efc15ec648f66485d9abc5eb4bcde4ad.ppt

- Количество слайдов: 22

KSD’s Global Custody Services Hae-Il Jang Managing Director Korea Securities Depository We bridge Asia and the rest of the world as Global Partner with internationally compatible investment services.

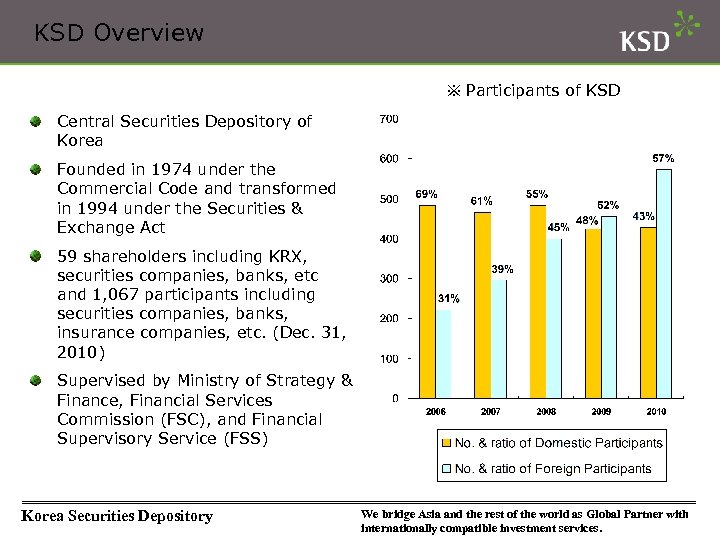

KSD Overview ※ Participants of KSD Central Securities Depository of Korea Founded in 1974 under the Commercial Code and transformed in 1994 under the Securities & Exchange Act 59 shareholders including KRX, securities companies, banks, etc and 1, 067 participants including securities companies, banks, insurance companies, etc. (Dec. 31, 2010) Supervised by Ministry of Strategy & Finance, Financial Services Commission (FSC), and Financial Supervisory Service (FSS) Korea Securities Depository We bridge Asia and the rest of the world as Global Partner with internationally compatible investment services.

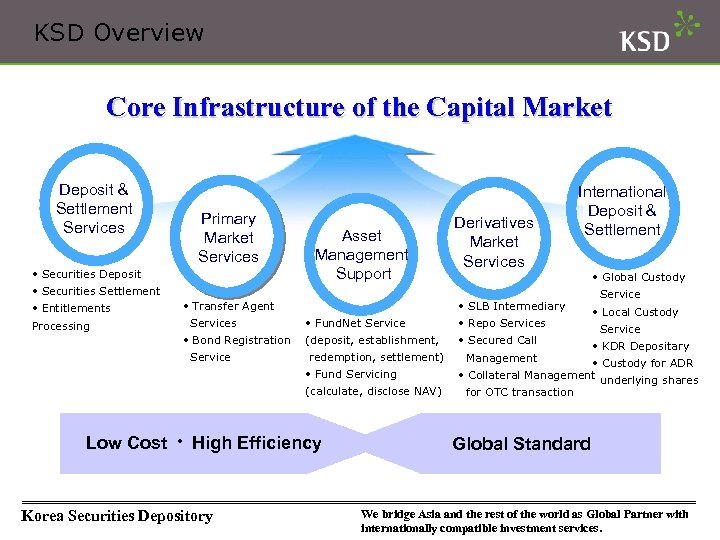

KSD Overview Core Infrastructure of the Capital Market Deposit & Settlement Services Primary Market Services • Securities Deposit Asset Management Support Derivatives Market Services International Deposit & Settlement • Global Custody • Securities Settlement • Entitlements Processing • Transfer Agent Services • Bond Registration Service • SLB Intermediary • Fund. Net Service • Repo Services (deposit, establishment, • Secured Call redemption, settlement) • Fund Servicing (calculate, disclose NAV) Low Cost ㆍ High Efficiency Korea Securities Depository Management Service • Local Custody Service • KDR Depositary • Custody for ADR • Collateral Management underlying shares for OTC transaction Global Standard We bridge Asia and the rest of the world as Global Partner with internationally compatible investment services.

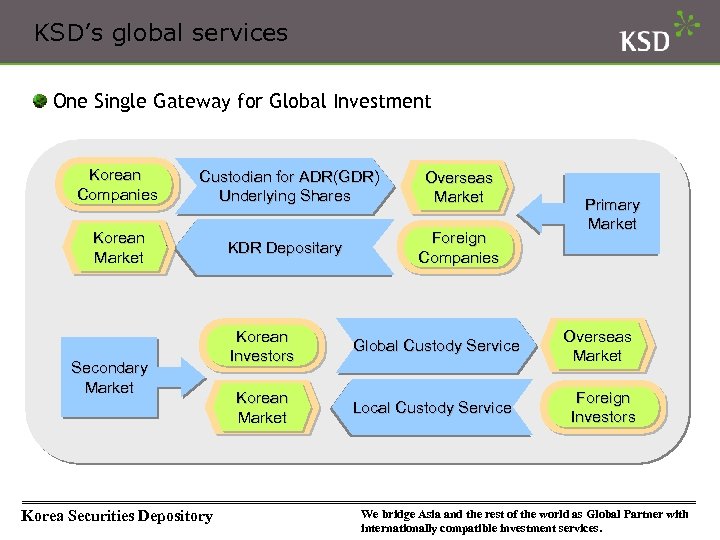

KSD’s global services One Single Gateway for Global Investment Korean Companies Custodian for ADR(GDR) Underlying Shares Overseas Market Korean 국내증권시장 Market KDR Depositary Foreign Companies Secondary Market Korea Securities Depository Korean Investors Global Custody Service Korean 국내증권시장 Market Local Custody Service Primary Market Overseas 국내증권시장 Market Foreign Investors We bridge Asia and the rest of the world as Global Partner with internationally compatible investment services.

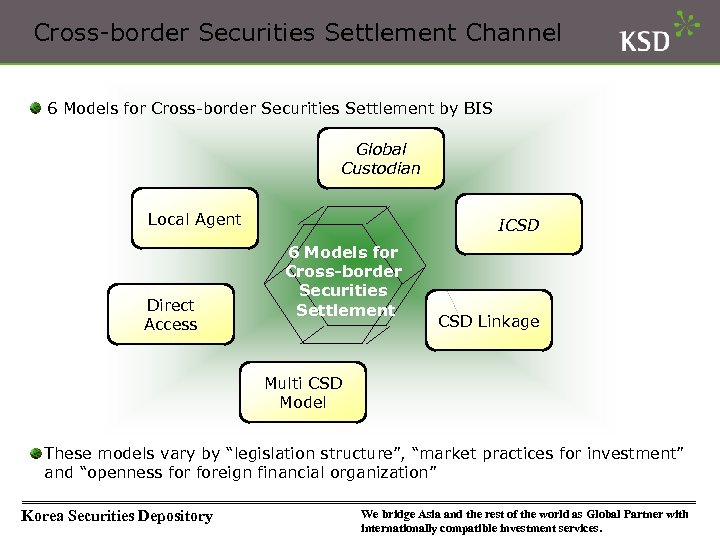

Cross-border Securities Settlement Channel 6 Models for Cross-border Securities Settlement by BIS Global Custodian Local Agent Direct Access ICSD 6 Models for Cross-border Securities Settlement CSD Linkage Multi CSD Model These models vary by “legislation structure”, “market practices for investment” and “openness foreign financial organization” Korea Securities Depository We bridge Asia and the rest of the world as Global Partner with internationally compatible investment services.

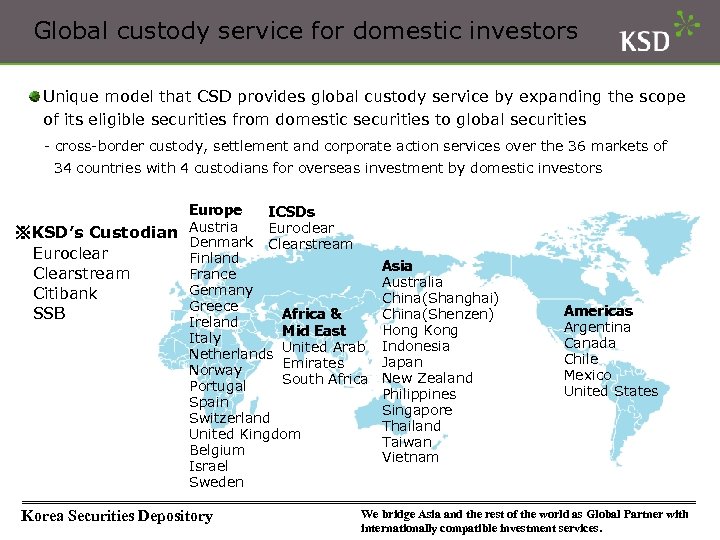

Global custody service for domestic investors Unique model that CSD provides global custody service by expanding the scope of its eligible securities from domestic securities to global securities - cross-border custody, settlement and corporate action services over the 36 markets of 34 countries with 4 custodians for overseas investment by domestic investors Europe ICSDs Euroclear ※KSD’s Custodian Austria Denmark Clearstream Euroclear Finland Clearstream France Germany Citibank Greece Africa & SSB Ireland Mid East Italy United Arab Netherlands Emirates Norway South Africa Portugal Spain Switzerland United Kingdom Belgium Israel Sweden Korea Securities Depository Asia Australia China(Shanghai) China(Shenzen) Hong Kong Indonesia Japan New Zealand Philippines Singapore Thailand Taiwan Vietnam Americas Argentina Canada Chile Mexico United States We bridge Asia and the rest of the world as Global Partner with internationally compatible investment services.

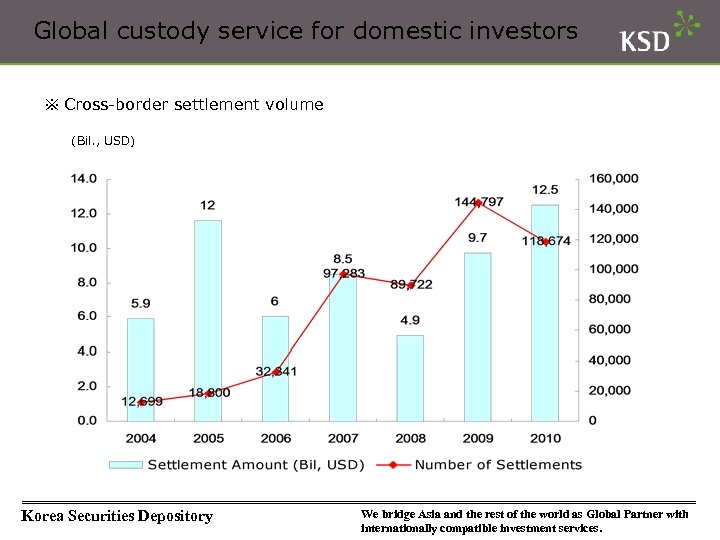

Global custody service for domestic investors ※ Cross-border settlement volume (Bil. , USD) Korea Securities Depository We bridge Asia and the rest of the world as Global Partner with internationally compatible investment services.

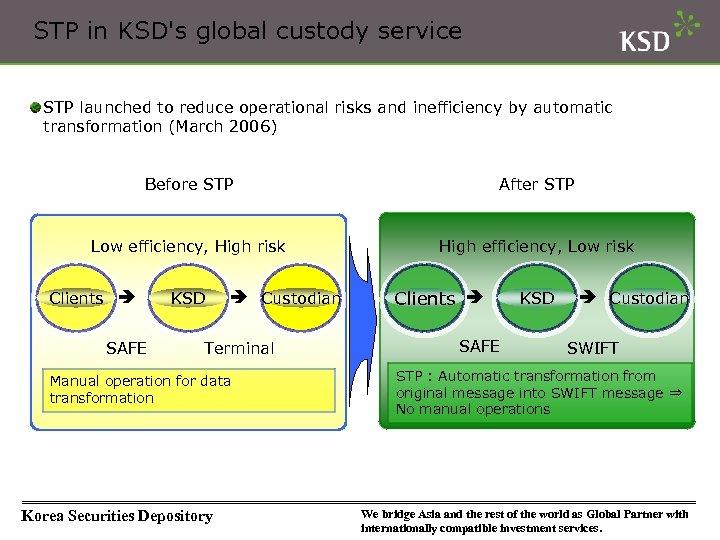

STP in KSD's global custody service STP launched to reduce operational risks and inefficiency by automatic transformation (March 2006) Before STP After STP Low efficiency, High risk High efficiency, Low risk Clients SAFE KSD Custodian Terminal Manual operation for data transformation Korea Securities Depository Clients SAFE KSD Custodian SWIFT STP : Automatic transformation from original message into SWIFT message ⇒ No manual operations We bridge Asia and the rest of the world as Global Partner with internationally compatible investment services.

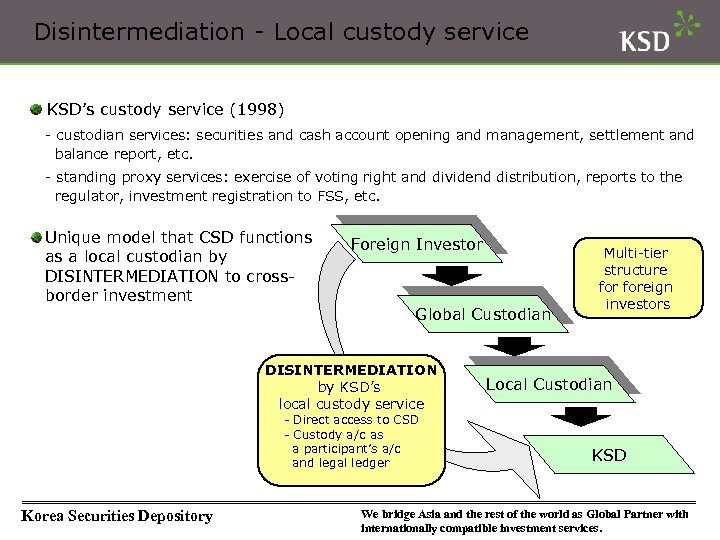

Disintermediation - Local custody service KSD’s custody service (1998) - custodian services: securities and cash account opening and management, settlement and balance report, etc. - standing proxy services: exercise of voting right and dividend distribution, reports to the regulator, investment registration to FSS, etc. Unique model that CSD functions as a local custodian by DISINTERMEDIATION to crossborder investment Foreign Investor Global Custodian DISINTERMEDIATION by KSD’s local custody service - Direct access to CSD - Custody a/c as a participant’s a/c and legal ledger Korea Securities Depository Multi-tier structure foreign investors Local Custodian KSD We bridge Asia and the rest of the world as Global Partner with internationally compatible investment services.

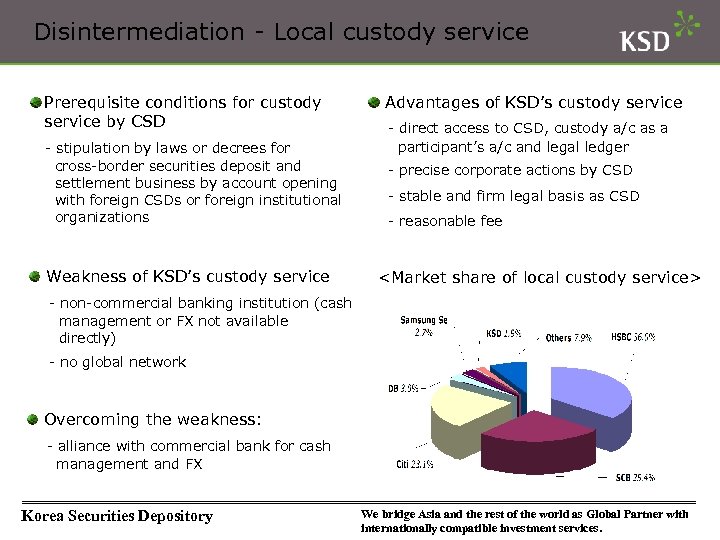

Disintermediation - Local custody service Prerequisite conditions for custody service by CSD - stipulation by laws or decrees for cross-border securities deposit and settlement business by account opening with foreign CSDs or foreign institutional organizations Weakness of KSD’s custody service Advantages of KSD’s custody service - direct access to CSD, custody a/c as a participant’s a/c and legal ledger - precise corporate actions by CSD - stable and firm legal basis as CSD - reasonable fee <Market share of local custody service> - non-commercial banking institution (cash management or FX not available directly) - no global network Overcoming the weakness: - alliance with commercial bank for cash management and FX Korea Securities Depository We bridge Asia and the rest of the world as Global Partner with internationally compatible investment services.

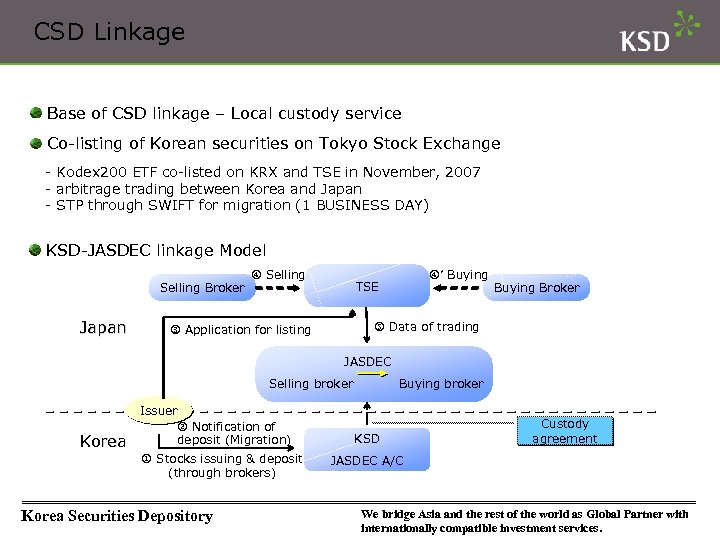

CSD Linkage Base of CSD linkage – Local custody service Co-listing of Korean securities on Tokyo Stock Exchange - Kodex 200 ETF co-listed on KRX and TSE in November, 2007 - arbitrage trading between Korea and Japan - STP through SWIFT for migration (1 BUSINESS DAY) KSD-JASDEC linkage Model Selling Broker Japan Selling ’ Buying TSE Buying Broker Data of trading Application for listing JASDEC Selling broker Korea Issuer Notification of deposit (Migration) Stocks issuing & deposit (through brokers) Korea Securities Depository Buying broker KSD Custody agreement JASDEC A/C We bridge Asia and the rest of the world as Global Partner with internationally compatible investment services.

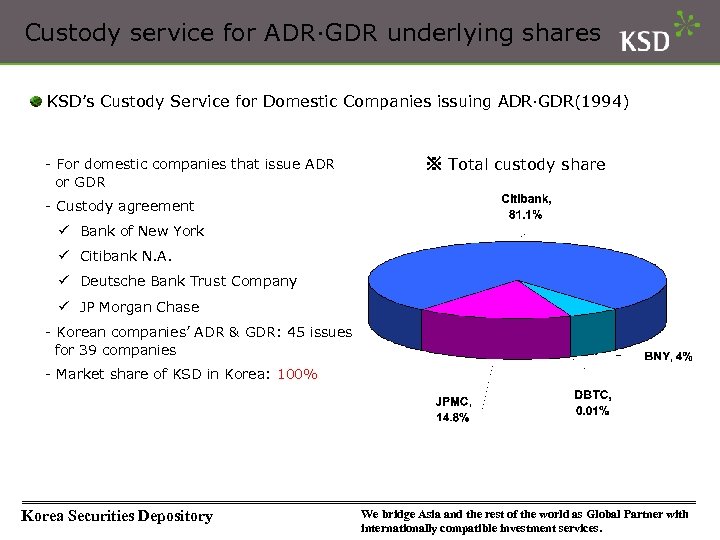

Custody service for ADR∙GDR underlying shares KSD’s Custody Service for Domestic Companies issuing ADR∙GDR(1994) - For domestic companies that issue ADR or GDR ※ Total custody share - Custody agreement ü Bank of New York ü Citibank N. A. ü Deutsche Bank Trust Company ü JP Morgan Chase - Korean companies’ ADR & GDR: 45 issues for 39 companies - Market share of KSD in Korea: 100% Korea Securities Depository We bridge Asia and the rest of the world as Global Partner with internationally compatible investment services.

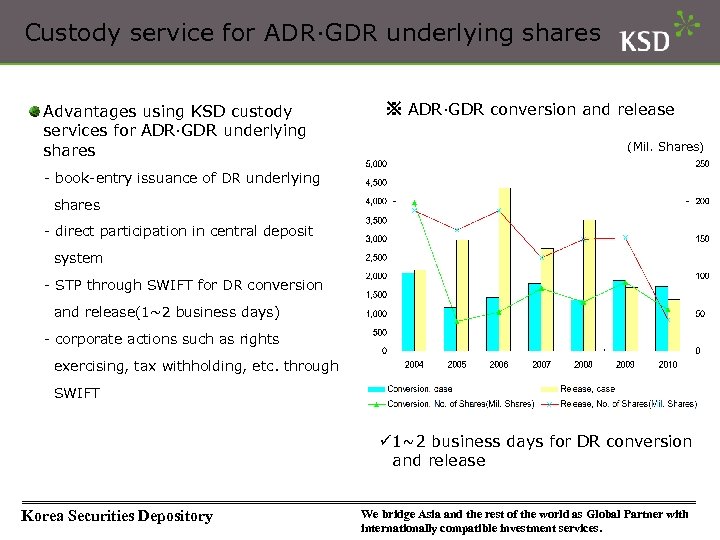

Custody service for ADR∙GDR underlying shares Advantages using KSD custody services for ADR∙GDR underlying shares ※ ADR∙GDR conversion and release (Mil. Shares) - book-entry issuance of DR underlying shares - direct participation in central deposit system - STP through SWIFT for DR conversion and release(1~2 business days) - corporate actions such as rights exercising, tax withholding, etc. through SWIFT ü 1~2 business days for DR conversion and release Korea Securities Depository We bridge Asia and the rest of the world as Global Partner with internationally compatible investment services.

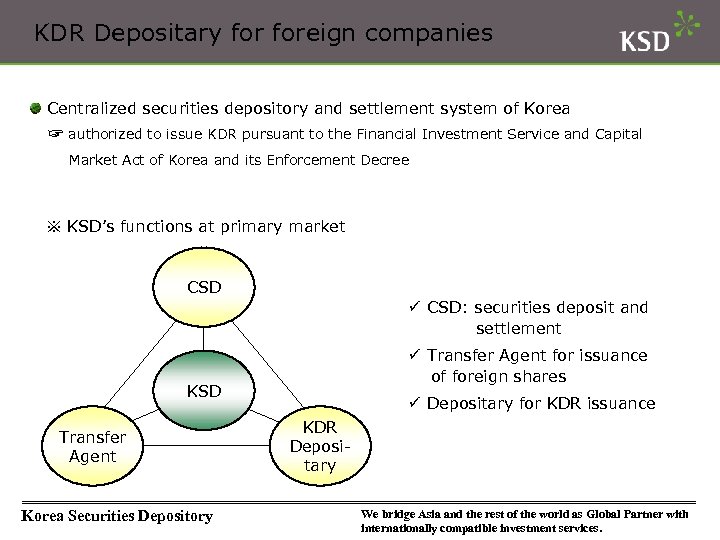

KDR Depositary foreign companies Centralized securities depository and settlement system of Korea ☞ authorized to issue KDR pursuant to the Financial Investment Service and Capital Market Act of Korea and its Enforcement Decree ※ KSD’s functions at primary market CSD ü CSD: securities deposit and settlement ü Transfer Agent for issuance of foreign shares KSD Transfer Agent Korea Securities Depository ü Depositary for KDR issuance KDR Depositary We bridge Asia and the rest of the world as Global Partner with internationally compatible investment services.

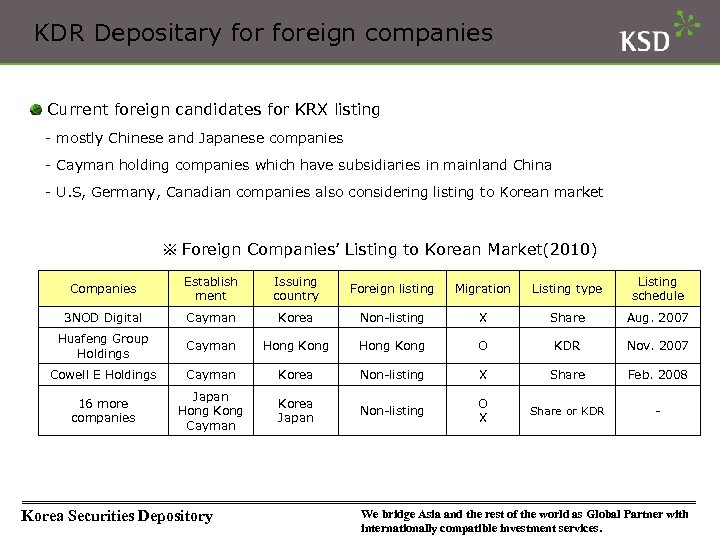

KDR Depositary foreign companies Current foreign candidates for KRX listing - mostly Chinese and Japanese companies - Cayman holding companies which have subsidiaries in mainland China - U. S, Germany, Canadian companies also considering listing to Korean market ※ Foreign Companies’ Listing to Korean Market(2010) Companies Establish ment Issuing country Foreign listing Migration Listing type Listing schedule 3 NOD Digital Cayman Korea Non-listing X Share Aug. 2007 Huafeng Group Holdings Cayman Hong Kong O KDR Nov. 2007 Cowell E Holdings Cayman Korea Non-listing X Share Feb. 2008 16 more companies Japan Hong Kong Cayman Korea Japan Non-listing O X Share or KDR - Korea Securities Depository We bridge Asia and the rest of the world as Global Partner with internationally compatible investment services.

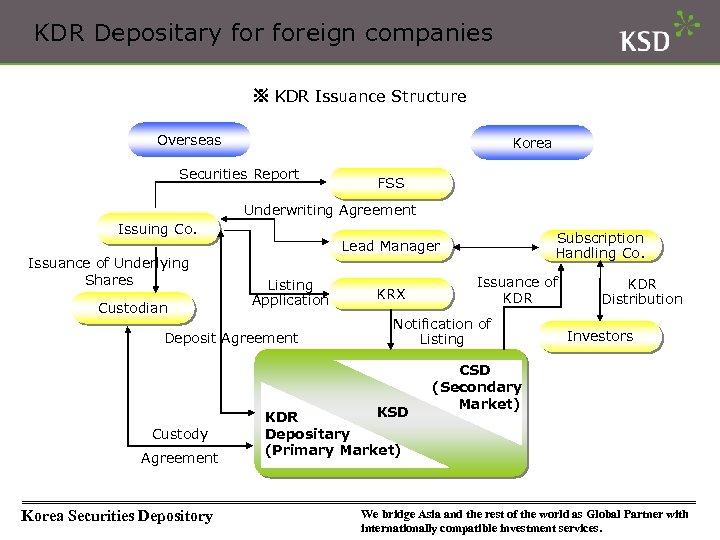

KDR Depositary foreign companies ※ KDR Issuance Structure Overseas Korea Securities Report FSS Underwriting Agreement Issuing Co. Issuance of Underlying Shares Custodian Listing Application Deposit Agreement Custody Agreement Korea Securities Depository Subscription Handling Co. Lead Manager KRX Issuance of KDR Notification of Listing KSD KDR Depositary (Primary Market) KDR Distribution Investors CSD (Secondary Market) We bridge Asia and the rest of the world as Global Partner with internationally compatible investment services.

Expandability of CSD's role in global market Unique global custody model by expanding its role from domestic securities to global securities, overcoming the limits of a traditional CSD Possibility and expandability of local custody service by CSD, implementing Disintermediation Fast and efficient CSD linkage model for the migration between the markets in the case of co-listed companies in the form of shares Depositary role of CSD in issuing DRs in domestic market as well as 4 major Depositary banks Korea Securities Depository We bridge Asia and the rest of the world as Global Partner with internationally compatible investment services.

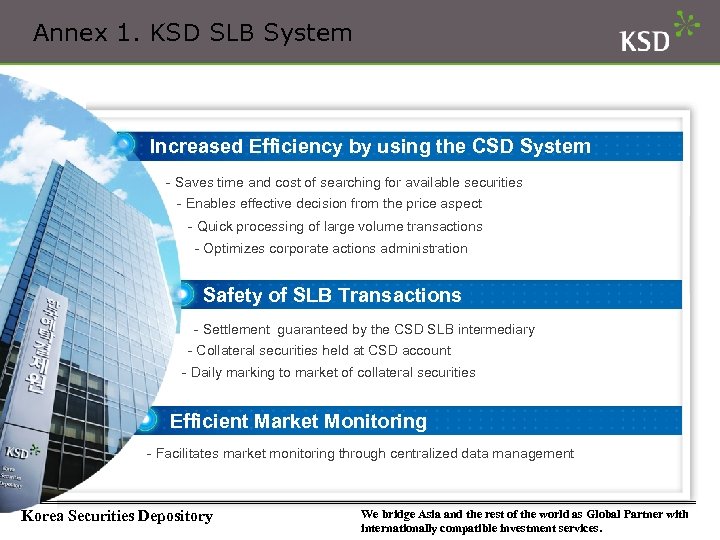

Annex 1. KSD SLB System Increased Efficiency by using the CSD System - Saves time and cost of searching for available securities - Enables effective decision from the price aspect - Quick processing of large volume transactions - Optimizes corporate actions administration Safety of SLB Transactions - Settlement guaranteed by the CSD SLB intermediary - Collateral securities held at CSD account - Daily marking to market of collateral securities Efficient Market Monitoring - Facilitates market monitoring through centralized data management Korea Securities Depository We bridge Asia and the rest of the world as Global Partner with internationally compatible investment services.

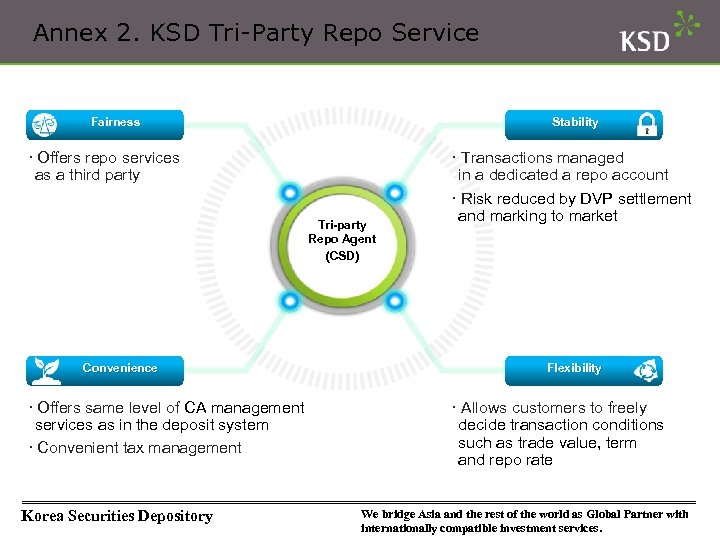

Annex 2. KSD Tri-Party Repo Service Fairness Stability · Offers repo services as a third party Tri-party Repo Agent (CSD) Convenience · Offers same level of CA management services as in the deposit system · Convenient tax management Korea Securities Depository · Transactions managed in a dedicated a repo account · Risk reduced by DVP settlement and marking to market Flexibility · Allows customers to freely decide transaction conditions such as trade value, term and repo rate We bridge Asia and the rest of the world as Global Partner with internationally compatible investment services.

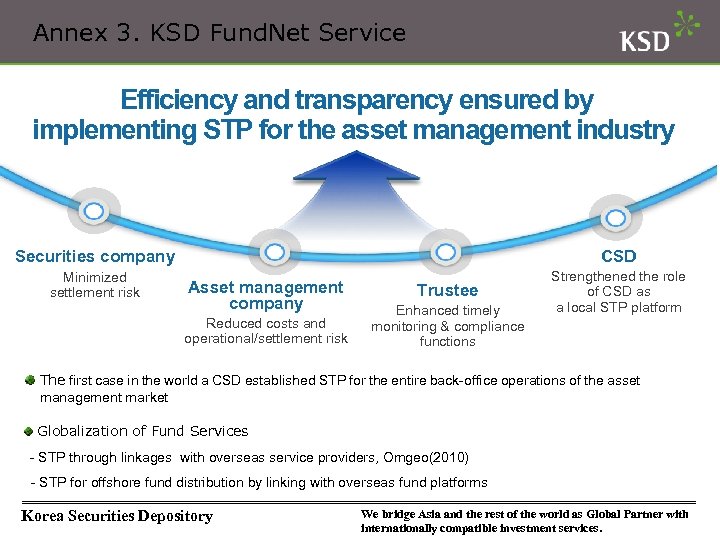

Annex 3. KSD Fund. Net Service Efficiency and transparency ensured by implementing STP for the asset management industry Securities company Minimized settlement risk CSD Asset management company Reduced costs and operational/settlement risk Trustee Enhanced timely monitoring & compliance functions Strengthened the role of CSD as a local STP platform The first case in the world a CSD established STP for the entire back-office operations of the asset management market Globalization of Fund Services - STP through linkages with overseas service providers, Omgeo(2010) - STP for offshore fund distribution by linking with overseas fund platforms Korea Securities Depository We bridge Asia and the rest of the world as Global Partner with internationally compatible investment services.

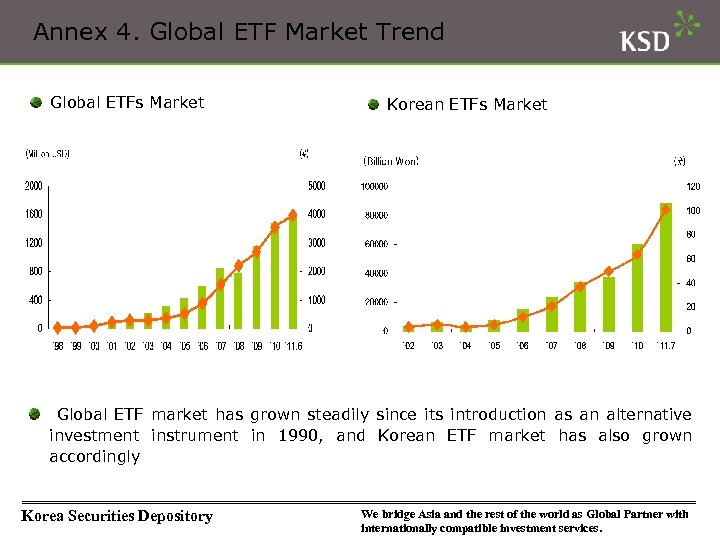

Annex 4. Global ETF Market Trend Global ETFs Market Korean ETFs Market Global ETF market has grown steadily since its introduction as an alternative investment instrument in 1990, and Korean ETF market has also grown accordingly Korea Securities Depository We bridge Asia and the rest of the world as Global Partner with internationally compatible investment services.

Thank You Korea Securities Depository We bridge Asia and the rest of the world as Global Partner with internationally compatible investment services.

efc15ec648f66485d9abc5eb4bcde4ad.ppt