dd57ebb99cfe3d8c767d3a447eb975cb.ppt

- Количество слайдов: 70

leadingtrader. com Strategies For Reducing Risk with Alessio Rastani The Science of Using A Stop-Loss

leadingtrader. com Strategies For Reducing Risk with Alessio Rastani The Science of Using A Stop-Loss

This presentation is neither a solicitation nor an offer to Buy/Sell stocks, futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this webinar. The past performance of any trading system or methodology is not necessarily indicative of future results.

This presentation is neither a solicitation nor an offer to Buy/Sell stocks, futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this webinar. The past performance of any trading system or methodology is not necessarily indicative of future results.

leadingtrader. com Strategies For Reducing Risk with Alessio Rastani The Science of Using A Stop-Loss

leadingtrader. com Strategies For Reducing Risk with Alessio Rastani The Science of Using A Stop-Loss

leadingtrader. com The Agenda 1) Understanding a stop-loss order 2) My top 3 techniques for placing a stop: 3) (i) simple (ii) advanced 4) A key indicator to watch before you place a trade 5) Ideal places to place a stop 6) Where You should never place your stop 7) Best and Worst Times To Trade

leadingtrader. com The Agenda 1) Understanding a stop-loss order 2) My top 3 techniques for placing a stop: 3) (i) simple (ii) advanced 4) A key indicator to watch before you place a trade 5) Ideal places to place a stop 6) Where You should never place your stop 7) Best and Worst Times To Trade

“You Can Never Go Broke Taking A Profit…” ~ Wall Street Saying

“You Can Never Go Broke Taking A Profit…” ~ Wall Street Saying

leadingtrader. com

leadingtrader. com

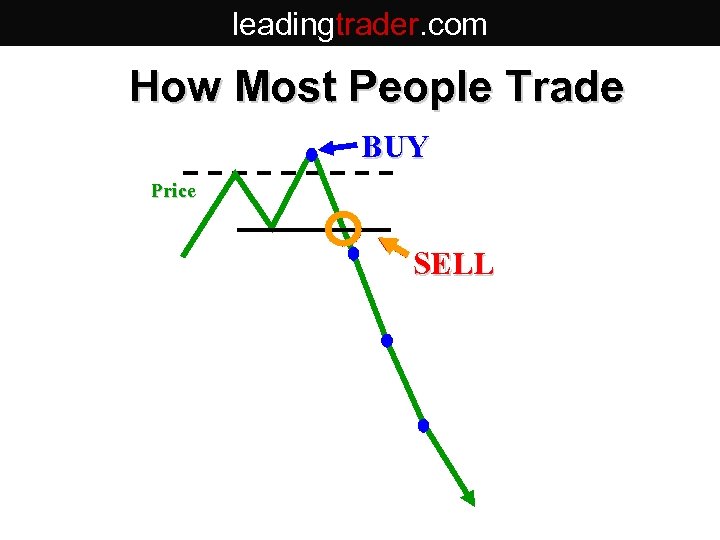

leadingtrader. com How Most People Trade BUY Price SELL

leadingtrader. com How Most People Trade BUY Price SELL

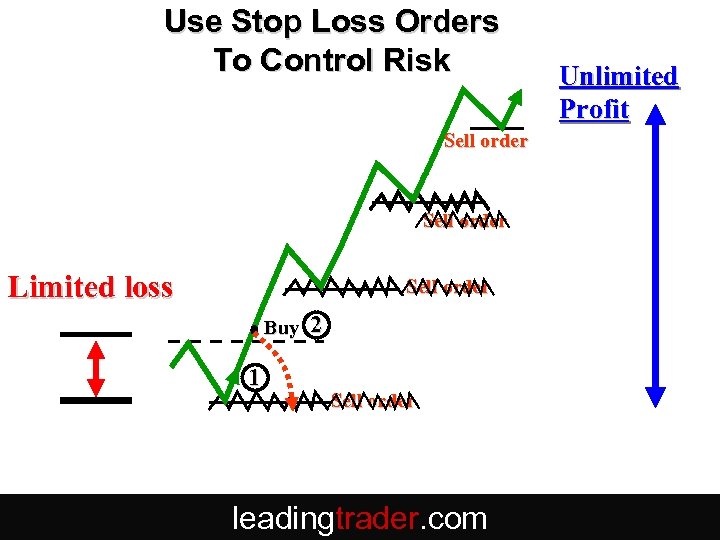

Use Stop Loss Orders To Control Risk Sell order Limited loss Sell order Buy 1 2 Sell order leadingtrader. com Unlimited Profit

Use Stop Loss Orders To Control Risk Sell order Limited loss Sell order Buy 1 2 Sell order leadingtrader. com Unlimited Profit

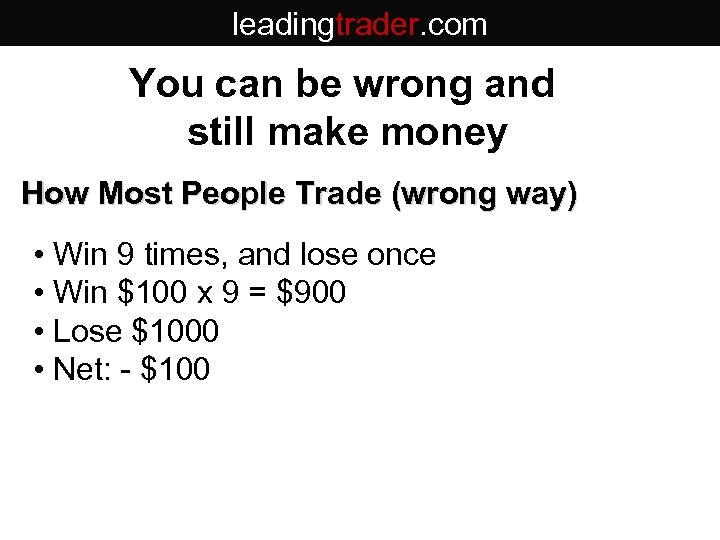

leadingtrader. com You can be wrong and still make money How Most People Trade (wrong way) • Win 9 times, and lose once • Win $100 x 9 = $900 • Lose $1000 • Net: - $100

leadingtrader. com You can be wrong and still make money How Most People Trade (wrong way) • Win 9 times, and lose once • Win $100 x 9 = $900 • Lose $1000 • Net: - $100

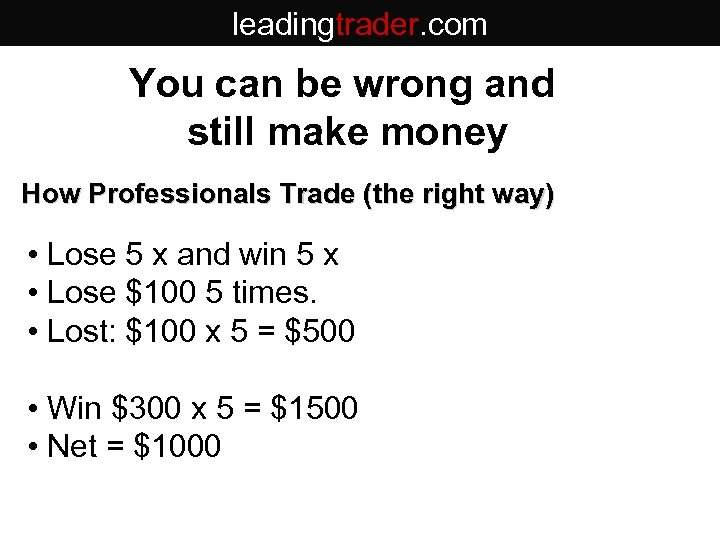

leadingtrader. com You can be wrong and still make money How Professionals Trade (the right way) • Lose 5 x and win 5 x • Lose $100 5 times. • Lost: $100 x 5 = $500 • Win $300 x 5 = $1500 • Net = $1000

leadingtrader. com You can be wrong and still make money How Professionals Trade (the right way) • Lose 5 x and win 5 x • Lose $100 5 times. • Lost: $100 x 5 = $500 • Win $300 x 5 = $1500 • Net = $1000

leadingtrader. com What is a Stop-Loss? 1) An order placed with a broker to exit the market (either to sell if you originally bought, or to buy back if you originally went short). 2) It is designed to LIMIT your LOSS and exposure to RISK. 3) It is not a choice. It is a MUST if you wish to protect your capital.

leadingtrader. com What is a Stop-Loss? 1) An order placed with a broker to exit the market (either to sell if you originally bought, or to buy back if you originally went short). 2) It is designed to LIMIT your LOSS and exposure to RISK. 3) It is not a choice. It is a MUST if you wish to protect your capital.

leadingtrader. com "Rule No. 1 is never lose money. Rule No. 2 is never forget rule number one. ” Warren Buffett PROTECT YOUR CAPITAL!

leadingtrader. com "Rule No. 1 is never lose money. Rule No. 2 is never forget rule number one. ” Warren Buffett PROTECT YOUR CAPITAL!

leadingtrader. com Where Do You Place Your Stop-loss?

leadingtrader. com Where Do You Place Your Stop-loss?

leadingtrader. com Where Do You Place Your Stop-Loss? 1. It Depends on at least 3 factors: 2. Your Strategy 3. Volatility of the market 4. What You See On The Chart: (i) Support/Resistance (ii) Price Structure

leadingtrader. com Where Do You Place Your Stop-Loss? 1. It Depends on at least 3 factors: 2. Your Strategy 3. Volatility of the market 4. What You See On The Chart: (i) Support/Resistance (ii) Price Structure

leadingtrader. com IMPORTANT: Your stop-loss should be placed based on the LOGICAL dynamics of the market!

leadingtrader. com IMPORTANT: Your stop-loss should be placed based on the LOGICAL dynamics of the market!

leadingtrader. com Where Do You Place Your Stop-Loss? 1. It does NOT depend on: (1) How much money you are prepared to lose or risk on a trade… (this is usually misunderstood) (2) Some arbitrary figure or percentage away from the entry price.

leadingtrader. com Where Do You Place Your Stop-Loss? 1. It does NOT depend on: (1) How much money you are prepared to lose or risk on a trade… (this is usually misunderstood) (2) Some arbitrary figure or percentage away from the entry price.

leadingtrader. com Wide Stops or Tight Stops?

leadingtrader. com Wide Stops or Tight Stops?

leadingtrader. com Very Tight Stops: too close to price (NOT RECOMMENDED) entry Stop-loss

leadingtrader. com Very Tight Stops: too close to price (NOT RECOMMENDED) entry Stop-loss

leadingtrader. com Very Wide Stops: unnecessarily too far from the entry price (NOT RECOMMENDED) Stop-loss

leadingtrader. com Very Wide Stops: unnecessarily too far from the entry price (NOT RECOMMENDED) Stop-loss

leadingtrader. com Wide Stop: A safe distance away from the price entry Stop-loss

leadingtrader. com Wide Stop: A safe distance away from the price entry Stop-loss

leadingtrader. com Tip No. 1 : Use wider stops and give it plenty of “wiggle room” (higher odds of success)

leadingtrader. com Tip No. 1 : Use wider stops and give it plenty of “wiggle room” (higher odds of success)

leadingtrader. com Tip No. 2: Reduce your position size (e. g. trade FEWER contracts/shares or £/per point) when using wide stops

leadingtrader. com Tip No. 2: Reduce your position size (e. g. trade FEWER contracts/shares or £/per point) when using wide stops

leadingtrader. com Logical Techniques For Placing A Stop-Loss

leadingtrader. com Logical Techniques For Placing A Stop-Loss

leadingtrader. com A Useful Rule To Remember: Ask Yourself: “Where does the price have to move to, to prove that I am wrong? ”

leadingtrader. com A Useful Rule To Remember: Ask Yourself: “Where does the price have to move to, to prove that I am wrong? ”

leadingtrader. com BAD NEWS: The more “smart” you think you are, the more money you will lose… (“smart” people don’t like to be wrong)

leadingtrader. com BAD NEWS: The more “smart” you think you are, the more money you will lose… (“smart” people don’t like to be wrong)

GOOD NEWS: The more honest you are to yourself, the better a trader you will be…

GOOD NEWS: The more honest you are to yourself, the better a trader you will be…

leadingtrader. com Logical Techniques For Placing A Stop-Loss

leadingtrader. com Logical Techniques For Placing A Stop-Loss

leadingtrader. com Strategy No. 1: Price Structure: Support & Resistance

leadingtrader. com Strategy No. 1: Price Structure: Support & Resistance

leadingtrader. com Price Structure: Support & Resistance 1. Most common and basic place for stoploss: 2. Previous highs and lows 3. Beneath support or above resistance

leadingtrader. com Price Structure: Support & Resistance 1. Most common and basic place for stoploss: 2. Previous highs and lows 3. Beneath support or above resistance

leadingtrader. com

leadingtrader. com

leadingtrader. com

leadingtrader. com

leadingtrader. com

leadingtrader. com

leadingtrader. com

leadingtrader. com

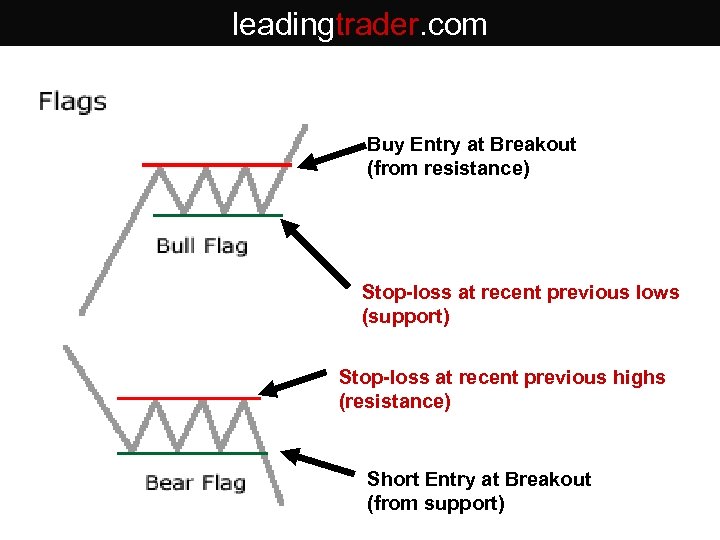

leadingtrader. com Buy Entry at Breakout (from resistance) Stop-loss at recent previous lows (support) Stop-loss at recent previous highs (resistance) Short Entry at Breakout (from support)

leadingtrader. com Buy Entry at Breakout (from resistance) Stop-loss at recent previous lows (support) Stop-loss at recent previous highs (resistance) Short Entry at Breakout (from support)

leadingtrader. com EURUSD – 5 min Flag Example Buy Entry at Breakout (from resistance) Stop-loss beneath recent Lows (support)

leadingtrader. com EURUSD – 5 min Flag Example Buy Entry at Breakout (from resistance) Stop-loss beneath recent Lows (support)

leadingtrader. com Flag Example Buy Entry at Breakout (from resistance) Stop-loss beneath recent Lows (support)

leadingtrader. com Flag Example Buy Entry at Breakout (from resistance) Stop-loss beneath recent Lows (support)

Strategy No. 2: Volatility-based stops

Strategy No. 2: Volatility-based stops

leadingtrader. com Plot “Average True Range” Indicator on your chart

leadingtrader. com Plot “Average True Range” Indicator on your chart

leadingtrader. com Free Charts: get. ETX. com Average True Range (ATR)

leadingtrader. com Free Charts: get. ETX. com Average True Range (ATR)

leadingtrader. com Free Charts: get. ETX. com

leadingtrader. com Free Charts: get. ETX. com

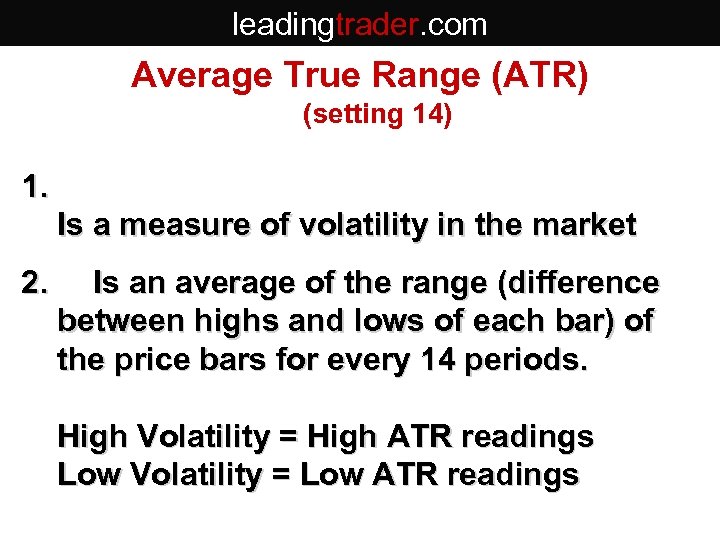

leadingtrader. com Average True Range (ATR) (setting 14) 1. Is a measure of volatility in the market 2. Is an average of the range (difference between highs and lows of each bar) of the price bars for every 14 periods. High Volatility = High ATR readings Low Volatility = Low ATR readings

leadingtrader. com Average True Range (ATR) (setting 14) 1. Is a measure of volatility in the market 2. Is an average of the range (difference between highs and lows of each bar) of the price bars for every 14 periods. High Volatility = High ATR readings Low Volatility = Low ATR readings

leadingtrader. com Dow Jones 30 - Daily Average True Range is 130 Dow points Average True Range

leadingtrader. com Dow Jones 30 - Daily Average True Range is 130 Dow points Average True Range

leadingtrader. com Dow Jones 30 – 1 hr Average True Range is 32 Dow points Average True Range

leadingtrader. com Dow Jones 30 – 1 hr Average True Range is 32 Dow points Average True Range

leadingtrader. com Dow Jones 30 – 5 min What is ATR? Average True Range

leadingtrader. com Dow Jones 30 – 5 min What is ATR? Average True Range

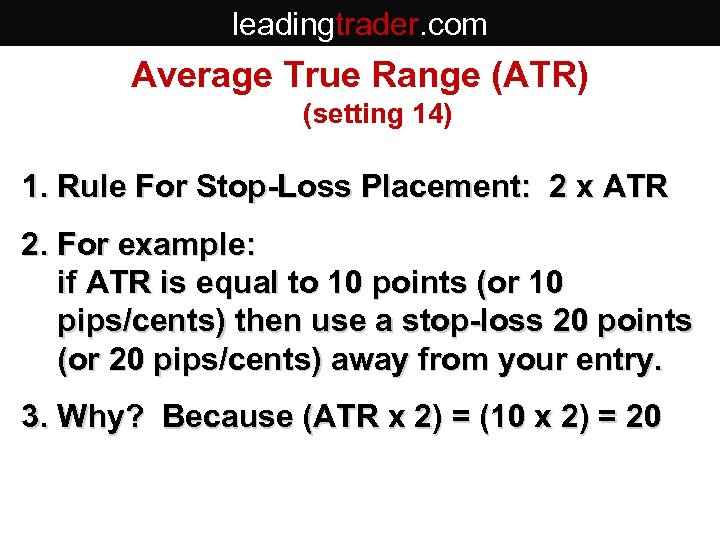

leadingtrader. com Average True Range (ATR) (setting 14) 1. Rule For Stop-Loss Placement: 2 x ATR 2. For example: if ATR is equal to 10 points (or 10 pips/cents) then use a stop-loss 20 points (or 20 pips/cents) away from your entry. 3. Why? Because (ATR x 2) = (10 x 2) = 20

leadingtrader. com Average True Range (ATR) (setting 14) 1. Rule For Stop-Loss Placement: 2 x ATR 2. For example: if ATR is equal to 10 points (or 10 pips/cents) then use a stop-loss 20 points (or 20 pips/cents) away from your entry. 3. Why? Because (ATR x 2) = (10 x 2) = 20

leadingtrader. com Dow Jones 30 – 5 min chart What is the stop-loss size based on ATR? Average True Range

leadingtrader. com Dow Jones 30 – 5 min chart What is the stop-loss size based on ATR? Average True Range

leadingtrader. com Dow Jones 30 – 5 min chart ATR x 2 means 13 x 2 = 26 point stop-loss Average True Range

leadingtrader. com Dow Jones 30 – 5 min chart ATR x 2 means 13 x 2 = 26 point stop-loss Average True Range

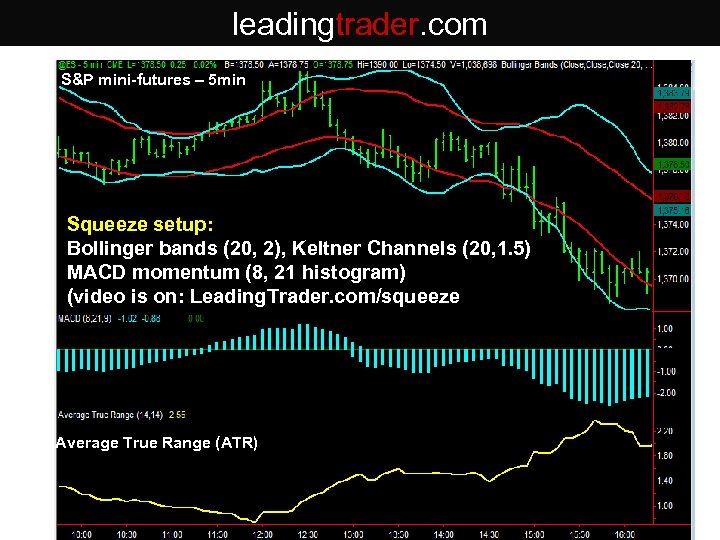

leadingtrader. com S&P mini-futures – 5 min Squeeze setup: Bollinger bands (20, 2), Keltner Channels (20, 1. 5) MACD momentum (8, 21 histogram) (video is on: Leading. Trader. com/squeeze Average True Range (ATR)

leadingtrader. com S&P mini-futures – 5 min Squeeze setup: Bollinger bands (20, 2), Keltner Channels (20, 1. 5) MACD momentum (8, 21 histogram) (video is on: Leading. Trader. com/squeeze Average True Range (ATR)

leadingtrader. com S&P mini-futures – 5 min Entry when the squeeze fires! But where is your stop-loss? Average True Range (ATR)

leadingtrader. com S&P mini-futures – 5 min Entry when the squeeze fires! But where is your stop-loss? Average True Range (ATR)

leadingtrader. com S&P mini-futures – 5 min For stops – you can use either: PRICE STRUCTURE (previous highs/lows) OR use 2 X ATR 2 x ATR = 2 x 1. 0 = 2 pt. stop distance 2 x ATR = 2 x 1. 6 = 3. 2 pt stop distance

leadingtrader. com S&P mini-futures – 5 min For stops – you can use either: PRICE STRUCTURE (previous highs/lows) OR use 2 X ATR 2 x ATR = 2 x 1. 0 = 2 pt. stop distance 2 x ATR = 2 x 1. 6 = 3. 2 pt stop distance

leadingtrader. com EURUSD – 4 hr Short Squeeze fires! Where is your stop?

leadingtrader. com EURUSD – 4 hr Short Squeeze fires! Where is your stop?

leadingtrader. com EURUSD – 4 hr Based on Price Structure (previous highs = 1. 3350)

leadingtrader. com EURUSD – 4 hr Based on Price Structure (previous highs = 1. 3350)

leadingtrader. com EURUSD – 4 hr Based on Volatility: ATR x 2 = 38 x 2 = 76 pips away from entry price

leadingtrader. com EURUSD – 4 hr Based on Volatility: ATR x 2 = 38 x 2 = 76 pips away from entry price

leadingtrader. com Risk Free trade: Once in profit, Don’t forget to move your stop to breakeven!

leadingtrader. com Risk Free trade: Once in profit, Don’t forget to move your stop to breakeven!

TIP – WRITE THIS DOWN! You can also trail your stop based on 2 X ATR

TIP – WRITE THIS DOWN! You can also trail your stop based on 2 X ATR

leadingtrader. com You can trail your stop based on 2 X ATR As the market moves in your favour, Trail your stop based on 2 x ATR

leadingtrader. com You can trail your stop based on 2 X ATR As the market moves in your favour, Trail your stop based on 2 x ATR

leadingtrader. com Keltner Pullack Setup (K. P. )

leadingtrader. com Keltner Pullack Setup (K. P. )

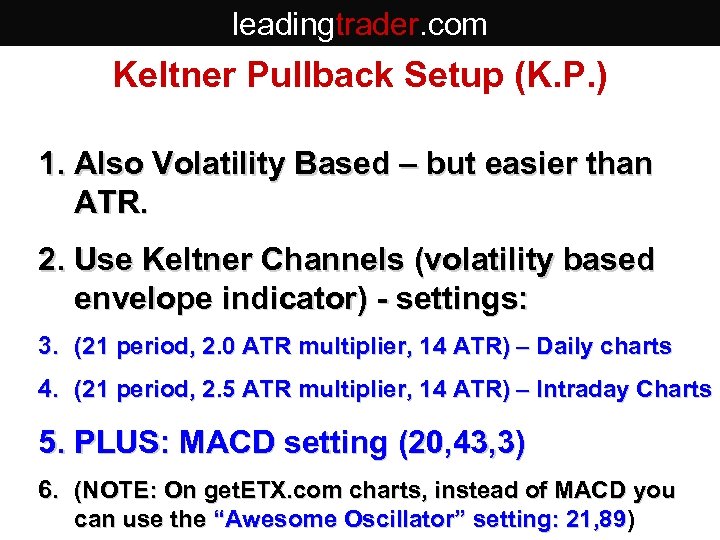

leadingtrader. com Keltner Pullback Setup (K. P. ) 1. Also Volatility Based – but easier than ATR. 2. Use Keltner Channels (volatility based envelope indicator) - settings: 3. (21 period, 2. 0 ATR multiplier, 14 ATR) – Daily charts 4. (21 period, 2. 5 ATR multiplier, 14 ATR) – Intraday Charts 5. PLUS: MACD setting (20, 43, 3) 6. (NOTE: On get. ETX. com charts, instead of MACD you can use the “Awesome Oscillator” setting: 21, 89)

leadingtrader. com Keltner Pullback Setup (K. P. ) 1. Also Volatility Based – but easier than ATR. 2. Use Keltner Channels (volatility based envelope indicator) - settings: 3. (21 period, 2. 0 ATR multiplier, 14 ATR) – Daily charts 4. (21 period, 2. 5 ATR multiplier, 14 ATR) – Intraday Charts 5. PLUS: MACD setting (20, 43, 3) 6. (NOTE: On get. ETX. com charts, instead of MACD you can use the “Awesome Oscillator” setting: 21, 89)

leadingtrader. com get. ETX. com Keltner Channel settings: (21, 2. 0) for Daily charts or (21, 2. 5) for intraday

leadingtrader. com get. ETX. com Keltner Channel settings: (21, 2. 0) for Daily charts or (21, 2. 5) for intraday

leadingtrader. com Daily Chart settings As the market moves in your favour, Trail your stop based on 2 x ATR

leadingtrader. com Daily Chart settings As the market moves in your favour, Trail your stop based on 2 x ATR

leadingtrader. com Intraday Chart settings

leadingtrader. com Intraday Chart settings

leadingtrader. com EURUSD – Daily Chart As the market moves in your favour, Trail your stop based on 2 x ATR Awesome oscillator (21, 89) on get. ETX. com is used as a directional filter

leadingtrader. com EURUSD – Daily Chart As the market moves in your favour, Trail your stop based on 2 x ATR Awesome oscillator (21, 89) on get. ETX. com is used as a directional filter

leadingtrader. com EURUSD – Daily Chart Sell Short Example: Entry at pullback to the Mid-band (21 EMA) (blue arrow) Stop-loss at UPPER Band (red arrow) First profit target at LOWER Band (magenta arrow) As the market moves in your favour, Trail your stop based on 2 x ATR Awesome oscillator (21, 89) on get. ETX. com is used as a directional filter

leadingtrader. com EURUSD – Daily Chart Sell Short Example: Entry at pullback to the Mid-band (21 EMA) (blue arrow) Stop-loss at UPPER Band (red arrow) First profit target at LOWER Band (magenta arrow) As the market moves in your favour, Trail your stop based on 2 x ATR Awesome oscillator (21, 89) on get. ETX. com is used as a directional filter

leadingtrader. com LONG (Buy) Example: Entry at pullback to the Mid-band (21 EMA) Stop-loss at LOWER Band First profit target at UPPER Band As the market moves in your favour, Trail your stop based on 2 x ATR

leadingtrader. com LONG (Buy) Example: Entry at pullback to the Mid-band (21 EMA) Stop-loss at LOWER Band First profit target at UPPER Band As the market moves in your favour, Trail your stop based on 2 x ATR

leadingtrader. com Sell Short Example: Entry at pullback to the Mid-band (21 EMA) As the market moves in your favour, Stop-loss at UPPER Band Trail your stop based on 2 x ATR First profit target at LOWER Band

leadingtrader. com Sell Short Example: Entry at pullback to the Mid-band (21 EMA) As the market moves in your favour, Stop-loss at UPPER Band Trail your stop based on 2 x ATR First profit target at LOWER Band

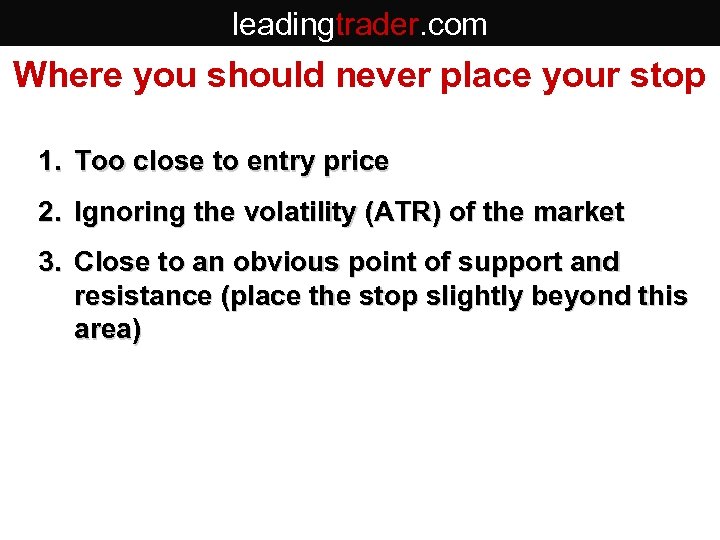

leadingtrader. com Where you should never place your stop 1. Too close to entry price 2. Ignoring the volatility (ATR) of the market 3. Close to an obvious point of support and resistance (place the stop slightly beyond this area)

leadingtrader. com Where you should never place your stop 1. Too close to entry price 2. Ignoring the volatility (ATR) of the market 3. Close to an obvious point of support and resistance (place the stop slightly beyond this area)

leadingtrader. com Best and Worst Times To Trade 1. Best Times: Tuesday – Thursday 10 am ET – 11: 30 am ET and then at 3 pm ET – 4 pm ET (last hour) 2. Worst Times: Too close to news announcements Lunchtime Doldrums 11: 30 am – 2 pm ET Typically the first half hour of market open Choppy Markets

leadingtrader. com Best and Worst Times To Trade 1. Best Times: Tuesday – Thursday 10 am ET – 11: 30 am ET and then at 3 pm ET – 4 pm ET (last hour) 2. Worst Times: Too close to news announcements Lunchtime Doldrums 11: 30 am – 2 pm ET Typically the first half hour of market open Choppy Markets

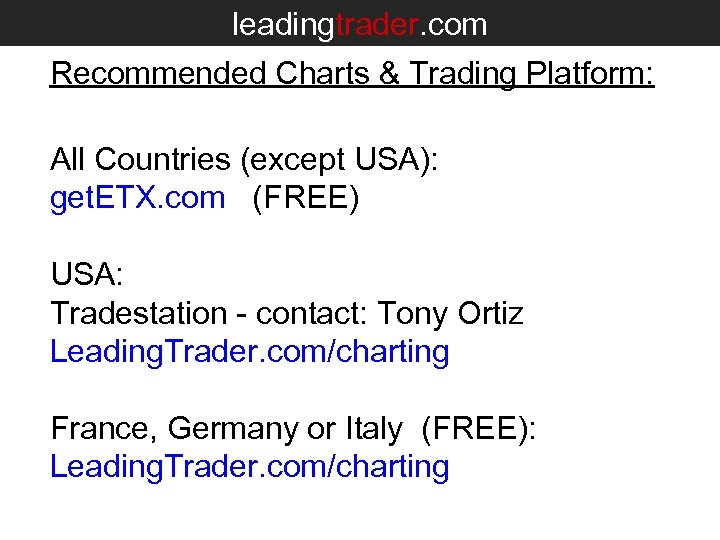

leadingtrader. com Recommended Charts & Trading Platform: All Countries (except USA): get. ETX. com (FREE) USA: Tradestation - contact: Tony Ortiz Leading. Trader. com/charting France, Germany or Italy (FREE): Leading. Trader. com/charting

leadingtrader. com Recommended Charts & Trading Platform: All Countries (except USA): get. ETX. com (FREE) USA: Tradestation - contact: Tony Ortiz Leading. Trader. com/charting France, Germany or Italy (FREE): Leading. Trader. com/charting

leadingtrader. com THANK YOU very much for attending this webinar! Next FREE Webinar: 2 -Day Live Trading Webinar with Alessio Rastani and Kevin Burton Thursday 3 rd May and Friday 4 th May

leadingtrader. com THANK YOU very much for attending this webinar! Next FREE Webinar: 2 -Day Live Trading Webinar with Alessio Rastani and Kevin Burton Thursday 3 rd May and Friday 4 th May