cec82180e8554026701f5ff678ed0dde.ppt

- Количество слайдов: 41

© Larry. N. Mitchell 2007 SOLGM Midlands/Central Region February 23 rd 2007 Seminar Larry. N. Mitchell Finance & Policy Analyst (Local Government)

© Larry. N. Mitchell 2007 SOLGM Midlands/Central Region February 23 rd 2007 Seminar Larry. N. Mitchell Finance & Policy Analyst (Local Government)

© Larry. N. Mitchell 2007 PRESENTER Larry. N. Mitchell Finance & Policy Analyst (Local Government) www. kauriglen. co. nz FEBRUARY 23 rd 2007 WAIRAKEI Larry. N. Mitchell Finance & Policy Analyst (Local Government)

© Larry. N. Mitchell 2007 PRESENTER Larry. N. Mitchell Finance & Policy Analyst (Local Government) www. kauriglen. co. nz FEBRUARY 23 rd 2007 WAIRAKEI Larry. N. Mitchell Finance & Policy Analyst (Local Government)

Agreed Session Outline Larry will cover the following very! topical matters relating to performance … • Rates … are just Council's costs 'in drag'. . . how do we contain both? • Local government cost structures and their 'context' • Excellence programmes. . . coupled with Council performance measurement and improvement frameworks Larry. N. Mitchell Finance & Policy Analyst (Local Government) 3

Agreed Session Outline Larry will cover the following very! topical matters relating to performance … • Rates … are just Council's costs 'in drag'. . . how do we contain both? • Local government cost structures and their 'context' • Excellence programmes. . . coupled with Council performance measurement and improvement frameworks Larry. N. Mitchell Finance & Policy Analyst (Local Government) 3

Session Outline • And if there is time • Economic – ‘financial’ Outcomes reporting … plus a brief discussion on four (financial) things that ‘really! need changing’ …. • Financial plans … inflation and five yearly • Reporting of operational expenditures • Reporting of surpluses and deficits • Treatment of asset revaluations Larry. N. Mitchell Finance & Policy Analyst (Local Government) 4

Session Outline • And if there is time • Economic – ‘financial’ Outcomes reporting … plus a brief discussion on four (financial) things that ‘really! need changing’ …. • Financial plans … inflation and five yearly • Reporting of operational expenditures • Reporting of surpluses and deficits • Treatment of asset revaluations Larry. N. Mitchell Finance & Policy Analyst (Local Government) 4

Rates … are just Council's costs 'in drag'. . . how do we contain both? FIRST Topic … Rates are ‘high’ because … • Dohh! …Council costs are high … for example regulatory costs are now the third highest aggregate of Council’s typical expenditures • Operating expenditures, particularly financial interest costs … have increased over the last five years … • Staff numbers … ‘managed’? Larry. N. Mitchell Finance & Policy Analyst (Local Government) 5

Rates … are just Council's costs 'in drag'. . . how do we contain both? FIRST Topic … Rates are ‘high’ because … • Dohh! …Council costs are high … for example regulatory costs are now the third highest aggregate of Council’s typical expenditures • Operating expenditures, particularly financial interest costs … have increased over the last five years … • Staff numbers … ‘managed’? Larry. N. Mitchell Finance & Policy Analyst (Local Government) 5

Rates … are just Council's costs 'in drag'. . . how do we contain both? Rates are ‘high’ because … • Council costs are high … for example regulatory costs rank third in aggregate and have overtaken water supply costs. They now total $364 million …up 26% in the last five years. Larry. N. Mitchell Finance & Policy Analyst (Local Government) 6

Rates … are just Council's costs 'in drag'. . . how do we contain both? Rates are ‘high’ because … • Council costs are high … for example regulatory costs rank third in aggregate and have overtaken water supply costs. They now total $364 million …up 26% in the last five years. Larry. N. Mitchell Finance & Policy Analyst (Local Government) 6

Rates … are just Council's costs 'in drag'. . . how do we contain both? Rates are ‘high’ because … • Council costs are high … for example some operating expenditures, such as financial interest costs have increased over the last five years by 56% …last year, interest costs were up by 12% to $220 million … but are still only 4% of total Council 2006 ‘opex’ expenditures of $5. 5 billion. Larry. N. Mitchell Finance & Policy Analyst (Local Government) 7

Rates … are just Council's costs 'in drag'. . . how do we contain both? Rates are ‘high’ because … • Council costs are high … for example some operating expenditures, such as financial interest costs have increased over the last five years by 56% …last year, interest costs were up by 12% to $220 million … but are still only 4% of total Council 2006 ‘opex’ expenditures of $5. 5 billion. Larry. N. Mitchell Finance & Policy Analyst (Local Government) 7

Rates … are just Council's costs 'in drag'. . . how do we contain both? Rates are ‘high’ because … • Council costs are high … for example Staff numbers have increased … the public use these numbers as a ‘lightening rod’ and in some cases they seem excessive? … but over the sector, staff numbers (unaudited) are up by (only) 12% in the last five years. Larry. N. Mitchell Finance & Policy Analyst (Local Government) 8

Rates … are just Council's costs 'in drag'. . . how do we contain both? Rates are ‘high’ because … • Council costs are high … for example Staff numbers have increased … the public use these numbers as a ‘lightening rod’ and in some cases they seem excessive? … but over the sector, staff numbers (unaudited) are up by (only) 12% in the last five years. Larry. N. Mitchell Finance & Policy Analyst (Local Government) 8

Rates … are just Council's costs 'in drag'. . . how do we contain both? And … Rates are ‘extremely! high’ for some Councils because … • Developers are not fully paying for growth • Central Government Subsidies are static in the face of rising capital work’s prices … • Costs are effectively not being reimbursed … as ‘reported’ by higher than ‘NZ Inc’ CPI (LG sector) construction price index data. Larry. N. Mitchell Finance & Policy Analyst (Local Government) 9

Rates … are just Council's costs 'in drag'. . . how do we contain both? And … Rates are ‘extremely! high’ for some Councils because … • Developers are not fully paying for growth • Central Government Subsidies are static in the face of rising capital work’s prices … • Costs are effectively not being reimbursed … as ‘reported’ by higher than ‘NZ Inc’ CPI (LG sector) construction price index data. Larry. N. Mitchell Finance & Policy Analyst (Local Government) 9

Rates … are just Council's costs 'in drag'. . . how do we contain both? • …according to the LG Funding report December 2006 … ‘projected rates are at about 6. 1% of household incomes on average but! … • …‘ 14 Councils are at 1 or more standard deviations above this average and are therefore ‘High’ rating Councils’. • This evidence accords with the findings of the Final PFI project … see the 4. 2. 3 handout (eight Councils not 14). Larry. N. Mitchell Finance & Policy Analyst (Local Government) 10

Rates … are just Council's costs 'in drag'. . . how do we contain both? • …according to the LG Funding report December 2006 … ‘projected rates are at about 6. 1% of household incomes on average but! … • …‘ 14 Councils are at 1 or more standard deviations above this average and are therefore ‘High’ rating Councils’. • This evidence accords with the findings of the Final PFI project … see the 4. 2. 3 handout (eight Councils not 14). Larry. N. Mitchell Finance & Policy Analyst (Local Government) 10

Rates … are just Council's costs 'in drag'. . . how do we contain both? • How do we contain both? … Rates and Costs … some suggestions – Refocus on input cost management plus … – Better overall accountability … particularly payroll/performance/costs – Maximise subsidy opportunities … ‘a tale of foregone opportunities’ Larry. N. Mitchell Finance & Policy Analyst (Local Government) 11

Rates … are just Council's costs 'in drag'. . . how do we contain both? • How do we contain both? … Rates and Costs … some suggestions – Refocus on input cost management plus … – Better overall accountability … particularly payroll/performance/costs – Maximise subsidy opportunities … ‘a tale of foregone opportunities’ Larry. N. Mitchell Finance & Policy Analyst (Local Government) 11

Rates … are just Council's costs 'in drag'. . . how do we contain both? • How do we contain both? … Rates and Costs? Some more suggestions – Control contract costs – Properly manage consultants – Use financial engineering, PPP’s and flexible treasury (balanced budget) management – Validate depreciation provisions Larry. N. Mitchell Finance & Policy Analyst (Local Government) 12

Rates … are just Council's costs 'in drag'. . . how do we contain both? • How do we contain both? … Rates and Costs? Some more suggestions – Control contract costs – Properly manage consultants – Use financial engineering, PPP’s and flexible treasury (balanced budget) management – Validate depreciation provisions Larry. N. Mitchell Finance & Policy Analyst (Local Government) 12

Rates … are just Council's costs 'in drag'. . . how do we contain both? • How do we contain both? Some final (unfashionable? ) suggestions – Stick to the knitting – Give nothing for nothing … a ‘free’? kerbside recycling refuse collection …Yeah Right! – Set the cost agenda by setting costs … not rates just on a cost plus basis – Focus on Council Performance/Excellence. Larry. N. Mitchell Finance & Policy Analyst (Local Government) 13

Rates … are just Council's costs 'in drag'. . . how do we contain both? • How do we contain both? Some final (unfashionable? ) suggestions – Stick to the knitting – Give nothing for nothing … a ‘free’? kerbside recycling refuse collection …Yeah Right! – Set the cost agenda by setting costs … not rates just on a cost plus basis – Focus on Council Performance/Excellence. Larry. N. Mitchell Finance & Policy Analyst (Local Government) 13

Local government cost structures and their 'context‘ (with ‘metrics’) SECOND topic … Cost Structures • The key finding based on recent LG Funding and other (Final PFI project Nov 06) research shows that … Projected 2006 -2016 rates as a proportion of household incomes over the same period increase only marginally from 5. 3% to 6. 1%. • So where is the problem? Larry. N. Mitchell Finance & Policy Analyst (Local Government) 14

Local government cost structures and their 'context‘ (with ‘metrics’) SECOND topic … Cost Structures • The key finding based on recent LG Funding and other (Final PFI project Nov 06) research shows that … Projected 2006 -2016 rates as a proportion of household incomes over the same period increase only marginally from 5. 3% to 6. 1%. • So where is the problem? Larry. N. Mitchell Finance & Policy Analyst (Local Government) 14

Local government cost structures and their 'context‘ (with ‘metrics’) • There is contradictory evidence about Council projected rates-costs relationships as reported in the (unreliable) 2006 LTCCP’s • With inflation taken ‘out’ and population adjustments ‘in’ … the ‘Larry’ data shows … – Rates are up $49 per capita (pc) – Operating revenues down $101 pc – Operating expenditures down $42 pc. Larry. N. Mitchell Finance & Policy Analyst (Local Government) 15

Local government cost structures and their 'context‘ (with ‘metrics’) • There is contradictory evidence about Council projected rates-costs relationships as reported in the (unreliable) 2006 LTCCP’s • With inflation taken ‘out’ and population adjustments ‘in’ … the ‘Larry’ data shows … – Rates are up $49 per capita (pc) – Operating revenues down $101 pc – Operating expenditures down $42 pc. Larry. N. Mitchell Finance & Policy Analyst (Local Government) 15

Local government cost structures and their 'context' • The problem therefore is partly that 2006 -2016 LTCCP dollars are reported with inflation included. Depreciation and asset creation numbers are unreliable! • These ‘LTCCP issues’ … increase the risk of inappropriate reporting of rates and costs, with media reporting a mixture of ‘apples with lemons’ … for example a celebrated Wellington City Council case … ‘Debt/Equity issues’. Larry. N. Mitchell Finance & Policy Analyst (Local Government) 16

Local government cost structures and their 'context' • The problem therefore is partly that 2006 -2016 LTCCP dollars are reported with inflation included. Depreciation and asset creation numbers are unreliable! • These ‘LTCCP issues’ … increase the risk of inappropriate reporting of rates and costs, with media reporting a mixture of ‘apples with lemons’ … for example a celebrated Wellington City Council case … ‘Debt/Equity issues’. Larry. N. Mitchell Finance & Policy Analyst (Local Government) 16

Local government cost structures and their 'context' • Council cost contexts differ from Council to Council. The LG Funding project report cites densities as being influential on costs … but not! note population … • Reliable co-relation’s of costs based upon global sector wide data must be supported by good data (not! 2006 LTCCP information) … particularly if subsidy and other funding related to Ability to Pay are to be advanced. Larry. N. Mitchell Finance & Policy Analyst (Local Government) 17

Local government cost structures and their 'context' • Council cost contexts differ from Council to Council. The LG Funding project report cites densities as being influential on costs … but not! note population … • Reliable co-relation’s of costs based upon global sector wide data must be supported by good data (not! 2006 LTCCP information) … particularly if subsidy and other funding related to Ability to Pay are to be advanced. Larry. N. Mitchell Finance & Policy Analyst (Local Government) 17

Local government cost structures and their 'context' • Case study’s … Context … ‘obfuscation’ … cases where budgeted costs for a period have not been exceeded and this is reported as ‘under budget’ … taking no account of price and or volume variances? • How fair, balanced and accurate is the reporting of these circumstances to elected members and to the public? Larry. N. Mitchell Finance & Policy Analyst (Local Government) 18

Local government cost structures and their 'context' • Case study’s … Context … ‘obfuscation’ … cases where budgeted costs for a period have not been exceeded and this is reported as ‘under budget’ … taking no account of price and or volume variances? • How fair, balanced and accurate is the reporting of these circumstances to elected members and to the public? Larry. N. Mitchell Finance & Policy Analyst (Local Government) 18

Local government cost structures and their 'context' • Context … ‘Cost control’ … management must have … – Good reporting and financial governance context … effective accountability is essential – Good example … Otorohanga District Council reports key variances by exception … on the Cafeteria notice board for all to see. Larry. N. Mitchell Finance & Policy Analyst (Local Government) 19

Local government cost structures and their 'context' • Context … ‘Cost control’ … management must have … – Good reporting and financial governance context … effective accountability is essential – Good example … Otorohanga District Council reports key variances by exception … on the Cafeteria notice board for all to see. Larry. N. Mitchell Finance & Policy Analyst (Local Government) 19

Local government cost structures and their 'context' • Context … ‘Cost control’ … management must have … – Good reporting and financial governance context … useful … and honest accountability is essential – Poor example … the Rodney District Council’s quarterly reports are unintelligible to elected members. Larry. N. Mitchell Finance & Policy Analyst (Local Government) 20

Local government cost structures and their 'context' • Context … ‘Cost control’ … management must have … – Good reporting and financial governance context … useful … and honest accountability is essential – Poor example … the Rodney District Council’s quarterly reports are unintelligible to elected members. Larry. N. Mitchell Finance & Policy Analyst (Local Government) 20

Excellence programmes. . . coupled with Council performance measurement and improvement frameworks THIRD Topic … ‘Excellence’ • The question of Council rates, costs and their context involves Councils actually demonstrating their costeffectiveness with Excellence! The issue then is how to achieve this as … • ‘Lets face it’ … for most NZ ratepayers, the rates bill is the public’s default cost-effectiveness option for their Council … a surrogate measure of Council costeffectiveness … in the absence of anything else. • Reportedly, 12 NZ Councils have to date embarked upon ‘Excellence’ programmes of one sort or another. Larry. N. Mitchell Finance & Policy Analyst (Local Government) 21

Excellence programmes. . . coupled with Council performance measurement and improvement frameworks THIRD Topic … ‘Excellence’ • The question of Council rates, costs and their context involves Councils actually demonstrating their costeffectiveness with Excellence! The issue then is how to achieve this as … • ‘Lets face it’ … for most NZ ratepayers, the rates bill is the public’s default cost-effectiveness option for their Council … a surrogate measure of Council costeffectiveness … in the absence of anything else. • Reportedly, 12 NZ Councils have to date embarked upon ‘Excellence’ programmes of one sort or another. Larry. N. Mitchell Finance & Policy Analyst (Local Government) 21

Excellence programmes. . . coupled with Council performance measurement and improvement frameworks • Performance indicators (within an Excellence framework) • Performance frameworks are an ideal to be targeted … few New Zealand Councils can claim to have one … Yet • Part of the solution includes positive proof of cost -effectiveness afforded to the public of their Council’s demonstrable … proven ‘Excellence’. Larry. N. Mitchell Finance & Policy Analyst (Local Government) 22

Excellence programmes. . . coupled with Council performance measurement and improvement frameworks • Performance indicators (within an Excellence framework) • Performance frameworks are an ideal to be targeted … few New Zealand Councils can claim to have one … Yet • Part of the solution includes positive proof of cost -effectiveness afforded to the public of their Council’s demonstrable … proven ‘Excellence’. Larry. N. Mitchell Finance & Policy Analyst (Local Government) 22

Excellence programmes. . . coupled with Council performance measurement and improvement frameworks • If ‘something is to be done’ … where to start? • An ‘Excellence’ entry level programme is an ‘excellent’ place to start … • Many issues (and potential pitfalls) such as … – Political will is needed – Management leadership and buy in – Culture and change management involved – The ‘Wanganui DC’ experience … focusing on costs. . . achieving excellence? Is the jury still out? Where were the auditors? Larry. N. Mitchell Finance & Policy Analyst (Local Government) 23

Excellence programmes. . . coupled with Council performance measurement and improvement frameworks • If ‘something is to be done’ … where to start? • An ‘Excellence’ entry level programme is an ‘excellent’ place to start … • Many issues (and potential pitfalls) such as … – Political will is needed – Management leadership and buy in – Culture and change management involved – The ‘Wanganui DC’ experience … focusing on costs. . . achieving excellence? Is the jury still out? Where were the auditors? Larry. N. Mitchell Finance & Policy Analyst (Local Government) 23

Excellence programmes. . . coupled with Council performance measurement and improvement frameworks An ‘Excellence’ programme is an ‘excellent’ place to start … • Make a principled start as an indication of sincere intention … • … to provide the public with assurances of costeffectiveness as an ‘earnest’ of intent …a process that from the beginning … sets realistic performance objectives … • For example … a principled goal …‘to improve current surveyed public satisfaction rates of Council performance from the present 55% to 80% within five years' …’ Larry. N. Mitchell Finance & Policy Analyst (Local Government) 24

Excellence programmes. . . coupled with Council performance measurement and improvement frameworks An ‘Excellence’ programme is an ‘excellent’ place to start … • Make a principled start as an indication of sincere intention … • … to provide the public with assurances of costeffectiveness as an ‘earnest’ of intent …a process that from the beginning … sets realistic performance objectives … • For example … a principled goal …‘to improve current surveyed public satisfaction rates of Council performance from the present 55% to 80% within five years' …’ Larry. N. Mitchell Finance & Policy Analyst (Local Government) 24

Excellence programmes. . . coupled with Council performance measurement and improvement frameworks • The Excellence ‘Champions’ … • Hutt City, Otorohanga and now (who would have thought it? … Christchurch City) NZLG ‘Excellence’ track records, each one different! • A ‘Silver’ Excellence award … (Hutt CC), or a homegrown Winner… (Otorohanga DC) • These are ‘substantial’ achievements • Cautions of ‘cost-effectiveness’ … for excellence programmes themselves! Larry. N. Mitchell Finance & Policy Analyst (Local Government) 25

Excellence programmes. . . coupled with Council performance measurement and improvement frameworks • The Excellence ‘Champions’ … • Hutt City, Otorohanga and now (who would have thought it? … Christchurch City) NZLG ‘Excellence’ track records, each one different! • A ‘Silver’ Excellence award … (Hutt CC), or a homegrown Winner… (Otorohanga DC) • These are ‘substantial’ achievements • Cautions of ‘cost-effectiveness’ … for excellence programmes themselves! Larry. N. Mitchell Finance & Policy Analyst (Local Government) 25

Excellence programmes. . . coupled with Council performance measurement and improvement frameworks Excellence … Where to start? … initially use the Nine ‘Criteria’ … a checklist for starting Performance/Excellence 1. Managing for innovation 2. Social responsibility 3. Focus on results and creating value 4. Systems perspective Larry. N. Mitchell Finance & Policy Analyst (Local Government) 26

Excellence programmes. . . coupled with Council performance measurement and improvement frameworks Excellence … Where to start? … initially use the Nine ‘Criteria’ … a checklist for starting Performance/Excellence 1. Managing for innovation 2. Social responsibility 3. Focus on results and creating value 4. Systems perspective Larry. N. Mitchell Finance & Policy Analyst (Local Government) 26

Excellence programmes. . . coupled with Council performance measurement and improvement frameworks Excellence … Where to start? … initially use the Nine ‘Criteria’ … a checklist for Performance Excellence … continued 5. Visionary leadership 6. Customer driven excellence 7. Organisational and personal learning 8. Valuing employees and partners 9. Focus on the future. Larry. N. Mitchell Finance & Policy Analyst (Local Government) 27

Excellence programmes. . . coupled with Council performance measurement and improvement frameworks Excellence … Where to start? … initially use the Nine ‘Criteria’ … a checklist for Performance Excellence … continued 5. Visionary leadership 6. Customer driven excellence 7. Organisational and personal learning 8. Valuing employees and partners 9. Focus on the future. Larry. N. Mitchell Finance & Policy Analyst (Local Government) 27

Excellence programmes. . . coupled with Council performance measurement and improvement frameworks • Cautions of cost-effectiveness need to be made relating to any ‘programme’ …whether Excellence, other performance based initiatives or cost containment strategies • Keep it simple … and cheap! The cost benefits results of (often costly) ‘full on’ Excellence programmes may not stack up … particularly given the broad brush ‘Outcomes’ results required • One example of a cost-effective approach … a case study justification for a framework built around the ‘Outcomes-Results’ ‘Base Stats’ module. Larry. N. Mitchell Finance & Policy Analyst (Local Government) 28

Excellence programmes. . . coupled with Council performance measurement and improvement frameworks • Cautions of cost-effectiveness need to be made relating to any ‘programme’ …whether Excellence, other performance based initiatives or cost containment strategies • Keep it simple … and cheap! The cost benefits results of (often costly) ‘full on’ Excellence programmes may not stack up … particularly given the broad brush ‘Outcomes’ results required • One example of a cost-effective approach … a case study justification for a framework built around the ‘Outcomes-Results’ ‘Base Stats’ module. Larry. N. Mitchell Finance & Policy Analyst (Local Government) 28

‘Outcomes-Results’ • Community outcomes are ‘well covered’ … the LTCCP has become an expensive growth industry with legions of planning gatekeepers in charge. • But what about (the forgotten? ) Economic well being(s)? Council’s own data … by itself fails to locate the issues. A comparative basis is essential for performance management. • ‘Outcomes-Results’ covers all of these. Larry. N. Mitchell Finance & Policy Analyst (Local Government) 29

‘Outcomes-Results’ • Community outcomes are ‘well covered’ … the LTCCP has become an expensive growth industry with legions of planning gatekeepers in charge. • But what about (the forgotten? ) Economic well being(s)? Council’s own data … by itself fails to locate the issues. A comparative basis is essential for performance management. • ‘Outcomes-Results’ covers all of these. Larry. N. Mitchell Finance & Policy Analyst (Local Government) 29

‘Outcomes-Results’ • Economic Outcomes are the most important … are they not? It all in the end comes down to the ‘$$$’s’ • ‘Outcomes-Results’ perspectives are centered upon an individual Council’s Economic wellbeing … including its Income and Wealth ‘stats’ • 30 key measures track at the individual Council level the key ‘$$$’s’ related vital stats essential to achieving … ‘Results’. . . Doing things! Larry. N. Mitchell Finance & Policy Analyst (Local Government) 30

‘Outcomes-Results’ • Economic Outcomes are the most important … are they not? It all in the end comes down to the ‘$$$’s’ • ‘Outcomes-Results’ perspectives are centered upon an individual Council’s Economic wellbeing … including its Income and Wealth ‘stats’ • 30 key measures track at the individual Council level the key ‘$$$’s’ related vital stats essential to achieving … ‘Results’. . . Doing things! Larry. N. Mitchell Finance & Policy Analyst (Local Government) 30

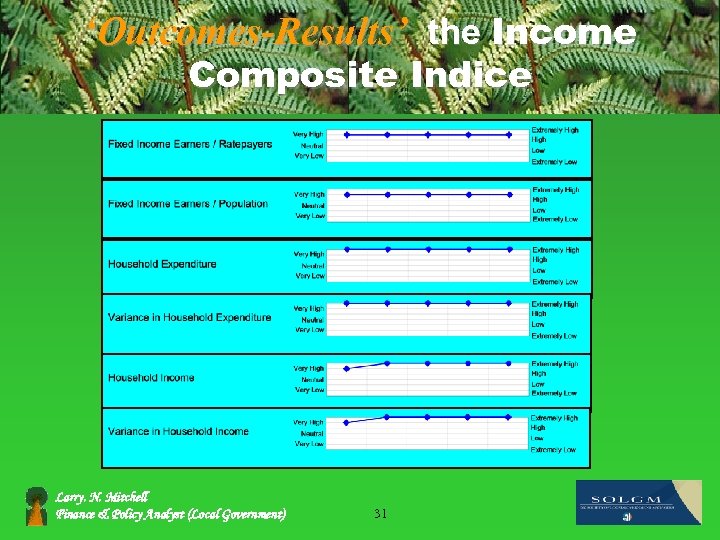

‘Outcomes-Results’ the Income Composite Indice Larry. N. Mitchell Finance & Policy Analyst (Local Government) 31

‘Outcomes-Results’ the Income Composite Indice Larry. N. Mitchell Finance & Policy Analyst (Local Government) 31

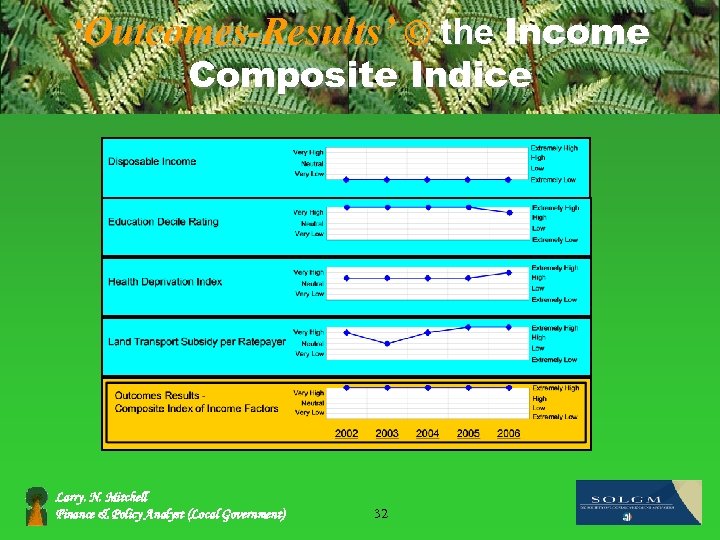

‘Outcomes-Results’ © the Income Composite Indice Larry. N. Mitchell Finance & Policy Analyst (Local Government) 32

‘Outcomes-Results’ © the Income Composite Indice Larry. N. Mitchell Finance & Policy Analyst (Local Government) 32

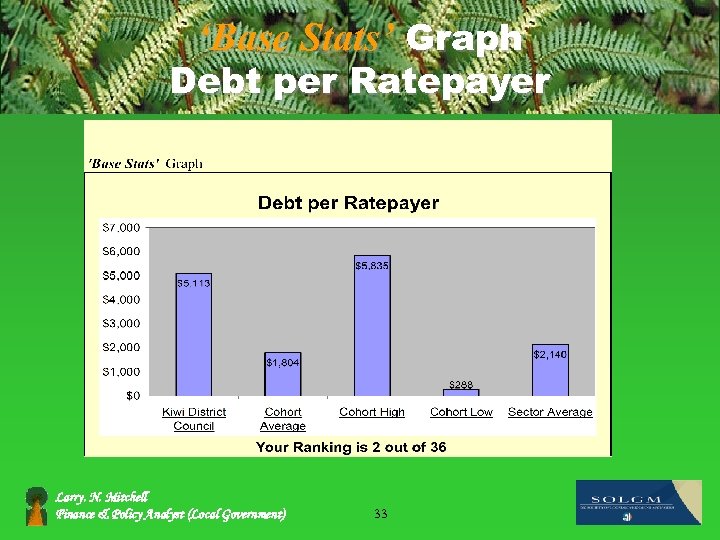

‘Base Stats’ Graph Debt per Ratepayer Larry. N. Mitchell Finance & Policy Analyst (Local Government) 33

‘Base Stats’ Graph Debt per Ratepayer Larry. N. Mitchell Finance & Policy Analyst (Local Government) 33

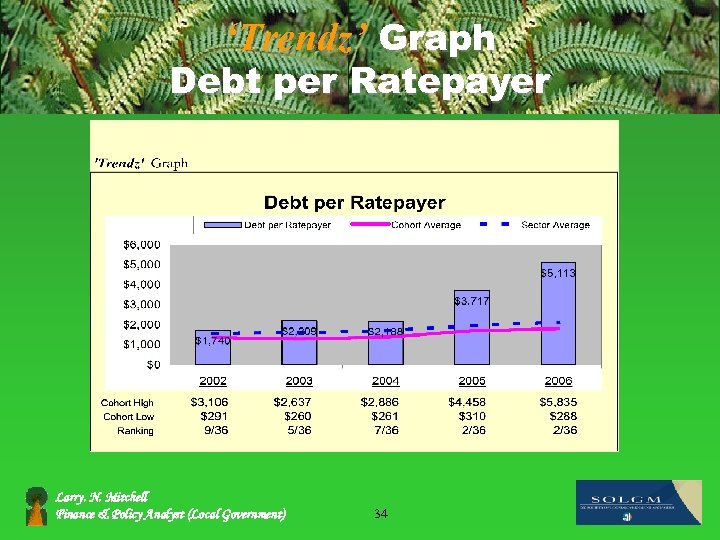

‘Trendz’ Graph Debt per Ratepayer Larry. N. Mitchell Finance & Policy Analyst (Local Government) 34

‘Trendz’ Graph Debt per Ratepayer Larry. N. Mitchell Finance & Policy Analyst (Local Government) 34

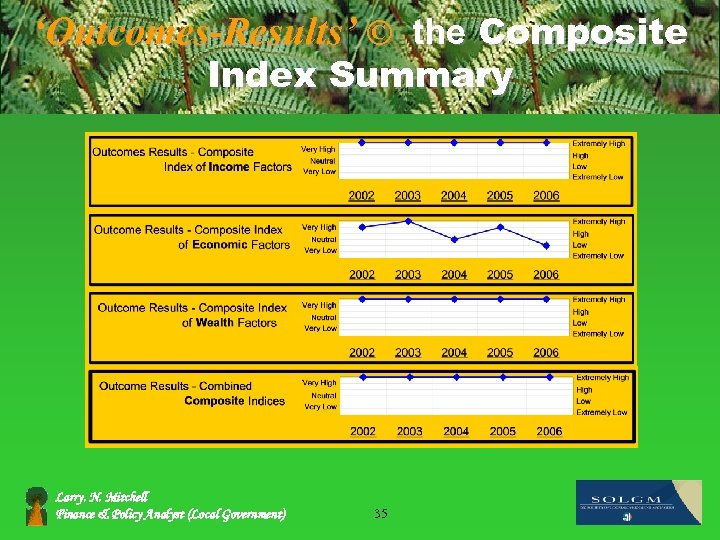

‘Outcomes-Results’ © the Composite Index Summary Larry. N. Mitchell Finance & Policy Analyst (Local Government) 35

‘Outcomes-Results’ © the Composite Index Summary Larry. N. Mitchell Finance & Policy Analyst (Local Government) 35

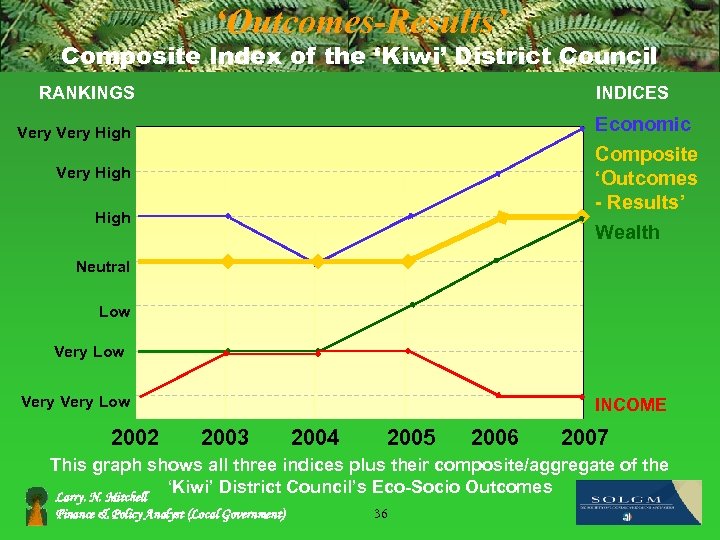

‘Outcomes-Results’ Composite Index of the ‘Kiwi’ District Council RANKINGS INDICES Economic Very High Composite ‘Outcomes - Results’ Wealth Very High Neutral Low Very Low 2002 INCOME 2003 2004 2005 2006 2007 This graph shows all three indices plus their composite/aggregate of the ‘Kiwi’ District Council’s Eco-Socio Outcomes Larry. N. Mitchell Finance & Policy Analyst (Local Government) 36

‘Outcomes-Results’ Composite Index of the ‘Kiwi’ District Council RANKINGS INDICES Economic Very High Composite ‘Outcomes - Results’ Wealth Very High Neutral Low Very Low 2002 INCOME 2003 2004 2005 2006 2007 This graph shows all three indices plus their composite/aggregate of the ‘Kiwi’ District Council’s Eco-Socio Outcomes Larry. N. Mitchell Finance & Policy Analyst (Local Government) 36

‘Outcomes-Results’ … the ‘Results’ of this approach • ‘Outcomes-Results’ … a co-ordinated approach • It is fit for purpose (cheap), it focuses upon key ‘$$$’s’ deliverables those that are controllable and or influenced by Council actions • ‘Outcomes-Results’ is now a de facto standard for ‘smaller’ Council’s reporting of Economic Outcomes • It is an understandable reporting of Council/ Community economic performance for elected members and for public consumption. Larry. N. Mitchell Finance & Policy Analyst (Local Government) 37

‘Outcomes-Results’ … the ‘Results’ of this approach • ‘Outcomes-Results’ … a co-ordinated approach • It is fit for purpose (cheap), it focuses upon key ‘$$$’s’ deliverables those that are controllable and or influenced by Council actions • ‘Outcomes-Results’ is now a de facto standard for ‘smaller’ Council’s reporting of Economic Outcomes • It is an understandable reporting of Council/ Community economic performance for elected members and for public consumption. Larry. N. Mitchell Finance & Policy Analyst (Local Government) 37

Session Conclusion • And if there is time? … to conclude… a brief discussion on four (financial) things that need changing’ … • Financial plans … inflation and five yearly • Reporting of operational expenditures • Reporting of surpluses and deficits • Treatment of revaluations Larry. N. Mitchell Finance & Policy Analyst (Local Government) 38

Session Conclusion • And if there is time? … to conclude… a brief discussion on four (financial) things that need changing’ … • Financial plans … inflation and five yearly • Reporting of operational expenditures • Reporting of surpluses and deficits • Treatment of revaluations Larry. N. Mitchell Finance & Policy Analyst (Local Government) 38

Session outline • • Questions … Discussion … Session objectives achieved? … Handouts and further dialogue … Larry. N. Mitchell Finance & Policy Analyst (Local Government) 39

Session outline • • Questions … Discussion … Session objectives achieved? … Handouts and further dialogue … Larry. N. Mitchell Finance & Policy Analyst (Local Government) 39

And now for …. Larry. N. Mitchell Finance & Policy Analyst (Local Government) 40

And now for …. Larry. N. Mitchell Finance & Policy Analyst (Local Government) 40

PO Box 103, Puhoi, North Auckland, NZ Ph: 09 422 0598 Fax: 09 422 0700 Mobile: 027 479 2328 All phones: 0800 784 648 (0800 PUHOI U) Skype callto: larryave Larry Mitchell is a Finance & Policy Analyst working with Local Government. His products include ‘Base Stats with Trendz’ reports, which now include ‘Outcomes-Results’ and ‘Data Mining’ benchmarks. Email: larry@kauriglen. co. nz Website: www. kauriglen. co. nz/larry Larry. N. Mitchell Finance & Policy Analyst (Local Government) 41

PO Box 103, Puhoi, North Auckland, NZ Ph: 09 422 0598 Fax: 09 422 0700 Mobile: 027 479 2328 All phones: 0800 784 648 (0800 PUHOI U) Skype callto: larryave Larry Mitchell is a Finance & Policy Analyst working with Local Government. His products include ‘Base Stats with Trendz’ reports, which now include ‘Outcomes-Results’ and ‘Data Mining’ benchmarks. Email: larry@kauriglen. co. nz Website: www. kauriglen. co. nz/larry Larry. N. Mitchell Finance & Policy Analyst (Local Government) 41