7feb2d8b56de4e98b6755edd759faca1.ppt

- Количество слайдов: 18

Latin America and the Global Crisis José De Gregorio Governor Central Bank of Chile CENTRAL BANK OF CHILE APRIL 24, 2009

Outline § Crisis’s Origins: Financial Regulation or Monetary Policy? § Inflation Developments § GDP Response and Prospects 2

Crisis’s Origins: Financial Regulation or Monetary Policy?

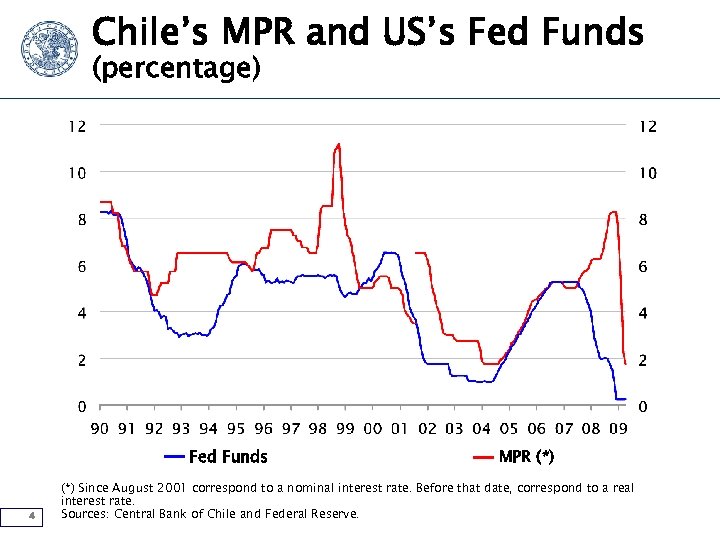

Chile’s MPR and US’s Fed Funds (percentage) Fed Funds 4 MPR (*) Since August 2001 correspond to a nominal interest rate. Before that date, correspond to a real interest rate. Sources: Central Bank of Chile and Federal Reserve.

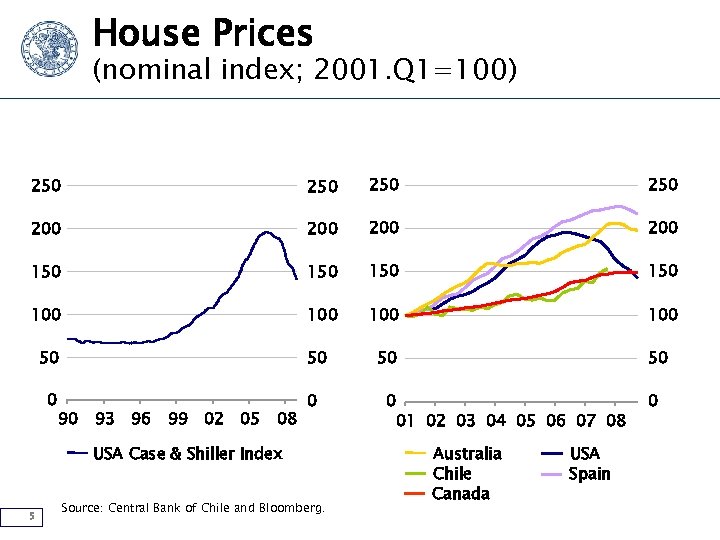

House Prices (nominal index; 2001. Q 1=100) 250 250 200 200 150 150 100 100 50 90 93 96 99 02 05 08 0 USA Case & Shiller Index 5 Source: Central Bank of Chile and Bloomberg. 50 01 02 03 04 05 06 07 08 Australia Chile Canada USA Spain 0

Issues on Financial Regulation and Innovation • Financial stability is insured by proper regulation and to a lesser extent by monetary policy. Low interest rates and abundant liquidity are necessary but not sufficient to generate financial instability. • The perils of securitization: what are the incentives for screening and monitoring mortgage loans? How to reap the potential benefits of risk sharing without increasing overall risk? • The extent of regulation: move beyond regulating institutions that depend on public trust and guarantees, to institutions that can threaten financial stability. • Relearn the lessons of the early 20 th century, before the creation of the FED: liquidity transformation is inherently risky without some form of systemic liquidity insurance. 6

Inflation Developments

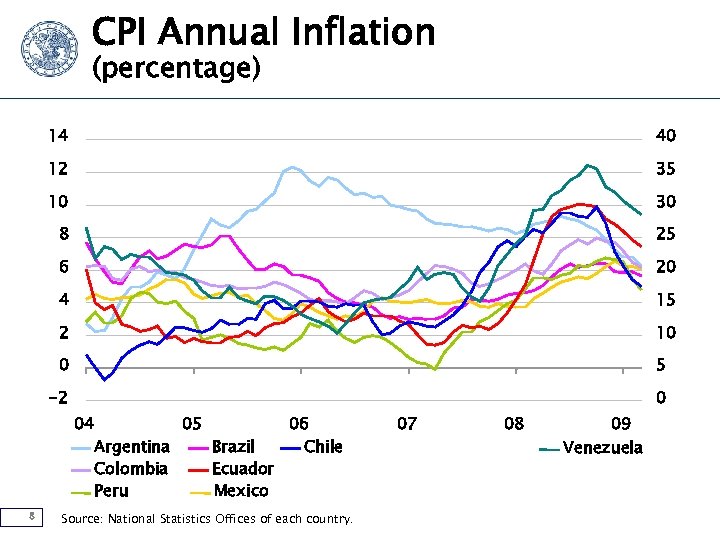

CPI Annual Inflation (percentage) 14 40 12 35 10 30 8 25 6 20 4 15 2 10 0 5 -2 0 04 05 06 Chile Argentina Brazil Colombia Ecuador Peru Mexico 8 Source: National Statistics Offices of each country. 07 08 09 Venezuela

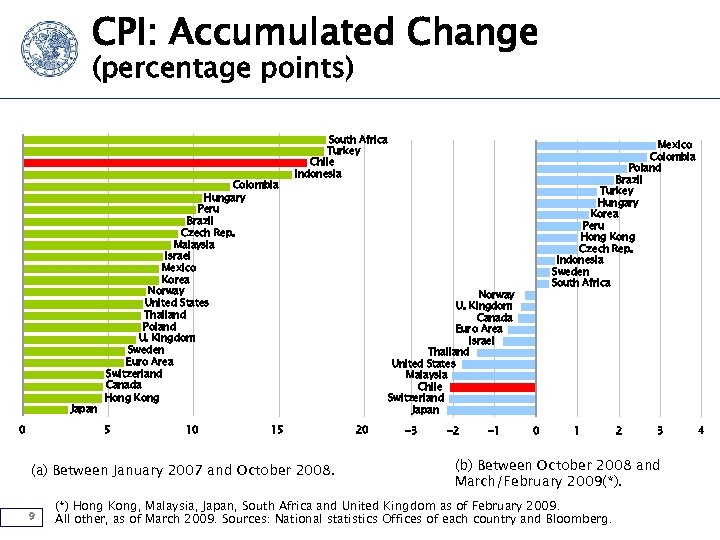

CPI: Accumulated Change (percentage points) Japan 0 Colombia Hungary Peru Brazil Czech Rep. Malaysia Israel Mexico Korea Norway United States Thailand Poland U. Kingdom Sweden Euro Area Switzerland Canada Hong Kong 5 10 South Africa Turkey Chile Indonesia 15 (a) Between January 2007 and October 2008. 9 Mexico Colombia Poland Brazil Turkey Hungary Korea Peru Hong Kong Czech Rep. Indonesia Sweden South Africa Norway U. Kingdom Canada Euro Area Israel Thailand United States Malaysia Chile Switzerland Japan 20 -3 -2 -1 0 1 2 3 (b) Between October 2008 and March/February 2009(*). (*) Hong Kong, Malaysia, Japan, South Africa and United Kingdom as of February 2009. All other, as of March 2009. Sources: National statistics Offices of each country and Bloomberg. 4

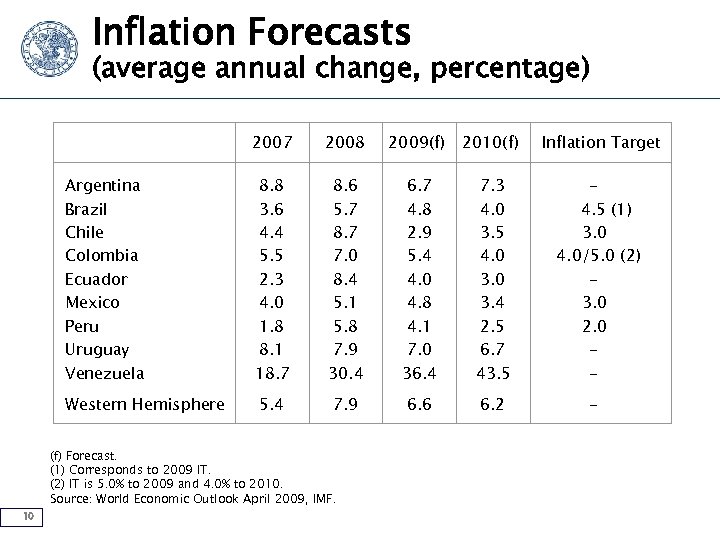

Inflation Forecasts (average annual change, percentage) 2007 2008 2009(f) 2010(f) Inflation Target Argentina Brazil Chile Colombia Ecuador Mexico Peru Uruguay Venezuela 8. 8 3. 6 4. 4 5. 5 2. 3 4. 0 1. 8 8. 1 18. 7 8. 6 5. 7 8. 7 7. 0 8. 4 5. 1 5. 8 7. 9 30. 4 6. 7 4. 8 2. 9 5. 4 4. 0 4. 8 4. 1 7. 0 36. 4 7. 3 4. 0 3. 5 4. 0 3. 4 2. 5 6. 7 43. 5 4. 5 (1) 3. 0 4. 0/5. 0 (2) 3. 0 2. 0 - Western Hemisphere 5. 4 7. 9 6. 6 6. 2 - (f) Forecast. (1) Corresponds to 2009 IT. (2) IT is 5. 0% to 2009 and 4. 0% to 2010. Source: World Economic Outlook April 2009, IMF. 10

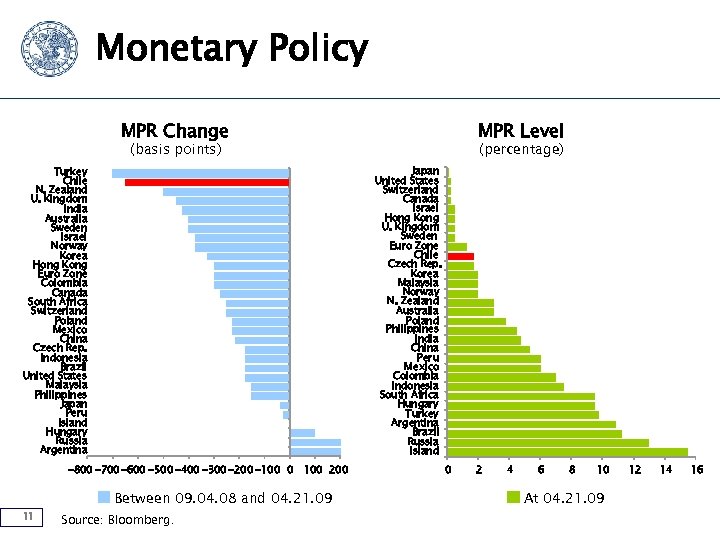

Monetary Policy MPR Change MPR Level (basis points) Japan United States Switzerland Canada Israel Hong Kong U. Kingdom Sweden Euro Zone Chile Czech Rep. Korea Malaysia Norway N. Zealand Australia Poland Philippines India China Peru Mexico Colombia Indonesia South Africa Hungary Turkey Argentina Brazil Russia Island Turkey Chile N. Zealand U. Kingdom India Australia Sweden Israel Norway Korea Hong Kong Euro Zone Colombia Canada South Africa Switzerland Poland Mexico China Czech Rep. Indonesia Brazil United States Malaysia Philippines Japan Peru Island Hungary Russia Argentina -800 -700 -600 -500 -400 -300 -200 -100 0 100 200 Between 09. 04. 08 and 04. 21. 09 11 (percentage) Source: Bloomberg. 0 2 4 6 8 10 At 04. 21. 09 12 14 16

GDP Response and Prospects

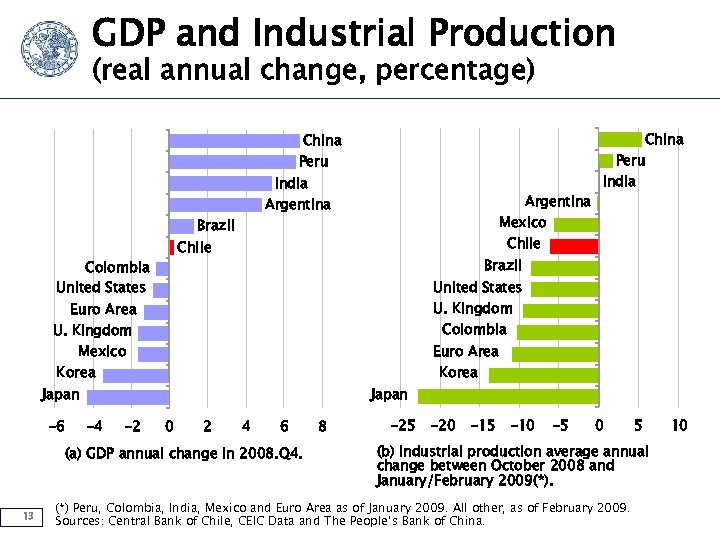

GDP and Industrial Production (real annual change, percentage) China Peru India Argentina Mexico Brazil Chile Colombia United States Brazil United States U. Kingdom Euro Area U. Kingdom Colombia Euro Area Korea Mexico Korea Japan -6 -4 -2 0 2 4 6 (a) GDP annual change in 2008. Q 4. 13 India 8 -25 -20 -15 -10 -5 0 5 (b) Industrial production average annual change between October 2008 and January/February 2009(*). (*) Peru, Colombia, India, Mexico and Euro Area as of January 2009. All other, as of February 2009. Sources: Central Bank of Chile, CEIC Data and The People’s Bank of China. 10

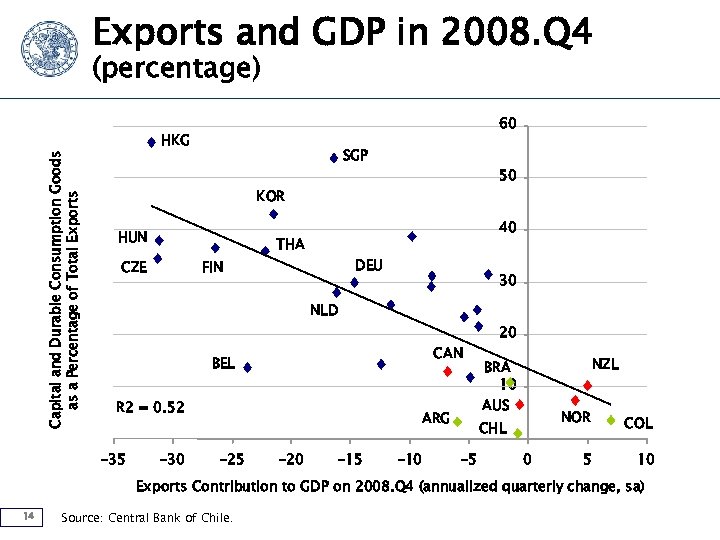

Exports and GDP in 2008. Q 4 (percentage) 60 Capital and Durable Consumption Goods as a Percentage of Total Exports HKG SGP 50 KOR HUN 40 THA CZE DEU FIN 30 NLD CAN BEL R 2 = 0. 52 -35 -30 -20 -15 -10 NZL BRA 10 AUS ARG -25 20 NOR CHL -5 0 COL 5 10 Exports Contribution to GDP on 2008. Q 4 (annualized quarterly change, sa) 14 Source: Central Bank of Chile.

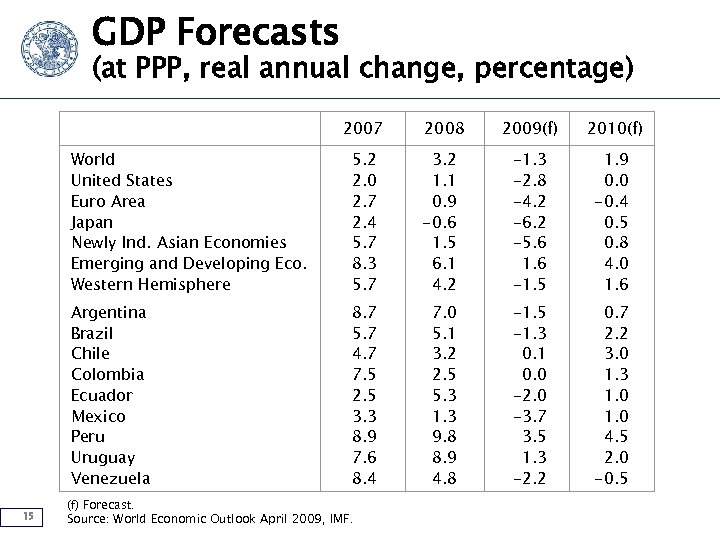

GDP Forecasts (at PPP, real annual change, percentage) 2007 2008 2009(f) 2010(f) World United States Euro Area Japan Newly Ind. Asian Economies Emerging and Developing Eco. Western Hemisphere 3. 2 1. 1 0. 9 -0. 6 1. 5 6. 1 4. 2 -1. 3 -2. 8 -4. 2 -6. 2 -5. 6 1. 6 -1. 5 1. 9 0. 0 -0. 4 0. 5 0. 8 4. 0 1. 6 Argentina Brazil Chile Colombia Ecuador Mexico Peru Uruguay Venezuela 15 5. 2 2. 0 2. 7 2. 4 5. 7 8. 3 5. 7 8. 7 5. 7 4. 7 7. 5 2. 5 3. 3 8. 9 7. 6 8. 4 7. 0 5. 1 3. 2 2. 5 5. 3 1. 3 9. 8 8. 9 4. 8 -1. 5 -1. 3 0. 1 0. 0 -2. 0 -3. 7 3. 5 1. 3 -2. 2 0. 7 2. 2 3. 0 1. 3 1. 0 4. 5 2. 0 -0. 5 (f) Forecast. Source: World Economic Outlook April 2009, IMF.

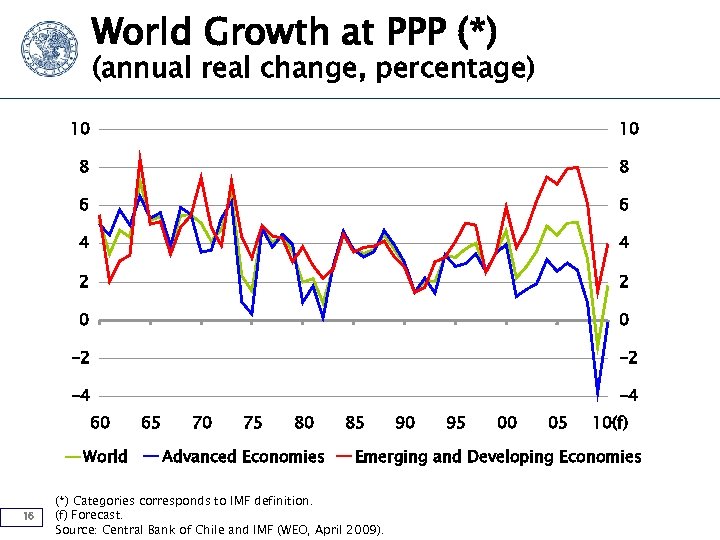

World Growth at PPP (*) (annual real change, percentage) 10 10 8 8 6 6 4 4 2 2 0 0 -2 -2 -4 -4 60 World 16 65 70 75 80 Advanced Economies 85 90 95 00 05 10(f) Emerging and Developing Economies (*) Categories corresponds to IMF definition. (f) Forecast. Source: Central Bank of Chile and IMF (WEO, April 2009).

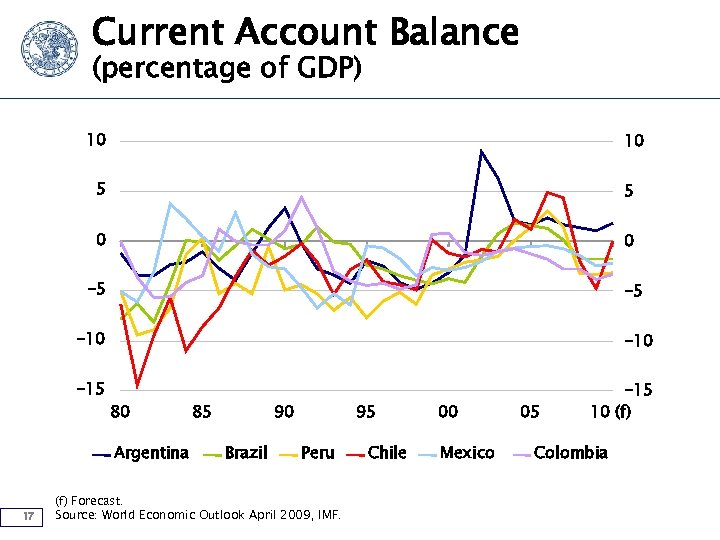

Current Account Balance (percentage of GDP) 10 10 5 5 0 0 -5 -5 -10 -15 10 (f) 80 Argentina 17 85 90 Brazil 95 Peru (f) Forecast. Source: World Economic Outlook April 2009, IMF. Chile 00 Mexico 05 Colombia

Latin America and the Global Crisis José De Gregorio Governor Central Bank of Chile CENTRAL BANK OF CHILE APRIL 24, 2009

7feb2d8b56de4e98b6755edd759faca1.ppt