c38941f66f70b31edbcd624f7d5cae9c.ppt

- Количество слайдов: 66

Learning Objectives

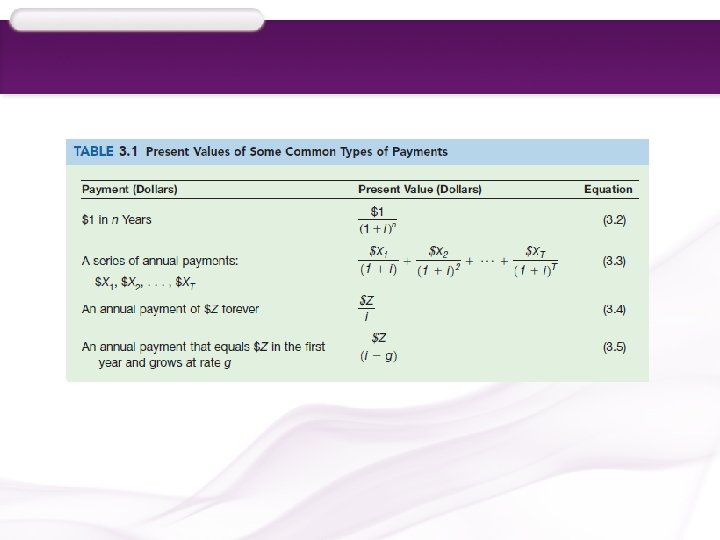

Valuing Income Streams

Future Value

Present Value

Present Value

A Series of Payments

Present Value: An Example

Payments Forever

Another Perpetuity

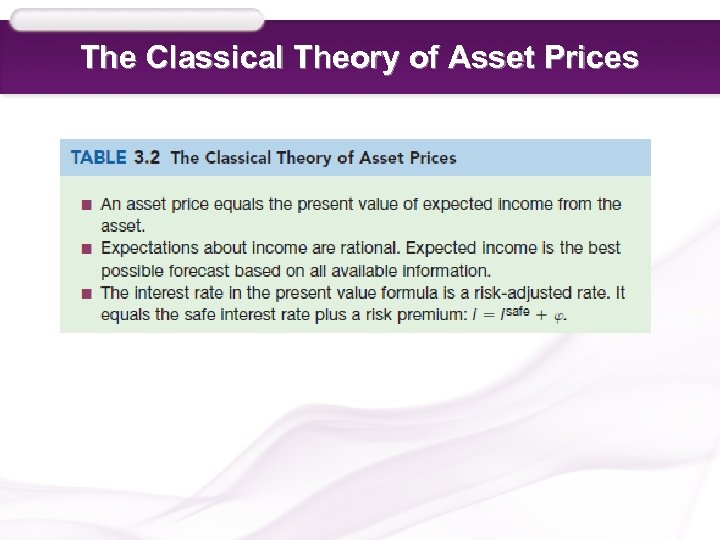

The Classical Theory of Asset Prices

Bond Prices

Bond Prices

Stock Prices

Expectations

Risk-free and Risky Interest Rates

Risk-free and Risky Interest Rates

The Classical Theory of Asset Prices

The Gordon Growth Model of Stock Prices

The Gordon Growth Model of Stock Prices

Fluctuations in Asset Prices

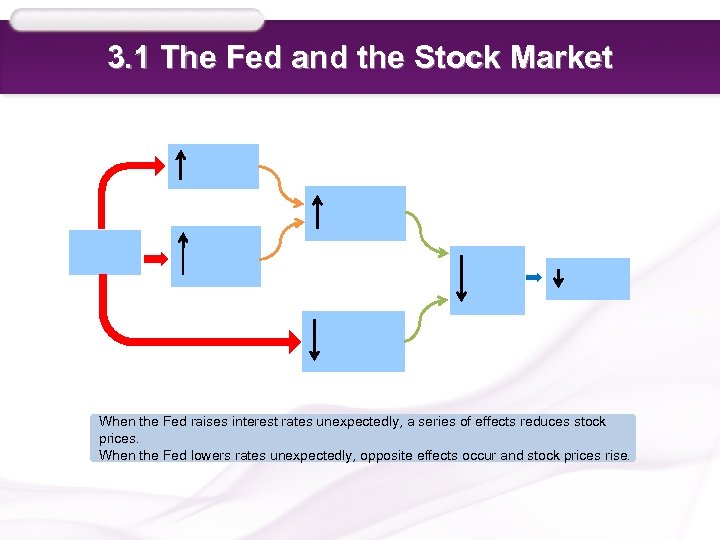

Case Study: The Fed and the Stock Market

Case Study: The Fed and the Stock Market

3. 1 The Fed and the Stock Market When the Fed raises interest rates unexpectedly, a series of effects reduces stock prices. When the Fed lowers rates unexpectedly, opposite effects occur and stock prices rise.

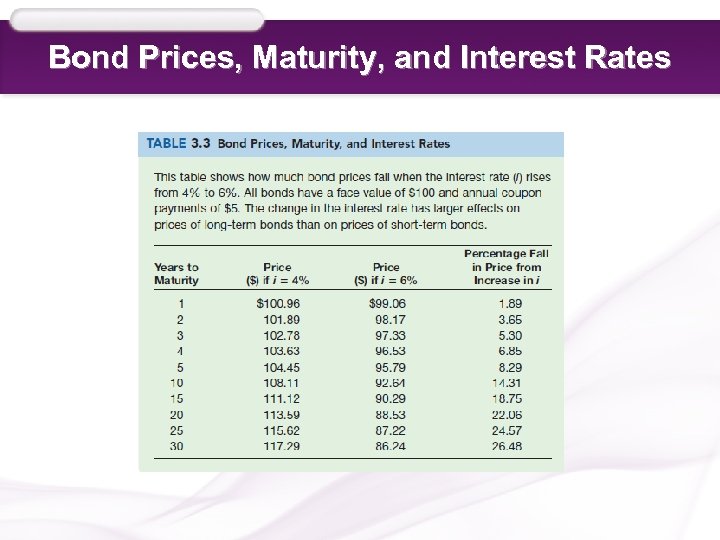

Which Asset Prices Are Most Volatile?

Bond Prices, Maturity, and Interest Rates

Which Asset Prices Are Most Volatile?

Asset-Price Bubbles

The House Price Bubble

Case Study: Tulipmania

Looking for Bubbles

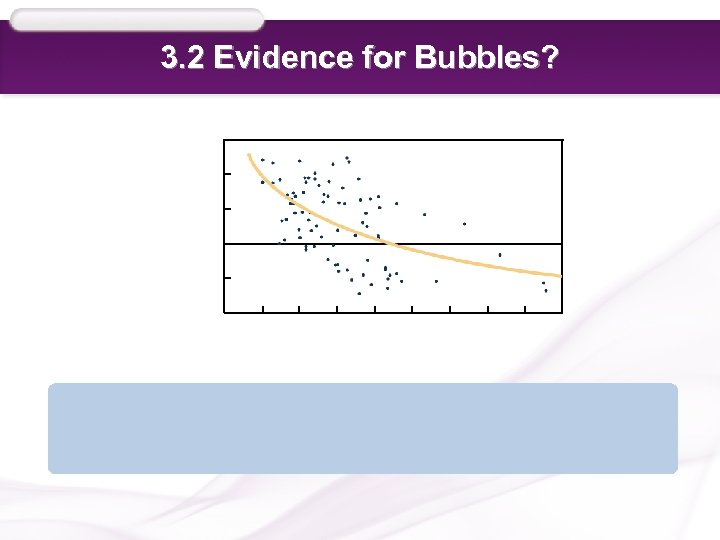

3. 2 Evidence for Bubbles? Each point in this graph represents a year between 1918 and 2000. The horizontal axis is the price -earnings ratio for stocks in the S&P 500, based on average earnings over the previous 10 years. The vertical axis is the average percentage change in S&P prices over the following 10 years, adjusted for inflation. (The 10 -year change after 2000 is estimated with data through 2009).

Case Study: The U. S. Stock Market, 19902010

Case Study: The U. S. Stock Market, 19902010

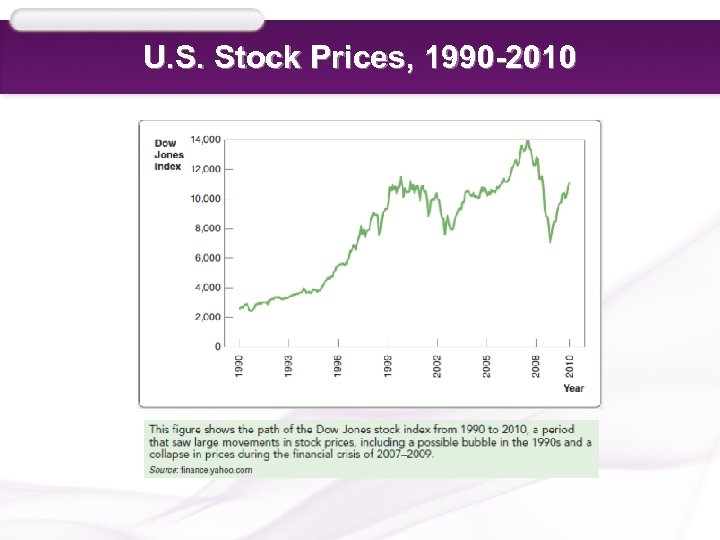

Case Study: The U. S. Stock Market, 19902010

U. S. Stock Prices, 1990 -2010

Asset-price Crashes

Case Study: The Two Big Crashes

Case Study: The Two Big Crashes

Crash Prevention

Crash Prevention

Yield to Maturity

Yield to Maturity

The Rate of Return

The Rate of Return

The Rate of Return

Stock and Bond Returns

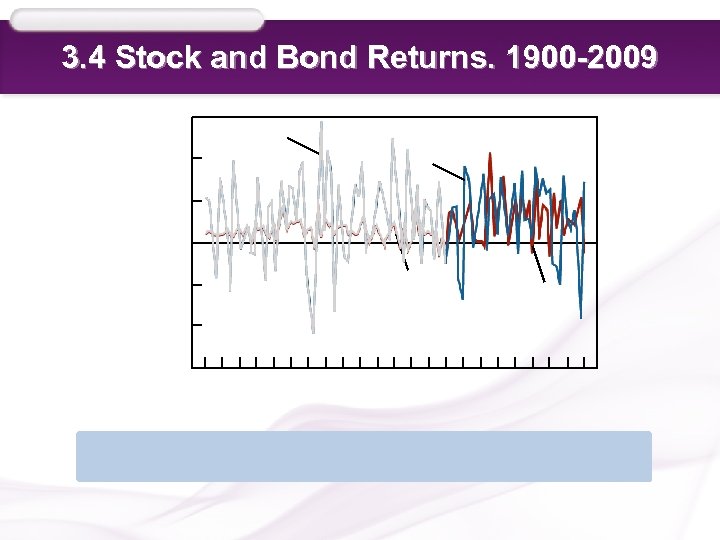

3. 4 Stock and Bond Returns. 1900 -2009

Rate of Return versus Yield to Maturity

Real and Nominal Interest Rates

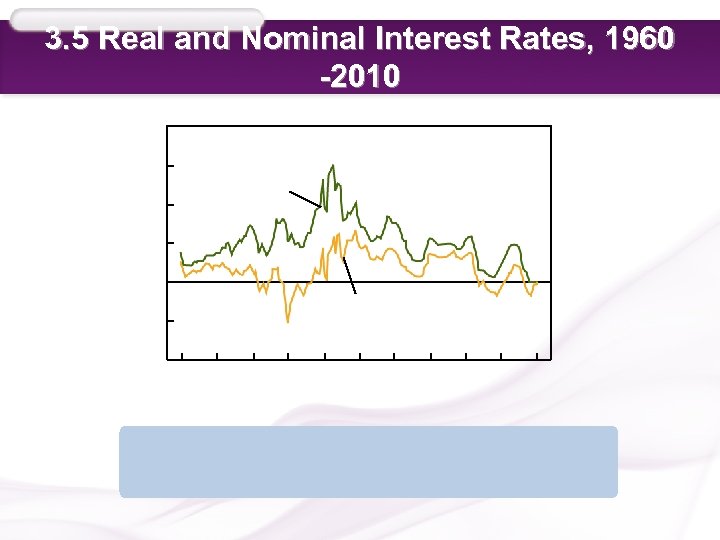

3. 5 Real and Nominal Interest Rates, 1960 -2010

Nominal and Real Asset Returns

Real Interest Rates: Ex Ante versus Ex Post

Ex Ante and Ex Post Real Interest Rates

Case Study: Inflation and the S&L Crisis

Inflation-Indexed Bonds

Chapter Summary

Chapter Summary

Chapter Summary

Chapter Summary

Chapter Summary

Chapter Summary

Chapter Summary

Chapter Summary

Chapter Summary

c38941f66f70b31edbcd624f7d5cae9c.ppt