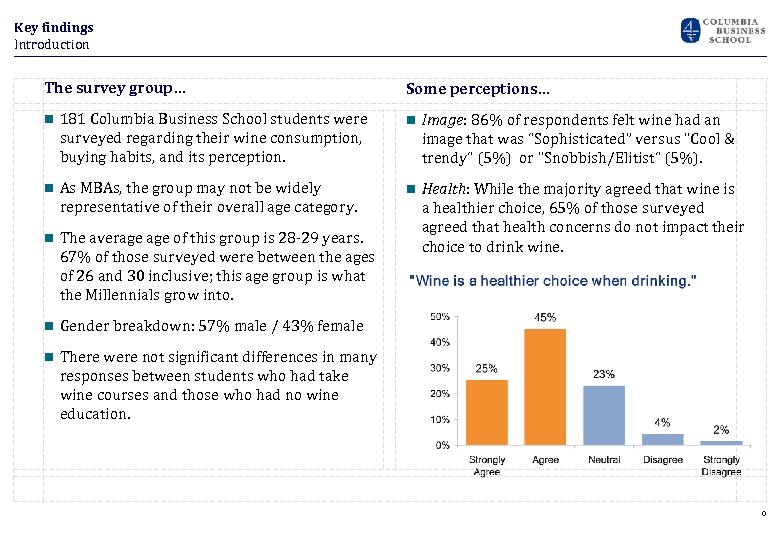

Key findings Introduction The survey group… Some perceptions… n 181 Columbia Business School students were n Image: 86% of respondents felt wine had an surveyed regarding their wine consumption, buying habits, and its perception. n As MBAs, the group may not be widely representative of their overall age category. n The average of this group is 28 -29 years. 67% of those surveyed were between the ages of 26 and 30 inclusive; this age group is what the Millennials grow into. image that was “Sophisticated” versus "Cool & trendy“ (5%) or "Snobbish/Elitist“ (5%). n Health: While the majority agreed that wine is a healthier choice, 65% of those surveyed agreed that health concerns do not impact their choice to drink wine. n Gender breakdown: 57% male / 43% female n There were not significant differences in many responses between students who had take wine courses and those who had no wine education. 0

Key findings Introduction The survey group… Some perceptions… n 181 Columbia Business School students were n Image: 86% of respondents felt wine had an surveyed regarding their wine consumption, buying habits, and its perception. n As MBAs, the group may not be widely representative of their overall age category. n The average of this group is 28 -29 years. 67% of those surveyed were between the ages of 26 and 30 inclusive; this age group is what the Millennials grow into. image that was “Sophisticated” versus "Cool & trendy“ (5%) or "Snobbish/Elitist“ (5%). n Health: While the majority agreed that wine is a healthier choice, 65% of those surveyed agreed that health concerns do not impact their choice to drink wine. n Gender breakdown: 57% male / 43% female n There were not significant differences in many responses between students who had take wine courses and those who had no wine education. 0

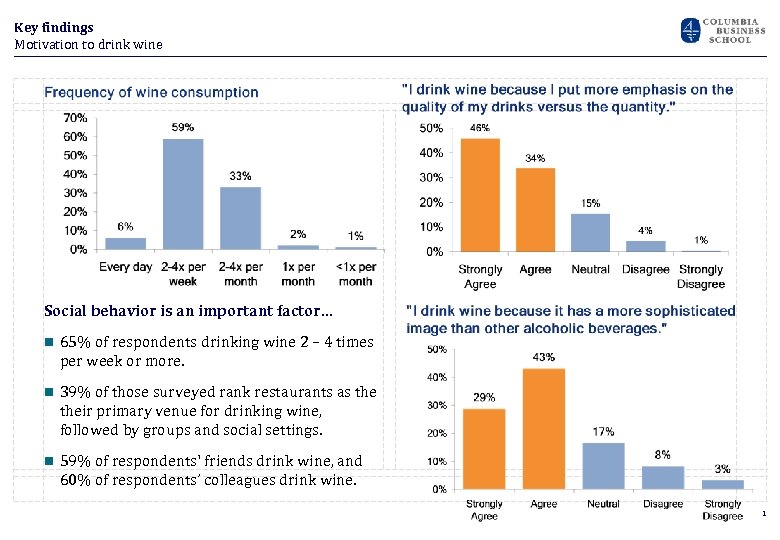

Key findings Motivation to drink wine Social behavior is an important factor… n 65% of respondents drinking wine 2 – 4 times per week or more. n 39% of those surveyed rank restaurants as their primary venue for drinking wine, followed by groups and social settings. n 59% of respondents' friends drink wine, and 60% of respondents’ colleagues drink wine. 1

Key findings Motivation to drink wine Social behavior is an important factor… n 65% of respondents drinking wine 2 – 4 times per week or more. n 39% of those surveyed rank restaurants as their primary venue for drinking wine, followed by groups and social settings. n 59% of respondents' friends drink wine, and 60% of respondents’ colleagues drink wine. 1

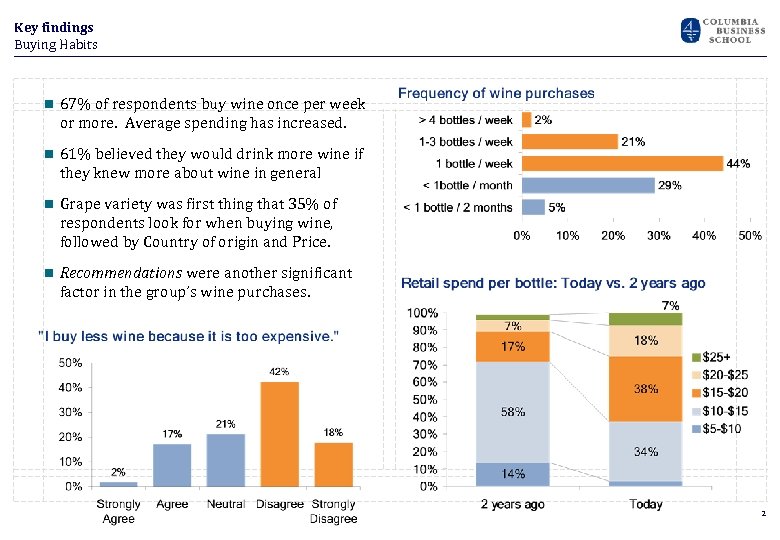

Key findings Buying Habits n 67% of respondents buy wine once per week or more. Average spending has increased. n 61% believed they would drink more wine if they knew more about wine in general n Grape variety was first thing that 35% of respondents look for when buying wine, followed by Country of origin and Price. n Recommendations were another significant factor in the group’s wine purchases. 2

Key findings Buying Habits n 67% of respondents buy wine once per week or more. Average spending has increased. n 61% believed they would drink more wine if they knew more about wine in general n Grape variety was first thing that 35% of respondents look for when buying wine, followed by Country of origin and Price. n Recommendations were another significant factor in the group’s wine purchases. 2

Survey Commentary Respondents wish they knew more about… n Specifics (regions, varietals, producers) - “The names of one or two producers in each varietal that i can trust” - “Knowing the key differences between the main kinds/categories of wine” n Food Pairing - “Which wine goes better with the particular meal I have” - “How to pick the right bottle at a restaurant” n Tasting - “How to describe what i am tasting (i. e. , oaky, smooth, etc. )” - “How to differentiate grape varieties only by tasting and smelling” n Vintages - “The vintage of great wine for each grape variety. It is so complicated to memorize it, but I think it’s worth it” 3

Survey Commentary Respondents wish they knew more about… n Specifics (regions, varietals, producers) - “The names of one or two producers in each varietal that i can trust” - “Knowing the key differences between the main kinds/categories of wine” n Food Pairing - “Which wine goes better with the particular meal I have” - “How to pick the right bottle at a restaurant” n Tasting - “How to describe what i am tasting (i. e. , oaky, smooth, etc. )” - “How to differentiate grape varieties only by tasting and smelling” n Vintages - “The vintage of great wine for each grape variety. It is so complicated to memorize it, but I think it’s worth it” 3

Survey Commentary Respondents favorite thing about wine is… n Tasting/Experience - “The taste and smell” - “The taste for sure, as well as how well it works with food” - “The feeling it gives the drinker it is unmatched by any other type of alcohol” - “Such a sensual experience” n Social Aspect - “Wine is about people who make it and enjoy it” - “Its flexibility and adaptability to virtually any social situation” - “Best social drink ever. . . a group can enjoy it together and goes great with a meal” - “Finding a good wine to pair with a meal with friends, and then drinking a little too much of it : )” n Variety/Surprise - “Never know what I'm going to get. . . adds excitement!” - “The variety. I love experiencing new wines” 4

Survey Commentary Respondents favorite thing about wine is… n Tasting/Experience - “The taste and smell” - “The taste for sure, as well as how well it works with food” - “The feeling it gives the drinker it is unmatched by any other type of alcohol” - “Such a sensual experience” n Social Aspect - “Wine is about people who make it and enjoy it” - “Its flexibility and adaptability to virtually any social situation” - “Best social drink ever. . . a group can enjoy it together and goes great with a meal” - “Finding a good wine to pair with a meal with friends, and then drinking a little too much of it : )” n Variety/Surprise - “Never know what I'm going to get. . . adds excitement!” - “The variety. I love experiencing new wines” 4