61316ad95d012d126eb29179f6652e03.ppt

- Количество слайдов: 32

Keynote Address: New medicines, new challenges: the SMC approach Anne Lee, Principal Pharmacist and Horizon Scanning, Scottish Medicines Consortium

Keynote Address: New medicines, new challenges: the SMC approach Anne Lee, Principal Pharmacist and Horizon Scanning, Scottish Medicines Consortium

New medicines, new challenges: the SMC approach Anne Lee Principal Pharmacist Scottish Medicines Consortium NPPG Conference November 2009

New medicines, new challenges: the SMC approach Anne Lee Principal Pharmacist Scottish Medicines Consortium NPPG Conference November 2009

Overview • SMC – historical context • A birds eye view of SMC -new medicines assessment (medicines for children) -horizon scanning • Current challenges with new medicines for pharmacy

Overview • SMC – historical context • A birds eye view of SMC -new medicines assessment (medicines for children) -horizon scanning • Current challenges with new medicines for pharmacy

From EBM to cost effectiveness……. 1992 UK Cochrane Centre established 1995 First SIGN guideline published 1999 NICE established 2002 First SMC advice issued

From EBM to cost effectiveness……. 1992 UK Cochrane Centre established 1995 First SIGN guideline published 1999 NICE established 2002 First SMC advice issued

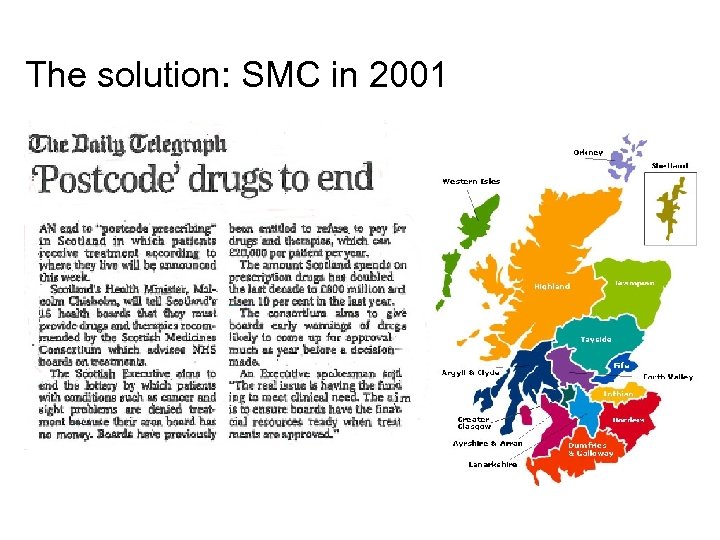

The solution: SMC in 2001

The solution: SMC in 2001

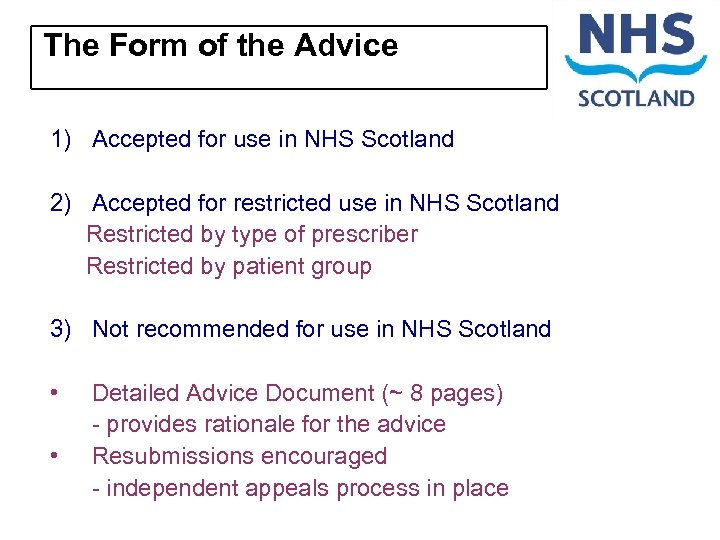

The Form of the Advice 1) Accepted for use in NHS Scotland 2) Accepted for restricted use in NHS Scotland Restricted by type of prescriber Restricted by patient group 3) Not recommended for use in NHS Scotland • • Detailed Advice Document (~ 8 pages) - provides rationale for the advice Resubmissions encouraged - independent appeals process in place

The Form of the Advice 1) Accepted for use in NHS Scotland 2) Accepted for restricted use in NHS Scotland Restricted by type of prescriber Restricted by patient group 3) Not recommended for use in NHS Scotland • • Detailed Advice Document (~ 8 pages) - provides rationale for the advice Resubmissions encouraged - independent appeals process in place

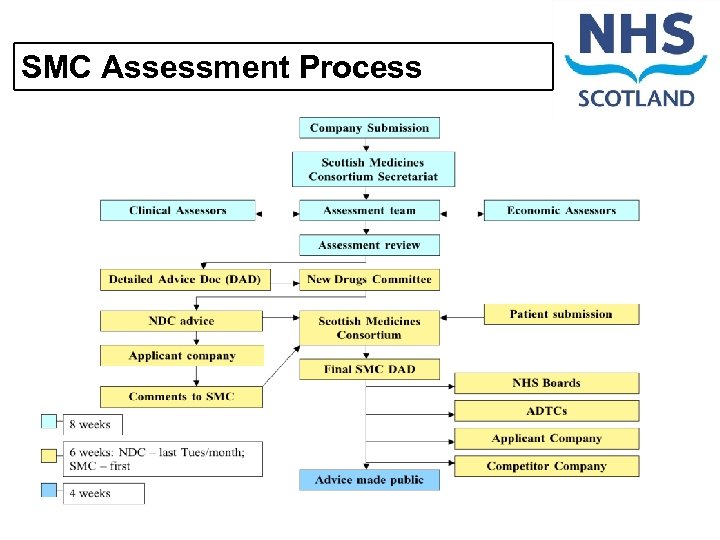

SMC Assessment Process

SMC Assessment Process

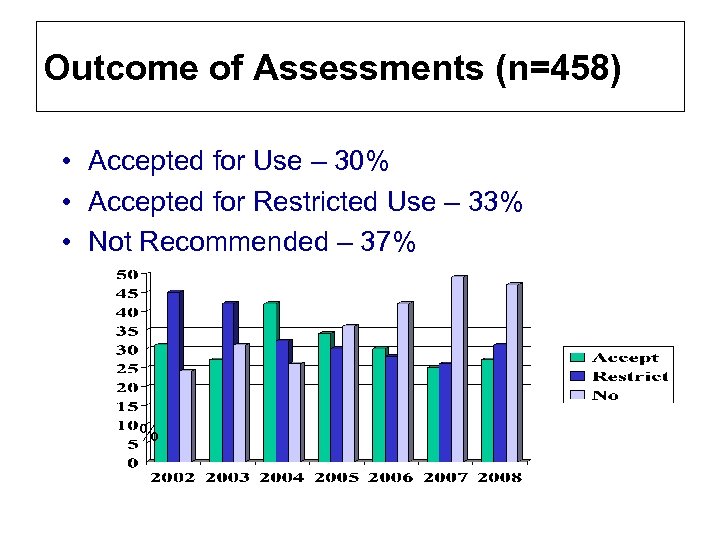

Outcome of Assessments (n=458) • Accepted for Use – 30% • Accepted for Restricted Use – 33% • Not Recommended – 37% %

Outcome of Assessments (n=458) • Accepted for Use – 30% • Accepted for Restricted Use – 33% • Not Recommended – 37% %

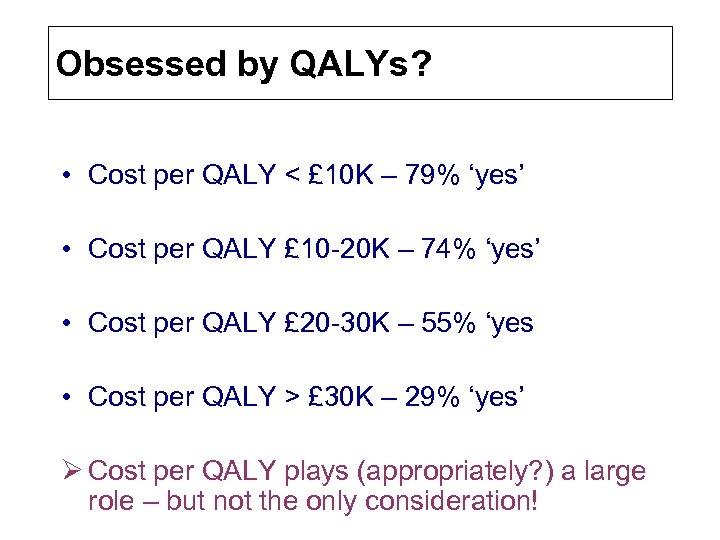

Obsessed by QALYs? • Cost per QALY < £ 10 K – 79% ‘yes’ • Cost per QALY £ 10 -20 K – 74% ‘yes’ • Cost per QALY £ 20 -30 K – 55% ‘yes • Cost per QALY > £ 30 K – 29% ‘yes’ Ø Cost per QALY plays (appropriately? ) a large role – but not the only consideration!

Obsessed by QALYs? • Cost per QALY < £ 10 K – 79% ‘yes’ • Cost per QALY £ 10 -20 K – 74% ‘yes’ • Cost per QALY £ 20 -30 K – 55% ‘yes • Cost per QALY > £ 30 K – 29% ‘yes’ Ø Cost per QALY plays (appropriately? ) a large role – but not the only consideration!

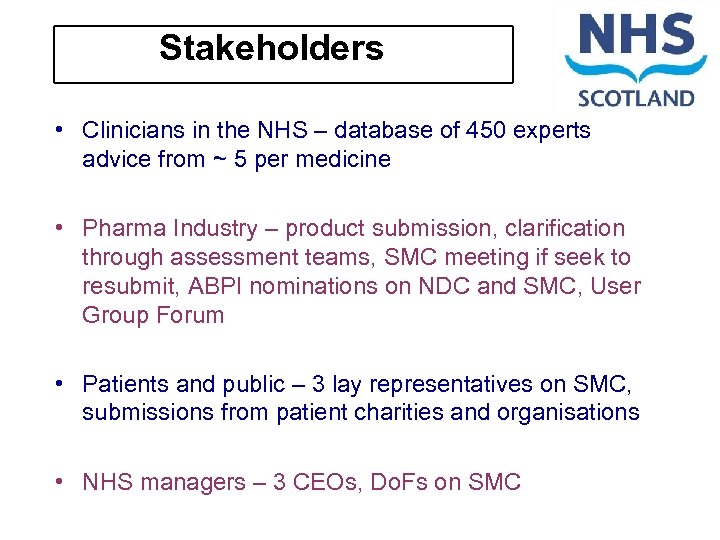

Stakeholders • Clinicians in the NHS – database of 450 experts advice from ~ 5 per medicine • Pharma Industry – product submission, clarification through assessment teams, SMC meeting if seek to resubmit, ABPI nominations on NDC and SMC, User Group Forum • Patients and public – 3 lay representatives on SMC, submissions from patient charities and organisations • NHS managers – 3 CEOs, Do. Fs on SMC

Stakeholders • Clinicians in the NHS – database of 450 experts advice from ~ 5 per medicine • Pharma Industry – product submission, clarification through assessment teams, SMC meeting if seek to resubmit, ABPI nominations on NDC and SMC, User Group Forum • Patients and public – 3 lay representatives on SMC, submissions from patient charities and organisations • NHS managers – 3 CEOs, Do. Fs on SMC

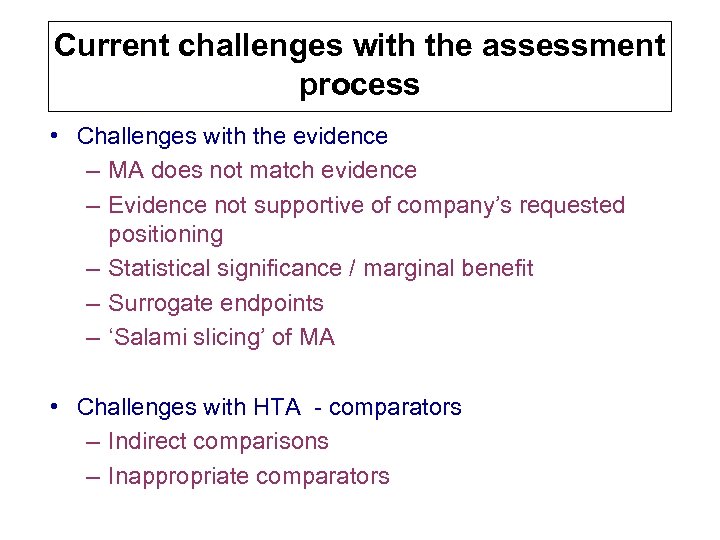

Current challenges with the assessment process • Challenges with the evidence – MA does not match evidence – Evidence not supportive of company’s requested positioning – Statistical significance / marginal benefit – Surrogate endpoints – ‘Salami slicing’ of MA • Challenges with HTA - comparators – Indirect comparisons – Inappropriate comparators

Current challenges with the assessment process • Challenges with the evidence – MA does not match evidence – Evidence not supportive of company’s requested positioning – Statistical significance / marginal benefit – Surrogate endpoints – ‘Salami slicing’ of MA • Challenges with HTA - comparators – Indirect comparisons – Inappropriate comparators

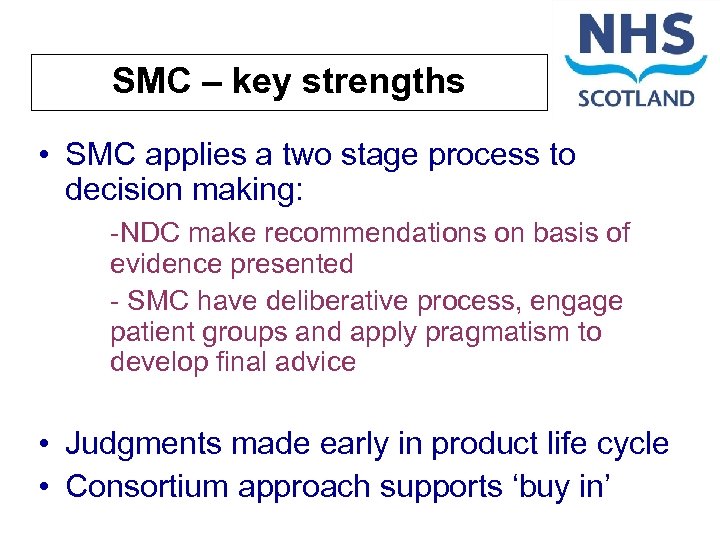

SMC – key strengths • SMC applies a two stage process to decision making: -NDC make recommendations on basis of evidence presented - SMC have deliberative process, engage patient groups and apply pragmatism to develop final advice • Judgments made early in product life cycle • Consortium approach supports ‘buy in’

SMC – key strengths • SMC applies a two stage process to decision making: -NDC make recommendations on basis of evidence presented - SMC have deliberative process, engage patient groups and apply pragmatism to develop final advice • Judgments made early in product life cycle • Consortium approach supports ‘buy in’

What has the SMC ever done for us?

What has the SMC ever done for us?

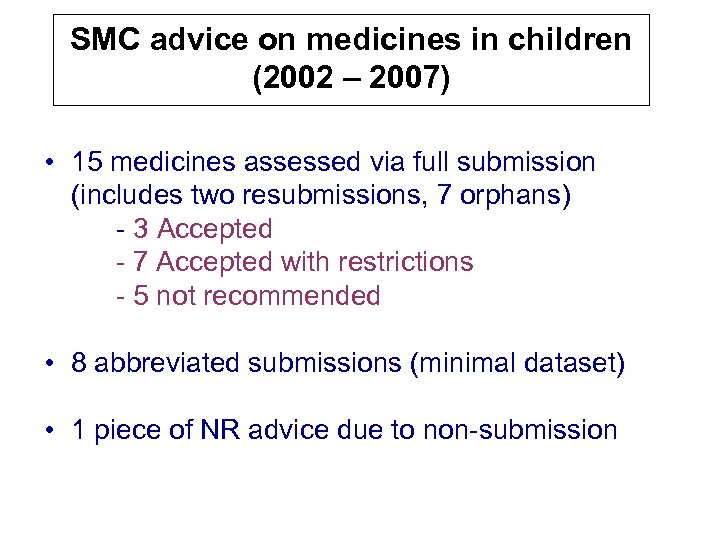

SMC advice on medicines in children (2002 – 2007) • 15 medicines assessed via full submission (includes two resubmissions, 7 orphans) - 3 Accepted - 7 Accepted with restrictions - 5 not recommended • 8 abbreviated submissions (minimal dataset) • 1 piece of NR advice due to non-submission

SMC advice on medicines in children (2002 – 2007) • 15 medicines assessed via full submission (includes two resubmissions, 7 orphans) - 3 Accepted - 7 Accepted with restrictions - 5 not recommended • 8 abbreviated submissions (minimal dataset) • 1 piece of NR advice due to non-submission

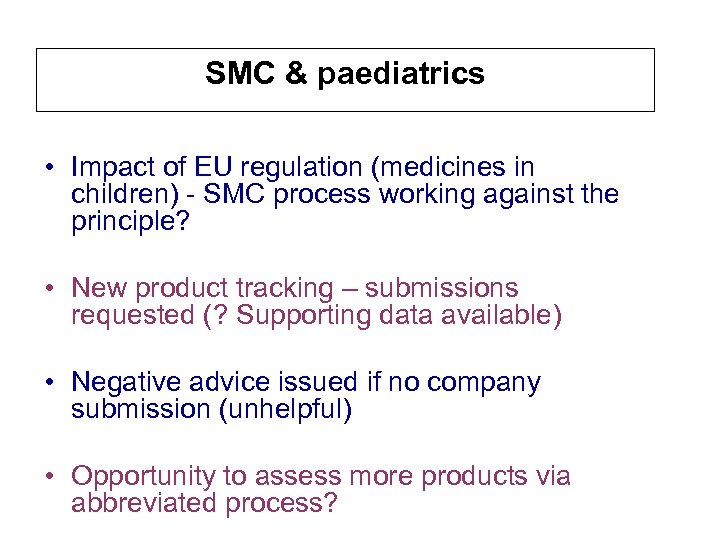

SMC & paediatrics • Impact of EU regulation (medicines in children) - SMC process working against the principle? • New product tracking – submissions requested (? Supporting data available) • Negative advice issued if no company submission (unhelpful) • Opportunity to assess more products via abbreviated process?

SMC & paediatrics • Impact of EU regulation (medicines in children) - SMC process working against the principle? • New product tracking – submissions requested (? Supporting data available) • Negative advice issued if no company submission (unhelpful) • Opportunity to assess more products via abbreviated process?

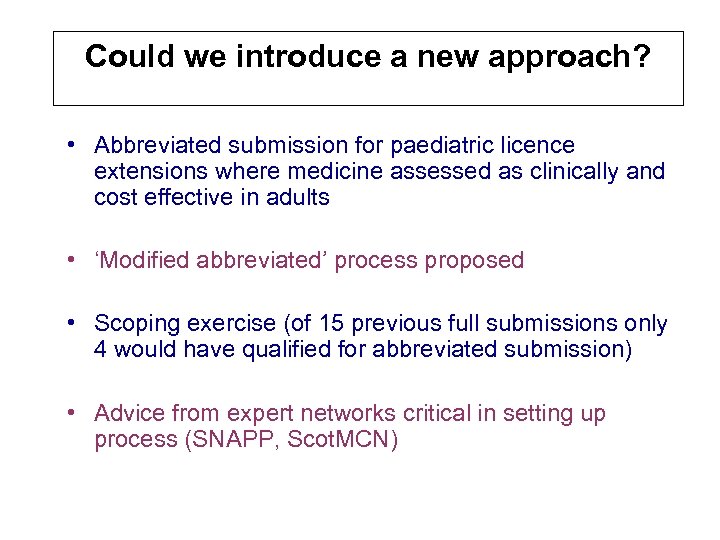

Could we introduce a new approach? • Abbreviated submission for paediatric licence extensions where medicine assessed as clinically and cost effective in adults • ‘Modified abbreviated’ process proposed • Scoping exercise (of 15 previous full submissions only 4 would have qualified for abbreviated submission) • Advice from expert networks critical in setting up process (SNAPP, Scot. MCN)

Could we introduce a new approach? • Abbreviated submission for paediatric licence extensions where medicine assessed as clinically and cost effective in adults • ‘Modified abbreviated’ process proposed • Scoping exercise (of 15 previous full submissions only 4 would have qualified for abbreviated submission) • Advice from expert networks critical in setting up process (SNAPP, Scot. MCN)

For medicines previously accepted by SMC for the relevant indication in adults (or products predating SMC) – abbreviated submission Advice from clinicians in both networks is sought to inform the decision on whether CE in children expected to be similar to that in adults

For medicines previously accepted by SMC for the relevant indication in adults (or products predating SMC) – abbreviated submission Advice from clinicians in both networks is sought to inform the decision on whether CE in children expected to be similar to that in adults

Experience in the first year • 8 abbreviated submissions accepted • 3 full submissions for paediatric medicines (stiripentol, caffeine, mecasermin) • Network advice invaluable • Some concern at NDC/SMC re no requirement for health economic case • Report to SMC on first year experience

Experience in the first year • 8 abbreviated submissions accepted • 3 full submissions for paediatric medicines (stiripentol, caffeine, mecasermin) • Network advice invaluable • Some concern at NDC/SMC re no requirement for health economic case • Report to SMC on first year experience

Audit Scotland 2005

Audit Scotland 2005

SMC horizon scanning • Support Health Board financial and service planning for new medicines • Reduces duplication of effort • Predicted NET budget impact for NHS Scotland (at yr 1 and yr 5) • Improve access to clinical & cost-effective new medicines

SMC horizon scanning • Support Health Board financial and service planning for new medicines • Reduces duplication of effort • Predicted NET budget impact for NHS Scotland (at yr 1 and yr 5) • Improve access to clinical & cost-effective new medicines

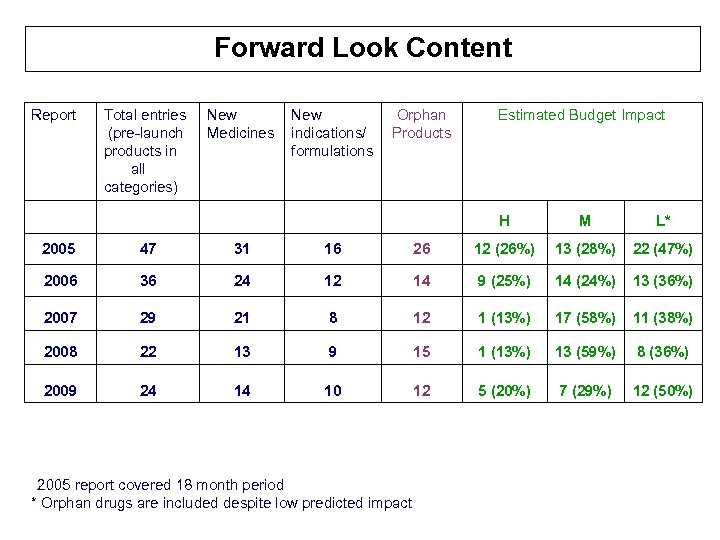

Forward Look Content Report Total entries (pre-launch products in all categories) New Medicines New indications/ formulations Orphan Products Estimated Budget Impact H M L* 2005 47 31 16 26 12 (26%) 13 (28%) 22 (47%) 2006 36 24 12 14 9 (25%) 14 (24%) 13 (36%) 2007 29 21 8 12 1 (13%) 17 (58%) 11 (38%) 2008 22 13 9 15 1 (13%) 13 (59%) 8 (36%) 2009 24 14 10 12 5 (20%) 7 (29%) 12 (50%) 2005 report covered 18 month period * Orphan drugs are included despite low predicted impact

Forward Look Content Report Total entries (pre-launch products in all categories) New Medicines New indications/ formulations Orphan Products Estimated Budget Impact H M L* 2005 47 31 16 26 12 (26%) 13 (28%) 22 (47%) 2006 36 24 12 14 9 (25%) 14 (24%) 13 (36%) 2007 29 21 8 12 1 (13%) 17 (58%) 11 (38%) 2008 22 13 9 15 1 (13%) 13 (59%) 8 (36%) 2009 24 14 10 12 5 (20%) 7 (29%) 12 (50%) 2005 report covered 18 month period * Orphan drugs are included despite low predicted impact

NHS board’s views on and use of N Forward Look

NHS board’s views on and use of N Forward Look

“The NHS has better information for planning medicines budgets, but boards still identified gaps. The Scottish Medicines Consortium (SMC) has made good progress in providing boards with information to help them plan. It now produces annual reports that include an estimate of the budget impact of medicines that should become available in the coming year. ” Audit Scotland. Managing the use of medicines in hospitals: a follow-up review. 2009.

“The NHS has better information for planning medicines budgets, but boards still identified gaps. The Scottish Medicines Consortium (SMC) has made good progress in providing boards with information to help them plan. It now produces annual reports that include an estimate of the budget impact of medicines that should become available in the coming year. ” Audit Scotland. Managing the use of medicines in hospitals: a follow-up review. 2009.

New medicines: new challenges

New medicines: new challenges

New medicines on the horizon • Expect more…. . – biopharmaceuticals / biosimilars – rare diseases - more orphan drugs • Advanced therapy medicinal products (ATMPs) - gene therapy - somatic cell therapy products - tissue engineered products Ø EU Advanced Therapies Regulation Ø EMEA Committee on Advanced Therapies

New medicines on the horizon • Expect more…. . – biopharmaceuticals / biosimilars – rare diseases - more orphan drugs • Advanced therapy medicinal products (ATMPs) - gene therapy - somatic cell therapy products - tissue engineered products Ø EU Advanced Therapies Regulation Ø EMEA Committee on Advanced Therapies

Current challenges with new medicines: SMC • Pharmaceutical Price Regulation Scheme (PPRS) 2009 • • • measures to promote innovation Patient access schemes Flexible pricing UK-wide horizon scanning database Metrics of uptake on new medicines

Current challenges with new medicines: SMC • Pharmaceutical Price Regulation Scheme (PPRS) 2009 • • • measures to promote innovation Patient access schemes Flexible pricing UK-wide horizon scanning database Metrics of uptake on new medicines

New medicines: challenges for pharmacy • Cost-effectiveness vs innovation • Disinvestment in medicines not costeffective • Biotechnology products - safety • Advanced therapy medicinal products • Personalised medicine

New medicines: challenges for pharmacy • Cost-effectiveness vs innovation • Disinvestment in medicines not costeffective • Biotechnology products - safety • Advanced therapy medicinal products • Personalised medicine

Thank you!

Thank you!

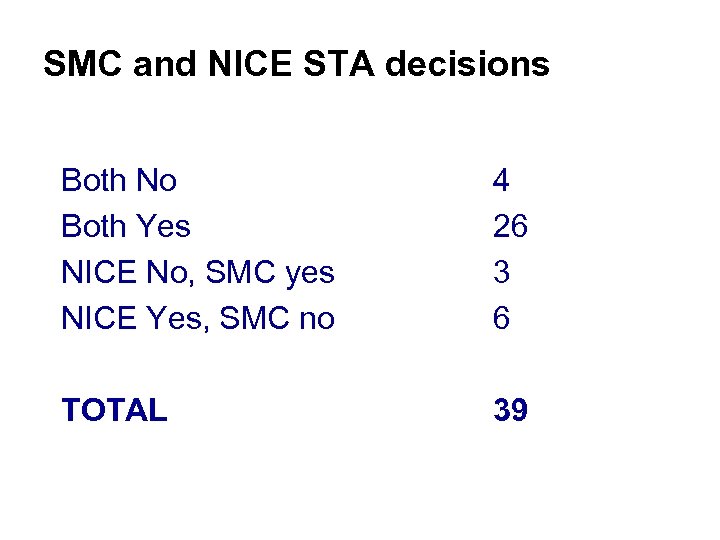

SMC and NICE STA decisions Both No Both Yes NICE No, SMC yes NICE Yes, SMC no 4 26 3 6 TOTAL 39

SMC and NICE STA decisions Both No Both Yes NICE No, SMC yes NICE Yes, SMC no 4 26 3 6 TOTAL 39