e99a06c1e837828ab0db54f5df8f5a9b.ppt

- Количество слайдов: 17

Latest overview of RUB FX & MM & Derivative Markets Dmitry Piskulov, Ph. D. (Econ. ) Member of NFEA Management Board, Chairman of the Committee for Professionalism; ICAP , Senior Adviser Moscow, 26 Nov 2010 National Foreign Exchange Association, Russia 1

Where RUB markets? Markets in Russian Ruble denominated instruments • ON SHORE: only domestic (residents) • OFF-SHORE: only non-residents • ON-SHORE deals with OFF-SHORE: cross-border RUB transactions HOW GLOBAL IS RUB? Moscow, 26 Nov 2010 National Foreign Exchange Association, Russia 2

What RUB instruments • • • FX spot FX outright and FX swaps FX derivatives (NDFs, Options) Cash MM deposits REPOs Interest rate derivatives: (IRS, FRA, CCS, IRO) Statistics on average daily turnover (ADT) from BIS, Basel; Central Bank of Russia – CBR; UK FXJSC of Bank of England Moscow, 26 Nov 2010 National Foreign Exchange Association, Russia 3

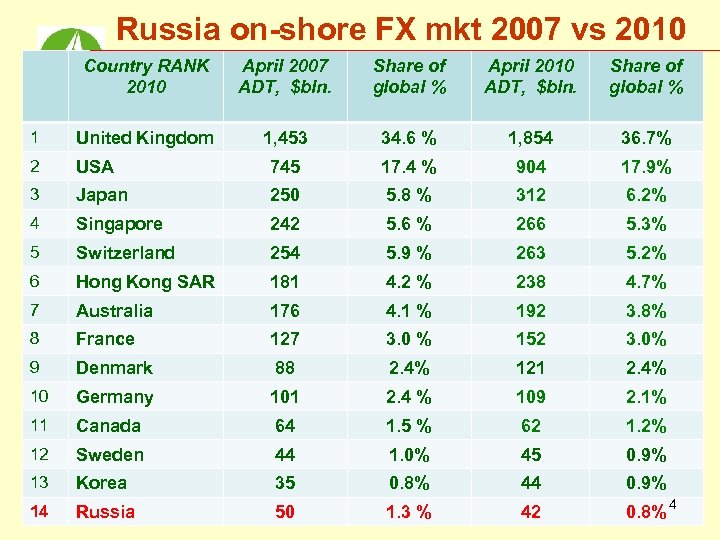

Russia on-shore FX mkt 2007 vs 2010 Country RANK 2010 April 2007 ADT, $bln. Share of global % April 2010 ADT, $bln. Share of global % 1 United Kingdom 1, 453 34. 6 % 1, 854 36. 7% 2 USA 745 17. 4 % 904 17. 9% 3 Japan 250 5. 8 % 312 6. 2% 4 Singapore 242 5. 6 % 266 5. 3% 5 Switzerland 254 5. 9 % 263 5. 2% 6 Hong Kong SAR 181 4. 2 % 238 4. 7% 7 Australia 176 4. 1 % 192 3. 8% 8 France 127 3. 0 % 152 3. 0% 9 Denmark 88 2. 4% 121 2. 4% 10 Germany 101 2. 4 % 109 2. 1% 11 Canada 64 1. 5 % 62 1. 2% 12 Sweden 44 1. 0% 45 0. 9% 13 Korea 35 0. 8% 44 0. 9% 14 Russia 50 1. 3 % 42 0. 8% 4

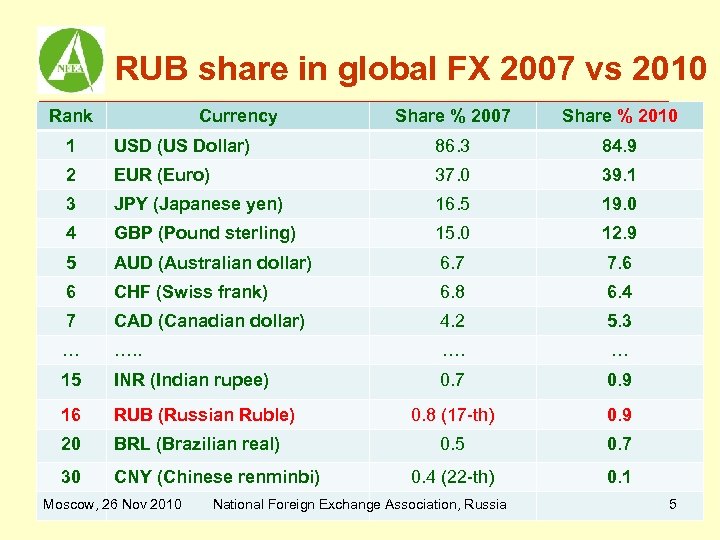

RUB share in global FX 2007 vs 2010 Rank Currency Share % 2007 Share % 2010 1 USD (US Dollar) 86. 3 84. 9 2 EUR (Euro) 37. 0 39. 1 3 JPY (Japanese yen) 16. 5 19. 0 4 GBP (Pound sterling) 15. 0 12. 9 5 AUD (Australian dollar) 6. 7 7. 6 6 CHF (Swiss frank) 6. 8 6. 4 7 CAD (Canadian dollar) 4. 2 5. 3 … …. . … 15 INR (Indian rupee) 0. 7 0. 9 16 RUB (Russian Ruble) 0. 8 (17 -th) 0. 9 20 BRL (Brazilian real) 0. 5 0. 7 30 CNY (Chinese renminbi) 0. 4 (22 -th) 0. 1 Moscow, 26 Nov 2010 National Foreign Exchange Association, Russia 5

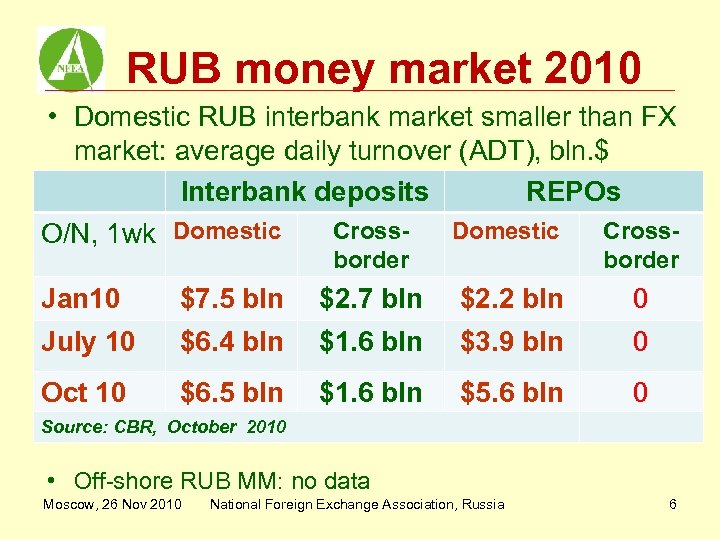

RUB money market 2010 • Domestic RUB interbank market smaller than FX market: average daily turnover (ADT), bln. $ Interbank deposits REPOs Cross. Domestic Cross. O/N, 1 wk Domestic border Jan 10 $7. 5 bln $2. 7 bln $2. 2 bln 0 July 10 $6. 4 bln $1. 6 bln $3. 9 bln 0 Oct 10 $6. 5 bln $1. 6 bln $5. 6 bln 0 Source: CBR, October 2010 • Off-shore RUB MM: no data Moscow, 26 Nov 2010 National Foreign Exchange Association, Russia 6

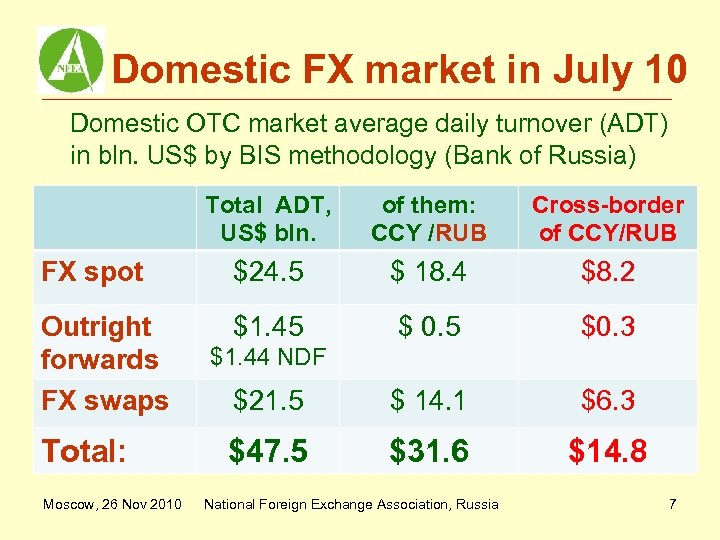

Domestic FX market in July 10 Domestic OTC market average daily turnover (ADT) in bln. US$ by BIS methodology (Bank of Russia) Total ADT, US$ bln. of them: CCY /RUB Cross-border of CCY/RUB FX spot $24. 5 $ 18. 4 $8. 2 Outright forwards FX swaps $1. 45 $ 0. 5 $0. 3 $21. 5 $ 14. 1 $6. 3 $47. 5 $31. 6 $14. 8 Total: Moscow, 26 Nov 2010 $1. 44 NDF National Foreign Exchange Association, Russia 7

FX on-shore interbank market in 2008 -10 Russian on-shore OTC FX average daily turnovers dropped in 2008 but stabilized in 2009 -2010 Month FX market volume MICEX Jul 2008 Apr 2009 Oct 2009 Feb 2010 Aug 2010 $ 119. 2 bln. $ 46. 2 bln. $ 54. 2 bln. $ 53. 4 bln $ 53. 8 bln $ 10. 5 bln. $ 9. 8 bln $10. 6 bln $10. 0 bln. $8. 8 bln. Oct 2010 $ 66. 7 bln. $11. 3 bln Moscow, 26 Nov 2010 National Foreign Exchange Association, Russia 8

RUB markets outside Russia • • Trading volumes(ADT) reported off-shore: FX instruments: $12 -13 bln. Money market instruments: $ 0. 5 -1 bln. Interest rate derivatives: $ 1 -2 bln. RUB bonds trading: $ 1 bln. Total (FX, MM, Der. ): $ 13. 5 -15 bln. Moscow, 26 Nov 2010 National Foreign Exchange Association, Russia 9

RUB markets outside Russia Main features: • More derivatives than cash products: on-shore cash pricing versus off-shore derivatives pricing • BUT: Cash products tend to rise quicker • Link Moscow-London (transactions done in Moscow in the name of London HO) • Number of banks (dealing codes): banks that entered RUB SSI and ready to deal): – Active: 60 (already dealt) – Potential: 181 (entered RUB SSI) Moscow, 26 Nov 2010 - National Foreign Exchange Association, Russia 10

RUB instruments outside Russia More RUB derivatives than cash products but cash products are rising • Cash: FX swaps, FX spot, cash deposits, RUB bonds (NEW) • Derivatives and CFDs: • NDFs & Outright forwards • FX options • Interest rate and XCY swaps • Forward rate agreement (FRA) • Overnight indexed swaps - OIS (NEW) – from 08/09/10 Moscow, 26 Nov 2010 National Foreign Exchange Association, Russia 11

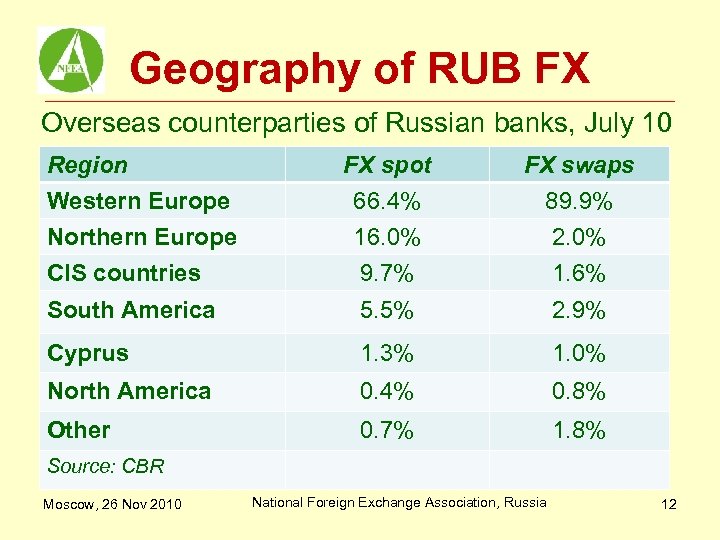

Geography of RUB FX Overseas counterparties of Russian banks, July 10 Region Western Europe Northern Europe CIS countries FX spot 66. 4% 16. 0% 9. 7% FX swaps 89. 9% 2. 0% 1. 6% South America 5. 5% 2. 9% Cyprus 1. 3% 1. 0% North America 0. 4% 0. 8% Other 0. 7% 1. 8% Source: CBR Moscow, 26 Nov 2010 National Foreign Exchange Association, Russia 12

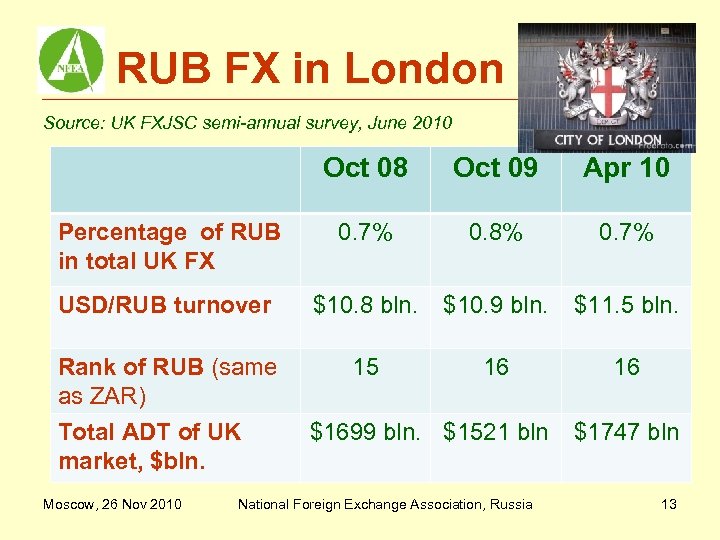

RUB FX in London Source: UK FXJSC semi-annual survey, June 2010 Oct 08 Oct 09 Apr 10 Percentage of RUB in total UK FX 0. 7% 0. 8% 0. 7% USD/RUB turnover $10. 8 bln. $10. 9 bln. $11. 5 bln. Rank of RUB (same as ZAR) Total ADT of UK market, $bln. 15 16 16 Moscow, 26 Nov 2010 $1699 bln. $1521 bln National Foreign Exchange Association, Russia $1747 bln 13

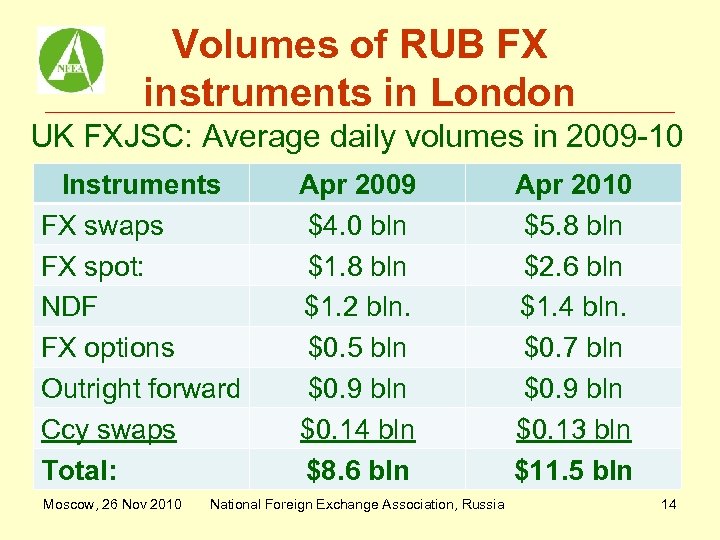

Volumes of RUB FX instruments in London UK FXJSC: Average daily volumes in 2009 -10 Instruments FX swaps FX spot: NDF FX options Outright forward Ccy swaps Total: Moscow, 26 Nov 2010 Apr 2009 $4. 0 bln $1. 8 bln $1. 2 bln. $0. 5 bln $0. 9 bln $0. 14 bln $8. 6 bln National Foreign Exchange Association, Russia Apr 2010 $5. 8 bln $2. 6 bln $1. 4 bln. $0. 7 bln $0. 9 bln $0. 13 bln $11. 5 bln 14

Challenges for authorities 1. Monitoring of round-the clock RUB FX quotes (also at night time in Moscow) 2. Support of RUB instruments in global electronic trading platforms (such as EBS, Reuters, Bloomberg etc. ) – possibility to establish the band 3. Direct access to RUB FOREX and RUB bonds in MICEX foreigners 4. Removal of obstacles in RUB clearing and settlements – - RTGS (BESP of CBR) - CLS Bank clearing currency(next to ZAR, MXN): Moscow, 26 Nov 2010 National Foreign Exchange Association, Russia 15

About NFEA • • • Established: October 1999 in Moscow as non-commercial organization; Membership: legal entities (local and global banks and brokers) operating in Russian spot/forward foreign exchange , money markets and derivatives; Management: the Board (28 market practitioners), 4 co-chairmen, 3 Committees (on Market Indices; for Professionalism, Ethics & Education; on Legal Affairs) Projects up to date: – 1999 -2001, 2006: Elaboration of Standards (Code of Conduct and Rules to Conduct Operations (Committee for Professionalism, Ethics & Education), – Market indices: Mos. Prime Rate (2005, RUB money market reference rate), NFEA FX SWAP RATE – new index for USD/RUB and EUR/RUB forwards - Standard Documentation for Russian OTC derivatives transactions (Russian analogue of ISDA Agreement) – completed in 2009 - RUONIA – Russian analogue of EONIA (since Sept 2010) International cooperation and working contacts: - ACI-The Financial Markets Association - ISDA (inclusion of Mos. Prime rate into ISDA definitions 2006) Moscow, 26 Nov 2010 National Foreign Exchange Association, Russia 16

Contact Details 13 Bolshoy Kislovskiy Per. , Moscow, 125009, Russia, Tel. +7 (495) 705 -9693, Fax: +7(495) 705 -9675. www. nva. ru, www. nfea. ru @ The Copyright National Foreign Exchange Association, 2008. All rights reserved. Any reproduction is only permitted with prior consent of NFEA. Moscow, 26 Nov 2010 National Foreign Exchange Association, Russia 17

e99a06c1e837828ab0db54f5df8f5a9b.ppt