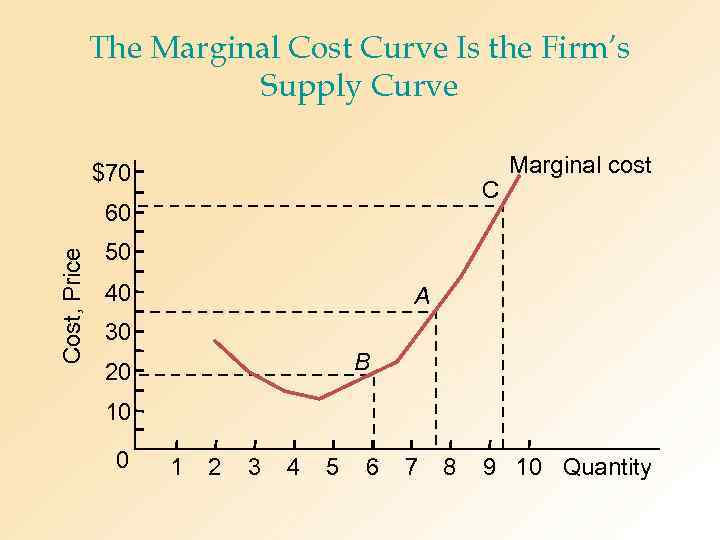

The Marginal Cost Curve Is the Firm’s Supply Curve $70 C Cost, Price 60 Marginal cost 50 40 A 30 B 20 10 0 1 2 3 4 5 6 7 8 9 10 Quantity

The Marginal Cost Curve Is the Firm’s Supply Curve $70 C Cost, Price 60 Marginal cost 50 40 A 30 B 20 10 0 1 2 3 4 5 6 7 8 9 10 Quantity

Firms Maximize Total Profit Firms seek to maximize total profit, not profit per unit. – Firms do not care about profit per unit. – As long as increasing output increases total profits, a profit-maximizing firm should produce more.

Firms Maximize Total Profit Firms seek to maximize total profit, not profit per unit. – Firms do not care about profit per unit. – As long as increasing output increases total profits, a profit-maximizing firm should produce more.

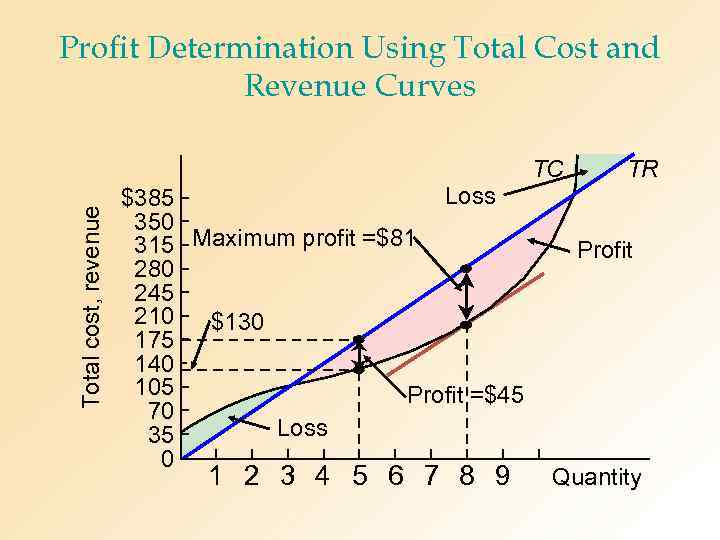

Profit Maximization Using Total Revenue and Total Cost • Profit is maximized where the vertical distance between total revenue and total cost is greatest. • At that output, MR (the slope of the total revenue curve) and MC (the slope of the total cost curve) are equal.

Profit Maximization Using Total Revenue and Total Cost • Profit is maximized where the vertical distance between total revenue and total cost is greatest. • At that output, MR (the slope of the total revenue curve) and MC (the slope of the total cost curve) are equal.

Profit Determination Using Total Cost and Revenue Curves Total cost, revenue TC Loss $385 350 315 Maximum profit =$81 280 245 210 $130 175 140 105 Profit =$45 70 Loss 35 0 1 2 3 4 5 6 7 8 9 TR Profit Quantity

Profit Determination Using Total Cost and Revenue Curves Total cost, revenue TC Loss $385 350 315 Maximum profit =$81 280 245 210 $130 175 140 105 Profit =$45 70 Loss 35 0 1 2 3 4 5 6 7 8 9 TR Profit Quantity

Total Profit at the Profit-Maximizing Level of Output • The P = MR = MC condition tells us how much output a competitive firm should produce to maximize profit. • It does not tell us how much profit the firm makes.

Total Profit at the Profit-Maximizing Level of Output • The P = MR = MC condition tells us how much output a competitive firm should produce to maximize profit. • It does not tell us how much profit the firm makes.

Determining Profit and Loss From a Table of Costs • Profit can be calculated from a table of costs and revenues. • Profit is determined by total revenue minus total cost.

Determining Profit and Loss From a Table of Costs • Profit can be calculated from a table of costs and revenues. • Profit is determined by total revenue minus total cost.

Costs Relevant to a Firm

Costs Relevant to a Firm

Costs Relevant to a Firm

Costs Relevant to a Firm

Determining Profit and Loss From a Graph Find output where MC = MR. The intersection of MC = MR (P) determines the quantity the firm will produce if it wishes to maximize profits.

Determining Profit and Loss From a Graph Find output where MC = MR. The intersection of MC = MR (P) determines the quantity the firm will produce if it wishes to maximize profits.

Determining Profit and Loss From a Graph Find profit per unit where MC = MR. – Drop a line down from where MC equals MR, and then to the ATC curve. – This is the profit per unit. – Extend a line back to the vertical axis to identify total profit.

Determining Profit and Loss From a Graph Find profit per unit where MC = MR. – Drop a line down from where MC equals MR, and then to the ATC curve. – This is the profit per unit. – Extend a line back to the vertical axis to identify total profit.

Determining Profit and Loss From a Graph • The firm makes a profit when the ATC curve is below the MR curve. • The firm incurs a loss when the ATC curve is above the MR curve.

Determining Profit and Loss From a Graph • The firm makes a profit when the ATC curve is below the MR curve. • The firm incurs a loss when the ATC curve is above the MR curve.

Determining Profit and Loss From a Graph Zero profit or loss where MC=MR and the ATC curve intersects this point. Even though economic profit is zero, all resources, including entrepreneurs, are being paid their opportunity costs.

Determining Profit and Loss From a Graph Zero profit or loss where MC=MR and the ATC curve intersects this point. Even though economic profit is zero, all resources, including entrepreneurs, are being paid their opportunity costs.

Determining Profits Graphically MC MC MC Price 65 65 65 60 60 60 55 55 55 ATC 50 50 50 ATC 45 45 45 40 40 D A P = MR 40 Loss P = MR 35 35 35 P = MR 30 30 30 Profit B ATC AVC 25 25 C 25 AVC E 20 20 20 15 15 15 10 10 10 5 5 5 0 0 0 1 2 3 4 56 7 8 910 12 1 2 3 4 5 6 7 8 91012 Quantity (b) Zero profit case a) Profit case (c) Loss case

Determining Profits Graphically MC MC MC Price 65 65 65 60 60 60 55 55 55 ATC 50 50 50 ATC 45 45 45 40 40 D A P = MR 40 Loss P = MR 35 35 35 P = MR 30 30 30 Profit B ATC AVC 25 25 C 25 AVC E 20 20 20 15 15 15 10 10 10 5 5 5 0 0 0 1 2 3 4 56 7 8 910 12 1 2 3 4 5 6 7 8 91012 Quantity (b) Zero profit case a) Profit case (c) Loss case

The Shutdown Point The firm will shut down if it cannot cover average variable costs. – A firm should continue to produce as long as price is greater than average variable cost. – If price falls below that point it makes sense to shut down temporarily and save the variable costs.

The Shutdown Point The firm will shut down if it cannot cover average variable costs. – A firm should continue to produce as long as price is greater than average variable cost. – If price falls below that point it makes sense to shut down temporarily and save the variable costs.

The Shutdown Point The shutdown point is the point at which the firm will be better off if it shuts down than it will if it stays in business.

The Shutdown Point The shutdown point is the point at which the firm will be better off if it shuts down than it will if it stays in business.

The Shutdown Point • If total revenue is more than total variable cost, the firm’s best strategy is to temporarily produce at a loss. • It is taking less of a loss than it would by shutting down.

The Shutdown Point • If total revenue is more than total variable cost, the firm’s best strategy is to temporarily produce at a loss. • It is taking less of a loss than it would by shutting down.

The Shutdown Decision MC Price 60 ATC 50 40 Loss P = MR 30 AVC 20 $17. 80 A 10 0 2 4 6 8 Quantity

The Shutdown Decision MC Price 60 ATC 50 40 Loss P = MR 30 AVC 20 $17. 80 A 10 0 2 4 6 8 Quantity

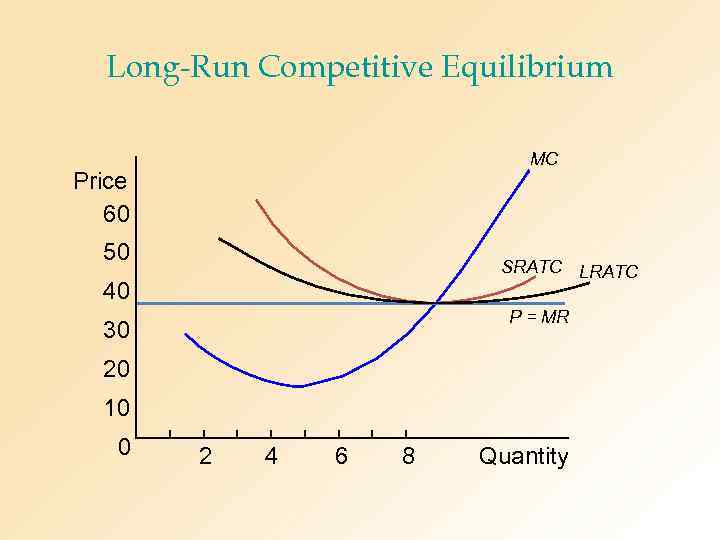

Long-Run Competitive Equilibrium Profits and losses are inconsistent with long-run equilibrium. – Profits create incentives for new firms to enter, output will increase, and the price will fall until zero profits are made. – The existence of losses will cause firms to leave the industry.

Long-Run Competitive Equilibrium Profits and losses are inconsistent with long-run equilibrium. – Profits create incentives for new firms to enter, output will increase, and the price will fall until zero profits are made. – The existence of losses will cause firms to leave the industry.

Long-Run Competitive Equilibrium • Only at zero profit will entry and exit stop. • The zero profit condition defines the long-run equilibrium of a competitive industry.

Long-Run Competitive Equilibrium • Only at zero profit will entry and exit stop. • The zero profit condition defines the long-run equilibrium of a competitive industry.

Long-Run Competitive Equilibrium MC Price 60 50 SRATC LRATC 40 P = MR 30 20 10 0 2 4 6 8 Quantity

Long-Run Competitive Equilibrium MC Price 60 50 SRATC LRATC 40 P = MR 30 20 10 0 2 4 6 8 Quantity

Long-Run Competitive Equilibrium The zero profit condition makes the analysis of competitive markets applicable to the real world. To determine whether markets are competitive, many economist focus on whether barriers to entry exist.

Long-Run Competitive Equilibrium The zero profit condition makes the analysis of competitive markets applicable to the real world. To determine whether markets are competitive, many economist focus on whether barriers to entry exist.

An Increase in Demand An increase in demand leads to higher prices and higher profits. – Existing firms increase output. – New firms enter the market, increasing output still more. – Price falls until all profit is competed away.

An Increase in Demand An increase in demand leads to higher prices and higher profits. – Existing firms increase output. – New firms enter the market, increasing output still more. – Price falls until all profit is competed away.

An Increase in Demand If input prices remain constant, the new equilibrium will be at the original price but with a higher output. The original firms return to their original output but since there are more firms in the market, the total market output increases.

An Increase in Demand If input prices remain constant, the new equilibrium will be at the original price but with a higher output. The original firms return to their original output but since there are more firms in the market, the total market output increases.

Market Response to an Increase in Demand Market Price Firm S 0 SR $9 7 C A D 0 0 AC S 1 SR B SLR MC $9 Profit 7 B A D 1 1, 200 Quantity 700 840 0 10 Quantity 12

Market Response to an Increase in Demand Market Price Firm S 0 SR $9 7 C A D 0 0 AC S 1 SR B SLR MC $9 Profit 7 B A D 1 1, 200 Quantity 700 840 0 10 Quantity 12

Long-Run Market Supply Two other possibilities exist: – Increasing-cost industry – factor prices rise as new firms enter the market and existing firms expand capacity. – Decreasing-cost industry – factor prices fall as industry output expands.

Long-Run Market Supply Two other possibilities exist: – Increasing-cost industry – factor prices rise as new firms enter the market and existing firms expand capacity. – Decreasing-cost industry – factor prices fall as industry output expands.

An Increasing-Cost Industry If inputs are specialized, factor prices are likely to rise when the increase in the industry-wide demand for inputs to production increases. This rise in factor costs would force costs up for each firm in the industry and increases the price at which firms earn zero profit. Therefore, in increasing-cost industries, the long-run supply curve is upward sloping.

An Increasing-Cost Industry If inputs are specialized, factor prices are likely to rise when the increase in the industry-wide demand for inputs to production increases. This rise in factor costs would force costs up for each firm in the industry and increases the price at which firms earn zero profit. Therefore, in increasing-cost industries, the long-run supply curve is upward sloping.

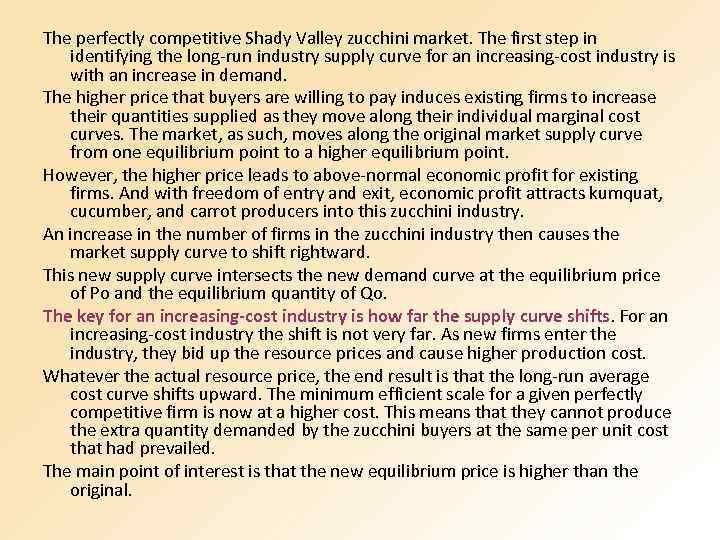

The perfectly competitive Shady Valley zucchini market. The first step in identifying the long-run industry supply curve for an increasing-cost industry is with an increase in demand. The higher price that buyers are willing to pay induces existing firms to increase their quantities supplied as they move along their individual marginal cost curves. The market, as such, moves along the original market supply curve from one equilibrium point to a higher equilibrium point. However, the higher price leads to above-normal economic profit for existing firms. And with freedom of entry and exit, economic profit attracts kumquat, cucumber, and carrot producers into this zucchini industry. An increase in the number of firms in the zucchini industry then causes the market supply curve to shift rightward. This new supply curve intersects the new demand curve at the equilibrium price of Po and the equilibrium quantity of Qo. The key for an increasing-cost industry is how far the supply curve shifts. For an increasing-cost industry the shift is not very far. As new firms enter the industry, they bid up the resource prices and cause higher production cost. Whatever the actual resource price, the end result is that the long-run average cost curve shifts upward. The minimum efficient scale for a given perfectly competitive firm is now at a higher cost. This means that they cannot produce the extra quantity demanded by the zucchini buyers at the same per unit cost that had prevailed. The main point of interest is that the new equilibrium price is higher than the original.

The perfectly competitive Shady Valley zucchini market. The first step in identifying the long-run industry supply curve for an increasing-cost industry is with an increase in demand. The higher price that buyers are willing to pay induces existing firms to increase their quantities supplied as they move along their individual marginal cost curves. The market, as such, moves along the original market supply curve from one equilibrium point to a higher equilibrium point. However, the higher price leads to above-normal economic profit for existing firms. And with freedom of entry and exit, economic profit attracts kumquat, cucumber, and carrot producers into this zucchini industry. An increase in the number of firms in the zucchini industry then causes the market supply curve to shift rightward. This new supply curve intersects the new demand curve at the equilibrium price of Po and the equilibrium quantity of Qo. The key for an increasing-cost industry is how far the supply curve shifts. For an increasing-cost industry the shift is not very far. As new firms enter the industry, they bid up the resource prices and cause higher production cost. Whatever the actual resource price, the end result is that the long-run average cost curve shifts upward. The minimum efficient scale for a given perfectly competitive firm is now at a higher cost. This means that they cannot produce the extra quantity demanded by the zucchini buyers at the same per unit cost that had prevailed. The main point of interest is that the new equilibrium price is higher than the original.

P S S 1 Pe Po LRC Pe D 1 D Qe Qe Qo Q

P S S 1 Pe Po LRC Pe D 1 D Qe Qe Qo Q

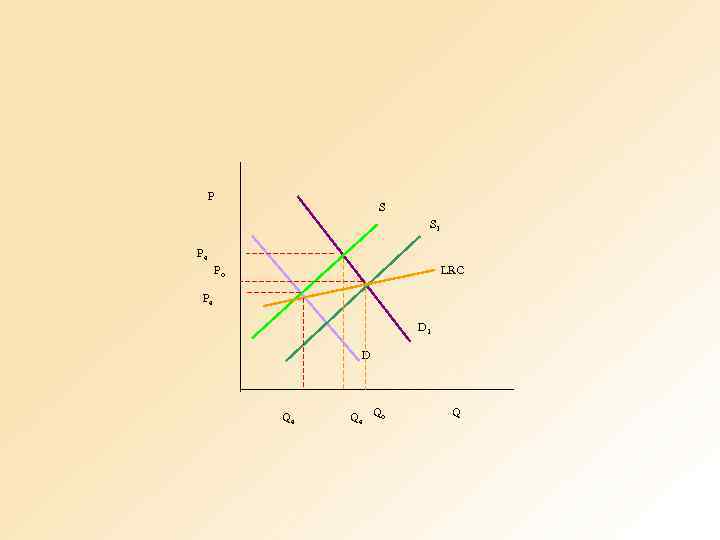

A Decreasing-Cost Industry If input prices decline when industry output expands, individual firms' marginal cost curves shift down and the long-run supply curve is downward sloping.

A Decreasing-Cost Industry If input prices decline when industry output expands, individual firms' marginal cost curves shift down and the long-run supply curve is downward sloping.

Possible explanations for decreasing costs High fixed costs For many industries, a large fraction of the costs may be fixed costs, which do no escalate with increasing production. This may be the case for knowledge goods such as commercial software and books, but it may also be the case for knowledgeintensive goods where investments in production techniques, tools and know-how is a large cost component. Large investments in technology In some cases, an increase in demand means more capital that allows for greater investments in technological progress that helps bring down the cost of production. Note that in this case, there is a timedependence: while an initial increase in demand leads to more investment that leads to lower costs of production, a subsequent reduction in demand may not lead to the costs reverting to earlier levels. Greater competition In some cases, a larger market to be served may cause a larger number of competing firms to enter the market, lowering costs due to competition.

Possible explanations for decreasing costs High fixed costs For many industries, a large fraction of the costs may be fixed costs, which do no escalate with increasing production. This may be the case for knowledge goods such as commercial software and books, but it may also be the case for knowledgeintensive goods where investments in production techniques, tools and know-how is a large cost component. Large investments in technology In some cases, an increase in demand means more capital that allows for greater investments in technological progress that helps bring down the cost of production. Note that in this case, there is a timedependence: while an initial increase in demand leads to more investment that leads to lower costs of production, a subsequent reduction in demand may not lead to the costs reverting to earlier levels. Greater competition In some cases, a larger market to be served may cause a larger number of competing firms to enter the market, lowering costs due to competition.

Which of the following is NOT an assumption of perfectly competitive markets? A) many buyers and many sellers B) no restriction on entry C) complete information about prices D) new entrants have higher costs

Which of the following is NOT an assumption of perfectly competitive markets? A) many buyers and many sellers B) no restriction on entry C) complete information about prices D) new entrants have higher costs

When a firm is considered to be a "price taker" that means that the firm A) can charge any price that it wants to charge, that is, "take" any price it wants. B) pays a fixed price for all of its inputs. C) will accept ("take") the lowest price that its customers offer. D) cannot influence the market price of the good that it sells.

When a firm is considered to be a "price taker" that means that the firm A) can charge any price that it wants to charge, that is, "take" any price it wants. B) pays a fixed price for all of its inputs. C) will accept ("take") the lowest price that its customers offer. D) cannot influence the market price of the good that it sells.

In perfect competition, the elasticity of demand for the product of a single firm is A) 0. B) between 0 and 1. C) 1. D) infinite.

In perfect competition, the elasticity of demand for the product of a single firm is A) 0. B) between 0 and 1. C) 1. D) infinite.

Quantit y sold Price 5 $15 6 $15 7 $15 In the above table, if the firm sells 5 units of output, its total revenue is A) $15. B) $30. C) $75. D) $90.

Quantit y sold Price 5 $15 6 $15 7 $15 In the above table, if the firm sells 5 units of output, its total revenue is A) $15. B) $30. C) $75. D) $90.

• In perfect competition, at al levels of output the market price is the same as the firm's ____. • A) marginal revenue • B) normal profit • C) average variable cost • D) fixed cost

• In perfect competition, at al levels of output the market price is the same as the firm's ____. • A) marginal revenue • B) normal profit • C) average variable cost • D) fixed cost

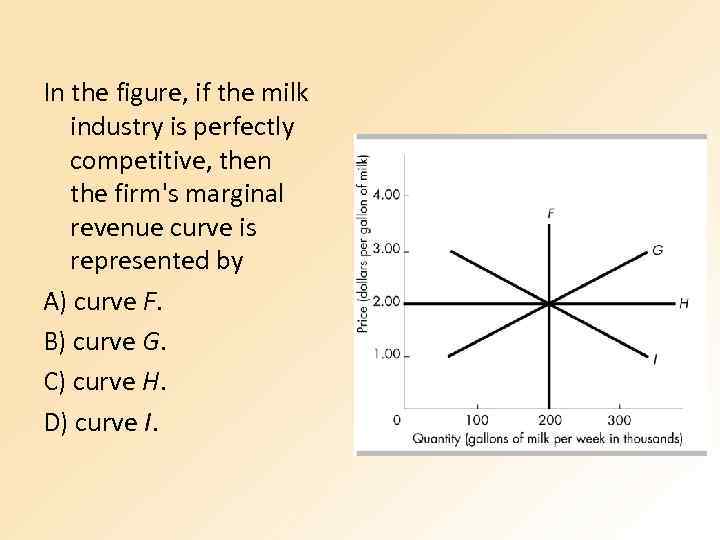

In the figure, if the milk industry is perfectly competitive, then the firm's marginal revenue curve is represented by A) curve F. B) curve G. C) curve H. D) curve I.

In the figure, if the milk industry is perfectly competitive, then the firm's marginal revenue curve is represented by A) curve F. B) curve G. C) curve H. D) curve I.

A perfectly competitive firm that is producing a positive quantity of a good maximizes its economic profit if it produces so that A) total revenue = total cost. B) marginal revenue = marginal cost. C) average revenue = average total cost. D) average total cost = average variable cost.

A perfectly competitive firm that is producing a positive quantity of a good maximizes its economic profit if it produces so that A) total revenue = total cost. B) marginal revenue = marginal cost. C) average revenue = average total cost. D) average total cost = average variable cost.

Charlie's Chimps is a perfectly competitive firm that produces cuddly chimps for children. The market price of a chimp is $10, and Charlie's produces 100 chimps at a marginal cost of $9 a chimp. Charlie's ____. A) is maximizing its profit B) will maximize its profit if it produces more than 100 chimps C) will maximize its profit if it lowers the price to $9 a chimp D) will maximize its profit if it produces fewer than 100 chimps

Charlie's Chimps is a perfectly competitive firm that produces cuddly chimps for children. The market price of a chimp is $10, and Charlie's produces 100 chimps at a marginal cost of $9 a chimp. Charlie's ____. A) is maximizing its profit B) will maximize its profit if it produces more than 100 chimps C) will maximize its profit if it lowers the price to $9 a chimp D) will maximize its profit if it produces fewer than 100 chimps

In the above figure, by increasing its output from Q 1 to Q 2, the firm A) reduces its marginal revenue. B) increases its marginal revenue. C) decreases its profit. D) increases its profit.

In the above figure, by increasing its output from Q 1 to Q 2, the firm A) reduces its marginal revenue. B) increases its marginal revenue. C) decreases its profit. D) increases its profit.

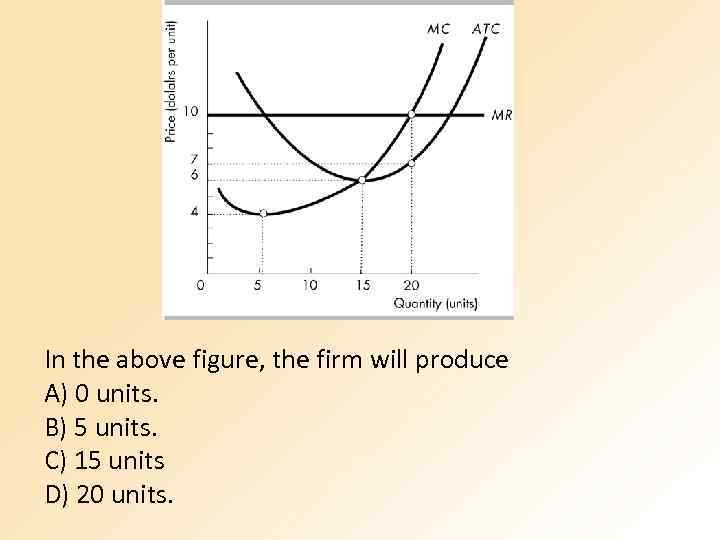

In the above figure, the firm will produce A) 0 units. B) 5 units. C) 15 units D) 20 units.

In the above figure, the firm will produce A) 0 units. B) 5 units. C) 15 units D) 20 units.

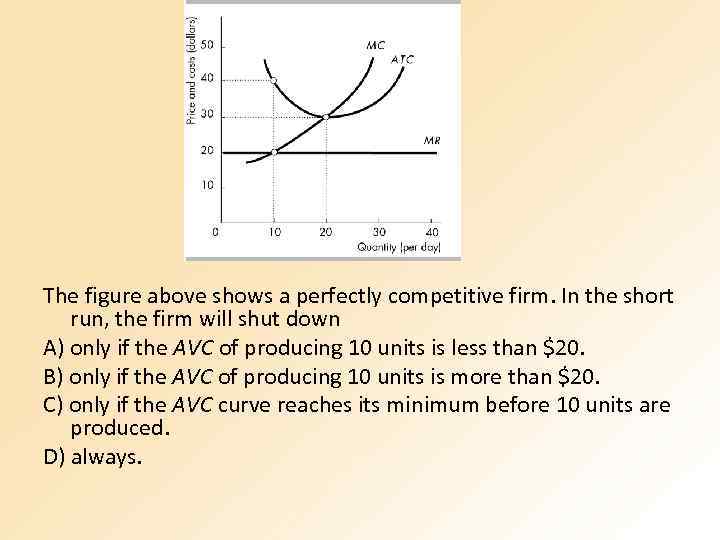

The figure above shows a perfectly competitive firm. In the short run, the firm will shut down A) only if the AVC of producing 10 units is less than $20. B) only if the AVC of producing 10 units is more than $20. C) only if the AVC curve reaches its minimum before 10 units are produced. D) always.

The figure above shows a perfectly competitive firm. In the short run, the firm will shut down A) only if the AVC of producing 10 units is less than $20. B) only if the AVC of producing 10 units is more than $20. C) only if the AVC curve reaches its minimum before 10 units are produced. D) always.

Problem 1 Pat’s Pizza Kitchen is a price taker. Its costs are in the table. Calculate Pat’s profit-maximizing output and economic profit if the market price is (i) $14 a pizza. (ii) $12 a pizza. (iii) $10 a pizza. What is Pat’s shutdown point and what is Pat’s economic profit if it shuts down temporarily? Derive Pat’s supply curve. Output (pizzas per hour) Total cost (dollars per hour) 0 10 1 21 2 30 3 41 4 54 5 69

Problem 1 Pat’s Pizza Kitchen is a price taker. Its costs are in the table. Calculate Pat’s profit-maximizing output and economic profit if the market price is (i) $14 a pizza. (ii) $12 a pizza. (iii) $10 a pizza. What is Pat’s shutdown point and what is Pat’s economic profit if it shuts down temporarily? Derive Pat’s supply curve. Output (pizzas per hour) Total cost (dollars per hour) 0 10 1 21 2 30 3 41 4 54 5 69

MR=P output min AVC = 10 = P=10 – shut down point TC P 1 P 2 P 3 TR 1 TR 2 TR 3 MC MR 1 MR 2 MR 3 TVC 0 10 14 12 10 0 1 20 14 12 10 10 2 30 14 12 10 28 24 20 10 14 12 10 3 41 14 12 10 42 36 30 11 14 12 4 54 14 12 10 56 48 40 13 14 5 69 14 12 10 70 60 50 15 14 AVC pr 1 pr 2 pr 3 -10 -10 10. 0 -6 -8 -10 20 10. 0 -2 -6 -10 15. 0 10 31 10. 3 1 -5 -11 13. 7 12 10 44 11. 0 2 -6 -14 13. 5 12 10 59 11. 8 1 -9 -19 13. 8 0 ATC

MR=P output min AVC = 10 = P=10 – shut down point TC P 1 P 2 P 3 TR 1 TR 2 TR 3 MC MR 1 MR 2 MR 3 TVC 0 10 14 12 10 0 1 20 14 12 10 10 2 30 14 12 10 28 24 20 10 14 12 10 3 41 14 12 10 42 36 30 11 14 12 4 54 14 12 10 56 48 40 13 14 5 69 14 12 10 70 60 50 15 14 AVC pr 1 pr 2 pr 3 -10 -10 10. 0 -6 -8 -10 20 10. 0 -2 -6 -10 15. 0 10 31 10. 3 1 -5 -11 13. 7 12 10 44 11. 0 2 -6 -14 13. 5 12 10 59 11. 8 1 -9 -19 13. 8 0 ATC

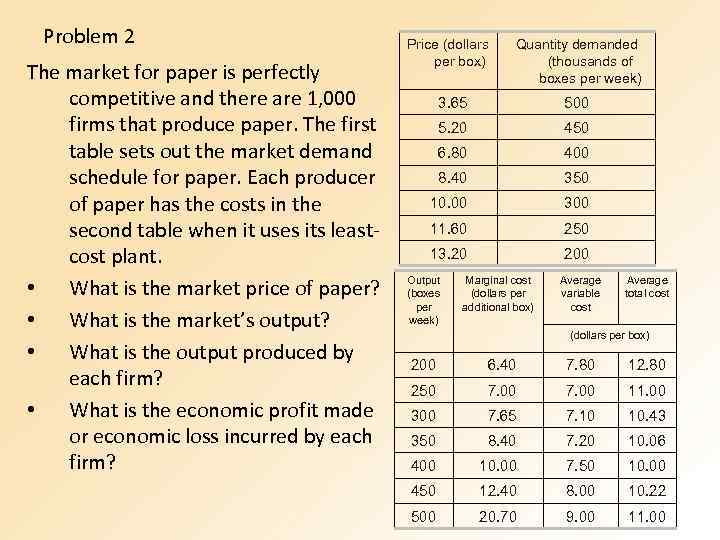

Problem 2 The market for paper is perfectly competitive and there are 1, 000 firms that produce paper. The first table sets out the market demand schedule for paper. Each producer of paper has the costs in the second table when it uses its leastcost plant. • What is the market price of paper? • What is the market’s output? • What is the output produced by each firm? • What is the economic profit made or economic loss incurred by each firm? Price (dollars per box) Quantity demanded (thousands of boxes per week) 3. 65 500 5. 20 450 6. 80 400 8. 40 350 10. 00 300 11. 60 250 13. 20 200 Output (boxes per week) Marginal cost (dollars per additional box) Average variable cost Average total cost (dollars per box) 200 6. 40 7. 80 12. 80 250 7. 00 11. 00 300 7. 65 7. 10 10. 43 350 8. 40 7. 20 10. 06 400 10. 00 7. 50 10. 00 450 12. 40 8. 00 10. 22 500 20. 70 9. 00 11. 00

Problem 2 The market for paper is perfectly competitive and there are 1, 000 firms that produce paper. The first table sets out the market demand schedule for paper. Each producer of paper has the costs in the second table when it uses its leastcost plant. • What is the market price of paper? • What is the market’s output? • What is the output produced by each firm? • What is the economic profit made or economic loss incurred by each firm? Price (dollars per box) Quantity demanded (thousands of boxes per week) 3. 65 500 5. 20 450 6. 80 400 8. 40 350 10. 00 300 11. 60 250 13. 20 200 Output (boxes per week) Marginal cost (dollars per additional box) Average variable cost Average total cost (dollars per box) 200 6. 40 7. 80 12. 80 250 7. 00 11. 00 300 7. 65 7. 10 10. 43 350 8. 40 7. 20 10. 06 400 10. 00 7. 50 10. 00 450 12. 40 8. 00 10. 22 500 20. 70 9. 00 11. 00

Problem 3 As more and more computer users read documents online rather than print them, the market demand for paper decreases and in the short run the demand schedule becomes the schedule shown in the table. If each firm producing paper has the costs set out in a table, what is the market price and the economic profit or loss of each firm in the short run? Price (dollars per box) Quantity demanded (thousands of boxes per week) 2. 95 500 4. 13 450 5. 30 400 6. 48 350 7. 65 300 8. 83 250 10. 00 200 11. 18 150 Output (boxes per week) Marginal cost (dollars per additional box) Average variable cost Average total cost (dollars per box) 200 6. 40 7. 80 12. 80 250 7. 00 11. 00 300 7. 65 7. 10 10. 43 350 8. 40 7. 20 10. 06 400 10. 00 7. 50 10. 00 450 12. 40 8. 00 10. 22 500 20. 70 9. 00 11. 00

Problem 3 As more and more computer users read documents online rather than print them, the market demand for paper decreases and in the short run the demand schedule becomes the schedule shown in the table. If each firm producing paper has the costs set out in a table, what is the market price and the economic profit or loss of each firm in the short run? Price (dollars per box) Quantity demanded (thousands of boxes per week) 2. 95 500 4. 13 450 5. 30 400 6. 48 350 7. 65 300 8. 83 250 10. 00 200 11. 18 150 Output (boxes per week) Marginal cost (dollars per additional box) Average variable cost Average total cost (dollars per box) 200 6. 40 7. 80 12. 80 250 7. 00 11. 00 300 7. 65 7. 10 10. 43 350 8. 40 7. 20 10. 06 400 10. 00 7. 50 10. 00 450 12. 40 8. 00 10. 22 500 20. 70 9. 00 11. 00

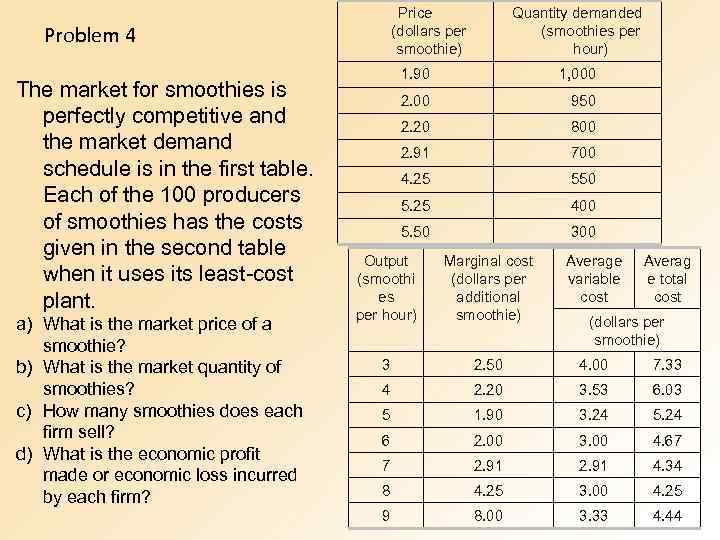

Price (dollars per smoothie) Problem 4 The market for smoothies is perfectly competitive and the market demand schedule is in the first table. Each of the 100 producers of smoothies has the costs given in the second table when it uses its least-cost plant. a) What is the market price of a smoothie? b) What is the market quantity of smoothies? c) How many smoothies does each firm sell? d) What is the economic profit made or economic loss incurred by each firm? Quantity demanded (smoothies per hour) 1. 90 1, 000 2. 00 950 2. 20 800 2. 91 700 4. 25 550 5. 25 400 5. 50 300 Output (smoothi es per hour) Marginal cost (dollars per additional smoothie) Average variable cost Averag e total cost 3 2. 50 4. 00 7. 33 4 2. 20 3. 53 6. 03 5 1. 90 3. 24 5. 24 6 2. 00 3. 00 4. 67 7 2. 91 4. 34 8 4. 25 3. 00 4. 25 9 8. 00 3. 33 4. 44 (dollars per smoothie)

Price (dollars per smoothie) Problem 4 The market for smoothies is perfectly competitive and the market demand schedule is in the first table. Each of the 100 producers of smoothies has the costs given in the second table when it uses its least-cost plant. a) What is the market price of a smoothie? b) What is the market quantity of smoothies? c) How many smoothies does each firm sell? d) What is the economic profit made or economic loss incurred by each firm? Quantity demanded (smoothies per hour) 1. 90 1, 000 2. 00 950 2. 20 800 2. 91 700 4. 25 550 5. 25 400 5. 50 300 Output (smoothi es per hour) Marginal cost (dollars per additional smoothie) Average variable cost Averag e total cost 3 2. 50 4. 00 7. 33 4 2. 20 3. 53 6. 03 5 1. 90 3. 24 5. 24 6 2. 00 3. 00 4. 67 7 2. 91 4. 34 8 4. 25 3. 00 4. 25 9 8. 00 3. 33 4. 44 (dollars per smoothie)

Problem 5 Figure shows the costs of Quick Copy, one of many copy shops near campus. If the market price of copying is 10¢ a page, calculate Quick Copy’s 1. Profit-maximizing output. 2. Economic profit.

Problem 5 Figure shows the costs of Quick Copy, one of many copy shops near campus. If the market price of copying is 10¢ a page, calculate Quick Copy’s 1. Profit-maximizing output. 2. Economic profit.

Problem 6 Grain prices have fallen roughly 50 percent from earlier this year. With better-than-expected crop yields, world grain production this year will rise nearly 5 percent from 2007 to a record high. Why did grain prices fall in 2008? Draw a graph to show that short-run effect on an individual farmer’s economic profit.

Problem 6 Grain prices have fallen roughly 50 percent from earlier this year. With better-than-expected crop yields, world grain production this year will rise nearly 5 percent from 2007 to a record high. Why did grain prices fall in 2008? Draw a graph to show that short-run effect on an individual farmer’s economic profit.