a8e9688ccc0ba703f10be11327db7973.ppt

- Количество слайдов: 25

KENYA REVENUE AUTHORITY REVENUE ADMINISTRATION REPORT JUL-DEC 2004 M. G. WAWERU COMMISSIONER GENERAL 27 JANUARY 2005 Kenya Revenue Authority

KENYA REVENUE AUTHORITY REVENUE ADMINISTRATION REPORT JUL-DEC 2004 M. G. WAWERU COMMISSIONER GENERAL 27 JANUARY 2005 Kenya Revenue Authority

Introduction • It is my pleasure to present to you the Half Year Revenue Performance and Administration Report of Kenya Revenue Authority for the period July to December 2004. • As is our practice, we shall report on not only the status of revenue performance but also on the implementation of the various initiatives that are contained in our balanced scorecard which is our performance contract with government and stakeholders. • These initiatives are viewed from four perspectives that form theme of our Plan; Enhanced Revenue Collection through Enhanced Quality Service to Kenya Revenue Authority Stakeholders, Modernisation of our Internal Processes

Introduction • It is my pleasure to present to you the Half Year Revenue Performance and Administration Report of Kenya Revenue Authority for the period July to December 2004. • As is our practice, we shall report on not only the status of revenue performance but also on the implementation of the various initiatives that are contained in our balanced scorecard which is our performance contract with government and stakeholders. • These initiatives are viewed from four perspectives that form theme of our Plan; Enhanced Revenue Collection through Enhanced Quality Service to Kenya Revenue Authority Stakeholders, Modernisation of our Internal Processes

OUR VISION To be the leading Revenue Authority in the world respected for professionalism, integrity and fairness. OBJECTIVES 1. Enhance Revenue Collection - ‘‘Our aim is to surpass the set revenue targets at lowest cost” 2. Enhance Quality of Service to our Stakeholders - “Our aim is to provide quality service at least cost with maximum satisfaction to our stakeholders” 3. Modernise our Internal Processes - “Our aim is to develop effective and efficient processes that take a single view of the taxpayer” 4. Revitalisation of our Workforce - “Our aim is to develop a workforce respected for technical competence, professionalism and courtesy” Kenya Revenue Authority

OUR VISION To be the leading Revenue Authority in the world respected for professionalism, integrity and fairness. OBJECTIVES 1. Enhance Revenue Collection - ‘‘Our aim is to surpass the set revenue targets at lowest cost” 2. Enhance Quality of Service to our Stakeholders - “Our aim is to provide quality service at least cost with maximum satisfaction to our stakeholders” 3. Modernise our Internal Processes - “Our aim is to develop effective and efficient processes that take a single view of the taxpayer” 4. Revitalisation of our Workforce - “Our aim is to develop a workforce respected for technical competence, professionalism and courtesy” Kenya Revenue Authority

The rating has been done using a traffic light system as follows: Red – Represents Little/ No Progress Amber – Represents Fair Progress Green – Represents Good Progress/ Results Kenya Revenue Authority

The rating has been done using a traffic light system as follows: Red – Represents Little/ No Progress Amber – Represents Fair Progress Green – Represents Good Progress/ Results Kenya Revenue Authority

OPERATING ENVIRONMENT §During the year 2004, real GDP grew by 2. 4% and it is expected to accelerate to 3% in 2005. The average growth rate for the FY 2004/05 is therefore expected to be at around 2. 7%. §During six month period of Jul – Dec 2004, inflation and 91 day T-Bill rates increased significantly and the Kenya Shilling depreciated marginally against the US$ Dollar. §Overall, the macroeconomic environment during this period was relatively favourable to revenue collection. Kenya Revenue Authority

OPERATING ENVIRONMENT §During the year 2004, real GDP grew by 2. 4% and it is expected to accelerate to 3% in 2005. The average growth rate for the FY 2004/05 is therefore expected to be at around 2. 7%. §During six month period of Jul – Dec 2004, inflation and 91 day T-Bill rates increased significantly and the Kenya Shilling depreciated marginally against the US$ Dollar. §Overall, the macroeconomic environment during this period was relatively favourable to revenue collection. Kenya Revenue Authority

REVENUE PERFORMANCE DURING THE FY 2004/05 § For the six months period ended 31 st December 2004, KRA exceeded the targets set by Treasury by 18. 1%. Compared to the period Jul-Dec 2003, revenue grew by 28. 3% § Under our Corporate Plan, our target was to exceed the Treasury target by 2%. In exceeding the Treasury target by 18. 1%, we exceeded our own corporate target by over 15%. Kenya Revenue Authority

REVENUE PERFORMANCE DURING THE FY 2004/05 § For the six months period ended 31 st December 2004, KRA exceeded the targets set by Treasury by 18. 1%. Compared to the period Jul-Dec 2003, revenue grew by 28. 3% § Under our Corporate Plan, our target was to exceed the Treasury target by 2%. In exceeding the Treasury target by 18. 1%, we exceeded our own corporate target by over 15%. Kenya Revenue Authority

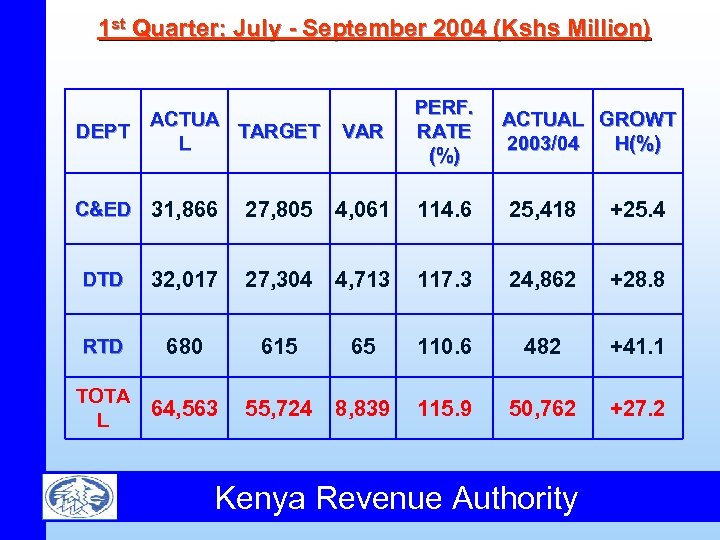

1 st Quarter: July - September 2004 (Kshs Million) ACTUA DEPT TARGET L VAR PERF. RATE (%) ACTUAL GROWT 2003/04 H(%) C&ED 31, 866 27, 805 4, 061 114. 6 25, 418 +25. 4 DTD 32, 017 27, 304 4, 713 117. 3 24, 862 +28. 8 RTD 680 615 65 110. 6 482 +41. 1 TOTA L 64, 563 55, 724 8, 839 115. 9 50, 762 +27. 2 Kenya Revenue Authority

1 st Quarter: July - September 2004 (Kshs Million) ACTUA DEPT TARGET L VAR PERF. RATE (%) ACTUAL GROWT 2003/04 H(%) C&ED 31, 866 27, 805 4, 061 114. 6 25, 418 +25. 4 DTD 32, 017 27, 304 4, 713 117. 3 24, 862 +28. 8 RTD 680 615 65 110. 6 482 +41. 1 TOTA L 64, 563 55, 724 8, 839 115. 9 50, 762 +27. 2 Kenya Revenue Authority

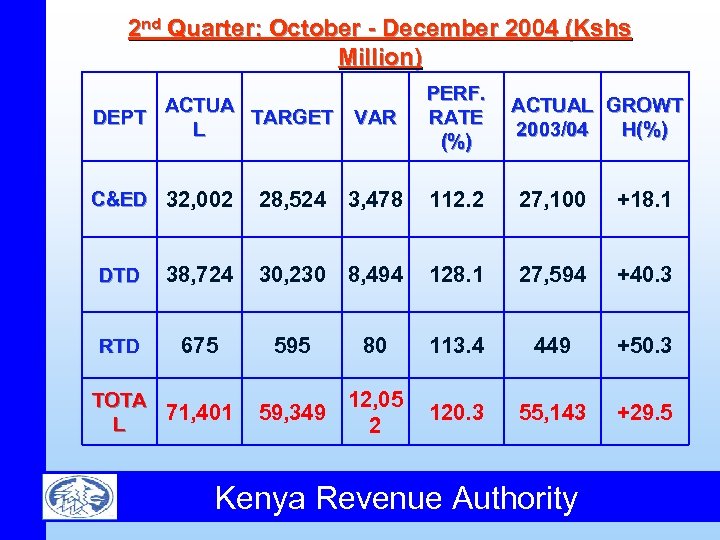

2 nd Quarter: October - December 2004 (Kshs Million) VAR PERF. RATE (%) C&ED 32, 002 28, 524 3, 478 112. 2 27, 100 +18. 1 DTD 38, 724 30, 230 8, 494 128. 1 27, 594 +40. 3 RTD 675 ACTUA DEPT TARGET L TOTA 71, 401 L ACTUAL GROWT 2003/04 H(%) 595 80 113. 4 449 +50. 3 59, 349 12, 05 2 120. 3 55, 143 +29. 5 Kenya Revenue Authority

2 nd Quarter: October - December 2004 (Kshs Million) VAR PERF. RATE (%) C&ED 32, 002 28, 524 3, 478 112. 2 27, 100 +18. 1 DTD 38, 724 30, 230 8, 494 128. 1 27, 594 +40. 3 RTD 675 ACTUA DEPT TARGET L TOTA 71, 401 L ACTUAL GROWT 2003/04 H(%) 595 80 113. 4 449 +50. 3 59, 349 12, 05 2 120. 3 55, 143 +29. 5 Kenya Revenue Authority

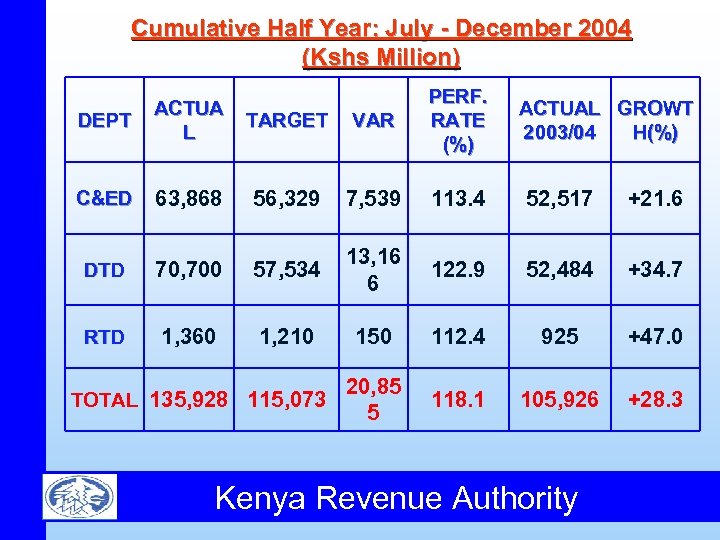

Cumulative Half Year: July - December 2004 (Kshs Million) DEPT ACTUA L TARGET VAR PERF. RATE (%) C&ED 63, 868 56, 329 7, 539 113. 4 52, 517 +21. 6 DTD 70, 700 57, 534 13, 16 6 122. 9 52, 484 +34. 7 RTD 1, 360 1, 210 150 112. 4 925 +47. 0 20, 85 5 118. 1 105, 926 +28. 3 TOTAL 135, 928 115, 073 ACTUAL GROWT 2003/04 H(%) Kenya Revenue Authority

Cumulative Half Year: July - December 2004 (Kshs Million) DEPT ACTUA L TARGET VAR PERF. RATE (%) C&ED 63, 868 56, 329 7, 539 113. 4 52, 517 +21. 6 DTD 70, 700 57, 534 13, 16 6 122. 9 52, 484 +34. 7 RTD 1, 360 1, 210 150 112. 4 925 +47. 0 20, 85 5 118. 1 105, 926 +28. 3 TOTAL 135, 928 115, 073 ACTUAL GROWT 2003/04 H(%) Kenya Revenue Authority

§ This good revenue performance was as a result of: • Aggressive implementation of tax administrative reform measures as articulated in the second Corporate Plan, • the overwhelming response to the tax amnesty 2004, • and the generally favourable economic environment. § The factors above, positively impacted on revenue as follows: • Administrative reforms - Kshs 8. 45 billion; • Economic fundamentals - Kshs 8 billion; and • Tax amnesty – Kshs 4. 4 billion. § What follows next is an assessment of the various revenue administration reforms undertaken that contributed to this performance. Kenya Revenue Authority

§ This good revenue performance was as a result of: • Aggressive implementation of tax administrative reform measures as articulated in the second Corporate Plan, • the overwhelming response to the tax amnesty 2004, • and the generally favourable economic environment. § The factors above, positively impacted on revenue as follows: • Administrative reforms - Kshs 8. 45 billion; • Economic fundamentals - Kshs 8 billion; and • Tax amnesty – Kshs 4. 4 billion. § What follows next is an assessment of the various revenue administration reforms undertaken that contributed to this performance. Kenya Revenue Authority

1. INITIATIVES TO ENHANCE REVENUE COLLECTION Broaden the tax base § Taxpayer Recruitment – A total of 10, 791 new taxpayers for Income Tax and 5, 177 for VAT were recruited realising Kshs. 283 million in additional revenue. Take over of stamp duty collection is complete. Work is underway to take over collection of land rates. A memorandum of understanding has already been signed with Mombasa City Council while Nairobi and Kisumu will follow soon. § Revenue Leakage – Implementation of the withholding VAT system continued with great success netting an additional 2, 180 taxpayers and realising Kshs 1. 0 billion in revenue per month. Controls in the petroleum, cigarettes and wines and spirits subsectors were tightened increasing revenue by over 10%. Kenya Revenue Authority

1. INITIATIVES TO ENHANCE REVENUE COLLECTION Broaden the tax base § Taxpayer Recruitment – A total of 10, 791 new taxpayers for Income Tax and 5, 177 for VAT were recruited realising Kshs. 283 million in additional revenue. Take over of stamp duty collection is complete. Work is underway to take over collection of land rates. A memorandum of understanding has already been signed with Mombasa City Council while Nairobi and Kisumu will follow soon. § Revenue Leakage – Implementation of the withholding VAT system continued with great success netting an additional 2, 180 taxpayers and realising Kshs 1. 0 billion in revenue per month. Controls in the petroleum, cigarettes and wines and spirits subsectors were tightened increasing revenue by over 10%. Kenya Revenue Authority

Improve compliance § Computerised risk management systems - KRA has installed a fixed and mobile X-ray scanner with risk profiling capabilities at the port of Kilindini. Implementation of VAT Kilindini Electronic Tax Registers is also in finalisation stages. § Effectiveness of taxpayer education programmes Numerous taxpayer sensitisation activities were organised for business communities, interest groups, educational institutions etc. Most notable was the ‘Taxpayers’ Week’, TV/Radio shows and for the first time KRA diversified into bill board campaigns for Tax Amnesty 2004. Enhance and Improve assessment/audit § 1, 159 audit cases were completed against a target of 2, 583. Several LTO officers were trained to improve their skills in the use of modern auditing tools. Implementation of joint audits in domestic taxes is at pilot implementation stages. Kenya Revenue Authority

Improve compliance § Computerised risk management systems - KRA has installed a fixed and mobile X-ray scanner with risk profiling capabilities at the port of Kilindini. Implementation of VAT Kilindini Electronic Tax Registers is also in finalisation stages. § Effectiveness of taxpayer education programmes Numerous taxpayer sensitisation activities were organised for business communities, interest groups, educational institutions etc. Most notable was the ‘Taxpayers’ Week’, TV/Radio shows and for the first time KRA diversified into bill board campaigns for Tax Amnesty 2004. Enhance and Improve assessment/audit § 1, 159 audit cases were completed against a target of 2, 583. Several LTO officers were trained to improve their skills in the use of modern auditing tools. Implementation of joint audits in domestic taxes is at pilot implementation stages. Kenya Revenue Authority

Improve debt and arrears management §Debt Management - Overall a total of Kshs 7. 2 billion was collected which accounts for 5. 3% of total cumulative revenue collected. A full review of all the outstanding debts was completed and identification of bad debts and the write offs is in progress. Improve exemptions management §Exemption/Remission Framework– KRA is in the processing of developing regulations for issuance of exemptions/remissions. This is a high priority area for the organization. Kenya Revenue Authority

Improve debt and arrears management §Debt Management - Overall a total of Kshs 7. 2 billion was collected which accounts for 5. 3% of total cumulative revenue collected. A full review of all the outstanding debts was completed and identification of bad debts and the write offs is in progress. Improve exemptions management §Exemption/Remission Framework– KRA is in the processing of developing regulations for issuance of exemptions/remissions. This is a high priority area for the organization. Kenya Revenue Authority

Effective Enforcement The Investigation and Enforcement function has been fully integrated. All technical officers in the department have undergone training on prosecution and other related areas such as evidence gathering. The formation of a component intelligence unit is underway. A policy on prosecution by KRA has also been developed and is currently under review. Budgeting system Several initiatives were expenditure controls: undertaken to enhance ü The KRA financial procedures manual is being finalised; ü Guidelines for activity based costing were implemented for the preparation of the 2005/06 budgets; ü Several modules in the Scala financial system were activated. Kenya Revenue Authority

Effective Enforcement The Investigation and Enforcement function has been fully integrated. All technical officers in the department have undergone training on prosecution and other related areas such as evidence gathering. The formation of a component intelligence unit is underway. A policy on prosecution by KRA has also been developed and is currently under review. Budgeting system Several initiatives were expenditure controls: undertaken to enhance ü The KRA financial procedures manual is being finalised; ü Guidelines for activity based costing were implemented for the preparation of the 2005/06 budgets; ü Several modules in the Scala financial system were activated. Kenya Revenue Authority

2. INITIATIVES TO ENHANCE QUALITY OF SERVICE DELIVERY Implement Quality Assurance Programme § There was limited progress over the last six months after sensitisation programmes were implemented. However the recruitment of a QAP consultant is in early stages. Develop and implement simplified compliance procedures § Some of our documentation was modified and simplified. The Income Tax Act is now updated and uploaded on the KRA website. We however recognise Kenya Revenue Authority that more needs to be done in this area.

2. INITIATIVES TO ENHANCE QUALITY OF SERVICE DELIVERY Implement Quality Assurance Programme § There was limited progress over the last six months after sensitisation programmes were implemented. However the recruitment of a QAP consultant is in early stages. Develop and implement simplified compliance procedures § Some of our documentation was modified and simplified. The Income Tax Act is now updated and uploaded on the KRA website. We however recognise Kenya Revenue Authority that more needs to be done in this area.

§Develop and implement an effective queue management framework To reduce queues in our premises various initiatives were implemented. The most notable was the introduction of direct banking with respect to C&E and VAT payments and opening up of more computerised cash receipting and corporate counters in RTD. We also recognise the need to do more under this initiative. §Actively pursue the enactment of the law on electronic documents § This remains a major impediment to development as it requires legislative changes. Kenya Revenue Authority

§Develop and implement an effective queue management framework To reduce queues in our premises various initiatives were implemented. The most notable was the introduction of direct banking with respect to C&E and VAT payments and opening up of more computerised cash receipting and corporate counters in RTD. We also recognise the need to do more under this initiative. §Actively pursue the enactment of the law on electronic documents § This remains a major impediment to development as it requires legislative changes. Kenya Revenue Authority

3. INITIATIVES TO MODERNISE INTERNAL PROCESSES Business Process Improvement and Integration §KRA has initiated the move towards a truly ‘one-stop facility’ for tax administration and the Office of Commissioner VAT & Income Tax and Excise have been integrated. However the integration process will be intensified across KRA to truly integrate functions in departments. Enhance the Effectiveness of LTO §The LTO has been significantly strengthened through equipment and training. However more still needs to be done and this will remain a high priority area. Enhance the effectiveness of the preventive service §Our Customs Preventive Service has been active in detection of and taking action on cases of drug trafficking, counterfeits and other prohibited goods. Kenya Revenue Authority

3. INITIATIVES TO MODERNISE INTERNAL PROCESSES Business Process Improvement and Integration §KRA has initiated the move towards a truly ‘one-stop facility’ for tax administration and the Office of Commissioner VAT & Income Tax and Excise have been integrated. However the integration process will be intensified across KRA to truly integrate functions in departments. Enhance the Effectiveness of LTO §The LTO has been significantly strengthened through equipment and training. However more still needs to be done and this will remain a high priority area. Enhance the effectiveness of the preventive service §Our Customs Preventive Service has been active in detection of and taking action on cases of drug trafficking, counterfeits and other prohibited goods. Kenya Revenue Authority

Computerisation Implementation of “Quick Wins” §Computer to staff ratio improved to 1: 4 an improvement from previous 1: 5; LAN and WAN coverage expanded; The electronic mail system rolled out to head office and most regions nationally. § Implementation of a replacement IT system for Customs began and piloting commenced in January 2005. Receiving and recording of income tax returns has been automated. Management of Oil installations has also been automated and the development of a waiver management module is now completed. However, work is yet to commence on implementing an Enterprise Resource Planning system. Implementation of KREISA A framework for an ICT strategy has been prepared and infrastructure acquired. Donor support has also been received for feasibility studies. Kenya Revenue Authority

Computerisation Implementation of “Quick Wins” §Computer to staff ratio improved to 1: 4 an improvement from previous 1: 5; LAN and WAN coverage expanded; The electronic mail system rolled out to head office and most regions nationally. § Implementation of a replacement IT system for Customs began and piloting commenced in January 2005. Receiving and recording of income tax returns has been automated. Management of Oil installations has also been automated and the development of a waiver management module is now completed. However, work is yet to commence on implementing an Enterprise Resource Planning system. Implementation of KREISA A framework for an ICT strategy has been prepared and infrastructure acquired. Donor support has also been received for feasibility studies. Kenya Revenue Authority

4. INITIATIVES TO REVITALISE HUMAN RESOURCES Revitalisation of Human Resources §Numerous training and capacity building initiatives were undertaken, with special emphasis on integration, computerised audits, take over of PSI functions, and post release audit. Staff welfare initiatives were also undertaken most notable being introduction of improved scheme of service for support staff, implementation of final phase of salary harmonisation and review of medical policy. Integrity Assurance §Provisions of the Public Sector Integrity Programme were implemented in full. Awareness on anti-corruption and promotion of integrity is now a mandatory component in all KRA courses. Corruption Prevention Committees have been formed and the Public Complaints and Information Centre continues to receive and act on intelligence information on corruption and fraud. Kenya Revenue Authority

4. INITIATIVES TO REVITALISE HUMAN RESOURCES Revitalisation of Human Resources §Numerous training and capacity building initiatives were undertaken, with special emphasis on integration, computerised audits, take over of PSI functions, and post release audit. Staff welfare initiatives were also undertaken most notable being introduction of improved scheme of service for support staff, implementation of final phase of salary harmonisation and review of medical policy. Integrity Assurance §Provisions of the Public Sector Integrity Programme were implemented in full. Awareness on anti-corruption and promotion of integrity is now a mandatory component in all KRA courses. Corruption Prevention Committees have been formed and the Public Complaints and Information Centre continues to receive and act on intelligence information on corruption and fraud. Kenya Revenue Authority

Expand corporate social responsibility §KRA participated visibly in various community initiatives. Notable was in areas of HIV and AIDs, National Disaster Fund, Hunger campaigns, Student Associations, etc. OVERVIEW OF BSC IMPLEMENTATION STATUS §Overall, there was significant progress as shown by the number of Greens and Amber colour ratings. §However, we recognise the need for immediate action to address the areas of weakness (Reds) that will be focused on. §The next slide summarises the global overview of our performance generally. Kenya Revenue Authority

Expand corporate social responsibility §KRA participated visibly in various community initiatives. Notable was in areas of HIV and AIDs, National Disaster Fund, Hunger campaigns, Student Associations, etc. OVERVIEW OF BSC IMPLEMENTATION STATUS §Overall, there was significant progress as shown by the number of Greens and Amber colour ratings. §However, we recognise the need for immediate action to address the areas of weakness (Reds) that will be focused on. §The next slide summarises the global overview of our performance generally. Kenya Revenue Authority

- To Pay Your Taxes is to Set our Country Free - A Performance Overview Kenya Revenue Authority

- To Pay Your Taxes is to Set our Country Free - A Performance Overview Kenya Revenue Authority

TAX AMNESTY 2004 PERFORMANCE § I am also pleased to present the performance of tax amnesty 2004 which was introduced by the Minister for Finance on the 10 th of June 2004. § It was very successful and we received an overwhelming response from all quarters of taxpayers in Kenya. § As earlier mentioned a sum of Kshs 4. 41 billion was realised in the six-month period from 11 June to 31 December 2004. This was collected from a total number of 4, 483 applications. § Domestic Taxes Department, which comprises of Income Tax and VAT accounted Authority of the Kenya Revenue for the bulk amnesty collections.

TAX AMNESTY 2004 PERFORMANCE § I am also pleased to present the performance of tax amnesty 2004 which was introduced by the Minister for Finance on the 10 th of June 2004. § It was very successful and we received an overwhelming response from all quarters of taxpayers in Kenya. § As earlier mentioned a sum of Kshs 4. 41 billion was realised in the six-month period from 11 June to 31 December 2004. This was collected from a total number of 4, 483 applications. § Domestic Taxes Department, which comprises of Income Tax and VAT accounted Authority of the Kenya Revenue for the bulk amnesty collections.

TAX AMNESTY 2004 PERFORMANCE § A total of Kshs. 2. 72 billion was realised in income tax from 2, 617 applications while Kshs. 1. 52 billion was realised in VAT from 872 applications. § Customs and Excise Department collected a total of Kshs. 163. 49 million from 803 applications. § Road Transport Department realised a sum of Kshs. 3. 57 million in traffic revenue as a result of amnesty granted under Customs & Excise on Motor vehicles. § We applaud all those who took advantage of the amnesty. Kenya Revenue Authority

TAX AMNESTY 2004 PERFORMANCE § A total of Kshs. 2. 72 billion was realised in income tax from 2, 617 applications while Kshs. 1. 52 billion was realised in VAT from 872 applications. § Customs and Excise Department collected a total of Kshs. 163. 49 million from 803 applications. § Road Transport Department realised a sum of Kshs. 3. 57 million in traffic revenue as a result of amnesty granted under Customs & Excise on Motor vehicles. § We applaud all those who took advantage of the amnesty. Kenya Revenue Authority

TAX AMNESTY 2004 PERFORMANCE § A preliminary review of the results indicates that some firms in certain sectors, generally known to be non compliant ignored the Tax Amnesty. § This is unfortunate as it is an indication of a resolve to remain non-compliant. § We have therefore extended a one month special offer of waiver of penalties, interest, additional tax and fines for such taxpayers until 31 st of January 2005. § I call upon them to take advantage of this final opportunity. § We are putting together a fool proof machinery to detect and prosecute tax evaders and we will deal very firmly with any cases of tax malpractice. Kenya Revenue Authority

TAX AMNESTY 2004 PERFORMANCE § A preliminary review of the results indicates that some firms in certain sectors, generally known to be non compliant ignored the Tax Amnesty. § This is unfortunate as it is an indication of a resolve to remain non-compliant. § We have therefore extended a one month special offer of waiver of penalties, interest, additional tax and fines for such taxpayers until 31 st of January 2005. § I call upon them to take advantage of this final opportunity. § We are putting together a fool proof machinery to detect and prosecute tax evaders and we will deal very firmly with any cases of tax malpractice. Kenya Revenue Authority

CONCLUDING REMARKS § In conclusion, KRA has indeed registered impressive results in revenue collections and service delivery to stakeholders. This is as a result of implementation of bold initiatives contained in the Second Corporate Plan. § The revenue target for the remaining six months of the FY 2004/05 is Kshs. 125. 23 billion. We are confident that we shall surpass this target as we intensify implementation of more initiatives under the reform and modernisation programme. § I wish to express special thanks to the Press for their support during the publicity campaign, our staff for their exemplary hard work, and our parent ministry (Ministry of Finance) for their continued support. - THANK YOU - Kenya Revenue Authority

CONCLUDING REMARKS § In conclusion, KRA has indeed registered impressive results in revenue collections and service delivery to stakeholders. This is as a result of implementation of bold initiatives contained in the Second Corporate Plan. § The revenue target for the remaining six months of the FY 2004/05 is Kshs. 125. 23 billion. We are confident that we shall surpass this target as we intensify implementation of more initiatives under the reform and modernisation programme. § I wish to express special thanks to the Press for their support during the publicity campaign, our staff for their exemplary hard work, and our parent ministry (Ministry of Finance) for their continued support. - THANK YOU - Kenya Revenue Authority