5f7d3d485d8eb3e96a82da622a0c4734.ppt

- Количество слайдов: 20

Korea-EU FTA - Implications for Global Businesses 2011. 11 United Kingdom Ministry of Foreign Affairs and Trade The Republic of Korea

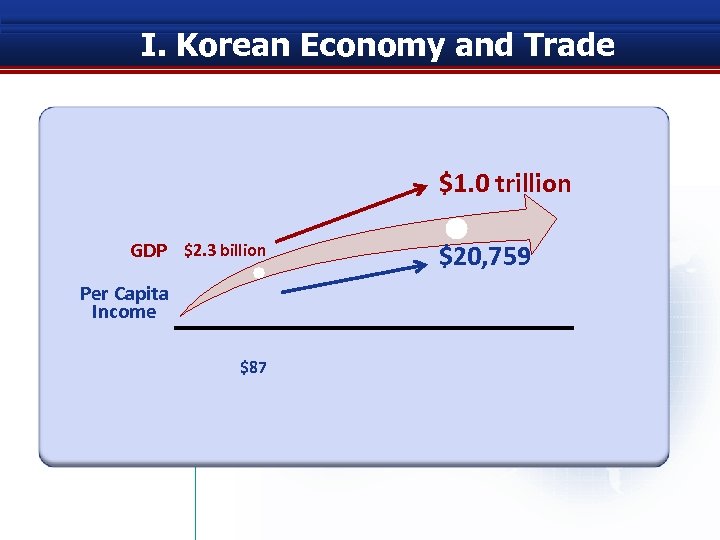

I. Korean Economy and Trade $1. 0 trillion GDP $2. 3 billion Per Capita Income $87 $20, 759

II. Korea’s FTA Policy (1)

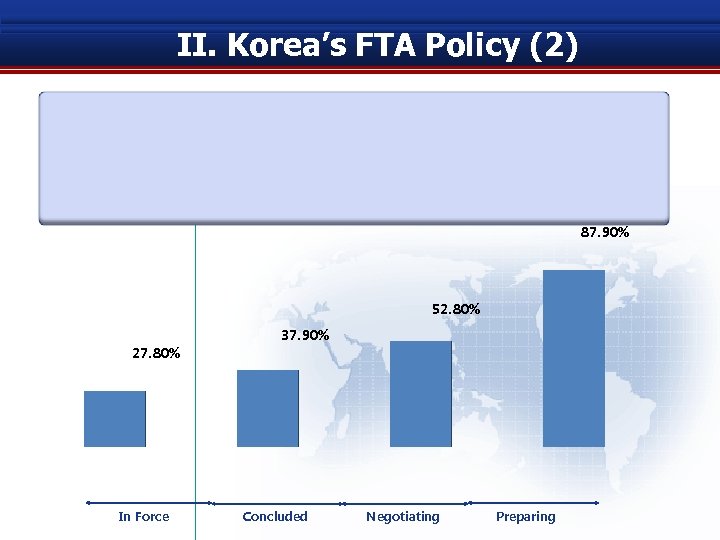

II. Korea’s FTA Policy (2) 87. 90% 52. 80% 27. 80% In Force 37. 90% Concluded Negotiating Preparing

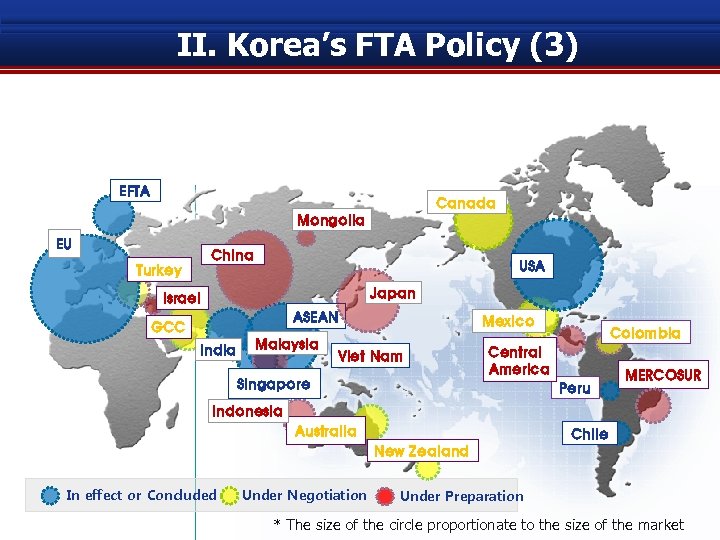

II. Korea’s FTA Policy (3) EFTA Canada Mongolia EU China USA Turkey Japan Israel ASEAN GCC India Malaysia Mexico Viet Nam Colombia Central America Singapore Peru MERCOSUR Indonesia Australia Chile New Zealand In effect or Concluded Under Negotiation Under Preparation * The size of the circle proportionate to the size of the market

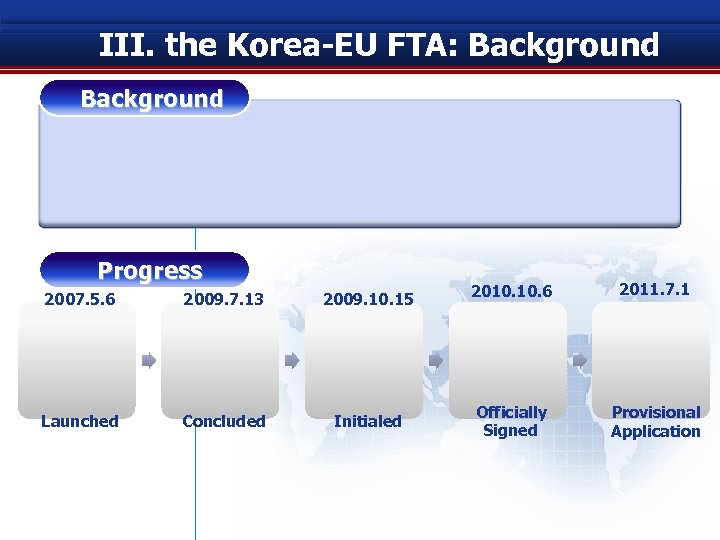

III. the Korea-EU FTA: Background Progress 2007. 5. 6 2009. 7. 13 2009. 10. 15 Launched Concluded Initialed 2010. 6 2011. 7. 1 Officially Signed Provisional Application

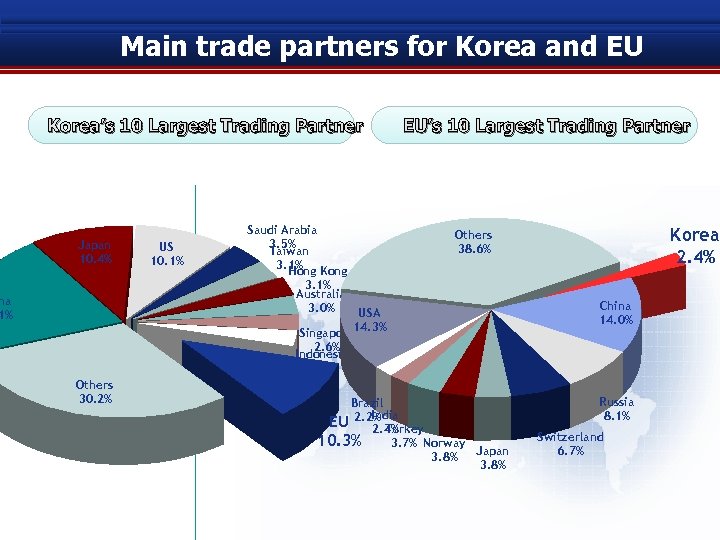

Main trade partners for Korea and EU Korea’s 10 Largest Trading Partner Japan 10. 4% US 10. 1% Saudi Arabia 3. 5% Taiwan 3. 1% Kong Hong EU’s 10 Largest Trading Partner 3. 1% Australia 3. 0% na 1% Korea 2. 4% Others 38. 6% USA 14. 3% Singapore China 14. 0% 2. 6% Indonesia 2. 6% Others 30. 2% Brazil India EU 2. 2% Turkey 2. 4% 10. 3% 3. 7% Norway Japan 3. 8% Russia 8. 1% Switzerland 6. 7%

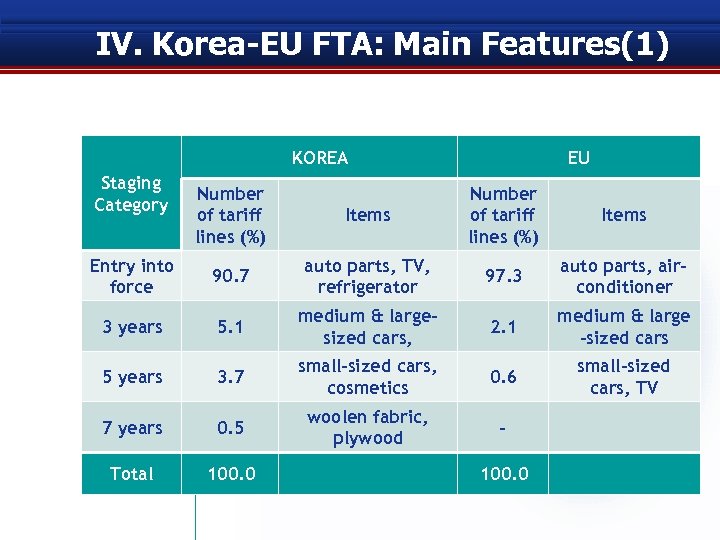

IV. Korea-EU FTA: Main Features(1) KOREA Staging Category Number of tariff lines (%) Entry into force EU Items Number of tariff lines (%) Items 90. 7 auto parts, TV, refrigerator 97. 3 auto parts, airconditioner 3 years 5. 1 medium & largesized cars, 2. 1 medium & large -sized cars 5 years 3. 7 small-sized cars, cosmetics 0. 6 small-sized cars, TV 7 years 0. 5 woolen fabric, plywood - Total 100. 0

High-Level Trade Deal K-Chile K-ASEAN Chile K-INDIA India Asian KORUS US KOREU EU

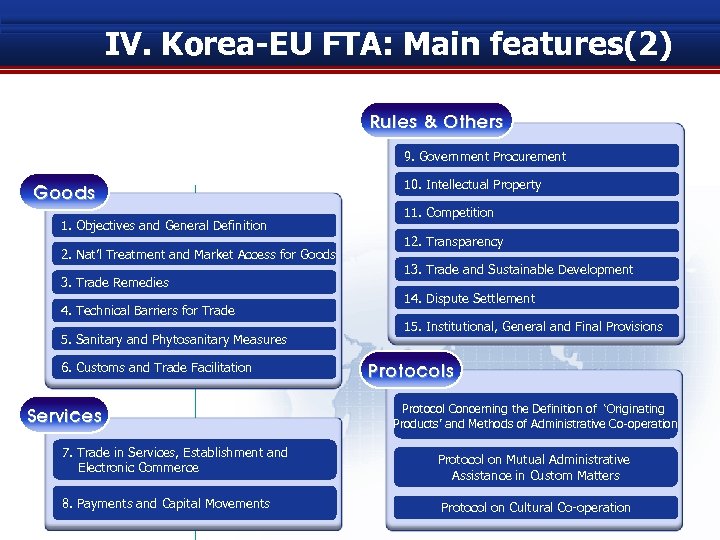

IV. Korea-EU FTA: Main features(2) Rules & Others 9. Government Procurement Goods 1. Objectives and General Definition 2. Nat’l Treatment and Market Access for Goods 3. Trade Remedies 4. Technical Barriers for Trade 5. Sanitary and Phytosanitary Measures 6. Customs and Trade Facilitation Services 7. Trade in Services, Establishment and Electronic Commerce 8. Payments and Capital Movements 10. Intellectual Property Rules & Others 11. Competition 12. Transparency 13. Trade and Sustainable Development 14. Dispute Settlement 15. Institutional, General and Final Provisions Protocol Concerning the Definition of ‘Originating Products’ and Methods of Administrative Co-operation Protocol on Mutual Administrative Assistance in Custom Matters Protocol on Cultural Co-operation

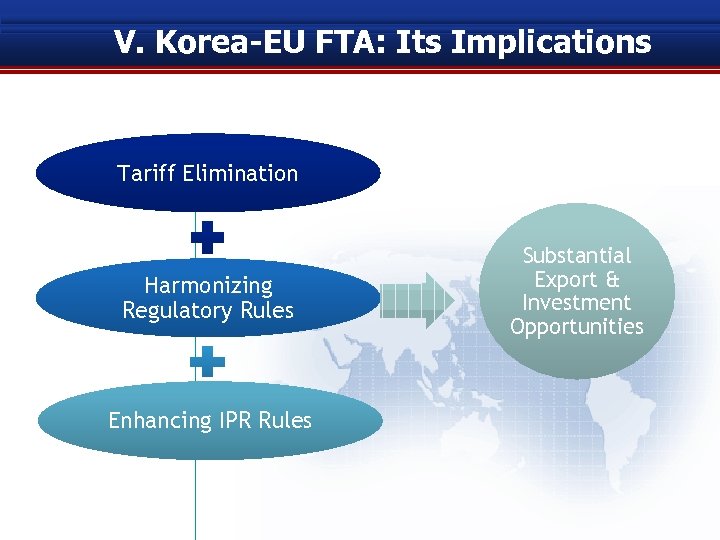

V. Korea-EU FTA: Its Implications Tariff Elimination Harmonizing Regulatory Rules Enhancing IPR Rules Substantial Export & Investment Opportunities

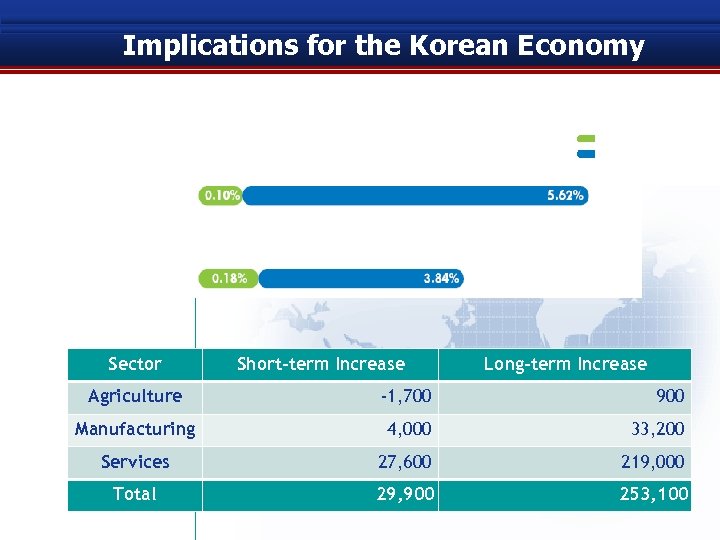

Implications for the Korean Economy Sector Short-term Increase Long-term Increase Agriculture -1, 700 900 Manufacturing 4, 000 33, 200 Services 27, 600 219, 000 Total 29, 900 253, 100

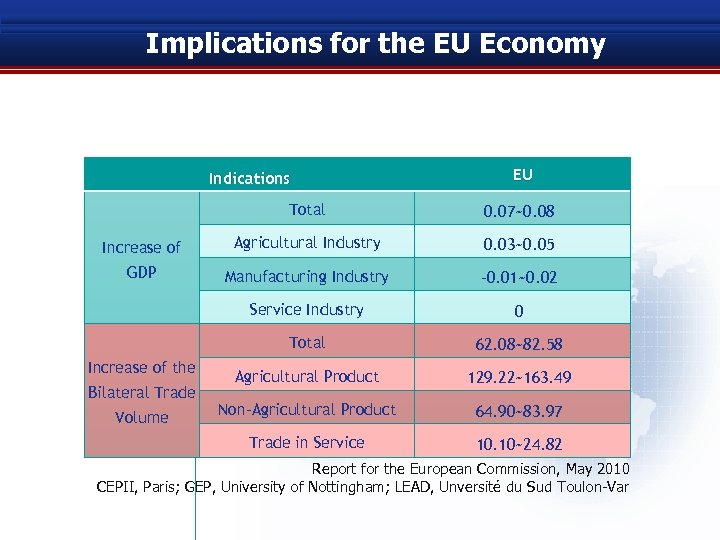

Implications for the EU Economy Indications EU Total 0. 07~0. 08 Increase of Agricultural Industry 0. 03~0. 05 GDP Manufacturing Industry -0. 01~0. 02 Service Industry 0 Total 62. 08~82. 58 Agricultural Product 129. 22~163. 49 Non-Agricultural Product 64. 90~83. 97 Trade in Service 10. 10~24. 82 Increase of the Bilateral Trade Volume Report for the European Commission, May 2010 CEPII, Paris; GEP, University of Nottingham; LEAD, Unversité du Sud Toulon-Var

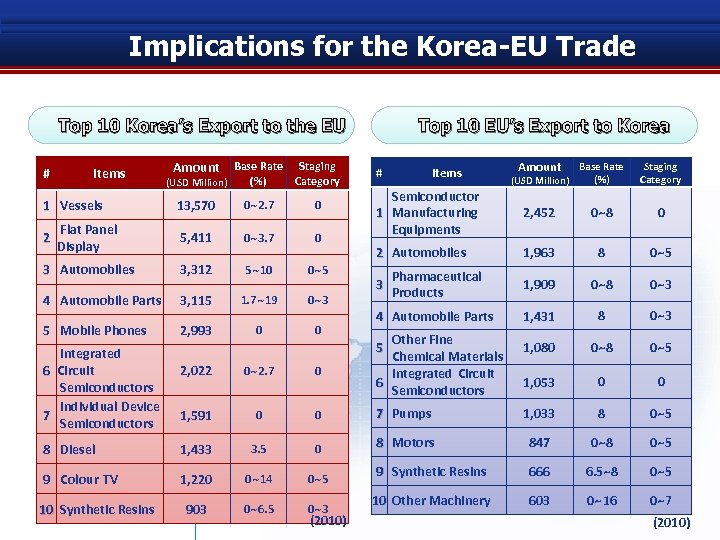

Implications for the Korea-EU Trade Top 10 Korea’s Export to the EU Amount Base Rate (USD Million) (%) Staging Category 13, 570 0~2. 7 0 Flat Panel Display 5, 411 0~3. 7 0 3 Automobiles 3, 312 5~10 0~5 4 Automobile Parts 3, 115 1. 7~19 0~3 5 Mobile Phones 2, 993 0 0 # Items 1 Vessels 2 Integrated 6 Circuit Semiconductors Individual Device 7 Semiconductors Top 10 EU’s Export to Korea (USD Million) Amount Base Rate (%) Staging Category Semiconductor 1 Manufacturing Equipments 2, 452 0~8 0 2 Automobiles 1, 963 8 0~5 Pharmaceutical Products 1, 909 0~8 0~3 4 Automobile Parts 1, 431 8 0~3 1, 080 0~8 0~5 1, 053 0 0 # 3 Items Other Fine Chemical Materials Integrated Circuit 6 Semiconductors 5 2, 022 0~2. 7 0 1, 591 0 0 7 Pumps 1, 033 8 0~5 8 Diesel 1, 433 3. 5 0 8 Motors 847 0~8 0~5 9 Colour TV 1, 220 0~14 0~5 9 Synthetic Resins 666 6. 5~8 0~5 903 0~6. 5 0~3 10 Other Machinery 603 0~16 0~7 10 Synthetic Resins (2010)

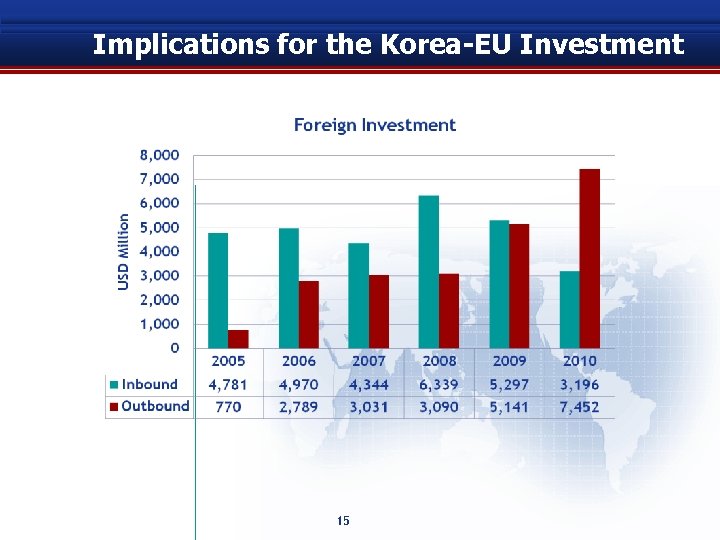

Implications for the Korea-EU Investment 15

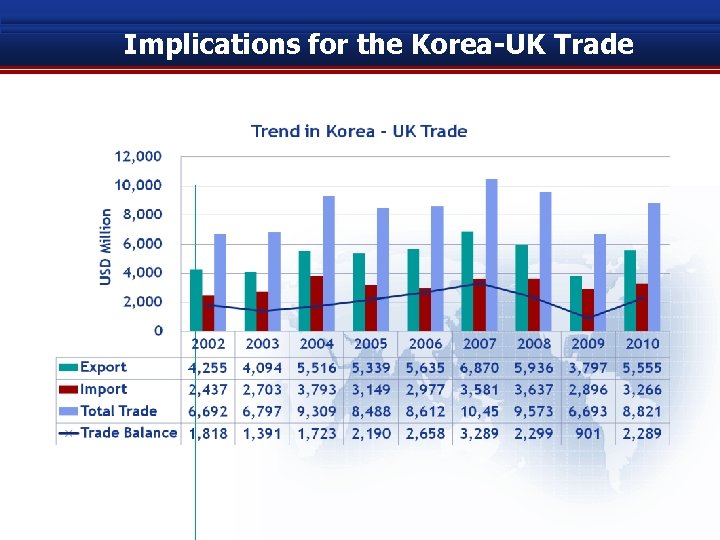

Implications for the Korea-UK Trade

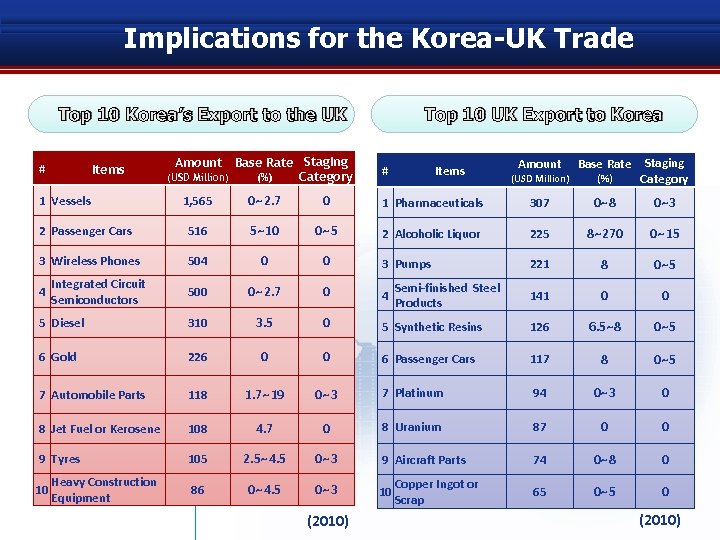

Implications for the Korea-UK Trade Top 10 Korea’s Export to the UK # Items Amount Base Rate Staging (USD Million) (%) Category Top 10 UK Export to Korea # Items Amount Base Rate (USD Million) (%) Staging Category 1, 565 0~2. 7 0 1 Pharmaceuticals 307 0~8 0~3 2 Passenger Cars 516 5~10 0~5 2 Alcoholic Liquor 225 8~270 0~15 3 Wireless Phones 504 0 0 3 Pumps 221 8 0~5 500 0~2. 7 0 4 141 0 0 5 Diesel 310 3. 5 0 5 Synthetic Resins 126 6. 5~8 0~5 6 Gold 226 0 0 6 Passenger Cars 117 8 0~5 7 Automobile Parts 118 1. 7~19 0~3 7 Platinum 94 0~3 0 8 Jet Fuel or Kerosene 108 4. 7 0 8 Uranium 87 0 0 9 Tyres 105 2. 5~4. 5 0~3 9 Aircraft Parts 74 0~8 0 86 0~4. 5 0~3 10 65 0~5 0 1 Vessels 4 10 Integrated Circuit Semiconductors Heavy Construction Equipment (2010) Semi-finished Steel Products Copper Ingot or Scrap (2010)

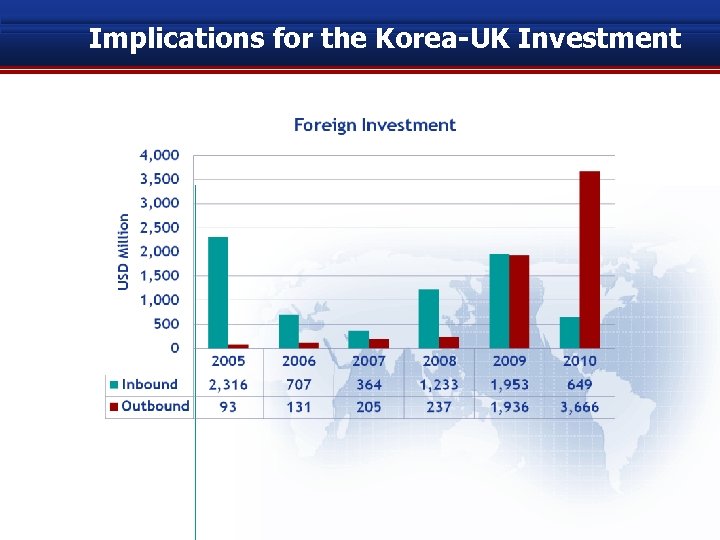

Implications for the Korea-UK Investment

VI. Korea-EU FTA: How to make it REAL

5f7d3d485d8eb3e96a82da622a0c4734.ppt