b2c92843490e6268495e7e2a37625136.ppt

- Количество слайдов: 17

Lawrence Berkeley National Laboratory Sales & Use Tax Guidelines 1

Sales & Use Tax Guidelines General Overview 2

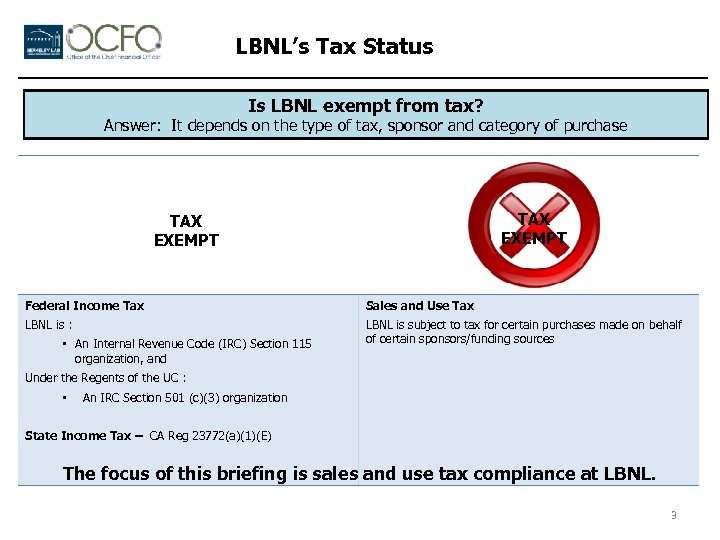

LBNL’s Tax Status Is LBNL exempt from tax? Answer: It depends on the type of tax, sponsor and category of purchase TAX EXEMPT Federal Income Tax Sales and Use Tax LBNL is : LBNL is subject to tax for certain purchases made on behalf of certain sponsors/funding sources • An Internal Revenue Code (IRC) Section 115 organization, and Under the Regents of the UC : • An IRC Section 501 (c)(3) organization State Income Tax – CA Reg 23772(a)(1)(E) The focus of this briefing is sales and use tax compliance at LBNL. 3

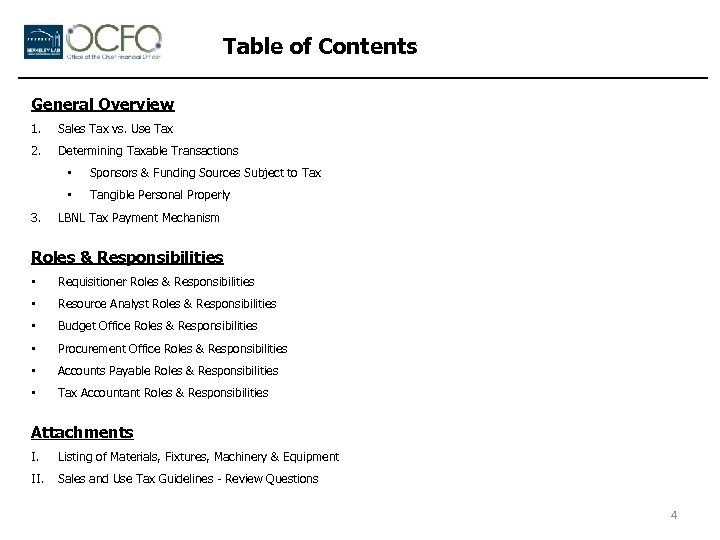

Table of Contents General Overview 1. Sales Tax vs. Use Tax 2. Determining Taxable Transactions • • 3. Sponsors & Funding Sources Subject to Tax Tangible Personal Properly LBNL Tax Payment Mechanism Roles & Responsibilities • Requisitioner Roles & Responsibilities • Resource Analyst Roles & Responsibilities • Budget Office Roles & Responsibilities • Procurement Office Roles & Responsibilities • Accounts Payable Roles & Responsibilities • Tax Accountant Roles & Responsibilities Attachments I. Listing of Materials, Fixtures, Machinery & Equipment II. Sales and Use Tax Guidelines - Review Questions 4

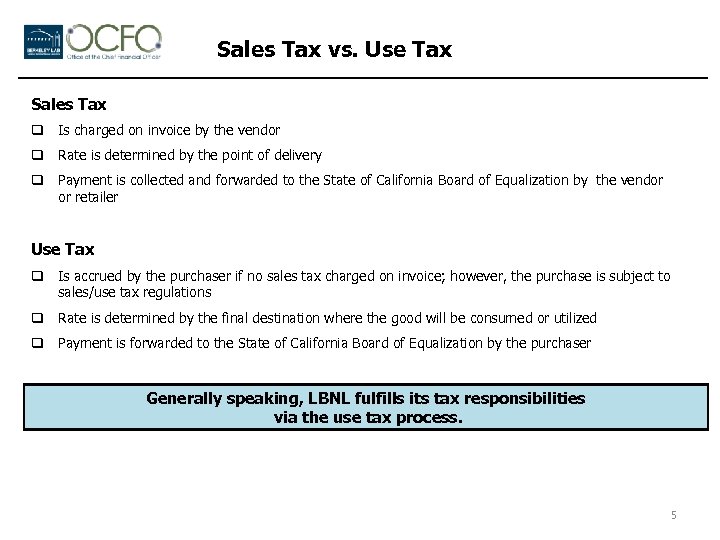

Sales Tax vs. Use Tax Sales Tax q Is charged on invoice by the vendor q Rate is determined by the point of delivery q Payment is collected and forwarded to the State of California Board of Equalization by the vendor or retailer Use Tax q Is accrued by the purchaser if no sales tax charged on invoice; however, the purchase is subject to sales/use tax regulations q Rate is determined by the final destination where the good will be consumed or utilized q Payment is forwarded to the State of California Board of Equalization by the purchaser Generally speaking, LBNL fulfills its tax responsibilities via the use tax process. 5

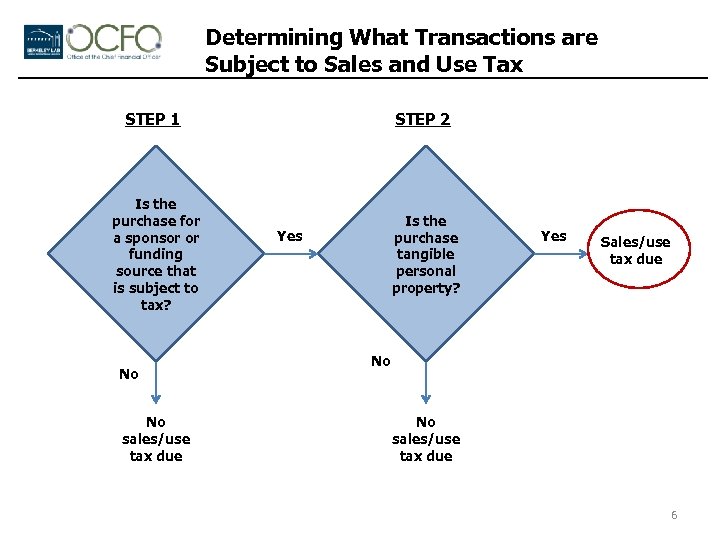

Determining What Transactions are Subject to Sales and Use Tax STEP 1 STEP 2 Is the purchase for a sponsor or funding source that is subject to tax? Is the purchase tangible personal property? No No sales/use tax due Yes Sales/use tax due No No sales/use tax due 6

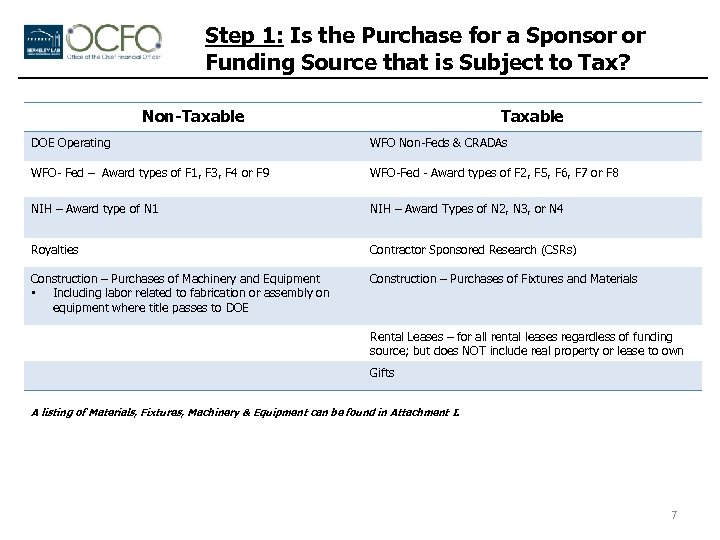

Step 1: Is the Purchase for a Sponsor or Funding Source that is Subject to Tax? Non-Taxable DOE Operating WFO Non-Feds & CRADAs WFO- Fed – Award types of F 1, F 3, F 4 or F 9 WFO-Fed - Award types of F 2, F 5, F 6, F 7 or F 8 NIH – Award type of N 1 NIH – Award Types of N 2, N 3, or N 4 Royalties Contractor Sponsored Research (CSRs) Construction – Purchases of Machinery and Equipment • Including labor related to fabrication or assembly on equipment where title passes to DOE Construction – Purchases of Fixtures and Materials Rental Leases – for all rental leases regardless of funding source; but does NOT include real property or lease to own Gifts A listing of Materials, Fixtures, Machinery & Equipment can be found in Attachment I. 7

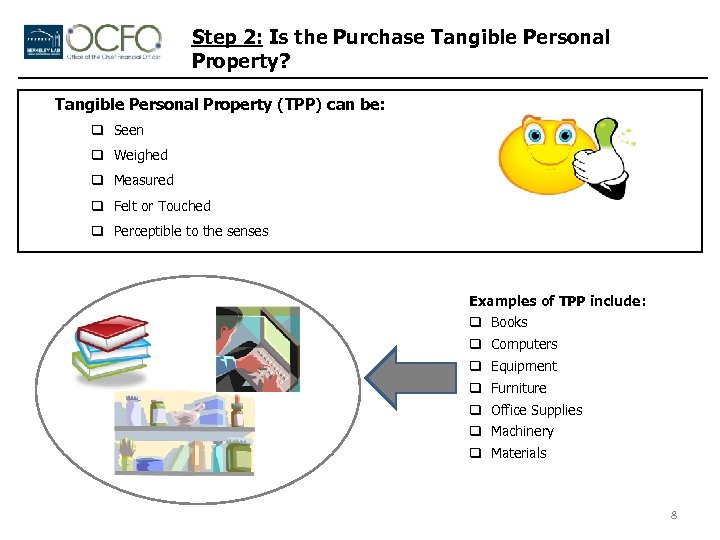

Step 2: Is the Purchase Tangible Personal Property? Tangible Personal Property (TPP) can be: q Seen q Weighed q Measured q Felt or Touched q Perceptible to the senses Examples of TPP include: q Books q Computers q Equipment q Furniture q Office Supplies q Machinery q Materials 8

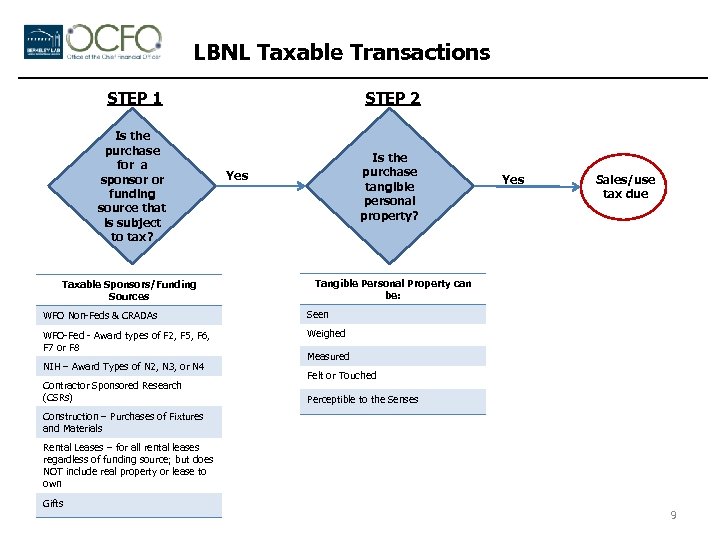

LBNL Taxable Transactions STEP 1 STEP 2 Is the purchase for a sponsor or funding source that is subject to tax? Is the purchase tangible personal property? Taxable Sponsors/Funding Sources Yes Sales/use tax due Tangible Personal Property can be: WFO Non-Feds & CRADAs Seen WFO-Fed - Award types of F 2, F 5, F 6, F 7 or F 8 Weighed NIH – Award Types of N 2, N 3, or N 4 Contractor Sponsored Research (CSRs) Measured Felt or Touched Perceptible to the Senses Construction – Purchases of Fixtures and Materials Rental Leases – for all rental leases regardless of funding source; but does NOT include real property or lease to own Gifts 9

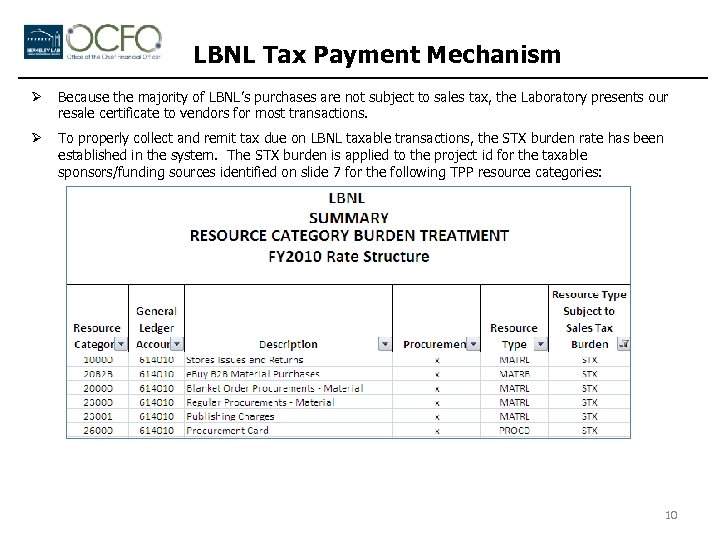

LBNL Tax Payment Mechanism Ø Because the majority of LBNL’s purchases are not subject to sales tax, the Laboratory presents our resale certificate to vendors for most transactions. Ø To properly collect and remit tax due on LBNL taxable transactions, the STX burden rate has been established in the system. The STX burden is applied to the project id for the taxable sponsors/funding sources identified on slide 7 for the following TPP resource categories: 10

LBNL Tax Payment Mechanism Ø Rental Contracts • • Ø The contract will include articles/clauses requiring the vendor to bill LBNL for use tax on the invoice. STX burden will not be applied to rental project ids. Construction Contracts • The contract will include articles/clauses addressing that the vendor will charge sales/use tax on materials and fixtures, and accept LBNL’s resale certificate to exempt sales/use tax on equipment and machinery, since title on equipment and machinery pass to the U. S. DOE. • Generally, the sales tax will be included in the construction contract pricing or on the invoice, not by STX burden code. “In this world nothing can be said to be certain, except death and taxes. ” Benjamin Franklin Questions? Please contact the Controller’s Office Tax Accountant, Yvonne Deshayes at x 6280. 11

Sales & Use Tax Guidelines Roles & Responsibilities 12

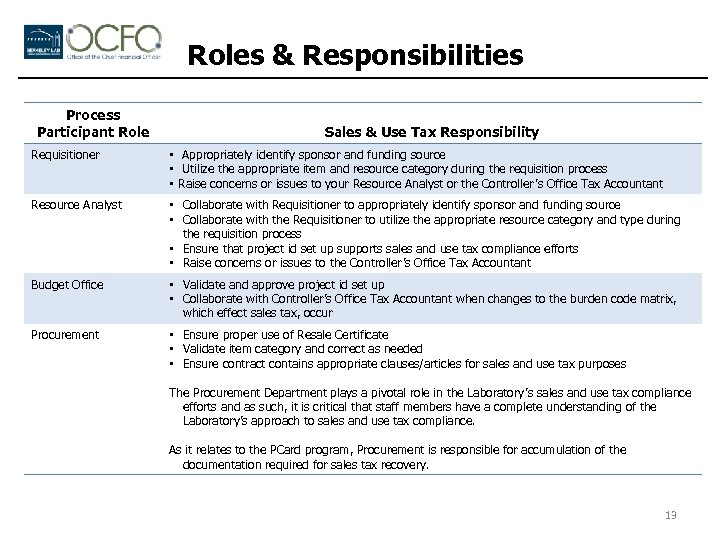

Roles & Responsibilities Process Participant Role Sales & Use Tax Responsibility Requisitioner • Appropriately identify sponsor and funding source • Utilize the appropriate item and resource category during the requisition process • Raise concerns or issues to your Resource Analyst or the Controller ’s Office Tax Accountant Resource Analyst • Collaborate with Requisitioner to appropriately identify sponsor and funding source • Collaborate with the Requisitioner to utilize the appropriate resource category and type during the requisition process • Ensure that project id set up supports sales and use tax compliance efforts • Raise concerns or issues to the Controller’s Office Tax Accountant Budget Office • Validate and approve project id set up • Collaborate with Controller’s Office Tax Accountant when changes to the burden code matrix, which effect sales tax, occur Procurement • Ensure proper use of Resale Certificate • Validate item category and correct as needed • Ensure contract contains appropriate clauses/articles for sales and use tax purposes The Procurement Department plays a pivotal role in the Laboratory ’s sales and use tax compliance efforts and as such, it is critical that staff members have a complete understanding of the Laboratory’s approach to sales and use tax compliance. As it relates to the PCard program, Procurement is responsible for accumulation of the documentation required for sales tax recovery. 13

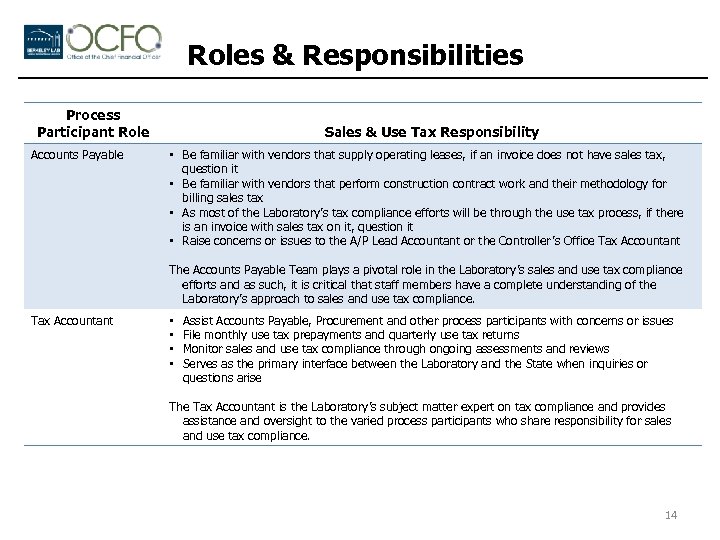

Roles & Responsibilities Process Participant Role Accounts Payable Sales & Use Tax Responsibility • Be familiar with vendors that supply operating leases, if an invoice does not have sales tax, question it • Be familiar with vendors that perform construction contract work and their methodology for billing sales tax • As most of the Laboratory’s tax compliance efforts will be through the use tax process, if there is an invoice with sales tax on it, question it • Raise concerns or issues to the A/P Lead Accountant or the Controller ’s Office Tax Accountant The Accounts Payable Team plays a pivotal role in the Laboratory’s sales and use tax compliance efforts and as such, it is critical that staff members have a complete understanding of the Laboratory’s approach to sales and use tax compliance. Tax Accountant • • Assist Accounts Payable, Procurement and other process participants with concerns or issues File monthly use tax prepayments and quarterly use tax returns Monitor sales and use tax compliance through ongoing assessments and reviews Serves as the primary interface between the Laboratory and the State when inquiries or questions arise The Tax Accountant is the Laboratory’s subject matter expert on tax compliance and provides assistance and oversight to the varied process participants who share responsibility for sales and use tax compliance. 14

Sales & Use Tax Guidelines Attachments 15

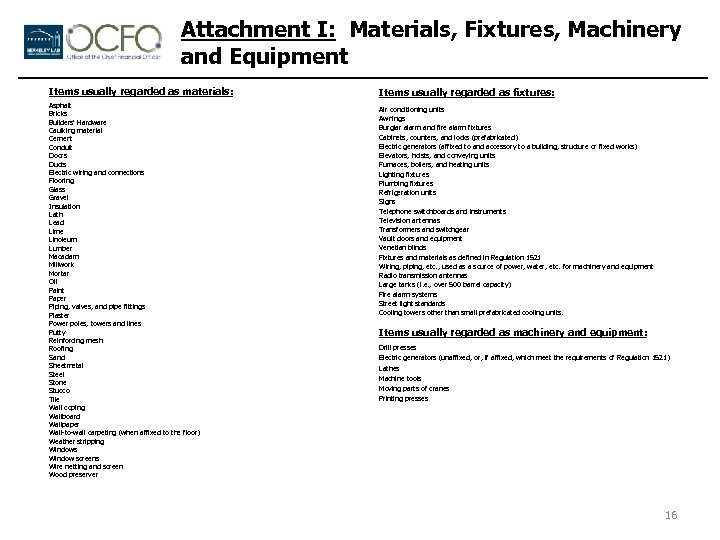

Attachment I: Materials, Fixtures, Machinery and Equipment Items usually regarded as materials: Asphalt Bricks Builders’ Hardware Caulking material Cement Conduit Doors Ducts Electric wiring and connections Flooring Glass Gravel Insulation Lath Lead Lime Linoleum Lumber Macadam Millwork Mortar Oil Paint Paper Piping, valves, and pipe fittings Plaster Power poles, towers and lines Putty Reinforcing mesh Roofing Sand Sheetmetal Steel Stone Stucco Tile Wall coping Wallboard Wallpaper Wall-to-wall carpeting (when affixed to the floor) Weather stripping Windows Window screens Wire netting and screen Wood preserver Items usually regarded as fixtures: Air conditioning units Awnings Burglar alarm and fire alarm fixtures Cabinets, counters, and locks (prefabricated) Electric generators (affixed to and accessory to a building, structure or fixed works) Elevators, hoists, and conveying units Furnaces, boilers, and heating units Lighting fixtures Plumbing fixtures Refrigeration units Signs Telephone switchboards and instruments Television antennas Transformers and switchgear Vault doors and equipment Venetian blinds Fixtures and materials as defined in Regulation 1521 Wiring, piping, etc. , used as a source of power, water, etc. for machinery and equipment Radio transmission antennas Large tanks (i. e. , over 500 barrel capacity) Fire alarm systems Street light standards Cooling towers other than small prefabricated cooling units. Items usually regarded as machinery and equipment: Drill presses Electric generators (unaffixed, or, if affixed, which meet the requirements of Regulation 1521) Lathes Machine tools Moving parts of cranes Printing presses 16

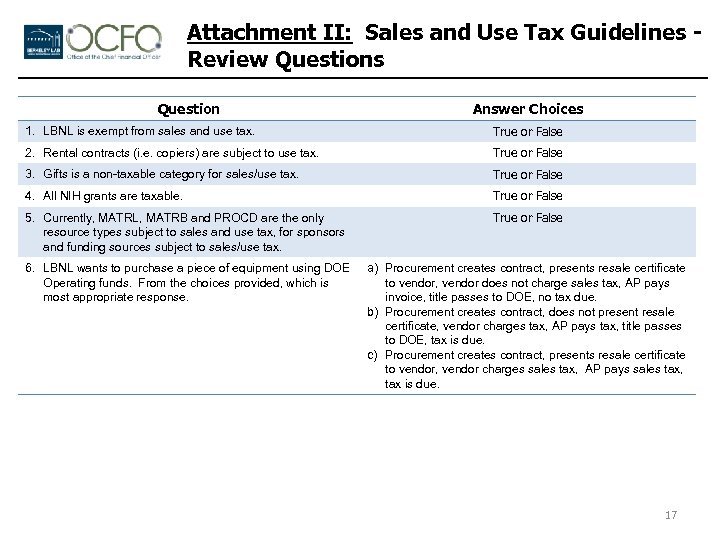

Attachment II: Sales and Use Tax Guidelines Review Questions Question Answer Choices 1. LBNL is exempt from sales and use tax. True or False 2. Rental contracts (i. e. copiers) are subject to use tax. True or False 3. Gifts is a non-taxable category for sales/use tax. True or False 4. All NIH grants are taxable. True or False 5. Currently, MATRL, MATRB and PROCD are the only resource types subject to sales and use tax, for sponsors and funding sources subject to sales/use tax. True or False 6. LBNL wants to purchase a piece of equipment using DOE Operating funds. From the choices provided, which is most appropriate response. a) Procurement creates contract, presents resale certificate to vendor, vendor does not charge sales tax, AP pays invoice, title passes to DOE, no tax due. b) Procurement creates contract, does not present resale certificate, vendor charges tax, AP pays tax, title passes to DOE, tax is due. c) Procurement creates contract, presents resale certificate to vendor, vendor charges sales tax, AP pays sales tax, tax is due. 17

b2c92843490e6268495e7e2a37625136.ppt