a9e9671d5adb9f7eab7f7e44b195e775.ppt

- Количество слайдов: 32

LATEST NEWS ON HEALTHCARE REFORM AND ITS IMPLICATIONS FOR STATES ALABAMA STATE BAR HEALTH LAW SECTION LUNCH & LEARN SERIES Tuesday, May 25, 2010 Balch & Bingham LLP – Assembly Room – 15 th Floor 1

LATEST NEWS ON HEALTHCARE REFORM AND ITS IMPLICATIONS FOR STATES ALABAMA STATE BAR HEALTH LAW SECTION LUNCH & LEARN SERIES Tuesday, May 25, 2010 Balch & Bingham LLP – Assembly Room – 15 th Floor 1

Latest News in Healthcare Reform: A Big Deal 2

Latest News in Healthcare Reform: A Big Deal 2

American Health Lawyers Association Healthcare Reform Legal Essentials 3

American Health Lawyers Association Healthcare Reform Legal Essentials 3

Consolidated Patient Protection and Affordability Act and Health Care and Education Reconciliation Act of 2010 4

Consolidated Patient Protection and Affordability Act and Health Care and Education Reconciliation Act of 2010 4

AHLA Healthcare Reform Discussion List 5

AHLA Healthcare Reform Discussion List 5

Healthcare Reform: The Law and Its Implications 6

Healthcare Reform: The Law and Its Implications 6

Healthcare Reform: The Law and Its Implications - Agenda 7

Healthcare Reform: The Law and Its Implications - Agenda 7

What AHLA Program Covered • Panel Discussions – – • Payment System Reform: Commercial Insurance Reform Constitutional Challenges to Health Insurance Reform The Practical Impact of Payment System Reform on the Marketplace Delivery System Reform: New Care Delivery, Quality, Efficiency, and Health Personnel Initiatives Drill Down Sessions – Implications for Insurers and Health Plans – The Impact of Healthcare Reform Legislation on Medicare, Medicaid and CHIP – Fraud and Abuse in Healthcare Reform: Will You Know It When They See It? – Toward Accountable Care: How Healthcare Reform will Shape Provider Integration – Implications for Hospitals and Health Systems – Implications for Sub-Acute, Home Care, Rehab and Nursing Home Providers – Impact on Life Sciences — Focusing on Drugs and Pharma Issues – The Winds of Change – Health Reform and the Future of Physician Practices 8

What AHLA Program Covered • Panel Discussions – – • Payment System Reform: Commercial Insurance Reform Constitutional Challenges to Health Insurance Reform The Practical Impact of Payment System Reform on the Marketplace Delivery System Reform: New Care Delivery, Quality, Efficiency, and Health Personnel Initiatives Drill Down Sessions – Implications for Insurers and Health Plans – The Impact of Healthcare Reform Legislation on Medicare, Medicaid and CHIP – Fraud and Abuse in Healthcare Reform: Will You Know It When They See It? – Toward Accountable Care: How Healthcare Reform will Shape Provider Integration – Implications for Hospitals and Health Systems – Implications for Sub-Acute, Home Care, Rehab and Nursing Home Providers – Impact on Life Sciences — Focusing on Drugs and Pharma Issues – The Winds of Change – Health Reform and the Future of Physician Practices 8

U. S. Healthcare Reform: The Law and Its Implications 9

U. S. Healthcare Reform: The Law and Its Implications 9

Goals of Health Care Reform • Where We Were - 46 Million uninsured 25 million underinsured Insureds bear cost of uninsured Providers and suppliers cost shift to accommodate treating of uninsured - Insureds pay higher premiums - Small group and individual coverage expensive/not available 10

Goals of Health Care Reform • Where We Were - 46 Million uninsured 25 million underinsured Insureds bear cost of uninsured Providers and suppliers cost shift to accommodate treating of uninsured - Insureds pay higher premiums - Small group and individual coverage expensive/not available 10

Goals of Health Care Reform • Where Health Care Reform Proposes to Take Us – Affordable commercial insurance • • Continuation of employer-sponsored group market Subsidies for individuals and small businesses Subsidies for 55 -64 age group Premium regulation – Coverage for U. S. residents • Minimum essential coverage • New individual and group plans: qualified plans • Rights for patients – Introduce competition into insurance market • The Exchanges 11

Goals of Health Care Reform • Where Health Care Reform Proposes to Take Us – Affordable commercial insurance • • Continuation of employer-sponsored group market Subsidies for individuals and small businesses Subsidies for 55 -64 age group Premium regulation – Coverage for U. S. residents • Minimum essential coverage • New individual and group plans: qualified plans • Rights for patients – Introduce competition into insurance market • The Exchanges 11

IMPLICATIONS FOR STATES 12

IMPLICATIONS FOR STATES 12

American Health Lawyers Association – Healthcare Reform Educational Task Force 13

American Health Lawyers Association – Healthcare Reform Educational Task Force 13

Robert Wood Johnson Foundation 14

Robert Wood Johnson Foundation 14

What Can We Learn from Massachusetts? 15

What Can We Learn from Massachusetts? 15

Implications for States - Is Massachusetts a Poster Child for the Remaining 49? • Massachusetts’ Goals – Access • Individual Mandate – 98% compliance evidenced by taxpayer filings • • Insurance reform Public Subsidies Employer contribution Model for insurance exchanges – Cost Controls • Not there in Massachusetts • $65 B spent on health care • Lessons Learned from Massachusetts - Must have public support - Political campaign - Prepare for implementation challenges - Coordinated multi-million dollar campaign (privately sponsored): outreach meetings, strong customer service phone bank, media outreach, direct mail, seminars/forums, paid advertising, grants to community organizations 16

Implications for States - Is Massachusetts a Poster Child for the Remaining 49? • Massachusetts’ Goals – Access • Individual Mandate – 98% compliance evidenced by taxpayer filings • • Insurance reform Public Subsidies Employer contribution Model for insurance exchanges – Cost Controls • Not there in Massachusetts • $65 B spent on health care • Lessons Learned from Massachusetts - Must have public support - Political campaign - Prepare for implementation challenges - Coordinated multi-million dollar campaign (privately sponsored): outreach meetings, strong customer service phone bank, media outreach, direct mail, seminars/forums, paid advertising, grants to community organizations 16

Mandated Changes in States’ Regulation of Individual and Group Insurance Markets • Insurance Market Reform – Effective for plan years beginning on/after 9/23/10 • • • Elimination of lifetime benefit caps Restrictions on plan rescission Coverage of preventive care Extension of coverage for children through age 25 and up to the age 26 Standards for preparing summaries of plan benefits – Effective for plan years beginning on/after 1/1/14 • • • Guaranteed issue and renewal Elimination of annual benefit caps Premium rating reforms Elimination of pre-existing condition exclusions Minimum coverage and cost-sharing design standards for individual/small group markets • Restrictions on coverage waiting periods in excess of 90 days 17

Mandated Changes in States’ Regulation of Individual and Group Insurance Markets • Insurance Market Reform – Effective for plan years beginning on/after 9/23/10 • • • Elimination of lifetime benefit caps Restrictions on plan rescission Coverage of preventive care Extension of coverage for children through age 25 and up to the age 26 Standards for preparing summaries of plan benefits – Effective for plan years beginning on/after 1/1/14 • • • Guaranteed issue and renewal Elimination of annual benefit caps Premium rating reforms Elimination of pre-existing condition exclusions Minimum coverage and cost-sharing design standards for individual/small group markets • Restrictions on coverage waiting periods in excess of 90 days 17

Mandated Changes in States’ Regulation of Individual and Group Insurance Markets • Insurance Market Reform – Role of States • Develop mechanism for applying reforms to insurance plans licensed to operate within states’ jurisdictions • Includes plans offered by state-sponsored Health Insurance Exchanges – Role of Secretary of Health and Human Services • Take necessary actions to ensure implementation 18

Mandated Changes in States’ Regulation of Individual and Group Insurance Markets • Insurance Market Reform – Role of States • Develop mechanism for applying reforms to insurance plans licensed to operate within states’ jurisdictions • Includes plans offered by state-sponsored Health Insurance Exchanges – Role of Secretary of Health and Human Services • Take necessary actions to ensure implementation 18

Mandated Changes in States’ Regulation of Individual and Group Insurance Markets • Health Insurance Exchanges – Must be operational 1/1/14 or Secretary will establish federally administered Exchange – Must be financially self-sustaining by 1/1/15 – Operated by state agency or non-for-profit entity established by state – May contract with entities (not insurance company or affiliate) to carry out one or more functions – May charge assessments or user fees to participating health plans – Must offer Qualified Health Plans (QHPs) in non-group/small group (100 or fewer employees) beginning in 2014 – May offer large group coverage (more than 100 employees) beginning in 2017 19

Mandated Changes in States’ Regulation of Individual and Group Insurance Markets • Health Insurance Exchanges – Must be operational 1/1/14 or Secretary will establish federally administered Exchange – Must be financially self-sustaining by 1/1/15 – Operated by state agency or non-for-profit entity established by state – May contract with entities (not insurance company or affiliate) to carry out one or more functions – May charge assessments or user fees to participating health plans – Must offer Qualified Health Plans (QHPs) in non-group/small group (100 or fewer employees) beginning in 2014 – May offer large group coverage (more than 100 employees) beginning in 2017 19

Mandated Changes in States’ Regulation of Individual and Group Insurance Markets • Health Insurance Exchanges – Must establish Small Business Health Option Programs to assist small businesses enroll their employees in participating QHPs – Must certify that health plan meets number of qualifying criteria to be offered through Exchange • Includes benefit design and cost-sharing requirements, marketing rules, provider network sufficiency, accreditation by Secretary-approved quality assurance entity, use of standard forms – QHPs not bound by state benefit mandates – unless State pays additional cost of such coverage for individuals receiving federal premium or cost-sharing subsidies 20

Mandated Changes in States’ Regulation of Individual and Group Insurance Markets • Health Insurance Exchanges – Must establish Small Business Health Option Programs to assist small businesses enroll their employees in participating QHPs – Must certify that health plan meets number of qualifying criteria to be offered through Exchange • Includes benefit design and cost-sharing requirements, marketing rules, provider network sufficiency, accreditation by Secretary-approved quality assurance entity, use of standard forms – QHPs not bound by state benefit mandates – unless State pays additional cost of such coverage for individuals receiving federal premium or cost-sharing subsidies 20

Mandated Changes in States’ Regulation of Individual and Group Insurance Markets • Health Insurance Exchanges – Not required to contract with plan that refuses to accept “generally applicable payment rates” – May not exclude plan “through imposition of premium price controls” but must consider “patterns or practices of excessive or unjustified premium increases” – May operate in more than one state – May be more than one Exchange per state 21

Mandated Changes in States’ Regulation of Individual and Group Insurance Markets • Health Insurance Exchanges – Not required to contract with plan that refuses to accept “generally applicable payment rates” – May not exclude plan “through imposition of premium price controls” but must consider “patterns or practices of excessive or unjustified premium increases” – May operate in more than one state – May be more than one Exchange per state 21

Medicaid Expansion - 2014 • Expansion of Coverage – Up to 133% of Federal Poverty Level for working adults • $14, 404 for individual and $29, 326 for family of four in 2009 – Employees eligible for Medicaid are not eligible for Exchange-based subsidy – Mississippi Medicaid enrollees will increase by 400, 000 22

Medicaid Expansion - 2014 • Expansion of Coverage – Up to 133% of Federal Poverty Level for working adults • $14, 404 for individual and $29, 326 for family of four in 2009 – Employees eligible for Medicaid are not eligible for Exchange-based subsidy – Mississippi Medicaid enrollees will increase by 400, 000 22

Payment System Reform: Commercial Insurance Reform “It is not the strongest of the species that survive, nor the most intelligent, but the one most responsive to change. ” - Author Unknown 23

Payment System Reform: Commercial Insurance Reform “It is not the strongest of the species that survive, nor the most intelligent, but the one most responsive to change. ” - Author Unknown 23

Payment System Reform: Commercial Insurance Reform • “In five decades, what the government has scripted is not what has happened…”’ – Evidence – PPS and explosion of outpatient services • Is federal timetable for commercial insurance reform – but active political component is not part of PPACA – Governors and lawsuits • Tectonic changes in 2014 – Individual mandate – Medicaid expansion – State exchanges • Between now and 2014 – Marketplace will be interpreting regulatory reforms 24

Payment System Reform: Commercial Insurance Reform • “In five decades, what the government has scripted is not what has happened…”’ – Evidence – PPS and explosion of outpatient services • Is federal timetable for commercial insurance reform – but active political component is not part of PPACA – Governors and lawsuits • Tectonic changes in 2014 – Individual mandate – Medicaid expansion – State exchanges • Between now and 2014 – Marketplace will be interpreting regulatory reforms 24

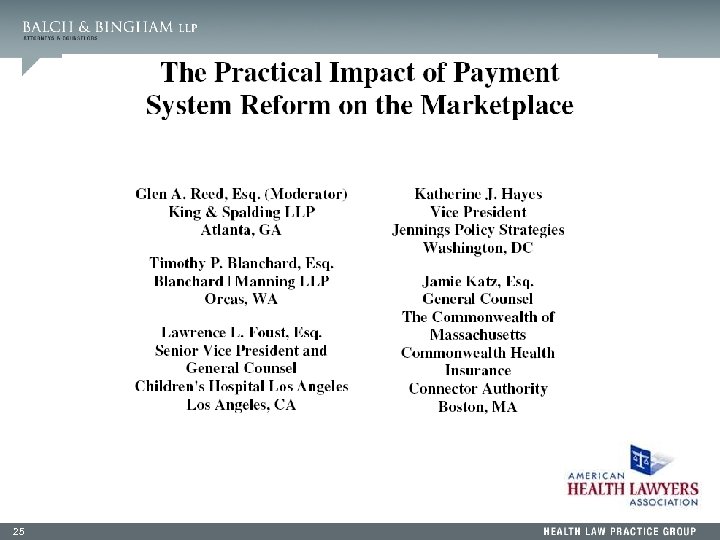

Implications for State Industries – Hospitals and Physicians as Employers • Large Employers • Small Employers 25

Implications for State Industries – Hospitals and Physicians as Employers • Large Employers • Small Employers 25

The Practical Impact of Payment System Reform on Marketplace • Comments regarding Insurers – Exchanges likely to drive carriers to more standardization – Travelocity/Expedia – good examples of Exchanges – More regulation of state insurance products, more rate setting for insurance as costs of premiums increase – More efforts to end state corporate practice of medicine restrictions – Will be more transparency in accounting for premium costs – Because insurers’ tools to deal with risks are being taken away, insurers will resort more to medical necessity issue and benefit plan issues – Buy insurance company stock! – Attorneys should bone up on managed care contracting skills – will be moving to case rates, capitation – economic squeezing – Many aspects of reform increase costs – costs will be passed along to maintain solvency of insurers – Insurance requirements primarily about solvency – keeping rates sufficiently high – Massachusetts’ Connector counsel mentions open meeting and public documents issues incident to Massachusetts Connector business negotiations 26

The Practical Impact of Payment System Reform on Marketplace • Comments regarding Insurers – Exchanges likely to drive carriers to more standardization – Travelocity/Expedia – good examples of Exchanges – More regulation of state insurance products, more rate setting for insurance as costs of premiums increase – More efforts to end state corporate practice of medicine restrictions – Will be more transparency in accounting for premium costs – Because insurers’ tools to deal with risks are being taken away, insurers will resort more to medical necessity issue and benefit plan issues – Buy insurance company stock! – Attorneys should bone up on managed care contracting skills – will be moving to case rates, capitation – economic squeezing – Many aspects of reform increase costs – costs will be passed along to maintain solvency of insurers – Insurance requirements primarily about solvency – keeping rates sufficiently high – Massachusetts’ Connector counsel mentions open meeting and public documents issues incident to Massachusetts Connector business negotiations 26

The Practical Impact of Payment System Reform on Marketplace • Comments regarding Employers – Employers will be rational – will calculate costs if more than 25 employees – On the other hand, may be confusing for small employers: large employers have HR departments; smaller at mercy of federal government/consultants – Elements in legislation that challenge paradigm of employer provided insurance – Rules indicate OK not to provide health care insurance – Many employers see insurance as way to attract employees – Workers will want to adhere to employer-based systems 27

The Practical Impact of Payment System Reform on Marketplace • Comments regarding Employers – Employers will be rational – will calculate costs if more than 25 employees – On the other hand, may be confusing for small employers: large employers have HR departments; smaller at mercy of federal government/consultants – Elements in legislation that challenge paradigm of employer provided insurance – Rules indicate OK not to provide health care insurance – Many employers see insurance as way to attract employees – Workers will want to adhere to employer-based systems 27

The Practical Impact of Payment System Reform on Marketplace • Comments regarding Individuals – Regulations will be confusing for all – Will continue to be some free riders – For individuals under 133% FPL – Medicaid coverage • Stigma – individuals may push back – Sliding scale subsidy: 133 -400% FPL • Lowest benefit plan – Individuals will pay penalty, wait till need insurance – because guaranteed issue and perhaps subsidy – Free choice certificate: person may have 7 -8 choices 28

The Practical Impact of Payment System Reform on Marketplace • Comments regarding Individuals – Regulations will be confusing for all – Will continue to be some free riders – For individuals under 133% FPL – Medicaid coverage • Stigma – individuals may push back – Sliding scale subsidy: 133 -400% FPL • Lowest benefit plan – Individuals will pay penalty, wait till need insurance – because guaranteed issue and perhaps subsidy – Free choice certificate: person may have 7 -8 choices 28

The Practical Impact of Payment System Reform on Marketplace • Comments regarding Physicians – Many male physicians will abandon practice to women – Paying off educational loans – lengthy process – As employers, will not reach 100% insured • Some will find cheaper to let employees go to Exchanges – Physician payment not subject to Independent Payment Advisory Board before 2015 – bad in short term – Some political will to stay course – but will be elections 29

The Practical Impact of Payment System Reform on Marketplace • Comments regarding Physicians – Many male physicians will abandon practice to women – Paying off educational loans – lengthy process – As employers, will not reach 100% insured • Some will find cheaper to let employees go to Exchanges – Physician payment not subject to Independent Payment Advisory Board before 2015 – bad in short term – Some political will to stay course – but will be elections 29

The Practical Impact of Payment System Reform on Marketplace • Comments regarding Providers – Will be back to basics, innovation, anticipation of “hits” • Hits: Independent Payment Advisory Board • Innovation: pilot programs – Pressure to control costs • Data more important • Compliance more important • Payor contracting important – Need to work out relationship with physicians – Will be difficult to get into ACOs – Next few years dynamic – should not make long term commitments 30

The Practical Impact of Payment System Reform on Marketplace • Comments regarding Providers – Will be back to basics, innovation, anticipation of “hits” • Hits: Independent Payment Advisory Board • Innovation: pilot programs – Pressure to control costs • Data more important • Compliance more important • Payor contracting important – Need to work out relationship with physicians – Will be difficult to get into ACOs – Next few years dynamic – should not make long term commitments 30

AHLA ANNUAL MEETING – 2010 Seattle, Washington 31

AHLA ANNUAL MEETING – 2010 Seattle, Washington 31

THANK YOU!!! Dinetia M. Newman Balch & Bingham LLP 401 East Capitol Street, Suite 200 Jackson, MS 39201 Telephone: (601) 965 -8169 Email: dnewman@balch. com 32

THANK YOU!!! Dinetia M. Newman Balch & Bingham LLP 401 East Capitol Street, Suite 200 Jackson, MS 39201 Telephone: (601) 965 -8169 Email: dnewman@balch. com 32