Capital assets.ppt

- Количество слайдов: 38

Lection 4. Capital assets 1. Definition of the capital and intangible assets 2. Major categories of plant and equipment 3. Depreciation and its variations 4. Indicators of usage of the capital assets

Lection 4. Capital assets 1. Definition of the capital and intangible assets 2. Major categories of plant and equipment 3. Depreciation and its variations 4. Indicators of usage of the capital assets

1. Definition of the capital and intangible assets The term capital (plant and equipment) is used to describe long-lasting assets acquired for use in the operation of the business Types of capital Advanced capital fixed variable Own capital Capital and operational assets

1. Definition of the capital and intangible assets The term capital (plant and equipment) is used to describe long-lasting assets acquired for use in the operation of the business Types of capital Advanced capital fixed variable Own capital Capital and operational assets

Advanced capital — It is money invested by owner in enterprise, for the purpose of profit reception. Capital assets — it is the part of fixed capital, which consists from value of plant assets and will benefit several production periods. Operational assets — it is the part of fixed capital, which is spent on purchase of materials, payment of personnel, and will benefit only the current period.

Advanced capital — It is money invested by owner in enterprise, for the purpose of profit reception. Capital assets — it is the part of fixed capital, which consists from value of plant assets and will benefit several production periods. Operational assets — it is the part of fixed capital, which is spent on purchase of materials, payment of personnel, and will benefit only the current period.

At the moment of enterprise creation its starting capital (К) is embodied in assets (А), invested by partners (founders), and shows cost of enterprise property. On this stage, when enterprise doesn’t have debts, its assets are equal to starting capital (А = К)

At the moment of enterprise creation its starting capital (К) is embodied in assets (А), invested by partners (founders), and shows cost of enterprise property. On this stage, when enterprise doesn’t have debts, its assets are equal to starting capital (А = К)

Assets it is the resources, controlled by enterprise, usage of which will result in gaining of economic benefits in future.

Assets it is the resources, controlled by enterprise, usage of which will result in gaining of economic benefits in future.

Own capital — it is the part of assets, which remains after subtraction of liabilities. К = А - 3 А = 3 + К З - liabilities

Own capital — it is the part of assets, which remains after subtraction of liabilities. К = А - 3 А = 3 + К З - liabilities

Functions of the capital assets 1. Long-term financing of economic activity 2. Responsibility and protection of creditor’s rights 3. Compensation of losses

Functions of the capital assets 1. Long-term financing of economic activity 2. Responsibility and protection of creditor’s rights 3. Compensation of losses

4. Financing liabilities 5. Financing of risks 6. Independence and power 7. Distribution of profits and assets

4. Financing liabilities 5. Financing of risks 6. Independence and power 7. Distribution of profits and assets

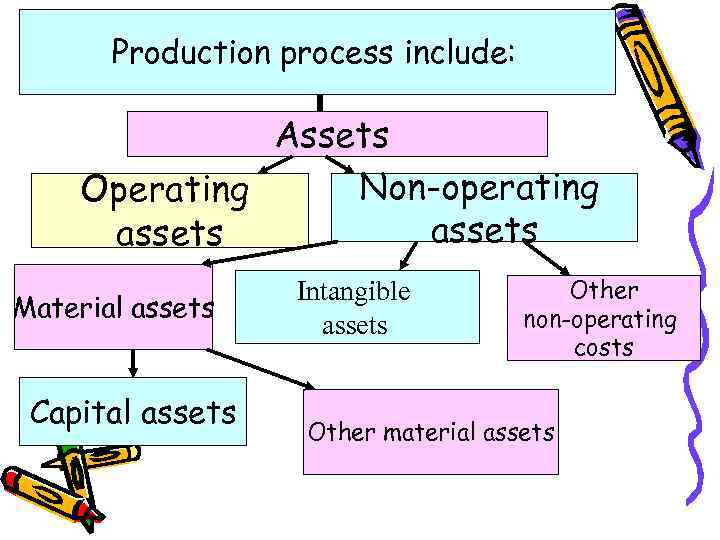

Production process include: Assets Non-operating Operating assets Material assets Capital assets Intangible assets Other non-operating costs Other material assets

Production process include: Assets Non-operating Operating assets Material assets Capital assets Intangible assets Other non-operating costs Other material assets

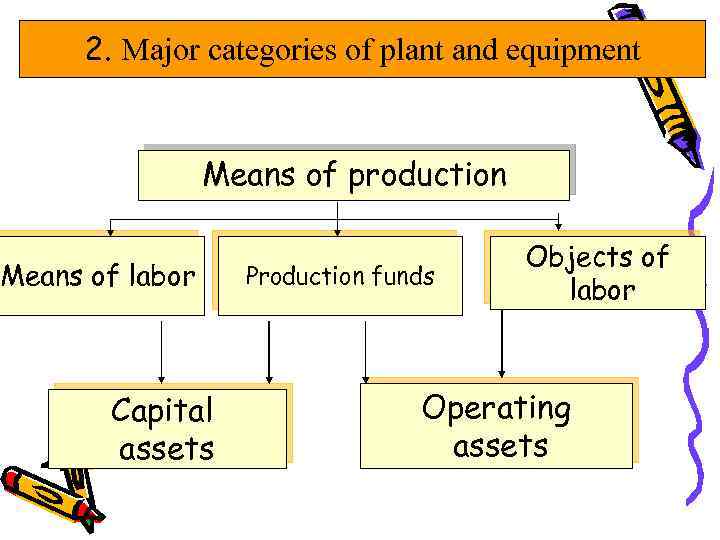

2. Major categories of plant and equipment Means of production Means of labor Capital assets Production funds Objects of labor Operating assets

2. Major categories of plant and equipment Means of production Means of labor Capital assets Production funds Objects of labor Operating assets

According to Ukrainian law «Tax Codex" definition “capital funds” designates the material values, which are intended to use in economical activity of enterprise during period, which are longer that 365 days and diminish its value because of physical deterioration and obsolescence

According to Ukrainian law «Tax Codex" definition “capital funds” designates the material values, which are intended to use in economical activity of enterprise during period, which are longer that 365 days and diminish its value because of physical deterioration and obsolescence

Operating funds — it’s a part of production funds in the kind of objects of labor, elements of which completely used in each production cycle, change or completely lose theirs natural form and transfer all their value on value of made products

Operating funds — it’s a part of production funds in the kind of objects of labor, elements of which completely used in each production cycle, change or completely lose theirs natural form and transfer all their value on value of made products

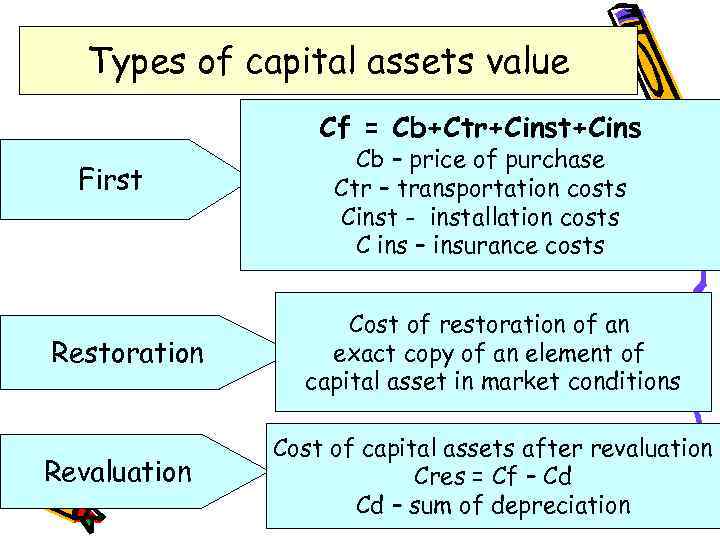

Types of capital assets value Сf = Сb+Сtr+Сinst+Сins First Restoration Revaluation Сb – price of purchase Сtr – transportation costs Сinst - installation costs C ins – insurance costs Cost of restoration of an exact copy of an element of capital asset in market conditions Cost of capital assets after revaluation Сres = Сf – Сd Сd – sum of depreciation

Types of capital assets value Сf = Сb+Сtr+Сinst+Сins First Restoration Revaluation Сb – price of purchase Сtr – transportation costs Сinst - installation costs C ins – insurance costs Cost of restoration of an exact copy of an element of capital asset in market conditions Cost of capital assets after revaluation Сres = Сf – Сd Сd – sum of depreciation

Residual Book value The sum, which enterprise expect to receive after disposal of capital assets Сbv = Сп+Вп+Вк+Врек-Вв-А Сп – value of capital assets at the beginning of the year Вп – expenses on maintenance of new assets Вк- expenses on major repairs Врек - expenses on reconstruction Вв – value of disposed capital assets А - sum of depreciation

Residual Book value The sum, which enterprise expect to receive after disposal of capital assets Сbv = Сп+Вп+Вк+Врек-Вв-А Сп – value of capital assets at the beginning of the year Вп – expenses on maintenance of new assets Вк- expenses on major repairs Врек - expenses on reconstruction Вв – value of disposed capital assets А - sum of depreciation

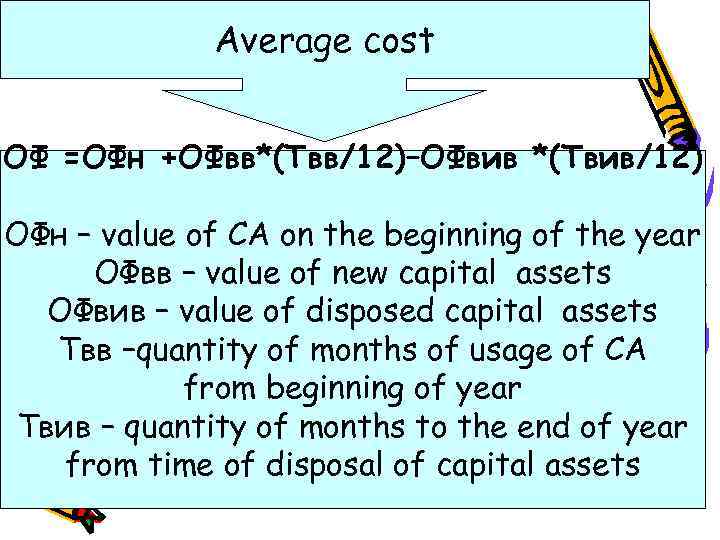

Average cost ОФ =ОФн +ОФвв*(Твв/12)–ОФвив *(Твив/12) ОФн – value of CA on the beginning of the year ОФвв – value of new capital assets ОФвив – value of disposed capital assets Твв –quantity of months of usage of CA from beginning of year Твив – quantity of months to the end of year from time of disposal of capital assets

Average cost ОФ =ОФн +ОФвв*(Твв/12)–ОФвив *(Твив/12) ОФн – value of CA on the beginning of the year ОФвв – value of new capital assets ОФвив – value of disposed capital assets Твв –quantity of months of usage of CA from beginning of year Твив – quantity of months to the end of year from time of disposal of capital assets

Classification of capital assets Group 1 - Land group 2 - capital costs for land improvement, not related to the construction group 3 – building, structures group 4 - machinery and equipment, of which: electronic computers and other machines for automatic processing of information associated with them means reading or printing the information related computer software (other than software acquisition costs are recognized as royalty and / or programs that are recognized intangible assets), and other information systems, switches, routers, modules, modems, uninterruptible power supplies and means for connection to telecommunication networks, telephones (including cellular), microphones and radios, which cost more than 2500 USD Group 5 - Vehicles Group 6 - tools, appliances, equipment (furniture) Group 7 - Animals Group 8 - perennial plants Group 9 - other fixed assets Group 10 – Library funds Group 11 - Low-value non-current assets Group 12 - Temporary (denotified) facilities Group 13 - Natural Resources Group 14 - Returnable packaging Group 15 – Items for rent Chapter 16 - Long-term biological assets

Classification of capital assets Group 1 - Land group 2 - capital costs for land improvement, not related to the construction group 3 – building, structures group 4 - machinery and equipment, of which: electronic computers and other machines for automatic processing of information associated with them means reading or printing the information related computer software (other than software acquisition costs are recognized as royalty and / or programs that are recognized intangible assets), and other information systems, switches, routers, modules, modems, uninterruptible power supplies and means for connection to telecommunication networks, telephones (including cellular), microphones and radios, which cost more than 2500 USD Group 5 - Vehicles Group 6 - tools, appliances, equipment (furniture) Group 7 - Animals Group 8 - perennial plants Group 9 - other fixed assets Group 10 – Library funds Group 11 - Low-value non-current assets Group 12 - Temporary (denotified) facilities Group 13 - Natural Resources Group 14 - Returnable packaging Group 15 – Items for rent Chapter 16 - Long-term biological assets

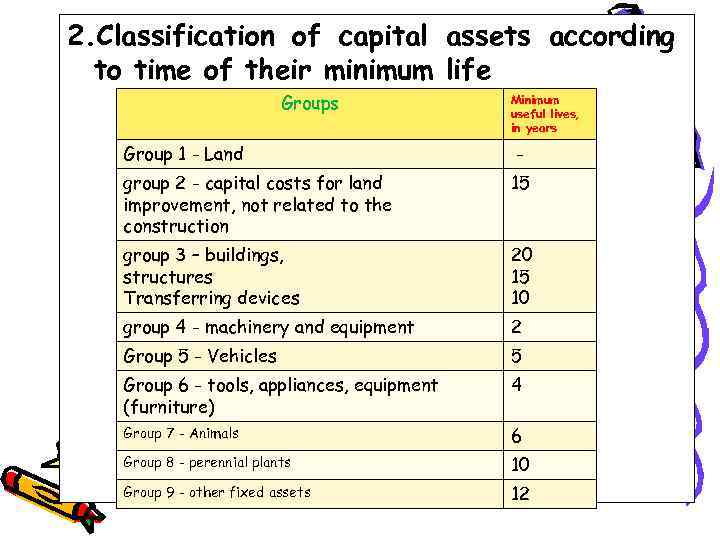

2. Classification of capital assets according to time of their minimum life Groups Minimum useful lives, in years Group 1 - Land - group 2 - capital costs for land improvement, not related to the construction 15 group 3 – buildings, structures Transferring devices 20 15 10 group 4 - machinery and equipment 2 Group 5 - Vehicles 5 Group 6 - tools, appliances, equipment (furniture) 4 Group 7 - Animals 6 Group 8 - perennial plants 10 Group 9 - other fixed assets 12

2. Classification of capital assets according to time of their minimum life Groups Minimum useful lives, in years Group 1 - Land - group 2 - capital costs for land improvement, not related to the construction 15 group 3 – buildings, structures Transferring devices 20 15 10 group 4 - machinery and equipment 2 Group 5 - Vehicles 5 Group 6 - tools, appliances, equipment (furniture) 4 Group 7 - Animals 6 Group 8 - perennial plants 10 Group 9 - other fixed assets 12

Groups Minimum useful lives, in years Group 10 – Library funds - Group 11 - Low-value non-current assets - Group 12 - Temporary (denotified) facilities 5 Group 13 - Natural Resources - Group 14 - Returnable packaging 6 Group 15 – Items for rent 5 Chapter 16 - Long-term biological assets 7

Groups Minimum useful lives, in years Group 10 – Library funds - Group 11 - Low-value non-current assets - Group 12 - Temporary (denotified) facilities 5 Group 13 - Natural Resources - Group 14 - Returnable packaging 6 Group 15 – Items for rent 5 Chapter 16 - Long-term biological assets 7

3. By role in economic activity. Active. Passive 4. By sphere of usage. Productional. Non-productional 5. By form of proprietyship. Own. Rented

3. By role in economic activity. Active. Passive 4. By sphere of usage. Productional. Non-productional 5. By form of proprietyship. Own. Rented

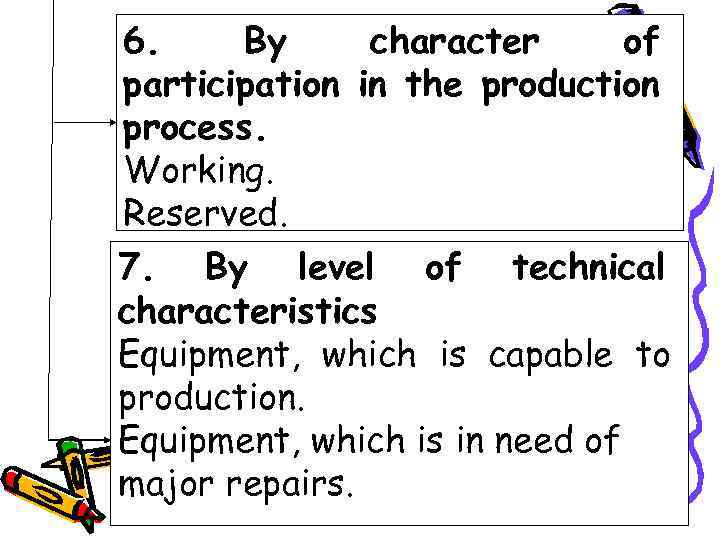

6. By character of participation in the production process. Working. Reserved. 7. By level of technical characteristics Equipment, which is capable to production. Equipment, which is in need of major repairs.

6. By character of participation in the production process. Working. Reserved. 7. By level of technical characteristics Equipment, which is capable to production. Equipment, which is in need of major repairs.

Structure of capital assets Production (functional, technological) structure Branch structure Age structure

Structure of capital assets Production (functional, technological) structure Branch structure Age structure

3. Depreciation of capital assets

3. Depreciation of capital assets

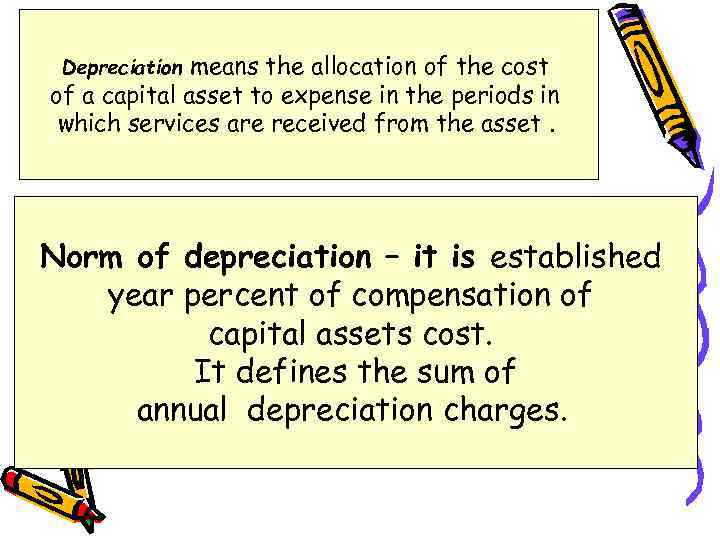

means the allocation of the cost of a capital asset to expense in the periods in which services are received from the asset. Depreciation Norm of depreciation – it is established year percent of compensation of capital assets cost. It defines the sum of annual depreciation charges.

means the allocation of the cost of a capital asset to expense in the periods in which services are received from the asset. Depreciation Norm of depreciation – it is established year percent of compensation of capital assets cost. It defines the sum of annual depreciation charges.

Norm of depreciation can be calculated as Depreciation cost

Norm of depreciation can be calculated as Depreciation cost

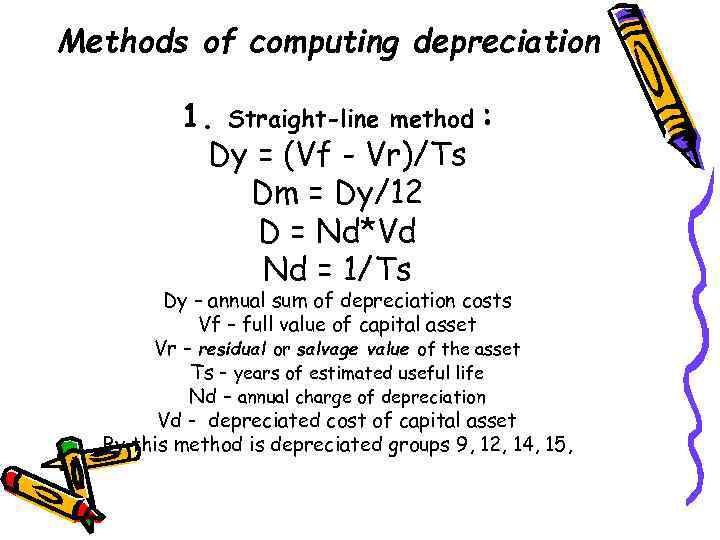

Methods of computing depreciation 1. Straight-line method : Dy = (Vf - Vr)/Ts Dm = Dy/12 D = Nd*Vd Nd = 1/Тs Dy – annual sum of depreciation costs Vf – full value of capital asset Vr – residual or salvage value of the asset Тs - years of estimated useful life Nd – annual charge of depreciation Vd - depreciated cost of capital asset By this method is depreciated groups 9, 12, 14, 15,

Methods of computing depreciation 1. Straight-line method : Dy = (Vf - Vr)/Ts Dm = Dy/12 D = Nd*Vd Nd = 1/Тs Dy – annual sum of depreciation costs Vf – full value of capital asset Vr – residual or salvage value of the asset Тs - years of estimated useful life Nd – annual charge of depreciation Vd - depreciated cost of capital asset By this method is depreciated groups 9, 12, 14, 15,

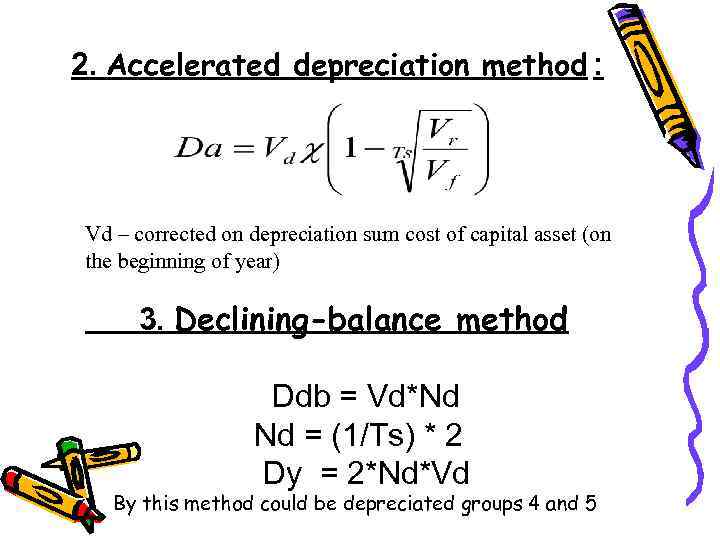

2. Accelerated depreciation method : Vd – corrected on depreciation sum cost of capital asset (on the beginning of year) 3. Declining-balance method Ddb = Vd*Nd Nd = (1/Тs) * 2 Dy = 2*Nd*Vd By this method could be depreciated groups 4 and 5

2. Accelerated depreciation method : Vd – corrected on depreciation sum cost of capital asset (on the beginning of year) 3. Declining-balance method Ddb = Vd*Nd Nd = (1/Тs) * 2 Dy = 2*Nd*Vd By this method could be depreciated groups 4 and 5

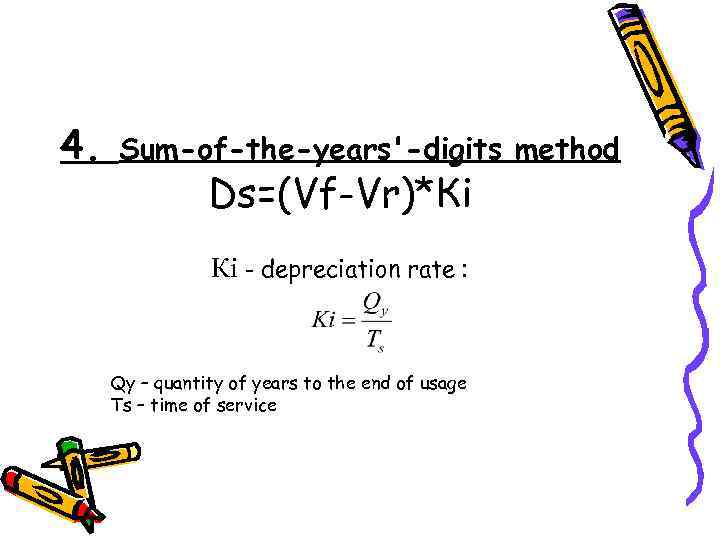

4. Sum-of-the-years'-digits method Ds=(Vf-Vr)*Кі Кі - depreciation rate : Qy – quantity of years to the end of usage Ts – time of service

4. Sum-of-the-years'-digits method Ds=(Vf-Vr)*Кі Кі - depreciation rate : Qy – quantity of years to the end of usage Ts – time of service

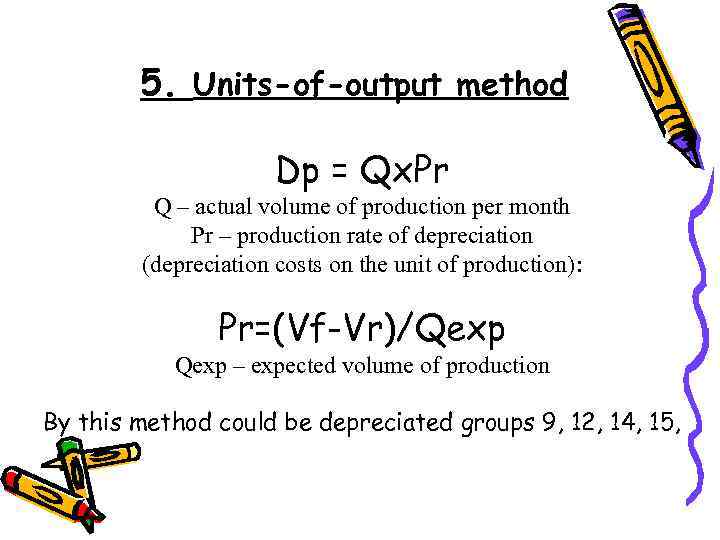

5. Units-of-output method Dp = Qx. Pr Q – actual volume of production per month Pr – production rate of depreciation (depreciation costs on the unit of production): Pr=(Vf-Vr)/Qexp – expected volume of production By this method could be depreciated groups 9, 12, 14, 15,

5. Units-of-output method Dp = Qx. Pr Q – actual volume of production per month Pr – production rate of depreciation (depreciation costs on the unit of production): Pr=(Vf-Vr)/Qexp – expected volume of production By this method could be depreciated groups 9, 12, 14, 15,

4. Types of deterioration and indicators of usage of the capital assets

4. Types of deterioration and indicators of usage of the capital assets

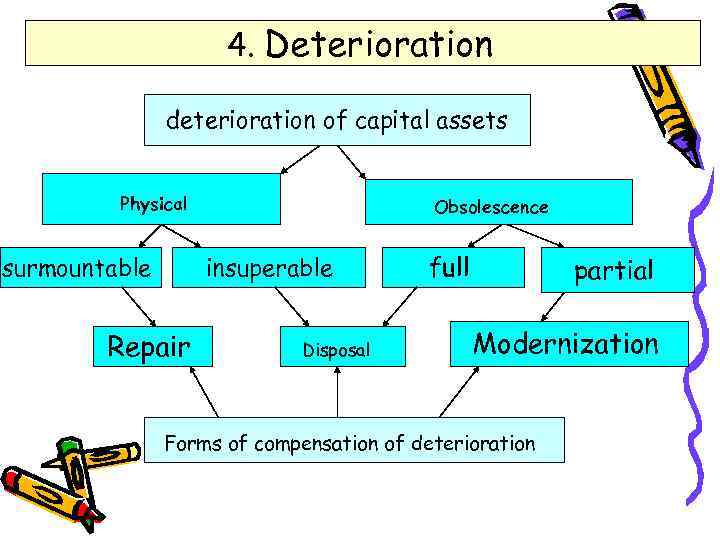

4. Deterioration deterioration of capital assets Physical Obsolescence insuperable surmountable Repair Disposal full partial Modernization Forms of compensation of deterioration

4. Deterioration deterioration of capital assets Physical Obsolescence insuperable surmountable Repair Disposal full partial Modernization Forms of compensation of deterioration

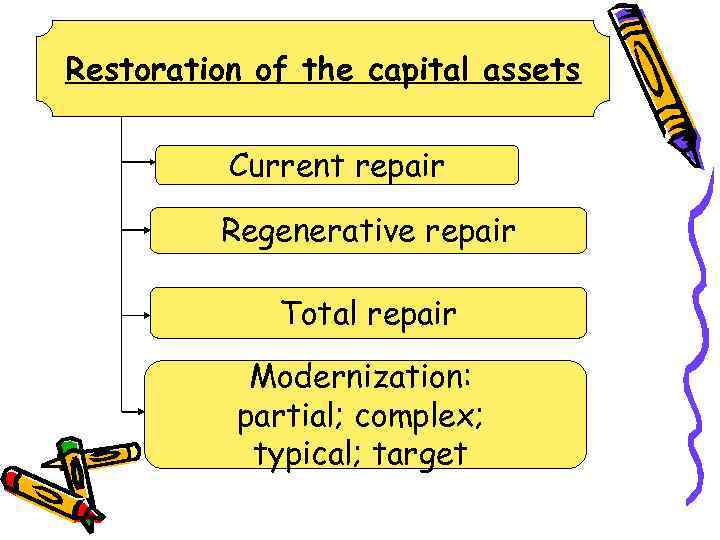

Restoration of the capital assets Current repair Regenerative repair Total repair Modernization: partial; complex; typical; target

Restoration of the capital assets Current repair Regenerative repair Total repair Modernization: partial; complex; typical; target

Indicators of usage of the capital assets: 1. Coefficient of including: ОФвв – value of new capital assets on the beginning of year Сf - full (first or restoration) value of capital assets on the end of year

Indicators of usage of the capital assets: 1. Coefficient of including: ОФвв – value of new capital assets on the beginning of year Сf - full (first or restoration) value of capital assets on the end of year

2. Coefficient of excluding ОФвиб – value of disposed capital assets Сf – full (first or restoration) value of capital assets on the beginning of year

2. Coefficient of excluding ОФвиб – value of disposed capital assets Сf – full (first or restoration) value of capital assets on the beginning of year

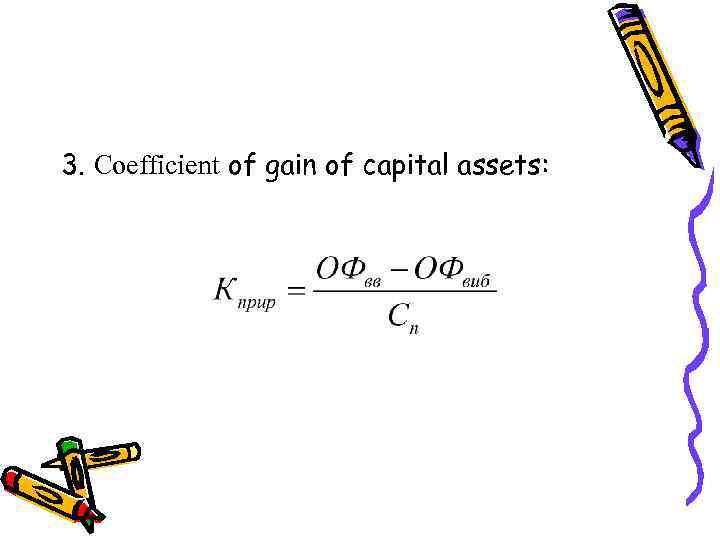

3. Coefficient of gain of capital assets:

3. Coefficient of gain of capital assets:

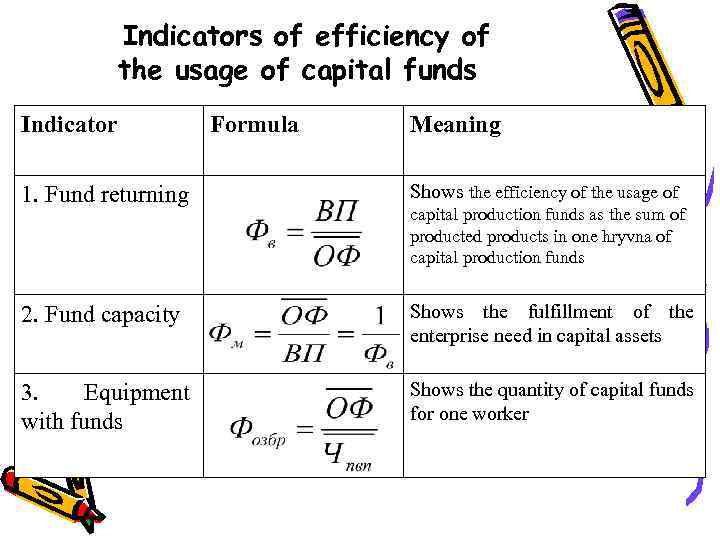

Indicators of efficiency of the usage of capital funds Indicator Formula Meaning 1. Fund returning Shows the efficiency of the usage of 2. Fund capacity Shows the fulfillment of the enterprise need in capital assets 3. Equipment with funds Shows the quantity of capital funds for one worker capital production funds as the sum of producted products in one hryvna of capital production funds

Indicators of efficiency of the usage of capital funds Indicator Formula Meaning 1. Fund returning Shows the efficiency of the usage of 2. Fund capacity Shows the fulfillment of the enterprise need in capital assets 3. Equipment with funds Shows the quantity of capital funds for one worker capital production funds as the sum of producted products in one hryvna of capital production funds

4. Average annual value of capital assets 5. Coefficient of Кекс = Shows the degree of extensive usage of Тф/Тплан usage of capital assets in time 6. Coefficient of Кін= intensive usage of Qф/Qпл capital assets Кін = Тфпр/Тпл. пр Shows the degree of usage of capital assets by produced products

4. Average annual value of capital assets 5. Coefficient of Кекс = Shows the degree of extensive usage of Тф/Тплан usage of capital assets in time 6. Coefficient of Кін= intensive usage of Qф/Qпл capital assets Кін = Тфпр/Тпл. пр Shows the degree of usage of capital assets by produced products

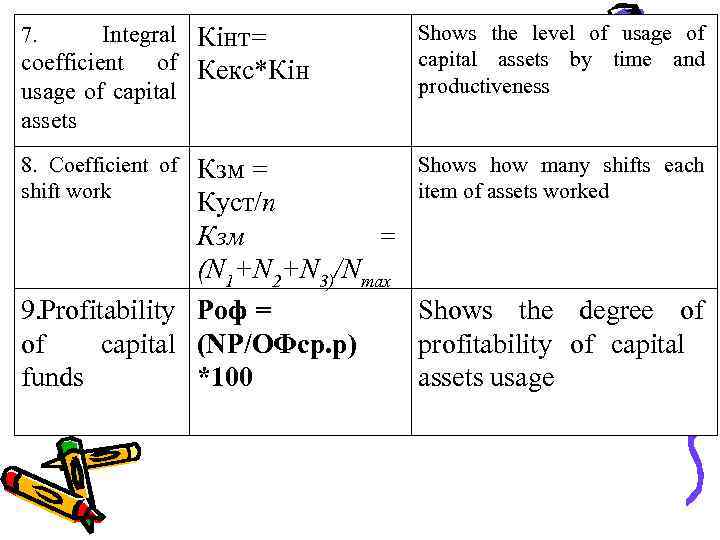

Integral Кінт= coefficient of Кекс*Кін usage of capital assets 7. 8. Coefficient of shift work Shows the level of usage of capital assets by time and productiveness Shows how many shifts each Кзм = item of assets worked Куст/п Кзм = (N 1+N 2+N 3)/Nmax 9. Profitability Роф = Shows the degree of of capital (NP/ОФср. р) profitability of capital funds *100 assets usage

Integral Кінт= coefficient of Кекс*Кін usage of capital assets 7. 8. Coefficient of shift work Shows the level of usage of capital assets by time and productiveness Shows how many shifts each Кзм = item of assets worked Куст/п Кзм = (N 1+N 2+N 3)/Nmax 9. Profitability Роф = Shows the degree of of capital (NP/ОФср. р) profitability of capital funds *100 assets usage

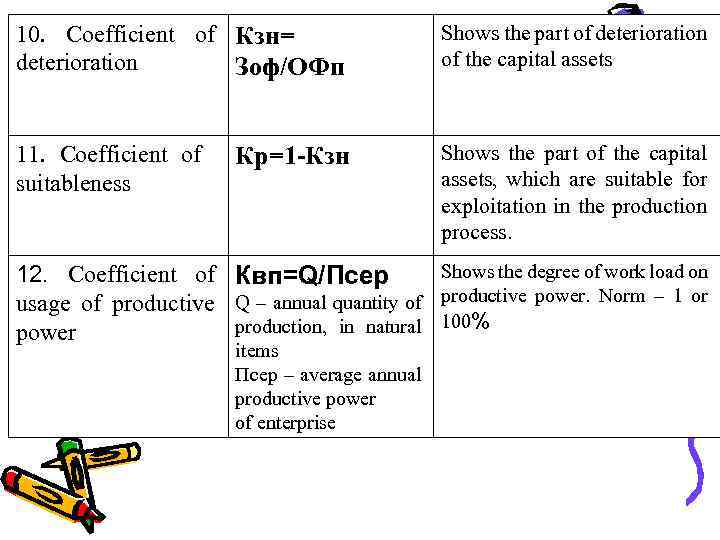

10. Coefficient of Кзн= deterioration Зоф/ОФп Shows the part of deterioration of the capital assets 11. Coefficient of suitableness Shows the part of the capital assets, which are suitable for exploitation in the production process. Кр=1 -Кзн Shows the degree of work load on 12. Coefficient of Квп=Q/Псер usage of productive Q – annual quantity of productive power. Norm – 1 or production, in natural 100% power items Псер – average annual productive power of enterprise

10. Coefficient of Кзн= deterioration Зоф/ОФп Shows the part of deterioration of the capital assets 11. Coefficient of suitableness Shows the part of the capital assets, which are suitable for exploitation in the production process. Кр=1 -Кзн Shows the degree of work load on 12. Coefficient of Квп=Q/Псер usage of productive Q – annual quantity of productive power. Norm – 1 or production, in natural 100% power items Псер – average annual productive power of enterprise