8a976424c353d6a2108429071c85c047.ppt

- Количество слайдов: 33

Leap. Frog Enterprises Inc. (LF) Richie Hartz, Patrick O’Donnell, Matthew Rasinski Tuesday, April 2 nd 2013 S

Leap. Frog Enterprises Inc. (LF) Richie Hartz, Patrick O’Donnell, Matthew Rasinski Tuesday, April 2 nd 2013 S

Agenda S Introduction S Company Overview S Industry Overview S Stock Performance S Financial Analysis S Valuation S Recommendation

Agenda S Introduction S Company Overview S Industry Overview S Stock Performance S Financial Analysis S Valuation S Recommendation

Introduction S Leap. Frog trades on the NYSE with ticker symbol LF S Company was founded in 1995 by Micheal Wood and Robert Lally and headquartered in Emeryville, California USA S Focus: educational entertainment S Concept was originally designed to educate Wood’s son through toys

Introduction S Leap. Frog trades on the NYSE with ticker symbol LF S Company was founded in 1995 by Micheal Wood and Robert Lally and headquartered in Emeryville, California USA S Focus: educational entertainment S Concept was originally designed to educate Wood’s son through toys

Company Overview S Leap. Frog - designs, develops, and markets technology-based products for the purpose of education S Demographics – infants through 9 years of age S Focus on math, reading, writing, science, social studies, creativity, life skills, and foreign languages S In 1995, with the aid of Stanford University Professor Dr. Robert Calfee, Leap. Frog developed their first toy called the Leap. Frog Phonics Desk (at a of price $50). S In 2013, the firms top product is the Disney Princess Bundle – a tablet complete with “Disney” apps (price $130)

Company Overview S Leap. Frog - designs, develops, and markets technology-based products for the purpose of education S Demographics – infants through 9 years of age S Focus on math, reading, writing, science, social studies, creativity, life skills, and foreign languages S In 1995, with the aid of Stanford University Professor Dr. Robert Calfee, Leap. Frog developed their first toy called the Leap. Frog Phonics Desk (at a of price $50). S In 2013, the firms top product is the Disney Princess Bundle – a tablet complete with “Disney” apps (price $130)

Product Overview S Learning games, apps, e. Books, videos, music, toys, and more S Currently sell 2 versions of Leap. Pads, 2 hand held computers (GS and the Explorer), 2 sets of e. Books (Tag and the Tag Junior), learning toys, and i. Phone and i. Pad apps S Leap. Pads -- $120 S GS and Explorer -- $70 S e. Books -- $25 to $170 bundles S Toys -- $10 to $25 S Apps -- $0. 99 www. Leap. Frog. com

Product Overview S Learning games, apps, e. Books, videos, music, toys, and more S Currently sell 2 versions of Leap. Pads, 2 hand held computers (GS and the Explorer), 2 sets of e. Books (Tag and the Tag Junior), learning toys, and i. Phone and i. Pad apps S Leap. Pads -- $120 S GS and Explorer -- $70 S e. Books -- $25 to $170 bundles S Toys -- $10 to $25 S Apps -- $0. 99 www. Leap. Frog. com

Leap. Frog Products

Leap. Frog Products

Recent News S Leapfrog has won over 80 awards from the Parent’s Choice Foundation S As of 2013 – The new management team has shifted their emphasis from toy development to educational entertainment S Leapfrog has sold more than 100 million books, over 100 million educational toys and over 55 million tablet and gaming platforms.

Recent News S Leapfrog has won over 80 awards from the Parent’s Choice Foundation S As of 2013 – The new management team has shifted their emphasis from toy development to educational entertainment S Leapfrog has sold more than 100 million books, over 100 million educational toys and over 55 million tablet and gaming platforms.

Transition Period Educational Entertainment Toy Development Transition by Management • Changes the target market from infant to grade-schooler • Addition rather then a substitute to current product line

Transition Period Educational Entertainment Toy Development Transition by Management • Changes the target market from infant to grade-schooler • Addition rather then a substitute to current product line

2013 Outlook S New product launches include: S Learn-to-read system S i. Phone and i. Pad apps S New version of Leap. Pad tablet S Global distribution networks S Including 4 interactive languages S Growth Strategy: long term investments in content, international expansion, online communities, systems, and new platforms

2013 Outlook S New product launches include: S Learn-to-read system S i. Phone and i. Pad apps S New version of Leap. Pad tablet S Global distribution networks S Including 4 interactive languages S Growth Strategy: long term investments in content, international expansion, online communities, systems, and new platforms

Accounting S Utilize FIFO inventory recognition S Emerville, California – Headquarters and Operations S Type of possession: Lease S Fontana, California – Distribution Center S Type of possession: Lease S Income tax benefits S 2012 – ($24, 504, 000) & 2011 – ($1, 137, 000) S Due to the recognition of previously unrecognized tax carryforwards

Accounting S Utilize FIFO inventory recognition S Emerville, California – Headquarters and Operations S Type of possession: Lease S Fontana, California – Distribution Center S Type of possession: Lease S Income tax benefits S 2012 – ($24, 504, 000) & 2011 – ($1, 137, 000) S Due to the recognition of previously unrecognized tax carryforwards

Manufacturing S Designed to maximize the use of outsourced services S With respect to physical production and distribution S Highly seasonal business S Manufacturers are located in Asia, primarily in China S Top three vendors supplied 73%, 65%, and 57% of Leap. Frog’s products in 2012, 2011, and 2010 respectively S Largest manufacturers are: Wynnewood Corp. Ltd. & WKK Technology Limited S They are billed by manufacturers in US dollars

Manufacturing S Designed to maximize the use of outsourced services S With respect to physical production and distribution S Highly seasonal business S Manufacturers are located in Asia, primarily in China S Top three vendors supplied 73%, 65%, and 57% of Leap. Frog’s products in 2012, 2011, and 2010 respectively S Largest manufacturers are: Wynnewood Corp. Ltd. & WKK Technology Limited S They are billed by manufacturers in US dollars

Operations S Develop products primarily in the United States S Marketing efforts are centered on North America S Lesser extent to Europe and the rest of the world S Foreign currency transactions are hedged through short term futures contracts

Operations S Develop products primarily in the United States S Marketing efforts are centered on North America S Lesser extent to Europe and the rest of the world S Foreign currency transactions are hedged through short term futures contracts

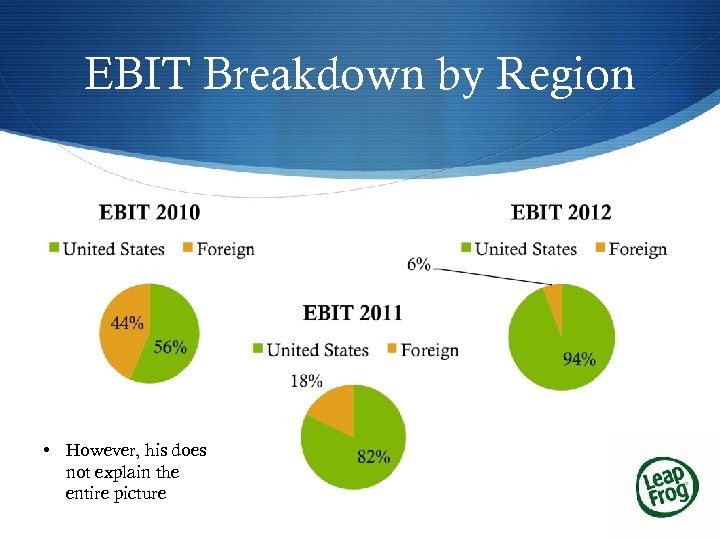

EBIT Breakdown by Region • However, his does not explain the entire picture

EBIT Breakdown by Region • However, his does not explain the entire picture

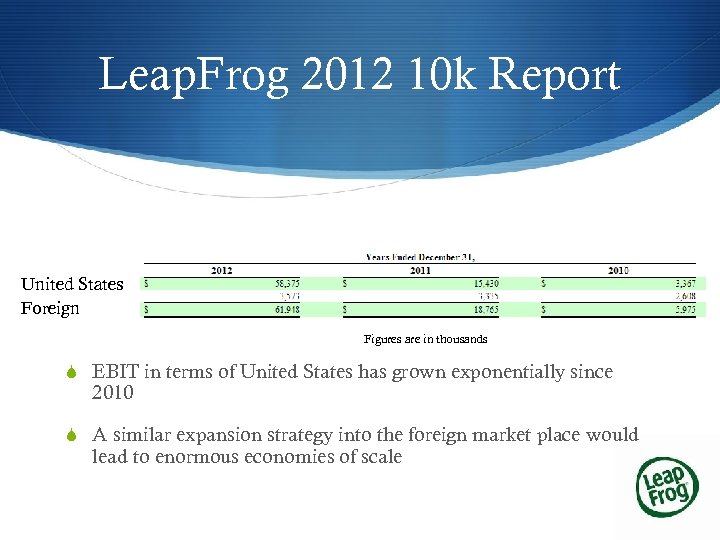

Leap. Frog 2012 10 k Report United States Foreign Figures are in thousands S EBIT in terms of United States has grown exponentially since 2010 S A similar expansion strategy into the foreign market place would lead to enormous economies of scale

Leap. Frog 2012 10 k Report United States Foreign Figures are in thousands S EBIT in terms of United States has grown exponentially since 2010 S A similar expansion strategy into the foreign market place would lead to enormous economies of scale

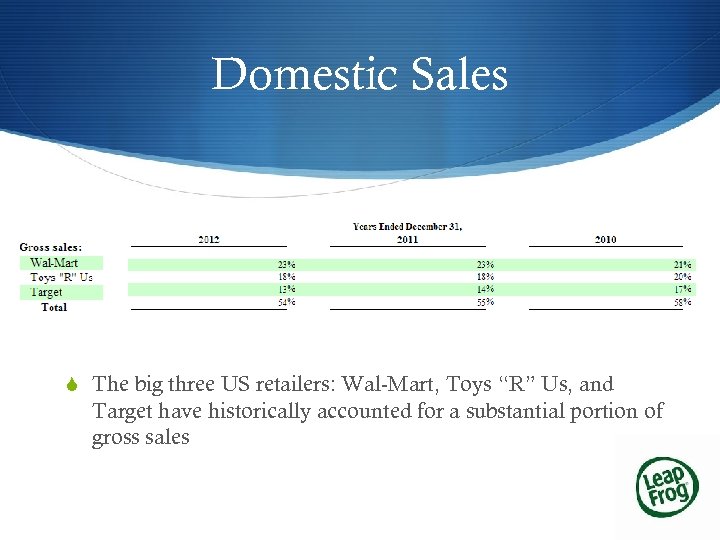

Domestic Sales S The big three US retailers: Wal-Mart, Toys “R” Us, and Target have historically accounted for a substantial portion of gross sales

Domestic Sales S The big three US retailers: Wal-Mart, Toys “R” Us, and Target have historically accounted for a substantial portion of gross sales

Equity Snapshot S Stock Price: $8. 33 S Beta: 1. 26 S TTM P/E: 6. 72 S Forward P/E: 11. 11 S PEG Ratio (5 year): 0. 67 S Price/Book: 1. 76 Source: www. finance. yahoo. com

Equity Snapshot S Stock Price: $8. 33 S Beta: 1. 26 S TTM P/E: 6. 72 S Forward P/E: 11. 11 S PEG Ratio (5 year): 0. 67 S Price/Book: 1. 76 Source: www. finance. yahoo. com

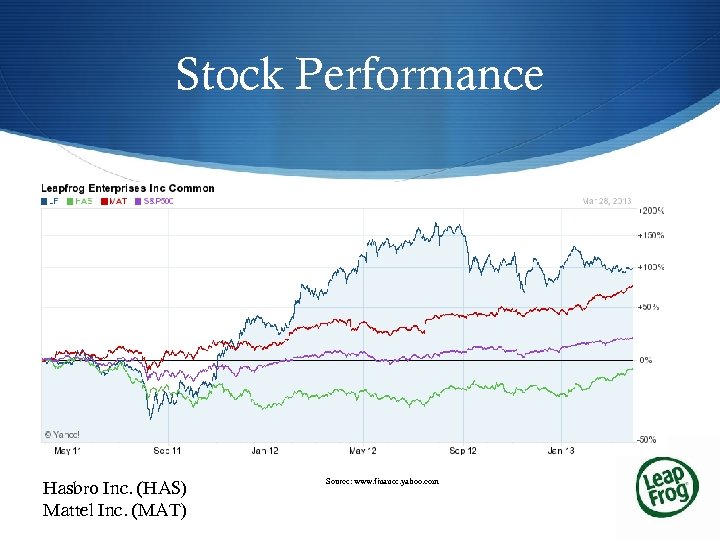

Stock Performance Hasbro Inc. (HAS) Mattel Inc. (MAT) Source: www. finance. yahoo. com

Stock Performance Hasbro Inc. (HAS) Mattel Inc. (MAT) Source: www. finance. yahoo. com

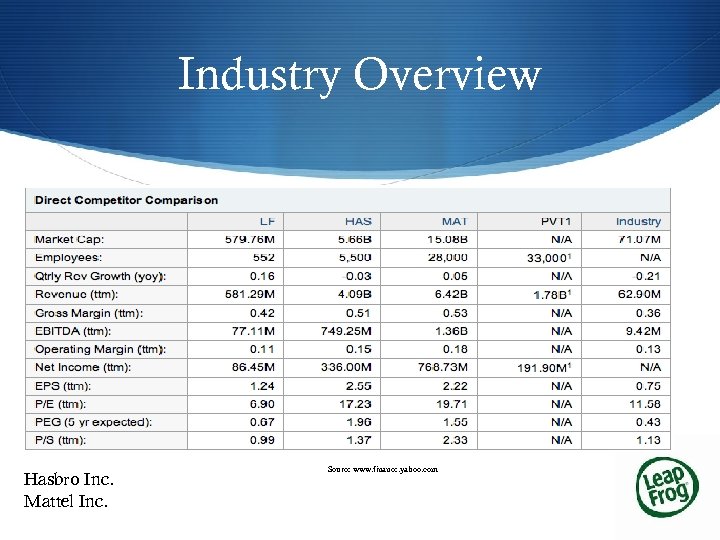

Industry Overview Hasbro Inc. Mattel Inc. Source www. finance. yahoo. com

Industry Overview Hasbro Inc. Mattel Inc. Source www. finance. yahoo. com

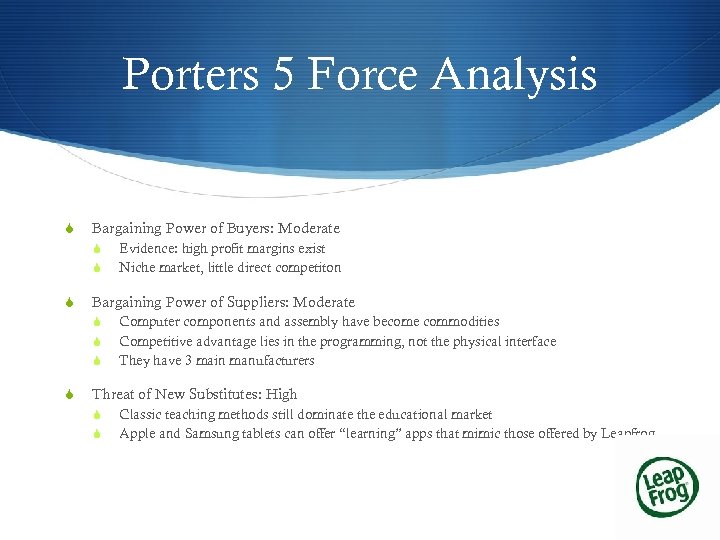

Porters 5 Force Analysis S Bargaining Power of Buyers: Moderate S S S Bargaining Power of Suppliers: Moderate S S Evidence: high profit margins exist Niche market, little direct competiton Computer components and assembly have become commodities Competitive advantage lies in the programming, not the physical interface They have 3 main manufacturers Threat of New Substitutes: High S S Classic teaching methods still dominate the educational market Apple and Samsung tablets can offer “learning” apps that mimic those offered by Leapfrog.

Porters 5 Force Analysis S Bargaining Power of Buyers: Moderate S S S Bargaining Power of Suppliers: Moderate S S Evidence: high profit margins exist Niche market, little direct competiton Computer components and assembly have become commodities Competitive advantage lies in the programming, not the physical interface They have 3 main manufacturers Threat of New Substitutes: High S S Classic teaching methods still dominate the educational market Apple and Samsung tablets can offer “learning” apps that mimic those offered by Leapfrog.

5 Force Analysis Continued S Competitive Rivalry within the Industry: Moderate S There is no definitive market dominance S Educational Technology for individual users is a relatively new industry (use of the “pad”) S Threat of New Entrants: High S App market is vast and easy to gain market presence S Brand loyalty has yet to be established – users “children” unable to recognize the difference between a Leapfrog product and an Apple Product.

5 Force Analysis Continued S Competitive Rivalry within the Industry: Moderate S There is no definitive market dominance S Educational Technology for individual users is a relatively new industry (use of the “pad”) S Threat of New Entrants: High S App market is vast and easy to gain market presence S Brand loyalty has yet to be established – users “children” unable to recognize the difference between a Leapfrog product and an Apple Product.

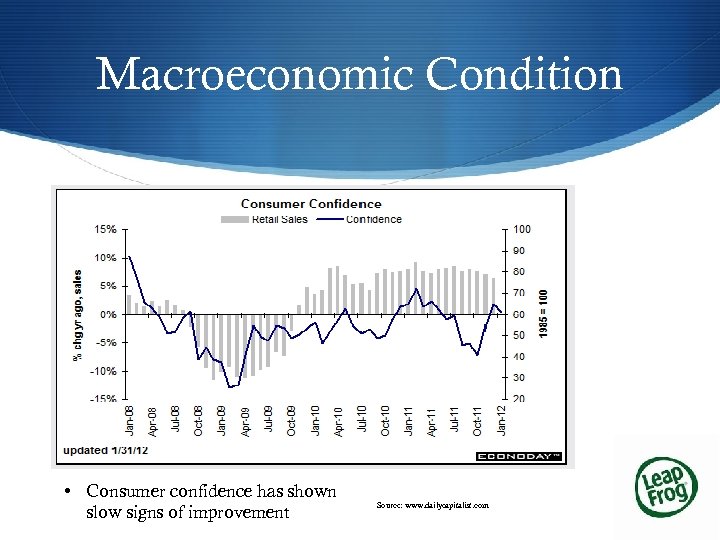

Macroeconomic Condition • Consumer confidence has shown slow signs of improvement Source: www. dailycapitalist. com

Macroeconomic Condition • Consumer confidence has shown slow signs of improvement Source: www. dailycapitalist. com

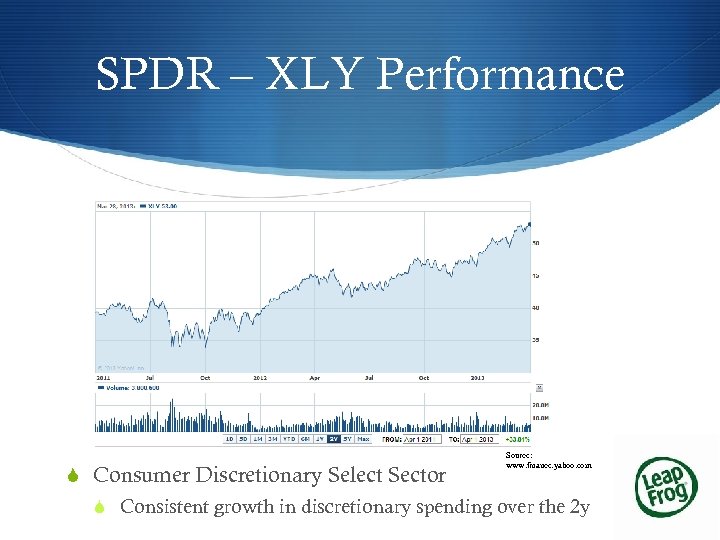

SPDR – XLY Performance S Consumer Discretionary Select Sector Source: www. finance. yahoo. com S Consistent growth in discretionary spending over the 2 y

SPDR – XLY Performance S Consumer Discretionary Select Sector Source: www. finance. yahoo. com S Consistent growth in discretionary spending over the 2 y

2012 th 4 Quarter Highlights of full year 2012 results compared to full year 2011 results: S Consolidated net sales were up 28%. S U. S. segment net sales were up 24%, and international segment net sales were up 38%. S Income from operations was up 170%. S Income from operations as a percentage of net sales was 11. 0%, more than double the prior year. S Net income was $86. 5 million, up 334%. S Adjusted EBITDA was $93. 1 million, up 89%. S Cash and cash equivalents were $120. 0 million as of December 31, 2012, up 67% compared to the balance as of December 31, 2011.

2012 th 4 Quarter Highlights of full year 2012 results compared to full year 2011 results: S Consolidated net sales were up 28%. S U. S. segment net sales were up 24%, and international segment net sales were up 38%. S Income from operations was up 170%. S Income from operations as a percentage of net sales was 11. 0%, more than double the prior year. S Net income was $86. 5 million, up 334%. S Adjusted EBITDA was $93. 1 million, up 89%. S Cash and cash equivalents were $120. 0 million as of December 31, 2012, up 67% compared to the balance as of December 31, 2011.

WHAT is Bringing in the Money? S According to management (2012 Annual Report): S -”Leap. Pad” – one of the generally more expensive items. S -“App” sales for i. Phone and i. Pad S In general, sales are increasing for the technology products, however the less technology intensive projects have greater margins.

WHAT is Bringing in the Money? S According to management (2012 Annual Report): S -”Leap. Pad” – one of the generally more expensive items. S -“App” sales for i. Phone and i. Pad S In general, sales are increasing for the technology products, however the less technology intensive projects have greater margins.

Revenue/Cost Tradeoffs S Overall Retail Inventory Levels have increased since 2010 S Sales increased by 5% while Cost of Goods increased by 6% (as a reflection of the proportionally higher sales of higher cost platforms “pads”) S Decreased Marketing expenditures to offset increased COGS (of technology products) and Operating expenditures.

Revenue/Cost Tradeoffs S Overall Retail Inventory Levels have increased since 2010 S Sales increased by 5% while Cost of Goods increased by 6% (as a reflection of the proportionally higher sales of higher cost platforms “pads”) S Decreased Marketing expenditures to offset increased COGS (of technology products) and Operating expenditures.

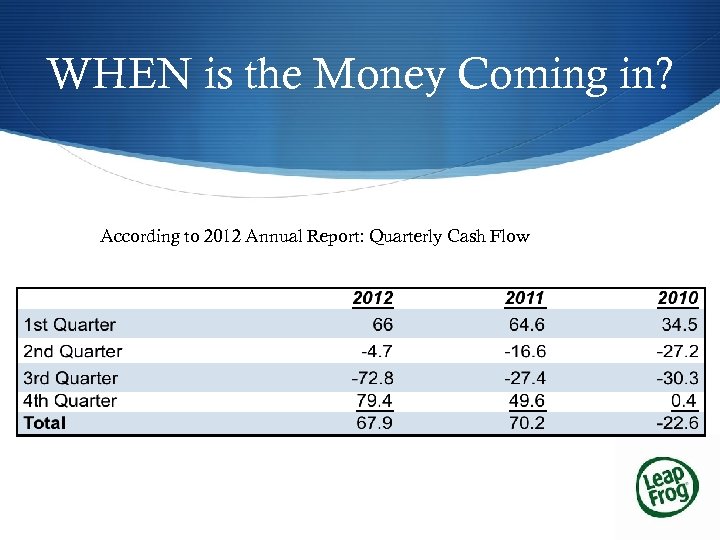

WHEN is the Money Coming in? According to 2012 Annual Report: Quarterly Cash Flow

WHEN is the Money Coming in? According to 2012 Annual Report: Quarterly Cash Flow

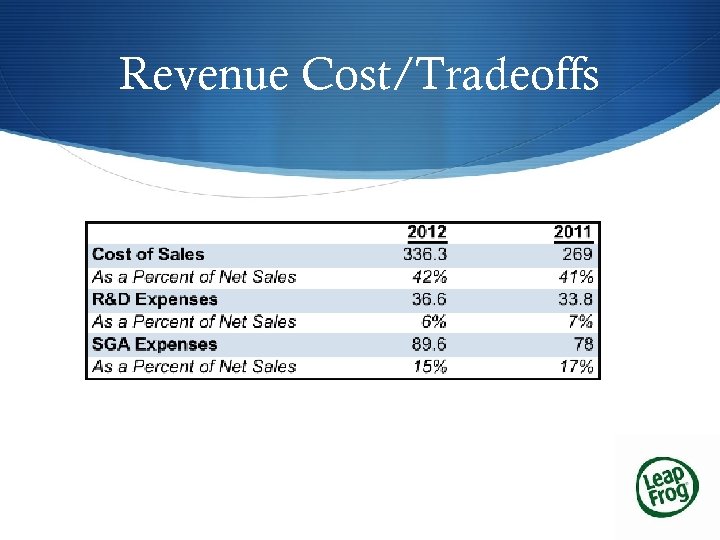

Revenue Cost/Tradeoffs

Revenue Cost/Tradeoffs

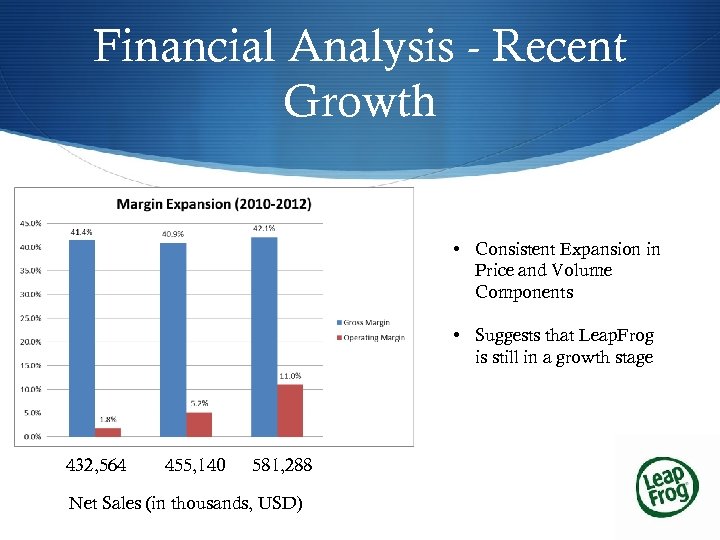

Financial Analysis - Recent Growth • Consistent Expansion in Price and Volume Components • Suggests that Leap. Frog is still in a growth stage 432, 564 455, 140 581, 288 Net Sales (in thousands, USD)

Financial Analysis - Recent Growth • Consistent Expansion in Price and Volume Components • Suggests that Leap. Frog is still in a growth stage 432, 564 455, 140 581, 288 Net Sales (in thousands, USD)

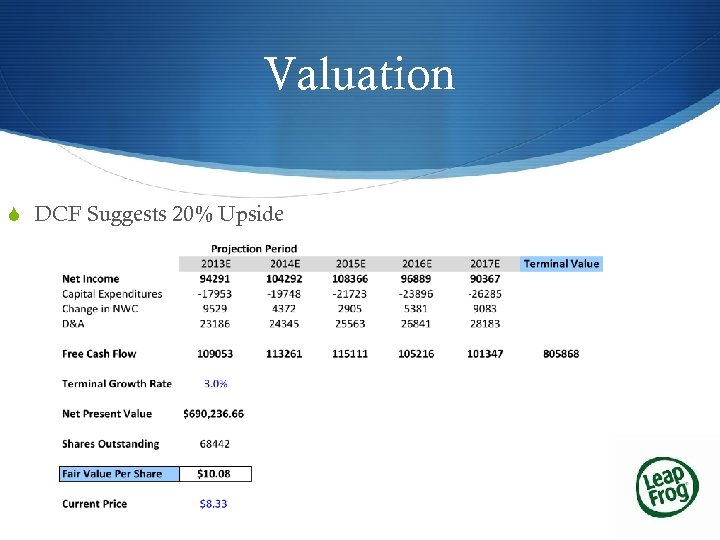

Valuation S DCF Suggests 20% Upside

Valuation S DCF Suggests 20% Upside

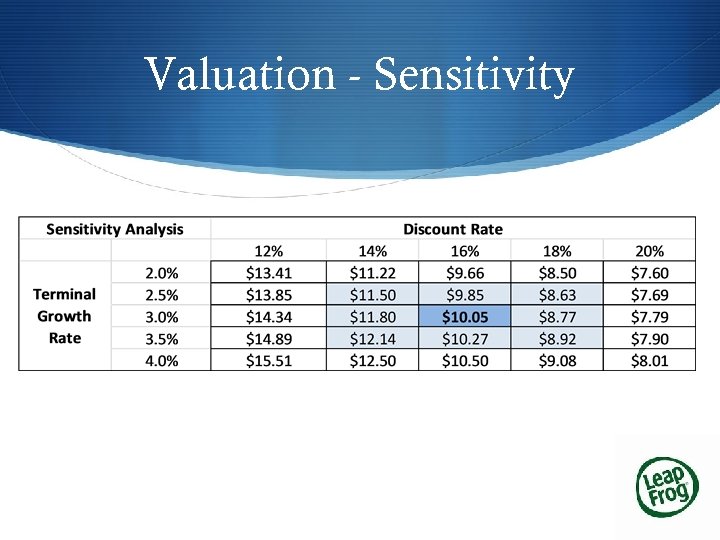

Valuation - Sensitivity

Valuation - Sensitivity

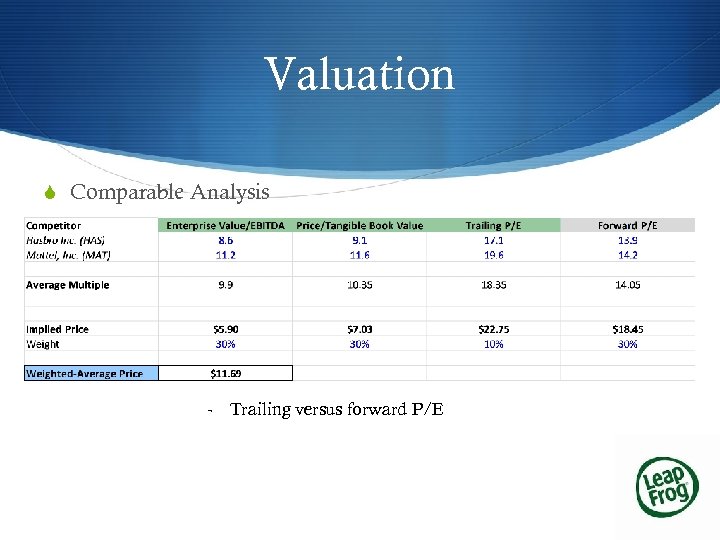

Valuation S Comparable Analysis - Trailing versus forward P/E

Valuation S Comparable Analysis - Trailing versus forward P/E

Decision Drivers S GICS Application S Clear Management Goals S Discounted Cash Flow S Comparable Analysis

Decision Drivers S GICS Application S Clear Management Goals S Discounted Cash Flow S Comparable Analysis

Recommendation S Buy 2000 Shares at the Current Market Price S Current Stock Price of $8. 20 S Order total: $16, 400

Recommendation S Buy 2000 Shares at the Current Market Price S Current Stock Price of $8. 20 S Order total: $16, 400