8f9789956f9b47cf65b1358eb13e4a11.ppt

- Количество слайдов: 17

Labor market, pensions and social protection in Latin America: an overview Carlos Grushka Expert Group Meeting on “Full Employment and Decent Work” Policies to promote social protection for all 2 -4 October 2007, United Nations, New York 1

Stylized facts in Latin America Low proportion of workers contributing to SS l Growing informal labor market l Slow growth and unfavorable labor dynamics l Slow job creation l Low formalization and expansion of salaried employment l Worsening labor conditions l Tax-based pension systems with financing difficulties, low coverage and quality l Similar problems do not imply unique strategies 2

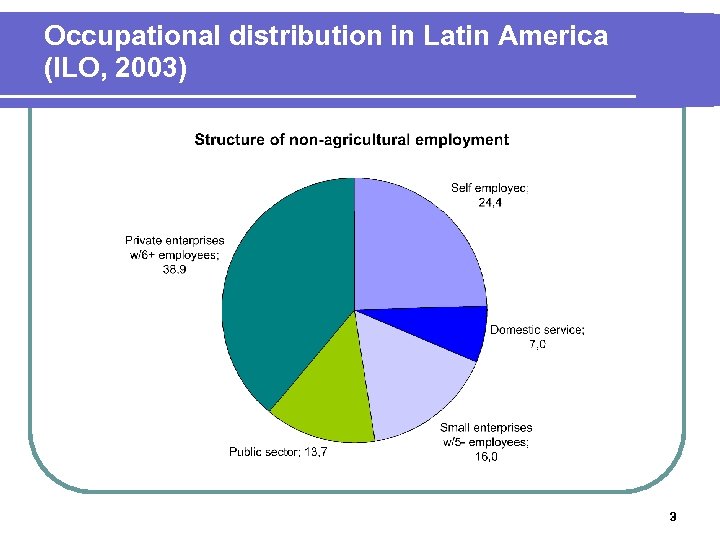

Occupational distribution in Latin America (ILO, 2003) 3

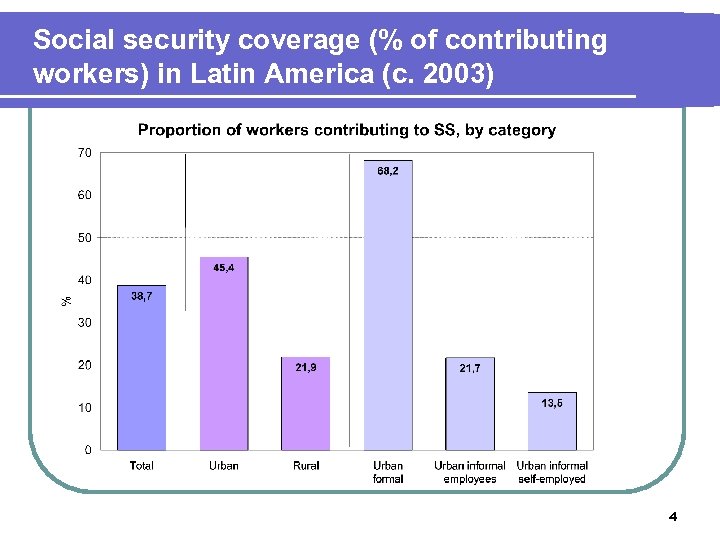

Social security coverage (% of contributing workers) in Latin America (c. 2003) 4

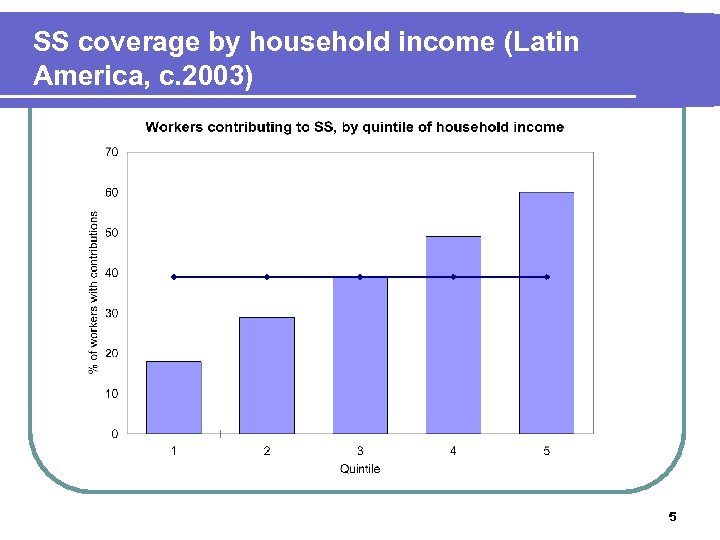

SS coverage by household income (Latin America, c. 2003) 5

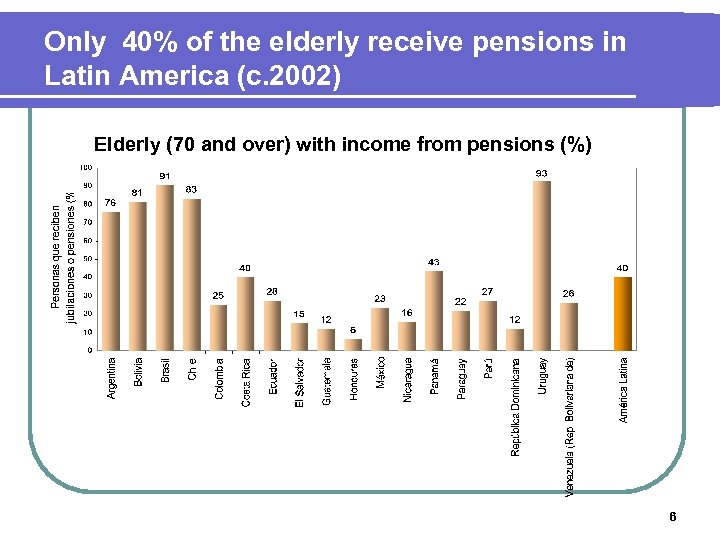

Only 40% of the elderly receive pensions in Latin America (c. 2002) Elderly (70 and over) with income from pensions (%) 6

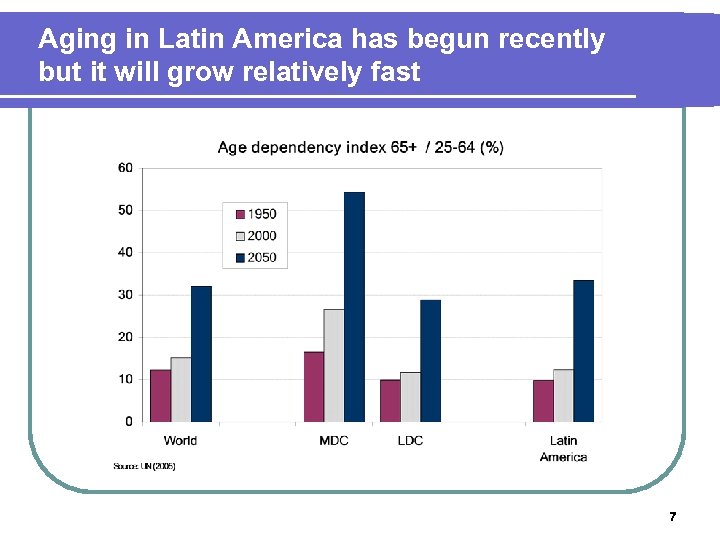

Aging in Latin America has begun recently but it will grow relatively fast 7

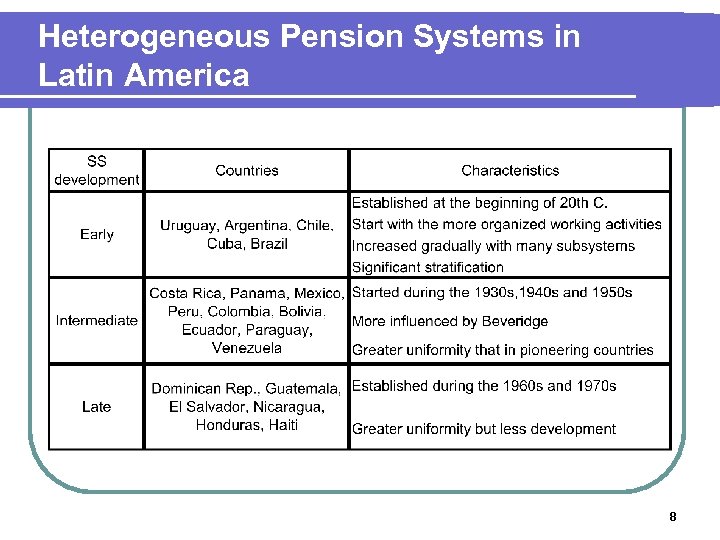

Heterogeneous Pension Systems in Latin America 8

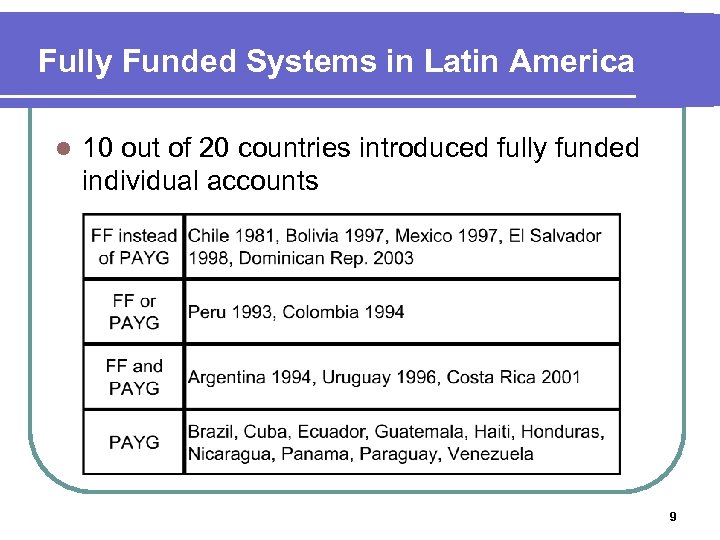

Fully Funded Systems in Latin America l 10 out of 20 countries introduced fully funded individual accounts 9

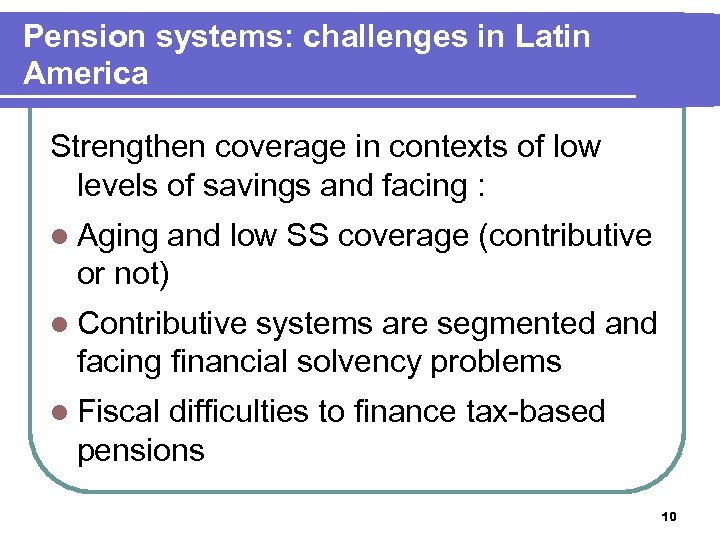

Pension systems: challenges in Latin America Strengthen coverage in contexts of low levels of savings and facing : l Aging and low SS coverage (contributive or not) l Contributive systems are segmented and facing financial solvency problems l Fiscal difficulties to finance tax-based pensions 10

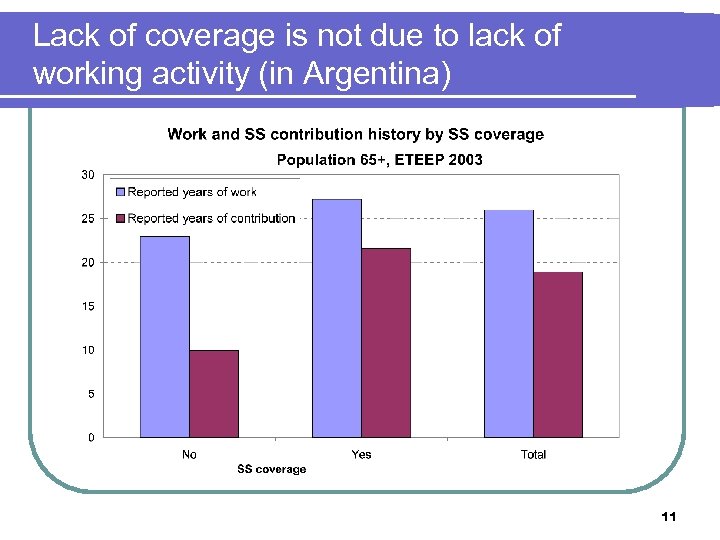

Lack of coverage is not due to lack of working activity (in Argentina) 11

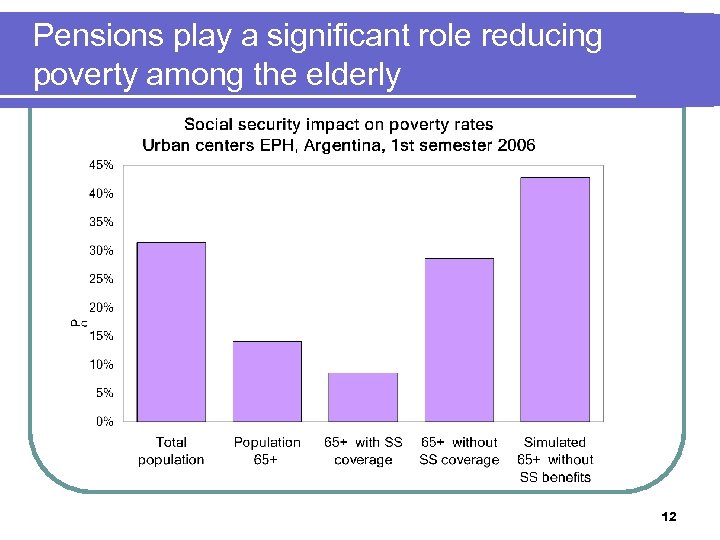

Pensions play a significant role reducing poverty among the elderly 12

Policy options to expand coverage l Increase coverage for the elderly through tax-based benefits l Stimulate participation in contributive pension systems keeping some redistribution l Take into account financial viability and transition costs (notional accounts? ) l Promote unified systems 13

Alternatives to increase coverage: few experiences in Latin America • Bolivia established an ‘universal’ pension (with severe financing and administrative problems) • Brazil established a ‘semi-contributive’ pension mainly for rural workers (with many collateral benefits!) • Chile is strengthening the tax-based pensions trying to integrate them in a SS unified system • Argentina has recently attempted a very original and complex way 14

Recent changes in Argentina (with very few data available!) • Regulation was passed allowing “to buy” a contributive pension by recognizing the debt for the lack of enough periods with contributions • This debt is paid through a discount on the new benefit • During the last year, 1. 5 million new pensions were granted (50% growth), with an estimated annual cost of 1% of GDP • Coverage increased significantly reaching almost 90% of the elderly 15

Financing the growth of coverage and expected trends The new spending is funded by: • the economic growth • strengthening the PAYG public regime (from the FF) • the loss of purchasing power for previous pensions (after the crisis the minimum pension was given priority) SS legal framework (theory) keep the Bismarckian model, but practice tends to follow Beveridge Perspectives are unclear given the claims for indexation of benefits and the very limited improvement in the labor market 16

Thank you! Carlos Grushka cgrushka@safjp. gov. ar 17

8f9789956f9b47cf65b1358eb13e4a11.ppt