055c9c34337e2228b3fb74e4dac69399.ppt

- Количество слайдов: 12

LARS JONUNG LESSONS FROM FINANCIAL INTEGRATION AND FINANCIAL CRISES IN SCANDINAVIA David G Mayes University of Auckland Bank of Finland

LARS JONUNG LESSONS FROM FINANCIAL INTEGRATION AND FINANCIAL CRISES IN SCANDINAVIA David G Mayes University of Auckland Bank of Finland

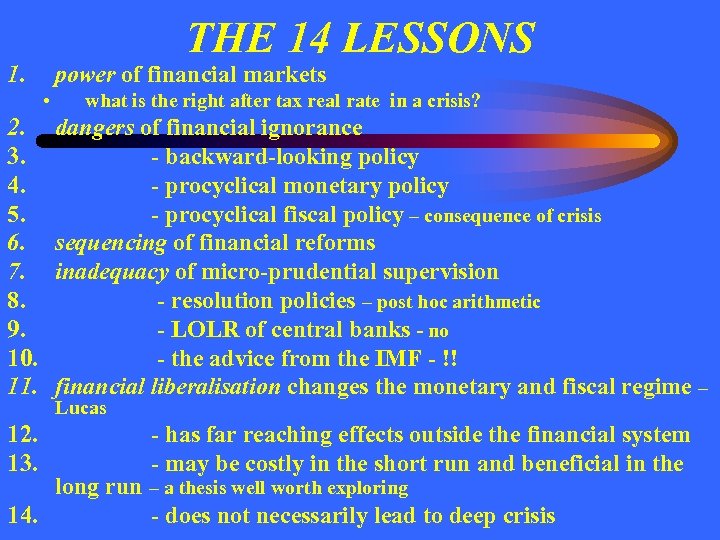

THE 14 LESSONS 1. power of financial markets • 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. what is the right after tax real rate in a crisis? dangers of financial ignorance - backward-looking policy - procyclical monetary policy - procyclical fiscal policy – consequence of crisis sequencing of financial reforms inadequacy of micro-prudential supervision - resolution policies – post hoc arithmetic - LOLR of central banks - no - the advice from the IMF - !! financial liberalisation changes the monetary and fiscal regime – Lucas - has far reaching effects outside the financial system - may be costly in the short run and beneficial in the long run – a thesis well worth exploring 14. - does not necessarily lead to deep crisis

THE 14 LESSONS 1. power of financial markets • 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. what is the right after tax real rate in a crisis? dangers of financial ignorance - backward-looking policy - procyclical monetary policy - procyclical fiscal policy – consequence of crisis sequencing of financial reforms inadequacy of micro-prudential supervision - resolution policies – post hoc arithmetic - LOLR of central banks - no - the advice from the IMF - !! financial liberalisation changes the monetary and fiscal regime – Lucas - has far reaching effects outside the financial system - may be costly in the short run and beneficial in the long run – a thesis well worth exploring 14. - does not necessarily lead to deep crisis

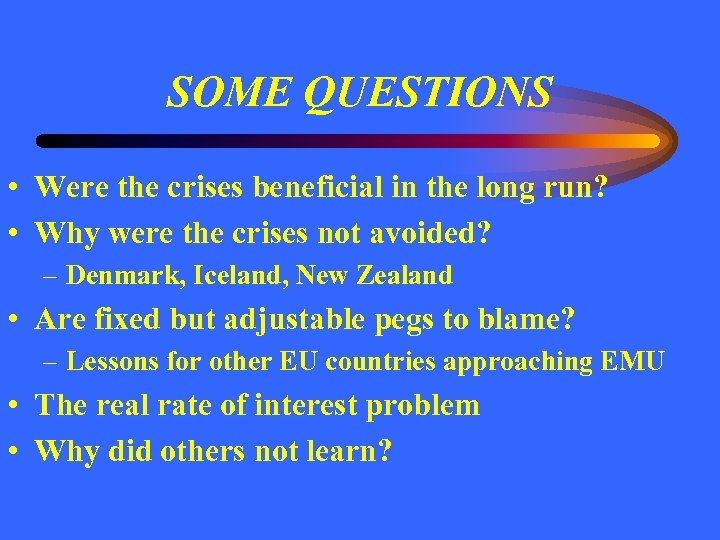

SOME QUESTIONS • Were the crises beneficial in the long run? • Why were the crises not avoided? – Denmark, Iceland, New Zealand • Are fixed but adjustable pegs to blame? – Lessons for other EU countries approaching EMU • The real rate of interest problem • Why did others not learn?

SOME QUESTIONS • Were the crises beneficial in the long run? • Why were the crises not avoided? – Denmark, Iceland, New Zealand • Are fixed but adjustable pegs to blame? – Lessons for other EU countries approaching EMU • The real rate of interest problem • Why did others not learn?

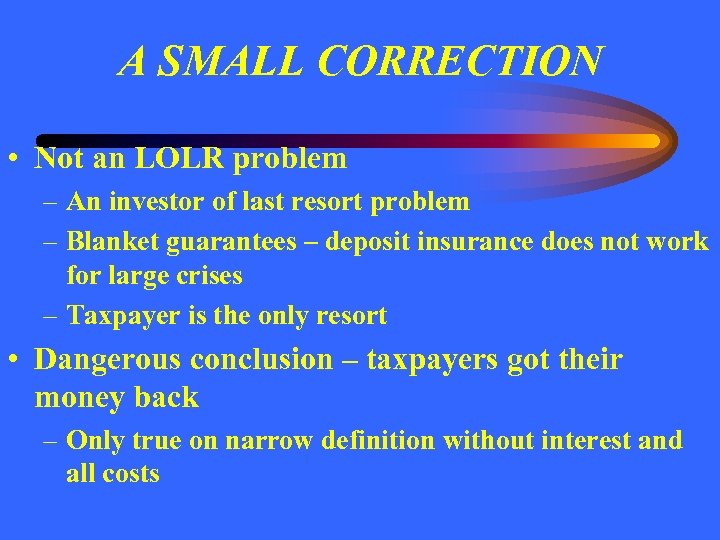

A SMALL CORRECTION • Not an LOLR problem – An investor of last resort problem – Blanket guarantees – deposit insurance does not work for large crises – Taxpayer is the only resort • Dangerous conclusion – taxpayers got their money back – Only true on narrow definition without interest and all costs

A SMALL CORRECTION • Not an LOLR problem – An investor of last resort problem – Blanket guarantees – deposit insurance does not work for large crises – Taxpayer is the only resort • Dangerous conclusion – taxpayers got their money back – Only true on narrow definition without interest and all costs

WHY WERE THE CRISES NOT AVOIDED? • The example of Denmark – Stronger banking supervision – More measured deregulation – Better timing BUT serious problems • The example of New Zealand – Studies of problems of deregulation (Hunn et al, 1989) – Strong advice to the banks – Mistake of pragmatic ordering but exchnage rate flexibility first

WHY WERE THE CRISES NOT AVOIDED? • The example of Denmark – Stronger banking supervision – More measured deregulation – Better timing BUT serious problems • The example of New Zealand – Studies of problems of deregulation (Hunn et al, 1989) – Strong advice to the banks – Mistake of pragmatic ordering but exchnage rate flexibility first

WHY WERE THE CRISES NOT AVOIDED? • Iceland 2000/1 – lucky not to make the same mistake – Privatisation – High household indebtedness (130% income) – House price inflation

WHY WERE THE CRISES NOT AVOIDED? • Iceland 2000/1 – lucky not to make the same mistake – Privatisation – High household indebtedness (130% income) – House price inflation

BENEFICIAL IN THE LONG RUN? • • Are shocks needed? Schumpeter? Can adjust to gradual pressure New Zealand in 1984 Need window of political opportunity – There is no alternative – Removal of restraints on private sector? – Labour market incentives? – But Danish flexicurity – Countries different – oil, EMU (forced adjustment for Finland

BENEFICIAL IN THE LONG RUN? • • Are shocks needed? Schumpeter? Can adjust to gradual pressure New Zealand in 1984 Need window of political opportunity – There is no alternative – Removal of restraints on private sector? – Labour market incentives? – But Danish flexicurity – Countries different – oil, EMU (forced adjustment for Finland

FIXED BUT ADJUSTABLE PEGS • Will fall under heavy attack – Are currency boards different? • Encourage defence and failure to adjust • Does this alter the problem of changes in real rates of interest? – High rates lower inflation faster under floating – Exchange rate rose when controls removed in NZ – Higher rates worsen competitiveness (Iceland, UK, NZ) intolerably for NZ

FIXED BUT ADJUSTABLE PEGS • Will fall under heavy attack – Are currency boards different? • Encourage defence and failure to adjust • Does this alter the problem of changes in real rates of interest? – High rates lower inflation faster under floating – Exchange rate rose when controls removed in NZ – Higher rates worsen competitiveness (Iceland, UK, NZ) intolerably for NZ

STOCKS VS FLOWS • Lesson clearly learnt by the profession by early 1980 s in US, UK and NZ but not in Nordics? • and not by the IMF?

STOCKS VS FLOWS • Lesson clearly learnt by the profession by early 1980 s in US, UK and NZ but not in Nordics? • and not by the IMF?

WHO WERE THE REAL CULPRITS? • Bad macro policy • Bad financial market policy (deregulation and supervision/capital requirements etc) • Bad luck • The Mayes et al. (2001) list

WHO WERE THE REAL CULPRITS? • Bad macro policy • Bad financial market policy (deregulation and supervision/capital requirements etc) • Bad luck • The Mayes et al. (2001) list

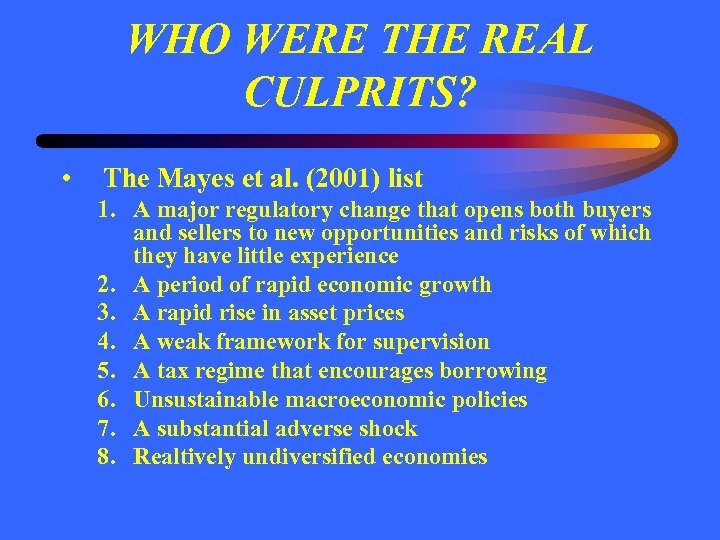

WHO WERE THE REAL CULPRITS? • The Mayes et al. (2001) list 1. A major regulatory change that opens both buyers and sellers to new opportunities and risks of which they have little experience 2. A period of rapid economic growth 3. A rapid rise in asset prices 4. A weak framework for supervision 5. A tax regime that encourages borrowing 6. Unsustainable macroeconomic policies 7. A substantial adverse shock 8. Realtively undiversified economies

WHO WERE THE REAL CULPRITS? • The Mayes et al. (2001) list 1. A major regulatory change that opens both buyers and sellers to new opportunities and risks of which they have little experience 2. A period of rapid economic growth 3. A rapid rise in asset prices 4. A weak framework for supervision 5. A tax regime that encourages borrowing 6. Unsustainable macroeconomic policies 7. A substantial adverse shock 8. Realtively undiversified economies

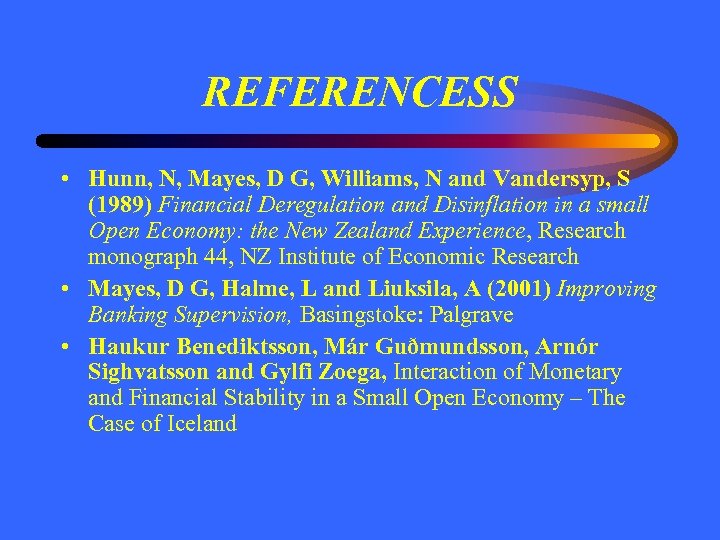

REFERENCESS • Hunn, N, Mayes, D G, Williams, N and Vandersyp, S (1989) Financial Deregulation and Disinflation in a small Open Economy: the New Zealand Experience, Research monograph 44, NZ Institute of Economic Research • Mayes, D G, Halme, L and Liuksila, A (2001) Improving Banking Supervision, Basingstoke: Palgrave • Haukur Benediktsson, Már Guðmundsson, Arnór Sighvatsson and Gylfi Zoega, Interaction of Monetary and Financial Stability in a Small Open Economy – The Case of Iceland

REFERENCESS • Hunn, N, Mayes, D G, Williams, N and Vandersyp, S (1989) Financial Deregulation and Disinflation in a small Open Economy: the New Zealand Experience, Research monograph 44, NZ Institute of Economic Research • Mayes, D G, Halme, L and Liuksila, A (2001) Improving Banking Supervision, Basingstoke: Palgrave • Haukur Benediktsson, Már Guðmundsson, Arnór Sighvatsson and Gylfi Zoega, Interaction of Monetary and Financial Stability in a Small Open Economy – The Case of Iceland