KB-M Week6.ppt

- Количество слайдов: 27

Korean Business & Management: Struggles of Korean Companies during the Financial Crisis Week 6

I think it was the financial crisis that literary put Samsung at the edge of dying, that forced them to rethink everything. Yes, initially there was a major resistance, a major barrier, but on the other hand because of the Asian financial crisis there was also the view that they had no other choice. There was nothing else they could do but this. -Eric Kim, former Chief Marketing Officer, Samsung Electronics- 2

Crisis Management by the IMF Question: What has been the role of the IMF in the international monetary systems since the collapse of Bretton Woods? Answer: n The IMF has redefined its mission, and now focuses on lending money to countries experiencing financial crises in exchange for enacting certain macroeconomic policies ¨ Membership in the IMF has grown to 186 countries in 2010, 54 of which has some type of IMF program in place 3

Financial Crises Post-Bretton Woods Three types of financial crises that have required involvement by the IMF are 1. A currency crisis - occurs when a speculative attack on the exchange value of a currency results in a sharp depreciation in the value of the currency, or forces authorities to expend large volumes of international currency reserves and sharply increase interest rates in order to defend prevailing exchange rates n 4

Financial Crises Post-Bretton Woods 2. A banking crisis - refers to a situation in which a loss of confidence in the banking system leads to a run on the banks, as individuals and companies withdraw their deposits 3. A foreign debt crisis - a situation in which a country cannot service its foreign debt obligations, whether private sector or government debt n Two crises that are particularly significant are 1. the 1995 Mexican currency crisis 2. the 1997 Asian currency crisis 5

The Mexican Currency Crisis of 1995 n The Mexican currency crisis of 1995 was a result of high Mexican debts, and a pegged exchange rate that did not allow for a natural adjustment of prices ¨ in order to keep Mexico from defaulting on its debt, a $50 billion aid package was created by the IMF n By 1997, Mexico was well on the way to recovery 6

The Asian Crisis Question: What were the causes of the 1997 Asian financial crisis? Answer: n The causes of the crisis can be traced to the previous decade when the region was experiencing unprecedented growth 1. The Investment Boom ¨ fueled by export-led growth ¨ large investments were often based on projections about future demand conditions that were unrealistic 7

The Asian Crisis 2. Excess Capacity n investments made on the basis of unrealistic projections about future demand conditions created significant excess capacity 3. The Debt Bomb n investments were often supported by dollar-based debts n when inflation and increasing imports put pressure on the currencies, the resulting devaluations led to default on dollar denominated debts 4. Expanding Imports n by the mid 1990 s, imports were expanding across the region causing balance of payments deficits n The balance of payments deficits made it difficult for countries to maintain their currencies against the U. S. dollar 8

The Asian Crisis By mid-1997, it became clear that several key Thai financial institutions were on the verge of default n Foreign exchange dealers and hedge funds started to speculate against the Thai baht, selling it short n After struggling to defend the peg, the Thai government abandoned its defense and announced that the baht would float freely against the dollar n 9

The Asian Crisis Thailand turned to the IMF for help n Speculation continued to affect other Asian countries including Malaysia, Indonesia, Singapore which all saw their currencies drop n ¨ these devaluations were mainly a result of excess investment, high borrowings, much of it in dollar denominated debt, and a deteriorating balance of payments position n South Korea was the final country in the region to fall 10

Evaluating the IMF’s Policies Question: How successful is the IMF at getting countries back on track? Answer: n In 2009, 54 countries were working IMF programs n All IMF loan packages come with conditions attached, generally a combination of tight macroeconomic policy and tight monetary policy n Many experts have criticized these policy prescriptions for three reasons 11

Evaluating the IMF’s Policies 1. Inappropriate Policies n The IMF has been criticized for having a “one-size-fits-all” approach to macroeconomic policy that is inappropriate for many countries 2. Moral Hazard n The IMF has also been criticized for exacerbating moral hazard (when people behave recklessly because they know they will be saved if things go wrong) 12

1. The Beginning of the Crisis n n In July 1997, Thailand faced unpretentious currency crisis, forcing to abandon peg of the Baht with US Dollar Thai economy collapsed, failing to serve payments on their foreign debts The neighboring countries also came also strong pressure resulting in drastic devaluation The whole south-east Asian countries went into recession 13

1. The Beginning of the Crisis n n n (cont. ) S. E Asian crisis spilled over to Korean economy, losing trade volumes Foreign capital run away and Bank of Korea depleted its foreign exchange reserve Some of the leading Korean companies (i, e, Hanbo, Kia) bankrupted and Korean Won seriously developed Capital outflows accelerated and Korea bankrupted (Fall, 1997) Korean financial crisis was liquidity crisis, forcing government seek bailout from IMF 14

1. The Beginning of the Crisis n (cont. ) Financial crisis delivered triple punches to Korean companies - Increasing burden to serve their foreign debts due to the Korean Won devaluation - The need to repay the foreign debt as foreign creditor reluctant to extend their loan - The need to reduce the domestic debt as a requirement of IMF 15

1. The Beginning of the Crisis n (cont. ) Financial constraints were too much for Korean firms - 9 out of 30 largest Korean firms bankrupted - Remaining largest firms were forced to bank-financed restructuring program until 2000 - The bankruptcies and restructuring programs resulted in large scale layoffs - Korea GDP shrank 5. 7% in 1998 16

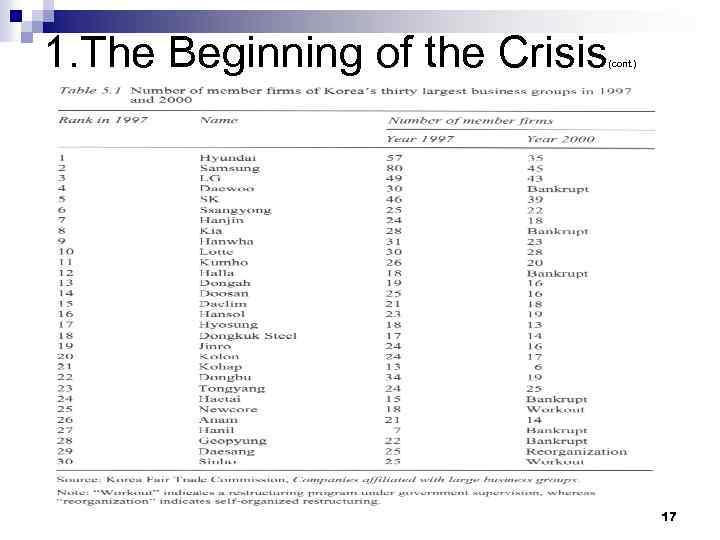

1. The Beginning of the Crisis (cont. ) 17

2. The Reasons for Korean Companies Failure n The failure of Korean companies was not due to the “BAD LUCK” - They failed to adapt shifting environmental changes - They failed to manage the steeply rising labor costs - Moral hazard by over-indebtness and groups’ internal mutual debt (mutual debt guarantee) n All of these deteriorated the financial structures of Korean companies vulnerable to the enviornmental shift 18

2. The Reasons for Korean Companies Failure (cont. ) n The major problems of Korean companies were their over-diversification - Samsung, for instance, spent huge amounts for automobile which was already overcapacity area n n Internal bureaucracy decreased organizational dynamism & creativity Companies suffered leadership problems 19

3. The Crisis Management n The financial crisis triggered major restructuring of Korean business groups led by government, bank and IMF condition - Main objective was to reduce the firm’s debt-equity ratios (212% in 1999 → 131% in 2004) - Revaluation of real estate and security holdings - Termination of group-internal mutual debt - Liquidation of non-viable companies 20

3. The Crisis Management n (cont. ) The government initiated “BIG DEAL” plan - Merger and/or swap between Chaebol groups in order to create more focused groups (ex. , LG semi-conductor → Hyundai Electronics, joint establishment of railroad company by Hyundai, Daewoo and Hanjin) n The “BIG DEAL” was effective, however, it was not without drawbacks 21

3. The Crisis Management n (cont. ) Aggressive restructuring efforts reduced the affiliated companies from 819 in 1997 to 544 in 2000 - Hyundai Group split into two smaller groups - LG Group spinoff (wire, electric power equipment, etc) n n The restructuring was initiated by government and companies themselves to re-focus on core industries Restructuring was characterized as streamlining and disposition of unrelated units 22

3. The Crisis Management n n n (cont. ) Financial crisis followed by tortuous restructuring was painful process for all Koreans However, it gave the opportunities to concentrate on core-business areas More importantly, Korean companies were able to open up their domestic vision to the world market by - conceiving the needs for global strategic alliance - observing the needs for global market exploration - understanding the intensified global competition 23

4. The Managerial Reform n n n The bigger impact by financial crisis to the Korean companies was MANGERIAL REFORMs Lack of transparency and Chaebol’s ownership and management structures were severely criticized →Improving corporate governance system became the nationwide agenda As a result, lists of new laws were enacted - Outside directors, new accounting rules, minority shareholder rights etc. 24

4. The Managerial Reform n (cont. ) At company level, strong efforts were made to adjust management systems to changing business environment - Simplified organizational structure - Reducing the doubling of effort - Giving up the lifetime employment - Flexible laying-offs systems - Introducing the incentive systems to boost efficiency instead of seniority based compensation 25

4. The Managerial Reform n n (cont. ) Another bigger impact by the Financial Crisis to Korea was the emergence of the venture companies Lots of highly educated workforces who laid-off during the crisis sought their own business model - In the area of high-tech, software, financial product etc. - Helped by strong government subsidies - Plenty of highly skilled human resource n Giant Venture companies were created 26

5. The Financial Crisis as New Opportunities n The impacts of the Financial Crisis to Korean economy and companies were the pressure of: - Financial transparency - Efficiency management systems - Advanced human resource management - Globalization - New leadership - MOST IMPORTANTLY, risk management 27

KB-M Week6.ppt