Lease.pptx

- Количество слайдов: 31

Leasing Valeria Cheremushkina Artem Shatilov Iván Ordoñez Eden Alemu Chris Wizda Zhao Meng Li Yihan

Leasing Valeria Cheremushkina Artem Shatilov Iván Ordoñez Eden Alemu Chris Wizda Zhao Meng Li Yihan

What is the Lease? ● Agreement ● Between 2 parties ● Lessor & Lessee ● According to Terms

What is the Lease? ● Agreement ● Between 2 parties ● Lessor & Lessee ● According to Terms

What is the Lease? ● Lessee – using property ● Owner – Lessor

What is the Lease? ● Lessee – using property ● Owner – Lessor

What is the Lease? ● Lessee pays some $ to Lessor for the right to use the property

What is the Lease? ● Lessee pays some $ to Lessor for the right to use the property

What is the Lease? ● Lease is for a fixed term (F. E. 12 months) ● Then Lessee returns property back

What is the Lease? ● Lease is for a fixed term (F. E. 12 months) ● Then Lessee returns property back

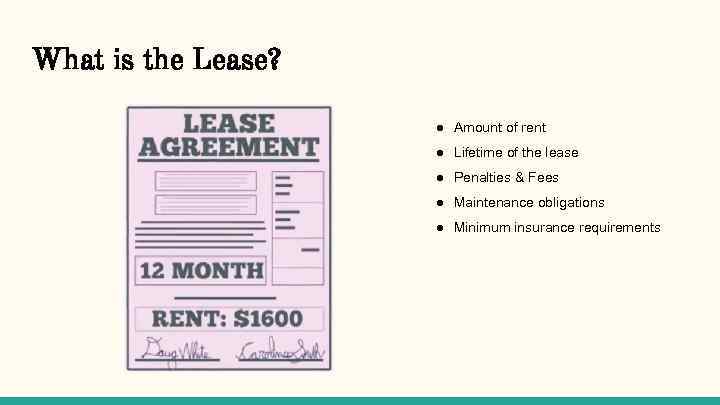

What is the Lease? ● Amount of rent ● Lifetime of the lease ● Penalties & Fees ● Maintenance obligations ● Minimum insurance requirements

What is the Lease? ● Amount of rent ● Lifetime of the lease ● Penalties & Fees ● Maintenance obligations ● Minimum insurance requirements

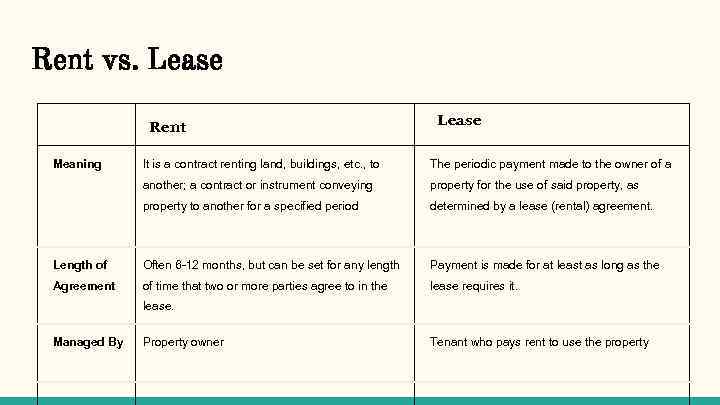

Rent vs. Lease Rent Meaning Lease It is a contract renting land, buildings, etc. , to The periodic payment made to the owner of a another; a contract or instrument conveying property for the use of said property, as property to another for a specified period determined by a lease (rental) agreement. Length of Often 6 -12 months, but can be set for any length Payment is made for at least as long as the Agreement of time that two or more parties agree to in the lease requires it. lease. Managed By Property owner Tenant who pays rent to use the property

Rent vs. Lease Rent Meaning Lease It is a contract renting land, buildings, etc. , to The periodic payment made to the owner of a another; a contract or instrument conveying property for the use of said property, as property to another for a specified period determined by a lease (rental) agreement. Length of Often 6 -12 months, but can be set for any length Payment is made for at least as long as the Agreement of time that two or more parties agree to in the lease requires it. lease. Managed By Property owner Tenant who pays rent to use the property

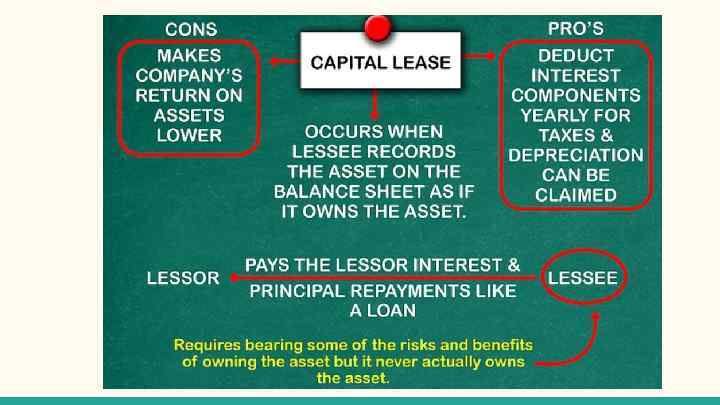

Definitions Capital (finance) lease - arrangement between Lessor and Lessee whereby lessor purchases the asset and transfers all the rights, risks and rewards to the lessee against a periodically fixed rental. Operating lease - is a type of lease in which the Lessor purchases the asset and leases it to the Lessee for a limited and small amount of time.

Definitions Capital (finance) lease - arrangement between Lessor and Lessee whereby lessor purchases the asset and transfers all the rights, risks and rewards to the lessee against a periodically fixed rental. Operating lease - is a type of lease in which the Lessor purchases the asset and leases it to the Lessee for a limited and small amount of time.

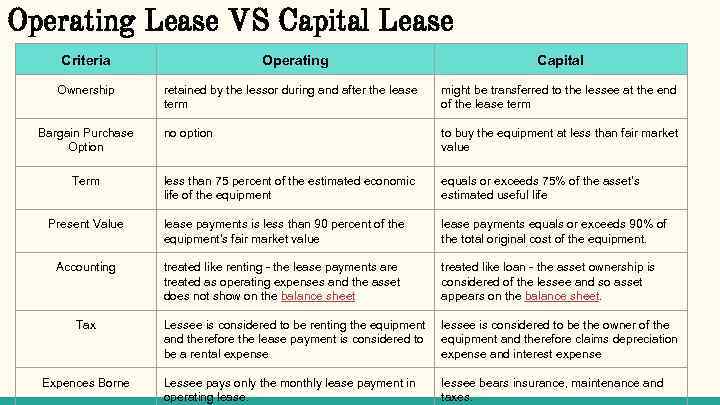

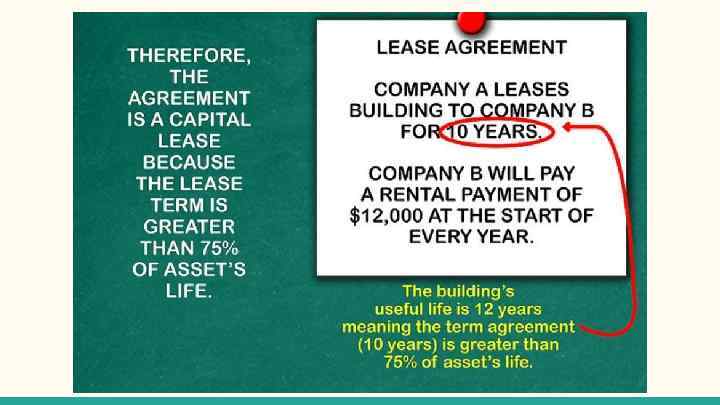

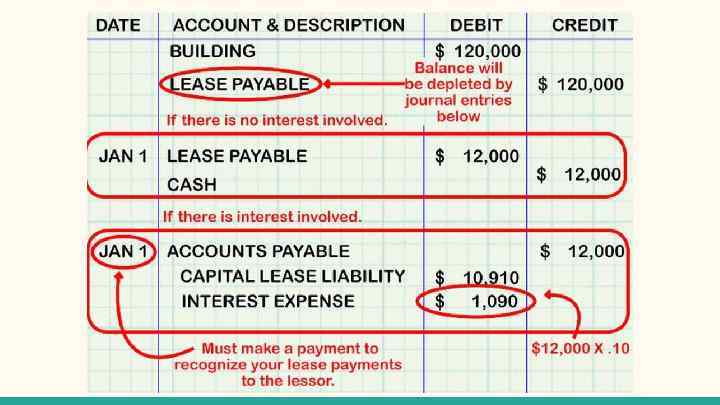

Operating Lease VS Capital Lease Criteria Ownership Operating Capital retained by the lessor during and after the lease term might be transferred to the lessee at the end of the lease term no option to buy the equipment at less than fair market value less than 75 percent of the estimated economic life of the equipment equals or exceeds 75% of the asset's estimated useful life Present Value lease payments is less than 90 percent of the equipment's fair market value lease payments equals or exceeds 90% of the total original cost of the equipment. Accounting treated like renting - the lease payments are treated as operating expenses and the asset does not show on the balance sheet treated like loan - the asset ownership is considered of the lessee and so asset appears on the balance sheet. Lessee is considered to be renting the equipment and therefore the lease payment is considered to be a rental expense lessee is considered to be the owner of the equipment and therefore claims depreciation expense and interest expense Lessee pays only the monthly lease payment in operating lease. lessee bears insurance, maintenance and taxes. Bargain Purchase Option Term Tax Expences Borne

Operating Lease VS Capital Lease Criteria Ownership Operating Capital retained by the lessor during and after the lease term might be transferred to the lessee at the end of the lease term no option to buy the equipment at less than fair market value less than 75 percent of the estimated economic life of the equipment equals or exceeds 75% of the asset's estimated useful life Present Value lease payments is less than 90 percent of the equipment's fair market value lease payments equals or exceeds 90% of the total original cost of the equipment. Accounting treated like renting - the lease payments are treated as operating expenses and the asset does not show on the balance sheet treated like loan - the asset ownership is considered of the lessee and so asset appears on the balance sheet. Lessee is considered to be renting the equipment and therefore the lease payment is considered to be a rental expense lessee is considered to be the owner of the equipment and therefore claims depreciation expense and interest expense Lessee pays only the monthly lease payment in operating lease. lessee bears insurance, maintenance and taxes. Bargain Purchase Option Term Tax Expences Borne

Which One Is Better For My Business?

Which One Is Better For My Business?

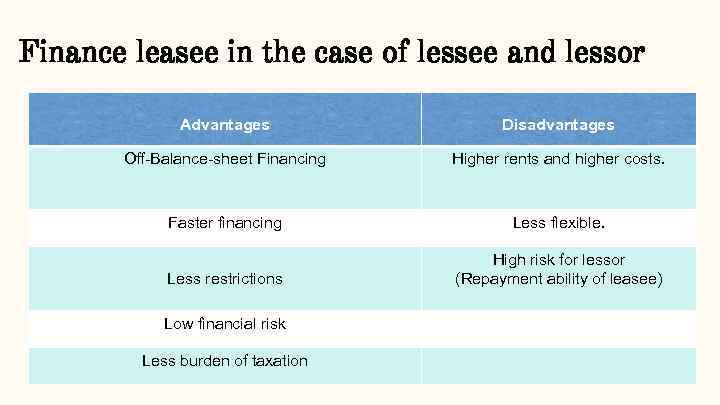

Finance leasee in the case of lessee and lessor Advantages Disadvantages Off-Balance-sheet Financing Higher rents and higher costs. Faster financing Less flexible. Less restrictions High risk for lessor (Repayment ability of leasee) Low financial risk Less burden of taxation

Finance leasee in the case of lessee and lessor Advantages Disadvantages Off-Balance-sheet Financing Higher rents and higher costs. Faster financing Less flexible. Less restrictions High risk for lessor (Repayment ability of leasee) Low financial risk Less burden of taxation

Operating Lease in case of lessee and lessor Advantages Disadvantages Off-balance-sheet financing Lack of ownership Short-term lease Lack Of Continuity Flexibility Recovery of Investment

Operating Lease in case of lessee and lessor Advantages Disadvantages Off-balance-sheet financing Lack of ownership Short-term lease Lack Of Continuity Flexibility Recovery of Investment

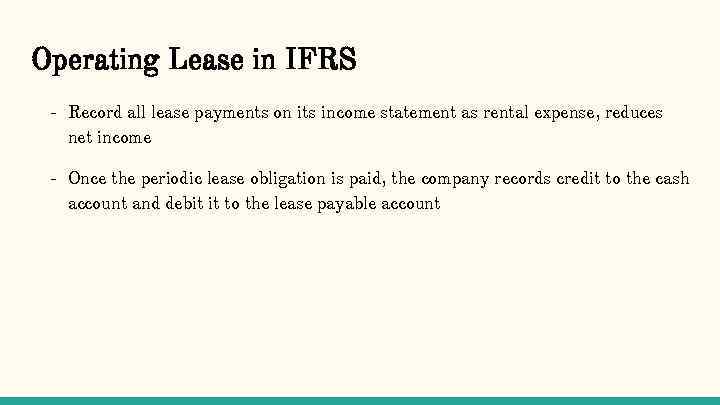

Operating Lease in IFRS - Record all lease payments on its income statement as rental expense, reduces net income - Once the periodic lease obligation is paid, the company records credit to the cash account and debit it to the lease payable account

Operating Lease in IFRS - Record all lease payments on its income statement as rental expense, reduces net income - Once the periodic lease obligation is paid, the company records credit to the cash account and debit it to the lease payable account

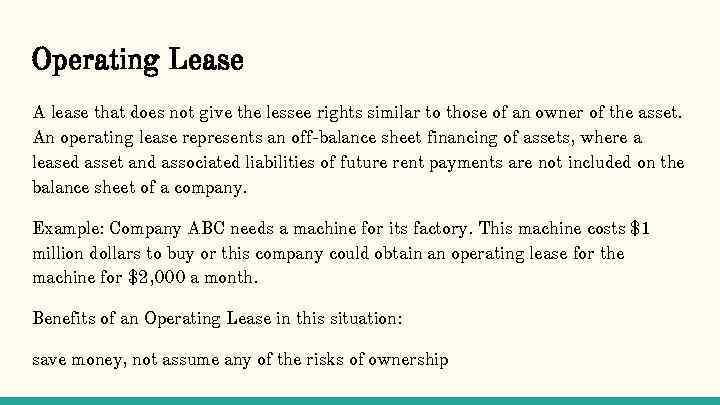

Operating Lease A lease that does not give the lessee rights similar to those of an owner of the asset. An operating lease represents an off-balance sheet financing of assets, where a leased asset and associated liabilities of future rent payments are not included on the balance sheet of a company. Example: Company ABC needs a machine for its factory. This machine costs $1 million dollars to buy or this company could obtain an operating lease for the machine for $2, 000 a month. Benefits of an Operating Lease in this situation: save money, not assume any of the risks of ownership

Operating Lease A lease that does not give the lessee rights similar to those of an owner of the asset. An operating lease represents an off-balance sheet financing of assets, where a leased asset and associated liabilities of future rent payments are not included on the balance sheet of a company. Example: Company ABC needs a machine for its factory. This machine costs $1 million dollars to buy or this company could obtain an operating lease for the machine for $2, 000 a month. Benefits of an Operating Lease in this situation: save money, not assume any of the risks of ownership

SALE AND LEASEBACK TRANSACTIONS

SALE AND LEASEBACK TRANSACTIONS

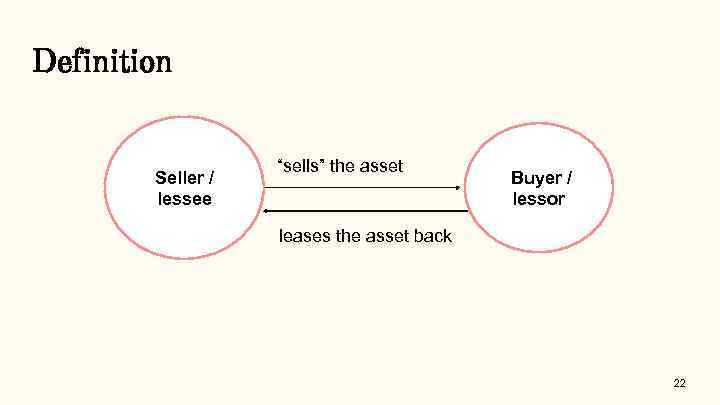

Definition Seller / lessee “sells” the asset Buyer / lessor leases the asset back 22

Definition Seller / lessee “sells” the asset Buyer / lessor leases the asset back 22

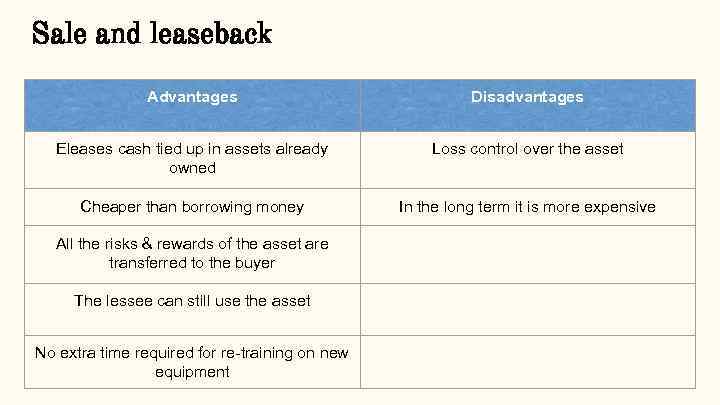

Sale and leaseback Advantages Disadvantages Eleases cash tied up in assets already owned Loss control over the asset Cheaper than borrowing money In the long term it is more expensive All the risks & rewards of the asset are transferred to the buyer The lessee can still use the asset No extra time required for re-training on new equipment

Sale and leaseback Advantages Disadvantages Eleases cash tied up in assets already owned Loss control over the asset Cheaper than borrowing money In the long term it is more expensive All the risks & rewards of the asset are transferred to the buyer The lessee can still use the asset No extra time required for re-training on new equipment

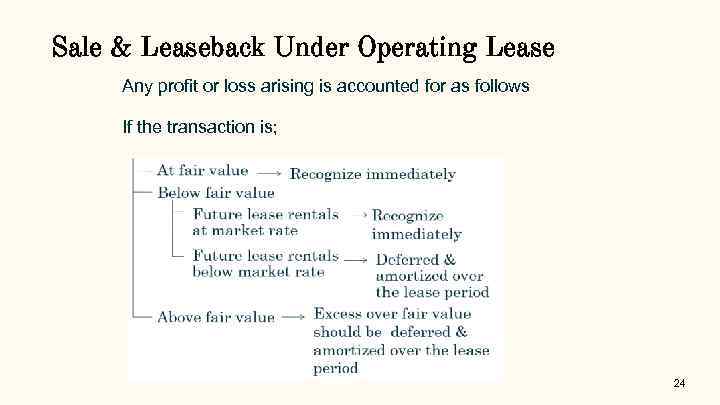

Sale & Leaseback Under Operating Lease Any profit or loss arising is accounted for as follows If the transaction is; 24

Sale & Leaseback Under Operating Lease Any profit or loss arising is accounted for as follows If the transaction is; 24

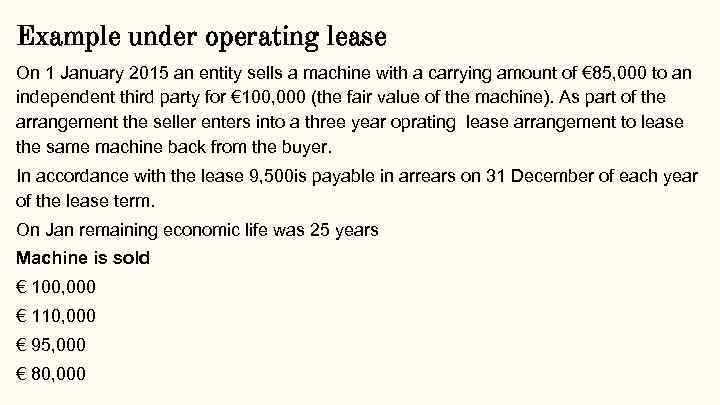

Example under operating lease On 1 January 2015 an entity sells a machine with a carrying amount of € 85, 000 to an independent third party for € 100, 000 (the fair value of the machine). As part of the arrangement the seller enters into a three year oprating lease arrangement to lease the same machine back from the buyer. In accordance with the lease 9, 500 is payable in arrears on 31 December of each year of the lease term. On Jan remaining economic life was 25 years Machine is sold € 100, 000 € 110, 000 € 95, 000 € 80, 000

Example under operating lease On 1 January 2015 an entity sells a machine with a carrying amount of € 85, 000 to an independent third party for € 100, 000 (the fair value of the machine). As part of the arrangement the seller enters into a three year oprating lease arrangement to lease the same machine back from the buyer. In accordance with the lease 9, 500 is payable in arrears on 31 December of each year of the lease term. On Jan remaining economic life was 25 years Machine is sold € 100, 000 € 110, 000 € 95, 000 € 80, 000

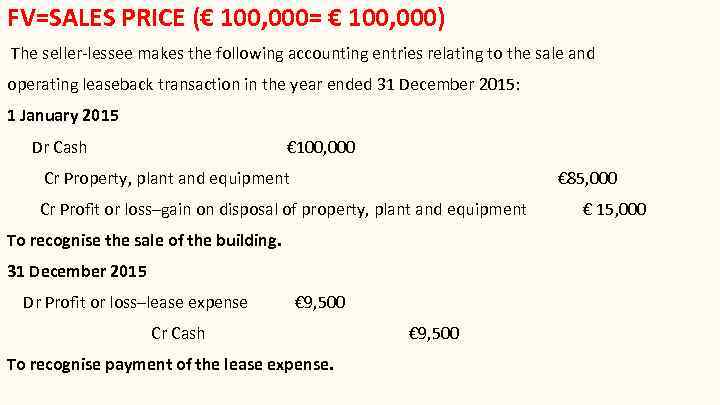

FV=SALES PRICE (€ 100, 000= € 100, 000) The seller-lessee makes the following accounting entries relating to the sale and operating leaseback transaction in the year ended 31 December 2015: 1 January 2015 Dr Cash € 100, 000 Cr Property, plant and equipment € 85, 000 Cr Profit or loss–gain on disposal of property, plant and equipment To recognise the sale of the building. 31 December 2015 Dr Profit or loss–lease expense € 9, 500 Cr Cash To recognise payment of the lease expense. € 9, 500 € 15, 000

FV=SALES PRICE (€ 100, 000= € 100, 000) The seller-lessee makes the following accounting entries relating to the sale and operating leaseback transaction in the year ended 31 December 2015: 1 January 2015 Dr Cash € 100, 000 Cr Property, plant and equipment € 85, 000 Cr Profit or loss–gain on disposal of property, plant and equipment To recognise the sale of the building. 31 December 2015 Dr Profit or loss–lease expense € 9, 500 Cr Cash To recognise payment of the lease expense. € 9, 500 € 15, 000

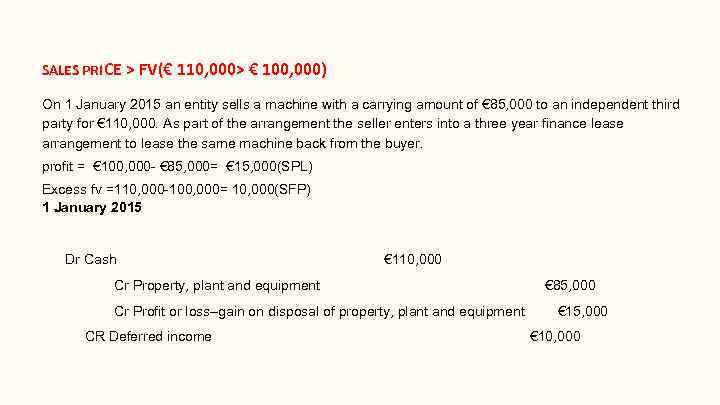

SALES PRI CE > FV(€ 110, 000> € 100, 000) On 1 January 2015 an entity sells a machine with a carrying amount of € 85, 000 to an independent third party for € 110, 000. As part of the arrangement the seller enters into a three year finance lease arrangement to lease the same machine back from the buyer. profit = € 100, 000 - € 85, 000= € 15, 000(SPL) Excess fv =110, 000 -100, 000= 10, 000(SFP) 1 January 2015 Dr Cash € 110, 000 Cr Property, plant and equipment Cr Profit or loss–gain on disposal of property, plant and equipment CR Deferred income € 85, 000 € 10, 000

SALES PRI CE > FV(€ 110, 000> € 100, 000) On 1 January 2015 an entity sells a machine with a carrying amount of € 85, 000 to an independent third party for € 110, 000. As part of the arrangement the seller enters into a three year finance lease arrangement to lease the same machine back from the buyer. profit = € 100, 000 - € 85, 000= € 15, 000(SPL) Excess fv =110, 000 -100, 000= 10, 000(SFP) 1 January 2015 Dr Cash € 110, 000 Cr Property, plant and equipment Cr Profit or loss–gain on disposal of property, plant and equipment CR Deferred income € 85, 000 € 10, 000

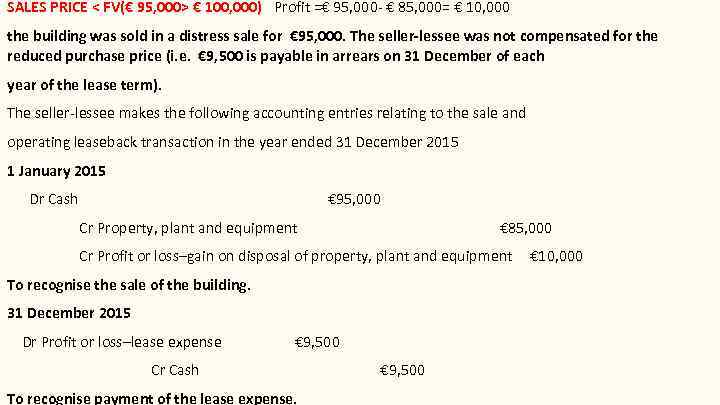

SALES PRICE < FV(€ 95, 000> € 100, 000) Profit =€ 95, 000 - € 85, 000= € 10, 000 the building was sold in a distress sale for € 95, 000. The seller-lessee was not compensated for the reduced purchase price (i. e. € 9, 500 is payable in arrears on 31 December of each year of the lease term). The seller-lessee makes the following accounting entries relating to the sale and operating leaseback transaction in the year ended 31 December 2015 1 January 2015 Dr Cash € 95, 000 Cr Property, plant and equipment € 85, 000 Cr Profit or loss–gain on disposal of property, plant and equipment To recognise the sale of the building. 31 December 2015 Dr Profit or loss–lease expense € 9, 500 Cr Cash To recognise payment of the lease expense. € 9, 500 € 10, 000

SALES PRICE < FV(€ 95, 000> € 100, 000) Profit =€ 95, 000 - € 85, 000= € 10, 000 the building was sold in a distress sale for € 95, 000. The seller-lessee was not compensated for the reduced purchase price (i. e. € 9, 500 is payable in arrears on 31 December of each year of the lease term). The seller-lessee makes the following accounting entries relating to the sale and operating leaseback transaction in the year ended 31 December 2015 1 January 2015 Dr Cash € 95, 000 Cr Property, plant and equipment € 85, 000 Cr Profit or loss–gain on disposal of property, plant and equipment To recognise the sale of the building. 31 December 2015 Dr Profit or loss–lease expense € 9, 500 Cr Cash To recognise payment of the lease expense. € 9, 500 € 10, 000

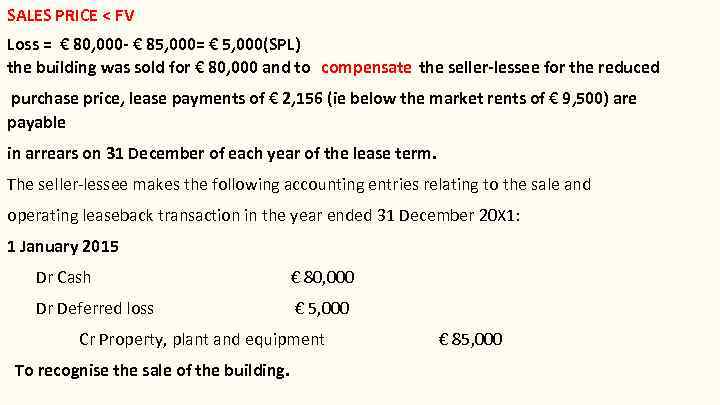

SALES PRICE < FV Loss = € 80, 000 - € 85, 000= € 5, 000(SPL) the building was sold for € 80, 000 and to compensate the seller-lessee for the reduced purchase price, lease payments of € 2, 156 (ie below the market rents of € 9, 500) are payable in arrears on 31 December of each year of the lease term. The seller-lessee makes the following accounting entries relating to the sale and operating leaseback transaction in the year ended 31 December 20 X 1: 1 January 2015 Dr Cash € 80, 000 Dr Deferred loss € 5, 000 Cr Property, plant and equipment To recognise the sale of the building. € 85, 000

SALES PRICE < FV Loss = € 80, 000 - € 85, 000= € 5, 000(SPL) the building was sold for € 80, 000 and to compensate the seller-lessee for the reduced purchase price, lease payments of € 2, 156 (ie below the market rents of € 9, 500) are payable in arrears on 31 December of each year of the lease term. The seller-lessee makes the following accounting entries relating to the sale and operating leaseback transaction in the year ended 31 December 20 X 1: 1 January 2015 Dr Cash € 80, 000 Dr Deferred loss € 5, 000 Cr Property, plant and equipment To recognise the sale of the building. € 85, 000

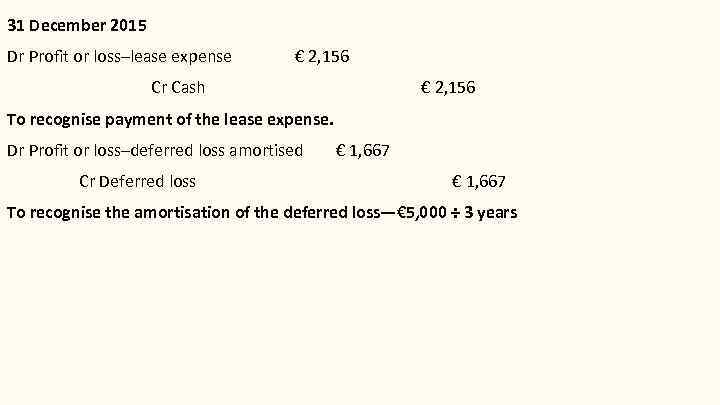

31 December 2015 Dr Profit or loss–lease expense € 2, 156 Cr Cash € 2, 156 To recognise payment of the lease expense. Dr Profit or loss–deferred loss amortised Cr Deferred loss € 1, 667 To recognise the amortisation of the deferred loss—€ 5, 000 ÷ 3 years

31 December 2015 Dr Profit or loss–lease expense € 2, 156 Cr Cash € 2, 156 To recognise payment of the lease expense. Dr Profit or loss–deferred loss amortised Cr Deferred loss € 1, 667 To recognise the amortisation of the deferred loss—€ 5, 000 ÷ 3 years

Thanks for your attention!

Thanks for your attention!