7f45ef3aa9490d0e57a75b3066e11b7e.ppt

- Количество слайдов: 61

KNOW YOUR RIGHTS: HOW TO APPLY FOR UNEMPLOYMENT INSURANCE BENEFITS & REPRESENT YOURSELF IN AN APPEALS HEARING Prepared by: The Workers Rights Clinic University of Maryland School of Law April 22, 2010

KNOW YOUR RIGHTS: HOW TO APPLY FOR UNEMPLOYMENT INSURANCE BENEFITS & REPRESENT YOURSELF IN AN APPEALS HEARING Prepared by: The Workers Rights Clinic University of Maryland School of Law April 22, 2010

OVERVIEW OF THE UNEMPLOYMENT INSURANCE SYSTEM

OVERVIEW OF THE UNEMPLOYMENT INSURANCE SYSTEM

What is Unemployment Insurance? Unemployment insurance is an employer-funded insurance program that provides benefits to persons who are unemployed through no fault of their own. The money for unemployment insurance benefits comes from revenue paid by employers. Maryland employers are required to pay quarterly unemployment insurance taxes each year. No deductions are ever made from a worker’s paycheck to pay for unemployment insurance benefits in Maryland.

What is Unemployment Insurance? Unemployment insurance is an employer-funded insurance program that provides benefits to persons who are unemployed through no fault of their own. The money for unemployment insurance benefits comes from revenue paid by employers. Maryland employers are required to pay quarterly unemployment insurance taxes each year. No deductions are ever made from a worker’s paycheck to pay for unemployment insurance benefits in Maryland.

How does a Person Apply for Benefits? To obtain UI benefits, an unemployed person must first file a claim with the DLLR. To file a claim, a person needs to call the DLLR or apply via the DLLR’s website and provide the following information: Name, Social Security number, Address and Telephone Number; and The Name, Payroll Address, Telephone Number and Reason for Separation for each Employer in the 18 Months prior to filing the claim. The DLLR will make an initial determination to determine whether the unemployed person is entitled to benefits.

How does a Person Apply for Benefits? To obtain UI benefits, an unemployed person must first file a claim with the DLLR. To file a claim, a person needs to call the DLLR or apply via the DLLR’s website and provide the following information: Name, Social Security number, Address and Telephone Number; and The Name, Payroll Address, Telephone Number and Reason for Separation for each Employer in the 18 Months prior to filing the claim. The DLLR will make an initial determination to determine whether the unemployed person is entitled to benefits.

What are a Claimant’s Responsibilities? A person initially filing for or currently receiving UI benefits must: Be able to work; be available for work; and must make an active search for full-time work Accept suitable work as defined by law File timely bi-weekly continued claims A person must report: All wages earned each week All monies received, including: Full or part-time wages, self-employment, odd jobs, pensions, annuities, holiday pay, vacation pay, severance pay, bonuses, and commission payments.

What are a Claimant’s Responsibilities? A person initially filing for or currently receiving UI benefits must: Be able to work; be available for work; and must make an active search for full-time work Accept suitable work as defined by law File timely bi-weekly continued claims A person must report: All wages earned each week All monies received, including: Full or part-time wages, self-employment, odd jobs, pensions, annuities, holiday pay, vacation pay, severance pay, bonuses, and commission payments.

How is the Weekly Benefit Amount Determined? A claimant’s weekly benefit amount is based on the amount of money all employers paid during the base period. Now have alternative base period Higher earnings = higher weekly benefit amount. The current weekly benefit amount provided by the Maryland Unemployment Insurance Law ranges from a minimum of $25 to a maximum of $410 (will be increasing to between $50 and $430)

How is the Weekly Benefit Amount Determined? A claimant’s weekly benefit amount is based on the amount of money all employers paid during the base period. Now have alternative base period Higher earnings = higher weekly benefit amount. The current weekly benefit amount provided by the Maryland Unemployment Insurance Law ranges from a minimum of $25 to a maximum of $410 (will be increasing to between $50 and $430)

For How Long can a Person Collect Benefits? The maximum amount of benefits a claimant may receive is 26 times their weekly benefit amount. A claimant may file claims for more than 26 weeks if they earned some wages and partial benefits were paid. Federal extensions may apply.

For How Long can a Person Collect Benefits? The maximum amount of benefits a claimant may receive is 26 times their weekly benefit amount. A claimant may file claims for more than 26 weeks if they earned some wages and partial benefits were paid. Federal extensions may apply.

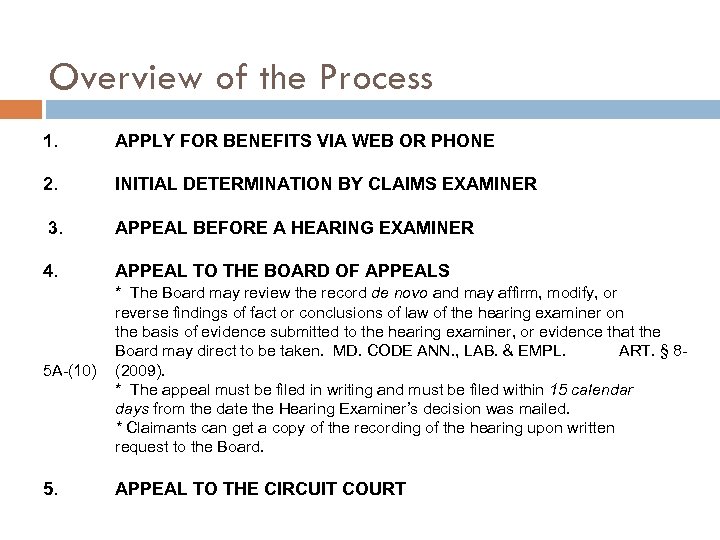

Overview of the Process 1. 2. APPLY FOR BENEFITS VIA WEB OR PHONE 3. APPEAL BEFORE A HEARING EXAMINER 4. APPEAL TO THE BOARD OF APPEALS INITIAL DETERMINATION BY CLAIMS EXAMINER * The Board may review the record de novo and may affirm, modify, or reverse findings of fact or conclusions of law of the hearing examiner on the basis of evidence submitted to the hearing examiner, or evidence that the Board may direct to be taken. MD. CODE ANN. , LAB. & EMPL. ART. § 85 A-(10) (2009). * The appeal must be filed in writing and must be filed within 15 calendar days from the date the Hearing Examiner’s decision was mailed. * Claimants can get a copy of the recording of the hearing upon written request to the Board. 5. APPEAL TO THE CIRCUIT COURT

Overview of the Process 1. 2. APPLY FOR BENEFITS VIA WEB OR PHONE 3. APPEAL BEFORE A HEARING EXAMINER 4. APPEAL TO THE BOARD OF APPEALS INITIAL DETERMINATION BY CLAIMS EXAMINER * The Board may review the record de novo and may affirm, modify, or reverse findings of fact or conclusions of law of the hearing examiner on the basis of evidence submitted to the hearing examiner, or evidence that the Board may direct to be taken. MD. CODE ANN. , LAB. & EMPL. ART. § 85 A-(10) (2009). * The appeal must be filed in writing and must be filed within 15 calendar days from the date the Hearing Examiner’s decision was mailed. * Claimants can get a copy of the recording of the hearing upon written request to the Board. 5. APPEAL TO THE CIRCUIT COURT

WHO IS ELIGIBLE? : VOLUNTARY QUIT

WHO IS ELIGIBLE? : VOLUNTARY QUIT

Can you be eligible if you quit? Good Cause Voluntary Quit = must show good cause Good cause Directly attributable to, arising from, or connected with the conditions of the workplace or the actions of the employer Md. Code Ann. Section 8 -1001

Can you be eligible if you quit? Good Cause Voluntary Quit = must show good cause Good cause Directly attributable to, arising from, or connected with the conditions of the workplace or the actions of the employer Md. Code Ann. Section 8 -1001

Three Questions to Ask Did you quit? Was it voluntary? Did you have 1. 2. 3. 1. 2. good cause? ; or “valid circumstances”?

Three Questions to Ask Did you quit? Was it voluntary? Did you have 1. 2. 3. 1. 2. good cause? ; or “valid circumstances”?

Question 1: Did you quit? Quit must be voluntary You quit of your own free choice Quit must be more than a vague indication of Intent “In a few months”: Wert v. Majestic Indus. , 183 -BR-89 “If things don’t improve”: Wolf v. Cargill, 891 -BH-88

Question 1: Did you quit? Quit must be voluntary You quit of your own free choice Quit must be more than a vague indication of Intent “In a few months”: Wert v. Majestic Indus. , 183 -BR-89 “If things don’t improve”: Wolf v. Cargill, 891 -BH-88

Question 1: Did you quit? (Cont. ) Voluntary quit can be through actions Failure to report to work for several days Refusal to accept transfer Voluntary quit may be constructive No alternative but to fire employee Must be for legal or contractual reasons

Question 1: Did you quit? (Cont. ) Voluntary quit can be through actions Failure to report to work for several days Refusal to accept transfer Voluntary quit may be constructive No alternative but to fire employee Must be for legal or contractual reasons

Question 1: Did you quit? (Cont. ) Not a voluntary quit if employee is: forced to resign On strike and refuses to return to job. It is voluntary quit if employee chooses to resign rather than face charges

Question 1: Did you quit? (Cont. ) Not a voluntary quit if employee is: forced to resign On strike and refuses to return to job. It is voluntary quit if employee chooses to resign rather than face charges

Question 1: Did you quit? (Cont. ) Leave of Absence issues Voluntary quit if: Refuse different job: same pay, convenient location, generally same duties Gasior v. Joseph A. Bank Manufacturing Co. , 23 -BR -9 Fail to return or unable to return after leave expires Not voluntary quit if: No work available after leave. Savage v. Church Hospital, 1067 BH-83

Question 1: Did you quit? (Cont. ) Leave of Absence issues Voluntary quit if: Refuse different job: same pay, convenient location, generally same duties Gasior v. Joseph A. Bank Manufacturing Co. , 23 -BR -9 Fail to return or unable to return after leave expires Not voluntary quit if: No work available after leave. Savage v. Church Hospital, 1067 BH-83

Question 1: Did you quit? (Cont. ) Buy Outs Voluntary quit if you have a real choice ER anticipated adequate number of people would take buy-out; claimant felt department gradually being eliminated Not voluntary quit if no real choice EEs led to believe jobs would be eliminated no matter what

Question 1: Did you quit? (Cont. ) Buy Outs Voluntary quit if you have a real choice ER anticipated adequate number of people would take buy-out; claimant felt department gradually being eliminated Not voluntary quit if no real choice EEs led to believe jobs would be eliminated no matter what

Question 1: Did you quit? (Cont. ) Temp Agency Issues Voluntary quit = if you begin working on temp assignment and leave before end of assignment Not voluntary quit if temp assignment ends and you fail to re-contact temp agency

Question 1: Did you quit? (Cont. ) Temp Agency Issues Voluntary quit = if you begin working on temp assignment and leave before end of assignment Not voluntary quit if temp assignment ends and you fail to re-contact temp agency

Question 2: Do you have good cause? Examples of good cause: Job endangers health or safety Employer relocates – transportation problems Religious beliefs or schedule Job requires employee to commit illegal or unethical acts Harassment or discrimination Significant modifications of employment contract, working conditions, pay

Question 2: Do you have good cause? Examples of good cause: Job endangers health or safety Employer relocates – transportation problems Religious beliefs or schedule Job requires employee to commit illegal or unethical acts Harassment or discrimination Significant modifications of employment contract, working conditions, pay

Question 2: Do you have good cause? Things that are never good cause (by statute) Self-employment Accompanying or joining non-military spouse Attending educational institution

Question 2: Do you have good cause? Things that are never good cause (by statute) Self-employment Accompanying or joining non-military spouse Attending educational institution

Question 3: Do you have valid circumstances? Valid circumstances = Related to employment OR not related to the employment, but necessitous or compelling and leaves the employee with no other choice but to resign Must exhaust all reasonable alternatives prior to quitting for personal reasons

Question 3: Do you have valid circumstances? Valid circumstances = Related to employment OR not related to the employment, but necessitous or compelling and leaves the employee with no other choice but to resign Must exhaust all reasonable alternatives prior to quitting for personal reasons

Question 3: Do you have valid circumstances? Examples of valid circumstances Health problems unrelated to job (must have medical documentation) Need to care for family/family emergencies Unexpected loss of babysitter Compelling financial circumstances Significant transportation problems that you seriously tried resolve (not your fault)

Question 3: Do you have valid circumstances? Examples of valid circumstances Health problems unrelated to job (must have medical documentation) Need to care for family/family emergencies Unexpected loss of babysitter Compelling financial circumstances Significant transportation problems that you seriously tried resolve (not your fault)

Distinction Good Cause/Valid Circumstances Good cause: No penalty for voluntary quit Valid circumstances: Disqualification for 5 to 10 weeks

Distinction Good Cause/Valid Circumstances Good cause: No penalty for voluntary quit Valid circumstances: Disqualification for 5 to 10 weeks

Burden of Proof Employer burden to show claimant quit Employee burden to show he or she had good cause or valid circumstances Employee goes first in hearing

Burden of Proof Employer burden to show claimant quit Employee burden to show he or she had good cause or valid circumstances Employee goes first in hearing

WHO IS ELIGIBLE? : DISCHARGE

WHO IS ELIGIBLE? : DISCHARGE

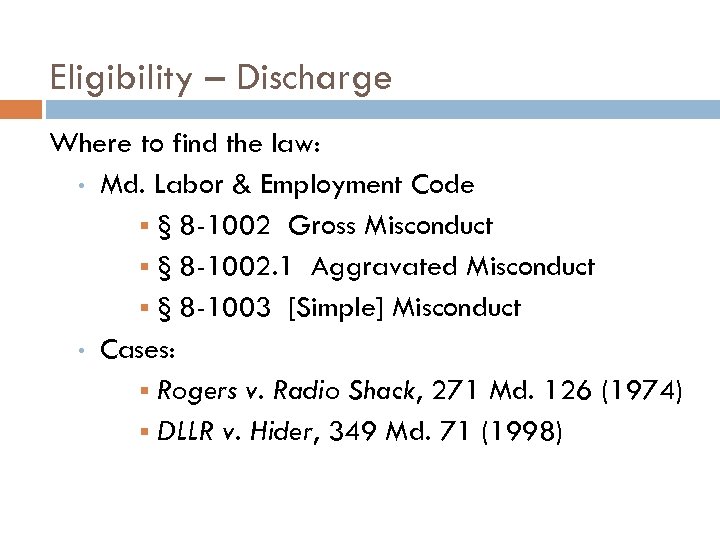

Eligibility – Discharge Where to find the law: • Md. Labor & Employment Code § § 8 -1002 Gross Misconduct § § 8 -1002. 1 Aggravated Misconduct § § 8 -1003 [Simple] Misconduct • Cases: § Rogers v. Radio Shack, 271 Md. 126 (1974) § DLLR v. Hider, 349 Md. 71 (1998)

Eligibility – Discharge Where to find the law: • Md. Labor & Employment Code § § 8 -1002 Gross Misconduct § § 8 -1002. 1 Aggravated Misconduct § § 8 -1003 [Simple] Misconduct • Cases: § Rogers v. Radio Shack, 271 Md. 126 (1974) § DLLR v. Hider, 349 Md. 71 (1998)

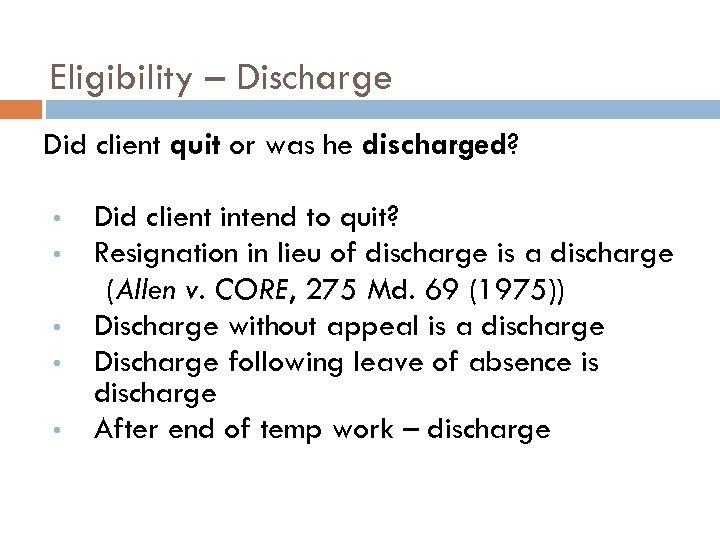

Eligibility – Discharge Did client quit or was he discharged? • • • Did client intend to quit? Resignation in lieu of discharge is a discharge (Allen v. CORE, 275 Md. 69 (1975)) Discharge without appeal is a discharge Discharge following leave of absence is discharge After end of temp work – discharge

Eligibility – Discharge Did client quit or was he discharged? • • • Did client intend to quit? Resignation in lieu of discharge is a discharge (Allen v. CORE, 275 Md. 69 (1975)) Discharge without appeal is a discharge Discharge following leave of absence is discharge After end of temp work – discharge

Eligibility – Discharge Only ineligible if discharge is for “misconduct” Special definition / meaning in UI Theme: unemployed by no fault of his own 3 types of misconduct 1. “simple” misconduct 2. gross misconduct 3. aggravated misconduct (least common)

Eligibility – Discharge Only ineligible if discharge is for “misconduct” Special definition / meaning in UI Theme: unemployed by no fault of his own 3 types of misconduct 1. “simple” misconduct 2. gross misconduct 3. aggravated misconduct (least common)

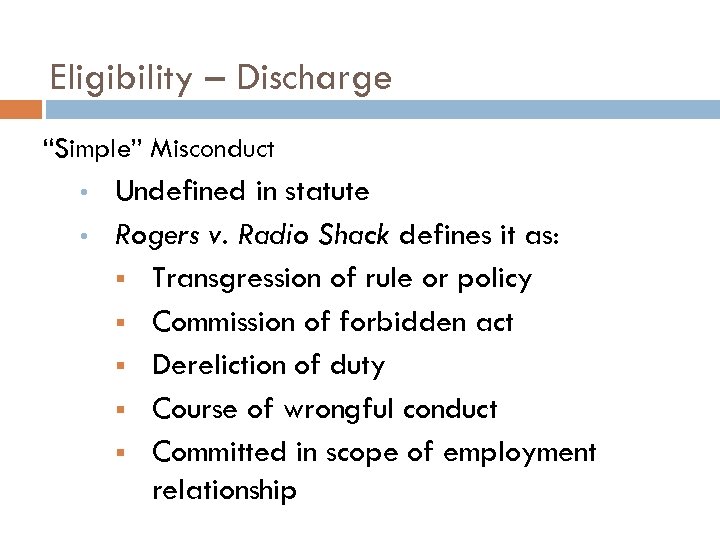

Eligibility – Discharge “Simple” Misconduct • • Undefined in statute Rogers v. Radio Shack defines it as: § Transgression of rule or policy § Commission of forbidden act § Dereliction of duty § Course of wrongful conduct § Committed in scope of employment relationship

Eligibility – Discharge “Simple” Misconduct • • Undefined in statute Rogers v. Radio Shack defines it as: § Transgression of rule or policy § Commission of forbidden act § Dereliction of duty § Course of wrongful conduct § Committed in scope of employment relationship

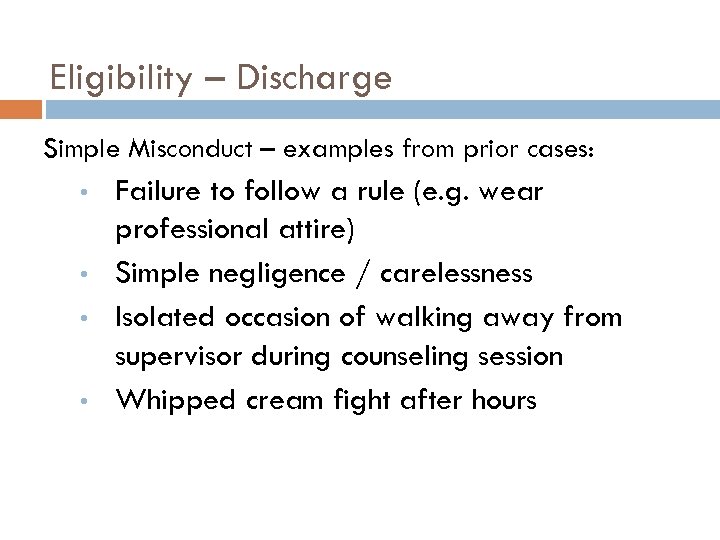

Eligibility – Discharge Simple Misconduct – examples from prior cases: • • Failure to follow a rule (e. g. wear professional attire) Simple negligence / carelessness Isolated occasion of walking away from supervisor during counseling session Whipped cream fight after hours

Eligibility – Discharge Simple Misconduct – examples from prior cases: • • Failure to follow a rule (e. g. wear professional attire) Simple negligence / carelessness Isolated occasion of walking away from supervisor during counseling session Whipped cream fight after hours

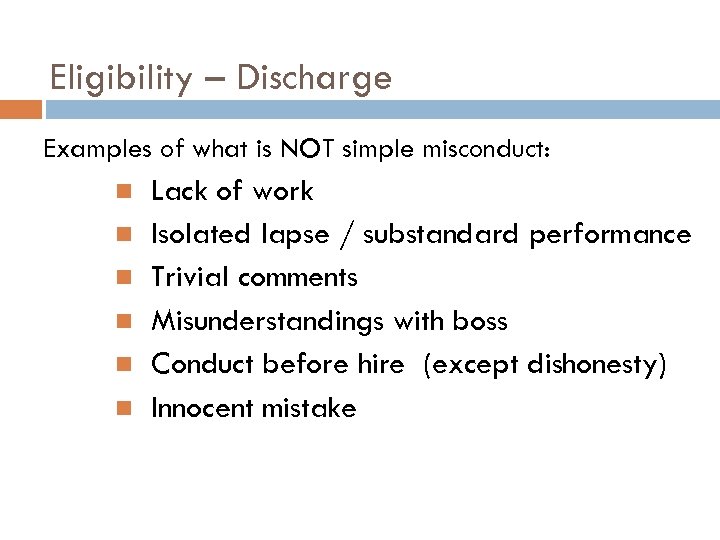

Eligibility – Discharge Examples of what is NOT simple misconduct: Lack of work Isolated lapse / substandard performance Trivial comments Misunderstandings with boss Conduct before hire (except dishonesty) Innocent mistake

Eligibility – Discharge Examples of what is NOT simple misconduct: Lack of work Isolated lapse / substandard performance Trivial comments Misunderstandings with boss Conduct before hire (except dishonesty) Innocent mistake

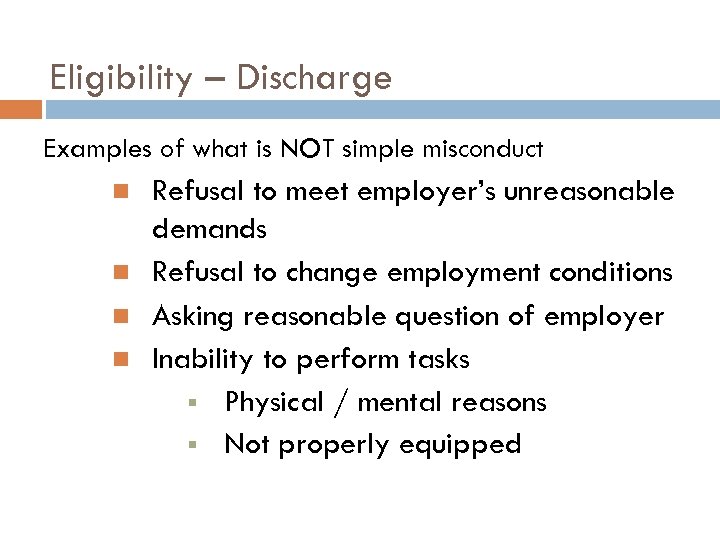

Eligibility – Discharge Examples of what is NOT simple misconduct Refusal to meet employer’s unreasonable demands Refusal to change employment conditions Asking reasonable question of employer Inability to perform tasks § Physical / mental reasons § Not properly equipped

Eligibility – Discharge Examples of what is NOT simple misconduct Refusal to meet employer’s unreasonable demands Refusal to change employment conditions Asking reasonable question of employer Inability to perform tasks § Physical / mental reasons § Not properly equipped

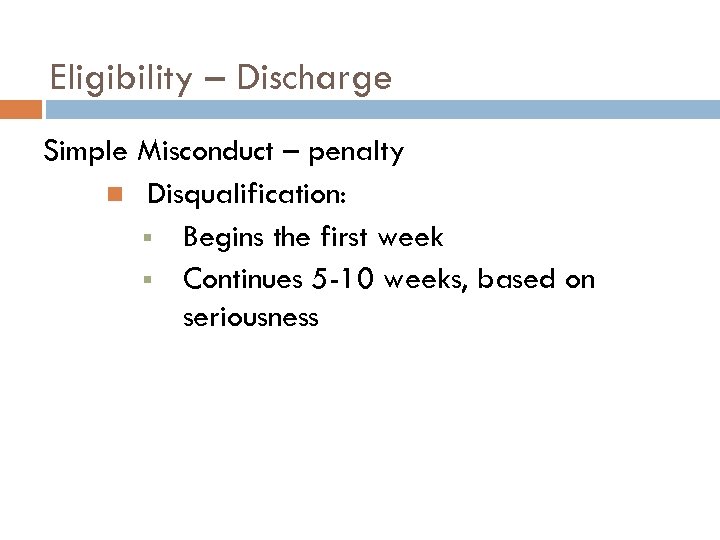

Eligibility – Discharge Simple Misconduct – penalty Disqualification: § Begins the first week § Continues 5 -10 weeks, based on seriousness

Eligibility – Discharge Simple Misconduct – penalty Disqualification: § Begins the first week § Continues 5 -10 weeks, based on seriousness

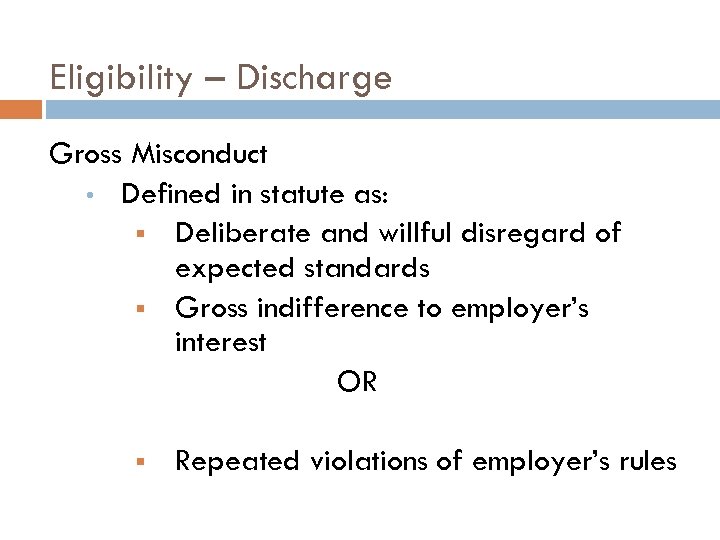

Eligibility – Discharge Gross Misconduct • Defined in statute as: § Deliberate and willful disregard of expected standards § Gross indifference to employer’s interest OR § Repeated violations of employer’s rules

Eligibility – Discharge Gross Misconduct • Defined in statute as: § Deliberate and willful disregard of expected standards § Gross indifference to employer’s interest OR § Repeated violations of employer’s rules

Eligibility – Discharge Gross Misconduct • case-by-case determination • more than just substandard performance • can be the cumulative effect of small incidents • role of prior warnings

Eligibility – Discharge Gross Misconduct • case-by-case determination • more than just substandard performance • can be the cumulative effect of small incidents • role of prior warnings

Eligibility – Discharge Gross Misconduct examples Repeated excessive tardiness and no medical excuse Refusing to switch shifts Refusal to do reasonable work with no explanation Supervisor spreads false layoff rumors Repeated rudeness to customers after warnings

Eligibility – Discharge Gross Misconduct examples Repeated excessive tardiness and no medical excuse Refusing to switch shifts Refusal to do reasonable work with no explanation Supervisor spreads false layoff rumors Repeated rudeness to customers after warnings

Eligibility – Discharge Gross Misconduct - penalty Disqualified from receiving benefits Begins the first week after discharge § Client may have to repay benefits • Continues until client is re-employed + earns enough wages

Eligibility – Discharge Gross Misconduct - penalty Disqualified from receiving benefits Begins the first week after discharge § Client may have to repay benefits • Continues until client is re-employed + earns enough wages

Eligibility – Discharge Aggravated Misconduct Defined in statute as: § Intentional conduct § Actual malice § Deliberate disregard for property or safety § Affects others § Serious assault or property damage/loss

Eligibility – Discharge Aggravated Misconduct Defined in statute as: § Intentional conduct § Actual malice § Deliberate disregard for property or safety § Affects others § Serious assault or property damage/loss

Eligibility – Discharge Aggravated Misconduct – examples a. Theft Value of property is not sole determining factor Intent is important b. Assault • Coworkers, supervisor • Provocation may be relevant

Eligibility – Discharge Aggravated Misconduct – examples a. Theft Value of property is not sole determining factor Intent is important b. Assault • Coworkers, supervisor • Provocation may be relevant

Eligibility – Discharge Aggravated Misconduct – penalty Disqualified from receiving benefits Begins the first week after discharge § Client may have to repay benefits • Continues until client is re-employed + earns enough wages

Eligibility – Discharge Aggravated Misconduct – penalty Disqualified from receiving benefits Begins the first week after discharge § Client may have to repay benefits • Continues until client is re-employed + earns enough wages

Eligibility – Discharge Misconduct burden of proof • Employer has the burden of proof • Prepond. of the evidence (51% - 49%) • Employer must establish: § Expectations were communicated § Expectations violated § Violation was reason for discharge • If employer does not attend hearing

Eligibility – Discharge Misconduct burden of proof • Employer has the burden of proof • Prepond. of the evidence (51% - 49%) • Employer must establish: § Expectations were communicated § Expectations violated § Violation was reason for discharge • If employer does not attend hearing

WHAT TO EXPECT AT THE LOWER APPEALS HEARING

WHAT TO EXPECT AT THE LOWER APPEALS HEARING

Get there Early Being 10 minutes late is a failure to appear If the party appealing fails to appear, the Board of Appeals May dismiss the appeal, or May issue a decision on the facts available. If the claimant has the burden of proof, they may still put on their case. COMAR 09. 32. 06. 02. M

Get there Early Being 10 minutes late is a failure to appear If the party appealing fails to appear, the Board of Appeals May dismiss the appeal, or May issue a decision on the facts available. If the claimant has the burden of proof, they may still put on their case. COMAR 09. 32. 06. 02. M

Who will be there? Hearing Examiner Employer A Supervisor An Human Resources or Other Representative Outside Agency – For ex. Talx An Attorney Claimant Witnesses – This is rare

Who will be there? Hearing Examiner Employer A Supervisor An Human Resources or Other Representative Outside Agency – For ex. Talx An Attorney Claimant Witnesses – This is rare

The Hiring of an Attorneys may be helpful if: Appeal involves a complex issue; or Appealing to the Board of Appeals or the Circuit Court. Types of Representation: A private attorney – There are limits to how much they can charge. $25 - $100 total per hearing Maximum of 150% of your weekly benefit A non-attorney – They cannot charge at all. Legal Aid Services.

The Hiring of an Attorneys may be helpful if: Appeal involves a complex issue; or Appealing to the Board of Appeals or the Circuit Court. Types of Representation: A private attorney – There are limits to how much they can charge. $25 - $100 total per hearing Maximum of 150% of your weekly benefit A non-attorney – They cannot charge at all. Legal Aid Services.

What are the rules? The Hearings last about 45 minutes The Hearing Examiner is there to serve as the Fact Finder and an Advocate. This is a very informal proceeding: Procedure Evidence It is in a small conference room, not in a courtroom

What are the rules? The Hearings last about 45 minutes The Hearing Examiner is there to serve as the Fact Finder and an Advocate. This is a very informal proceeding: Procedure Evidence It is in a small conference room, not in a courtroom

How to Construct the Testimony Claimants should limit testimony to the event that led to the termination. Make a timeline of the events. But, it is important to think of your work history. Any written or verbal warnings? Any positive or negative work performance evaluations? Any evidence of this?

How to Construct the Testimony Claimants should limit testimony to the event that led to the termination. Make a timeline of the events. But, it is important to think of your work history. Any written or verbal warnings? Any positive or negative work performance evaluations? Any evidence of this?

What to Expect in the Appeal Be prepared Be organized Stay calm Plan ahead What is your employer going to say? Get Fact Finding Report from DLLR Case Prep: Not for use as evidence Remember: The Hearing is a clean slate

What to Expect in the Appeal Be prepared Be organized Stay calm Plan ahead What is your employer going to say? Get Fact Finding Report from DLLR Case Prep: Not for use as evidence Remember: The Hearing is a clean slate

DOS AND DON’TS OF THE UI APPEALS HEARING

DOS AND DON’TS OF THE UI APPEALS HEARING

Do: Be Prepared Get organized! Review the Fact Finding Report Completed by the Claims Examiner during your telephone interview Go to the DLLR office at 1100 North Eutaw Street to pick yours up Try to anticipate what the employer is going to say Gather your documents

Do: Be Prepared Get organized! Review the Fact Finding Report Completed by the Claims Examiner during your telephone interview Go to the DLLR office at 1100 North Eutaw Street to pick yours up Try to anticipate what the employer is going to say Gather your documents

Do: Be Honest The Hearing Examiner is there to get the whole story Even if the employer thinks you did something wrong, you may have had a good reason (i. e. were you late to work because you were sick? )

Do: Be Honest The Hearing Examiner is there to get the whole story Even if the employer thinks you did something wrong, you may have had a good reason (i. e. were you late to work because you were sick? )

Do: Stay Focused Keep to the topic at hand The Hearing Examiner needs to hear about the termination event What happened on the day you were terminated? What specific events led to your termination or resignation Do not bring up things that are irrelevant or events that happened in the past

Do: Stay Focused Keep to the topic at hand The Hearing Examiner needs to hear about the termination event What happened on the day you were terminated? What specific events led to your termination or resignation Do not bring up things that are irrelevant or events that happened in the past

If You Are Receiving Benefits… DO continue to file your Tele-certs or Web-certs

If You Are Receiving Benefits… DO continue to file your Tele-certs or Web-certs

Do: Think About Your Next Step If the Hearing Examiner does not rule in your favor, consider the next steps in the DLLR appeals process: Appeal to the Board of Appeals Appeal to your local circuit court

Do: Think About Your Next Step If the Hearing Examiner does not rule in your favor, consider the next steps in the DLLR appeals process: Appeal to the Board of Appeals Appeal to your local circuit court

Don’t: Be Late To The Hearing Plan to arrive at least 30 minutes early If you arrive more than 10 minutes after your scheduled hearing time, you lose your right to be heard by the hearing examiner

Don’t: Be Late To The Hearing Plan to arrive at least 30 minutes early If you arrive more than 10 minutes after your scheduled hearing time, you lose your right to be heard by the hearing examiner

Don’t: Lose Your Cool Control your temper Don’t disrespect the employer Even if the employer says something that is not true, or says something you do not agree with, don’t interrupt

Don’t: Lose Your Cool Control your temper Don’t disrespect the employer Even if the employer says something that is not true, or says something you do not agree with, don’t interrupt

Don’t: Forget Your Evidence Bring three (3) copies of all relevant documents Work policies and regulations Copies of emails Doctor’s notes Memos Performance reviews Anything else that may be relevant

Don’t: Forget Your Evidence Bring three (3) copies of all relevant documents Work policies and regulations Copies of emails Doctor’s notes Memos Performance reviews Anything else that may be relevant

Don’t: Be afraid to ask for help A list of resources will be available at the end of this presentation.

Don’t: Be afraid to ask for help A list of resources will be available at the end of this presentation.

REFERENCES

REFERENCES

References University of Maryland School of Law Workers’ Rights Clinic…………(410) 706 -2013 Maryland DLLR Unemployment Insurance Division……………. (410) 949 -0022 DLLR Unemployment Insurance Digest : https: //www. dllr. state. md. us/appeals/decisions/index. shtml What You Should Know About Unemployment Insurance in Maryland: http: //www. dllr. state. md. us/employment/clmtguide/uiclmtpam phlet. pdf

References University of Maryland School of Law Workers’ Rights Clinic…………(410) 706 -2013 Maryland DLLR Unemployment Insurance Division……………. (410) 949 -0022 DLLR Unemployment Insurance Digest : https: //www. dllr. state. md. us/appeals/decisions/index. shtml What You Should Know About Unemployment Insurance in Maryland: http: //www. dllr. state. md. us/employment/clmtguide/uiclmtpam phlet. pdf

References Maryland Legal Aid Services Anne Arundel County, 229 Hanover St. , Annapolis, MD 21401; (410) 263 -8330 (Annapolis), (410) 269 -0846 (Baltimore), (301) 261 -1956 (Washington), (800) 6668330 Baltimore City, 500 E. Lexington St. , Baltimore MD 21202; (410) 951 -7777, (800) 999 -8904 Cherry Hill Neighborhood Ctr. , 606 Cherry Hill Rd. , Balto. , MD 21225; (410) 3554223 Baltimore County, 29 W. Susquehanna Ave. , Suite 305, Towson MD 21204; (410) 296 -6705 Lower Eastern Shore (Wicomico, Dorchester, Worcester, Somerset), 111 High St. , Salisbury MD 21801; (410) 546 -5511, (800) 444 -4099 Metropolitan Maryland (Prince George's), 6811 Kenilworth Ave. , Suite 500, Riverdale MD 20737; (301) 560 -2100, (888) 215 -5316

References Maryland Legal Aid Services Anne Arundel County, 229 Hanover St. , Annapolis, MD 21401; (410) 263 -8330 (Annapolis), (410) 269 -0846 (Baltimore), (301) 261 -1956 (Washington), (800) 6668330 Baltimore City, 500 E. Lexington St. , Baltimore MD 21202; (410) 951 -7777, (800) 999 -8904 Cherry Hill Neighborhood Ctr. , 606 Cherry Hill Rd. , Balto. , MD 21225; (410) 3554223 Baltimore County, 29 W. Susquehanna Ave. , Suite 305, Towson MD 21204; (410) 296 -6705 Lower Eastern Shore (Wicomico, Dorchester, Worcester, Somerset), 111 High St. , Salisbury MD 21801; (410) 546 -5511, (800) 444 -4099 Metropolitan Maryland (Prince George's), 6811 Kenilworth Ave. , Suite 500, Riverdale MD 20737; (301) 560 -2100, (888) 215 -5316

References Maryland Legal Aid Services Midwestern Maryland (Frederick, Carroll & Washington), 22 S. Market St. , Frederick MD 21701; (301) 694 -7414, (800) 679 -8813 Northeastern Maryland (Harford, Cecil), 103 South Hickory Avenue, Bel Air MD 21014; (410) 836 -8202 (Harford), (410) 879 -3755 (Baltimore), (800) 444 -9529 Southern Maryland (Charles, St. Mary's & Calvert), 15364 Prince Frederick Rd. , Hughesville MD 20637; (301) 932 -6661 (Charles), (301) 884 -5935 (St. Mary's), (410) 535 -3278 (Calvert), (301) 843 -5850 (D. C. ) Upper Eastern Shore (Queen Anne's, Caroline, Kent & Talbot), Tred Avon Square, Suite 3, Easton MD 21601; (410) 763 -9676, (800) 477 -2543 Western Maryland (Allegany & Garrett), 110 Greene St. , Cumberland MD 21502; (301) 777 -7474, (866) 389 -5243

References Maryland Legal Aid Services Midwestern Maryland (Frederick, Carroll & Washington), 22 S. Market St. , Frederick MD 21701; (301) 694 -7414, (800) 679 -8813 Northeastern Maryland (Harford, Cecil), 103 South Hickory Avenue, Bel Air MD 21014; (410) 836 -8202 (Harford), (410) 879 -3755 (Baltimore), (800) 444 -9529 Southern Maryland (Charles, St. Mary's & Calvert), 15364 Prince Frederick Rd. , Hughesville MD 20637; (301) 932 -6661 (Charles), (301) 884 -5935 (St. Mary's), (410) 535 -3278 (Calvert), (301) 843 -5850 (D. C. ) Upper Eastern Shore (Queen Anne's, Caroline, Kent & Talbot), Tred Avon Square, Suite 3, Easton MD 21601; (410) 763 -9676, (800) 477 -2543 Western Maryland (Allegany & Garrett), 110 Greene St. , Cumberland MD 21502; (301) 777 -7474, (866) 389 -5243