b37a10532a521fbc602d0aaf07c73f2d.ppt

- Количество слайдов: 45

LAWN CARE AND LANDSCAPING IOWA SALES TAX ISSUES Terry O’Neill Taxpayer Service Specialist

LAWN CARE AND LANDSCAPING IOWA SALES TAX ISSUES Terry O’Neill Taxpayer Service Specialist

What is Taxable? All tangible personal property unless a specific exemption has been written into Iowa Law. 2

What is Taxable? All tangible personal property unless a specific exemption has been written into Iowa Law. 2

Taxation is the Rule for Tangible Personal Property 3

Taxation is the Rule for Tangible Personal Property 3

Exemption is the Rule for Services Unless listed in Iowa law 4

Exemption is the Rule for Services Unless listed in Iowa law 4

Which Services are Taxable? List of taxable services on our website: https: //tax. iowa. gov/iowa-sales-and-use-taxtaxable-services-0 5

Which Services are Taxable? List of taxable services on our website: https: //tax. iowa. gov/iowa-sales-and-use-taxtaxable-services-0 5

Subject to Iowa Sales Tax? Lawn Care? Landscaping? YES

Subject to Iowa Sales Tax? Lawn Care? Landscaping? YES

Lawn Care

Lawn Care

Taxable Lawn Care • • mowing trimming watering fertilizing seeding sodding killing insects, moles, weeds, or fungi

Taxable Lawn Care • • mowing trimming watering fertilizing seeding sodding killing insects, moles, weeds, or fungi

What is a Lawn? • • cemetery grounds golf courses parks grass surrounding residential or commercial buildings or structures Taxable, unless the property owner is exempt.

What is a Lawn? • • cemetery grounds golf courses parks grass surrounding residential or commercial buildings or structures Taxable, unless the property owner is exempt.

What Isn’t a Lawn? • • ditches vacant lots railroad right-of-way isolated patch of grass or weeds Care is not taxable.

What Isn’t a Lawn? • • ditches vacant lots railroad right-of-way isolated patch of grass or weeds Care is not taxable.

What Property Owners Are Exempt? Some examples are: • Governmental entities • Public schools • Private, nonprofit educational institutions • Nonprofit hospitals, hospices, and museums

What Property Owners Are Exempt? Some examples are: • Governmental entities • Public schools • Private, nonprofit educational institutions • Nonprofit hospitals, hospices, and museums

Are All Nonprofits Exempt? No, most nonprofit organizations are taxable, including: • Churches • Most charitable organizations • Social clubs and similar organizations

Are All Nonprofits Exempt? No, most nonprofit organizations are taxable, including: • Churches • Most charitable organizations • Social clubs and similar organizations

Does Everyone Need to Collect Sales Tax? Yes, unless: • owner is the only one providing services; • owner is a full-time student; and • total gross receipts for a calendar year is less than $5, 000.

Does Everyone Need to Collect Sales Tax? Yes, unless: • owner is the only one providing services; • owner is a full-time student; and • total gross receipts for a calendar year is less than $5, 000.

QUIZ QUESTION #1 I’m mowing the grass at a church-owned cemetery. Do I need to collect sales tax? ü Yes. Churches are taxable & a cemetery is considered a lawn.

QUIZ QUESTION #1 I’m mowing the grass at a church-owned cemetery. Do I need to collect sales tax? ü Yes. Churches are taxable & a cemetery is considered a lawn.

Landscaping

Landscaping

Landscaping Defined • Arrange or modify natural condition of land • Public or private use or enjoyment This is taxable.

Landscaping Defined • Arrange or modify natural condition of land • Public or private use or enjoyment This is taxable.

Taxable Landscaping • Excavating • Planting • Pruning • Placing sand, rock, wood chips

Taxable Landscaping • Excavating • Planting • Pruning • Placing sand, rock, wood chips

What Isn’t Taxable? • Landscape Architect – services separately stated and billed – registered under Iowa Code section 544 B. 2 • For a Building or Structure that is – new construction – reconstruction – alteration – expansion, or – remodeling Sales Tax

What Isn’t Taxable? • Landscape Architect – services separately stated and billed – registered under Iowa Code section 544 B. 2 • For a Building or Structure that is – new construction – reconstruction – alteration – expansion, or – remodeling Sales Tax

QUIZ QUESTION #2 a Construction of a new building was completed in January. I’m hired in April to do the landscaping. Do I collect sales tax? ü No. The service is performed in connection with new construction. 19

QUIZ QUESTION #2 a Construction of a new building was completed in January. I’m hired in April to do the landscaping. Do I collect sales tax? ü No. The service is performed in connection with new construction. 19

QUIZ QUESTION #2 b Construction of a new building was completed in May. I’m hired in September to do the landscaping. Do I collect sales tax? ü Yes. The service is NOT performed in connection with new construction. 20

QUIZ QUESTION #2 b Construction of a new building was completed in May. I’m hired in September to do the landscaping. Do I collect sales tax? ü Yes. The service is NOT performed in connection with new construction. 20

Materials

Materials

What About Materials? • • • fertilizer chemicals sod seed dirt trees Tax Free • • • shrubbery bulbs sand woodchips rock other similar items if purchased for resale.

What About Materials? • • • fertilizer chemicals sod seed dirt trees Tax Free • • • shrubbery bulbs sand woodchips rock other similar items if purchased for resale.

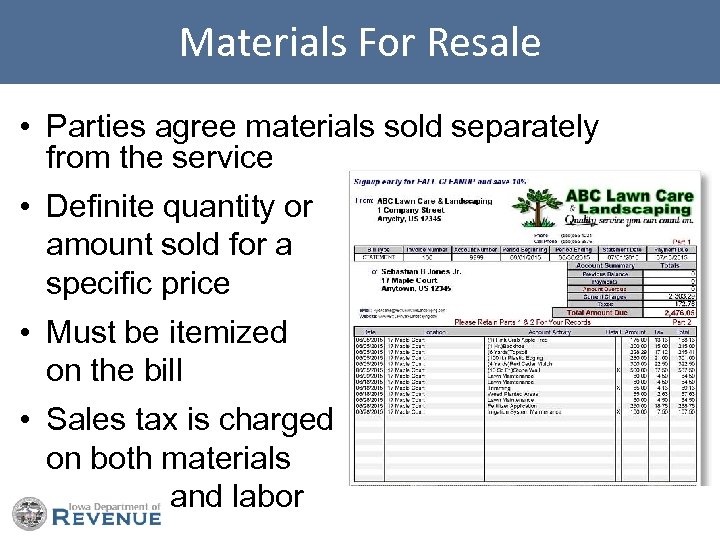

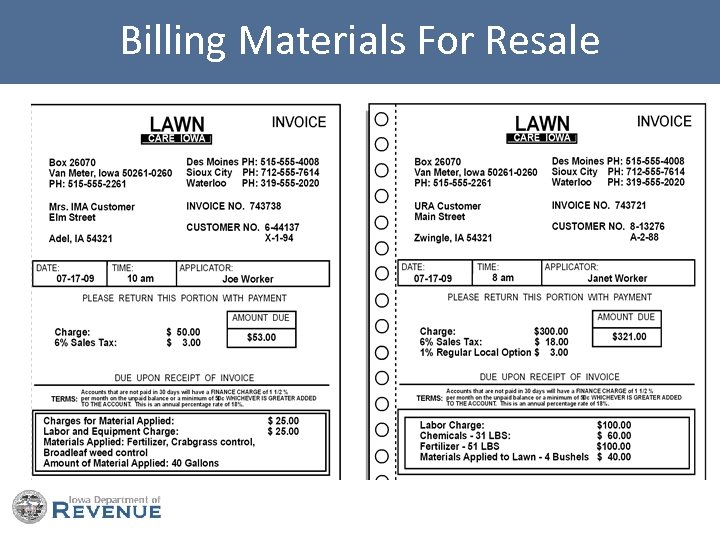

Materials For Resale • Parties agree materials sold separately from the service • Definite quantity or amount sold for a specific price • Must be itemized on the bill • Sales tax is charged on both materials and labor

Materials For Resale • Parties agree materials sold separately from the service • Definite quantity or amount sold for a specific price • Must be itemized on the bill • Sales tax is charged on both materials and labor

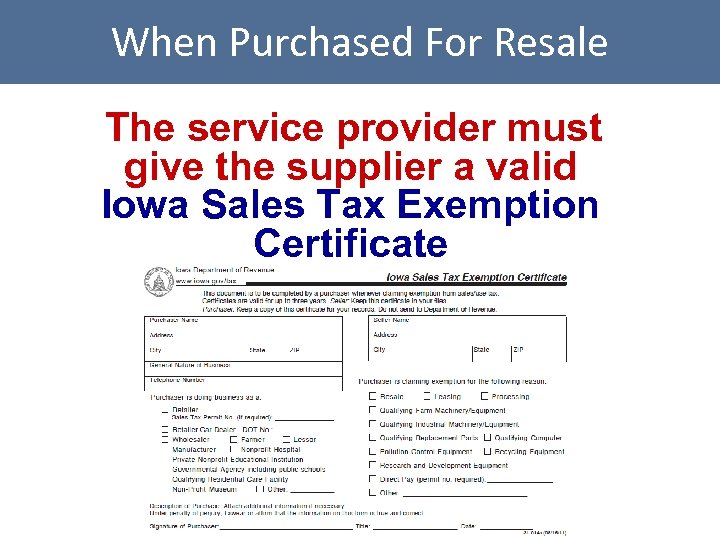

When Purchased For Resale The service provider must give the supplier a valid Iowa Sales Tax Exemption Certificate

When Purchased For Resale The service provider must give the supplier a valid Iowa Sales Tax Exemption Certificate

Billing Materials For Resale

Billing Materials For Resale

Jenny’s Lawn Care Bill’s Lawn Care Mow, trim, labor 50. 00 20 lbs. Seed 30. 00 Mow, trim, seed 80. 00 tax 5. 60 80. 00 Local option 1%. 80 6% tax 4. 80 total due: Total due: $85. 60 Retailer of materials labor and BUYS MATERIALS TAX EXEMPT Retailer of taxable labor PAYS TAX ON MATERIALS

Jenny’s Lawn Care Bill’s Lawn Care Mow, trim, labor 50. 00 20 lbs. Seed 30. 00 Mow, trim, seed 80. 00 tax 5. 60 80. 00 Local option 1%. 80 6% tax 4. 80 total due: Total due: $85. 60 Retailer of materials labor and BUYS MATERIALS TAX EXEMPT Retailer of taxable labor PAYS TAX ON MATERIALS

When retailers fail to itemize Landscape Materials separately from exempt labor, the total bill is taxable

When retailers fail to itemize Landscape Materials separately from exempt labor, the total bill is taxable

QUIZ QUESTION #3 I don’t separately itemize materials on my bill to the customer. Can I buy those materials exempt from sales tax? ü No. Separately itemized bills are one requirement of purchasing tax free for resale. 28

QUIZ QUESTION #3 I don’t separately itemize materials on my bill to the customer. Can I buy those materials exempt from sales tax? ü No. Separately itemized bills are one requirement of purchasing tax free for resale. 28

Landscape Contractors

Landscape Contractors

Can Landscapers be Contractors? YES When providing both labor and materials to build a structure, for that portion of the job.

Can Landscapers be Contractors? YES When providing both labor and materials to build a structure, for that portion of the job.

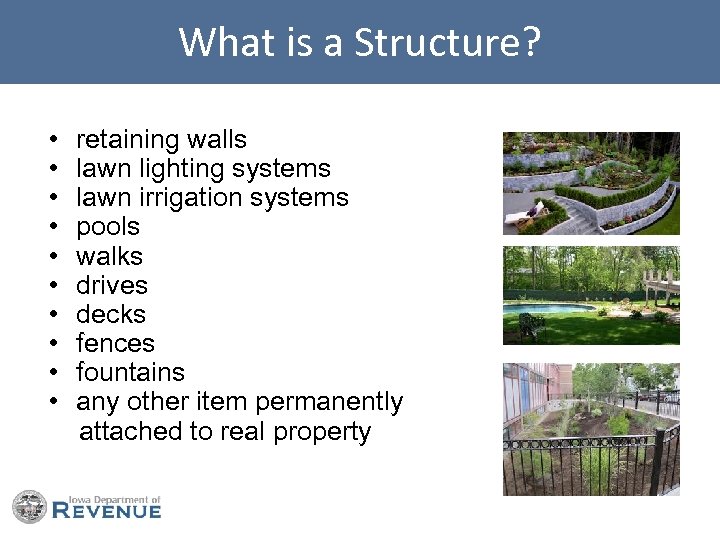

What is a Structure? • • • retaining walls lawn lighting systems lawn irrigation systems pools walks drives decks fences fountains any other item permanently attached to real property

What is a Structure? • • • retaining walls lawn lighting systems lawn irrigation systems pools walks drives decks fences fountains any other item permanently attached to real property

Building Materials • • concrete railroad ties wood bricks stone pavers pipe conduit

Building Materials • • concrete railroad ties wood bricks stone pavers pipe conduit

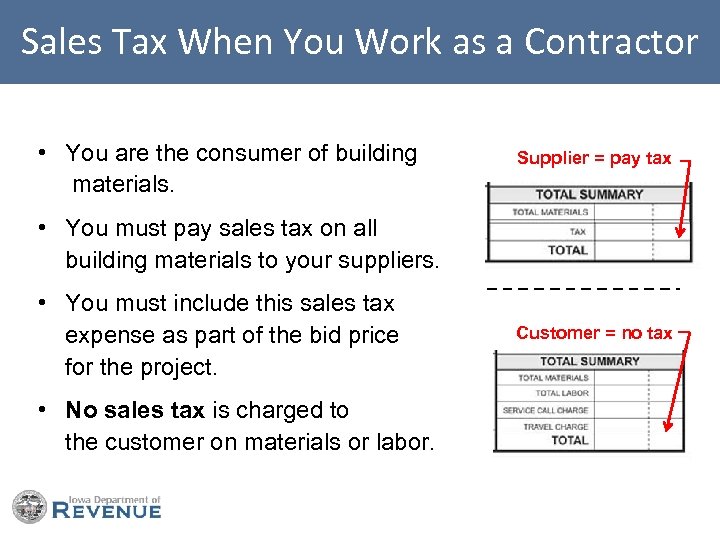

Sales Tax When You Work as a Contractor • You are the consumer of building materials. Supplier = pay tax • You must pay sales tax on all building materials to your suppliers. • You must include this sales tax expense as part of the bid price for the project. • No sales tax is charged to the customer on materials or labor. Customer = no tax

Sales Tax When You Work as a Contractor • You are the consumer of building materials. Supplier = pay tax • You must pay sales tax on all building materials to your suppliers. • You must include this sales tax expense as part of the bid price for the project. • No sales tax is charged to the customer on materials or labor. Customer = no tax

QUIZ QUESTION #4 I have a contract to build a retaining wall. Can I purchase the stones I use to construct the wall tax free for resale ? ü No. Contractors are the final consumers of building materials.

QUIZ QUESTION #4 I have a contract to build a retaining wall. Can I purchase the stones I use to construct the wall tax free for resale ? ü No. Contractors are the final consumers of building materials.

http: //itrl. idr. iowa. gov/ 35

http: //itrl. idr. iowa. gov/ 35

https: //tax. iowa. gov 36

https: //tax. iowa. gov 36

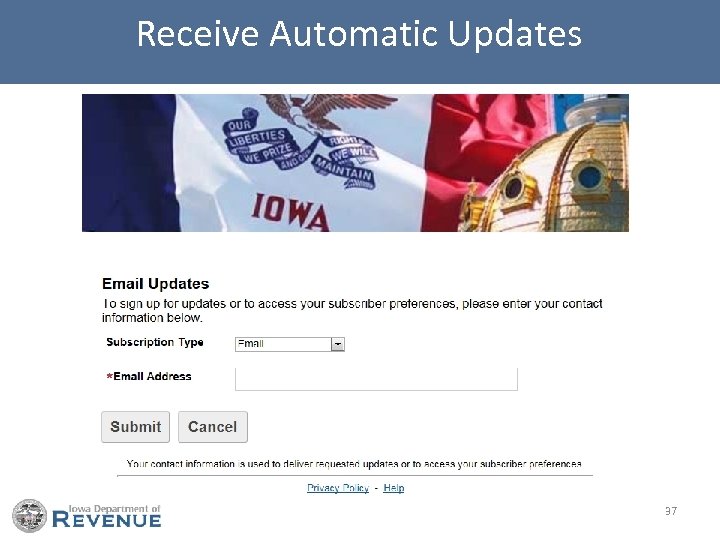

Receive Automatic Updates 37

Receive Automatic Updates 37

Subscribe to the Following Topics • • • Newsroom Tax Information e. File & Pay Information Sign-up for Due Date Reminders Economic, Fiscal, & Statistical Information Electronic Filing NOTE: These replace the e. Lists formerly used 38

Subscribe to the Following Topics • • • Newsroom Tax Information e. File & Pay Information Sign-up for Due Date Reminders Economic, Fiscal, & Statistical Information Electronic Filing NOTE: These replace the e. Lists formerly used 38

Follow Us on Twitter @IDRBusiness. Tax @IDRIncome. Tax @IDRTax. Pros 39

Follow Us on Twitter @IDRBusiness. Tax @IDRIncome. Tax @IDRTax. Pros 39

Like Us on Facebook www. facebook. com/iowadepartmentofrevenue 40

Like Us on Facebook www. facebook. com/iowadepartmentofrevenue 40

Need More Information? • More details can be found on our website: Landscaping & Lawn Care publication • Call us: 8 a. m. - 4: 15 p. m. CT 515 -281 -3114 / 800 -367 -3388 • Email us at idr@iowa. gov 41

Need More Information? • More details can be found on our website: Landscaping & Lawn Care publication • Call us: 8 a. m. - 4: 15 p. m. CT 515 -281 -3114 / 800 -367 -3388 • Email us at idr@iowa. gov 41

Protect Yourself from Identity Theft • IDR will always identify itself. • We will NEVER ask you to provide your full Social Security Number by email or regular mail. • We do not send emails asking for personal or financial information. This includes any type of electronic communication, such as text messages and social media channels.

Protect Yourself from Identity Theft • IDR will always identify itself. • We will NEVER ask you to provide your full Social Security Number by email or regular mail. • We do not send emails asking for personal or financial information. This includes any type of electronic communication, such as text messages and social media channels.

Protect Yourself from Identity Theft If you are unsure the communication you received is official: • Do not provide any personal or confidential information. • Contact us. We will confirm whether the communication you received was from the Iowa Department of Revenue.

Protect Yourself from Identity Theft If you are unsure the communication you received is official: • Do not provide any personal or confidential information. • Contact us. We will confirm whether the communication you received was from the Iowa Department of Revenue.

Purpose of this Webinar This presentation is intended for general educational purposes only. Anyone involved in an audit or protest must contact the Department representative they are working with on that issue.

Purpose of this Webinar This presentation is intended for general educational purposes only. Anyone involved in an audit or protest must contact the Department representative they are working with on that issue.

Questions and Answers and Evaluation Time 45

Questions and Answers and Evaluation Time 45