3d7bb3d28b1062039839a9ebefad86be.ppt

- Количество слайдов: 51

Kotler, Brown, Burton, Deans, Armstrong Marketing 8 e Chapter 12: Pricing for value

Chapter Objectives 1. 2. 3. 4. Explain how marketing objectives, marketing mix strategy, costs and other company factors affect pricing decisions. List and discuss factors outside the company that affect pricing decisions. Explain how price setting depends on consumer perceptions of price and on the price-demand relationship. Compare the five general pricing approaches. 5. 6. 7. 8. Describe the main strategies for pricing new products. Explain how companies find a set of prices that maximises the profits from the total product mix. Explain how companies adjust their prices to take into account different types of customers and situations. Explain why companies decide to change their prices.

Introduction • Price is the amount of money charged for a product or service • Price has many names—rent, tuition, fee, fare tariff, rate, interest and so on • Is a main factor affecting consumer choice • Only element in the marketing mix that produces revenue—all others are costs (investments) • Is the ‘easiest’ element of the marketing mix to change and use in tactical ploys

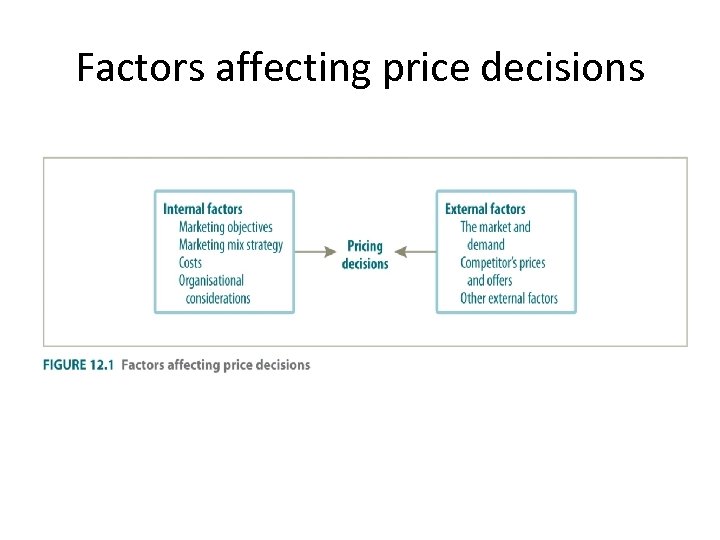

Factors affecting price decisions

Factors to consider when setting prices • Internal factors affecting pricing decisions: – Marketing objectives—product strategy (target market and positioning) must be decided before setting the price • Survival—set low prices hoping to spark demand • Current profit maximisation—long run ignored • Market-share leadership—low prices hoping that larger share will lower costs and increase profits • Product-quality leadership—higher prices • Other objectives—barrier to entry, keep loyal customers, sales promotions

Factors to consider when setting prices • Marketing mix strategy: – Price is only one aspect of the marketing mix – Price decisions must be coordinated with product design, distribution and promotion decisions to form a consistent and effective marketing program. – Decisions in these areas can affect price • High quality product requires higher price to recoup higher costs – Price can be crucial for positioning

Factors to consider when setting prices • Marketer must consider the total marketing mix when setting prices – If product is positioned on non-price factors then decisions about quality, promotion and distribution will strongly affect price – If price is a critical positioning factor then price will strongly affect the other marketing mix elements

Costs • Costs set the floor for the price that the company can charge for its products. • The company wants to charge a price that covers all its costs for producing, distributing and selling the product and also delivers a fair rate of return for its effort and risk. • Costs may be an important element in the pricing strategy. • Lower costs may mean lower prices, greater sales and profits.

The economics of information-based products • Information goods such as software, books, movies and music have a different cost structure from tangible products. • Most of the production costs are fixed costs that cannot be recovered if production is stopped. • The variable costs for producing additional copies are very low.

Organisational considerations • Management must decide who within the organisation should set prices. • In small companies, price setting is often handled by top management. • In large companies, price setting is typically handled by divisional or product line managers. • Sadly, marketers can be left out of pricing decisions

External factors affecting pricing decisions • The market and demand – Pricing in different types of markets – Consumer perceptions of price and value – Price and consumption – Price elasticity of demand – Competitor’s prices and offers – Other external factors

The market and demand • Pure competition: The market consists of many buyers and sellers trading in a uniform commodity. No single buyer or seller has much effect on the going market price. • Monopolistic competition: The market consists of many buyers and sellers. A range of prices occurs because sellers can differentiate their offers to the buyers. • Oligopolistic competition: The market consists of a few sellers who are highly sensitive to each other’s pricing and marketing strategies. The product can be uniform or non-uniform. The sellers are few because it is difficult for new sellers to enter the market. • A pure monopoly: This consists of one seller. The seller may be a government monopoly, a private, regulated monopoly or a private, non-regulated monopoly. Pricing is handled differently in each case.

Consumer perceptions of price and value • Pricing requires more than technical expertise. It requires creative judgment and awareness of buyers’ motivations. • The key to effective pricing is the same one that opens doors in other marketing functions—a creative awareness of who buyers are, why they buy and how they make their buying decisions. • The recognition that buyers differ in these dimensions is as important for effective pricing as it is for effective promotion, distribution or product development. • Consumers decide whether a price is right

Pricing and consumption • Evidence suggests that consumption of a product or service increases at the time when consumers actually pay for it – A study shows that consumption at a health club closely followed the timing of payments, then declined steadily until the next payment.

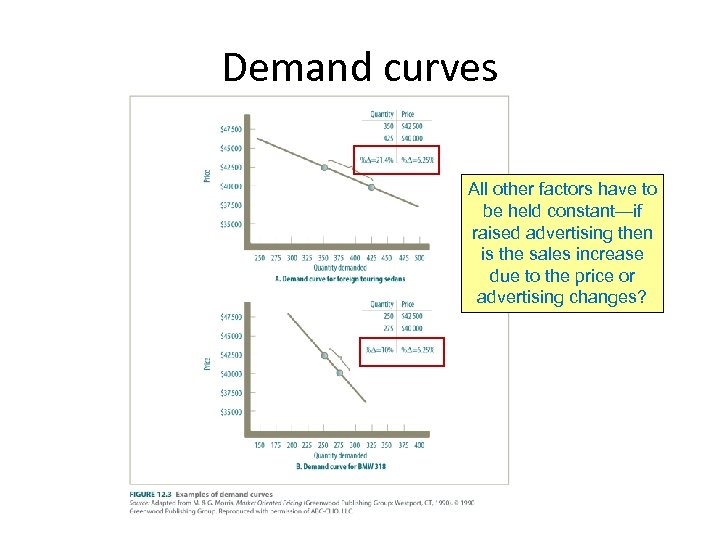

Analysing the price-demand relationship • Each price the company might charge will lead to a different level of demand. • The relationship between the price charged and the resulting demand level is shown in the demand curve—see next slide

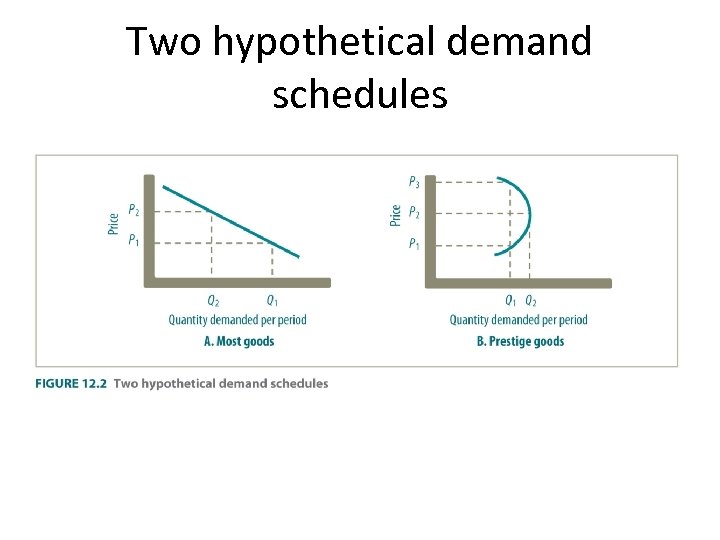

Two hypothetical demand schedules

Demand curves All other factors have to be held constant—if raised advertising then is the sales increase due to the price or advertising changes?

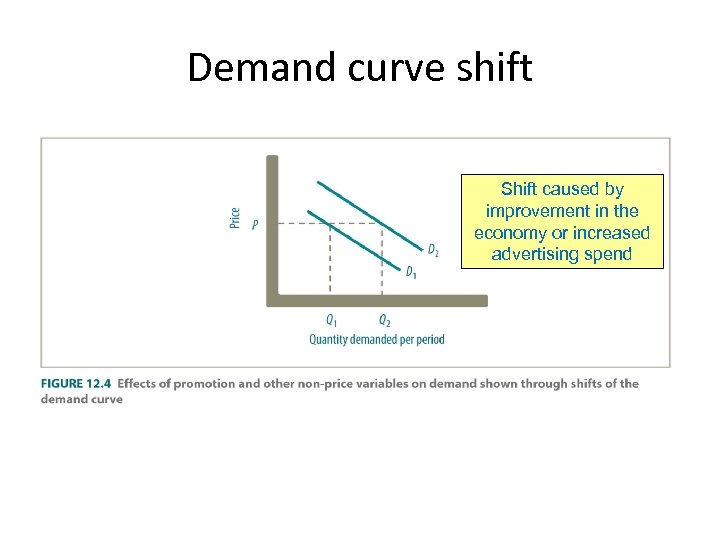

Demand curve shift Shift caused by improvement in the economy or increased advertising spend

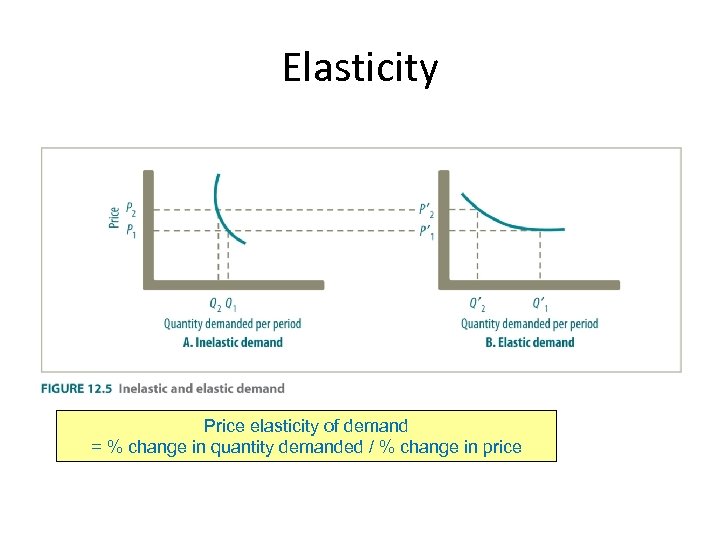

Elasticity Price elasticity of demand = % change in quantity demanded / % change in price

Competitors’ prices and offers • Competitors’ prices and their reactions to other companies’ pricing must be considered. • Each company must learn the price and quality of their competitors’ offers which may provide a basis for its own strategy.

Other external factors • Economic conditions can have a strong impact on the outcomes of the company’s pricing strategies. – Inflation, boom or recession and interest rates • Impact on members in the value chain • Government – Trade Practices Act – Australian Competition and Consumer Commission

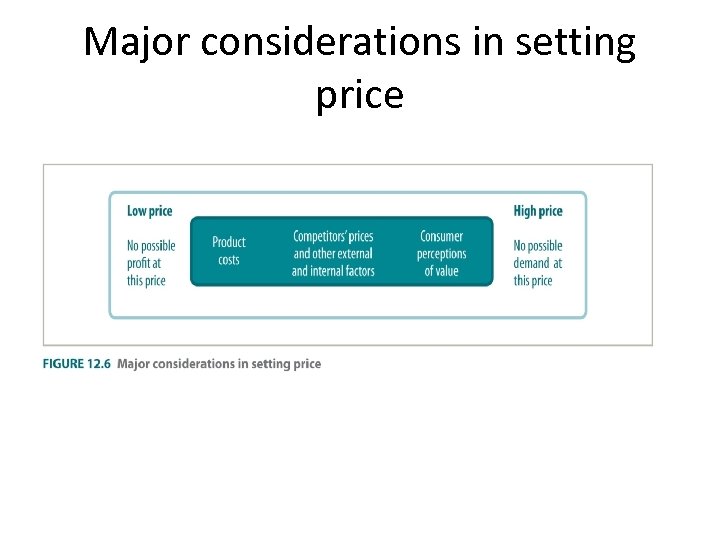

General pricing approaches • The price the company charges will be between one that is too low to produce a profit and one that is too high to produce any demand. • Product costs set a floor to the price; consumer perceptions of the product’s value set the ceiling. • The company must consider competitors’ prices and other external and internal factors to find the best price between these two extremes.

Major considerations in setting price

General pricing approaches • • Cost-plus pricing Break-even analysis and target profit pricing Value-based pricing Competition-based pricing – Economic value pricing – Going-rate pricing – Sealed-bid pricing • Relationship pricing – Special relationship – Enrichment – Shared risk and reward

Cost-plus pricing and break-even analysis • The simplest pricing method is cost-plus pricing adding a standard mark-up to the cost of the product • The company tries to determine the price at which it will break-even or make the target profit it seeks. • Target pricing uses the concept of a break-even chart. A break-even chart shows the total cost and total revenue expected at different sales volume levels—see Appendix 2 p. 660 onwards

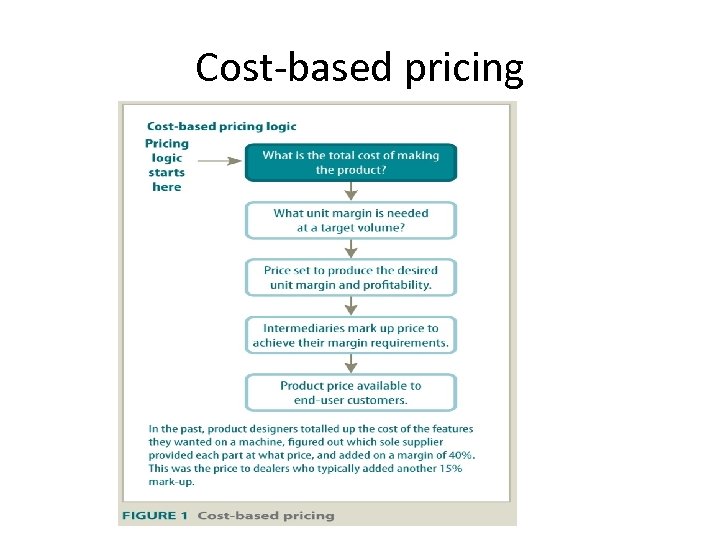

Cost-based pricing

Value-based pricing • Value-based pricing uses buyers’ perceptions of value, not the seller’s cost, as the key to pricing • The company uses the non-price variables in the marketing mix to build up perceived value in the buyers’ minds • Price is set to match the perceived value.

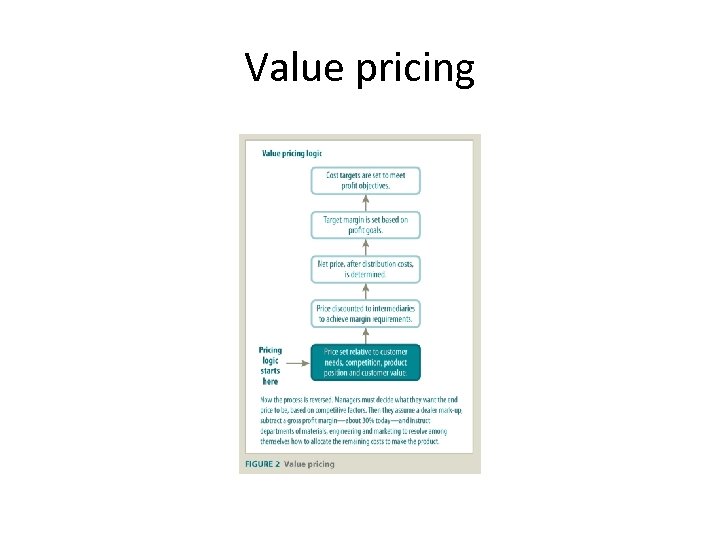

Value pricing

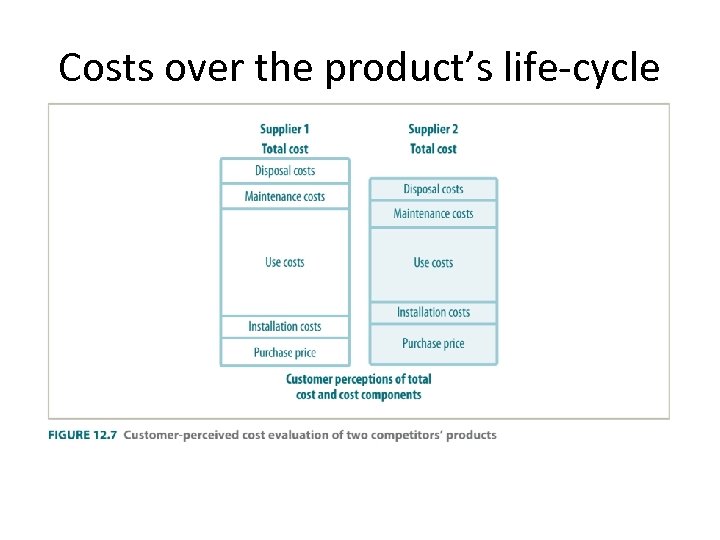

Competition-based pricing • Economic-value pricing – For many industrial products, the costs perceived by customers extend well beyond the price charged. – An industrial purchaser perceives the cost of equipment as including installation, maintenance, training and use of consumables, as well as the basic purchase price. – Equipment purchases are evaluated over their economic lives and comparisons between competitors go beyond straight price assessment.

Costs over the product’s life-cycle

Competition-based pricing • Going-rate pricing – The company bases its price largely on competitors’ prices, with less attention paid to its own costs or demand. – The company might charge the same, more or less than its major competitors. – In oligopolistic industries that sell a commodity such as steel, paper or fertiliser, companies normally charge the same price. – The smaller firms follow the leader—they change their prices when the market leader’s prices change, rather than when their own demand or cost changes.

Competition-based pricing • Sealed-bid/tenders – Using sealed-bid pricing, a company bases its price on how it thinks competitors will price rather than on its own costs or demand. The company wants to win a contract, and winning the contract requires pricing lower than other companies. – However, the company cannot set its price below a certain level. It cannot price below cost without harming its position, but the higher it sets its price above its costs, the lower its chance of getting the contract.

Performance-based pricing • Becoming more popular in service industries • Can be protection for the – Seller—paid when all services delivered and – Buyer—not have to pay when services not delivered • Forces parties to be more explicit about objectives, limitations, issues and so on • Improves communications which often leads to relationship pricing

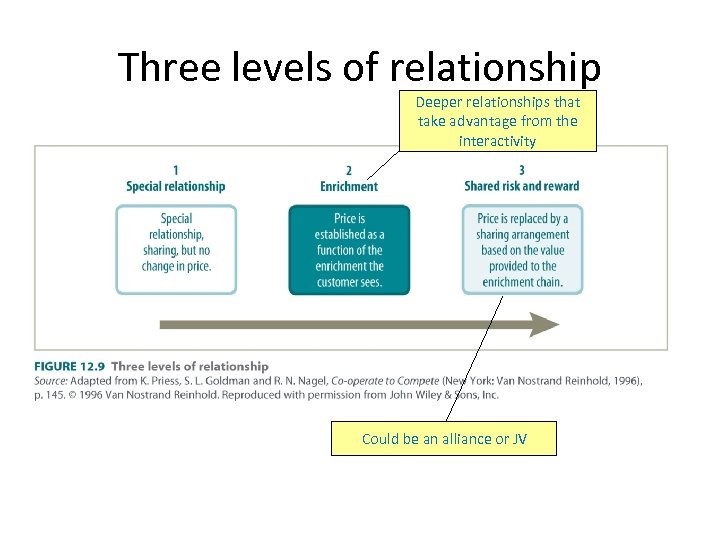

Three levels of relationship Deeper relationships that take advantage from the interactivity Could be an alliance or JV

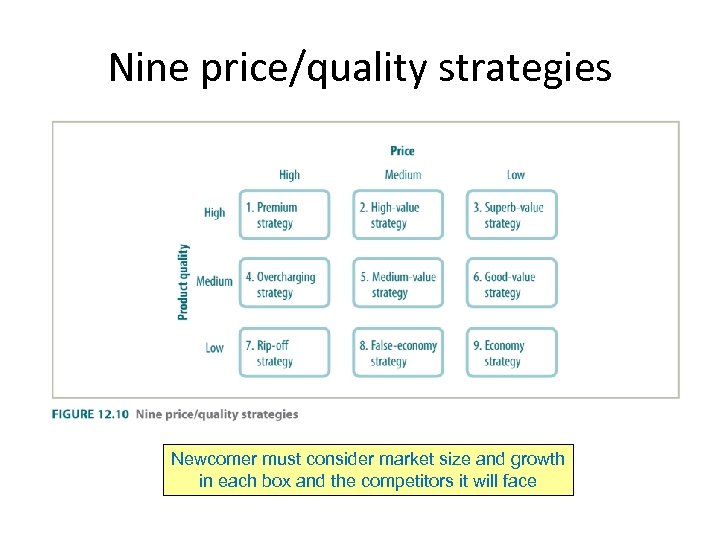

New-product pricing strategies • Companies bringing out an innovative, patent-protected product tend to adopt either – Market-skimming pricing—many companies that invent new products set high prices initially to ‘skim’ revenue layer by layer from the market. – Marketing-penetration pricing—companies may initially set a low initial price in order to penetrate the market quickly. • Pricing an imitative new product—the company must decide where to position the product on quality and price—see the next slide.

Nine price/quality strategies Newcomer must consider market size and growth in each box and the competitors it will face

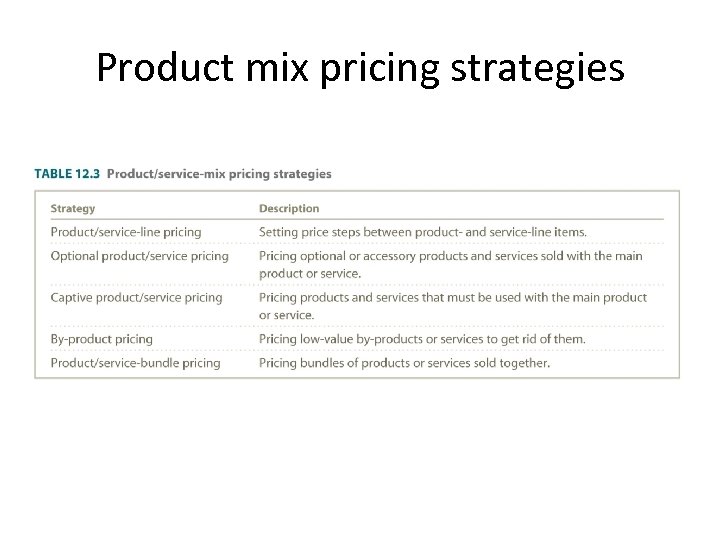

Product mix pricing strategies

Product mix and service mix pricing strategies (1) • Product/service-line pricing – Companies usually develop product lines rather than single products – Management must determine what price steps to set between the various models of the products • Optional product/service pricing – Companies offer to sell optional or accessory products or services along with their main product

Product mix and service mix pricing strategies (2) • Captive product/service pricing – Companies that make products that must be used along with a main product use this strategy – In services, this is called two-part pricing, where the price of the service is broken into a fixed fee plus variable usage rate. • By-product pricing – Many companies produce by-products in the production process—sales help reduce the costs of main products and make their main products’ price more competitive

Product mix and service mix pricing strategies (3) • Product/service-bundle pricing – Many companies use product/service bundle pricing in order to reduce price and attract more customers – An airline that provides a package ticket, which includes free accommodation and breakfast • This may stop the customer from switching to the competitors • However, the bundle pricing must be low enough to attract buyers.

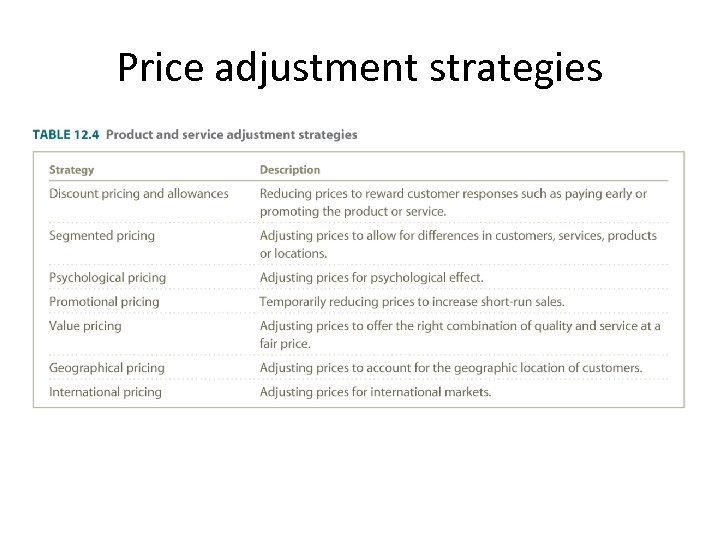

Price adjustment strategies

Price-adjustment strategies • Discount pricing and allowances—adjust the basic price to reward customers for certain responses, such as early payment of bills, volume purchases and buying offseason. • Cash discounts—a price reduction to buyers who pay their bills promptly. • Quantity discount—a price reduction for large volumes. • Functional discounts—a reduction offered by the seller to trade channel members, retailers and wholesalers who perform functions such as selling, storing and record keeping. • Seasonal discounts—price reduction for out of season purchases. • Allowances—trade-in allowances and promotional allowances.

Segmented pricing • In segmented pricing, the company sells a product or service at two or more prices even though the difference is not based on differences in costs: – Customer segment pricing—different segments pay different prices—seniors pay less – Product-form pricing—different versions of the product are priced differently, but not according to differences in their costs—DVD recorders with different hard drives – Location pricing—different locations are priced differently even though the cost of offering each location is the same— airline seats – Time pricing—prices are varied seasonally, by the month, by the day and even by the hour—off-peak times

Psychological pricing • Price indicates something about the product. • Many consumers use price to judge quality. • In psychological pricing, sellers consider the psychology of prices and not simply the economics. • Another aspect of psychological pricing is reference prices—prices that buyers carry in their minds and refer to when they look at a given product. – The reference price might be formed by noting current prices, remembering past prices or assessing the buying situation.

Promotional pricing • Companies temporarily price their products below list price and sometimes even below cost. • Stores often price a few products as loss leaders to attract customer to the store in the hope they will buy other items at normal mark-ups. • Special-event pricing takes place during certain seasons to draw more customers, such as in January to attract Christmas shoppers back. • Heavy discounting can reduce brand equity in the long run

Value pricing and geographical pricing • Value pricing starts with the customer and the benefits the product creates relative to key competitors. • Geographical pricing is a decision about how to price products to different customers in different parts of the country. • International pricing—companies that market their products internationally must decide what prices to charge in the different countries in which they operate – In some cases, a uniform price is set worldwide but most companies adjust their prices to reflect local market conditions.

Price flexibility on the Net • The internet provides opportunities to test prices, segment customers and adjust to changes in supply and demand. • Prices can be changed with speed. • Online prices are not always lower than in offline stores. • Good examples of internet pricing strategies are e. Bay and Priceline. com

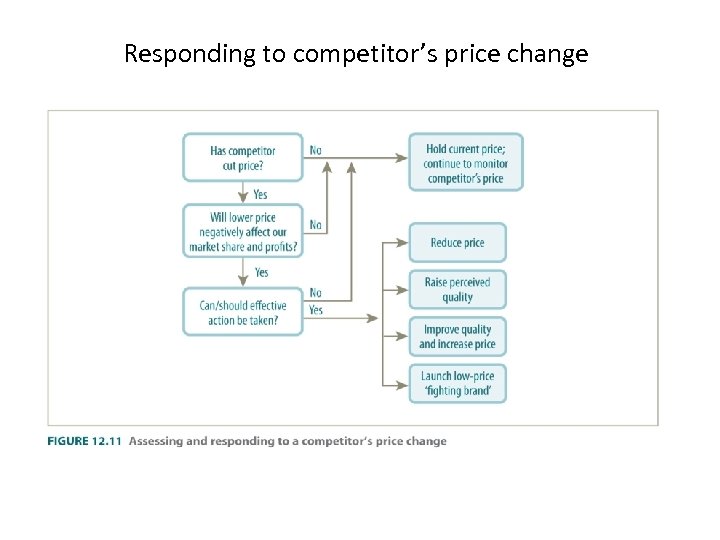

Price changes • Companies may need to initiate price changes and this may be due to: – Excess capacity, competition, etc. – Factors such as inflation and rising costs. • Buyer reactions to price changes: – Customers do not always put a straightforward interpretation on price changes, believing that the change indicates something about the product quality. • Competitor reactions to price changes: – Competitors are most likely to react when the number of firms involved is small, when the product is uniform and when the buyers are well informed—see next slide.

Responding to competitor’s price change

Steps to effective pricing • Determine the value the • Measure and monitor the net customer places on the prices obtained in the market product. —know the effects of price changes, discounts, etc. • Assess the different value by different market • Assess customers’ emotional segments. responses to prices. • Determine price sensitivity. • Determine whether the market segment or key • Identify the best pricing customer provides sufficient structure. returns in relation to costs to • Take account of serve. competitors’ likely reactions.

Summary • Despite the increased role of non-price factors in the modern marketing process, price remains an important element of the marketing mix. • Many internal and external factors influence pricing decisions. • In the end, the consumer decides whether the company has set the right price and they may differ in the values they assign to different product features.

3d7bb3d28b1062039839a9ebefad86be.ppt