a702e9951069c57d5aa74a0e5e4cd50e.ppt

- Количество слайдов: 33

Latin American Economic Outlook 2008 China and India: Angel or Devils for Latin America? Based on Chapter 4 of the Report Javier Santiso Director, OECD Development Centre China, April 2008

Latin American Economic Outlook 2008 China and India: Angel or Devils for Latin America? Based on Chapter 4 of the Report Javier Santiso Director, OECD Development Centre China, April 2008

The OECD and Latin America: An emerging commitment • • Latin American market democracies matter for the OECD and its member countries The Latin American dimension at the OECD: Ø Mexico: Member since 1994; Chile: candidate since May 2007; Brazil: enhanced cooperation, May 2007 Ø Economic Surveys: 1992, 1995, 1997, 1998, 1999 2000, 2002, 2003, 2005, 2007 2000, 2005, 2006 Ø Latin American Economic Outlook 2008

The OECD and Latin America: An emerging commitment • • Latin American market democracies matter for the OECD and its member countries The Latin American dimension at the OECD: Ø Mexico: Member since 1994; Chile: candidate since May 2007; Brazil: enhanced cooperation, May 2007 Ø Economic Surveys: 1992, 1995, 1997, 1998, 1999 2000, 2002, 2003, 2005, 2007 2000, 2005, 2006 Ø Latin American Economic Outlook 2008

The Development Centre: A bridge between the OECD and emerging regions • Membership of the Development Centre With a Governing Board open to emerging countries, the Development Centre provides a framework for dialogue and experience sharing with regions all over the world. • Three Latin American countries are members of the Centre: – Mexico – Chile – Brazil

The Development Centre: A bridge between the OECD and emerging regions • Membership of the Development Centre With a Governing Board open to emerging countries, the Development Centre provides a framework for dialogue and experience sharing with regions all over the world. • Three Latin American countries are members of the Centre: – Mexico – Chile – Brazil

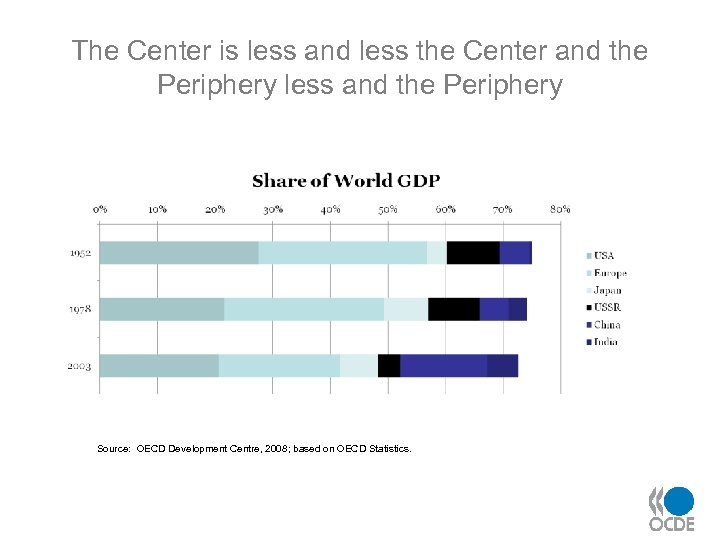

The Center is less and less the Center and the Periphery less and the Periphery Source: OECD Development Centre, 2008; based on OECD Statistics.

The Center is less and less the Center and the Periphery less and the Periphery Source: OECD Development Centre, 2008; based on OECD Statistics.

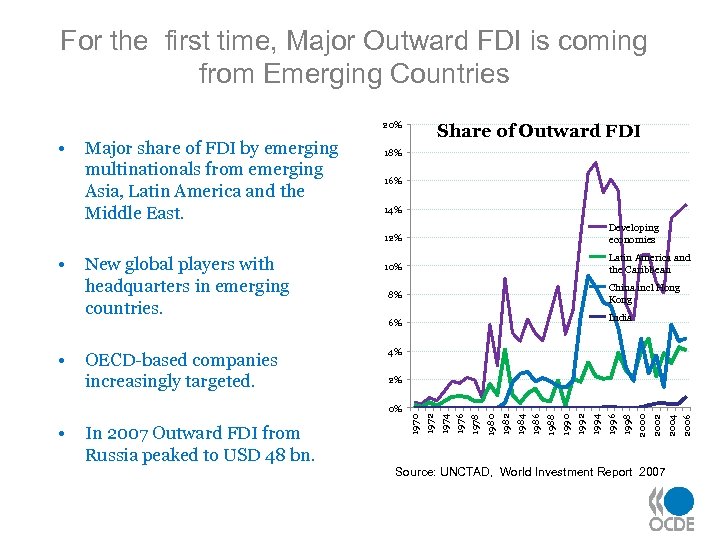

For the first time, Major Outward FDI is coming from Emerging Countries 20% • Major share of FDI by emerging multinationals from emerging Asia, Latin America and the Middle East. Share of Outward FDI 18% 16% 14% 12% • • New global players with headquarters in emerging countries. OECD-based companies increasingly targeted. Developing economies 10% Latin America and the Caribbean China incl Hong Kong 8% India 6% 4% 2% Source: UNCTAD, World Investment Report 2007 2006 2004 2002 2000 1998 1996 1994 1992 1990 1988 1986 1984 1982 1980 1978 1976 1974 In 2007 Outward FDI from Russia peaked to USD 48 bn. 1972 • 1970 0%

For the first time, Major Outward FDI is coming from Emerging Countries 20% • Major share of FDI by emerging multinationals from emerging Asia, Latin America and the Middle East. Share of Outward FDI 18% 16% 14% 12% • • New global players with headquarters in emerging countries. OECD-based companies increasingly targeted. Developing economies 10% Latin America and the Caribbean China incl Hong Kong 8% India 6% 4% 2% Source: UNCTAD, World Investment Report 2007 2006 2004 2002 2000 1998 1996 1994 1992 1990 1988 1986 1984 1982 1980 1978 1976 1974 In 2007 Outward FDI from Russia peaked to USD 48 bn. 1972 • 1970 0%

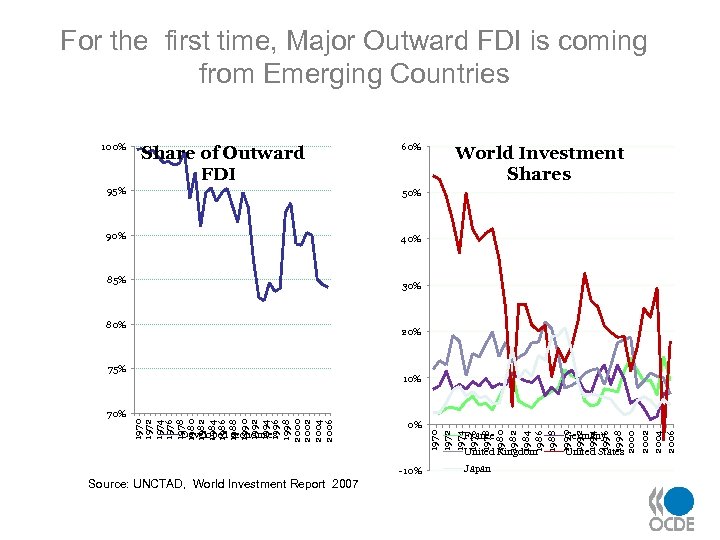

For the first time, Major Outward FDI is coming from Emerging Countries 100% Share of Outward FDI 60% 95% 50% 90% World Investment Shares 40% 85% 30% 80% 20% 75% 10% 1970 1972 1974 1976 1978 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 70% Developed economies 0% United States 1970 1972 1974 1976 1978 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 Germany United Kingdom -10% Source: UNCTAD, World Investment Report 2007 France Japan

For the first time, Major Outward FDI is coming from Emerging Countries 100% Share of Outward FDI 60% 95% 50% 90% World Investment Shares 40% 85% 30% 80% 20% 75% 10% 1970 1972 1974 1976 1978 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 70% Developed economies 0% United States 1970 1972 1974 1976 1978 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 Germany United Kingdom -10% Source: UNCTAD, World Investment Report 2007 France Japan

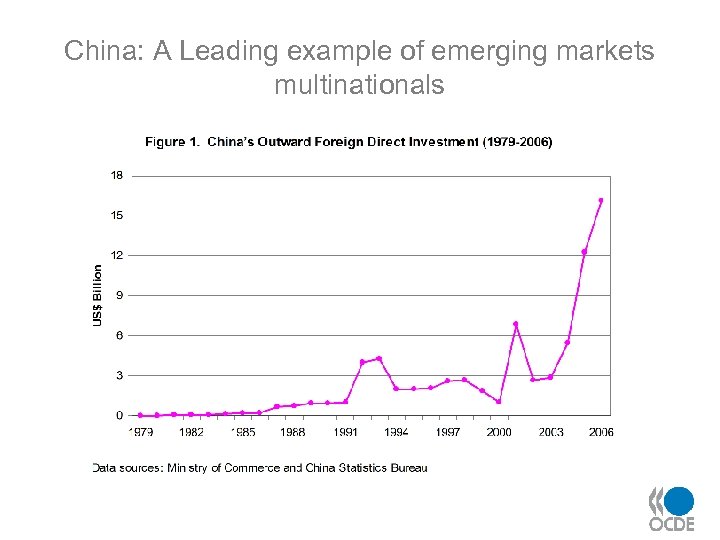

China: A Leading example of emerging markets multinationals

China: A Leading example of emerging markets multinationals

1 Trade Competition: An echo of the Asian boom 2 Specialisation: Evidence of a potential draw 3 Infrastructure: A key for competitiveness

1 Trade Competition: An echo of the Asian boom 2 Specialisation: Evidence of a potential draw 3 Infrastructure: A key for competitiveness

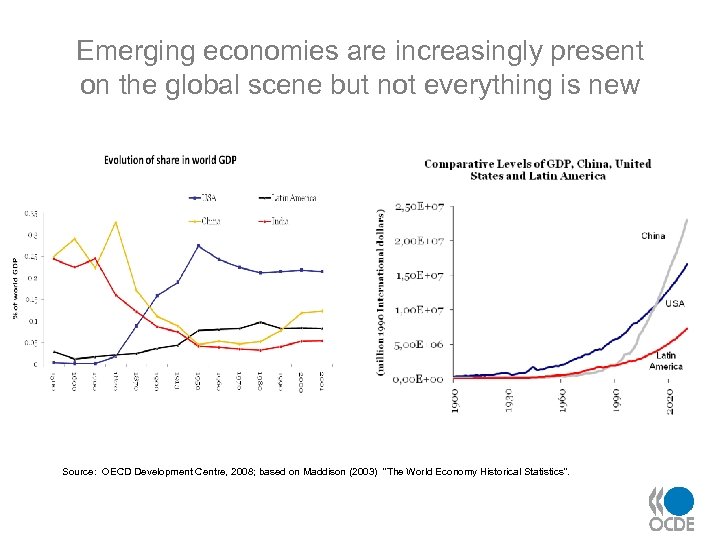

Emerging economies are increasingly present on the global scene but not everything is new Source: OECD Development Centre, 2008; based on Maddison (2003) “The World Economy Historical Statistics”.

Emerging economies are increasingly present on the global scene but not everything is new Source: OECD Development Centre, 2008; based on Maddison (2003) “The World Economy Historical Statistics”.

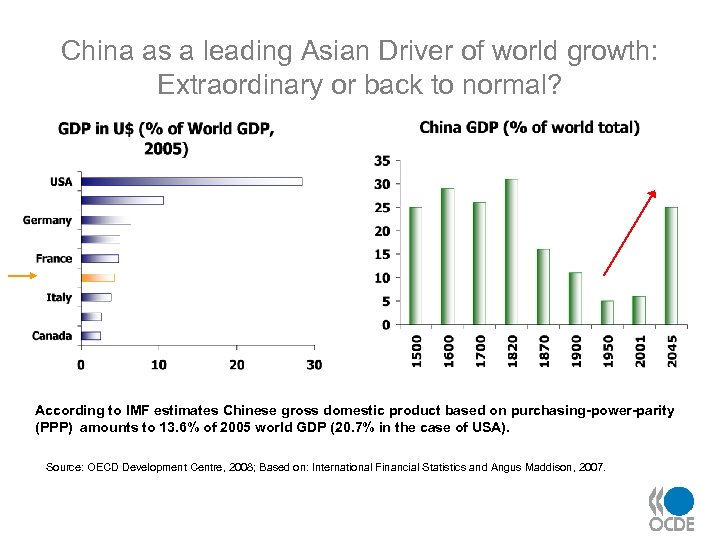

China as a leading Asian Driver of world growth: Extraordinary or back to normal? According to IMF estimates Chinese gross domestic product based on purchasing-power-parity (PPP) amounts to 13. 6% of 2005 world GDP (20. 7% in the case of USA). Source: OECD Development Centre, 2008; Based on: International Financial Statistics and Angus Maddison, 2007.

China as a leading Asian Driver of world growth: Extraordinary or back to normal? According to IMF estimates Chinese gross domestic product based on purchasing-power-parity (PPP) amounts to 13. 6% of 2005 world GDP (20. 7% in the case of USA). Source: OECD Development Centre, 2008; Based on: International Financial Statistics and Angus Maddison, 2007.

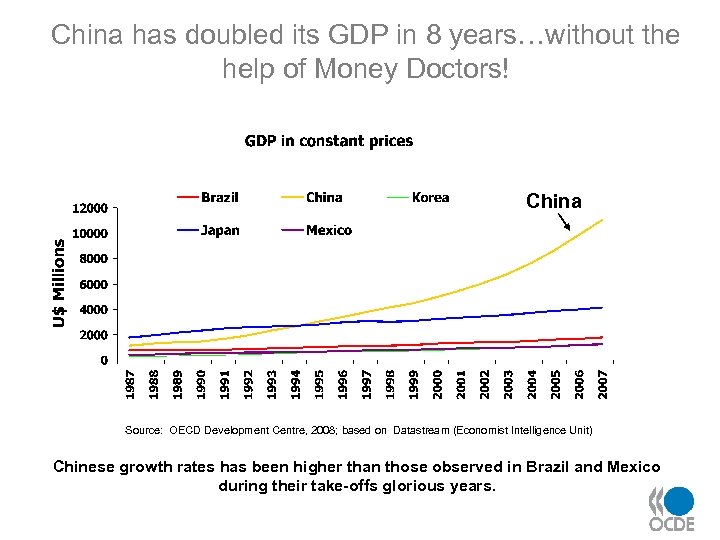

China has doubled its GDP in 8 years…without the help of Money Doctors! China Source: OECD Development Centre, 2008; based on Datastream (Economist Intelligence Unit) Chinese growth rates has been higher than those observed in Brazil and Mexico during their take-offs glorious years.

China has doubled its GDP in 8 years…without the help of Money Doctors! China Source: OECD Development Centre, 2008; based on Datastream (Economist Intelligence Unit) Chinese growth rates has been higher than those observed in Brazil and Mexico during their take-offs glorious years.

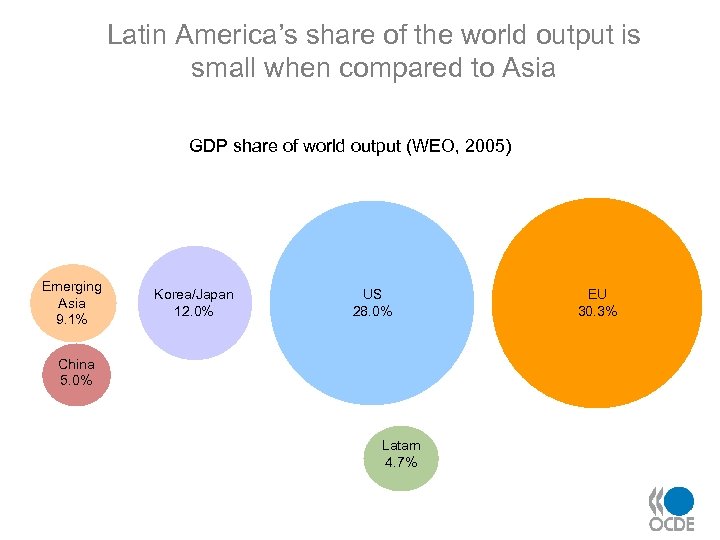

Latin America’s share of the world output is small when compared to Asia GDP share of world output (WEO, 2005) Emerging Asia 9. 1% Korea/Japan 12. 0% US 28. 0% China 5. 0% Latam 4. 7% EU 30. 3%

Latin America’s share of the world output is small when compared to Asia GDP share of world output (WEO, 2005) Emerging Asia 9. 1% Korea/Japan 12. 0% US 28. 0% China 5. 0% Latam 4. 7% EU 30. 3%

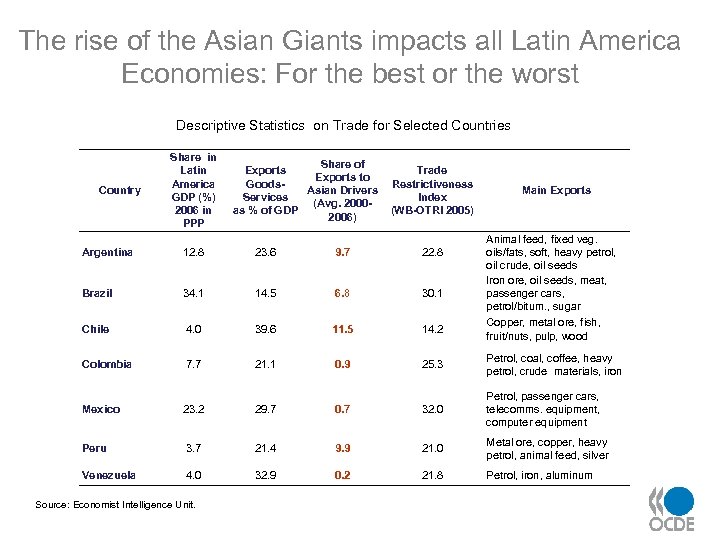

The rise of the Asian Giants impacts all Latin America Economies: For the best or the worst Descriptive Statistics on Trade for Selected Countries Country Share in Latin America GDP (%) 2006 in PPP Share of Exports to Goods. Asian Drivers Services (Avg. 2000 as % of GDP 2006) Trade Restrictiveness Index (WB-OTRI 2005) Main Exports Animal feed, fixed veg. oils/fats, soft, heavy petrol, oil crude, oil seeds Iron ore, oil seeds, meat, passenger cars, petrol/bitum. , sugar Copper, metal ore, fish, fruit/nuts, pulp, wood Argentina 12. 8 23. 6 9. 7 22. 8 Brazil 34. 1 14. 5 6. 8 30. 1 Chile 4. 0 39. 6 11. 5 14. 2 Colombia 7. 7 21. 1 0. 9 25. 3 Petrol, coal, coffee, heavy petrol, crude materials, iron Mexico 23. 2 29. 7 0. 7 32. 0 Petrol, passenger cars, telecomms. equipment, computer equipment Peru 3. 7 21. 4 9. 9 21. 0 Metal ore, copper, heavy petrol, animal feed, silver Venezuela 4. 0 32. 9 0. 2 21. 8 Petrol, iron, aluminum Source: Economist Intelligence Unit.

The rise of the Asian Giants impacts all Latin America Economies: For the best or the worst Descriptive Statistics on Trade for Selected Countries Country Share in Latin America GDP (%) 2006 in PPP Share of Exports to Goods. Asian Drivers Services (Avg. 2000 as % of GDP 2006) Trade Restrictiveness Index (WB-OTRI 2005) Main Exports Animal feed, fixed veg. oils/fats, soft, heavy petrol, oil crude, oil seeds Iron ore, oil seeds, meat, passenger cars, petrol/bitum. , sugar Copper, metal ore, fish, fruit/nuts, pulp, wood Argentina 12. 8 23. 6 9. 7 22. 8 Brazil 34. 1 14. 5 6. 8 30. 1 Chile 4. 0 39. 6 11. 5 14. 2 Colombia 7. 7 21. 1 0. 9 25. 3 Petrol, coal, coffee, heavy petrol, crude materials, iron Mexico 23. 2 29. 7 0. 7 32. 0 Petrol, passenger cars, telecomms. equipment, computer equipment Peru 3. 7 21. 4 9. 9 21. 0 Metal ore, copper, heavy petrol, animal feed, silver Venezuela 4. 0 32. 9 0. 2 21. 8 Petrol, iron, aluminum Source: Economist Intelligence Unit.

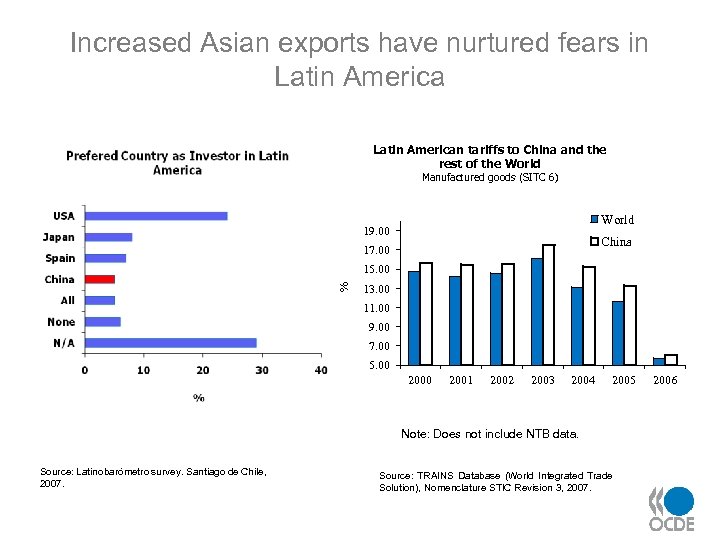

Increased Asian exports have nurtured fears in Latin American tariffs to China and the rest of the World Manufactured goods (SITC 6) World 19. 00 China 17. 00 % 15. 00 13. 00 11. 00 9. 00 7. 00 5. 00 2001 2002 2003 2004 2005 Note: Does not include NTB data. Source: Latinobarómetro survey. Santiago de Chile, 2007. Source: TRAINS Database (World Integrated Trade Solution), Nomenclature STIC Revision 3, 2007. 2006

Increased Asian exports have nurtured fears in Latin American tariffs to China and the rest of the World Manufactured goods (SITC 6) World 19. 00 China 17. 00 % 15. 00 13. 00 11. 00 9. 00 7. 00 5. 00 2001 2002 2003 2004 2005 Note: Does not include NTB data. Source: Latinobarómetro survey. Santiago de Chile, 2007. Source: TRAINS Database (World Integrated Trade Solution), Nomenclature STIC Revision 3, 2007. 2006

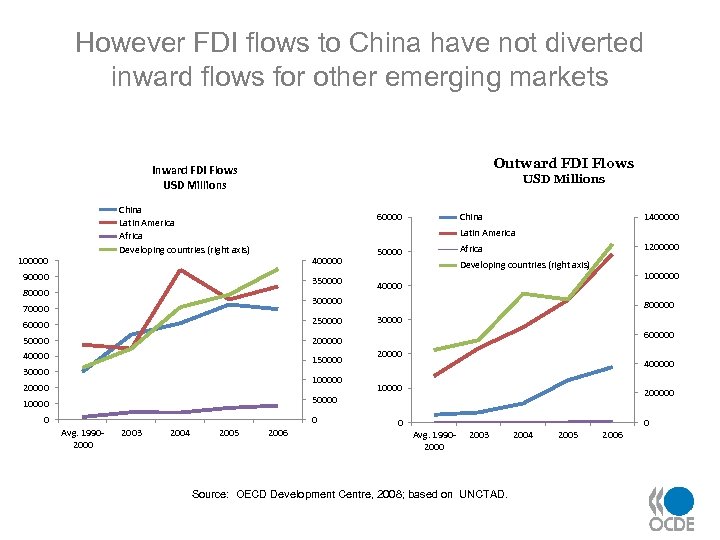

However FDI flows to China have not diverted inward flows for other emerging markets Outward FDI Flows Inward FDI Flows USD Millions China Latin America Africa Developing countries (right axis) 100000 China 60000 1400000 Latin America 400000 90000 350000 80000 1200000 Africa 50000 Developing countries (right axis) 1000000 40000 300000 70000 60000 250000 200000 40000 150000 800000 30000 100000 20000 50000 10000 0 0 Avg. 19902000 2003 2004 2005 2006 600000 20000 400000 10000 200000 0 0 Avg. 19902000 2003 Source: OECD Development Centre, 2008; based on UNCTAD. 2004 2005 2006

However FDI flows to China have not diverted inward flows for other emerging markets Outward FDI Flows Inward FDI Flows USD Millions China Latin America Africa Developing countries (right axis) 100000 China 60000 1400000 Latin America 400000 90000 350000 80000 1200000 Africa 50000 Developing countries (right axis) 1000000 40000 300000 70000 60000 250000 200000 40000 150000 800000 30000 100000 20000 50000 10000 0 0 Avg. 19902000 2003 2004 2005 2006 600000 20000 400000 10000 200000 0 0 Avg. 19902000 2003 Source: OECD Development Centre, 2008; based on UNCTAD. 2004 2005 2006

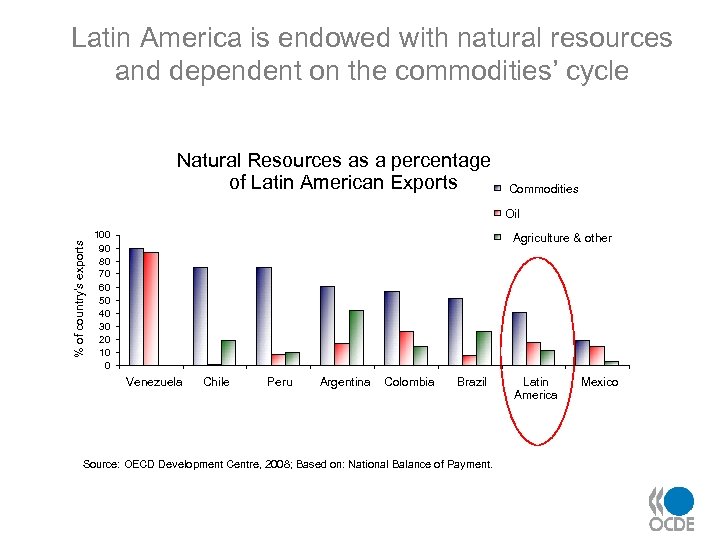

Latin America is endowed with natural resources and dependent on the commodities’ cycle Natural Resources as a percentage of Latin American Exports Commodities % of country's exports Oil 100 90 80 70 60 50 40 30 20 10 0 Agriculture & other Venezuela Chile Peru Argentina Colombia Brazil Source: OECD Development Centre, 2008; Based on: National Balance of Payment. Latin America Mexico

Latin America is endowed with natural resources and dependent on the commodities’ cycle Natural Resources as a percentage of Latin American Exports Commodities % of country's exports Oil 100 90 80 70 60 50 40 30 20 10 0 Agriculture & other Venezuela Chile Peru Argentina Colombia Brazil Source: OECD Development Centre, 2008; Based on: National Balance of Payment. Latin America Mexico

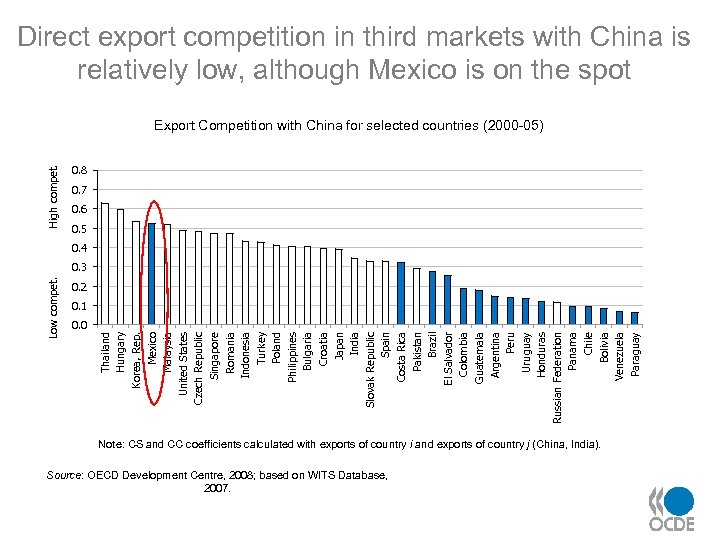

Direct export competition in third markets with China is relatively low, although Mexico is on the spot High compet. Export Competition with China for selected countries (2000 -05) 0. 8 0. 7 0. 6 0. 5 0. 4 0. 2 0. 1 0. 0 Thailand Hungary Korea, Rep. Mexico Malaysia United States Czech Republic Singapore Romania Indonesia Turkey Poland Philippines Bulgaria Croatia Japan India Slovak Republic Spain Costa Rica Pakistan Brazil El Salvador Colombia Guatemala Argentina Peru Uruguay Honduras Russian Federation Panama Chile Bolivia Venezuela Paraguay Low compet. 0. 3 Note: CS and CC coefficients calculated with exports of country i and exports of country j (China, India). Source: OECD Development Centre, 2008; based on WITS Database, 2007.

Direct export competition in third markets with China is relatively low, although Mexico is on the spot High compet. Export Competition with China for selected countries (2000 -05) 0. 8 0. 7 0. 6 0. 5 0. 4 0. 2 0. 1 0. 0 Thailand Hungary Korea, Rep. Mexico Malaysia United States Czech Republic Singapore Romania Indonesia Turkey Poland Philippines Bulgaria Croatia Japan India Slovak Republic Spain Costa Rica Pakistan Brazil El Salvador Colombia Guatemala Argentina Peru Uruguay Honduras Russian Federation Panama Chile Bolivia Venezuela Paraguay Low compet. 0. 3 Note: CS and CC coefficients calculated with exports of country i and exports of country j (China, India). Source: OECD Development Centre, 2008; based on WITS Database, 2007.

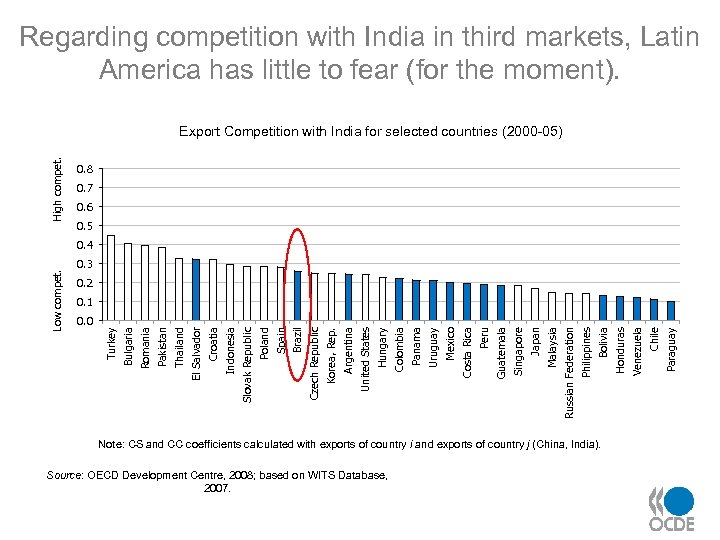

Regarding competition with India in third markets, Latin America has little to fear (for the moment). High compet. Export Competition with India for selected countries (2000 -05) 0. 8 0. 7 0. 6 0. 5 0. 3 0. 2 0. 1 Note: CS and CC coefficients calculated with exports of country i and exports of country j (China, India). Source: OECD Development Centre, 2008; based on WITS Database, 2007. Paraguay Chile Venezuela Honduras Bolivia Philippines Russian Federation Malaysia Japan Singapore Guatemala Peru Costa Rica Mexico Uruguay Panama Colombia Hungary United States Argentina Korea, Rep. Czech Republic Brazil Spain Poland Slovak Republic Indonesia Croatia El Salvador Thailand Pakistan Romania Bulgaria 0. 0 Turkey Low compet. 0. 4

Regarding competition with India in third markets, Latin America has little to fear (for the moment). High compet. Export Competition with India for selected countries (2000 -05) 0. 8 0. 7 0. 6 0. 5 0. 3 0. 2 0. 1 Note: CS and CC coefficients calculated with exports of country i and exports of country j (China, India). Source: OECD Development Centre, 2008; based on WITS Database, 2007. Paraguay Chile Venezuela Honduras Bolivia Philippines Russian Federation Malaysia Japan Singapore Guatemala Peru Costa Rica Mexico Uruguay Panama Colombia Hungary United States Argentina Korea, Rep. Czech Republic Brazil Spain Poland Slovak Republic Indonesia Croatia El Salvador Thailand Pakistan Romania Bulgaria 0. 0 Turkey Low compet. 0. 4

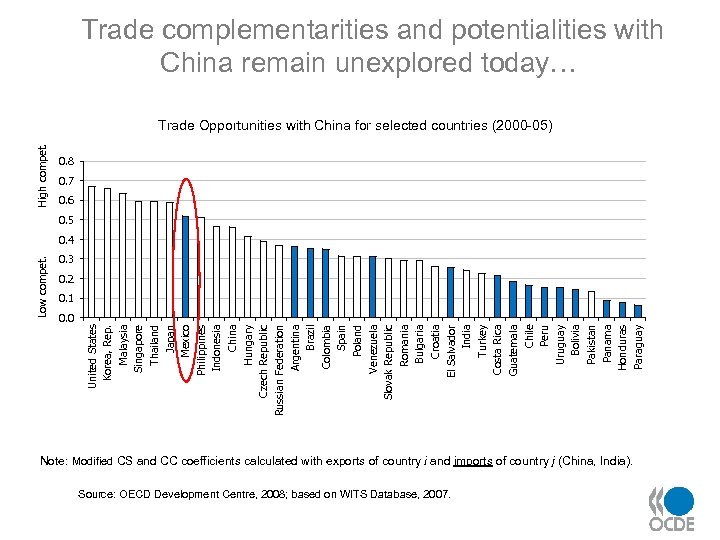

Trade complementarities and potentialities with China remain unexplored today… High compet. Trade Opportunities with China for selected countries (2000 -05) 0. 8 0. 7 0. 6 0. 5 0. 3 0. 2 0. 1 0. 0 United States Korea, Rep. Malaysia Singapore Thailand Japan Mexico Philippines Indonesia China Hungary Czech Republic Russian Federation Argentina Brazil Colombia Spain Poland Venezuela Slovak Republic Romania Bulgaria Croatia El Salvador India Turkey Costa Rica Guatemala Chile Peru Uruguay Bolivia Pakistan Panama Honduras Paraguay Low compet. 0. 4 Note: Modified CS and CC coefficients calculated with exports of country i and imports of country j (China, India). Source: OECD Development Centre, 2008; based on WITS Database, 2007.

Trade complementarities and potentialities with China remain unexplored today… High compet. Trade Opportunities with China for selected countries (2000 -05) 0. 8 0. 7 0. 6 0. 5 0. 3 0. 2 0. 1 0. 0 United States Korea, Rep. Malaysia Singapore Thailand Japan Mexico Philippines Indonesia China Hungary Czech Republic Russian Federation Argentina Brazil Colombia Spain Poland Venezuela Slovak Republic Romania Bulgaria Croatia El Salvador India Turkey Costa Rica Guatemala Chile Peru Uruguay Bolivia Pakistan Panama Honduras Paraguay Low compet. 0. 4 Note: Modified CS and CC coefficients calculated with exports of country i and imports of country j (China, India). Source: OECD Development Centre, 2008; based on WITS Database, 2007.

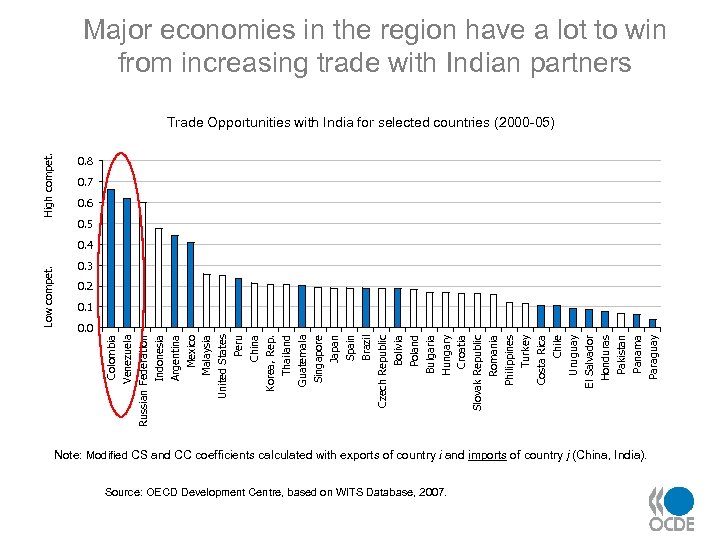

Major economies in the region have a lot to win from increasing trade with Indian partners High compet. Trade Opportunities with India for selected countries (2000 -05) 0. 8 0. 7 0. 6 0. 5 0. 3 0. 2 0. 1 0. 0 Colombia Venezuela Russian Federation Indonesia Argentina Mexico Malaysia United States Peru China Korea, Rep. Thailand Guatemala Singapore Japan Spain Brazil Czech Republic Bolivia Poland Bulgaria Hungary Croatia Slovak Republic Romania Philippines Turkey Costa Rica Chile Uruguay El Salvador Honduras Pakistan Panama Paraguay Low compet. 0. 4 Note: Modified CS and CC coefficients calculated with exports of country i and imports of country j (China, India). Source: OECD Development Centre, based on WITS Database, 2007.

Major economies in the region have a lot to win from increasing trade with Indian partners High compet. Trade Opportunities with India for selected countries (2000 -05) 0. 8 0. 7 0. 6 0. 5 0. 3 0. 2 0. 1 0. 0 Colombia Venezuela Russian Federation Indonesia Argentina Mexico Malaysia United States Peru China Korea, Rep. Thailand Guatemala Singapore Japan Spain Brazil Czech Republic Bolivia Poland Bulgaria Hungary Croatia Slovak Republic Romania Philippines Turkey Costa Rica Chile Uruguay El Salvador Honduras Pakistan Panama Paraguay Low compet. 0. 4 Note: Modified CS and CC coefficients calculated with exports of country i and imports of country j (China, India). Source: OECD Development Centre, based on WITS Database, 2007.

1 Trade Competition: An echo of the Asian boom 2 Specialisation: Evidence of a potential draw 3 Infrastructure: A key for competitiveness

1 Trade Competition: An echo of the Asian boom 2 Specialisation: Evidence of a potential draw 3 Infrastructure: A key for competitiveness

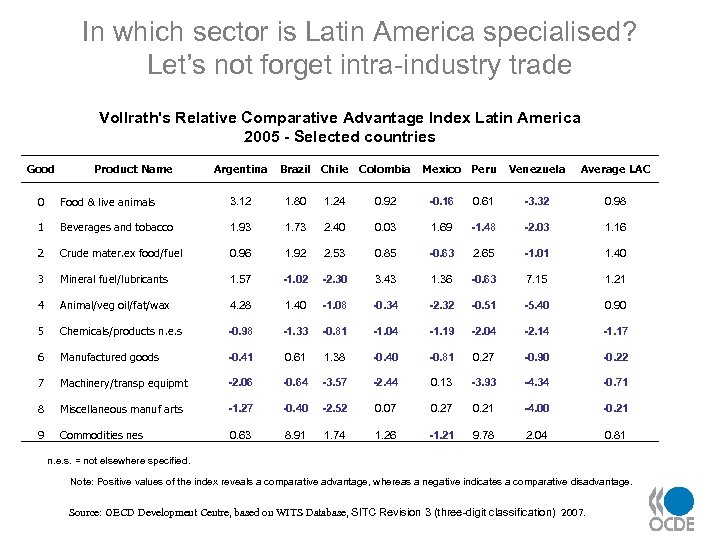

In which sector is Latin America specialised? Let’s not forget intra-industry trade Vollrath's Relative Comparative Advantage Index Latin America 2005 - Selected countries Good Product Name Argentina Brazil Chile Colombia Mexico Peru Venezuela Average LAC 0 Food & live animals 3. 12 1. 80 1. 24 0. 92 -0. 16 0. 61 -3. 32 0. 98 1 Beverages and tobacco 1. 93 1. 73 2. 40 0. 03 1. 69 -1. 48 -2. 03 1. 16 2 Crude mater. ex food/fuel 0. 96 1. 92 2. 53 0. 85 -0. 63 2. 65 -1. 01 1. 40 3 Mineral fuel/lubricants 1. 57 -1. 02 -2. 30 3. 43 1. 36 -0. 63 7. 15 1. 21 4 Animal/veg oil/fat/wax 4. 28 1. 40 -1. 08 -0. 34 -2. 32 -0. 51 -5. 40 0. 90 5 Chemicals/products n. e. s -0. 98 -1. 33 -0. 81 -1. 04 -1. 19 -2. 04 -2. 14 -1. 17 6 Manufactured goods -0. 41 0. 61 1. 38 -0. 40 -0. 81 0. 27 -0. 90 -0. 22 7 Machinery/transp equipmt -2. 06 -0. 64 -3. 57 -2. 44 0. 13 -3. 93 -4. 34 -0. 71 8 Miscellaneous manuf arts -1. 27 -0. 40 -2. 52 0. 07 0. 21 -4. 00 -0. 21 9 Commodities nes 0. 63 8. 91 1. 74 1. 26 -1. 21 9. 78 2. 04 0. 81 n. e. s. = not elsewhere specified. Note: Positive values of the index reveals a comparative advantage, whereas a negative indicates a comparative disadvantage. Source: OECD Development Centre, based on WITS Database, SITC Revision 3 (three-digit classification) 2007.

In which sector is Latin America specialised? Let’s not forget intra-industry trade Vollrath's Relative Comparative Advantage Index Latin America 2005 - Selected countries Good Product Name Argentina Brazil Chile Colombia Mexico Peru Venezuela Average LAC 0 Food & live animals 3. 12 1. 80 1. 24 0. 92 -0. 16 0. 61 -3. 32 0. 98 1 Beverages and tobacco 1. 93 1. 73 2. 40 0. 03 1. 69 -1. 48 -2. 03 1. 16 2 Crude mater. ex food/fuel 0. 96 1. 92 2. 53 0. 85 -0. 63 2. 65 -1. 01 1. 40 3 Mineral fuel/lubricants 1. 57 -1. 02 -2. 30 3. 43 1. 36 -0. 63 7. 15 1. 21 4 Animal/veg oil/fat/wax 4. 28 1. 40 -1. 08 -0. 34 -2. 32 -0. 51 -5. 40 0. 90 5 Chemicals/products n. e. s -0. 98 -1. 33 -0. 81 -1. 04 -1. 19 -2. 04 -2. 14 -1. 17 6 Manufactured goods -0. 41 0. 61 1. 38 -0. 40 -0. 81 0. 27 -0. 90 -0. 22 7 Machinery/transp equipmt -2. 06 -0. 64 -3. 57 -2. 44 0. 13 -3. 93 -4. 34 -0. 71 8 Miscellaneous manuf arts -1. 27 -0. 40 -2. 52 0. 07 0. 21 -4. 00 -0. 21 9 Commodities nes 0. 63 8. 91 1. 74 1. 26 -1. 21 9. 78 2. 04 0. 81 n. e. s. = not elsewhere specified. Note: Positive values of the index reveals a comparative advantage, whereas a negative indicates a comparative disadvantage. Source: OECD Development Centre, based on WITS Database, SITC Revision 3 (three-digit classification) 2007.

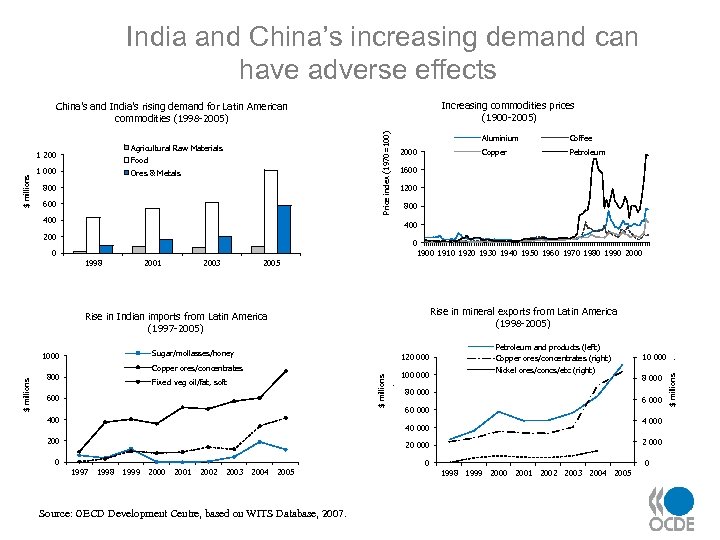

India and China’s increasing demand can have adverse effects Increasing commodities prices (1900 -2005) Agricultural Raw Materials 1 200 Food 1 000 Ores & Metals 800 600 400 Aluminium Petroleum 1600 1200 800 400 200 0 1900 1910 1920 1930 1940 1950 1960 1970 1980 1990 2000 0 2001 2003 2005 Rise in mineral exports from Latin America (1998 -2005) Rise in Indian imports from Latin America (1997 -2005) Sugar/mollasses/honey 1000 120 000 800 $ millions. Copper ores/concentrates Fixed veg oil/fat, soft 600 400 100 000 Petroleum and products (left) Copper ores/concentrates (right) Nickel ores/concs/etc (right) 80 000 6 000 4 000 20 000 0 1997 1998 1999 2000 2001 2002 2003 2004 2005 Source: OECD Development Centre, based on WITS Database, 2007. 8 000 60 000 40 000 200 10 000 0 0 1998 1999 2000 2001 2002 2003 2004 2005 . 1998 $ millions Coffee Copper 2000 $ millions Price index (1970=100) China’s and India’s rising demand for Latin American commodities (1998 -2005)

India and China’s increasing demand can have adverse effects Increasing commodities prices (1900 -2005) Agricultural Raw Materials 1 200 Food 1 000 Ores & Metals 800 600 400 Aluminium Petroleum 1600 1200 800 400 200 0 1900 1910 1920 1930 1940 1950 1960 1970 1980 1990 2000 0 2001 2003 2005 Rise in mineral exports from Latin America (1998 -2005) Rise in Indian imports from Latin America (1997 -2005) Sugar/mollasses/honey 1000 120 000 800 $ millions. Copper ores/concentrates Fixed veg oil/fat, soft 600 400 100 000 Petroleum and products (left) Copper ores/concentrates (right) Nickel ores/concs/etc (right) 80 000 6 000 4 000 20 000 0 1997 1998 1999 2000 2001 2002 2003 2004 2005 Source: OECD Development Centre, based on WITS Database, 2007. 8 000 60 000 40 000 200 10 000 0 0 1998 1999 2000 2001 2002 2003 2004 2005 . 1998 $ millions Coffee Copper 2000 $ millions Price index (1970=100) China’s and India’s rising demand for Latin American commodities (1998 -2005)

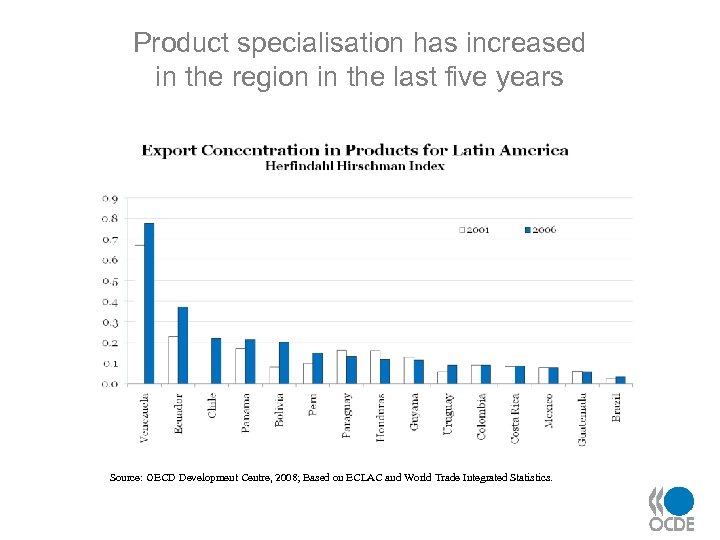

Product specialisation has increased in the region in the last five years Source: OECD Development Centre, 2008; Based on ECLAC and World Trade Integrated Statistics.

Product specialisation has increased in the region in the last five years Source: OECD Development Centre, 2008; Based on ECLAC and World Trade Integrated Statistics.

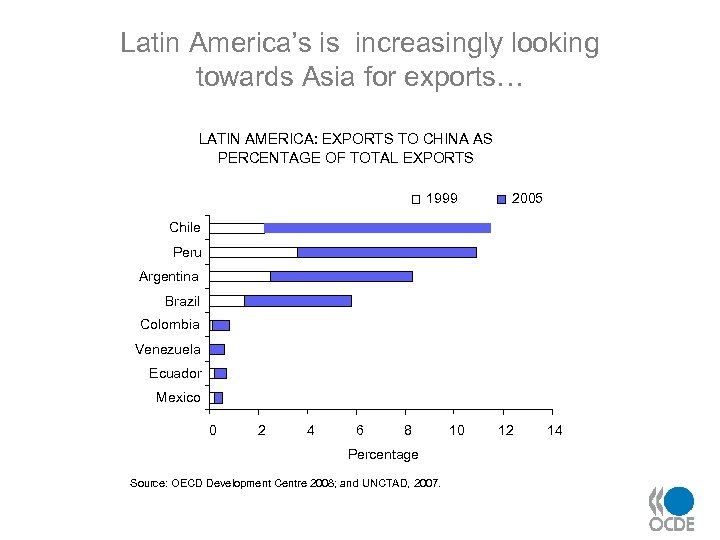

Latin America’s is increasingly looking towards Asia for exports… LATIN AMERICA: EXPORTS TO CHINA AS PERCENTAGE OF TOTAL EXPORTS 1999 2005 Chile Peru Argentina Brazil Colombia Venezuela Ecuador Mexico 0 2 4 6 8 Percentage Source: OECD Development Centre 2008; and UNCTAD, 2007. 10 12 14

Latin America’s is increasingly looking towards Asia for exports… LATIN AMERICA: EXPORTS TO CHINA AS PERCENTAGE OF TOTAL EXPORTS 1999 2005 Chile Peru Argentina Brazil Colombia Venezuela Ecuador Mexico 0 2 4 6 8 Percentage Source: OECD Development Centre 2008; and UNCTAD, 2007. 10 12 14

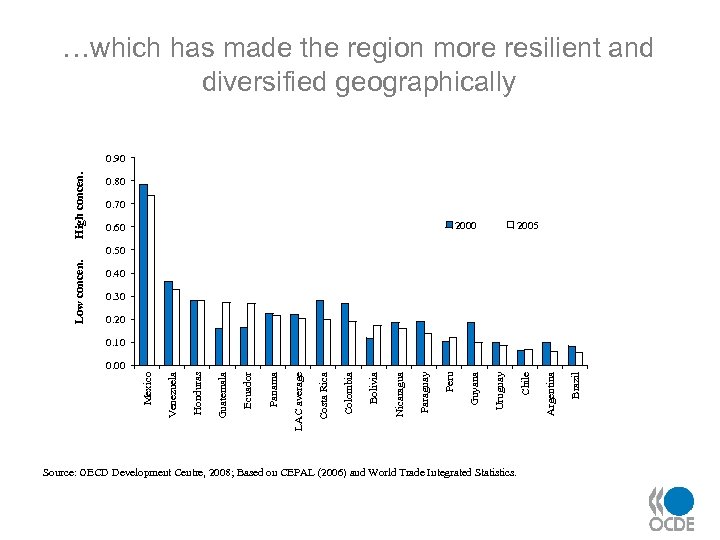

…which has made the region more resilient and diversified geographically High concen. 0. 90 0. 80 0. 70 2000 0. 60 2005 Low concen. 0. 50 0. 40 0. 30 0. 20 0. 10 Source: OECD Development Centre, 2008; Based on CEPAL (2006) and World Trade Integrated Statistics. Brazil Argentina Chile Uruguay Guyana Peru Paraguay Nicaragua Bolivia Colombia Costa Rica LAC average Panama Ecuador Guatemala Honduras Venezuela Mexico 0. 00

…which has made the region more resilient and diversified geographically High concen. 0. 90 0. 80 0. 70 2000 0. 60 2005 Low concen. 0. 50 0. 40 0. 30 0. 20 0. 10 Source: OECD Development Centre, 2008; Based on CEPAL (2006) and World Trade Integrated Statistics. Brazil Argentina Chile Uruguay Guyana Peru Paraguay Nicaragua Bolivia Colombia Costa Rica LAC average Panama Ecuador Guatemala Honduras Venezuela Mexico 0. 00

1 Trade Competition: An echo of the Asian boom 2 Specialisation: Evidence of a potential draw 3 Infrastructure: A key for competitiveness

1 Trade Competition: An echo of the Asian boom 2 Specialisation: Evidence of a potential draw 3 Infrastructure: A key for competitiveness

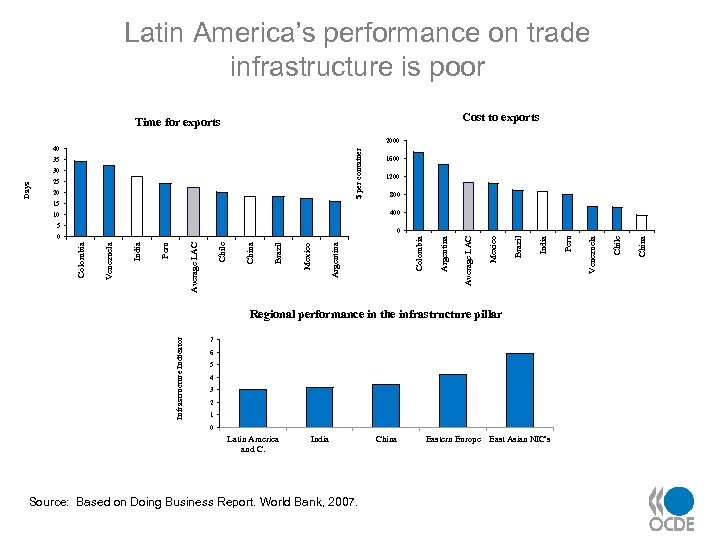

Latin America’s performance on trade infrastructure is poor Cost to exports Time for exports 2000 $ per container 40 35 Days 30 25 20 1600 1200 800 15 400 10 5 Infrastructure Indicator Regional performance in the infrastructure pillar 7 6 5 4 3 2 1 0 Latin America and C. India Source: Based on Doing Business Report. World Bank, 2007. China Eastern Europe East Asian NIC's China Chile Venezuela Peru India Brazil Mexico Average LAC Argentina Mexico Brazil China Chile Average LAC Peru India Venezuela Colombia 0 0

Latin America’s performance on trade infrastructure is poor Cost to exports Time for exports 2000 $ per container 40 35 Days 30 25 20 1600 1200 800 15 400 10 5 Infrastructure Indicator Regional performance in the infrastructure pillar 7 6 5 4 3 2 1 0 Latin America and C. India Source: Based on Doing Business Report. World Bank, 2007. China Eastern Europe East Asian NIC's China Chile Venezuela Peru India Brazil Mexico Average LAC Argentina Mexico Brazil China Chile Average LAC Peru India Venezuela Colombia 0 0

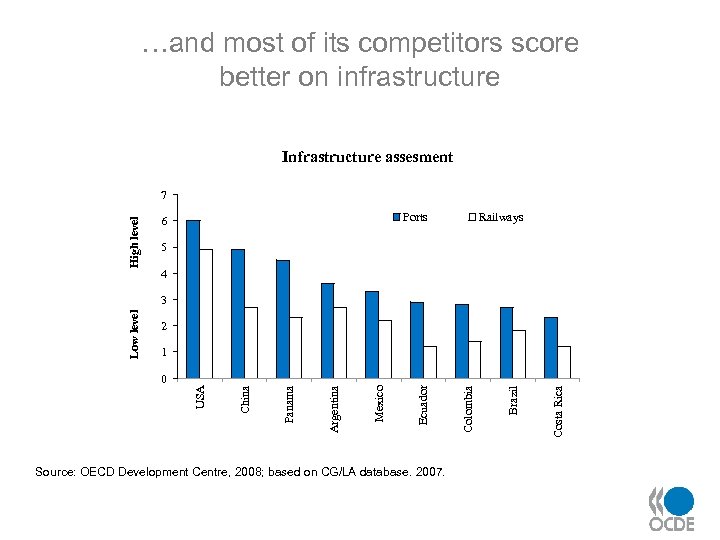

…and most of its competitors score better on infrastructure Infrastructure assesment High level 7 Ports 6 Railways 5 4 2 Source: OECD Development Centre, 2008; based on CG/LA database. 2007. Costa Rica Brazil Colombia Ecuador Mexico Argentina Panama 0 China 1 USA Low level 3

…and most of its competitors score better on infrastructure Infrastructure assesment High level 7 Ports 6 Railways 5 4 2 Source: OECD Development Centre, 2008; based on CG/LA database. 2007. Costa Rica Brazil Colombia Ecuador Mexico Argentina Panama 0 China 1 USA Low level 3

A wake up call for reforms: The proximity to export markets Mexico benefits from its geographic proximity to its major export markets: • Lower transport and communication costs • Access to FTA • Just-in-time delivery 24 Days 11, 700 Km 4 Days 160 Km Shipping time Mexico is more competitive in manufacturing more sophisticated products which require frequent communication with the client or supplier and short reaction times.

A wake up call for reforms: The proximity to export markets Mexico benefits from its geographic proximity to its major export markets: • Lower transport and communication costs • Access to FTA • Just-in-time delivery 24 Days 11, 700 Km 4 Days 160 Km Shipping time Mexico is more competitive in manufacturing more sophisticated products which require frequent communication with the client or supplier and short reaction times.

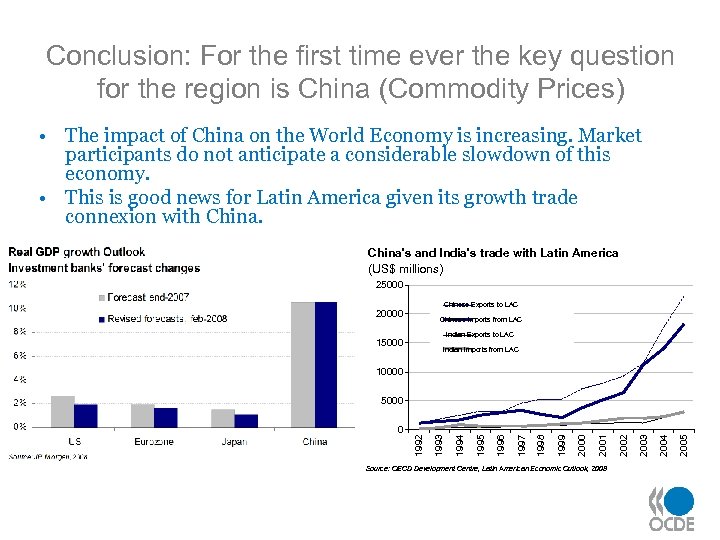

Conclusion: For the first time ever the key question for the region is China (Commodity Prices) • The impact of China on the World Economy is increasing. Market participants do not anticipate a considerable slowdown of this economy. • This is good news for Latin America given its growth trade connexion with China's and India's trade with Latin America (US$ millions) 25000 Chinese Exports to LAC 20000 Chinese Imports from LAC Indian Exports to LAC 15000 Indian Imports from LAC 10000 Source: OECD Development Centre, Latin American Economic Outlook, 2008 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 0 1992 5000

Conclusion: For the first time ever the key question for the region is China (Commodity Prices) • The impact of China on the World Economy is increasing. Market participants do not anticipate a considerable slowdown of this economy. • This is good news for Latin America given its growth trade connexion with China's and India's trade with Latin America (US$ millions) 25000 Chinese Exports to LAC 20000 Chinese Imports from LAC Indian Exports to LAC 15000 Indian Imports from LAC 10000 Source: OECD Development Centre, Latin American Economic Outlook, 2008 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 0 1992 5000

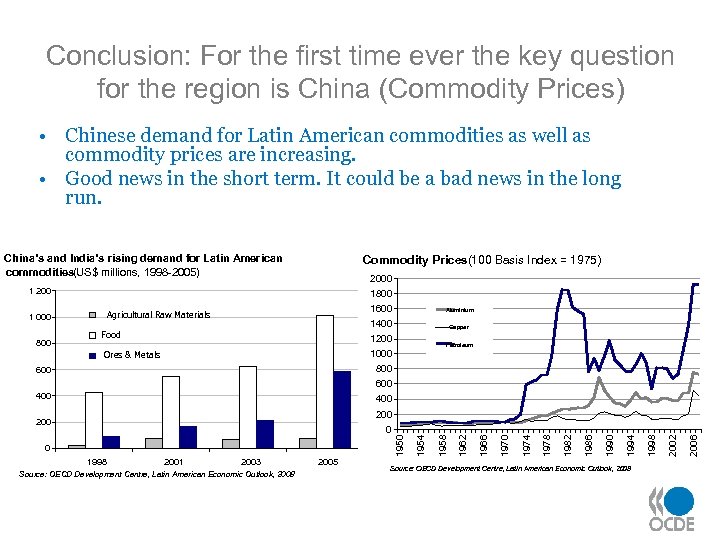

Conclusion: For the first time ever the key question for the region is China (Commodity Prices) • Chinese demand for Latin American commodities as well as commodity prices are increasing. • Good news in the short term. It could be a bad news in the long run. China’s and India’s rising demand for Latin American commodities(US$ millions, 1998 -2005) Commodity Prices(100 Basis Index = 1975) 2000 1 200 1800 1600 Food Aluminium 1400 Agricultural Raw Materials 1 000 Copper 1200 1000 Ores & Metals Petroleum 800 600 400 Source: OECD Development Centre, Latin American Economic Outlook, 2008 2006 2002 1998 1994 1990 1986 1982 1978 1974 2005 1970 2003 1966 2001 1962 1998 Source: OECD Development Centre, Latin American Economic Outlook, 2008 1958 0 1954 0 1950 200

Conclusion: For the first time ever the key question for the region is China (Commodity Prices) • Chinese demand for Latin American commodities as well as commodity prices are increasing. • Good news in the short term. It could be a bad news in the long run. China’s and India’s rising demand for Latin American commodities(US$ millions, 1998 -2005) Commodity Prices(100 Basis Index = 1975) 2000 1 200 1800 1600 Food Aluminium 1400 Agricultural Raw Materials 1 000 Copper 1200 1000 Ores & Metals Petroleum 800 600 400 Source: OECD Development Centre, Latin American Economic Outlook, 2008 2006 2002 1998 1994 1990 1986 1982 1978 1974 2005 1970 2003 1966 2001 1962 1998 Source: OECD Development Centre, Latin American Economic Outlook, 2008 1958 0 1954 0 1950 200

Latin American Economic Outlook 2008 www. oecd. org/dev/leo Thank you Merci Obrigado Gracias

Latin American Economic Outlook 2008 www. oecd. org/dev/leo Thank you Merci Obrigado Gracias