7d36bcdc17bbb44136c74990ac013ef0.ppt

- Количество слайдов: 14

Leasing vs. Buying Computers for an Engineering Firm Project Presentation Team 1 EGR 403 – Section 02 6 -7: 50 pm T/Th

Our Roles Team 1 Members n Jacob Hagman – Organizer n Justino Rojas – Techie n Micheal Jones – Techie n John Amir. Abbassi – Summarizer

Our Project n To analyze the options of leasing vs. purchasing a set of 50 workstations for an engineering firm n n n High End Machines Estimating 3 Year Term Manufacturers: Dell vs. IBM

Evaluating our Options n Advantages of Leasing You can get much more equipment at once, since you don't have to pay for all of it in a lump sum. n You can spread payments over time on a regular and predictable basis. n You can afford to keep all of your hardware at much the same level. n Equipment warranties also often last the same period as a lease. n

Evaluating our Options n Disadvantages of Leasing You don't own the equipment so you must be more careful what you do with it. n You won't want to spend money to customize, expand, or modify the equipment unless you want to either remove the modifications or lose the money when the equipment is returned. n

Evaluating our Options n Advantages of Purchasing You own the equipment, so you can do with it what you like, including upgrading it or throwing it away. n You may be able to resell it while it has some residual value n

Evaluating our Options n Disadvantages of Purchasing Depreciation & Salvage Value n Computers purchased may lead to in-equivalent workstations. Leading to uneven employee productivity and concerns with morale. n

Evaluating our Options n Disadvantages of Purchasing continued… n Support concerns n Becomes hard to maintain a standard “machine image” with different hardware configurations. n Technicians must be able to maintain a variety of operating systems. n As machines age, some parts become impossible or expensive to find.

Analysis Monthly Payments are not an accurate means of economic analysis n Annual worth method proved to be most appropriate n Two percent fixed loan compared with lease to buy options n

Analysis n n n Cash flow diagrams observed 2% fixed loan vs lease to buy options Annual Worth Analysis done on both scenarios

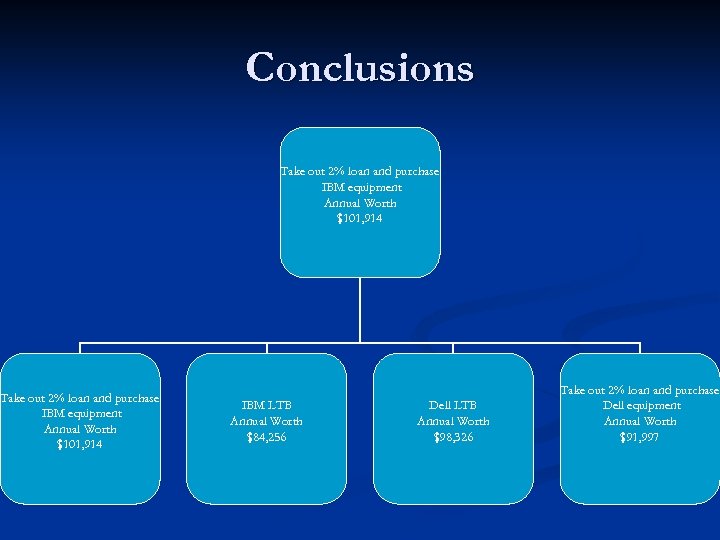

Conclusions Take out 2% loan and purchase IBM equipment Annual Worth $101, 914 IBM LTB Annual Worth $84, 256 Dell LTB Annual Worth $98, 326 Take out 2% loan and purchase Dell equipment Annual Worth $91, 997

Sensitivity Analysis Other Fixed Loan options n Increase Annual Benefit to $240, 000 n No Salvage Value n

Web Resources n Bankrate – www. bankrate. com n Covers small business, real estate, mortgage, insurance, and credit information. Provides Finance calculators and investment advice.

Web Resources n MSN Money – moneycentral. msn. com n Provides financial information on loans, stocks, leasing, and financial investing. Provides great variety of information pooled from multiple sources. Can forward to mobile devices.

7d36bcdc17bbb44136c74990ac013ef0.ppt