ffe49c4a4bf1b23d670421f8ce07b76d.ppt

- Количество слайдов: 165

Lecture 11 Capital Budgeting

Lecture Review

Capital Budgeting

Capital Budgeting

Methods for Capital Budgeting

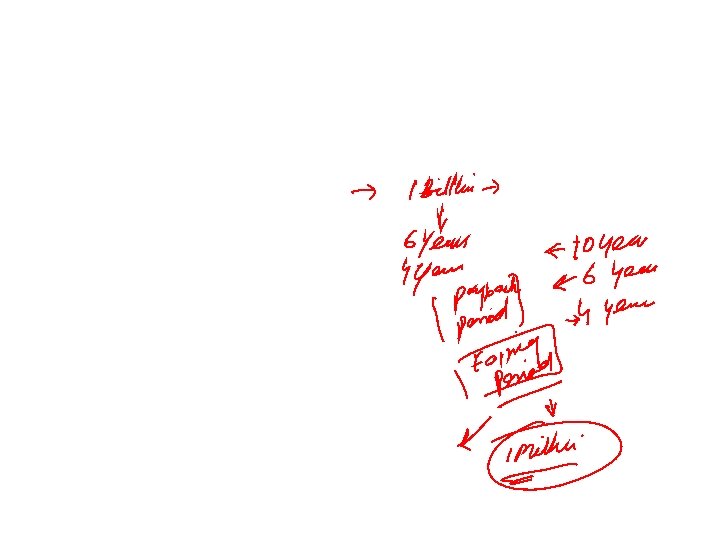

NET Present Value (NPV)

Multinational Capital Budgeting

Lecture Review

Lecture 12

Lecture Review

Lecture Review

Lecture Review

Multinational Restructuring

Chapter Objectives

Multinational Restructuring

Online Application

International Acquisitions

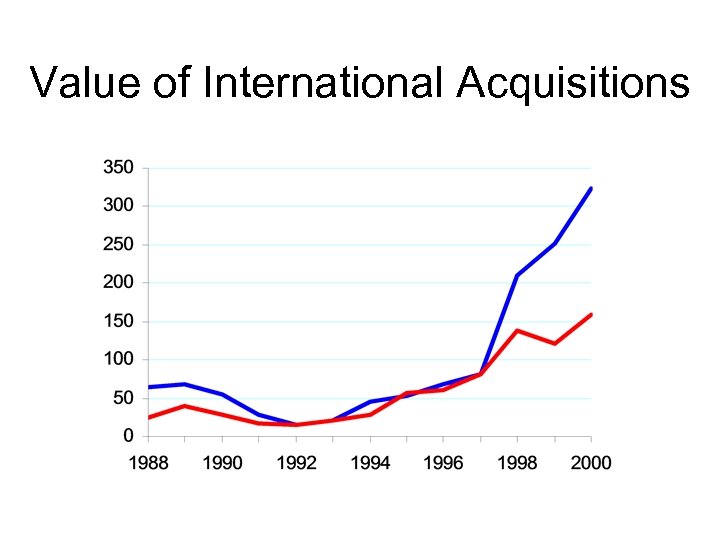

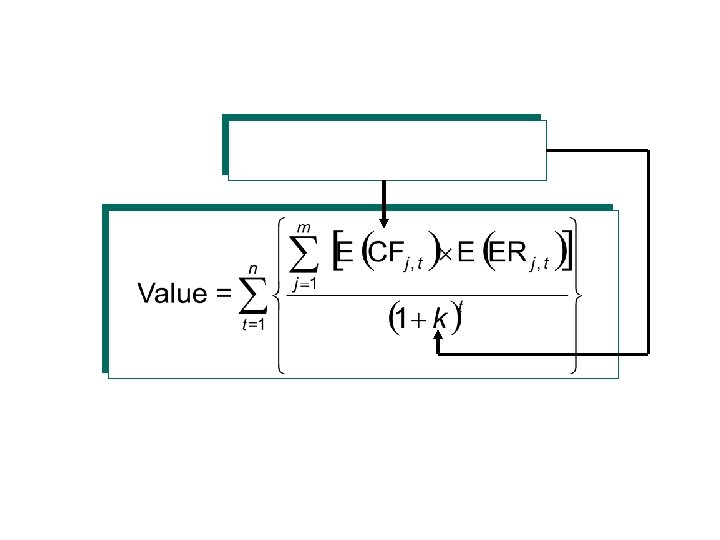

Value of International Acquisitions

Value of International Acquisitions

International Acquisitions

International Acquisitions

International Acquisitions

International Acquisitions

Online Application

International Acquisitions

International Acquisitions

Online Application

The Valuation Process

Why Valuations of a Target May Vary Among MNCs

Why Valuations of a Target May Vary Among MNCs

Why Valuations of a Target May Vary Among MNCs

Other Types of Multinational Restructuring

Other Types of Multinational Restructuring

Other Types of Multinational Restructuring

Other Types of Multinational Restructuring

Restructuring Decisions As Real Options

Restructuring Decisions As Real Options

Chapter Review

Chapter Review

Chapter Review

Chapter Review

Chapter Review

Country Risk Analysis

Chapter Objectives

Country Risk Analysis

Country Risk Analysis

Political Risk Factors

Political Risk Factors

Political Risk Factors

Corruption Perceptions Index

Financial Risk Factors

Types of Country Risk Assessment

Types of Country Risk Assessment

Types of Country Risk Assessment

Techniques of Assessing Country Risk

Techniques of Assessing Country Risk

Techniques of Assessing Country Risk

Developing A Country Risk Rating

Developing A Country Risk Rating

Developing A Country Risk Rating

Developing A Country Risk Rating

Comparing Risk Ratings Among Countries

Actual Country Risk Ratings Across Countries

Incorporating Country Risk in Capital Budgeting

Incorporating Country Risk in Capital Budgeting

Applications of Country Risk Analysis

Applications of Country Risk Analysis

Reducing Exposure to Host Government Takeovers

Reducing Exposure to Host Government Takeovers

Reducing Exposure to Host Government Takeovers

Chapter Review

Chapter Review

Chapter Review

Chapter Review

Chapter Review

Chapter Review

Multinational Cost of Capital & Capital Structure

Chapter Objectives

Cost of Capital

Cost of Capital

Cost of Capital

Cost of Capital

Cost of Capital for MNCs

Cost of Capital for MNCs

Cost of Capital for MNCs

Cost of Capital for MNCs

Cost of Capital for MNCs

Cost of Capital for MNCs

Cost of Capital for MNCs

Cost of Capital for MNCs

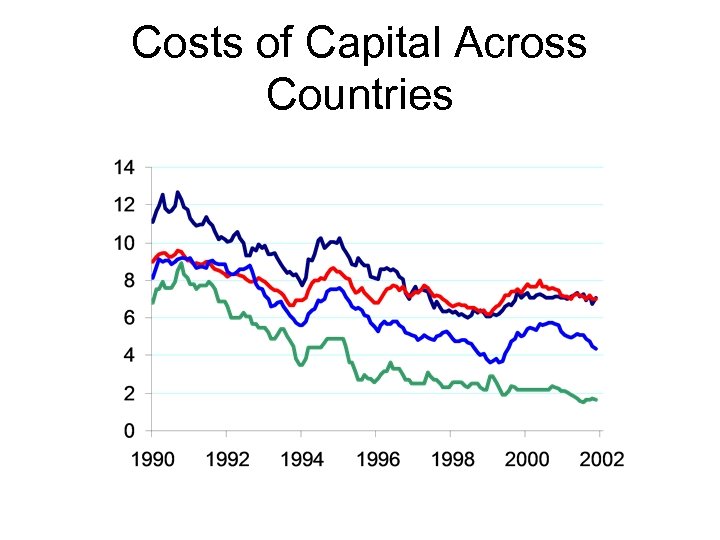

Costs of Capital Across Countries

Costs of Capital Across Countries

Costs of Capital Across Countries

Costs of Capital Across Countries

Costs of Capital Across Countries

Costs of Capital Across Countries

Costs of Capital Across Countries

Costs of Capital Across Countries

Using the Cost of Capital for Assessing Foreign Projects

Using the Cost of Capital for Assessing Foreign Projects

The MNC’s Capital Structure Decision

The MNC’s Capital Structure Decision

The MNC’s Capital Structure Decision

The MNC’s Capital Structure Decision

The MNC’s Capital Structure Decision

The MNC’s Capital Structure Decision

Interaction Between Subsidiary and Parent Financing Decisions

Interaction Between Subsidiary and Parent Financing Decisions

Interaction Between Subsidiary and Parent Financing Decisions

Using a Target Capital Structure on a Local versus Global Basis

Using a Target Capital Structure on a Local versus Global Basis

Using a Target Capital Structure on a Local versus Global Basis

Chapter Review

Chapter Review

Chapter Review

Chapter Review

Chapter Review

Financing International Trade

Chapter Objectives

Trade Finance Methods

Trade Finance Methods

Trade Finance Methods

Trade Finance Methods

Trade Finance Methods

Trade Finance Methods

Trade Finance Methods

Trade Finance Methods

Trade Finance Methods

Chapter Review

Chapter Review

ffe49c4a4bf1b23d670421f8ce07b76d.ppt