3011601b051e6619af6598b259c383cc.ppt

- Количество слайдов: 33

Latin American Economic Outlook 2008 Javier Santiso Acting Director Chief Development Economist OECD Development Centre Washington, 6 th December 2007

Latin American Economic Outlook 2008 Javier Santiso Acting Director Chief Development Economist OECD Development Centre Washington, 6 th December 2007

The OECD and Latin America: An emerging commitment • • Latin American market democracies matter for the OECD and its member countries The Latin American dimension at the OECD: Ø Mexico: Member since 1994; Chile: candidate since May 2007; Brazil: enhanced cooperation, May 2007 Ø Economic Surveys: 1992, 1995, 1997, 1998, 1999 2000, 2002, 2003, 2005, 2007 2000, 2005, 2006 Ø Latin American Economic Outlook 2008

The OECD and Latin America: An emerging commitment • • Latin American market democracies matter for the OECD and its member countries The Latin American dimension at the OECD: Ø Mexico: Member since 1994; Chile: candidate since May 2007; Brazil: enhanced cooperation, May 2007 Ø Economic Surveys: 1992, 1995, 1997, 1998, 1999 2000, 2002, 2003, 2005, 2007 2000, 2005, 2006 Ø Latin American Economic Outlook 2008

The Development Centre: A bridge between the OECD and emerging regions • Membership of the Development Centre With a Governing Board open to OECD non-member countries, the Development Centre provides a framework for dialogue and experience sharing with emerging regions all over the world. • Three Latin American countries are members of the Centre: – Mexico – Chile – Brazil

The Development Centre: A bridge between the OECD and emerging regions • Membership of the Development Centre With a Governing Board open to OECD non-member countries, the Development Centre provides a framework for dialogue and experience sharing with emerging regions all over the world. • Three Latin American countries are members of the Centre: – Mexico – Chile – Brazil

Latin American Economic Outlook: The key tools • Informal Advisory Board: Scholars and policy makers from Latin America and OECD countries enrich the analytical work of the project. • Research and Publications: The Development Centre collaborates with OECD experts, international organisations and various Latin American think-tanks. • Dialogue Forum: Key government officials from OECD and Latin American countries share experiences about the design and implementation of public policies.

Latin American Economic Outlook: The key tools • Informal Advisory Board: Scholars and policy makers from Latin America and OECD countries enrich the analytical work of the project. • Research and Publications: The Development Centre collaborates with OECD experts, international organisations and various Latin American think-tanks. • Dialogue Forum: Key government officials from OECD and Latin American countries share experiences about the design and implementation of public policies.

I II IV Fiscal Policy and Legitimacy Pensions, Capital Markets and Corporate Governance Multinationals, Telecommunications and Development China, India and the Challenge of Specialisation

I II IV Fiscal Policy and Legitimacy Pensions, Capital Markets and Corporate Governance Multinationals, Telecommunications and Development China, India and the Challenge of Specialisation

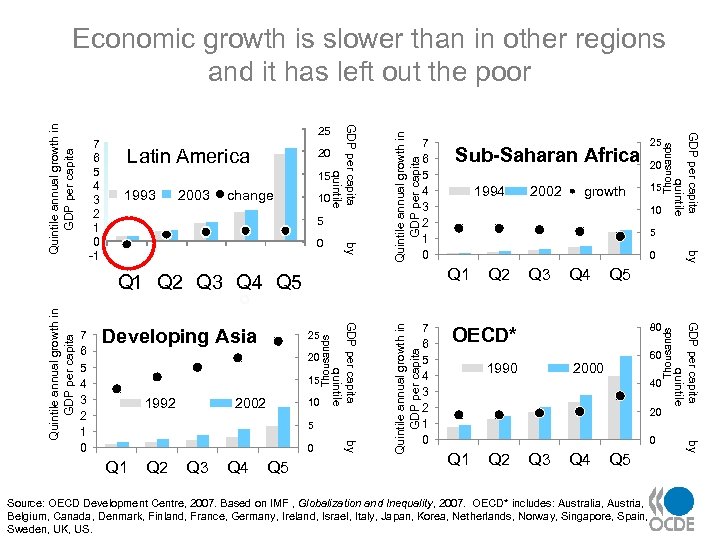

2003 change 10 5 2002 10 5 Q 1 Q 2 Q 3 Q 4 Q 5 15 5 0 Q 2 Q 3 Q 4 Q 5 80 OECD* 1990 60 2000 40 20 0 Q 1 Q 2 Q 3 Q 4 Q 5 Source: OECD Development Centre, 2007. Based on IMF , Globalization and Inequality, 2007. OECD* includes: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Ireland, Israel, Italy, Japan, Korea, Netherlands, Norway, Singapore, Spain, Sweden, UK, US. by 0 Quintile annual growth in GDP per capita 1992 Thousands 15 by Quintile annual growth in GDP per capita 20 7 6 5 4 3 2 1 0 growth GDP per capita quintile 25 GDP per capita quintile Developing Asia 2002 10 Q 1 Q 2 Q 3 Q 4 Q 5 7 6 5 4 3 2 1 0 1994 20 by by 0 Sub-Saharan Africa 25 Thousands 1993 7 6 5 4 3 2 1 0 Thousands 15 Quintile annual growth in GDP per capita Latin America 20 GDP per capita quintile 25 7 6 5 4 3 2 1 0 -1 GDP per capita quintile Quintile annual growth in GDP per capita Economic growth is slower than in other regions and it has left out the poor

2003 change 10 5 2002 10 5 Q 1 Q 2 Q 3 Q 4 Q 5 15 5 0 Q 2 Q 3 Q 4 Q 5 80 OECD* 1990 60 2000 40 20 0 Q 1 Q 2 Q 3 Q 4 Q 5 Source: OECD Development Centre, 2007. Based on IMF , Globalization and Inequality, 2007. OECD* includes: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Ireland, Israel, Italy, Japan, Korea, Netherlands, Norway, Singapore, Spain, Sweden, UK, US. by 0 Quintile annual growth in GDP per capita 1992 Thousands 15 by Quintile annual growth in GDP per capita 20 7 6 5 4 3 2 1 0 growth GDP per capita quintile 25 GDP per capita quintile Developing Asia 2002 10 Q 1 Q 2 Q 3 Q 4 Q 5 7 6 5 4 3 2 1 0 1994 20 by by 0 Sub-Saharan Africa 25 Thousands 1993 7 6 5 4 3 2 1 0 Thousands 15 Quintile annual growth in GDP per capita Latin America 20 GDP per capita quintile 25 7 6 5 4 3 2 1 0 -1 GDP per capita quintile Quintile annual growth in GDP per capita Economic growth is slower than in other regions and it has left out the poor

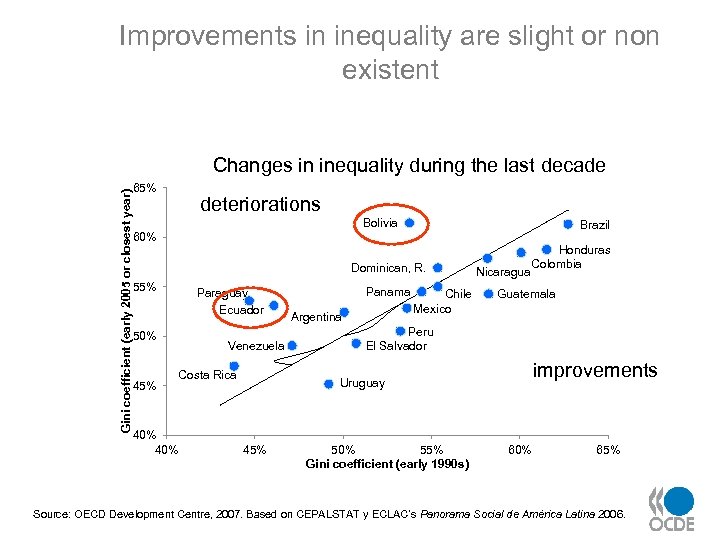

Improvements in inequality are slight or non existent Gini coefficient (early 2005 or closest year) Changes in inequality during the last decade 65% deteriorations Bolivia Brazil 60% Dominican, R. 55% Paraguay Ecuador 50% 45% Venezuela Costa Rica 40% Panama Argentina Chile Mexico Nicaragua Honduras Colombia Guatemala Peru El Salvador improvements Uruguay 45% 50% 55% Gini coefficient (early 1990 s) 60% 65% Source: OECD Development Centre, 2007. Based on CEPALSTAT y ECLAC’s Panorama Social de América Latina 2006.

Improvements in inequality are slight or non existent Gini coefficient (early 2005 or closest year) Changes in inequality during the last decade 65% deteriorations Bolivia Brazil 60% Dominican, R. 55% Paraguay Ecuador 50% 45% Venezuela Costa Rica 40% Panama Argentina Chile Mexico Nicaragua Honduras Colombia Guatemala Peru El Salvador improvements Uruguay 45% 50% 55% Gini coefficient (early 1990 s) 60% 65% Source: OECD Development Centre, 2007. Based on CEPALSTAT y ECLAC’s Panorama Social de América Latina 2006.

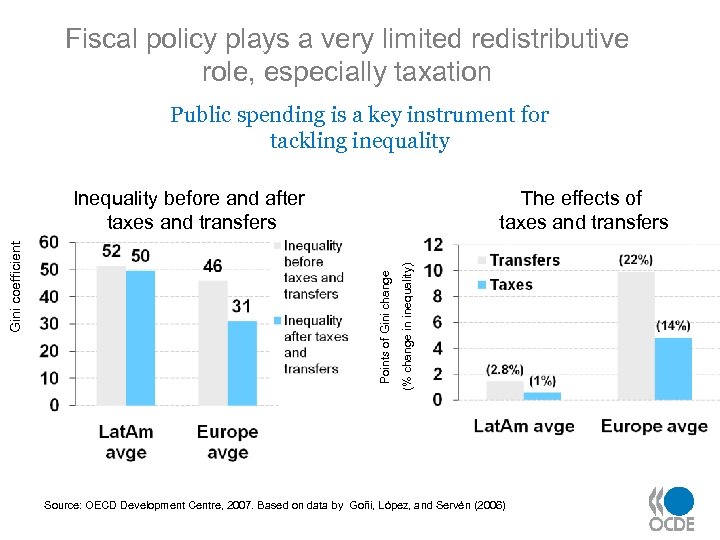

Fiscal policy plays a very limited redistributive role, especially taxation Public spending is a key instrument for tackling inequality (% change in inequality) The effects of taxes and transfers Points of Gini change Gini coefficient Inequality before and after taxes and transfers Source: OECD Development Centre, 2007. Based on data by Goñi, López, and Servén (2006)

Fiscal policy plays a very limited redistributive role, especially taxation Public spending is a key instrument for tackling inequality (% change in inequality) The effects of taxes and transfers Points of Gini change Gini coefficient Inequality before and after taxes and transfers Source: OECD Development Centre, 2007. Based on data by Goñi, López, and Servén (2006)

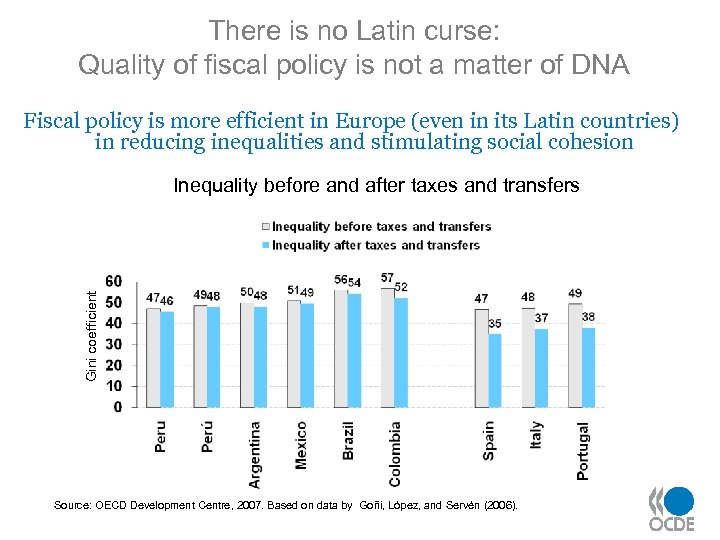

There is no Latin curse: Quality of fiscal policy is not a matter of DNA Fiscal policy is more efficient in Europe (even in its Latin countries) in reducing inequalities and stimulating social cohesion Gini coefficient Inequality before and after taxes and transfers Source: OECD Development Centre, 2007. Based on data by Goñi, López, and Servén (2006).

There is no Latin curse: Quality of fiscal policy is not a matter of DNA Fiscal policy is more efficient in Europe (even in its Latin countries) in reducing inequalities and stimulating social cohesion Gini coefficient Inequality before and after taxes and transfers Source: OECD Development Centre, 2007. Based on data by Goñi, López, and Servén (2006).

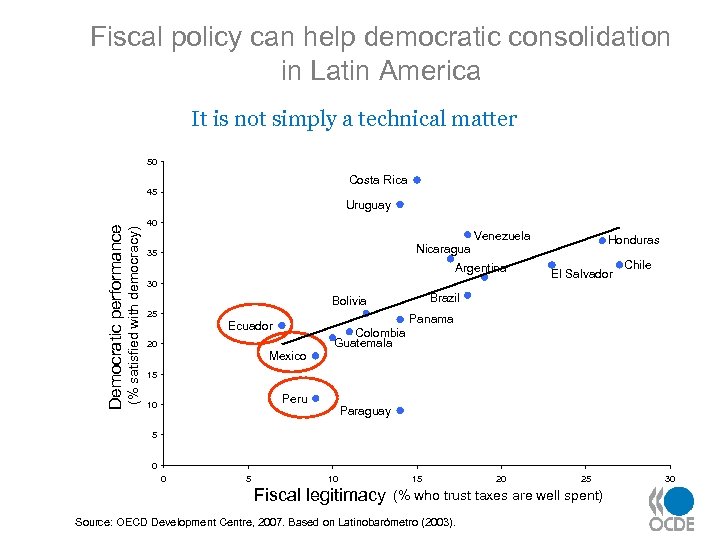

Fiscal policy can help democratic consolidation in Latin America It is not simply a technical matter 50 Costa Rica 45 (% satisfied with democracy) Democratic performance Uruguay 40 Venezuela Honduras Nicaragua 35 Argentina 30 25 20 Mexico Chile Brazil Bolivia Ecuador El Salvador Colombia Guatemala Panama 15 Peru 10 Paraguay 5 0 0 5 10 Fiscal legitimacy 15 20 25 (% who trust taxes are well spent) Source: OECD Development Centre, 2007. Based on Latinobarómetro (2003). 30

Fiscal policy can help democratic consolidation in Latin America It is not simply a technical matter 50 Costa Rica 45 (% satisfied with democracy) Democratic performance Uruguay 40 Venezuela Honduras Nicaragua 35 Argentina 30 25 20 Mexico Chile Brazil Bolivia Ecuador El Salvador Colombia Guatemala Panama 15 Peru 10 Paraguay 5 0 0 5 10 Fiscal legitimacy 15 20 25 (% who trust taxes are well spent) Source: OECD Development Centre, 2007. Based on Latinobarómetro (2003). 30

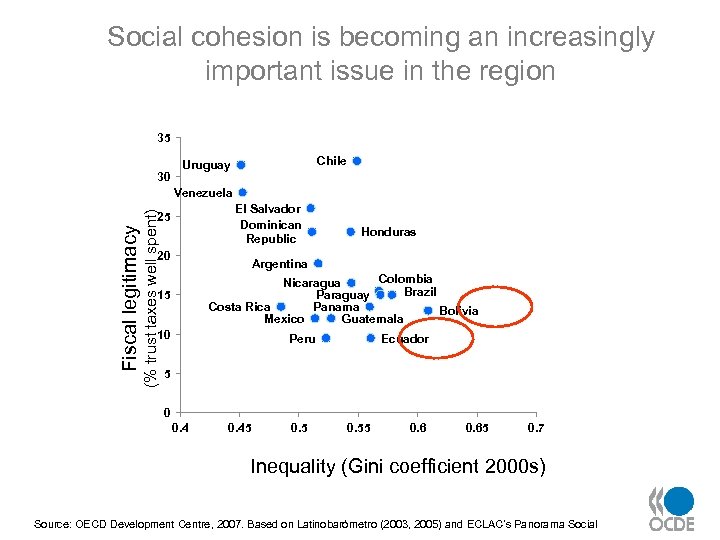

Social cohesion is becoming an increasingly important issue in the region 35 30 Chile Uruguay (% trust taxes well spent) Venezuela El Salvador Dominican Republic Fiscal legitimacy 25 20 Honduras Argentina Colombia Nicaragua Brazil Paraguay Costa Rica Panama Bolivia Mexico Guatemala 15 10 Peru Ecuador 5 0 0. 45 0. 55 0. 65 0. 7 Inequality (Gini coefficient 2000 s) Source: OECD Development Centre, 2007. Based on Latinobarómetro (2003, 2005) and ECLAC’s Panorama Social

Social cohesion is becoming an increasingly important issue in the region 35 30 Chile Uruguay (% trust taxes well spent) Venezuela El Salvador Dominican Republic Fiscal legitimacy 25 20 Honduras Argentina Colombia Nicaragua Brazil Paraguay Costa Rica Panama Bolivia Mexico Guatemala 15 10 Peru Ecuador 5 0 0. 45 0. 55 0. 65 0. 7 Inequality (Gini coefficient 2000 s) Source: OECD Development Centre, 2007. Based on Latinobarómetro (2003, 2005) and ECLAC’s Panorama Social

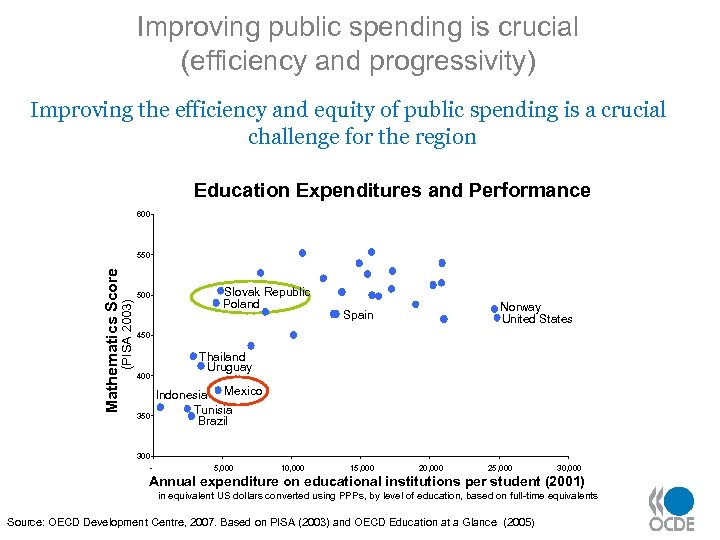

Improving public spending is crucial (efficiency and progressivity) Improving the efficiency and equity of public spending is a crucial challenge for the region Education Expenditures and Performance 600 (PISA 2003) Mathematics Score 550 500 Slovak Republic Poland Norway United States Spain 450 400 350 300 - Thailand Uruguay Indonesia Mexico Tunisia Brazil 5, 000 10, 000 15, 000 20, 000 25, 000 30, 000 Annual expenditure on educational institutions per student (2001) in equivalent US dollars converted using PPPs, by level of education, based on full-time equivalents Source: OECD Development Centre, 2007. Based on PISA (2003) and OECD Education at a Glance (2005)

Improving public spending is crucial (efficiency and progressivity) Improving the efficiency and equity of public spending is a crucial challenge for the region Education Expenditures and Performance 600 (PISA 2003) Mathematics Score 550 500 Slovak Republic Poland Norway United States Spain 450 400 350 300 - Thailand Uruguay Indonesia Mexico Tunisia Brazil 5, 000 10, 000 15, 000 20, 000 25, 000 30, 000 Annual expenditure on educational institutions per student (2001) in equivalent US dollars converted using PPPs, by level of education, based on full-time equivalents Source: OECD Development Centre, 2007. Based on PISA (2003) and OECD Education at a Glance (2005)

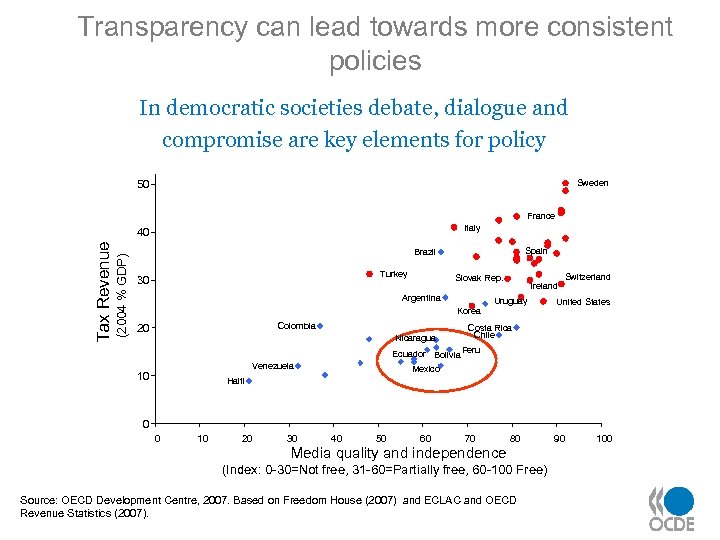

Transparency can lead towards more consistent policies In democratic societies debate, dialogue and compromise are key elements for policy Sweden 50 France Italy (2004 % GDP) Tax Revenue 40 Spain Brazil Turkey 30 Slovak Rep. Argentina Ireland Uruguay Korea Colombia 20 Nicaragua Switzerland United States Costa Rica Chile Ecuador Bolivia Peru Venezuela 10 Mexico Haiti 0 0 10 20 30 40 50 60 70 Media quality and independence 80 (Index: 0 -30=Not free, 31 -60=Partially free, 60 -100 Free) Source: OECD Development Centre, 2007. Based on Freedom House (2007) and ECLAC and OECD Revenue Statistics (2007). 90 100

Transparency can lead towards more consistent policies In democratic societies debate, dialogue and compromise are key elements for policy Sweden 50 France Italy (2004 % GDP) Tax Revenue 40 Spain Brazil Turkey 30 Slovak Rep. Argentina Ireland Uruguay Korea Colombia 20 Nicaragua Switzerland United States Costa Rica Chile Ecuador Bolivia Peru Venezuela 10 Mexico Haiti 0 0 10 20 30 40 50 60 70 Media quality and independence 80 (Index: 0 -30=Not free, 31 -60=Partially free, 60 -100 Free) Source: OECD Development Centre, 2007. Based on Freedom House (2007) and ECLAC and OECD Revenue Statistics (2007). 90 100

I II IV Fiscal Policy and Legitimacy Pensions, Capital Markets and Corporate Governance Multinationals, Telecommunications and Development China, India and the Challenge of Specialisation

I II IV Fiscal Policy and Legitimacy Pensions, Capital Markets and Corporate Governance Multinationals, Telecommunications and Development China, India and the Challenge of Specialisation

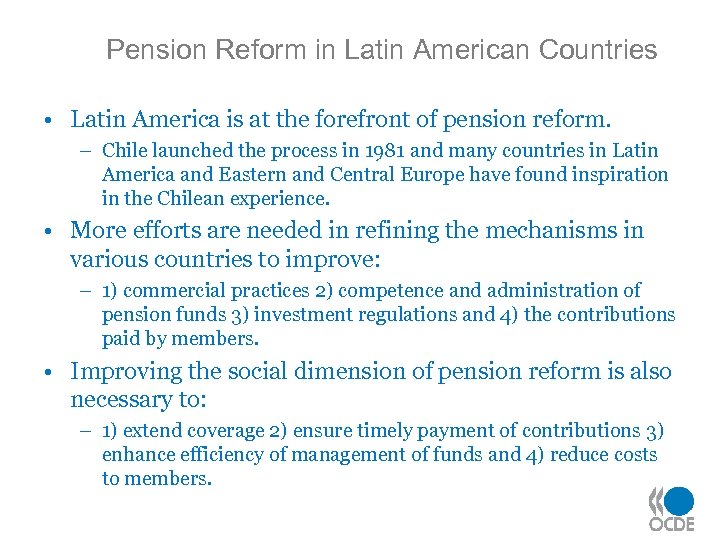

Pension Reform in Latin American Countries • Latin America is at the forefront of pension reform. – Chile launched the process in 1981 and many countries in Latin America and Eastern and Central Europe have found inspiration in the Chilean experience. • More efforts are needed in refining the mechanisms in various countries to improve: – 1) commercial practices 2) competence and administration of pension funds 3) investment regulations and 4) the contributions paid by members. • Improving the social dimension of pension reform is also necessary to: – 1) extend coverage 2) ensure timely payment of contributions 3) enhance efficiency of management of funds and 4) reduce costs to members.

Pension Reform in Latin American Countries • Latin America is at the forefront of pension reform. – Chile launched the process in 1981 and many countries in Latin America and Eastern and Central Europe have found inspiration in the Chilean experience. • More efforts are needed in refining the mechanisms in various countries to improve: – 1) commercial practices 2) competence and administration of pension funds 3) investment regulations and 4) the contributions paid by members. • Improving the social dimension of pension reform is also necessary to: – 1) extend coverage 2) ensure timely payment of contributions 3) enhance efficiency of management of funds and 4) reduce costs to members.

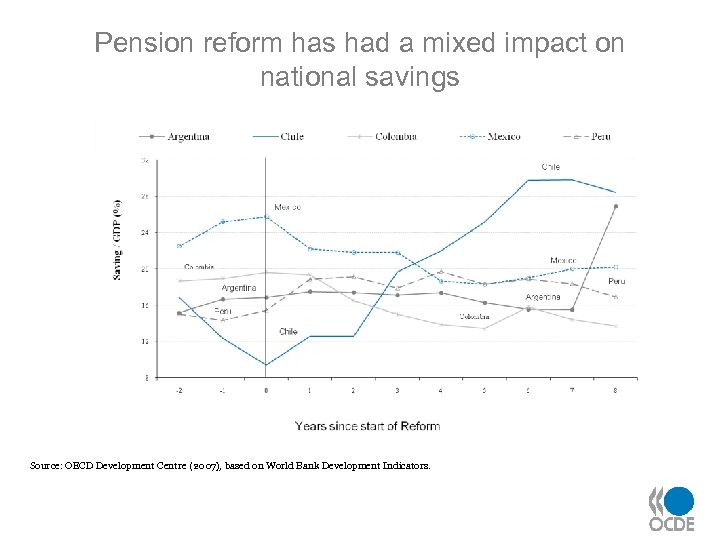

Pension reform has had a mixed impact on national savings Source: OECD Development Centre (2007), based on World Bank Development Indicators.

Pension reform has had a mixed impact on national savings Source: OECD Development Centre (2007), based on World Bank Development Indicators.

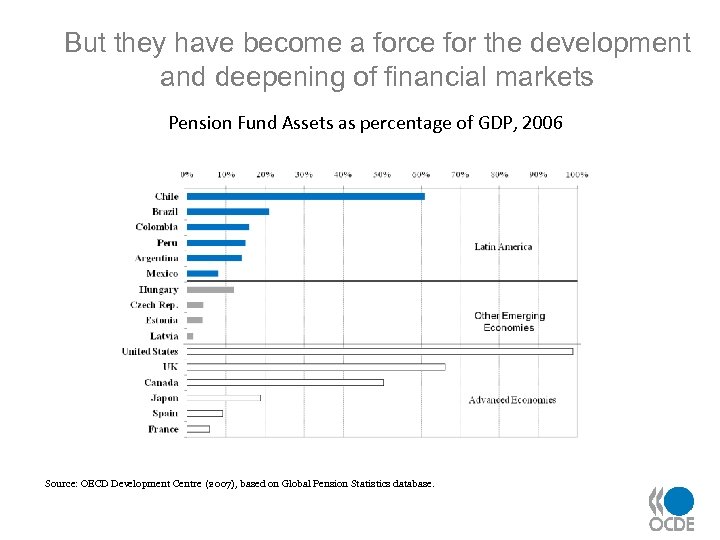

But they have become a force for the development and deepening of financial markets Pension Fund Assets as percentage of GDP, 2006 Source: OECD Development Centre (2007), based on Global Pension Statistics database.

But they have become a force for the development and deepening of financial markets Pension Fund Assets as percentage of GDP, 2006 Source: OECD Development Centre (2007), based on Global Pension Statistics database.

I II IV Fiscal Policy and Legitimacy Pensions, Capital Markets and Corporate Governance Multinationals, Telecommunications and Development China, India and the Challenge of Specialisation

I II IV Fiscal Policy and Legitimacy Pensions, Capital Markets and Corporate Governance Multinationals, Telecommunications and Development China, India and the Challenge of Specialisation

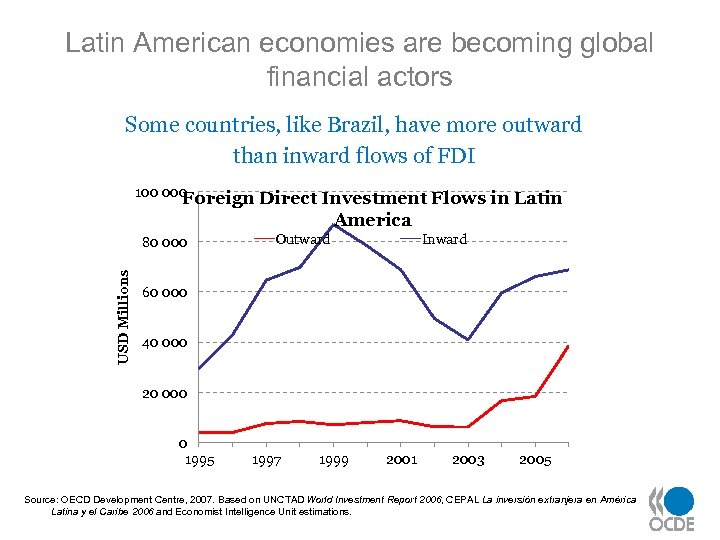

Latin American economies are becoming global financial actors Some countries, like Brazil, have more outward than inward flows of FDI 100 000 Foreign Direct Investment Flows in Latin America USD Millions 80 000 Outward Inward 60 000 40 000 20 000 0 1995 1997 1999 2001 2003 2005 Source: OECD Development Centre, 2007. Based on UNCTAD World Investment Report 2006, CEPAL La inversión extranjera en América Latina y el Caribe 2006 and Economist Intelligence Unit estimations.

Latin American economies are becoming global financial actors Some countries, like Brazil, have more outward than inward flows of FDI 100 000 Foreign Direct Investment Flows in Latin America USD Millions 80 000 Outward Inward 60 000 40 000 20 000 0 1995 1997 1999 2001 2003 2005 Source: OECD Development Centre, 2007. Based on UNCTAD World Investment Report 2006, CEPAL La inversión extranjera en América Latina y el Caribe 2006 and Economist Intelligence Unit estimations.

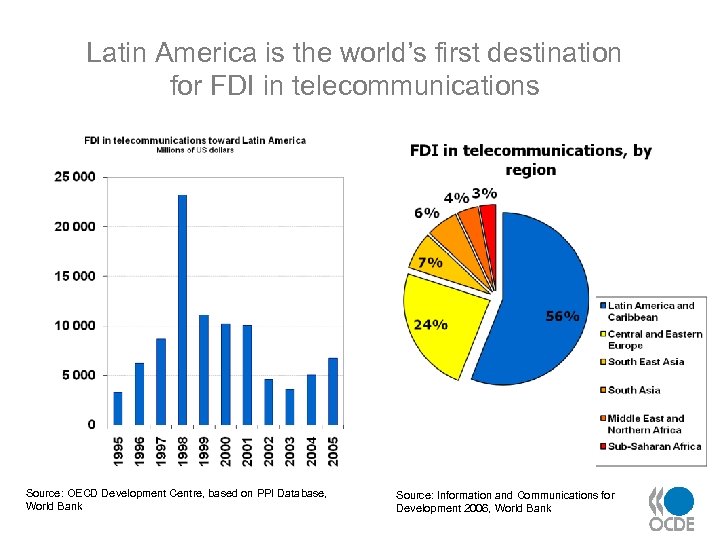

Latin America is the world’s first destination for FDI in telecommunications Source: OECD Development Centre, based on PPI Database, World Bank Source: Information and Communications for Development 2006, World Bank

Latin America is the world’s first destination for FDI in telecommunications Source: OECD Development Centre, based on PPI Database, World Bank Source: Information and Communications for Development 2006, World Bank

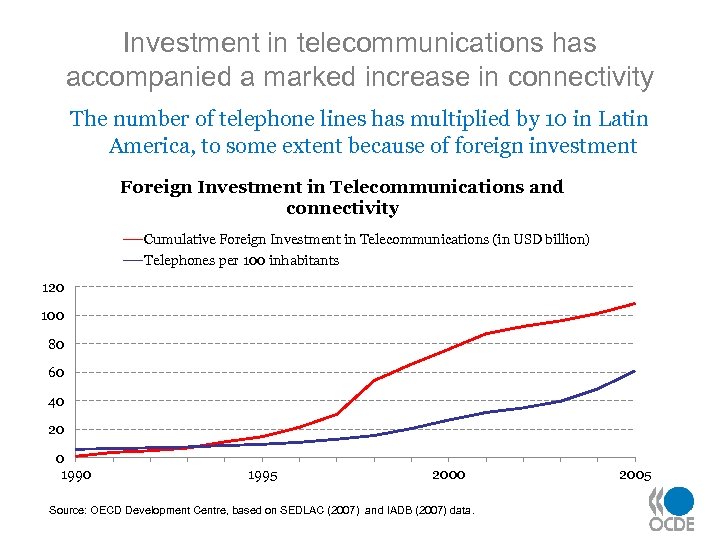

Investment in telecommunications has accompanied a marked increase in connectivity The number of telephone lines has multiplied by 10 in Latin America, to some extent because of foreign investment Foreign Investment in Telecommunications and connectivity Cumulative Foreign Investment in Telecommunications (in USD billion) Telephones per 100 inhabitants 120 100 80 60 40 20 0 1995 2000 Source: OECD Development Centre, based on SEDLAC (2007) and IADB (2007) data. 2005

Investment in telecommunications has accompanied a marked increase in connectivity The number of telephone lines has multiplied by 10 in Latin America, to some extent because of foreign investment Foreign Investment in Telecommunications and connectivity Cumulative Foreign Investment in Telecommunications (in USD billion) Telephones per 100 inhabitants 120 100 80 60 40 20 0 1995 2000 Source: OECD Development Centre, based on SEDLAC (2007) and IADB (2007) data. 2005

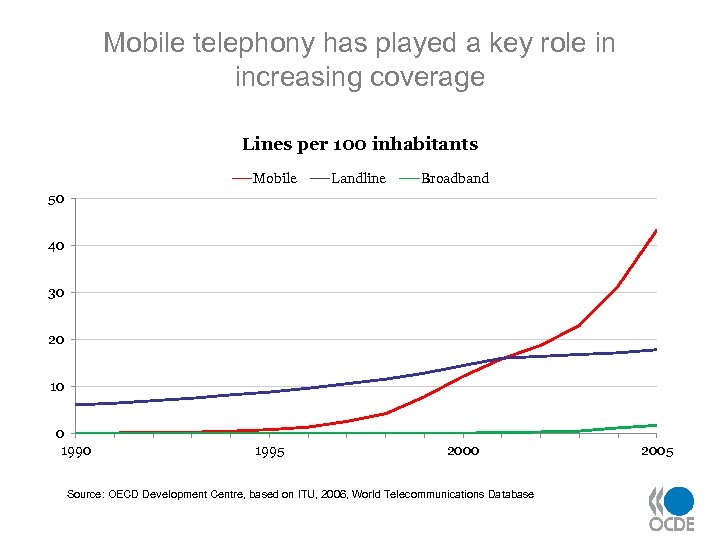

Mobile telephony has played a key role in increasing coverage Lines per 100 inhabitants Mobile Landline Broadband 50 40 30 20 10 0 1995 2000 Source: OECD Development Centre, based on ITU, 2006, World Telecommunications Database 2005

Mobile telephony has played a key role in increasing coverage Lines per 100 inhabitants Mobile Landline Broadband 50 40 30 20 10 0 1995 2000 Source: OECD Development Centre, based on ITU, 2006, World Telecommunications Database 2005

However, the connectivity boom has not benefited all in the same way Inequality is high: a quarter of poor households have a telephone at home, 3 times less than high-income households Proportion of the population with a telephone at home Richest quintile Poorest quintile 1 0. 8 0. 6 0. 4 Source: OECD Development Centre, based on SEDLAC surveys. Haití Nicaragua Perú Bolivia Paraguay México Costa Rica Brasil Argentina 0 Chile 0. 2

However, the connectivity boom has not benefited all in the same way Inequality is high: a quarter of poor households have a telephone at home, 3 times less than high-income households Proportion of the population with a telephone at home Richest quintile Poorest quintile 1 0. 8 0. 6 0. 4 Source: OECD Development Centre, based on SEDLAC surveys. Haití Nicaragua Perú Bolivia Paraguay México Costa Rica Brasil Argentina 0 Chile 0. 2

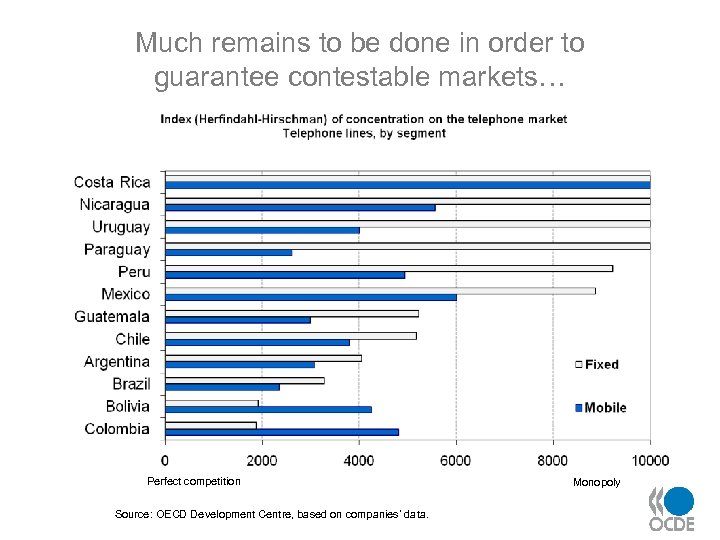

Much remains to be done in order to guarantee contestable markets… Perfect competition Source: OECD Development Centre, based on companies’ data. Monopoly

Much remains to be done in order to guarantee contestable markets… Perfect competition Source: OECD Development Centre, based on companies’ data. Monopoly

I II IV Fiscal Policy and Legitimacy Pensions, Capital Markets and Corporate Governance Multinationals, Telecommunications and Development China, India and the Challenge of Specialisation

I II IV Fiscal Policy and Legitimacy Pensions, Capital Markets and Corporate Governance Multinationals, Telecommunications and Development China, India and the Challenge of Specialisation

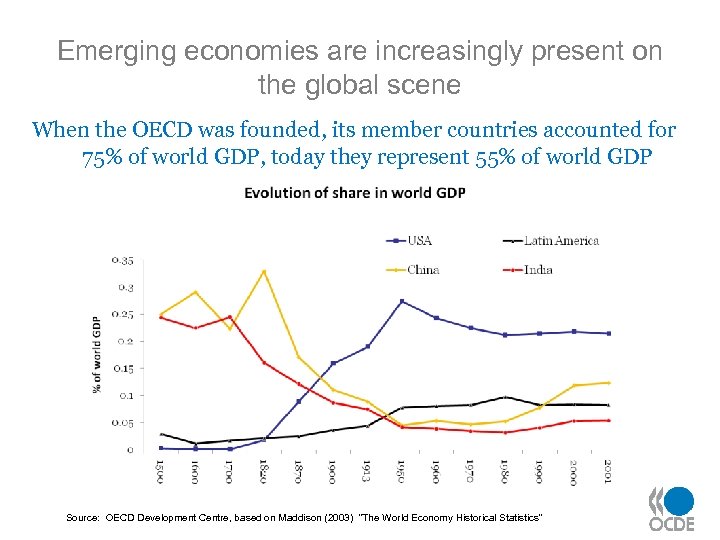

Emerging economies are increasingly present on the global scene When the OECD was founded, its member countries accounted for 75% of world GDP, today they represent 55% of world GDP Source: OECD Development Centre, based on Maddison (2003) “The World Economy Historical Statistics”

Emerging economies are increasingly present on the global scene When the OECD was founded, its member countries accounted for 75% of world GDP, today they represent 55% of world GDP Source: OECD Development Centre, based on Maddison (2003) “The World Economy Historical Statistics”

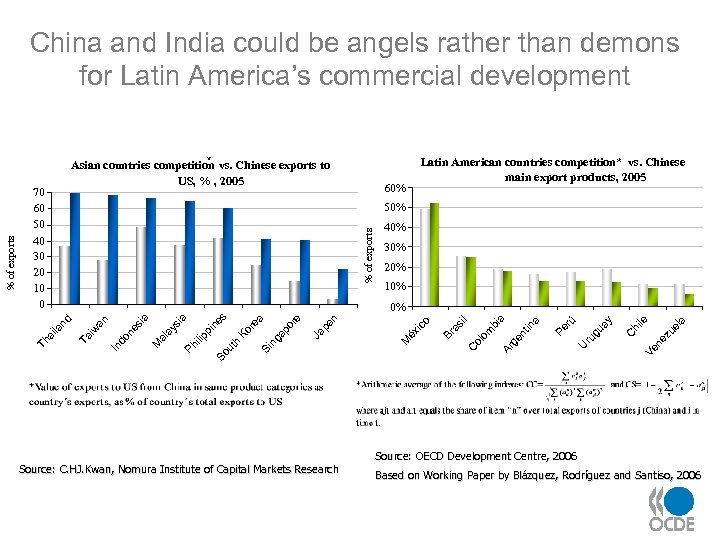

China and India could be angels rather than demons for Latin America’s commercial development Latin American countries competition* vs. Chinese main export products, 2005 70 60 50 40 30 20 10 0 60% % of exports 50% 40% 30% 20% 10% Source: C. HJ. Kwan, Nomura Institute of Capital Markets Research el a le zu hi ne C Ve U ru gu ay rú Pe nt in a a bi m ol o C Ar ge il as Br o ic éx M pa n Ja or e ng ap a Si ut h pi So ilip Ko re ne s a Ph al ay si a M ne si an In do iw Ta nd 0% ai la Th % of exports * Asian countries competition vs. Chinese exports to US, % , 2005 Source: OECD Development Centre, 2006 Based on Working Paper by Blázquez, Rodríguez and Santiso, 2006

China and India could be angels rather than demons for Latin America’s commercial development Latin American countries competition* vs. Chinese main export products, 2005 70 60 50 40 30 20 10 0 60% % of exports 50% 40% 30% 20% 10% Source: C. HJ. Kwan, Nomura Institute of Capital Markets Research el a le zu hi ne C Ve U ru gu ay rú Pe nt in a a bi m ol o C Ar ge il as Br o ic éx M pa n Ja or e ng ap a Si ut h pi So ilip Ko re ne s a Ph al ay si a M ne si an In do iw Ta nd 0% ai la Th % of exports * Asian countries competition vs. Chinese exports to US, % , 2005 Source: OECD Development Centre, 2006 Based on Working Paper by Blázquez, Rodríguez and Santiso, 2006

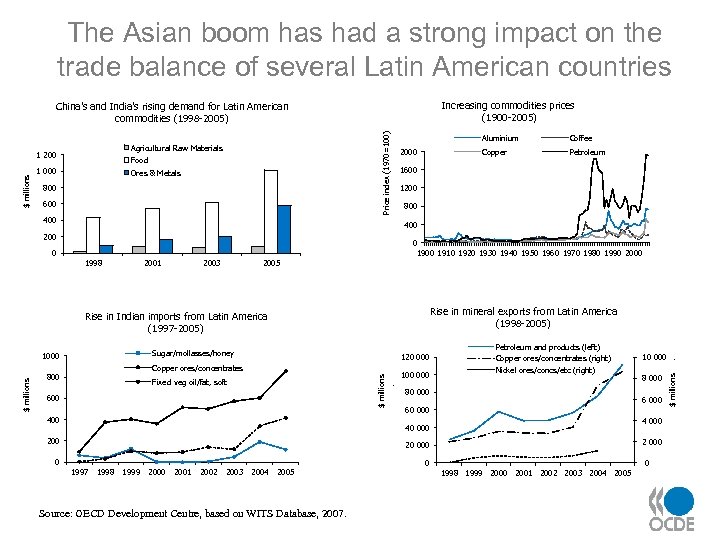

The Asian boom has had a strong impact on the trade balance of several Latin American countries Increasing commodities prices (1900 -2005) Agricultural Raw Materials 1 200 Food 1 000 Ores & Metals 800 600 400 Aluminium Petroleum 1600 1200 800 400 200 0 1900 1910 1920 1930 1940 1950 1960 1970 1980 1990 2000 0 2001 2003 2005 Rise in mineral exports from Latin America (1998 -2005) Rise in Indian imports from Latin America (1997 -2005) Sugar/mollasses/honey 1000 120 000 800 $ millions. Copper ores/concentrates Fixed veg oil/fat, soft 600 400 100 000 Petroleum and products (left) Copper ores/concentrates (right) Nickel ores/concs/etc (right) 80 000 6 000 4 000 20 000 0 1997 1998 1999 2000 2001 2002 2003 2004 2005 Source: OECD Development Centre, based on WITS Database, 2007. 8 000 60 000 40 000 200 10 000 0 0 1998 1999 2000 2001 2002 2003 2004 2005 . 1998 $ millions Coffee Copper 2000 $ millions Price index (1970=100) China’s and India’s rising demand for Latin American commodities (1998 -2005)

The Asian boom has had a strong impact on the trade balance of several Latin American countries Increasing commodities prices (1900 -2005) Agricultural Raw Materials 1 200 Food 1 000 Ores & Metals 800 600 400 Aluminium Petroleum 1600 1200 800 400 200 0 1900 1910 1920 1930 1940 1950 1960 1970 1980 1990 2000 0 2001 2003 2005 Rise in mineral exports from Latin America (1998 -2005) Rise in Indian imports from Latin America (1997 -2005) Sugar/mollasses/honey 1000 120 000 800 $ millions. Copper ores/concentrates Fixed veg oil/fat, soft 600 400 100 000 Petroleum and products (left) Copper ores/concentrates (right) Nickel ores/concs/etc (right) 80 000 6 000 4 000 20 000 0 1997 1998 1999 2000 2001 2002 2003 2004 2005 Source: OECD Development Centre, based on WITS Database, 2007. 8 000 60 000 40 000 200 10 000 0 0 1998 1999 2000 2001 2002 2003 2004 2005 . 1998 $ millions Coffee Copper 2000 $ millions Price index (1970=100) China’s and India’s rising demand for Latin American commodities (1998 -2005)

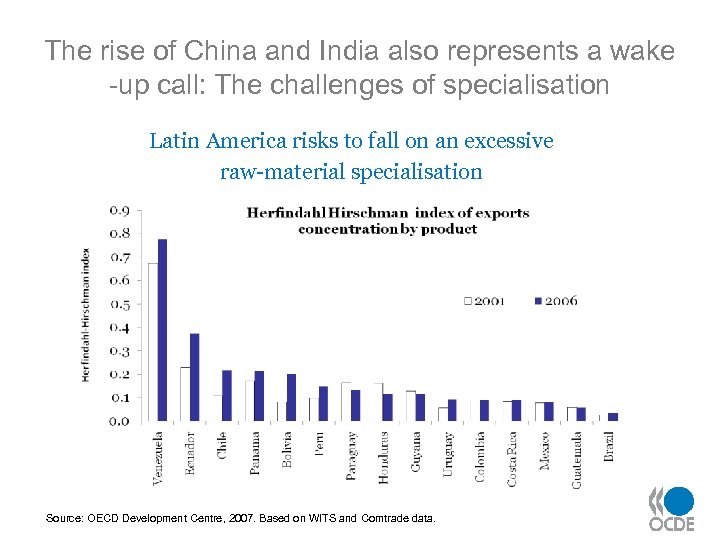

The rise of China and India also represents a wake -up call: The challenges of specialisation Latin America risks to fall on an excessive raw-material specialisation Source: OECD Development Centre, 2007. Based on WITS and Comtrade data.

The rise of China and India also represents a wake -up call: The challenges of specialisation Latin America risks to fall on an excessive raw-material specialisation Source: OECD Development Centre, 2007. Based on WITS and Comtrade data.

Exploiting comparative advantages: The proximity to export markets Mexico benefits from its geographic proximity to its major export markets 24 Days 11, 700 Km 4 Days 160 Km Shipping time Mexico is more competitive in manufacturing more sophisticated products which require short delivery times

Exploiting comparative advantages: The proximity to export markets Mexico benefits from its geographic proximity to its major export markets 24 Days 11, 700 Km 4 Days 160 Km Shipping time Mexico is more competitive in manufacturing more sophisticated products which require short delivery times

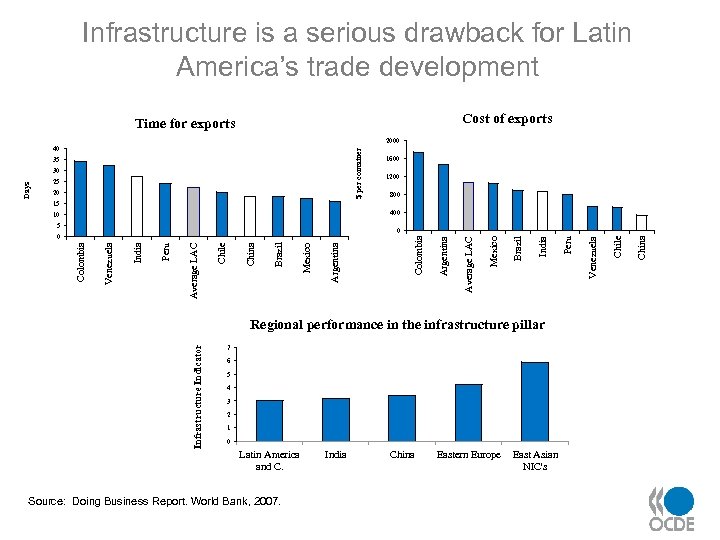

Infrastructure is a serious drawback for Latin America’s trade development Cost of exports Time for exports 2000 $ per container 40 35 Days 30 25 20 1600 1200 800 15 400 10 5 Infrastructure Indicator Regional performance in the infrastructure pillar 7 6 5 4 3 2 1 0 Latin America and C. Source: Doing Business Report. World Bank, 2007. India China Eastern Europe East Asian NIC's China Chile Venezuela Peru India Brazil Mexico Average LAC Argentina Mexico Brazil China Chile Average LAC Peru India Venezuela Colombia 0 0

Infrastructure is a serious drawback for Latin America’s trade development Cost of exports Time for exports 2000 $ per container 40 35 Days 30 25 20 1600 1200 800 15 400 10 5 Infrastructure Indicator Regional performance in the infrastructure pillar 7 6 5 4 3 2 1 0 Latin America and C. Source: Doing Business Report. World Bank, 2007. India China Eastern Europe East Asian NIC's China Chile Venezuela Peru India Brazil Mexico Average LAC Argentina Mexico Brazil China Chile Average LAC Peru India Venezuela Colombia 0 0

Latin American Economic Outlook 2009 and more • Fiscal Policy and development. • Innovation and development. • Migration and development.

Latin American Economic Outlook 2009 and more • Fiscal Policy and development. • Innovation and development. • Migration and development.

Latin American Economic Outlook 2008 Javier Santiso Acting Director Chief Development Economist OECD Development Centre Washington, 6 th December 2007

Latin American Economic Outlook 2008 Javier Santiso Acting Director Chief Development Economist OECD Development Centre Washington, 6 th December 2007