d9e3d8bbef8a6138b4f880bf15567b99.ppt

- Количество слайдов: 34

Khula Enterprise Finance Ltd -Overview. Parliamentary Portfolio Committee on Economic Development 19 March 2010 1

Khula Enterprise Finance Ltd -Overview. Parliamentary Portfolio Committee on Economic Development 19 March 2010 1

Presentation Outline • Background • Mandate, Vision and Mission • SME Financing Landscape • SME Finance Role Players • Khula’s Current Business Model • Products and Delivery Channels • Financing Partners • Strategic Focus • Achievements • Limitations of the Current Model • Financial Implications • Cabinet Approval of Khula Direct • International Benchmarking Lessons on Direct Lending • Re-engineering Khula for Direct Lending • Strategic Priorities and Initiatives • Implications on the Balanced Scorecard and impact On End Users • Khula Direct Overview • Closing Remarks 2

Presentation Outline • Background • Mandate, Vision and Mission • SME Financing Landscape • SME Finance Role Players • Khula’s Current Business Model • Products and Delivery Channels • Financing Partners • Strategic Focus • Achievements • Limitations of the Current Model • Financial Implications • Cabinet Approval of Khula Direct • International Benchmarking Lessons on Direct Lending • Re-engineering Khula for Direct Lending • Strategic Priorities and Initiatives • Implications on the Balanced Scorecard and impact On End Users • Khula Direct Overview • Closing Remarks 2

Background § Khula, is a development finance institution (DFI) reporting to the Department of Trade and Industry (the dti), with an independent Board of Directors § Khula was established in 1996 and its mandate derives from the dti White Paper on the National Strategy for the Development of Small Business (1995). § The decision to establish Khula as a wholesale rather than a retail institution was taken after considering the following factors: • The role of the State is to create an enabling environment rather than to participate directly. • Government backed guarantees would assure Commercial banks and other financial institutions and get them to participate in the SMME sector. • As a wholesale financier; Khula works through a network of partners inter alia Commercial Banks; non-bank RFIs; and other partners – to ensure that SMMEs have access to finance. 3

Background § Khula, is a development finance institution (DFI) reporting to the Department of Trade and Industry (the dti), with an independent Board of Directors § Khula was established in 1996 and its mandate derives from the dti White Paper on the National Strategy for the Development of Small Business (1995). § The decision to establish Khula as a wholesale rather than a retail institution was taken after considering the following factors: • The role of the State is to create an enabling environment rather than to participate directly. • Government backed guarantees would assure Commercial banks and other financial institutions and get them to participate in the SMME sector. • As a wholesale financier; Khula works through a network of partners inter alia Commercial Banks; non-bank RFIs; and other partners – to ensure that SMMEs have access to finance. 3

Background (cont…) § Since the creation of the South African Micro Finance Apex Fund (SAMAF) Khula concentrates its efforts on the upper end of the funding gap - providing funding above R 10 k and therefore refers to lending to Small and Medium Enterprises (SMEs) rather than SMMEs. 4

Background (cont…) § Since the creation of the South African Micro Finance Apex Fund (SAMAF) Khula concentrates its efforts on the upper end of the funding gap - providing funding above R 10 k and therefore refers to lending to Small and Medium Enterprises (SMEs) rather than SMMEs. 4

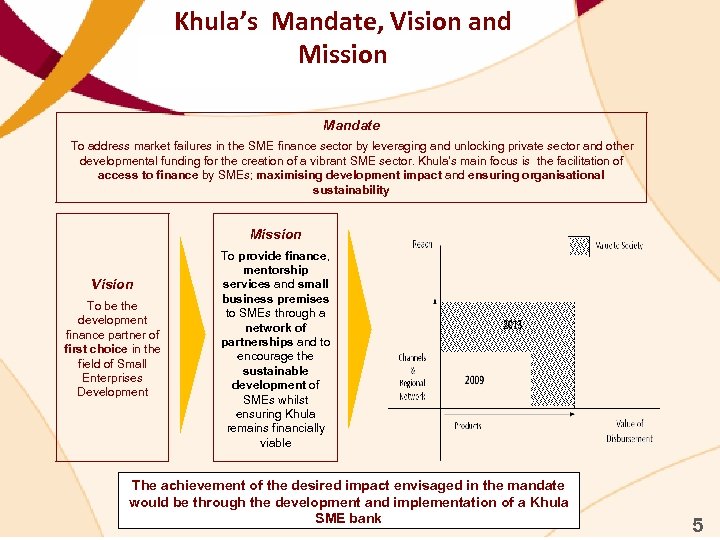

Khula’s Mandate, Vision and Mission Mandate To address market failures in the SME finance sector by leveraging and unlocking private sector and other developmental funding for the creation of a vibrant SME sector. Khula’s main focus is the facilitation of access to finance by SMEs; maximising development impact and ensuring organisational sustainability Mission Vision To be the development finance partner of first choice in the field of Small Enterprises Development To provide finance, mentorship services and small business premises to SMEs through a network of partnerships and to encourage the sustainable development of SMEs whilst ensuring Khula remains financially viable The achievement of the desired impact envisaged in the mandate would be through the development and implementation of a Khula SME bank 5

Khula’s Mandate, Vision and Mission Mandate To address market failures in the SME finance sector by leveraging and unlocking private sector and other developmental funding for the creation of a vibrant SME sector. Khula’s main focus is the facilitation of access to finance by SMEs; maximising development impact and ensuring organisational sustainability Mission Vision To be the development finance partner of first choice in the field of Small Enterprises Development To provide finance, mentorship services and small business premises to SMEs through a network of partnerships and to encourage the sustainable development of SMEs whilst ensuring Khula remains financially viable The achievement of the desired impact envisaged in the mandate would be through the development and implementation of a Khula SME bank 5

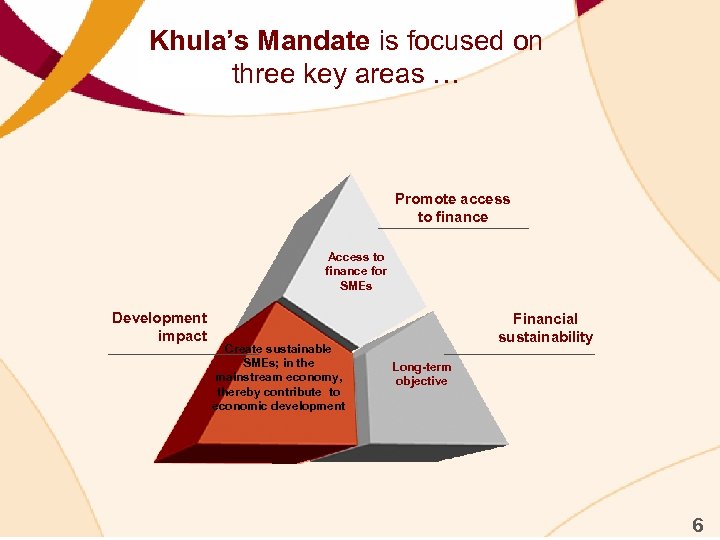

Khula’s Mandate is focused on three key areas … Promote access to finance Access to finance for SMEs Development impact Create sustainable SMEs; in the mainstream economy, thereby contribute to economic development Financial sustainability Long-term objective 6

Khula’s Mandate is focused on three key areas … Promote access to finance Access to finance for SMEs Development impact Create sustainable SMEs; in the mainstream economy, thereby contribute to economic development Financial sustainability Long-term objective 6

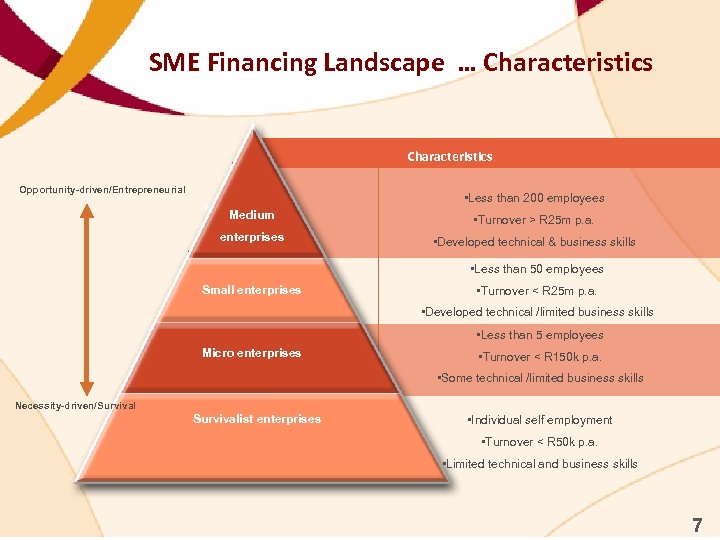

SME Financing Landscape … Characteristics Opportunity-driven/Entrepreneurial Medium • Less than 200 employees Medium • Turnover > R 25 m p. a. enterprises • Developed technical & business skills enterprises • Less than 50 employees Small enterprises • Turnover < R 25 m p. a. • Developed technical /limited business skills • Less than 5 employees Micro enterprises Survivalist enterprises • Turnover < R 150 k p. a. • Some technical /limited business skills Necessity-driven/Survivalist enterprises • Individual self employment • Turnover < R 50 k p. a. • Limited technical and business skills 7

SME Financing Landscape … Characteristics Opportunity-driven/Entrepreneurial Medium • Less than 200 employees Medium • Turnover > R 25 m p. a. enterprises • Developed technical & business skills enterprises • Less than 50 employees Small enterprises • Turnover < R 25 m p. a. • Developed technical /limited business skills • Less than 5 employees Micro enterprises Survivalist enterprises • Turnover < R 150 k p. a. • Some technical /limited business skills Necessity-driven/Survivalist enterprises • Individual self employment • Turnover < R 50 k p. a. • Limited technical and business skills 7

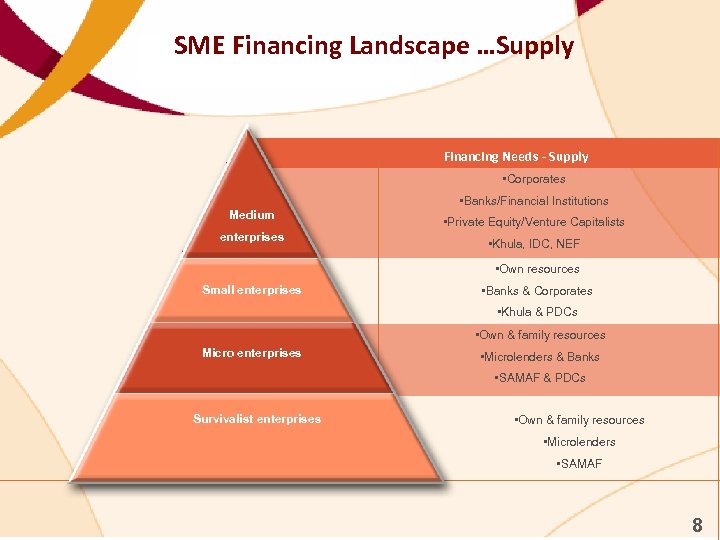

SME Financing Landscape …Supply Financing Needs - Supply • Corporates Medium enterprises • Banks/Financial Institutions • Private Equity/Venture Capitalists • Khula, IDC, NEF • Own resources Small enterprises • Banks & Corporates • Khula & PDCs • Own & family resources Micro enterprises Survivalist enterprises • Microlenders & Banks • SAMAF & PDCs • Own & family resources • Microlenders • SAMAF 8

SME Financing Landscape …Supply Financing Needs - Supply • Corporates Medium enterprises • Banks/Financial Institutions • Private Equity/Venture Capitalists • Khula, IDC, NEF • Own resources Small enterprises • Banks & Corporates • Khula & PDCs • Own & family resources Micro enterprises Survivalist enterprises • Microlenders & Banks • SAMAF & PDCs • Own & family resources • Microlenders • SAMAF 8

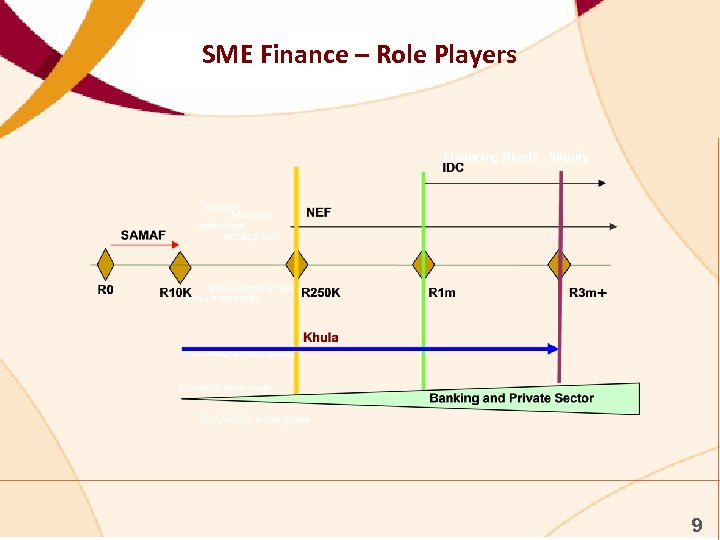

SME Finance – Role Players Financing Needs - Supply Medium enterprises Small enterprises Micro enterprises Survivalist enterprises 9

SME Finance – Role Players Financing Needs - Supply Medium enterprises Small enterprises Micro enterprises Survivalist enterprises 9

Khula’s Current Business Model • Wholesale financier with total reliance on intermediaries • Leverage private sector funding • Facilitator vs. Direct lender - role of the State as an enabler rather than direct participant • Capitalisation structure - funds are required in order not to erode capital base 10

Khula’s Current Business Model • Wholesale financier with total reliance on intermediaries • Leverage private sector funding • Facilitator vs. Direct lender - role of the State as an enabler rather than direct participant • Capitalisation structure - funds are required in order not to erode capital base 10

Financing Gap Filled by Khula • Primarily black-owned ; owner-managed formal SMEs • SMEs requiring financial resources between R 10 000 and R 3 million • Start-up and expansions of early stage businesses • Focus on underserved provinces, rural areas and “urban poor” communities • Focus on women-owned enterprises 11

Financing Gap Filled by Khula • Primarily black-owned ; owner-managed formal SMEs • SMEs requiring financial resources between R 10 000 and R 3 million • Start-up and expansions of early stage businesses • Focus on underserved provinces, rural areas and “urban poor” communities • Focus on women-owned enterprises 11

Product Offering Suite of innovative financing instruments o Business Loans o Credit Guarantees Khula Wholesale o Equity funds and Joint-Ventures o Pre- & post Loan Mentorship Khula Products o Business Premises (Retail & Industrial) o Manage third party funds o Working Capital o Guarantees Financing Partners [Banks, RFIs, Corporate Sector Partners, Public Sector Partners] Retail o Equity Finance o Bridging Finance Financing Instruments o Asset Finance o Invoice Discounting & Factoring o Group lending o Asset accumulation SMEs End-user o Job creation o Regional development Development Impact o Economic transformation 12

Product Offering Suite of innovative financing instruments o Business Loans o Credit Guarantees Khula Wholesale o Equity funds and Joint-Ventures o Pre- & post Loan Mentorship Khula Products o Business Premises (Retail & Industrial) o Manage third party funds o Working Capital o Guarantees Financing Partners [Banks, RFIs, Corporate Sector Partners, Public Sector Partners] Retail o Equity Finance o Bridging Finance Financing Instruments o Asset Finance o Invoice Discounting & Factoring o Group lending o Asset accumulation SMEs End-user o Job creation o Regional development Development Impact o Economic transformation 12

Financing Partners Some of Khula’s Financing Partners are: Ithala Development Finance Corporation Business Finance Promotion Agency (BFPA) Anglo Zimele True Group Small Enterprise Foundation (SEF) Marang Financial Services Business Partners New Business Finance (NBF). Meridian Fund Identity Development Fund (IDF) Enablis Standard Bank Nedbank Absa First National Bank, etc 13

Financing Partners Some of Khula’s Financing Partners are: Ithala Development Finance Corporation Business Finance Promotion Agency (BFPA) Anglo Zimele True Group Small Enterprise Foundation (SEF) Marang Financial Services Business Partners New Business Finance (NBF). Meridian Fund Identity Development Fund (IDF) Enablis Standard Bank Nedbank Absa First National Bank, etc 13

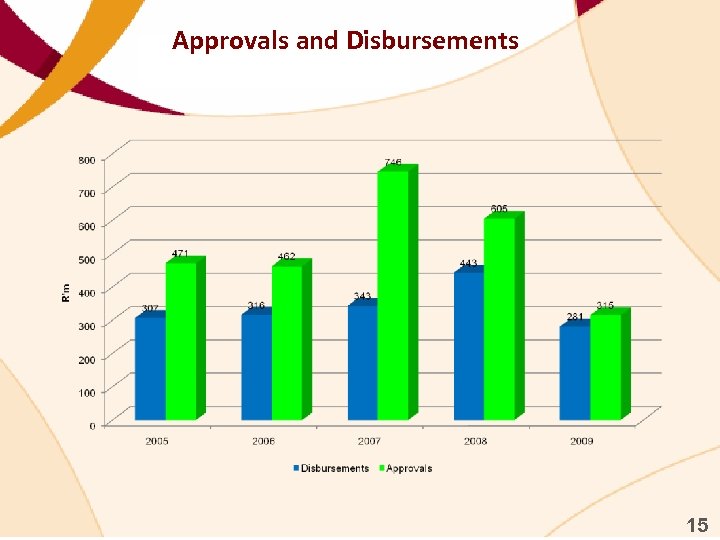

Strategic Focus In 2004 Khula took a new strategic direction aimed at growing the organisation’s reach and impact in order to better support the needs of SMEs. Khula changed its target market, operational model and introduced new channels and products increased disbursements to SMEs. Bad debts and claims were kept as low as possible but pressure is being felt as a result of the impact of the present global economic crunch. Public opinion and perceptions about Khula are steadily improving. To raise delivery to the next level and make more meaningful impact, Cabinet in December 2008 approved that Khula’s mandate be extended to include direct lending activities. 14

Strategic Focus In 2004 Khula took a new strategic direction aimed at growing the organisation’s reach and impact in order to better support the needs of SMEs. Khula changed its target market, operational model and introduced new channels and products increased disbursements to SMEs. Bad debts and claims were kept as low as possible but pressure is being felt as a result of the impact of the present global economic crunch. Public opinion and perceptions about Khula are steadily improving. To raise delivery to the next level and make more meaningful impact, Cabinet in December 2008 approved that Khula’s mandate be extended to include direct lending activities. 14

Approvals and Disbursements 15

Approvals and Disbursements 15

Achievements (cont. ) Loan Book Growth 1000 985 900 860 R'm 800 700 681 600 559 500 2006 2007 Loan Book Growth 2008 2009 16

Achievements (cont. ) Loan Book Growth 1000 985 900 860 R'm 800 700 681 600 559 500 2006 2007 Loan Book Growth 2008 2009 16

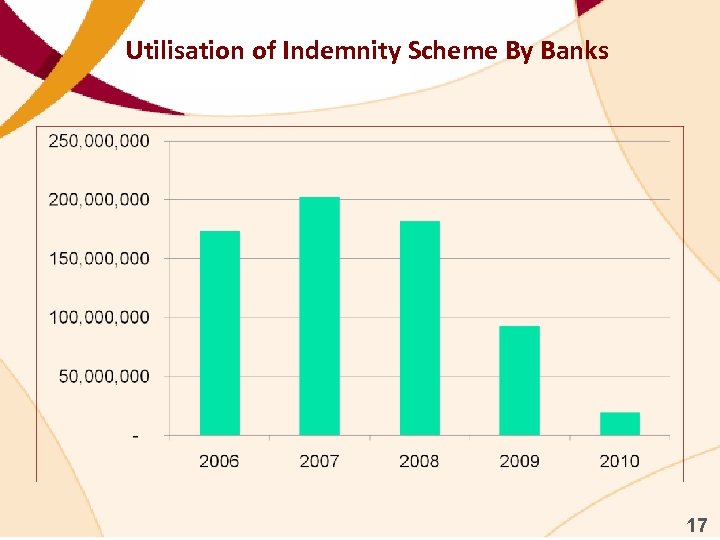

Utilisation of Indemnity Scheme By Banks 17

Utilisation of Indemnity Scheme By Banks 17

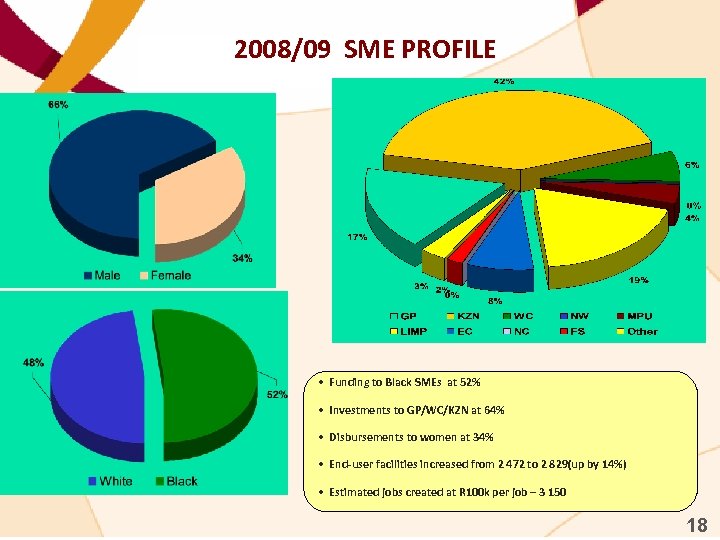

2008/09 SME PROFILE • Funding to Black SMEs at 52% • Investments to GP/WC/KZN at 64% • Disbursements to women at 34% • End-user facilities increased from 2 472 to 2 829(up by 14%) • Estimated jobs created at R 100 k per job – 3 150 18

2008/09 SME PROFILE • Funding to Black SMEs at 52% • Investments to GP/WC/KZN at 64% • Disbursements to women at 34% • End-user facilities increased from 2 472 to 2 829(up by 14%) • Estimated jobs created at R 100 k per job – 3 150 18

Achievements (Cont…) Disbursed more than R 2. 5 bn to SMEs sinception Remained liquid Continued to show a surplus each year irrespective of undercapitalization Built up asset base to approximately R 1. 2 bn 19

Achievements (Cont…) Disbursed more than R 2. 5 bn to SMEs sinception Remained liquid Continued to show a surplus each year irrespective of undercapitalization Built up asset base to approximately R 1. 2 bn 19

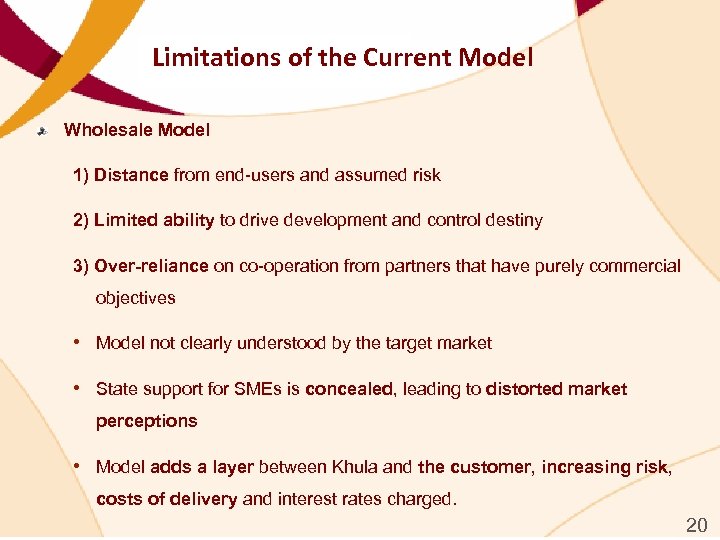

Limitations of the Current Model Wholesale Model 1) Distance from end-users and assumed risk 2) Limited ability to drive development and control destiny 3) Over-reliance on co-operation from partners that have purely commercial objectives • Model not clearly understood by the target market • State support for SMEs is concealed, leading to distorted market perceptions • Model adds a layer between Khula and the customer, increasing risk, costs of delivery and interest rates charged. 20

Limitations of the Current Model Wholesale Model 1) Distance from end-users and assumed risk 2) Limited ability to drive development and control destiny 3) Over-reliance on co-operation from partners that have purely commercial objectives • Model not clearly understood by the target market • State support for SMEs is concealed, leading to distorted market perceptions • Model adds a layer between Khula and the customer, increasing risk, costs of delivery and interest rates charged. 20

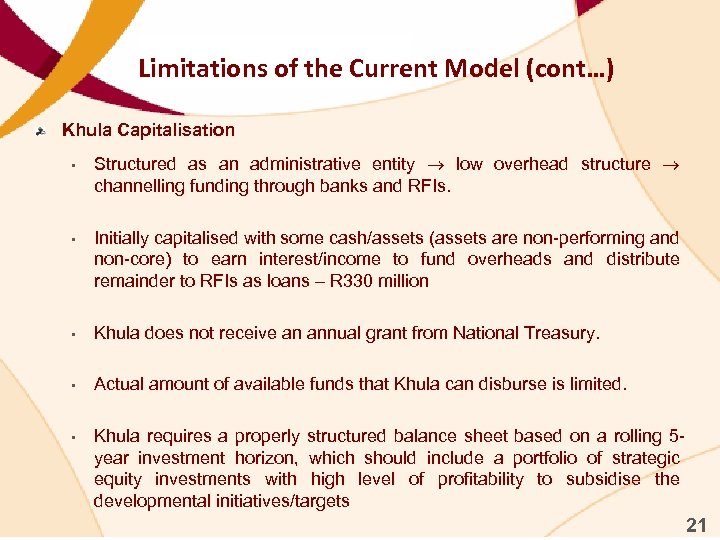

Limitations of the Current Model (cont…) Khula Capitalisation • Structured as an administrative entity low overhead structure channelling funding through banks and RFIs. • Initially capitalised with some cash/assets (assets are non-performing and non-core) to earn interest/income to fund overheads and distribute remainder to RFIs as loans – R 330 million • Khula does not receive an annual grant from National Treasury. • Actual amount of available funds that Khula can disburse is limited. • Khula requires a properly structured balance sheet based on a rolling 5 year investment horizon, which should include a portfolio of strategic equity investments with high level of profitability to subsidise the developmental initiatives/targets 21

Limitations of the Current Model (cont…) Khula Capitalisation • Structured as an administrative entity low overhead structure channelling funding through banks and RFIs. • Initially capitalised with some cash/assets (assets are non-performing and non-core) to earn interest/income to fund overheads and distribute remainder to RFIs as loans – R 330 million • Khula does not receive an annual grant from National Treasury. • Actual amount of available funds that Khula can disburse is limited. • Khula requires a properly structured balance sheet based on a rolling 5 year investment horizon, which should include a portfolio of strategic equity investments with high level of profitability to subsidise the developmental initiatives/targets 21

Financial Implications Since 2004/5 Khula alerted the shareholder that by 2010 Khula would no longer be able to maintain its momentum of delivery to its target market without additional funds. If no funds are received and Khula continues its current strategic thrust it will start eroding its capital base and suffer losses. To be financially sustainable and deliver on its mandate and strategic direction, Khula requires capital injection that would allow for a portfolio of strategic investments with a high level of profitability to subsidise the highly developmental initiatives and allow for increased demands on capital disbursements. Change in Khula’s Articles of Association, so that through an Act of Parliament, Khula becomes a flagship SME Bank, which will also allow Khula to borrow so as not to be reliant only on government funding 22

Financial Implications Since 2004/5 Khula alerted the shareholder that by 2010 Khula would no longer be able to maintain its momentum of delivery to its target market without additional funds. If no funds are received and Khula continues its current strategic thrust it will start eroding its capital base and suffer losses. To be financially sustainable and deliver on its mandate and strategic direction, Khula requires capital injection that would allow for a portfolio of strategic investments with a high level of profitability to subsidise the highly developmental initiatives and allow for increased demands on capital disbursements. Change in Khula’s Articles of Association, so that through an Act of Parliament, Khula becomes a flagship SME Bank, which will also allow Khula to borrow so as not to be reliant only on government funding 22

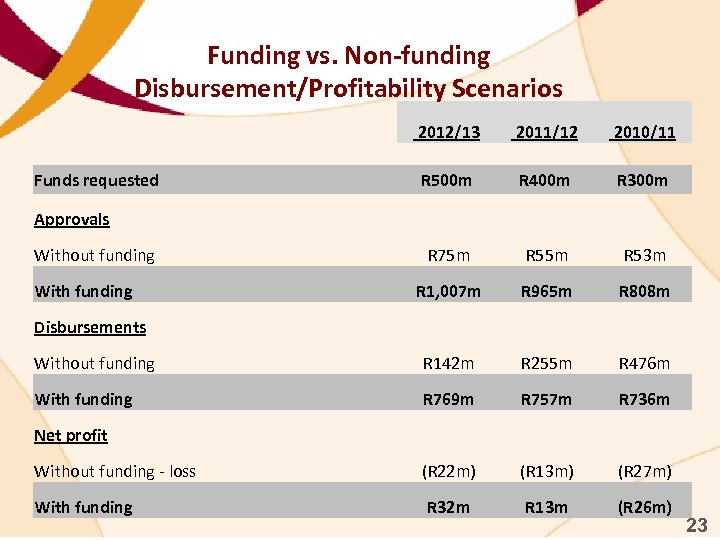

Funding vs. Non-funding Disbursement/Profitability Scenarios 2012/13 2011/12 2010/11 R 500 m R 400 m R 300 m R 75 m R 53 m R 1, 007 m R 965 m R 808 m Without funding R 142 m R 255 m R 476 m With funding R 769 m R 757 m R 736 m Without funding - loss (R 22 m) (R 13 m) (R 27 m) With funding R 32 m R 13 m (R 26 m) Funds requested Approvals Without funding With funding Disbursements Net profit 23

Funding vs. Non-funding Disbursement/Profitability Scenarios 2012/13 2011/12 2010/11 R 500 m R 400 m R 300 m R 75 m R 53 m R 1, 007 m R 965 m R 808 m Without funding R 142 m R 255 m R 476 m With funding R 769 m R 757 m R 736 m Without funding - loss (R 22 m) (R 13 m) (R 27 m) With funding R 32 m R 13 m (R 26 m) Funds requested Approvals Without funding With funding Disbursements Net profit 23

Cabinet Approval of Khula Direct Model • Low impact and unsatisfactory results of Wholesale Model led to submission of Khula Direct Lending Proposal to Cabinet. • In December 2008, Cabinet approved the “KHULA DIRECT” business case subject to Shareholder: a) Approval of business & implementation plans b) Capitalisation of Khula • In 2009, the content of Cabinet approval was discussed with the Portfolio Committee, which confirmed the need for the business plan, international benchmarking study and local research. • Both the international benchmark study and local research were undertaken. 24

Cabinet Approval of Khula Direct Model • Low impact and unsatisfactory results of Wholesale Model led to submission of Khula Direct Lending Proposal to Cabinet. • In December 2008, Cabinet approved the “KHULA DIRECT” business case subject to Shareholder: a) Approval of business & implementation plans b) Capitalisation of Khula • In 2009, the content of Cabinet approval was discussed with the Portfolio Committee, which confirmed the need for the business plan, international benchmarking study and local research. • Both the international benchmark study and local research were undertaken. 24

International Benchmarking Lessons On Direct Lending • Government is prime funder and key player • Government support and commitment to SMEs at highest level of government • Research and developments of new products is the key elements • Centralize the risk management processes • Clearly defined and easy to understand client recruitment and credit process which ensures that they get the “Correct clients. ” • Quick turn-around times due to clearly defined loan disbursement processes • Place strong emphasis on credit risk management • Extensive Network of branches which enable them to visit SMEs throughout the country • Commitment to SME support in the country at the highest level of government • Provide integrated support - Financial and non-financial. 25

International Benchmarking Lessons On Direct Lending • Government is prime funder and key player • Government support and commitment to SMEs at highest level of government • Research and developments of new products is the key elements • Centralize the risk management processes • Clearly defined and easy to understand client recruitment and credit process which ensures that they get the “Correct clients. ” • Quick turn-around times due to clearly defined loan disbursement processes • Place strong emphasis on credit risk management • Extensive Network of branches which enable them to visit SMEs throughout the country • Commitment to SME support in the country at the highest level of government • Provide integrated support - Financial and non-financial. 25

Local Research Findings • Fin. Mark Trust report estimates that demand for R 10 k – R 50 k exists for 525, 000 enterprises (27% GP) and 160, 000 enterprises require R 50 k – R 250 k (50% in GP) • Poor access to finance in rural areas – costly to supply, low density • Banks have to factor cost of capital into their price – makes products expensive – don’t easily fund < R 50 k, always seek security • Inflexible approach to financing SMEs • Unsuccessful SME lending due to 75% borrowers being self-employed cf. microfinance model which bases collections on salary deductions • 41. 6% of all credit consumers had impaired credit files in December 2008 • Lack of security can be substituted with credit history in paying for • rent, • telecommunications (other than prepaid) • municipal services • retail purchases on credit • Insurance 26

Local Research Findings • Fin. Mark Trust report estimates that demand for R 10 k – R 50 k exists for 525, 000 enterprises (27% GP) and 160, 000 enterprises require R 50 k – R 250 k (50% in GP) • Poor access to finance in rural areas – costly to supply, low density • Banks have to factor cost of capital into their price – makes products expensive – don’t easily fund < R 50 k, always seek security • Inflexible approach to financing SMEs • Unsuccessful SME lending due to 75% borrowers being self-employed cf. microfinance model which bases collections on salary deductions • 41. 6% of all credit consumers had impaired credit files in December 2008 • Lack of security can be substituted with credit history in paying for • rent, • telecommunications (other than prepaid) • municipal services • retail purchases on credit • Insurance 26

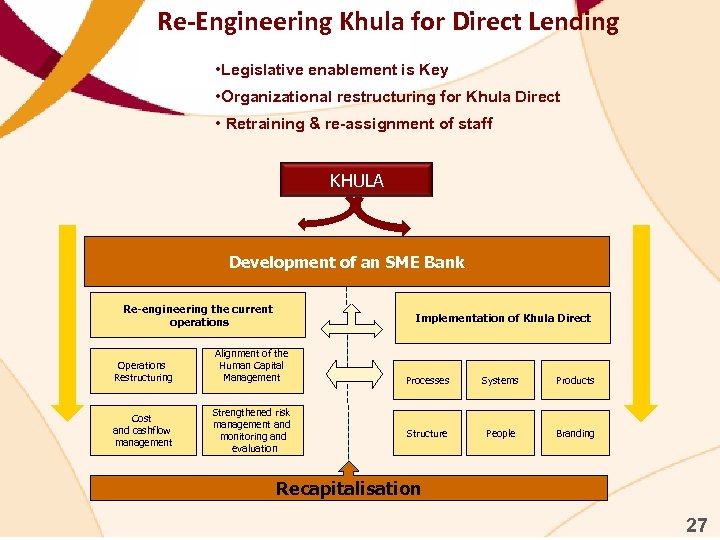

Re-Engineering Khula for Direct Lending • Legislative enablement is Key • Organizational restructuring for Khula Direct • Retraining & re-assignment of staff KHULA Development of an SME Bank Re-engineering the current operations Operations Restructuring Cost and cashflow management Implementation of Khula Direct Alignment of the Human Capital Management Strengthened risk management and monitoring and evaluation Processes Systems Products Structure People Branding Recapitalisation 27

Re-Engineering Khula for Direct Lending • Legislative enablement is Key • Organizational restructuring for Khula Direct • Retraining & re-assignment of staff KHULA Development of an SME Bank Re-engineering the current operations Operations Restructuring Cost and cashflow management Implementation of Khula Direct Alignment of the Human Capital Management Strengthened risk management and monitoring and evaluation Processes Systems Products Structure People Branding Recapitalisation 27

Key Strategic Priorities Re-engineering current Operations Restructuring of operations to ensure meeting of existing commitments and effective support to Khula Direct Cost of cashflow management Strengthening of cost and cashflow management Influence of Khula on SME policy formulation Khula to play a prominent role in shaping and positioning SME development through research and development. Alignment of Human Capital Realignment of human capital intervention to ensure meeting of existing commitments and effective support to Khula Direct Strengthened risk management and monitoring and evaluation Strengthening the risk management of all of Khula’s investments and partnerships, especially the larger transactions Branding and positioning of Khula Position the Khula organization/brand as the flagship DFI in SME financing 28

Key Strategic Priorities Re-engineering current Operations Restructuring of operations to ensure meeting of existing commitments and effective support to Khula Direct Cost of cashflow management Strengthening of cost and cashflow management Influence of Khula on SME policy formulation Khula to play a prominent role in shaping and positioning SME development through research and development. Alignment of Human Capital Realignment of human capital intervention to ensure meeting of existing commitments and effective support to Khula Direct Strengthened risk management and monitoring and evaluation Strengthening the risk management of all of Khula’s investments and partnerships, especially the larger transactions Branding and positioning of Khula Position the Khula organization/brand as the flagship DFI in SME financing 28

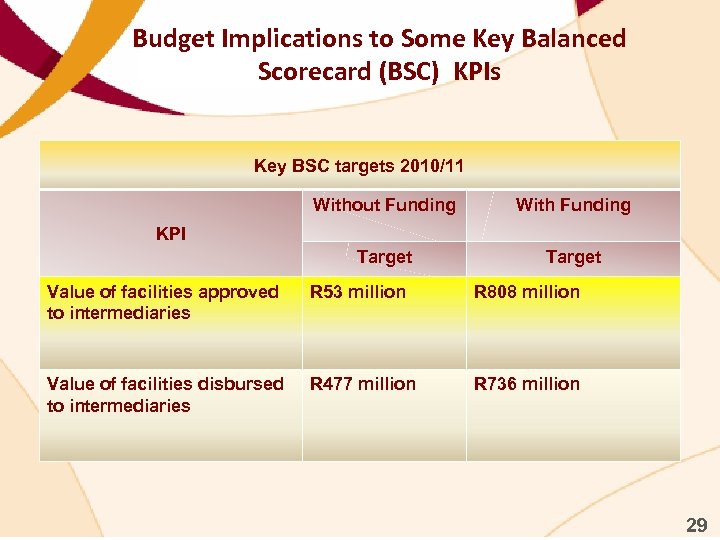

Budget Implications to Some Key Balanced Scorecard (BSC) KPIs Key BSC targets 2010/11 Without Funding With Funding Target KPI Value of facilities approved to intermediaries R 53 million R 808 million Value of facilities disbursed to intermediaries R 477 million R 736 million 29

Budget Implications to Some Key Balanced Scorecard (BSC) KPIs Key BSC targets 2010/11 Without Funding With Funding Target KPI Value of facilities approved to intermediaries R 53 million R 808 million Value of facilities disbursed to intermediaries R 477 million R 736 million 29

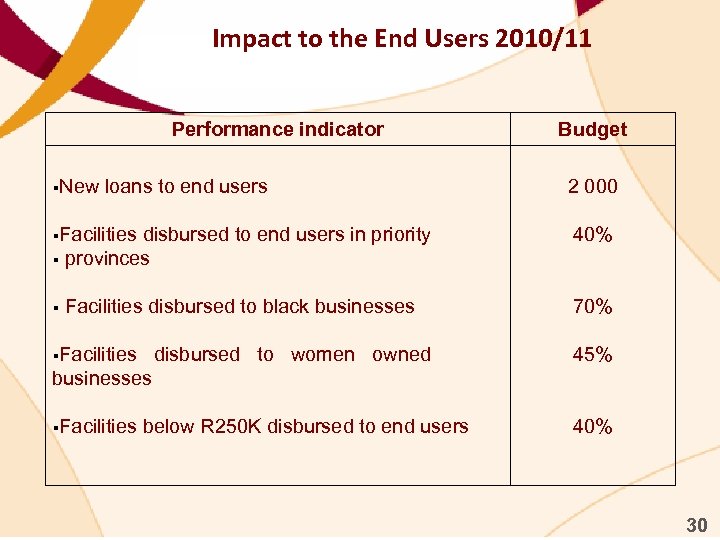

Impact to the End Users 2010/11 Performance indicator §New loans to end users §Facilities Budget 2 000 disbursed to end users in priority § provinces 40% Facilities disbursed to black businesses 70% § §Facilities disbursed to women owned 45% businesses §Facilities below R 250 K disbursed to end users 40% 30

Impact to the End Users 2010/11 Performance indicator §New loans to end users §Facilities Budget 2 000 disbursed to end users in priority § provinces 40% Facilities disbursed to black businesses 70% § §Facilities disbursed to women owned 45% businesses §Facilities below R 250 K disbursed to end users 40% 30

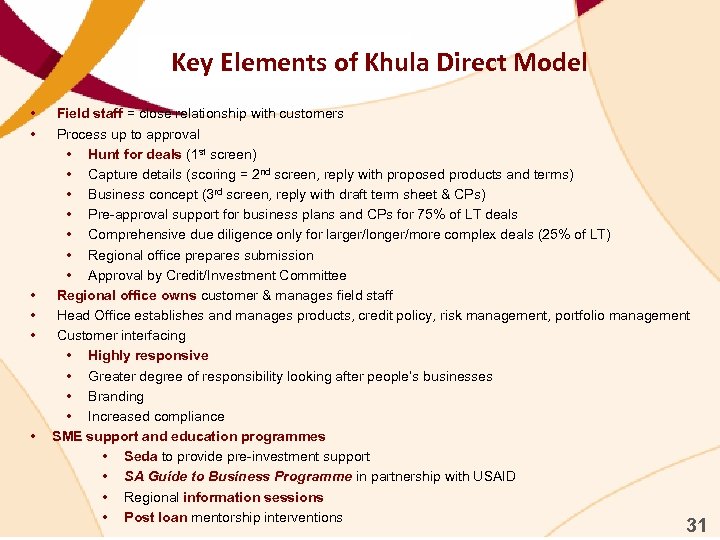

Key Elements of Khula Direct Model • • • Field staff = close relationship with customers Process up to approval • Hunt for deals (1 st screen) • Capture details (scoring = 2 nd screen, reply with proposed products and terms) • Business concept (3 rd screen, reply with draft term sheet & CPs) • Pre-approval support for business plans and CPs for 75% of LT deals • Comprehensive due diligence only for larger/longer/more complex deals (25% of LT) • Regional office prepares submission • Approval by Credit/Investment Committee Regional office owns customer & manages field staff Head Office establishes and manages products, credit policy, risk management, portfolio management Customer interfacing • Highly responsive • Greater degree of responsibility looking after people’s businesses • Branding • Increased compliance SME support and education programmes • Seda to provide pre-investment support • SA Guide to Business Programme in partnership with USAID • Regional information sessions • Post loan mentorship interventions 31

Key Elements of Khula Direct Model • • • Field staff = close relationship with customers Process up to approval • Hunt for deals (1 st screen) • Capture details (scoring = 2 nd screen, reply with proposed products and terms) • Business concept (3 rd screen, reply with draft term sheet & CPs) • Pre-approval support for business plans and CPs for 75% of LT deals • Comprehensive due diligence only for larger/longer/more complex deals (25% of LT) • Regional office prepares submission • Approval by Credit/Investment Committee Regional office owns customer & manages field staff Head Office establishes and manages products, credit policy, risk management, portfolio management Customer interfacing • Highly responsive • Greater degree of responsibility looking after people’s businesses • Branding • Increased compliance SME support and education programmes • Seda to provide pre-investment support • SA Guide to Business Programme in partnership with USAID • Regional information sessions • Post loan mentorship interventions 31

Market Positioning Criteria that define our position Geographic location Less urban, deeply rural Product set Address needs of whole business - simple Pricing Risk-based. Earn fees and interest Degree of security Low on small facilities, be creative Owner’s contribution Low (higher pricing) - commitment Phase of business Start-up, early growth, expansion Size of deal R 10 k – R 3 m, mostly around R 250 k Size of business SME Experience of entrepreneurs Preferably as good as it gets, in industry Market sectors All, except sin industries Position in value-chain More secondary than tertiary Competitiveness Indifferent globally, locally must be unique Growth prospects Yes, increase employment Export opportunities Outside of local community 32

Market Positioning Criteria that define our position Geographic location Less urban, deeply rural Product set Address needs of whole business - simple Pricing Risk-based. Earn fees and interest Degree of security Low on small facilities, be creative Owner’s contribution Low (higher pricing) - commitment Phase of business Start-up, early growth, expansion Size of deal R 10 k – R 3 m, mostly around R 250 k Size of business SME Experience of entrepreneurs Preferably as good as it gets, in industry Market sectors All, except sin industries Position in value-chain More secondary than tertiary Competitiveness Indifferent globally, locally must be unique Growth prospects Yes, increase employment Export opportunities Outside of local community 32

Concluding Remarks Khula is a DFI dedicated to the needs of small business Key differentiator is focus on start-ups, small loans and underserved provinces Khula has undergone a strategic shift to enhance focus and delivery Maximum outreach and impact will be achieved, in part, through: Direct lending to SMEs Targeted use of Credit Indemnity Scheme More direct approach to wholesale funding through RFIs Utilisation of the Financing Partners infrastructure Capitalisation is required to follow through with strategic choices made 33

Concluding Remarks Khula is a DFI dedicated to the needs of small business Key differentiator is focus on start-ups, small loans and underserved provinces Khula has undergone a strategic shift to enhance focus and delivery Maximum outreach and impact will be achieved, in part, through: Direct lending to SMEs Targeted use of Credit Indemnity Scheme More direct approach to wholesale funding through RFIs Utilisation of the Financing Partners infrastructure Capitalisation is required to follow through with strategic choices made 33

THANK YOU Khula Client Liaison Centre number 08600 KHULA (54852) Website - http: //www. khula. org. za Email - helpline@khula. org. za 34

THANK YOU Khula Client Liaison Centre number 08600 KHULA (54852) Website - http: //www. khula. org. za Email - helpline@khula. org. za 34