3638b76894a898a179f3b70206e2e497.ppt

- Количество слайдов: 57

Laura Ludeña Head of Market Insights Google Spain Nuevos usos de la estadística en la sociedad del conocimiento y de la red Eustat. Donostia Julio 2013 Google Confidential and Proprietary 1

Laura Ludeña Head of Market Insights Google Spain Nuevos usos de la estadística en la sociedad del conocimiento y de la red Eustat. Donostia Julio 2013 Google Confidential and Proprietary 1

Agenda 1. Uso de la estadística para conocer el mundo digital 2. Uso de la estadística para mejorar los productos publicitarios 3. Uso de la estadística para medir la efectividad de los productos publicitarios Google Confidential and Proprietary 2

Agenda 1. Uso de la estadística para conocer el mundo digital 2. Uso de la estadística para mejorar los productos publicitarios 3. Uso de la estadística para medir la efectividad de los productos publicitarios Google Confidential and Proprietary 2

1. Usos de la estadística para entender el mundo digital Google Confidential and Proprietary 4

1. Usos de la estadística para entender el mundo digital Google Confidential and Proprietary 4

Estadísticas globales y para España Google Confidential and Proprietary 5

Estadísticas globales y para España Google Confidential and Proprietary 5

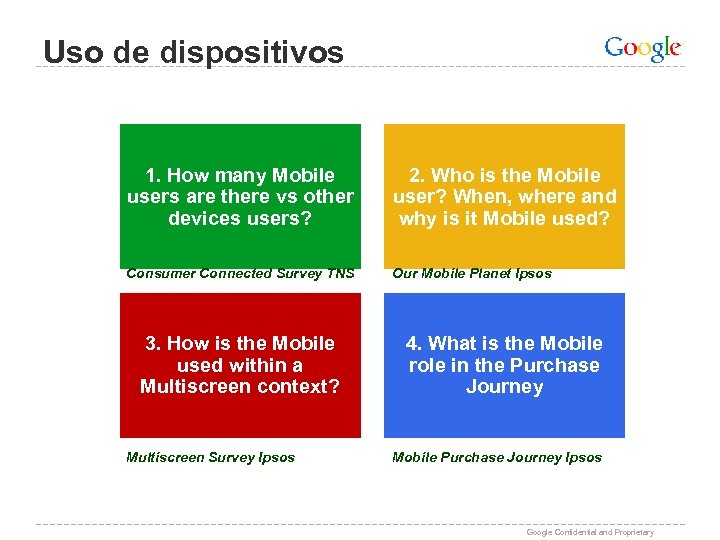

Uso de dispositivos 1. How many Mobile users are there vs other devices users? 2. Who is the Mobile user? When, where and why is it Mobile used? Consumer Connected Survey TNS Our Mobile Planet Ipsos 3. How is the Mobile used within a Multiscreen context? Multiscreen Survey Ipsos 4. What is the Mobile role in the Purchase Journey Mobile Purchase Journey Ipsos Google Confidential and Proprietary

Uso de dispositivos 1. How many Mobile users are there vs other devices users? 2. Who is the Mobile user? When, where and why is it Mobile used? Consumer Connected Survey TNS Our Mobile Planet Ipsos 3. How is the Mobile used within a Multiscreen context? Multiscreen Survey Ipsos 4. What is the Mobile role in the Purchase Journey Mobile Purchase Journey Ipsos Google Confidential and Proprietary

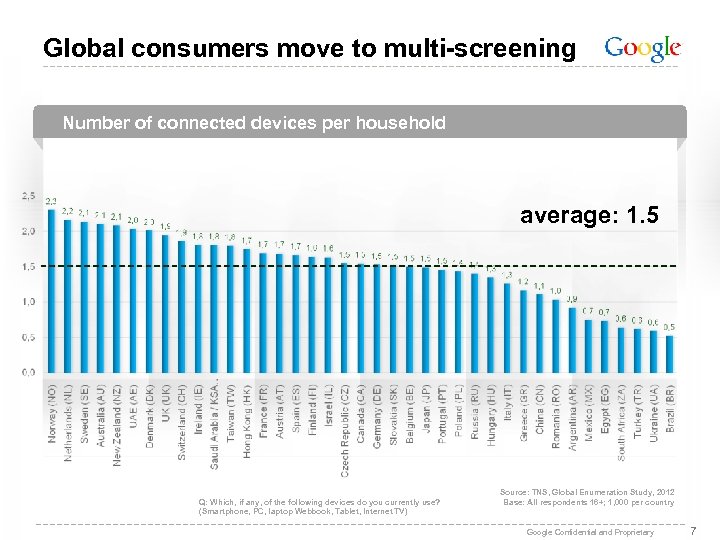

Global consumers move to multi-screening Number of connected devices per household average: 1. 5 Q: Which, if any, of the following devices do you currently use? (Smartphone, PC, laptop Webbook, Tablet, Internet TV) Source: TNS, Global Enumeration Study, 2012 Base: All respondents 16+; 1, 000 per country Google Confidential and Proprietary 7

Global consumers move to multi-screening Number of connected devices per household average: 1. 5 Q: Which, if any, of the following devices do you currently use? (Smartphone, PC, laptop Webbook, Tablet, Internet TV) Source: TNS, Global Enumeration Study, 2012 Base: All respondents 16+; 1, 000 per country Google Confidential and Proprietary 7

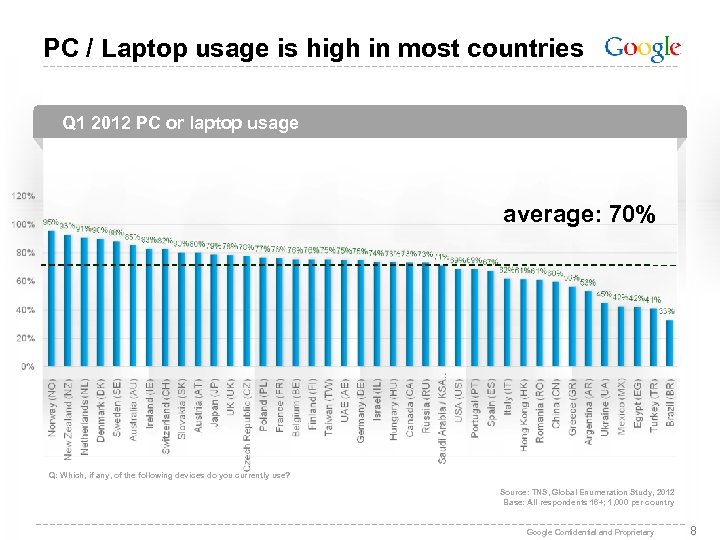

PC / Laptop usage is high in most countries Q 1 2012 PC or laptop usage average: 70% Q: Which, if any, of the following devices do you currently use? Source: TNS, Global Enumeration Study, 2012 Base: All respondents 16+; 1, 000 per country Google Confidential and Proprietary 8

PC / Laptop usage is high in most countries Q 1 2012 PC or laptop usage average: 70% Q: Which, if any, of the following devices do you currently use? Source: TNS, Global Enumeration Study, 2012 Base: All respondents 16+; 1, 000 per country Google Confidential and Proprietary 8

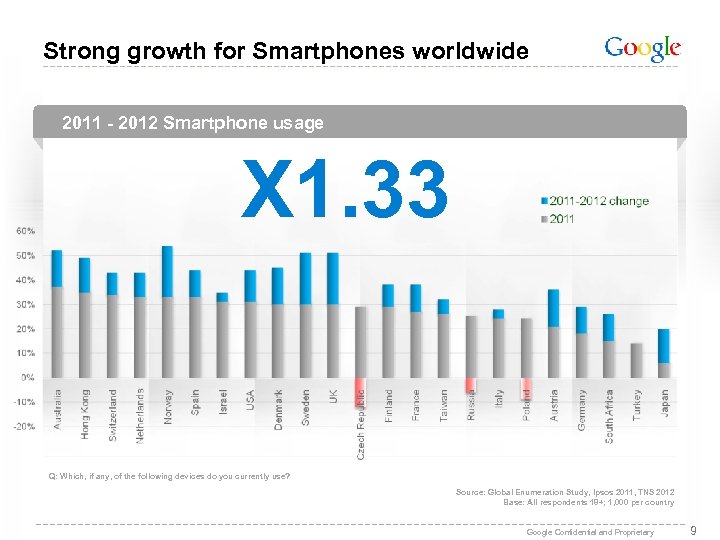

Strong growth for Smartphones worldwide 2011 - 2012 Smartphone usage X 1. 33 Q: Which, if any, of the following devices do you currently use? Source: Global Enumeration Study, Ipsos 2011, TNS 2012 Base: All respondents 18+; 1, 000 per country Google Confidential and Proprietary 9

Strong growth for Smartphones worldwide 2011 - 2012 Smartphone usage X 1. 33 Q: Which, if any, of the following devices do you currently use? Source: Global Enumeration Study, Ipsos 2011, TNS 2012 Base: All respondents 18+; 1, 000 per country Google Confidential and Proprietary 9

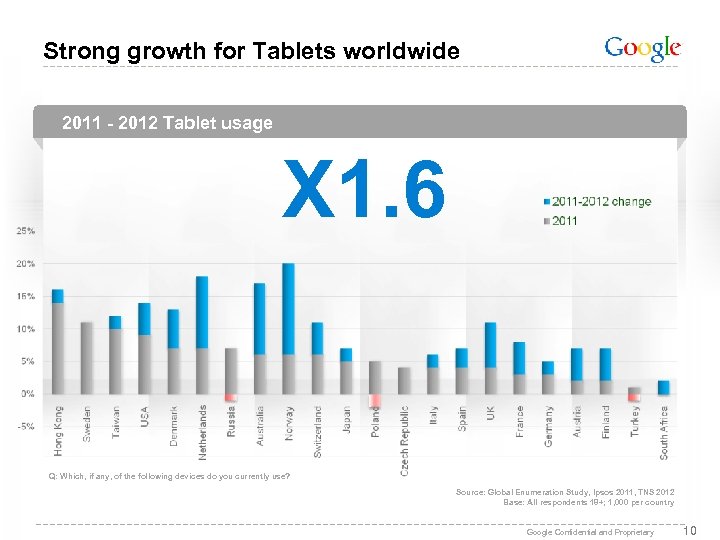

Strong growth for Tablets worldwide 2011 - 2012 Tablet usage X 1. 6 Q: Which, if any, of the following devices do you currently use? Source: Global Enumeration Study, Ipsos 2011, TNS 2012 Base: All respondents 18+; 1, 000 per country Google Confidential and Proprietary 10

Strong growth for Tablets worldwide 2011 - 2012 Tablet usage X 1. 6 Q: Which, if any, of the following devices do you currently use? Source: Global Enumeration Study, Ipsos 2011, TNS 2012 Base: All respondents 18+; 1, 000 per country Google Confidential and Proprietary 10

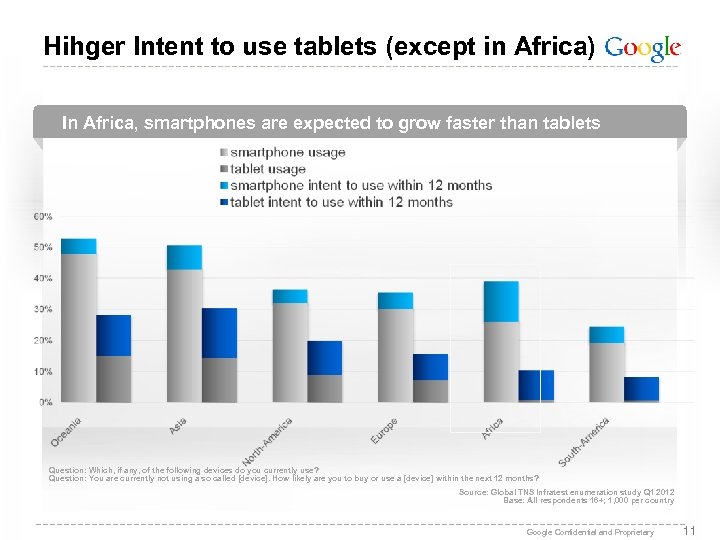

Hihger Intent to use tablets (except in Africa) In Africa, smartphones are expected to grow faster than tablets Question: Which, if any, of the following devices do you currently use? Question: You are currently not using a so called [device]. How likely are you to buy or use a [device] within the next 12 months? Source: Global TNS Infratest enumeration study Q 1 2012 Base: All respondents 16+; 1, 000 per country Google Confidential and Proprietary 11

Hihger Intent to use tablets (except in Africa) In Africa, smartphones are expected to grow faster than tablets Question: Which, if any, of the following devices do you currently use? Question: You are currently not using a so called [device]. How likely are you to buy or use a [device] within the next 12 months? Source: Global TNS Infratest enumeration study Q 1 2012 Base: All respondents 16+; 1, 000 per country Google Confidential and Proprietary 11

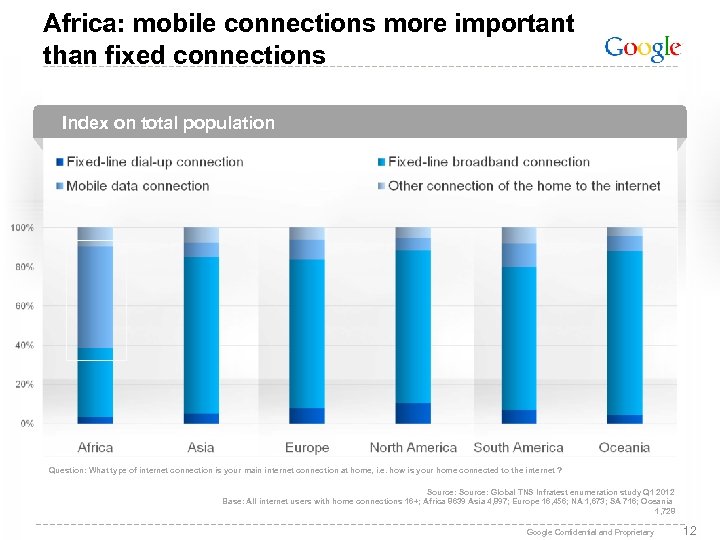

Africa: mobile connections more important than fixed connections Index on total population Question: What type of internet connection is your main internet connection at home, i. e. how is your home connected to the internet ? Source: Global TNS Infratest enumeration study Q 1 2012 Base: All internet users with home connections 16+; Africa 8639 Asia 4, 897; Europe 16, 456; NA 1, 673; SA 716; Oceania 1, 728 Google Confidential and Proprietary 12

Africa: mobile connections more important than fixed connections Index on total population Question: What type of internet connection is your main internet connection at home, i. e. how is your home connected to the internet ? Source: Global TNS Infratest enumeration study Q 1 2012 Base: All internet users with home connections 16+; Africa 8639 Asia 4, 897; Europe 16, 456; NA 1, 673; SA 716; Oceania 1, 728 Google Confidential and Proprietary 12

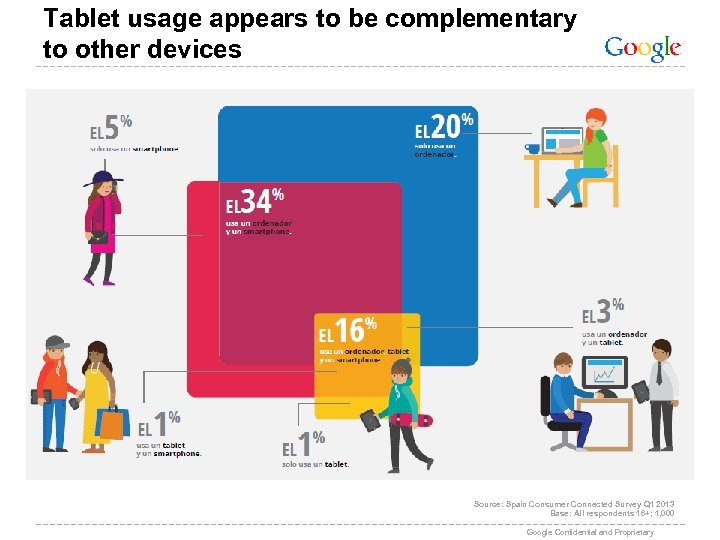

Tablet usage appears to be complementary to other devices Source: Spain Consumer Connected Survey Q 1 2013 Base: All respondents 16+; 1, 000 Google Confidential and Proprietary

Tablet usage appears to be complementary to other devices Source: Spain Consumer Connected Survey Q 1 2013 Base: All respondents 16+; 1, 000 Google Confidential and Proprietary

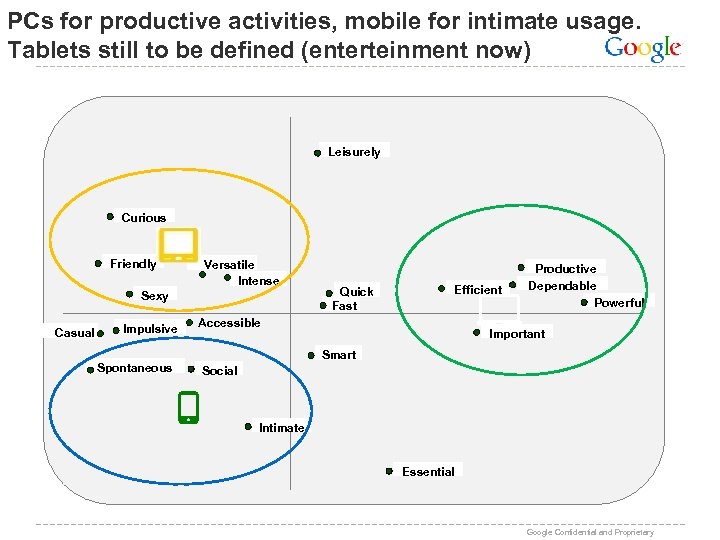

PCs for productive activities, mobile for intimate usage. Tablets still to be defined (enterteinment now) Leisurely Curious Friendly Versatile Intense Sexy Casual Impulsive Spontaneous Quick Fast Efficient Accessible Productive Dependable Powerful Important Smart Social Intimate Essential Google Confidential and Proprietary

PCs for productive activities, mobile for intimate usage. Tablets still to be defined (enterteinment now) Leisurely Curious Friendly Versatile Intense Sexy Casual Impulsive Spontaneous Quick Fast Efficient Accessible Productive Dependable Powerful Important Smart Social Intimate Essential Google Confidential and Proprietary

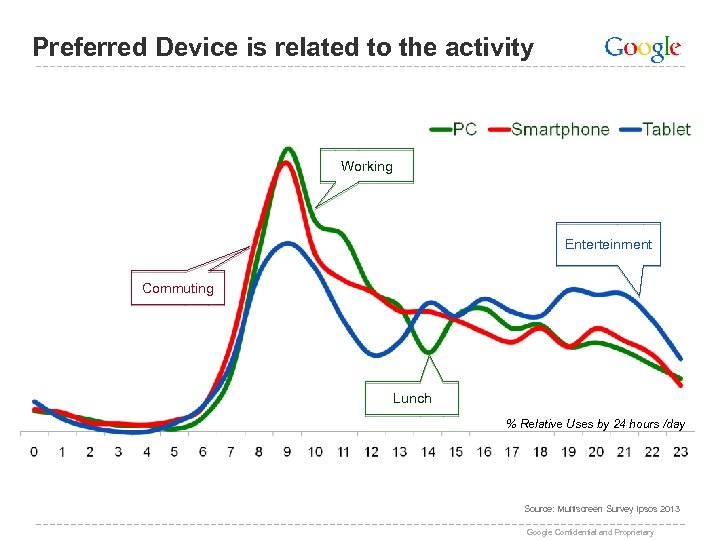

Preferred Device is related to the activity Working Enterteinment Commuting Lunch % Relative Uses by 24 hours /day Source: Multiscreen Survey Ipsos 2013 Google Confidential and Proprietary

Preferred Device is related to the activity Working Enterteinment Commuting Lunch % Relative Uses by 24 hours /day Source: Multiscreen Survey Ipsos 2013 Google Confidential and Proprietary

Uso de smartphone Source: Our Mobile Planet Ipsos 2013 Google Confidential and Proprietary

Uso de smartphone Source: Our Mobile Planet Ipsos 2013 Google Confidential and Proprietary

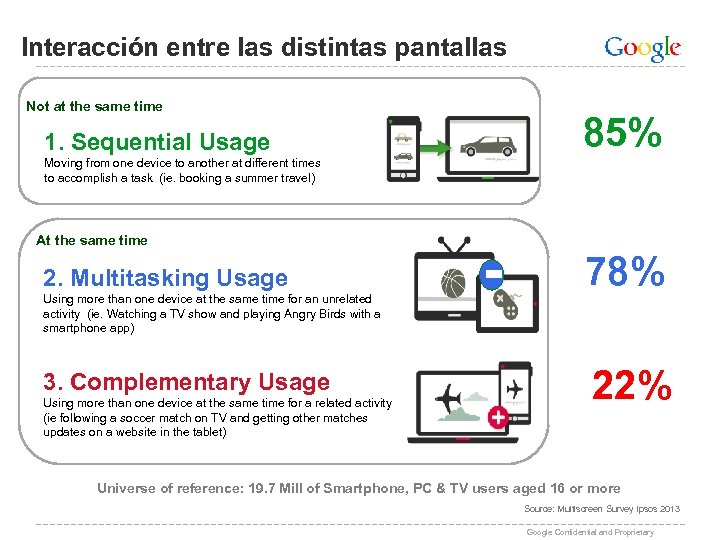

Interacción entre las distintas pantallas Not at the same time 85% 1. Sequential Usage Moving from one device to another at different times to accomplish a task (ie. booking a summer travel) At the same time 2. Multitasking Usage Using more than one device at the same time for an unrelated activity (ie. Watching a TV show and playing Angry Birds with a smartphone app) 3. Complementary Usage Using more than one device at the same time for a related activity (ie following a soccer match on TV and getting other matches updates on a website in the tablet) - 78% 22% Universe of reference: 19. 7 Mill of Smartphone, PC & TV users aged 16 or more Source: Multiscreen Survey Ipsos 2013 Google Confidential and Proprietary

Interacción entre las distintas pantallas Not at the same time 85% 1. Sequential Usage Moving from one device to another at different times to accomplish a task (ie. booking a summer travel) At the same time 2. Multitasking Usage Using more than one device at the same time for an unrelated activity (ie. Watching a TV show and playing Angry Birds with a smartphone app) 3. Complementary Usage Using more than one device at the same time for a related activity (ie following a soccer match on TV and getting other matches updates on a website in the tablet) - 78% 22% Universe of reference: 19. 7 Mill of Smartphone, PC & TV users aged 16 or more Source: Multiscreen Survey Ipsos 2013 Google Confidential and Proprietary

89% of smartphone users have looked for local 19, 248, 624 ind information 77% 14, 821, 441 ind have taken action as a result 32% 6, 159, 560 ind 27% 5, 197, 129 ind have visited the business have called the business or service How often do you look for information about local businesses or services on your smartphone? (Ever) Base: Private smartphone users who use the Internet in general and who look at least less than once a month for information on their smartphone, Smartphone n= 891 Which of the following actions have you taken after having looked up this type of information (business or services close to your location)? Source: Our Mobile Planet Ipsos 2013 Google Confidential and Proprietary

89% of smartphone users have looked for local 19, 248, 624 ind information 77% 14, 821, 441 ind have taken action as a result 32% 6, 159, 560 ind 27% 5, 197, 129 ind have visited the business have called the business or service How often do you look for information about local businesses or services on your smartphone? (Ever) Base: Private smartphone users who use the Internet in general and who look at least less than once a month for information on their smartphone, Smartphone n= 891 Which of the following actions have you taken after having looked up this type of information (business or services close to your location)? Source: Our Mobile Planet Ipsos 2013 Google Confidential and Proprietary

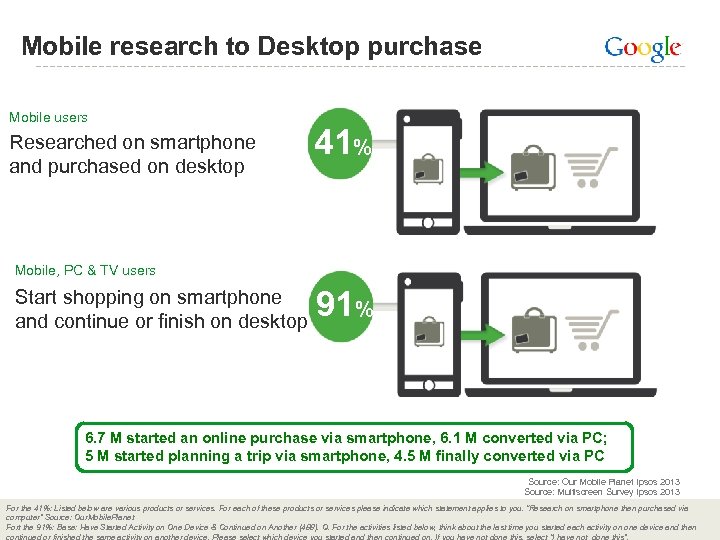

Mobile research to Desktop purchase Mobile users Researched on smartphone and purchased on desktop 41% Mobile, PC & TV users Start shopping on smartphone and continue or finish on desktop 91% 6. 7 M started an online purchase via smartphone, 6. 1 M converted via PC; 5 M started planning a trip via smartphone, 4. 5 M finally converted via PC Source: Our Mobile Planet Ipsos 2013 Source: Multiscreen Survey Ipsos 2013 For the 41%: Listed below are various products or services. For each of these products or services please indicate which statement applies to you. “Research on smartphone then purchased via computer” Source: Our. Mobile. Planet Fort the 91%: Base: Have Started Activity on One Device & Continued on Another (488). Q. For the activities listed below, think about the last time you started each activity on one device and then Google Confidential and Proprietary continued or finished the same activity on another device. Please select which device you started and then continued on. If you have not done this, select “I have not done this”.

Mobile research to Desktop purchase Mobile users Researched on smartphone and purchased on desktop 41% Mobile, PC & TV users Start shopping on smartphone and continue or finish on desktop 91% 6. 7 M started an online purchase via smartphone, 6. 1 M converted via PC; 5 M started planning a trip via smartphone, 4. 5 M finally converted via PC Source: Our Mobile Planet Ipsos 2013 Source: Multiscreen Survey Ipsos 2013 For the 41%: Listed below are various products or services. For each of these products or services please indicate which statement applies to you. “Research on smartphone then purchased via computer” Source: Our. Mobile. Planet Fort the 91%: Base: Have Started Activity on One Device & Continued on Another (488). Q. For the activities listed below, think about the last time you started each activity on one device and then Google Confidential and Proprietary continued or finished the same activity on another device. Please select which device you started and then continued on. If you have not done this, select “I have not done this”.

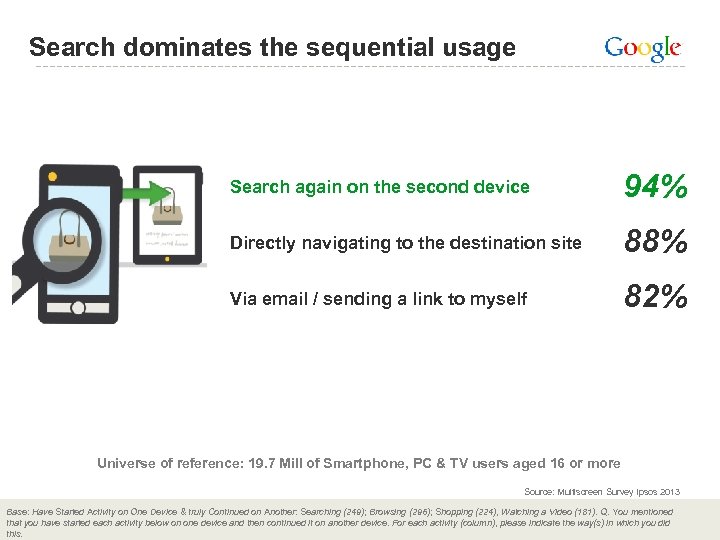

Search dominates the sequential usage Search again on the second device 94% Directly navigating to the destination site 88% Via email / sending a link to myself 82% Universe of reference: 19. 7 Mill of Smartphone, PC & TV users aged 16 or more Source: Multiscreen Survey Ipsos 2013 Base: Have Started Activity on One Device & truly Continued on Another: Searching (249); Browsing (296); Shopping (224), Watching a Video (181). Q. You mentioned that you have started each activity below on one device and then continued it on another device. For each activity (column), please indicate the way(s) in which you did Google Confidential and Proprietary this.

Search dominates the sequential usage Search again on the second device 94% Directly navigating to the destination site 88% Via email / sending a link to myself 82% Universe of reference: 19. 7 Mill of Smartphone, PC & TV users aged 16 or more Source: Multiscreen Survey Ipsos 2013 Base: Have Started Activity on One Device & truly Continued on Another: Searching (249); Browsing (296); Shopping (224), Watching a Video (181). Q. You mentioned that you have started each activity below on one device and then continued it on another device. For each activity (column), please indicate the way(s) in which you did Google Confidential and Proprietary this.

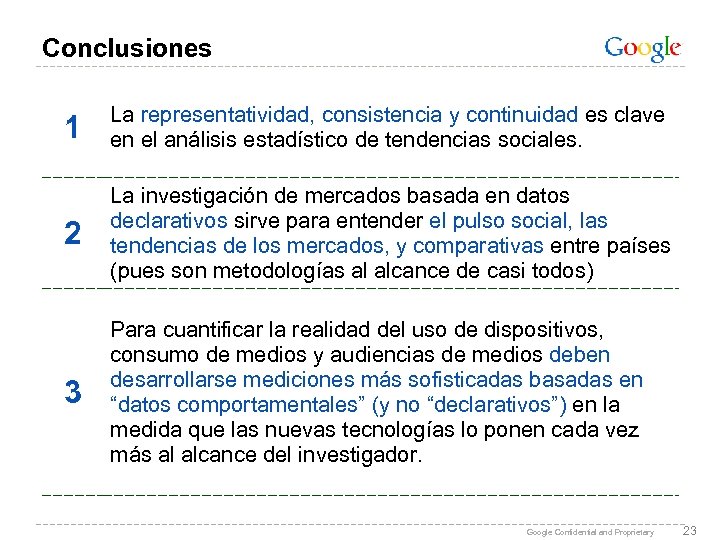

Conclusiones 1 La representatividad, consistencia y continuidad es clave en el análisis estadístico de tendencias sociales. 2 La investigación de mercados basada en datos declarativos sirve para entender el pulso social, las tendencias de los mercados, y comparativas entre países (pues son metodologías al alcance de casi todos) 3 Para cuantificar la realidad del uso de dispositivos, consumo de medios y audiencias de medios deben desarrollarse mediciones más sofisticadas basadas en “datos comportamentales” (y no “declarativos”) en la medida que las nuevas tecnologías lo ponen cada vez más al alcance del investigador. Google Confidential and Proprietary 23

Conclusiones 1 La representatividad, consistencia y continuidad es clave en el análisis estadístico de tendencias sociales. 2 La investigación de mercados basada en datos declarativos sirve para entender el pulso social, las tendencias de los mercados, y comparativas entre países (pues son metodologías al alcance de casi todos) 3 Para cuantificar la realidad del uso de dispositivos, consumo de medios y audiencias de medios deben desarrollarse mediciones más sofisticadas basadas en “datos comportamentales” (y no “declarativos”) en la medida que las nuevas tecnologías lo ponen cada vez más al alcance del investigador. Google Confidential and Proprietary 23

Usos de la estadística para mejorar el marketing Google Confidential and Proprietary 24

Usos de la estadística para mejorar el marketing Google Confidential and Proprietary 24

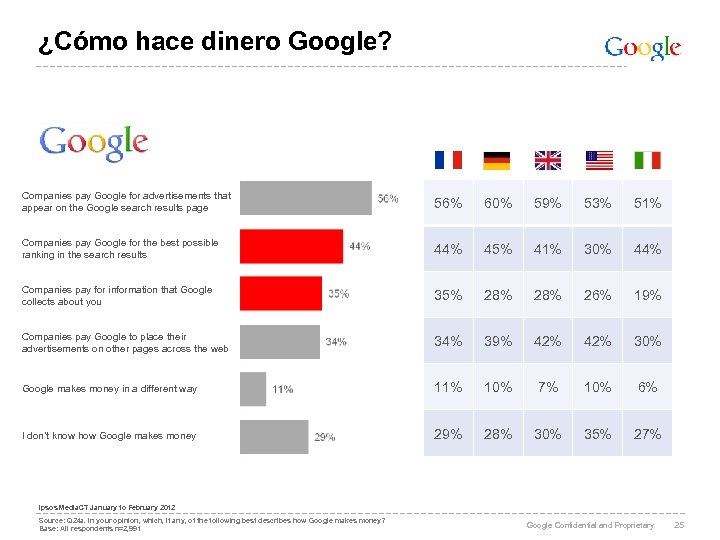

¿Cómo hace dinero Google? Companies pay Google for advertisements that appear on the Google search results page 56% 60% 59% 53% 51% Companies pay Google for the best possible ranking in the search results 44% 45% 41% 30% 44% Companies pay for information that Google collects about you 35% 28% 26% 19% Companies pay Google to place their advertisements on other pages across the web 34% 39% 42% 30% Google makes money in a different way 11% 10% 7% 10% 6% I don’t know how Google makes money 29% 28% 30% 35% 27% Ipsos Media. CT January to February 2012 Source: Q 24 a. In your opinion, which, if any, of the following best describes how Google makes money? Base: All respondents n=2, 991 Google Confidential and Proprietary 25

¿Cómo hace dinero Google? Companies pay Google for advertisements that appear on the Google search results page 56% 60% 59% 53% 51% Companies pay Google for the best possible ranking in the search results 44% 45% 41% 30% 44% Companies pay for information that Google collects about you 35% 28% 26% 19% Companies pay Google to place their advertisements on other pages across the web 34% 39% 42% 30% Google makes money in a different way 11% 10% 7% 10% 6% I don’t know how Google makes money 29% 28% 30% 35% 27% Ipsos Media. CT January to February 2012 Source: Q 24 a. In your opinion, which, if any, of the following best describes how Google makes money? Base: All respondents n=2, 991 Google Confidential and Proprietary 25

Google Confidential and Proprietary 26

Google Confidential and Proprietary 26

Push Google Confidential and Proprietary 27

Push Google Confidential and Proprietary 27

Pull How much you’re willing to pay (bids) How “good” your ads are (relevance) Competition Google Confidential and Proprietary 28

Pull How much you’re willing to pay (bids) How “good” your ads are (relevance) Competition Google Confidential and Proprietary 28

La estadística aplicada a la comprensión de las necesidades del consumidor: Search Google Confidential and Proprietary 29

La estadística aplicada a la comprensión de las necesidades del consumidor: Search Google Confidential and Proprietary 29

La estadística aplicada a la comprensión de las necesidades del consumidor: Google Analytics 30

La estadística aplicada a la comprensión de las necesidades del consumidor: Google Analytics 30

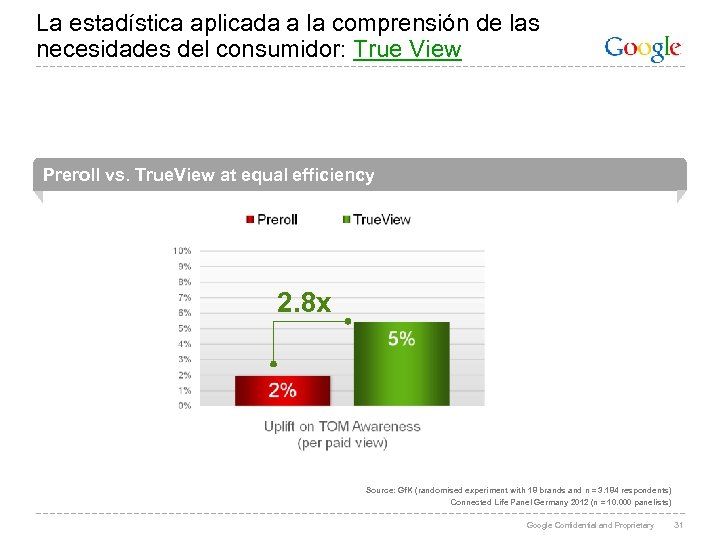

La estadística aplicada a la comprensión de las necesidades del consumidor: True View Preroll vs. True. View at equal efficiency 2. 8 x Source: Gf. K (randomised experiment with 18 brands and n = 3. 184 respondents) Connected Life Panel Germany 2012 (n = 10. 000 panelists) Google Confidential and Proprietary 31

La estadística aplicada a la comprensión de las necesidades del consumidor: True View Preroll vs. True. View at equal efficiency 2. 8 x Source: Gf. K (randomised experiment with 18 brands and n = 3. 184 respondents) Connected Life Panel Germany 2012 (n = 10. 000 panelists) Google Confidential and Proprietary 31

La estadística aplicada a la comprensión de las necesidades del consumidor: Retargeting Google Confidential and Proprietary 32

La estadística aplicada a la comprensión de las necesidades del consumidor: Retargeting Google Confidential and Proprietary 32

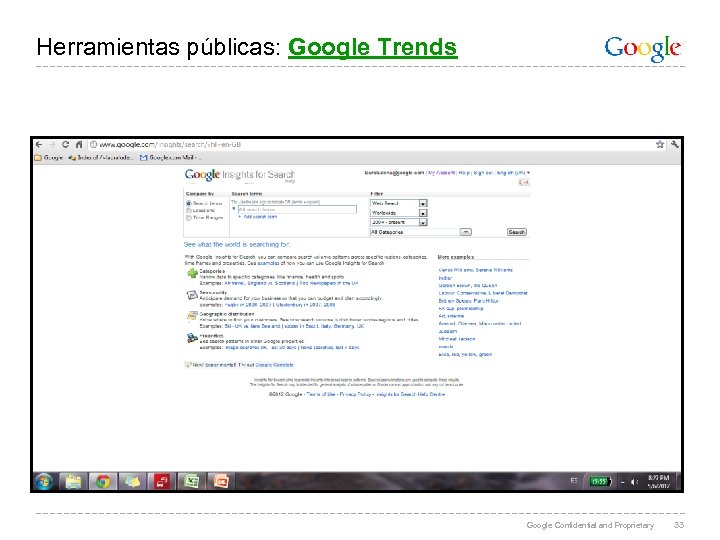

Herramientas públicas: Google Trends Google Confidential and Proprietary 33

Herramientas públicas: Google Trends Google Confidential and Proprietary 33

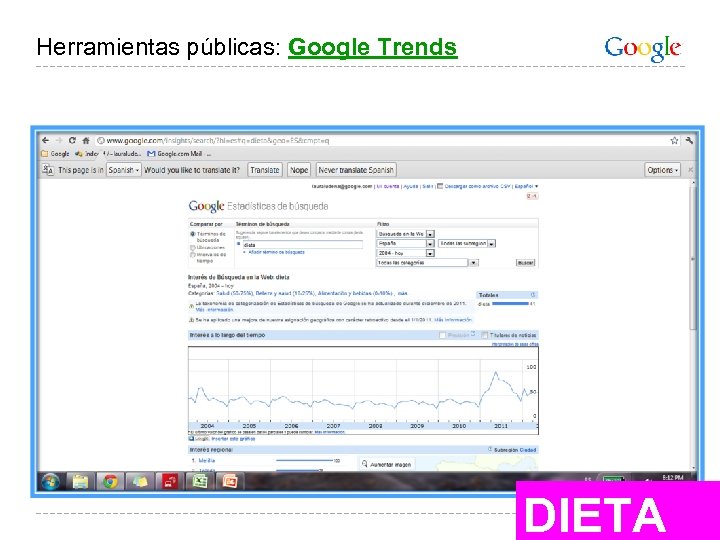

Herramientas públicas: Google Trends DIETA Google Confidential and Proprietary 34

Herramientas públicas: Google Trends DIETA Google Confidential and Proprietary 34

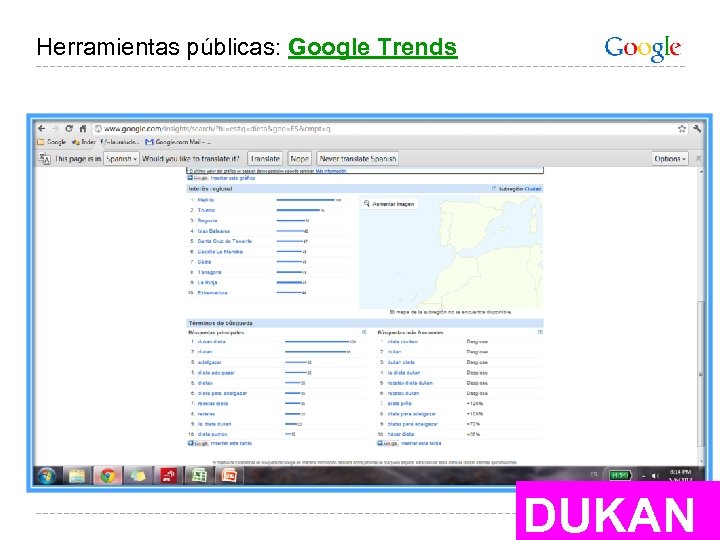

Herramientas públicas: Google Trends DUKAN Google Confidential and Proprietary 35

Herramientas públicas: Google Trends DUKAN Google Confidential and Proprietary 35

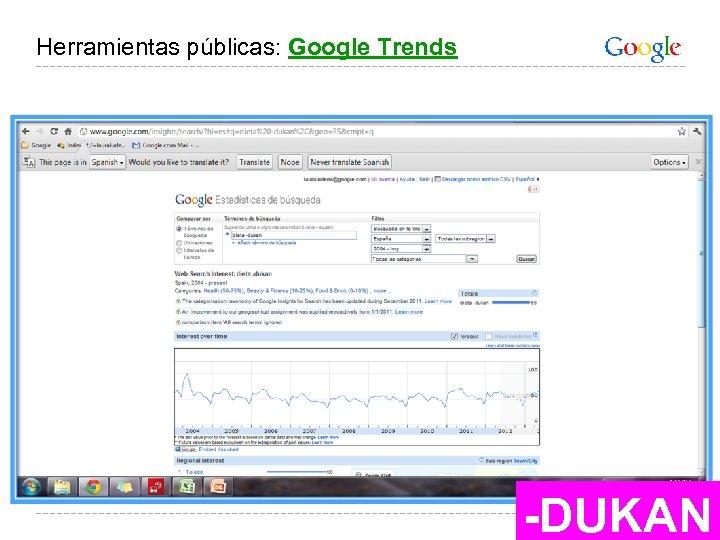

Herramientas públicas: Google Trends -DUKAN Google Confidential and Proprietary 36

Herramientas públicas: Google Trends -DUKAN Google Confidential and Proprietary 36

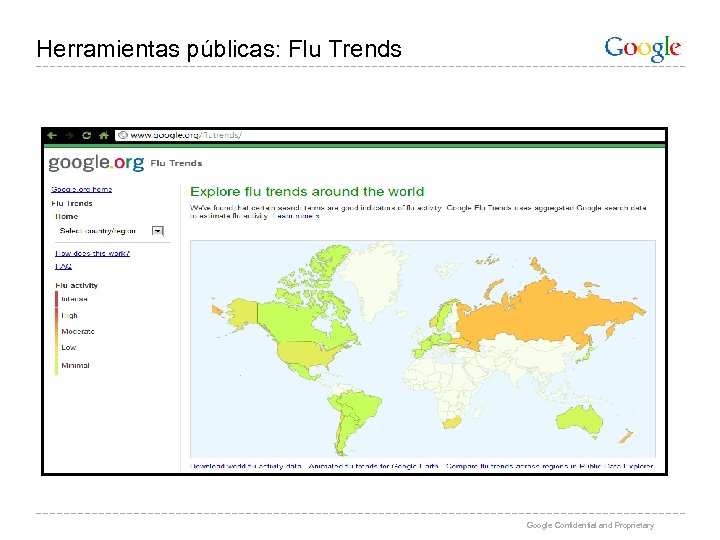

Herramientas públicas: Flu Trends Google Confidential and Proprietary

Herramientas públicas: Flu Trends Google Confidential and Proprietary

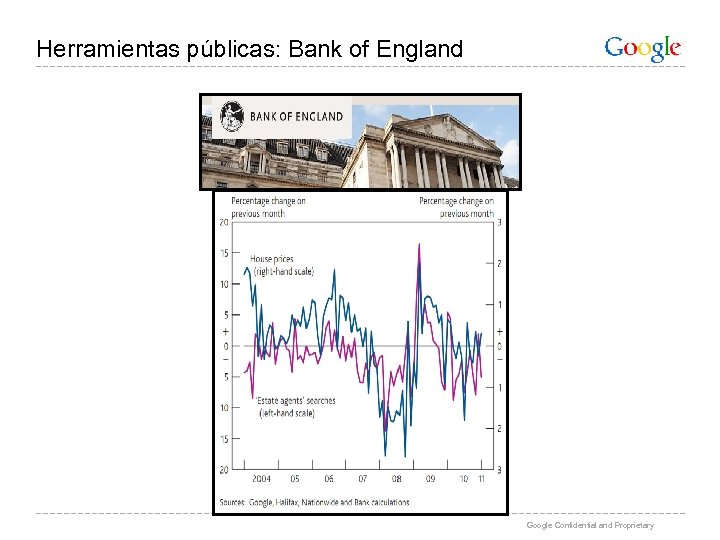

Herramientas públicas: Bank of England Google Confidential and Proprietary

Herramientas públicas: Bank of England Google Confidential and Proprietary

Conclusiones 1 La libre elección de información ha cambiado el modo en el que el consumidor está dispuesto a acceder al contenido publicitario. 2 La estadística tiene un papel clave para conectar las necesidades del consumidor al contenido y formato publicitario que está dispuesto a aceptar y valorar en última instancia. 3 Existen herramientas públicas accesibles para todos que permiten entender y optimizar nuestra oferta, y ejemplos que nos inspiran al uso de la estadística para mejorar la gestión de múltiples productos y servicios. Google Confidential and Proprietary 39

Conclusiones 1 La libre elección de información ha cambiado el modo en el que el consumidor está dispuesto a acceder al contenido publicitario. 2 La estadística tiene un papel clave para conectar las necesidades del consumidor al contenido y formato publicitario que está dispuesto a aceptar y valorar en última instancia. 3 Existen herramientas públicas accesibles para todos que permiten entender y optimizar nuestra oferta, y ejemplos que nos inspiran al uso de la estadística para mejorar la gestión de múltiples productos y servicios. Google Confidential and Proprietary 39

Uso de la estadística para medir la efectividad del marketing Google Confidential and Proprietary 40

Uso de la estadística para medir la efectividad del marketing Google Confidential and Proprietary 40

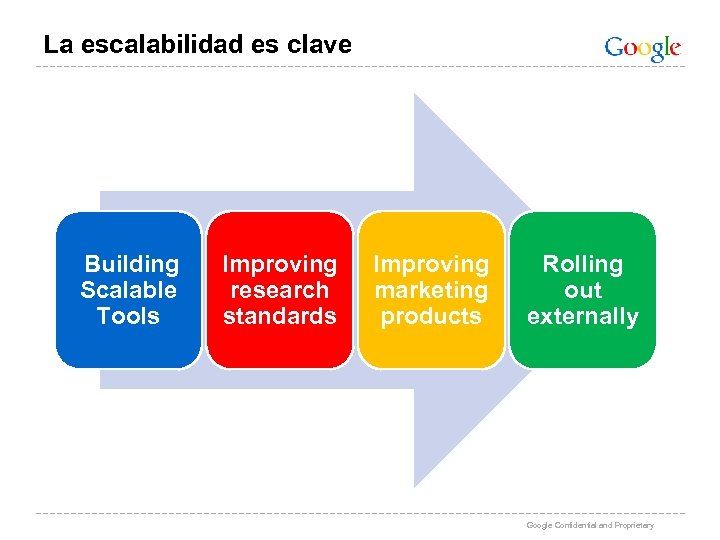

La escalabilidad es clave Building Scalable Tools Improving research standards Improving marketing products Rolling out externally Google Confidential and Proprietary

La escalabilidad es clave Building Scalable Tools Improving research standards Improving marketing products Rolling out externally Google Confidential and Proprietary

El consenso también Google Confidential and Proprietary 42

El consenso también Google Confidential and Proprietary 42

Tres dimensiones fundamentales To demonstrate & empower digital effectiveness within Media Mix Reach Branding Sales Google Confidential and Proprietary

Tres dimensiones fundamentales To demonstrate & empower digital effectiveness within Media Mix Reach Branding Sales Google Confidential and Proprietary

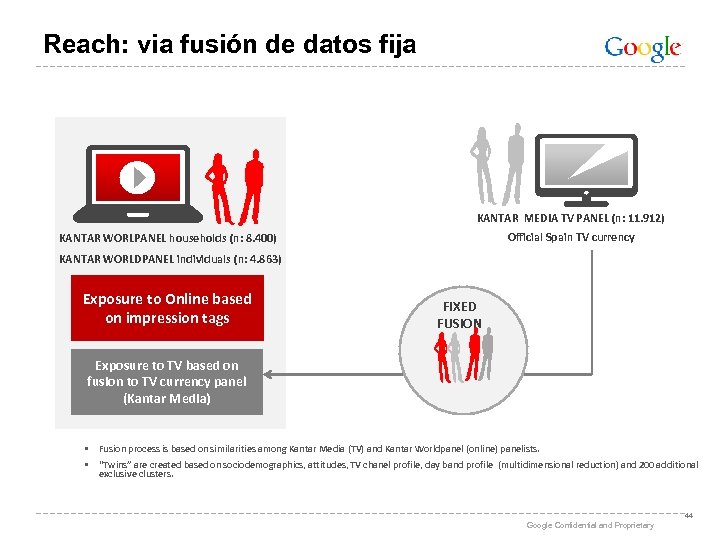

Reach: via fusión de datos fija KANTAR MEDIA TV PANEL (n: 11. 912) Official Spain TV currency KANTAR WORLPANEL households (n: 8. 400) KANTAR WORLDPANEL individuals (n: 4. 863) Exposure to Online based on impression tags FIXED FUSION Exposure to TV based on fusion to TV currency panel (Kantar Media) • Fusion process is based on similarities among Kantar Media (TV) and Kantar Worldpanel (online) panelists. • “Twins” are created based on sociodemographics, attitudes, TV chanel profile, day band profile (multidimensional reduction) and 200 additional exclusive clusters. 44 Google Confidential and Proprietary

Reach: via fusión de datos fija KANTAR MEDIA TV PANEL (n: 11. 912) Official Spain TV currency KANTAR WORLPANEL households (n: 8. 400) KANTAR WORLDPANEL individuals (n: 4. 863) Exposure to Online based on impression tags FIXED FUSION Exposure to TV based on fusion to TV currency panel (Kantar Media) • Fusion process is based on similarities among Kantar Media (TV) and Kantar Worldpanel (online) panelists. • “Twins” are created based on sociodemographics, attitudes, TV chanel profile, day band profile (multidimensional reduction) and 200 additional exclusive clusters. 44 Google Confidential and Proprietary

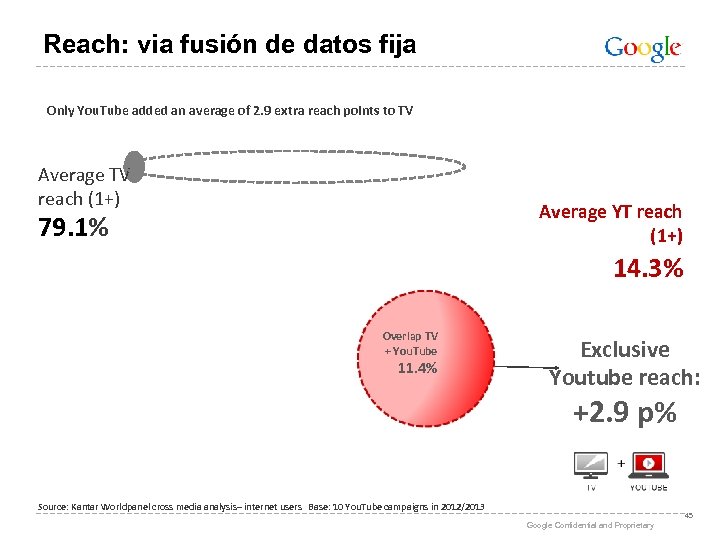

Reach: via fusión de datos fija Only You. Tube added an average of 2. 9 extra reach points to TV Average TV reach (1+) Average YT reach (1+) 79. 1% 14. 3% Only TV 67. 7% Overlap TV + You. Tube 11. 4% Exclusive Youtube reach: +2. 9 p% Source: Kantar Worldpanel cross media analysis– internet users Base: 10 You. Tube campaigns in 2012/2013 45 Google Confidential and Proprietary

Reach: via fusión de datos fija Only You. Tube added an average of 2. 9 extra reach points to TV Average TV reach (1+) Average YT reach (1+) 79. 1% 14. 3% Only TV 67. 7% Overlap TV + You. Tube 11. 4% Exclusive Youtube reach: +2. 9 p% Source: Kantar Worldpanel cross media analysis– internet users Base: 10 You. Tube campaigns in 2012/2013 45 Google Confidential and Proprietary

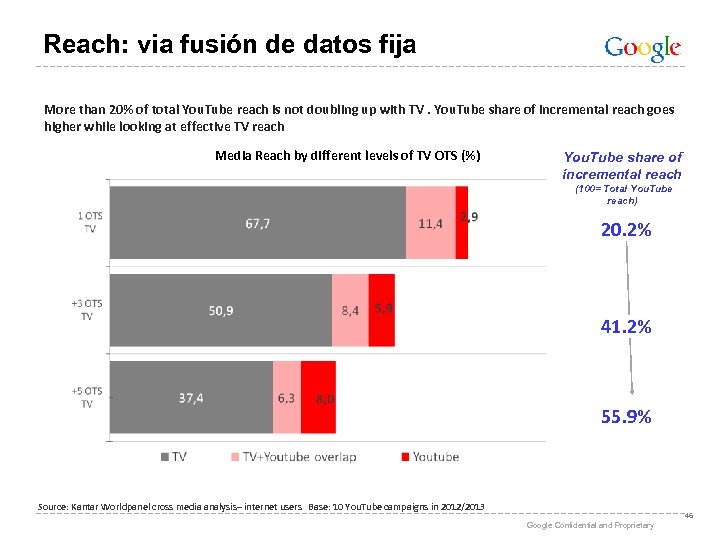

Reach: via fusión de datos fija More than 20% of total You. Tube reach is not doubling up with TV. You. Tube share of incremental reach goes higher while looking at effective TV reach Media Reach by different levels of TV OTS (%) You. Tube share of incremental reach (100= Total You. Tube reach) 20. 2% 41. 2% 55. 9% Source: Kantar Worldpanel cross media analysis– internet users Base: 10 You. Tube campaigns in 2012/2013 46 Google Confidential and Proprietary

Reach: via fusión de datos fija More than 20% of total You. Tube reach is not doubling up with TV. You. Tube share of incremental reach goes higher while looking at effective TV reach Media Reach by different levels of TV OTS (%) You. Tube share of incremental reach (100= Total You. Tube reach) 20. 2% 41. 2% 55. 9% Source: Kantar Worldpanel cross media analysis– internet users Base: 10 You. Tube campaigns in 2012/2013 46 Google Confidential and Proprietary

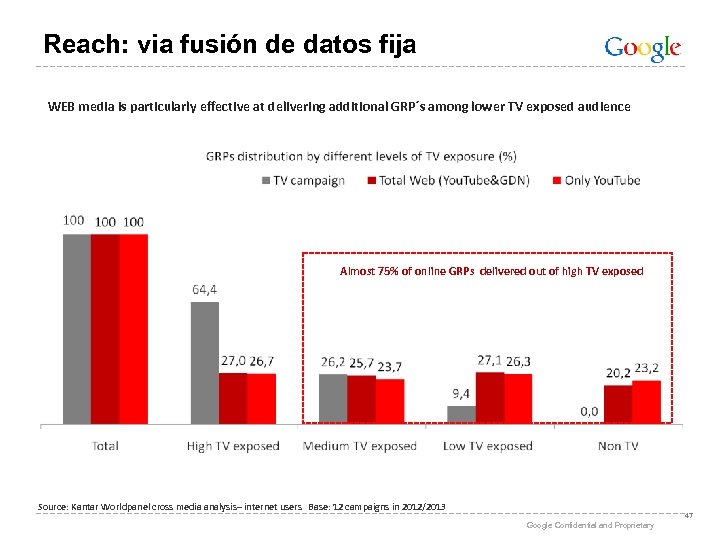

Reach: via fusión de datos fija WEB media is particularly effective at delivering additional GRP´s among lower TV exposed audience Almost 75% of online GRPs delivered out of high TV exposed Source: Kantar Worldpanel cross media analysis– internet users Base: 12 campaigns in 2012/2013 47 Google Confidential and Proprietary

Reach: via fusión de datos fija WEB media is particularly effective at delivering additional GRP´s among lower TV exposed audience Almost 75% of online GRPs delivered out of high TV exposed Source: Kantar Worldpanel cross media analysis– internet users Base: 12 campaigns in 2012/2013 47 Google Confidential and Proprietary

Reach: via Single Source Panel • What we did: § Analyzed 80 TV campaigns for different products of leading advertisers § TV media plans by Ebiquity, You. Tube media plans simulated by Google • Data source: § Single-source panel: Measurement of individual TV & online behavior from same consumers in 5, 000 households within Gf. K Media Efficiency Panel Google Confidential and Proprietary 48

Reach: via Single Source Panel • What we did: § Analyzed 80 TV campaigns for different products of leading advertisers § TV media plans by Ebiquity, You. Tube media plans simulated by Google • Data source: § Single-source panel: Measurement of individual TV & online behavior from same consumers in 5, 000 households within Gf. K Media Efficiency Panel Google Confidential and Proprietary 48

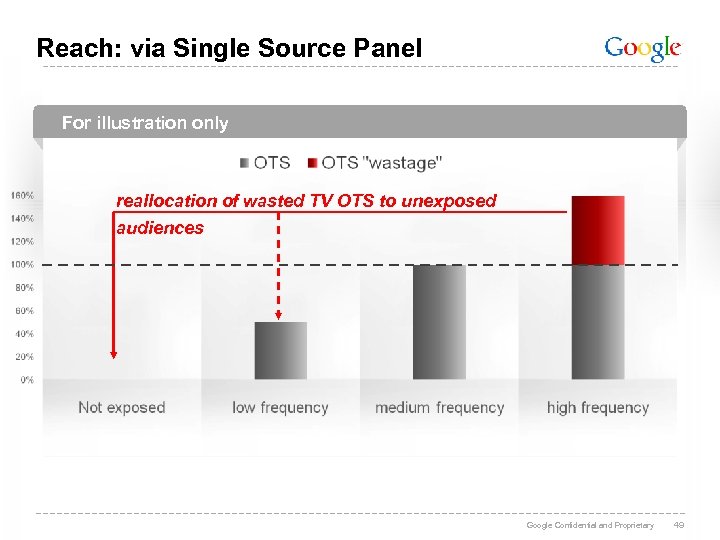

Reach: via Single Source Panel For illustration only reallocation of wasted TV OTS to unexposed audiences Google Confidential and Proprietary 49

Reach: via Single Source Panel For illustration only reallocation of wasted TV OTS to unexposed audiences Google Confidential and Proprietary 49

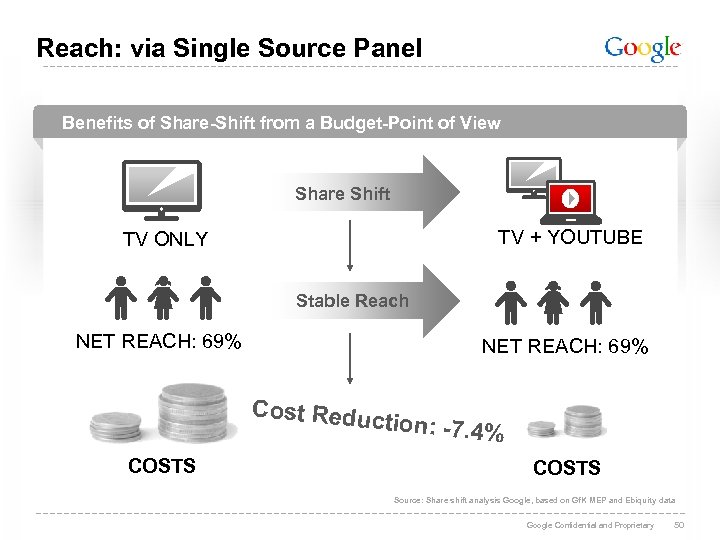

Reach: via Single Source Panel Benefits of Share-Shift from a Budget-Point of View Share Shift TV + YOUTUBE TV ONLY Stable Reach NET REACH: 69% Cost Redu ction: -7. 4% COSTS Source: Share shift analysis Google, based on Gf. K MEP and Ebiquity data Google Confidential and Proprietary 50

Reach: via Single Source Panel Benefits of Share-Shift from a Budget-Point of View Share Shift TV + YOUTUBE TV ONLY Stable Reach NET REACH: 69% Cost Redu ction: -7. 4% COSTS Source: Share shift analysis Google, based on Gf. K MEP and Ebiquity data Google Confidential and Proprietary 50

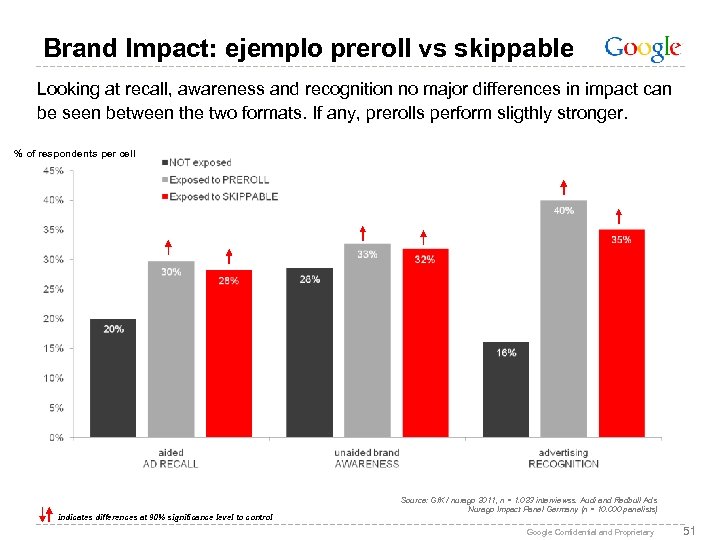

Brand Impact: ejemplo preroll vs skippable Looking at recall, awareness and recognition no major differences in impact can be seen between the two formats. If any, prerolls perform sligthly stronger. % of respondents per cell indicates differences at 90% significance level to control Source: Gf. K / nurago 2011, n = 1. 023 interviewss. Audi and Redbull Ads Nurago Impact Panel Germany (n = 10. 000 panelists) Google Confidential and Proprietary 51

Brand Impact: ejemplo preroll vs skippable Looking at recall, awareness and recognition no major differences in impact can be seen between the two formats. If any, prerolls perform sligthly stronger. % of respondents per cell indicates differences at 90% significance level to control Source: Gf. K / nurago 2011, n = 1. 023 interviewss. Audi and Redbull Ads Nurago Impact Panel Germany (n = 10. 000 panelists) Google Confidential and Proprietary 51

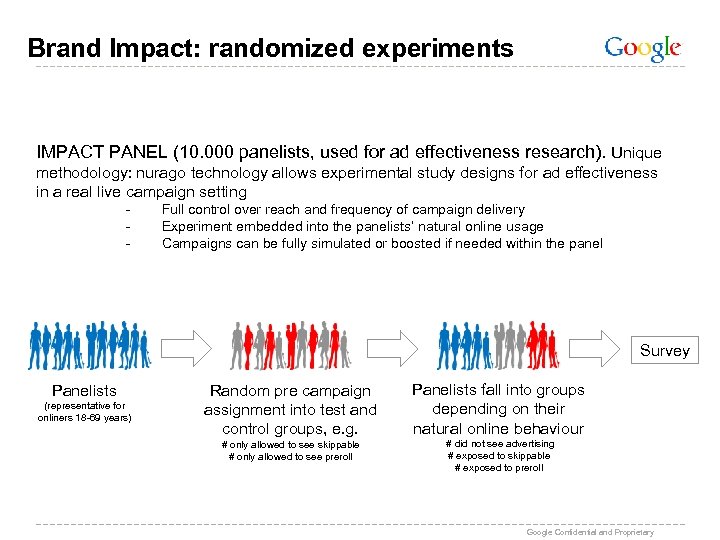

Brand Impact: randomized experiments IMPACT PANEL (10. 000 panelists, used for ad effectiveness research). Unique methodology: nurago technology allows experimental study designs for ad effectiveness in a real live campaign setting - Full control over reach and frequency of campaign delivery Experiment embedded into the panelists‘ natural online usage Campaigns can be fully simulated or boosted if needed within the panel Survey Panelists (representative for onliners 18 -69 years) Random pre campaign assignment into test and control groups, e. g. Panelists fall into groups depending on their natural online behaviour # only allowed to see skippable # only allowed to see preroll # did not see advertising # exposed to skippable # exposed to preroll Google Confidential and Proprietary

Brand Impact: randomized experiments IMPACT PANEL (10. 000 panelists, used for ad effectiveness research). Unique methodology: nurago technology allows experimental study designs for ad effectiveness in a real live campaign setting - Full control over reach and frequency of campaign delivery Experiment embedded into the panelists‘ natural online usage Campaigns can be fully simulated or boosted if needed within the panel Survey Panelists (representative for onliners 18 -69 years) Random pre campaign assignment into test and control groups, e. g. Panelists fall into groups depending on their natural online behaviour # only allowed to see skippable # only allowed to see preroll # did not see advertising # exposed to skippable # exposed to preroll Google Confidential and Proprietary

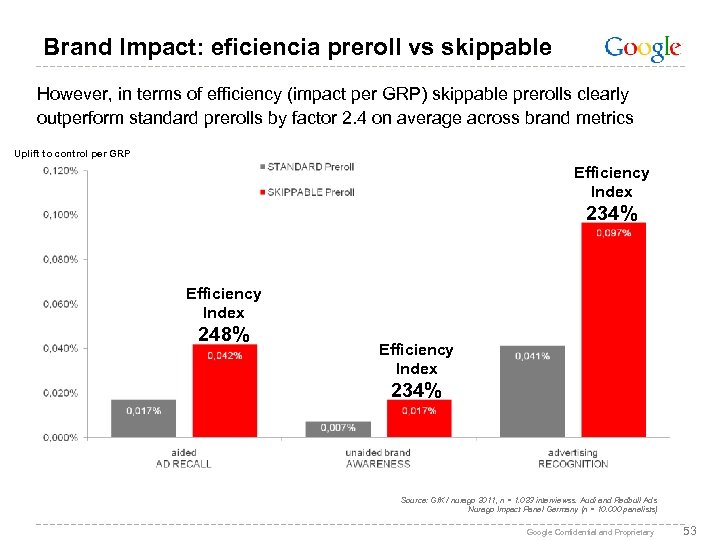

Brand Impact: eficiencia preroll vs skippable However, in terms of efficiency (impact per GRP) skippable prerolls clearly outperform standard prerolls by factor 2. 4 on average across brand metrics Uplift to control per GRP Efficiency Index 234% Efficiency Index 248% Efficiency Index 234% Source: Gf. K / nurago 2011, n = 1. 023 interviewss. Audi and Redbull Ads Nurago Impact Panel Germany (n = 10. 000 panelists) Google Confidential and Proprietary 53

Brand Impact: eficiencia preroll vs skippable However, in terms of efficiency (impact per GRP) skippable prerolls clearly outperform standard prerolls by factor 2. 4 on average across brand metrics Uplift to control per GRP Efficiency Index 234% Efficiency Index 248% Efficiency Index 234% Source: Gf. K / nurago 2011, n = 1. 023 interviewss. Audi and Redbull Ads Nurago Impact Panel Germany (n = 10. 000 panelists) Google Confidential and Proprietary 53

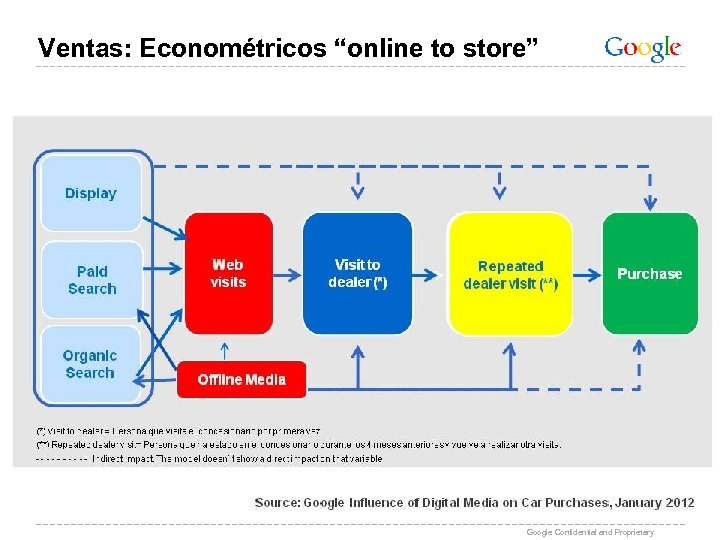

Ventas: Econométricos “online to store” Google Confidential and Proprietary

Ventas: Econométricos “online to store” Google Confidential and Proprietary

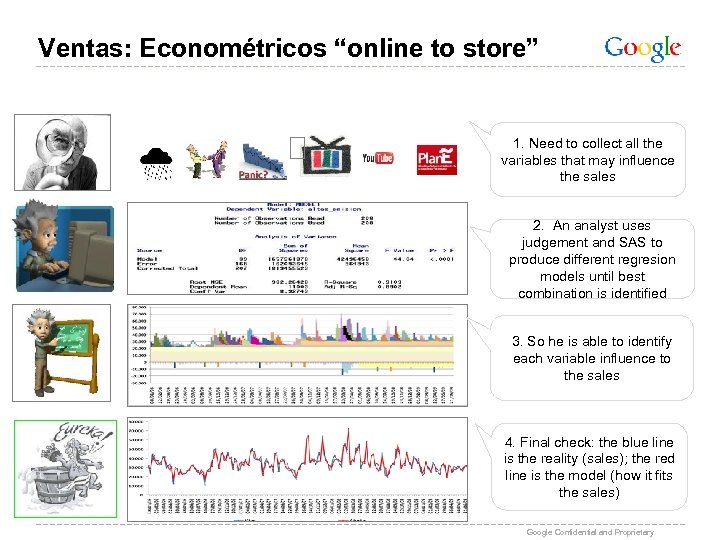

Ventas: Econométricos “online to store” 1. Need to collect all the variables that may influence the sales 2. An analyst uses judgement and SAS to produce different regresion models until best combination is identified 3. So he is able to identify each variable influence to the sales 4. Final check: the blue line is the reality (sales); the red line is the model (how it fits the sales) Google Confidential and Proprietary

Ventas: Econométricos “online to store” 1. Need to collect all the variables that may influence the sales 2. An analyst uses judgement and SAS to produce different regresion models until best combination is identified 3. So he is able to identify each variable influence to the sales 4. Final check: the blue line is the reality (sales); the red line is the model (how it fits the sales) Google Confidential and Proprietary

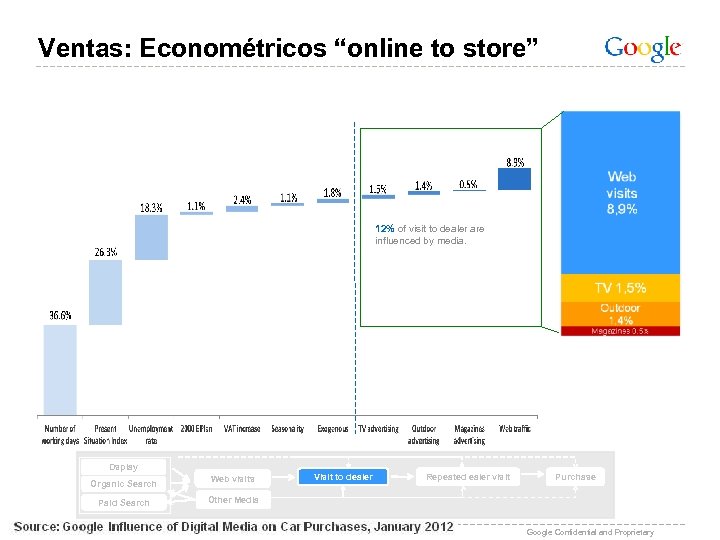

Ventas: Econométricos “online to store” 12% of visit to dealer are influenced by media. Dsplay Organic Search Paid Search Web visits Visit to dealer Repeated ealer visit Purchase Other Media Google Confidential and Proprietary

Ventas: Econométricos “online to store” 12% of visit to dealer are influenced by media. Dsplay Organic Search Paid Search Web visits Visit to dealer Repeated ealer visit Purchase Other Media Google Confidential and Proprietary

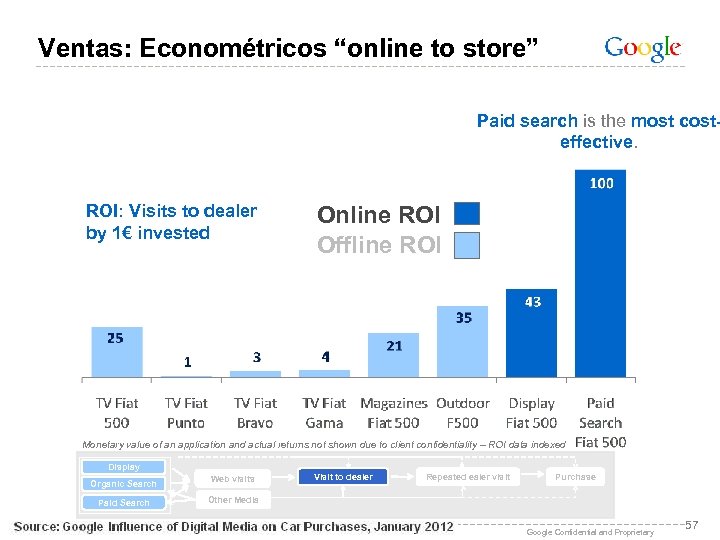

Ventas: Econométricos “online to store” Paid search is the most costeffective. ROI: Visits to dealer by 1€ invested Online ROI Offline ROI Monetary value of an application and actual returns not shown due to client confidentiality – ROI data indexed Display Organic Search Paid Search Web visits Visit to dealer Repeated ealer visit Purchase Other Media Google Confidential and Proprietary 57

Ventas: Econométricos “online to store” Paid search is the most costeffective. ROI: Visits to dealer by 1€ invested Online ROI Offline ROI Monetary value of an application and actual returns not shown due to client confidentiality – ROI data indexed Display Organic Search Paid Search Web visits Visit to dealer Repeated ealer visit Purchase Other Media Google Confidential and Proprietary 57

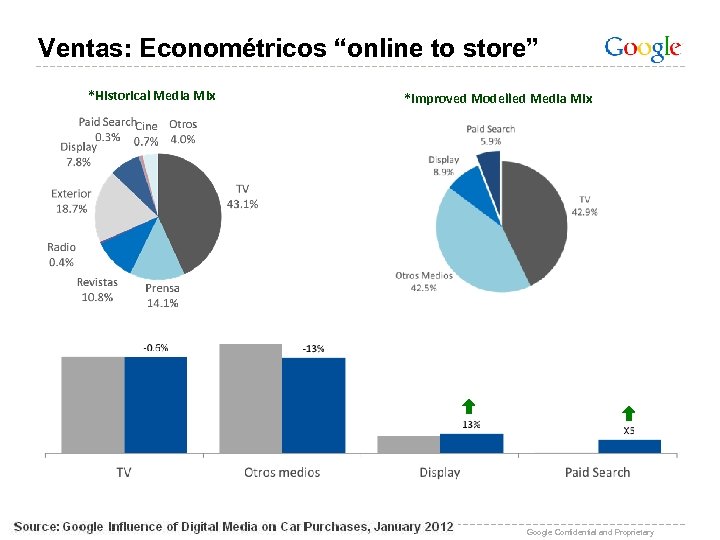

Ventas: Econométricos “online to store” *Historical Media Mix *Improved Modelled Media Mix Google Confidential and Proprietary

Ventas: Econométricos “online to store” *Historical Media Mix *Improved Modelled Media Mix Google Confidential and Proprietary

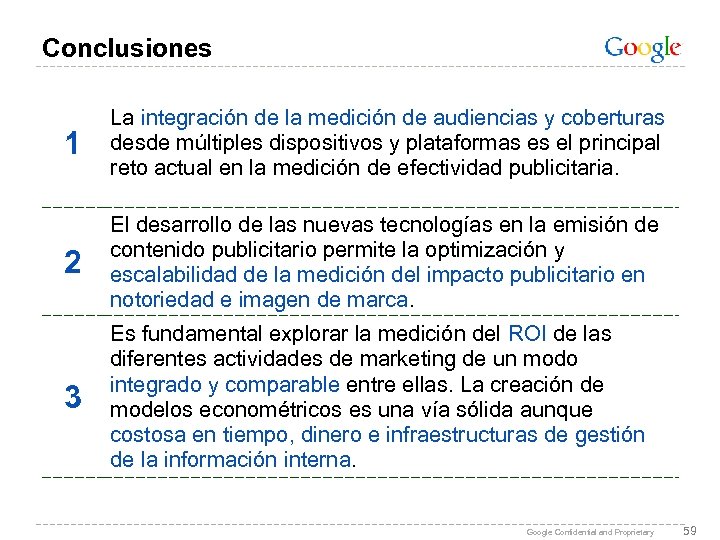

Conclusiones 1 La integración de la medición de audiencias y coberturas desde múltiples dispositivos y plataformas es el principal reto actual en la medición de efectividad publicitaria. 2 El desarrollo de las nuevas tecnologías en la emisión de contenido publicitario permite la optimización y escalabilidad de la medición del impacto publicitario en notoriedad e imagen de marca. 3 Es fundamental explorar la medición del ROI de las diferentes actividades de marketing de un modo integrado y comparable entre ellas. La creación de modelos econométricos es una vía sólida aunque costosa en tiempo, dinero e infraestructuras de gestión de la información interna. Google Confidential and Proprietary 59

Conclusiones 1 La integración de la medición de audiencias y coberturas desde múltiples dispositivos y plataformas es el principal reto actual en la medición de efectividad publicitaria. 2 El desarrollo de las nuevas tecnologías en la emisión de contenido publicitario permite la optimización y escalabilidad de la medición del impacto publicitario en notoriedad e imagen de marca. 3 Es fundamental explorar la medición del ROI de las diferentes actividades de marketing de un modo integrado y comparable entre ellas. La creación de modelos econométricos es una vía sólida aunque costosa en tiempo, dinero e infraestructuras de gestión de la información interna. Google Confidential and Proprietary 59

¿Preguntas? Google Confidential and Proprietary 60

¿Preguntas? Google Confidential and Proprietary 60