262070e452741d3164fd5e55ad970edc.ppt

- Количество слайдов: 42

Leadership Academy 2017 The Chapter Treasurer Bruce Herdman Past Ontario District Treasurer & VP - Finance bherdman 3495@gmail. com

OVERVIEW What we’ll cover • Treasurer’s role § Income taxes § Ontario Not-for-profit Corporations Act (ONCA) § Your questions

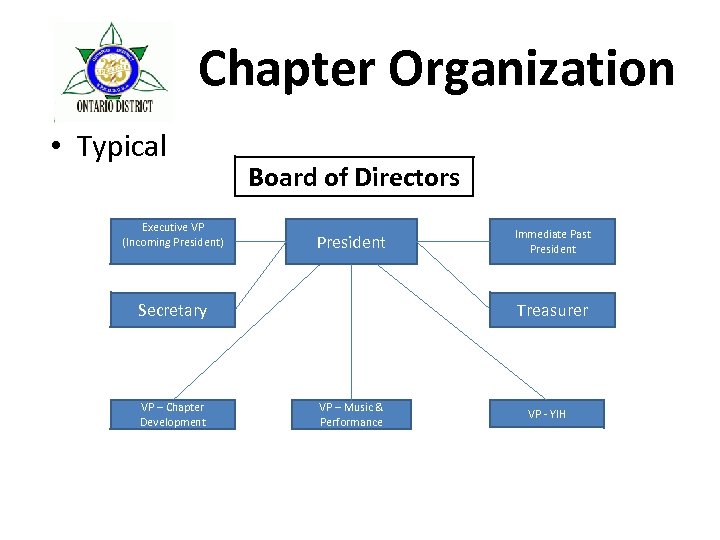

Chapter Organization • Typical Executive VP (Incoming President) Board of Directors President Secretary VP – Chapter Development Immediate Past President Treasurer VP – Music & Performance VP - YIH

The Treasurer § § § The treasurer is, in effect, the chapter’s Chief Financial Officer As such it is his responsibility to plan, control and report on the chapter’s financial activities and to offer sound financial advice to the chapter board The treasurer collects the chapter’s funds and pays the chapter’s bills and maintains clear and complete records of those activities The treasurer must file the Chapter’s income tax returns no later than 6 months following the Chapter’s fiscal year end, typically December 31 (Return must be filed by June 30) The treasurer must ensure that a copy of the prior year financial review of the Chapter’s records is sent to the Society by June 30 each year The treasurer should be organized, detail minded and possess a rudimentary understanding of bookkeeping

Leadership and the Successful Chapter Remember You are part of a team!

Treasurer’s Resources Manuals On the Society Web site www. barbershop. org • Treasurer’s Manual • Treasurer’s forms • Chapter Management Guide On the District Web site www. ontariodistrict. com • By-Laws, Operations and Procedures Manual

Treasurer’s Resources Chapter documentation • By-laws, minutes, management guide • Newsletters People • Your predecessor • Other chapter treasurers • District Treasurer Dave Smith (david. smith. dd@gmail. com) • Jama Clinard – Controller, BHS (finance@barbershop. org)

Chapter Suspension Cause • Failure to report through e. Biz by June 30 that the financial review has taken place Treasurer has primary responsibility to prevent this from happening!

Dues The dues structure for membership in the Barbershop Harmony Society consists of three tiers. Tier 1 - Local or Chapter dues - are used to help pay ongoing Chapter costs such as rental of the practice hall, purchase of sheet music and learning media and other supplies. Tier 2 - Ontario District dues - currently $65 annually. District dues are used to help pay the cost of music education programs for individuals, quartets and chapters. They partially offset the costs of conventions where barbershoppers gather for a variety of activities including chorus and quartet contests. $6 per year for each regular member and $3 per year for each senior and youth (Y 2) member are allocated to the Onta Fame fund to offset the travel costs of chorus and quartet members who qualify for international competitions. Tier 3 - International dues - currently $125 (US) annually. International dues are used to help pay the costs of operating the Barbershop Harmony Society’s office in Nashville, Tennessee. The Society maintains a music library, arranges and prints music, produces learning media and co -ordinates conventions, seminars and training sessions. International dues include a subscription to the "Harmonizer" magazine, published six times each year.

Dues Society and District dues are billed to members • Encourage members to pay their Society and District dues on-line, through the Members’ Only portal of www. barbershop. org • Ontario chapters’ dues ARE NOT collected by the Society • Society & District Dues –chapters have different policies as to payment of dues, such as “Pay-As-You-Sing” but each member is responsible for the payment of his dues. • Member is ineligible to participate in chorus and quartet competitions if dues are delinquent at the time of the convention

Income Taxes DO CHAPTERS HAVE TO FILE AN ANNUAL INCOME TAX RETURN ? The short answer is “YES”

Income Taxes In order to maintain its Not-for-profit status, a Chapter must operate strictly in accordance with the stated purposes of its Letters Patent • Net income must not inure to the benefit of its members • The Chapter must not participate or intervene in any political campaign on behalf of any candidate for public office • The Chapter must not attempt to influence legislation by propaganda or otherwise

Income Taxes Beginning in fiscal years ending AFTER January 1, 2009 (for us that meant beginning in 2010 for the fiscal year ended December 31, 2009) Not-for-profit Corporations were required to file: • T 2 Short Return • T 1178 General Index of Financial Information Short • TSCH 546 Corporations Information Act Annual Return for Ontario Corporations

Income Taxes Let’s take a look at how to complete a Chapter’s tax return. It is not nearly as daunting as it may first appear. The Canada Revenue Agency’s (CRA) tax forms you will need are accessible on their web site and are “fillable, savable forms”.

Income Taxes The forms you must file are: T 2 Short T 1178 Schedule 546

Income Taxes The T 2 Short, the T 1178 and Form 546 are accessible on the CRA web site and are ‘savable, fillable forms’. So, let’s go step by step. In your web browser enter http: //www. cra-arc. gc. ca/E/pbg/tf/t 2 short/README. html (The ‘E’ stands for ‘English) and then click on T 2 short-fill-16 e. pdf

Income Taxes Click on the blue hi-lighted t 2 short-fill-16 e. pdf and the actual 4 page T 2 Short Return for 2016 is available to you. Hint - because these are all ‘fillable’ forms, save each form to your computer and make a copy. This saves going back to the internet if you want to get the form again.

Income Taxes The 4 pages of the T 2 Short Return form are: 1. Instructions 2. Schedule 1 S – Reconciliation of book (recorded) income or loss to income or loss for tax purposes 3. Corporate information (200 S) 4. Attachments, Additional Information and Certification

Income Taxes At the top of the page you will see • The T 2 Short Return is a simpler version of the T 2 Corporation Income Tax Return. There are two categories of corporations that are eligible to use this return. You can use this return if the corporation is: • a Canadian-controlled private corporation throughout the tax year and has either a loss or a nil net income for income tax purposes this year; or • exempt from tax under section 149 of the Income Tax Act (such as a non-profit organization) • Chapters qualify as exempt from tax under section 149 • (Let’s assume the six disqualifiers listed do not apply)

Income Taxes 1. Instructions – use this page to guide you through the completion of the return 2. Be sure to enter the correct name and Business Number (BN) on each schedule submitted 3. Schedule 1 S – Chapters may ignore this schedule or the schedule can be completed by entering the chapter’s profit or loss on the first line (Line A) and on the last line (Line G)

Income Taxes 5. Form 200 S (Corporate Information) must be fully completed. ü Line 40 on page 1 of Schedule 200; check off box Number 2 (Other private corporation) ü Line 85 on page 1 of Schedule 200; check off box Number 4 (Exempt under other paragraphs of section 149) ü Line 300 on page 1 of Schedule 200; remove the brackets if you are entering a positive amount (net income). Note: The CRA will not calculate tax on this income as not-forprofit corporations are tax exempt. 6. Attachments, Additional Information and Certification ü ü Read and complete all questions. Complete lines 951 – 957 and, if necessary, lines 958 and 959.

Income Taxes To access the form T 1178 go to http: //www. cra-arc. gc. ca/E/pbg/tf/t 1178/README. html And you get T 1178 – General Index of Financial Information – Short (last update 2016 -12 -14) Click on the blue hi-lighted t 1178 -fill-16 e. pdf

Income Taxes The T 1178 form is now available for you to complete. ü - Schedule 100 – complete if your chapter maintains accounting for assets and liabilities. Most chapters will enter their cash balance on Line 1000 and a corresponding amount on Line 3849. ü - Schedule 125 – complete in detail for accounting reported on your annual financial statements. If a category of revenue or expense does not match exactly with the description of items on form T 1178, enter the amounts on Lines 8230 (revenues) or 9270 (expenses). Disregard the second page related to “farming”. ü - Schedule 141 – complete in detail.

Income Taxes The final form needed is Schedule 546 To access this form copy or type the following into your web browser http: //www. cra-arc. gc. ca/E/pbg/tf/t 2 sch 546/README. html T 2 SCH 546 Corporations Information Act Annual Return for Ontario Corporations (2009 and later tax years) Last modified: 2010 -06 -11 Click on t 2 sch 546 -fill-10 e. pdf

Income Taxes • Schedule 546 identifies information related to the corporation. It is my suggestion that in Part 2, you enter the name and address of the Chapter Treasurer so that all correspondence from the CRA will be issued to him. • Part 7 is vitally important as it records the officers and directors of each chapter. This section need only be completed when there is a change to the following positions – President, Secretary, Treasurer, Immediate Past President (IPP) and Executive Vice President (EVP) Use line 816/817 for the IPP and 866/867 for the EVP. • You will require a separate page for each change - i. e. incoming officers on one page; outgoing officers on another. • LIST ONLY THE FIVE (5) MOST ACTIVE OFICERS

Income Taxes Mail the completed, dated and signed income tax returns to: Canada Revenue Agency Business Returns Division 1050 Notre Dame Avenue Sudbury, ON P 3 A 5 C 1

Income Taxes And finally, Update e. Biz to indicate that your tax return has been filed. Go to www. barbershop. org Click on the ‘Members Only’ portal on the right to enter e. Biz Hover your mouse over the heading ‘My Memberships’ and click on ‘My Chapters’ when that choice appears Choose the chapter whose records you wish to update (some men belong to more than one chapter) Click on ‘Financial Filings’ – on the right in the blue headline Update your information on this page

ONCA ALERT The Canada Corporations Act (CCA) had not been updated since it came into effect in 1917 A new Canada Not-for-profit Corporations Act (CNCA) which replaces Part II of the CCA was enacted June 23, 2009 and was proclaimed into law October 17, 2011. The new CNCA required significant adjustments to the by-laws and some other aspects of all federally incorporated not-for-profit corporations. I believe there are two federally incorporated Chapters in the Ontario District. Those two chapters were required to continue under the CNCA through a transition process which was to be completed no later than October 17, 2014.

ONCA ALERT Similarly, until 2010, the Ontario Corporations Act (OCA) had not been substantively amended since 1953. A new Ontario Not-for-profit Corporations Act (ONCA) which replaces Part III of the OCA was enacted May 12, 2010 and received Royal Assent on October 25, 2010. For more detailed information regarding ONCA, go to the ONCA web site https: //www. ontario. ca/page/rules-not-profit-and-charitablecorporations#section-0

ONCA ALERT Key elements of ONCA A – Incorporation and corporate powers 1. Removes ministerial discretion to incorporate 2. Receive a certificate of incorporation, not letters patent 3. Only one incorporator is needed – currently at least four are required 4. Corporation has the capacity, rights, powers and privileges of a natural person

ONCA ALERT Key elements of ONCA B – Public Benefit Corporations (PBCs) All Ontario corporations will be categorized into PBCs and non PBCs include • Charitable corporations (the District) • Non charitable corporations that receive more than $10, 000 in a financial year in funding from public donations or a federal, provincial or municipal government or an agency of such government (such as a Trillium grant)

ONCA ALERT If a corporation is NOT a PBC it is, by default, a non PBC. There are several rules governing what a PBC or a non PBC is allowed to do, what it must do and what it is prohibited from doing. I will leave it to each chapter to be sure they understand the rules. For most of us, I’m sure, it will be a matter of business as usual. Most chapters in the Ontario District will ordinarily qualify as a non PBC. The District itself will be a PBC.

ONCA ALERT Rules regarding directors ONCA permits directors of a PBC to fix their remuneration from the Corporation and to receive reasonable remuneration and expenses for any service they provide to the Corporation in any other capacity. Directors of a PBC that is a charitable corporation are prohibited from receiving remuneration, directly or indirectly from the Corporation, but those directors may be reimbursed for out-of-pocket expenses.

ONCA ALERT Rules regarding liquidation, termination of membership Upon the liquidation or dissolution of a PBC, its net assets must be distributed as follows: If it is a charitable corporation, then to a charitable corporation with similar purposes OR to a government or government agency If it is a non-charitable corporation, then to a PBC with similar purposes OR to a government or government agency

ONCA ALERT Rules regarding liquidation, termination of membership Upon the liquidation or dissolution of a non-PBC, its net assets must be distributed in accordance with the articles OR, if the articles do not address that issue, then rateably to the members. BUT A PBC may NOT distribute the fair value of a membership to a member upon termination of that member’s membership. (I assume a non-PBC is allowed to do this if it is so stated in the articles. )

ONCA ALERT Under CNCA a corporation MUST comply with the requirements of the transition process. Under ONCA, compliance with the transition process is optional. There are potential pitfalls to not complying with the transition process.

ONCA ALERT If the transition process is not taken: • Corporation will NOT be dissolved • Letters Patent, Supplementary Letters Patent and Bylaws will be deemed to be amended to comply with ONCA, resulting in non-compliant provisions being deemed invalid • This will result in uncertainty in relation to which provisions remain valid Better to do the transition process

ONCA ALERT This means that the Ontario District and all Chapters will need to: § Review letters patent and by-laws § Prepare articles of amendment and new by-laws § Get membership approval § File required documents § Certificate of amendment will be issued As a charity, the Ontario District will be required to send the certificate of amendment, articles of amendment and new by-laws to the CRA.

ONCA ALERT Financial Reviews – Public Benefit Corporations PBCs with gross annual revenues (GAR) of less than $100, 000 may dispense with both an audit and a review engagement, by extraordinary resolution (80% of the membership) PBCs with GAR of more than $100, 000 but less than $500, 000 may elect to have a review engagement instead of an audit, by extraordinary resolution (80% of the membership) The second of these is the category into which the District will fall

ONCA ALERT Financial Reviews – Non Public Benefit Corporations Non PBCs with gross annual revenues (GAR) of less than $500, 000 may dispense with both an audit and a review engagement by extraordinary resolution (80% of the membership) I don’t believe there is any chapter in the Ontario District that will require either an audit or a review engagement.

ONCA ALERT The next two pages are a government-provided Rules for not-for-profit and charitable corporations and can be found at https: //www. ontario. ca/page/rules-not-profit-and-charitablecorporations#section-0 You should take the time to read this since all our chapters will eventually be required to conform to ONCA

ONCA ALERT If you’re having a little trouble getting to sleep one night, go to https: //www. ontario. ca/laws/statute/10 n 15 This is the act itself, in all its glory. At a mere 71 pages of “Times New Roman- font size 10” it’ll give you something to do as you sip your warm milk.

262070e452741d3164fd5e55ad970edc.ppt